Leading America’s Uranium Production Resurgence

NYSE American: UEC

The new uranium bull market is underway…

…and best of all, it’s still early-innings which means you haven’t missed out on the coming profit windfall.

The company featured in this Special Report — Texas-based Uranium Energy Corporation (NYSE-American: UEC) — is America's leading and fastest growing uranium mining company and is poised to lead our nation’s resurgent uranium production sector as a near-term producer. UEC boasts a robust pipeline of resource-stage uranium projects in Arizona, New Mexico, Texas, Wyoming, and Saskatchewan, Canada. It controls a significant equity stake in the only royalty company in the sector, Uranium Royalty Corp. UEC is also systematically amassing one of the largest portfolios of US-warehoused U3O8 at approximately 5 million pounds. It’s a company that’s very well-positioned in the domestic uranium sector at a time when the US government is finally addressing its national security concerns regarding the need for increased uranium supply from American sources.

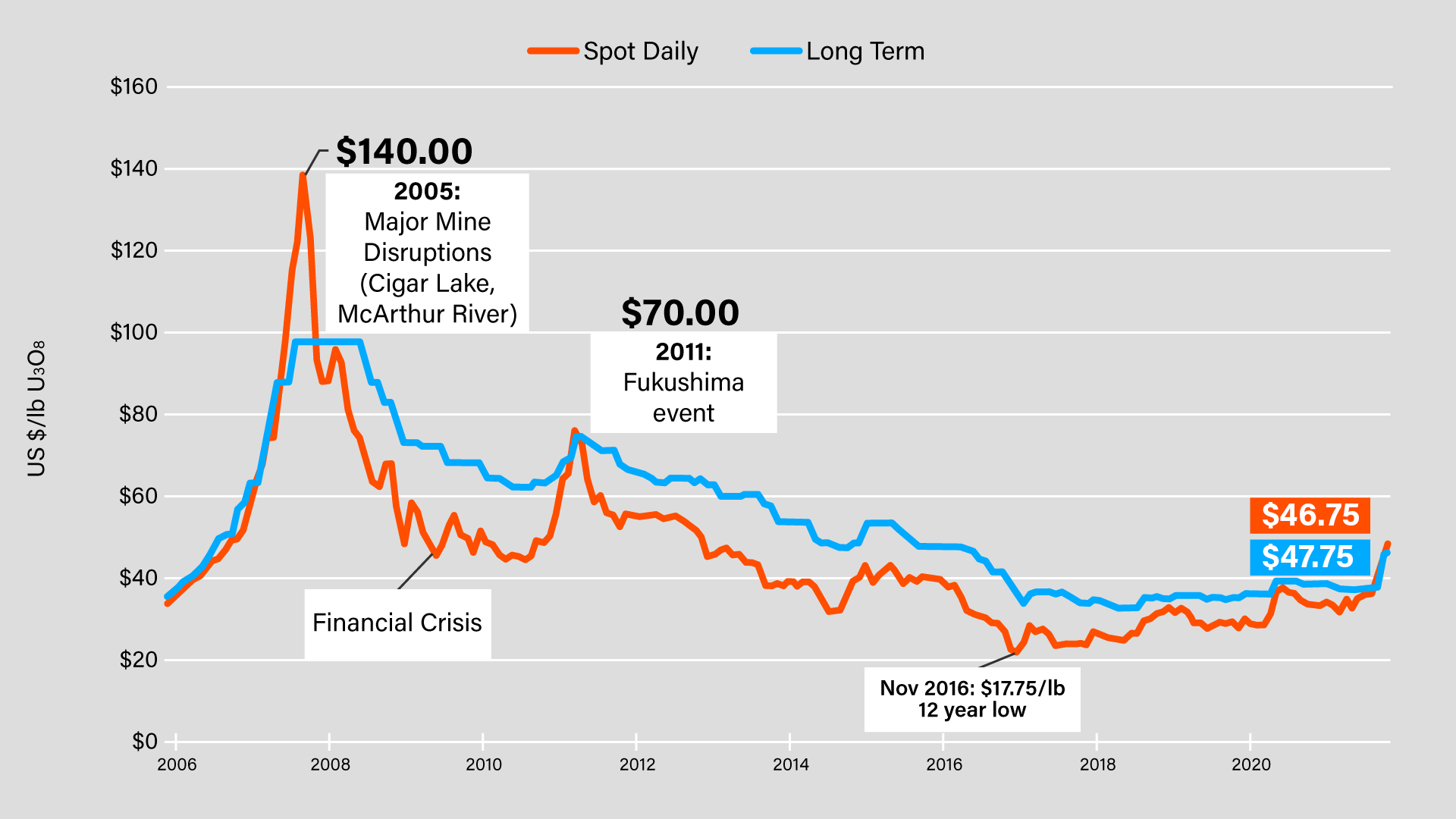

The profound double-impact of COVID-19 and Russia’s invasion of Ukraine on the global uranium market, coupled with a renewed acceptance of nuclear as “clean, emission-free, reliable energy” has kicked off events that are already seeing the uranium spot-price — and related equities — ratcheting higher.

Currently, the price of uranium — or “yellowcake” as it is commonly referred — is around US$50 per pound.

It’s likely headed north of US$75 per pound soon — and this report details precisely why.

Over the next ten years, the world will need ~200 million pounds of uranium annually. But there is only about 150 million pounds per year globally with all-in sustaining costs (AISC) below US$50 per pound — and 20% or more of that has been knocked offline due to COVID-related and other global supply disruptions.

Russia’s invasion of Ukraine is causing further alarm as Putin’s regime supplies about 16% of US uranium imports through its state-run firm Rosatom.

The US has already placed a ban on imports of Russian oil and other energy products. Uranium may be next; such a move would undoubtedly put additional upward pricing pressure on a commodity that’s already in short supply.

Additionally, the US Department of Energy is currently asking Congress for $4.3 billion to buy domestically sourced, low-enriched uranium as yet another key measure aimed at removing Russian uranium from the global supply chain.

Keep in mind also that, at today’s spot price, only around 100 million pounds of supply per year is economic or only about HALF of what the world needs. A spot price well above US$50 per pound will be needed — and is expected — over the next few years.

That reality has kicked off a new bull market in U3O8 prices and select small-cap uranium stocks — including Uranium Energy Corp. (NYSE-American: UEC).

A New Uranium Bull Market Emerges

Uranium’s previous bull market kicked off in 2006 when Cameco’s Cigar Lake Mine — which provides ~7% of global annual uranium supply — flooded while it was being built, prompting a run on uranium that sent the spot price to a jaw-dropping US$140 per pound.

It simultaneously sent uranium stocks significantly higher in percentage terms with some like UEX Energy, Energy Fuels, Laramide Resources, and International Enexco delivering a few thousand to +100,000% returns.

The commodities sector is known for the stocks within it offering leverage to the underlying price of the commodity.

The uranium subsector epitomizes this.

Uranium Energy Corp. has been set up from the outset to capitalize on the uranium upswing the “clean-energy” world is now bearing witness to.

A Miniscule Market with Immense Leverage to Rising Prices

The uranium market is incredibly small compared to other commodities.

Kazakhstan alone produces ~40% of global supply. It does this through Kazatomprom, its national uranium company, which listed 25% of its shares on the London Stock Exchange in 2018. Those shares have a market capitalization of about US$12 billion.

The next largest public pure-play is Cameco Corporation (NYSE: CCJ), which produces ~10% of annual global supply and has a market capitalization of around US$10 billion.

In other words, roughly half of the world’s uranium production is represented by less than US$30 billion in market cap. In contrast, Amazon alone has a market capitalization of around US$1 trillion.

From there, the pure-plays get small very quickly. The “largest” uranium producer in the United States, for example, is Energy Fuels (NASDAQ: UUUU).

Largest is in quotes given it will likely only produce between 30,000 to 60,000 pounds of U3O8 this calendar year. Its market cap is around US$1 billion but has mostly been below that for years.

If you were to look up the top holdings of the Global X Uranium ETF (NYSE: URA), you would see that those three companies make up three of the top five holdings.

The other two are NexGen Energy, with its world-class but undeveloped Arrow project in Saskatchewan, and Denison Mines, with its large but also undeveloped Wheeler River project on the other side of the Athabasca Basin.

Those five companies make up over 50% of the sector ETF.

Hence, the uranium world is incredibly small, which is why even slight inflows into the sector can create such stark leverage reflected in the equities — especially the small-caps.

Utilities Will Drive the Next Upward Leg of the Uranium Boom

The biggest and most important buyers in the uranium space are the utilities. And here’s where it gets really interesting.

For years, the utilities have been able to lock up uranium supplies at depressed prices.

That’s changing now.

The combination of supply cuts from the highest-margin producers and utilities coming back into the market will create the greatest uranium bull market anyone has ever seen.

You see, for utilities, price is secondary to securing supply. That’s because the price they pay for yellowcake makes up a very small portion of the total cost of operating a nuclear reactor.

And for mine start-ups and restarts to be economic, uranium prices need to be north of US$75 per pound. That’s the low-water-mark incentive price to build a new uranium mine in today’s economy.

The bottom line is that no developer can bring a new uranium mine from development to production at US$50 per pound uranium.

And that means we’re almost guaranteed to see higher contract prices.

That’s why uranium bull markets are so powerful. It’s also why the profits can be so life-changing.

Whether the utilities pay US$50 per pound or US$150 per pound… THEY HAVE TO BUY!

With nuclear power providing some 15% of global baseload clean electricity… either the utilities buy uranium at higher prices… or the lights go out!

The utilities’ last major contracting cycle was in 2010. And when you look at the levels of uncovered reactor requirements starting next year and the year after that... every year, it gets larger and larger.

Not only is the biggest buyer starting to come back into the market… but governments that just years ago vowed to move away from nuclear energy are now realizing that there isn’t a cleaner, safer, more economic option in the world.

China, Japan, India, South Korea, and even the US are now fully onboard with a cleaner energy future that will require vast amounts of uranium.

In fact, China just confirmed its intent to build 150 new nuclear reactors over the next 15 years as part of their newly-enhanced decarbonization mandate. That's more reactors than have been built in the last 35 years!

France also just announced they’re going to be building a new generation of nuclear reactors for the first time in decades.

And there’s also the advent of Small Modular Reactors — or SMRs — right here in America.

SMRs offer key advantages over traditional reactors such as relatively small physical footprints, reduced capital investment, ability to be sited in locations not possible for larger nuclear plants, and provisions for incremental power additions.

In other words, strong tailwinds are forming for the uranium sector at large.

And then there’s the retail speculator who, until now, hasn’t had a viable vehicle to buy physical uranium with the press of a button or by placing a phone call.

That’s all changing now too…

Sprott Inc. recently launched what amounts to a new uranium ETF by taking over Uranium Participation Corp (TSX: U)(OTC: URPTF).

The formation of the Sprott Physical Uranium Trust is a big deal. In fact, we believe Sprott's 200,000-plus investors will look at this as a way to directly purchase physical pounds without having to take delivery, which Sprott will do for them.

They’ve done it with gold. They’ve done it with silver. And now they’re doing it with yellowcake!

Sprott has already announced an initial investment of over US$1.3 billion. That will likely grow over the coming quarters.

The Kazakhs quickly followed suit with their own US$500 million physical uranium fund.

Those two funds are combining to tighten an already strained uranium supply market… resulting in the first upward leg of the new uranium bull market with U3O8 prices surging from US$25 per pound to currently around US$50 per pound.

We talked about the utilities. They’re starting to enter now.

Historically, it is the utilities that have been the main driver for higher uranium prices.

A new contracting cycle is just now underway with utilities entering the market to secure their next long-term U3O8 contracts.

As that cycle continues to gather momentum, we could see uranium prices surge first to US$75 per pound… and eventually to record highs above US$140 per pound.

Could we see US$200 uranium in the not too distant future? We believe so!

And while that high a price would likely be unsustainable over the longer-term — it won’t matter!

That’s because any surge above US$75 per pound could send the share prices of select small-cap uranium firms much higher… resulting in substantial gains for well-positioned investors.

So yes, the gains in the uranium spot price will be incredible... but the top junior uranium exploration firms will make those gains look paltry in comparison.

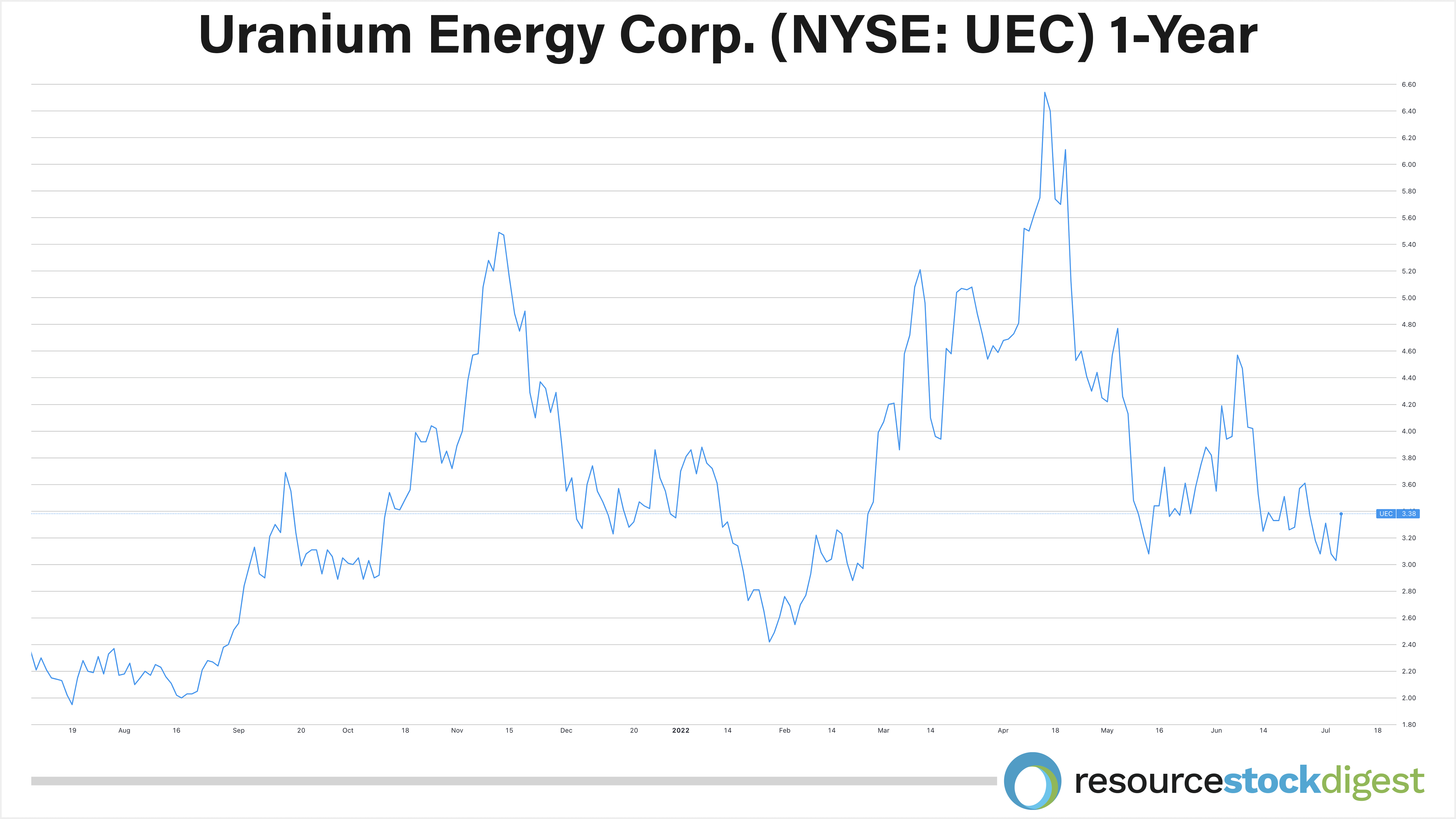

And that brings us to Uranium Energy Corporation (UEC) — currently undervalued below US$4 per share and rapidly elevating its profile as America’s next domestic uranium producer.

A Clear Path to Uranium Stock Profits

There are several ways for individual investors to participate in the current uranium boom... from the junior explorers, to the mid-tier producers, all the way to the majors.

We’ve been paying special attention to the juniors — such as Uranium Energy Corp. (NYSE-American: UEC) — because that’s where the largest percentage gains can be made in the shortest amount of time.

UEC has taken a number of well-timed measures to position itself as a future low-cost North American uranium producer in a rising U3O8 market.

Management has spent considerable time and energy getting permits in-place for its low-cost ISR (in-situ recovery) uranium projects, which means it is poised to move swiftly toward production as yellowcake prices continue to trend higher — ideally north of US$75 per pound in short order.

TRANSLATION: Uranium Energy Corp. — currently trading well below US$4 per share — is one of only a handful of publicly-traded US uranium exploration and development companies with the capability of attaining near-term domestic U3O8 production.

Additionally — as part of a process that commenced in Q1 2021 — UEC has agreements in place to secure 5 million pounds of US-warehoused U3O8 at a volume-weighted average price of approximately US$38 per pound, which is well below spot, with delivery dates out to late-2025.

As noted, the price of yellowcake is trending upward — currently right around US$50/lb — which means the value of UEC’s growing inventory of US-warehoused uranium is also on the rise.

In addition to strengthening the company’s balance sheet — which currently stands at over US$180 million of cash and liquid assets and no debt — this direct uranium purchase initiative should also lend accretive support to UEC’s future marketing efforts with utilities as a means of accelerating future cash flows.

A Proven Acquisition & Development Strategy

(UEC President & CEO)

The Uranium Energy Corp. team, led by president & CEO, Amir Adnani, utilized the most recent downturn in the global uranium sector to systematically acquire one of the largest databases of historic uranium exploration and development in the entire country.

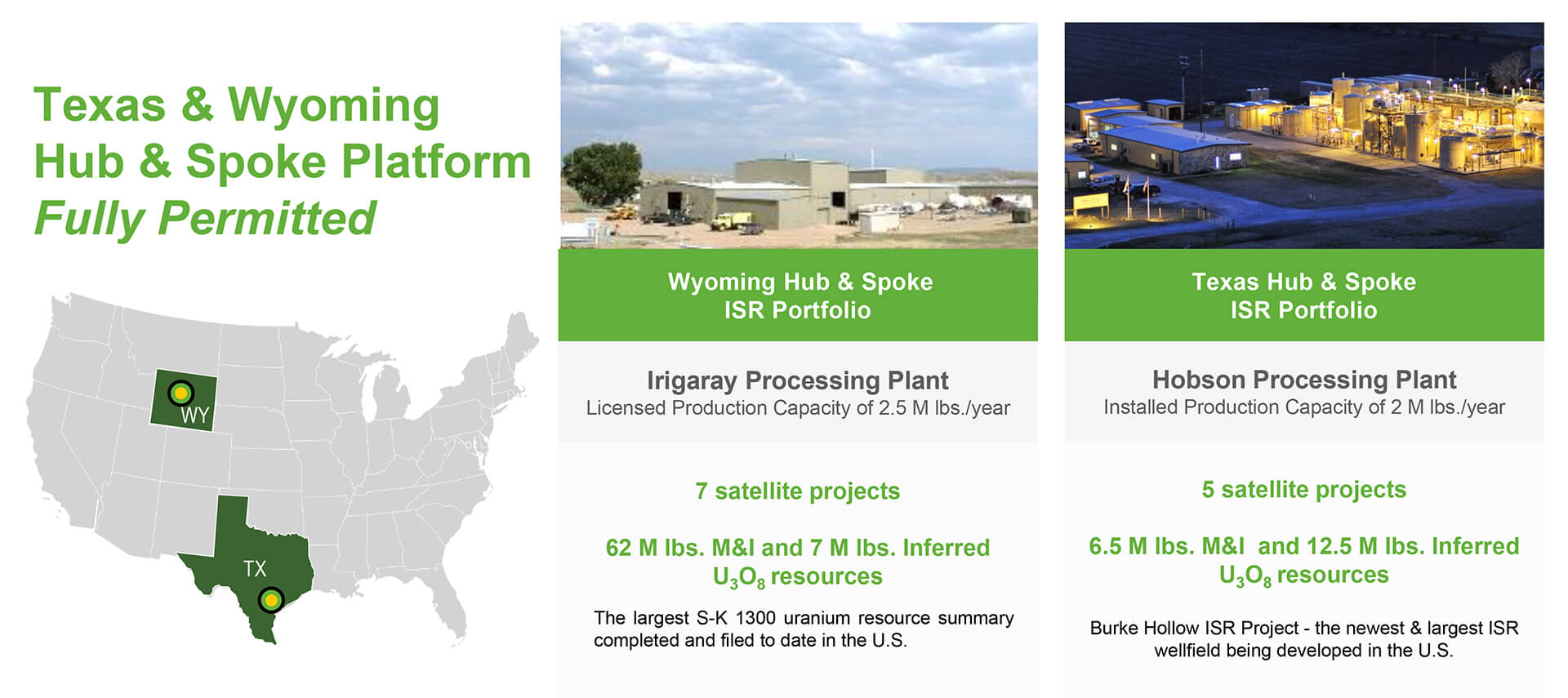

That database is now enabling the company to advance its impressive suite of fully-permitted, low-cost ISR (in-situ recovery) uranium production projects primarily located in the US states of Texas, Wyoming, New Mexico, and Colorado — a hotbed for American uranium resources.

Plus, the company has been on an M&A tear since Q4 2021 with two key accretive acquisitions: Uranium One Americas (US assets) and UEX Corporation (Canadian assets) — making UEC America’s largest uranium mining company.

In Wyoming, UEC controls the flagship Reno Creek ISR Uranium Project, which is the largest permitted, pre-construction ISR uranium project in the nation.

And keep in mind that permits for uranium mines can oftentimes take 5 to 10 years to acquire.

That puts UEC in the unique position of being able to expeditiously ramp-up to uranium production as the price for yellowcake continues to rise amid increasing demand coupled with unprecedented global supply disruptions related to COVID and Russia’s invasion of Ukraine.

It’s equally important to note that ISR projects are considered a much lower-cost and much more environmentally-friendly alternative to conventional uranium mining and represent the preferred uranium mining methodology in North America along with the largest source of growth in uranium production globally.

Reno Creek Uranium Project

One of UEC’s most advanced properties is the Reno Creek ISR Uranium Project, Wyoming, which boasts a Measured & Indicated (M&I) resource of 32 million tons grading 0.041% U3O8 containing 26 million pounds of uranium and an Inferred resource of 1.92 million tons grading 0.039% U3O8 containing 1.49 million pounds.

The flagship project is licensed to produce 2 million pounds U3O8 per year and holds a modified Permit-to-Construct — allowing the company to move forward with construction of ISR wellfields that could also contribute to the strategic US Uranium Reserve.

Hobson Processing Facility

In South Texas, UEC’s hub-and-spoke operations are anchored by the fully-built and licensed Hobson Processing Facility (see below) which is central to the company’s Burke Hollow, Palangana, and Goliad ISR uranium projects.

The facility has a capacity of 2 million pounds U3O8 per year and has license amendments pending to increase that capacity.

Burke Hollow Uranium Project

UEC’s Burke Hollow Uranium Project is a 19,000-acre property located within the South Texas Uranium Trend, fifty miles to the southeast of the company’s Hobson Processing Plant.

Burke Hollow — which has the potential to be the largest Goliad Formation deposit ever discovered in the South Texas Uranium Trend — has received all four of its major permits required for uranium extraction from the Texas Commission of Environmental Quality and the EPA.

Drill results to-date have produced intercepts of 2.45 to 4.48 grade thickness (GT), which is well above the 0.3 GT cut-off for ISR resource estimation and wellfield development.

Palangana ISR Uranium Mine

UEC’s Palangana ISR Uranium Mine is a past producer, has proven production capabilities, and received renewal permits in 2019 authorizing extraction for an additional 10 years.

The project has an M&I resource estimate of 393,000 tons grading 0.135% U3O8 containing 1,057,000 pounds and an Inferred resource of 328,000 tons grading 0.176% U3O8 containing 1,154,000 pounds U3O8.

Combined, UEC has a near-term extraction profile of 4 million pounds U3O8 per year from its Wyoming and South Texas ISR projects — putting the company in the driver’s seat for near-term, low-cost domestic uranium production.

Strategic Acquisition: Uranium One Americas

UEC’s accretive acquisition of Uranium One Americas in Q4 2021 marked the largest all-cash uranium-focused acquisition by a western firm in over 10 years.

The acquisition — which effectively doubles the size of UEC’s production capacity in three key categories: total number of permitted US ISR projects, resources, and processing infrastructure — includes, among other assets, seven projects in the Powder River Basin, three of which are fully permitted, and five in the Great Divide Basin, Wyoming.

As part of the acquisition, UEC has received US$18 million plus 25 Wyoming-based ISR uranium projects.

As part of the acquisition, UEC has received US$18 million plus 25 Wyoming-based ISR uranium projects.

Next steps include transitioning the historical resources to fully-compliant status by filing updated technical reports while also exploring operational synergies by way of pairing the projects with the company’s Irigaray Processing Plant, Wyoming.

Strategic Acquisition: UEX Corporation

UEC’s acquisition of UEX Corporation in Q2 2022 marked the company’s expansion of uranium development assets into Canada and effectively, again, doubled the size of UEC’s attributable M&I uranium resources.

The newly acquired portfolio includes 29 uranium projects covering key areas of the producing eastern side, and development western side, of Saskatchewan’s prolific Athabasca Basin — the single highest-grade depository of uranium in the world.

Five of the 29 projects are considered advanced-resource-stage and are already in strong joint-venture partnerships with established uranium miners (including Orano and industry-leader Cameco).

The acquisition allows UEC to remain operationally focused in the US while benefiting from a new development pipeline with significant exploration potential in Canada.

Uranium Energy CEO, Amir Adnani, commented via press release:

“UEC’s acquisition of Uranium One Americas, Inc. [U1A] in December 2021 marked the largest M&A transaction in the uranium sector in about a decade. The transaction was highly accretive for the Company, and we have seen a very positive response from our shareholders and the marketplace. The strategic acquisition of UEX has the same characteristics and will grow our diversified portfolio in the politically stable and mining friendly jurisdiction of Canada. It also marks the largest North American M&A transaction in the uranium sector following the U1A acquisition. This transaction underscores UEC’s sector leading strategy as the fastest growing, pure play, 100% un-hedged uranium company with assets only in the Western hemisphere. As with the U1A acquisition, the purchase price is equal to only 13.7% of the pro forma market capitalization, yet the acquisition is expected to more than double the size of our attributable measured and indicated uranium resources. This opportunity provides entry into two of Canada’s most prospective uranium districts in Saskatchewan and Nunavut, and cements UEC’s position as not only a leading American uranium mining company but a North American one as well…”

An Impressive Team of Industry Professionals

UEC is led by Amir Adnani, president & CEO, who is also the founder of GoldMining, Inc., a gold-resources acquisition and development company that has grown to control a sizable portfolio of gold projects across the Americas. You’ll be hearing directly from Mr. Adnani in just a moment.

Spencer Abraham is a former US Energy Secretary and currently serves as UEC’s chairman. Under his stewardship, the department made major advances in the development of new energy technologies, successfully implemented a variety of nuclear non-proliferation and nuclear security programs after the September 11 attacks, and launched initiatives aimed at improving the nation’s energy security.

Scott Melbye, executive vice president, boasts 35 years of experience in senior roles with uranium majors Cameco, Uranium One, and Kazatomprom. Scott is the former president of Uranium Producers of America and chair of the World Nuclear Fuel Market.

Leading the technical team are Robert Underdown (VP of Production & Operations), Clyde Yancey (VP of Exploration), and Andy Kurrus (VP of Resource Development) who together bring more than 100 years of combined industry experience to the company.

Exclusive Interview with Uranium Energy CEO Amir Adnani

Our own Gerardo Del Real of Resource Stock Digest sat down with Uranium Energy president & CEO Amir Adnani for an exclusive, in-depth interview. Please enjoy!

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the president & CEO of Uranium Energy Corp. — Mr. Amir Adnani. Amir, I can't think of a better person to be talking to this Friday. How are you today?

Amir Adnani: I'm great. How are you doing Gerardo? It's good to connect with you, and we’ve got lots to talk about and cover.

Gerardo Del Real: I am well, thank you for asking. We absolutely do. And the reason I say there is no one I'd rather be talking with this morning is because of the news that we received this week from the Department of Energy. I'd love to get your take.

I know you're involved very heavily behind the scenes. I know your views on energy independence and how the US and North America can play an important part in that. So this news has to be as bullish as you could possibly get for the start to the second half of the year, right?

Amir Adnani: Yeah, Gerardo, I've spent 18 years of my life banging the table and talking about the importance of having domestic capabilities to mine uranium. One in every five homes in America is powered by nuclear energy. That means uranium is needed. And you could argue one in every ten homes in America has been powered by ‘Russian’ uranium all this long because 50% of imports into the US have been coming from Russia for nuclear fuel and uranium.

And so this, I feel like, has been a lifetime of effort and thinking and planning and building from my perspective because this is exactly what Uranium Energy Corp. has had as its business plan and mission statement all along — to build US-based uranium projects and mines and operations and people.

I'm just very sad and it's unfortunate that it took a war for the government in the US and finally this administration to take action and to start to take action that clearly demonstrates we're going to have a bifurcated market moving forward. It's going to be an east versus west type of market.

The Department of Energy in the US is asking Congress for billions of dollars to put towards US uranium conversion enrichment. I think other politically-stable jurisdictions that are US allies, namely Canada, will be benefiting from this bifurcation as well.

And so the long and short of it is yes, and in a way, I couldn't think of a more historic event and I feel like, again, after such a long period of committing what we've been doing at Uranium Energy for this cause, we're finally seeing the development that validates why we built this company the way we did.

But again, I'm sorry that it's taken a war and, of course, all the human casualty elements of this war for us to end up at what we're calling good news for our sector. But it is what it is… and that's the nature of the world we're in right now.

And I don't think it's just uranium; I think there's a lot of discussion going on in energy, around energy independence, national security, energy security — are really big topics right now. And uranium is one of a number of, I think, key commodities that we need to think about having access to from our own backyard.

Gerardo Del Real: That's very well said. Human toll aside, which, obviously, I couldn't agree with you more, Amir, as to the human cost and just the frustration that exists, I think, for everybody that's got a pulse, right, that it took what it took for us to act. But the bottom line is or does appear to be bipartisan support to get this done.

Uranium Energy Corp., you mentioned, you've spent the last 18 years petitioning and lobbying for a better way forward, and I think I have to give credit where credit is due. Uranium Energy Corp. is very well-positioned. You and the team have done a brilliant job of putting it and shareholders in a position to really benefit from the positive aspects of the news that was delivered this week. Can you speak to that a bit?

Amir Adnani: Well, you definitely have to have a long-term view in the resource business. We've had that approach. What we have today in Uranium Energy Corp. is, by far, the leading company in the United States when it comes to uranium development and mining.

We have a portfolio that is larger than any other company in terms of total resources in the ground that are, first of all, fully-permitted for production. Second, benefiting from the low-cost environmentally-friendly in-situ recovery method.

We're only active in states where those states support uranium mining and local stakeholders and, from a community point of view, there's support for uranium mining. We're not operating in any states where there's opposition to uranium mining. And this is really key because in today's world, in any world, you need to have social license today with the greater role that ESG plays and ESG-focused funds play in capital allocation.

It's really key that you're developing projects in states and areas where you have local support and there's a regulatory framework to permit. It doesn't get better than Texas and Wyoming in the Western hemisphere. These are states that have multi-decade histories of uranium mining.

Our own company, we're a proven uranium miner. We mined uranium in 2010 and mined uranium for a number of years before shutting down due to the low uranium prices that the world experienced from 2011 until last year, basically, when we've seen this incredible resurgence.

But you look at it, Gerardo, we have two production platforms between Texas and Wyoming. We own two fully-built and licensed processing plants. We can process our own uranium at these locations. Eight different satellite projects that could be mined using the low-cost in-situ recovery and shipped to our central processing plants — close to 150 million pounds of uranium in the ground in all categories of compliant resources. By far, the largest S-K 1300 compliant resource report in the US that was issued recently was the one we put up for the Wyoming projects.

And then finally, the balance sheet. You look at our most recent announcement that we had the other day. We have over US$180 million of cash and liquid assets on our balance sheet; no debt. I repeat, no debt and over US$180 million of cash and liquid assets.

This company is in its strongest position from a balance sheet point of view relative to other uranium companies on the planet. But in the US, definitely, in a leadership position to restart production and be a reliable source of supply to the US government and to US utilities and Western utilities.

You look at also what we've done with our physical uranium portfolio. We were buying physical uranium and contracting for physical uranium last year when the uranium prices were less than US$30 per pound. Today, uranium prices are over US$50 per pound. And we've put together a portfolio of 5 million pounds of uranium that we contracted, kind of like a stream that comes to us at a fixed cost of $38 per pound between now and late-2025.

This gives us a very reliable way of getting access to uranium while we ramp up production. And it's a great balance sheet asset as uranium prices go up. All of our future deliveries and uranium that we've acquired so far are in-the-money or have appreciated substantially in value as the uranium price has gone up.

So to have access to 5 million pounds of physical uranium at today's price and today's market where we have a tight market for uranium — there's going to be CAPEX and OPEX involved with building uranium mines moving forward — to have 5 million pounds of physical uranium with no CAPEX/OPEX. And to have that all be US-warehoused. All of our physical uranium and future deliveries are for US settlement on US soil. And this is the largest US-warehoused portfolio of any company that I'm aware of only in the US.

So to really kind of highlight here is that I think it's not only the resource base in the ground, it's the resource base in the ground plus the fully-permitted projects, plus the processing plants, plus the physical uranium… and all capped off with a very strong balance sheet.

Gerardo Del Real: I've described the uranium equities trading pattern as a two-steps-forward, one-step-back type of situation. I think we've seen that recently. And I think the step back that a lot of the equities took is, in my opinion, probably at or near completion.

For those that maybe feel like they missed out on the early innings — if I'm using a baseball analogy of the uranium bull market that we're in — where do you think we are? If we're using that baseball analogy, if it's a nine-inning game… where do you think we are in that uranium bull cycle?

Amir Adnani: In any commodity that's been in a bear market for over a decade and where there's been underinvestment, you start by looking at supply/demand. And we look at supply/demand today after a decade of no investment in mine development and a really long bear market.

Again, for most listeners, normal commodity ups and downs are where you might have three bad years and two good years. We had over 10 bad years in uranium, okay? So this is an unusually long bear market. It doesn't get worse.

Now with that, we arrive today and we have a market that is going to be consuming close to 200 million pounds of uranium annually, producing 135 million. So you have a 65 million pound structural deficit this year. At that supply deficit compounded over the next seven or eight years to the end of the decade is over 400 million pounds. And so, these are big numbers.

So then you ask yourself, ‘Great, the uranium price is up as a result,’ which it is; it's gone from US$25 a pound to US$50 a pound year-over-year. That's a big move. So, ‘Hey, Amir, Gerardo, with this structural deficit, this big move in the uranium price, how many new uranium mines are under construction worldwide to stimulate the supply side?’ The answer is zero!

And so, where are we in this inning, getting back to your question, we’ve got to be in the first inning because what happens is, once you come out of a long bear market, the commodity price moves up, which it has in uranium. But then, you start to see mine development. And that mine development then starts to take pace and accelerate until you get to a market that's in equilibrium. At US$50, US$52 uranium, there's not a single brand new uranium mine under construction anywhere in the world.

There are a number of restarts. For example, our company is the leading player out there when it comes to a restart. What is a restart? That's a project that was built already. In our case, when we acquired Uranium One from the Russian government late last year — which was a really big transaction for us; the biggest M&A deal in the sector — the Russians had spent $400 million building these assets over the last decade. This, for us today, constitutes a restart.

But how many new projects are being built? The answer is zero. So what does that mean? The price of uranium at US$50 to US$52 per pound is nowhere near what would be deemed incentive levels to see worldwide projects get developed. Until that happens, we're in the early innings of what this new uranium bull market is all about. And whether that incentive price is US$75 or US$100 per pound, time will tell.

Of course, we have inflation at a 40-year high. We have supply chain bottlenecks and raw materials — and there's delays in everything. If you want to do a renovation at your home, if you want to put in a new deck, or if you want to paint your home or whatever the case is — there's delays with everything.

Now, imagine if you're building a billion-dollar mine. And that's what a brand new mine is going to cost. A brand new mine isn't going to be a simple exercise to just put a few million dollars in and build something. Brand new mines are going to take years and hundreds of millions of dollars in the industry to be built. So, I believe we're in the very early innings of this new uranium bull market. We know we're in a bull market because the price of the commodity has signaled that to us with a big move year-over-year after a decade of just doing nothing.

And now — whether it's the supply/demand fundamentals or the global move towards decarbonization and the importance that nuclear power is receiving as a key ingredient in the energy mix moving forward to help reduce carbon levels and decarbonize — this is a whole new setup from a positive point of view for nuclear that we've never seen before.

I've never seen the stars align, in my almost 20 years in the sector, the way they're aligning right now for nuclear energy and for the fundamentals of the uranium sector.

Gerardo Del Real: Amir, well said as always. Thank you so much for your time and your insights and looking forward to chatting, catching up, and connecting in person soon.

Amir Adnani: Thank you, Gerardo.

A Green-Energy Opportunity in Uranium

For all of the reasons outlined in this Special Report — a revitalization of America’s uranium industry appears imminent.

We’re already seeing the beginning stages of this pending resurgence with a recent U3O8 price move from the US$25/lb range to currently right around US$50/lb.

You also just heard from Uranium Energy CEO Amir Adnani. He says:

“What we have today in Uranium Energy Corp. is, by far, the leading company in the United States when it comes to uranium development and mining. We have a portfolio that is larger than any other company in terms of total resources in the ground… We own two fully-built and licensed processing plants. We can process our own uranium at these locations. Eight different satellite projects that could be mined using the low-cost in-situ recovery and shipped to our central processing plants — close to 150 million pounds of uranium in the ground in all categories of compliant resources… We have over US$180 million of cash and liquid assets on our balance sheet; no debt… And we've put together a portfolio of 5 million pounds of uranium that we contracted, kind of like a stream that comes to us at a fixed cost of $38 per pound between now and late-2025.”

The bottom line is that there are very few US uranium exploration and development firms that are set to go with fully-permitted projects once the signal flashes green.

That’s happening now with the Biden administration’s plans to seek congressional approval for $4.3 billion in purchases of low-enriched uranium from US suppliers.

That makes Uranium Energy Corporation (NYSE-American: UEC) — with its seven permitted US ISR uranium projects and two production-ready ISR hub and spoke platforms in South Texas and Wyoming anchored by fully-licensed and operational processing capacity at the Hobson and Irigaray processing plants — a go-to name in the space.

It also puts UEC in the rare position of being able to quickly ramp up to domestic production as US utilities continue to make U3O8 purchases in the open market.

And that’s not even mentioning UEC’s recent accretive acquisition of UEX, which brings with it 29 uranium projects in Canada’s prolific Athabasca Basin.

Well-Funded to Achieve its Near-Term Objectives

At over US$180 million in cash and liquid assets and no debt, UEC has one of the most impressive balance sheets of any company in the junior resource space.

That includes a ~20% equity stake [15 million shares at an average cost base of C$1.09 per share] in Uranium Royalty Corp. (TSX-V: URC) — the first and only publicly-listed uranium royalty and streaming company. URC currently trades above C$3 per share.

The value of that equity position has increased dramatically following Uranium Royalty’s 2021 acquisition of royalties on Cameco’s MacArthur River and Cigar Lake mines in Canada’s Athabasca Basin — the two largest high-grade uranium mines in the world.

We also discussed UEC’s ongoing program of physical uranium purchases in the spot market, which is already beginning to pay dividends as U3O8 prices continue to rise.

The company now has agreements in place to secure 5 million pounds of US-warehoused U3O8 at a volume-weighted average price of approximately US$38 per pound, which is well below spot, with delivery dates out to late-2025.

With no less than four fully-permitted ISR uranium projects on US soil with a 4 million lb/yr production profile, a ground floor opportunity is emerging for foresighted investors seeking exposure to a resurgent US uranium market as the world turns to clean-burning, carbon-emission-free nuclear power.

The company is also implementing a full ESG program for its operations, including corporate governance and stakeholder interests.

Now is an opportune time for speculators to commence their own due diligence on Uranium Energy Corporation — symbol UEC on the NYSE-American Stock Exchange.

You can learn more about Uranium Energy Corporation, sign-up to the company’s investor list, and receive an investor kit here.

Also, click here to get real-time updates from the company on their Twitter feed.

— Resource Stock Digest Research

Click here to see more from Uranium Energy Corp.