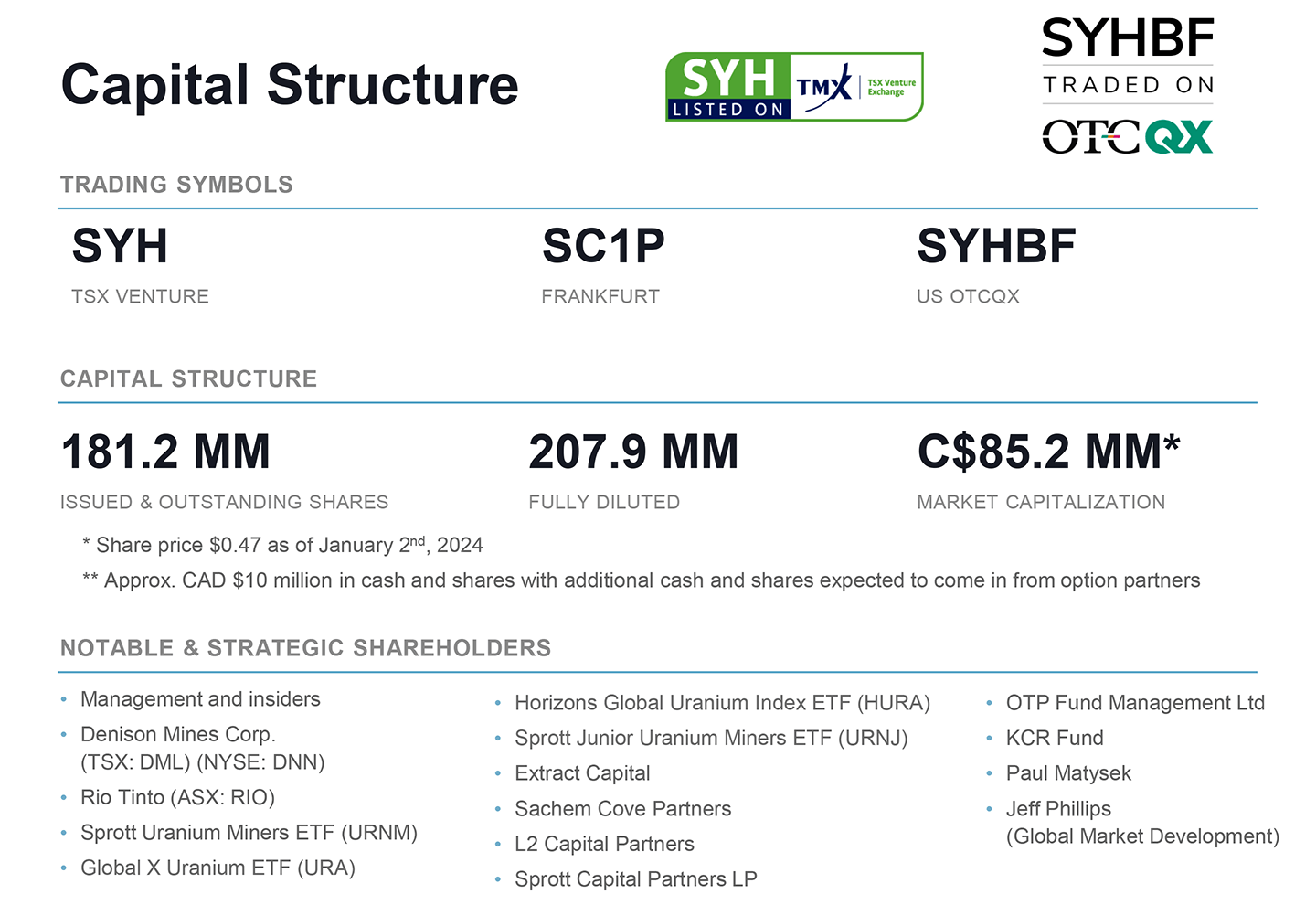

TSX-V: SYH | OTC: SYHBF

Advancing Multiple High-Grade Uranium Exploration Projects in the 2024 Uranium Bull Market

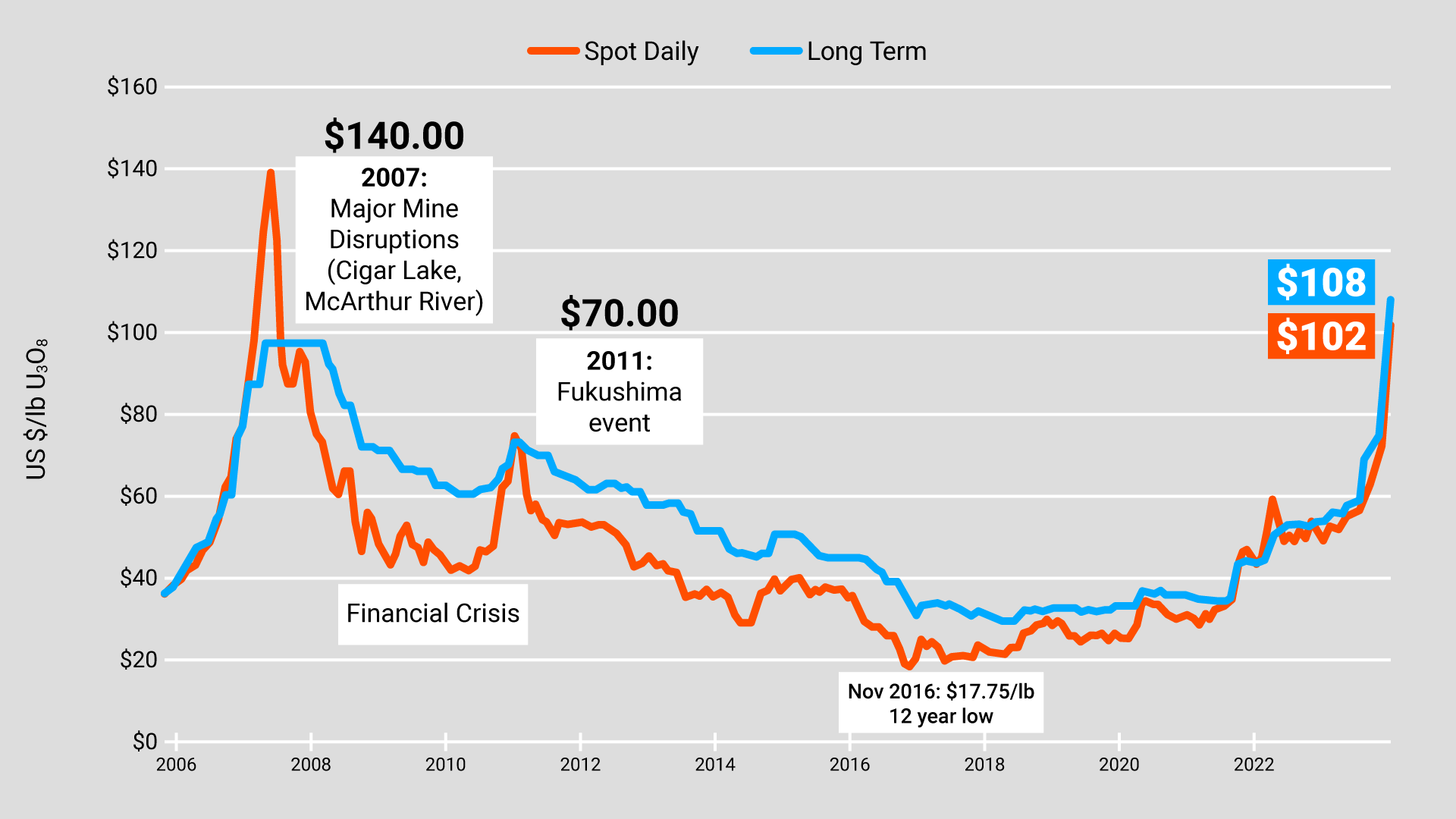

The new uranium bull market is now underway with U3O8 prices surging to decade-plus highs above US$100 per pound…

…and best of all, it’s still early innings with more potential upside and uranium equities offering additional value relative to the commodity price.

The small-cap uranium company featured in this report — Skyharbour Resources Ltd. — has acquired an extensive portfolio of uranium exploration projects in Canada’s prolific Athabasca Basin and is well-positioned to benefit from improving uranium market fundamentals with 25 projects, ten of which are drill-ready, covering over 520,000 hectares (over 1.2 million acres) of land.

The flagship projects are the 100%-owned Moore Lake Uranium Project located 15 km east of Denison’s Wheeler River uranium project and 39 km south of Cameco’s McArthur River uranium mine as well as the adjacent Russell Lake Project being optioned from Rio Tinto. Additionally, SYH has a total of 8 partner-funded uranium projects in the Athabasca Basin region as part of their prospect generator strategy.

Uranium Bull Market Underway in ‘24

There’s a major positive shift happening in the global nuclear energy market.

The world is quickly realizing that lofty climate goals will be impossible to meet without clean-burning, carbon-emissions-free nuclear energy being an integral part of the clean-energy mix.

That fact is adding escalating pressure on an already constrained global uranium supply.

With uranium, what we arrive at is a market that’s consuming close to 200 million pounds of yellowcake annually — yet producing only around 140 million pounds.

That equates to a 60-million-pound structural deficit this year… which, when compounded over the next six years to the end of the current decade, balloons to a jaw-dropping ~360 million pounds.

That’s a staggeringly large deficit… and it underpins the escalating need for new domestic and friendly uranium sources reaching the supply chain.

And it’s really only the start.

On the demand side, we have Japan looking to restart a further 16 of its reactors. The island nation is also seeking ways to safely extend the plant-life of its existing reactor fleet from 40 to 60 years.

China just approved the construction of six new nuclear reactors across three provinces with plans to build 150 new reactors over the next 15 years as part of their newly-enhanced decarbonization mandate.

South Korea and India have also joined the fray and are now fully onboard with a cleaner energy future that will require vast amounts of uranium, or U3O8.

In Europe, France’s economy minister has doubled down on the need for a top-to-bottom overhaul of the electricity market saying, “there is no energetic transition without nuclear energy.” The nation has announced plans to construct a new generation of nuclear reactors for the first time in decades.

Even Finland’s Green Party — following decades of staunch opposition — voted overwhelmingly last year to categorize nuclear power as a form of sustainable energy. At present, one-third of Finland’s electricity is derived from nuclear power. And in 2023, the country’s OL3 reactor, Europe’s largest, finally went online.

Other European nations are quickly falling in line with Finland’s pro-nuclear stance. Britain and Sweden are each planning new nuclear reactor projects with Belgium and Spain also cementing their support for the clean energy source.

At the COP28 conference in Dubai in December 2023, 22 nations including some of the largest economies in the world, signed a declaration to triple nuclear capacity by 2050.

Here in the United States, TerraPower is currently constructing a US$4B nuclear power plant in Wyoming that’ll use an all-new blend of enriched uranium.

Once completed, it is expected to generate efficient, low-cost, clean energy while utilizing enhanced safety standards that greatly reduce the risk of accident — even on par with wind power plants.

NuScale recently became the first company to be granted approval by the US government on small modular reactor (SMR) designs with the US Nuclear Regulatory Commission giving it the green light. Privately-owned Standard Power followed up that news with an announced partnership with NuScale on the construction of two SMRs to power its data center company customers.

Put plainly, increased uranium demand is coming from all angles. And that includes a new contracting cycle that’s just now getting underway with major utilities entering the market to secure their next long-term U3O8 contracts.

The combination of dwindling secondary supplies, supply cuts from the highest-margin producers, and utilities coming back into the market will create what many experts agree could be the greatest uranium bull market anyone has ever seen.

The Inflation Reduction Act of 2022 also provides funding for US nuclear power projects, including a tax credit for electricity produced at qualified nuclear power facilities.

Next, you have to look at the precariousness of the global uranium supply to really get the full picture.

Kazakhstan — a former soviet republic and the world’s largest uranium producer — produces roughly 40% of global supply. Last year, as you may recall, the country erupted into what’s now known as ‘Bloody January’ wherein over 225 people were killed in a government crackdown on nationwide protests.

Cameco, which owns 40% of the giant Inkai uranium mine in Kazakhstan, had this to say:

“As 40% of the world's uranium supply, any disruption in Kazakhstan could of course be a significant catalyst in the uranium market. If nothing else, it's a reminder for utilities that an over-reliance on any one source of supply is risky. It also reinforces the shift in risk from suppliers to utilities that has occurred in this market.”

Cameco, which accounts for roughly 17% of global uranium production, is experiencing production issues of its own — to the tune of about a 2.7 million pound shortfall expected for 2023 — citing ongoing difficulties at its Cigar Lake and McArthur River mines as well as at its Key Lake Mill in Canada.

Uranium supply is being further hampered by a recent military coup in Niger (the world's seventh-largest producer representing over 4% of supply).

It’s that type of geopolitical chaos that’s leading to increased energy insecurity around the world as supply comes under increasing pressure, particularly in the global uranium market.

Uranium supply is also under siege as companies look to capitalize on the opportunity to purchase large amounts of drummed uranium in the open spot market with the Sprott Physical Uranium Trust (SPUT) acquiring some 50M lbs over the last couple of years — and with others like Yellowcake PLC and Uranium Energy Corporation following suit.

As a result, uranium inventories are continuing to shrink, most notably from 3.5 years to around 2 years of supply right here in the United States, well below the historical average.

We also talked about restarts and lifespan extensions on reactors… and it’s not just Japan that’s going down that road.

In California, steps are underway to potentially extend the life of the Diablo Canyon reactor for an additional 5 years from 2025 to 2030. The same exact thing is happening in countries such as Belgium, Finland, and Slovakia.

All of that is to say that any further disruptions to the global uranium supply chain could lead to a run on uranium spot prices — possibly like what we saw back in 2006-07 when uranium soared to US$140 per pound upon the flooding of Cameco’s Cigar Lake Mine.

That upsurge caused the share prices of most uranium mining companies to breakout… resulting in substantial gains for well-timed investors.

We’re currently just north of US$100 per pound U3O8. A couple of years ago, uranium prices were languishing at the US$30/lb level. So the uptrend is undoubtedly underway as you can tell by the uranium price chart below.

With geopolitical upheaval at an all-time high in key uranium producing countries, including Russia (which will have its uranium exports sanctioned by the United States in the coming years), the writing’s clearly on the wall for higher uranium prices going forward.

It also underpins the need for increased uranium production from safe jurisdictions such as the Athabasca Basin, located in Northern Saskatchewan, Canada, where Skyharbour is operating.

It’s still early innings in the current uranium uptrend, which means now is an opportune time for resource investors to consider positioning for what could be a material move higher.

Enter Skyharbour Resources Ltd. (TSX-V: SYH)(OTC: SYHBF).

Skyharbour Resources: A Brilliant Growth Model

Skyharbour Resources Ltd. (TSX-V: SYH | OTC: SYHBF) is a high-grade uranium exploration and early stage development company with 25 projects, ten of which are drill-ready, covering over 520,000 hectares (over 1.2 million acres) of land in the prolific Athabasca Basin of Saskatchewan, Canada.

These projects range from more advanced-stage exploration assets that either host small uranium resources and/or have high-grade U3O8 mineralization in previous drilling, to earlier-stage exploration properties ideal for optioning out to partner companies who then fund the exploration.

The Athabasca Basin is truly where the big boys come to play!

Industry leaders like Cameco have their largest uranium mines in the Athabasca. These are some of the biggest and richest uranium mines in the world… including behemoths like McArthur River and Cigar Lake.

Saskatchewan is consistently ranked as one of the best mining jurisdictions in the world, per the Fraser Institute — a benefit that simply cannot be overstated in today’s world where the nationalization or over-taxation of mining assets from foreign operators is commonplace.

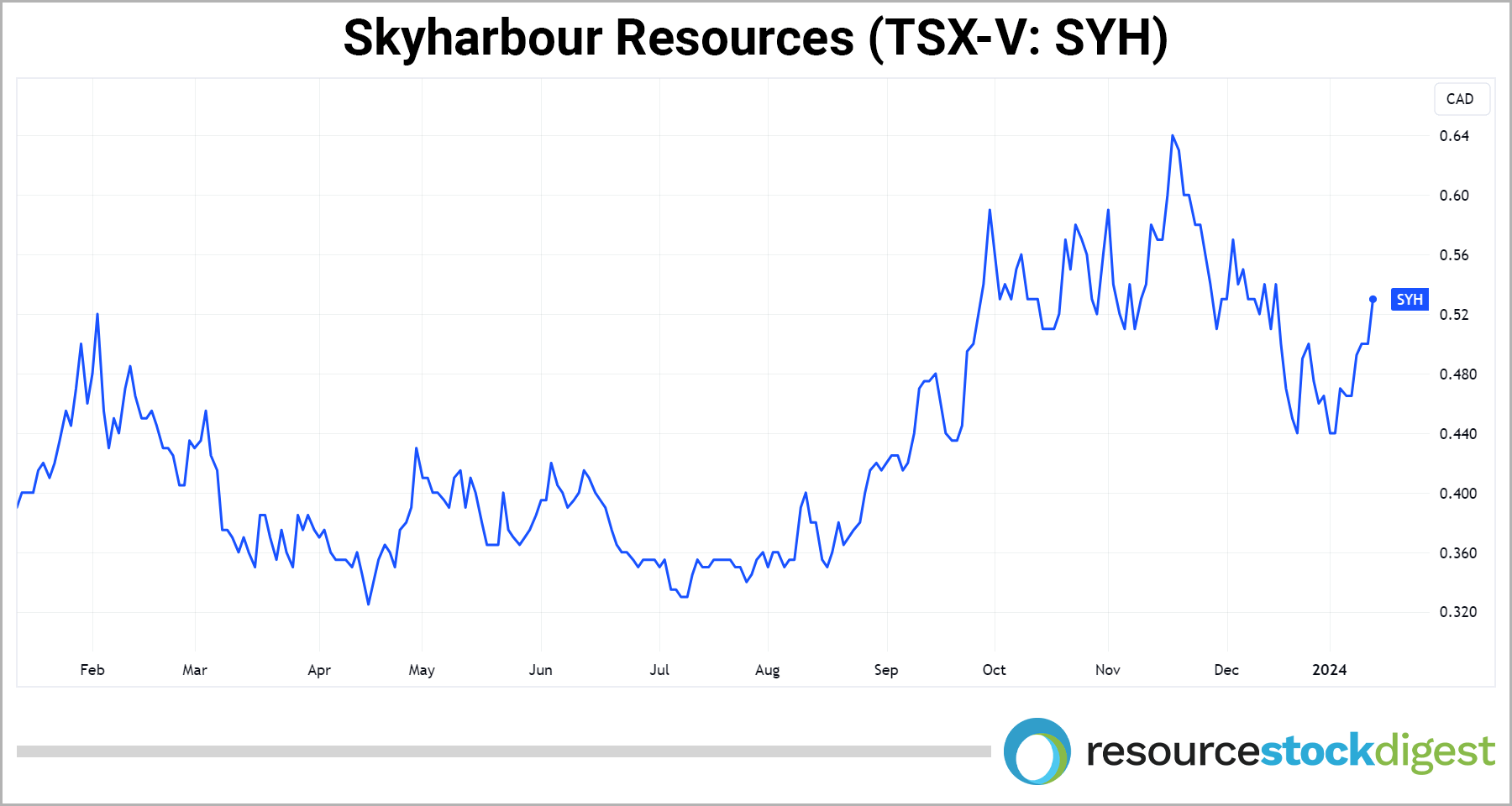

With its own core projects plus several additional prospective properties being advanced by partners in the Athabasca Basin region, Skyharbour Resources Ltd. — currently trading around C$0.50 per share — represents an intriguing speculation in the North American uranium exploration space.

Co-Flagship Property: Moore Uranium Project

Skyharbour owns 100% of the 137 sq mi Moore Uranium Project located 9 miles east of Denison’s Wheeler River uranium project and 24 miles south of Cameco’s McArthur River uranium mine — all situated in Canada’s famed Athabasca Basin.

The Athabasca Basin hosts the world's richest uranium deposits and mines, producing approx. 15-20% of world’s primary uranium supply.

In 2016, Skyharbour acquired the Moore property from Denison Mines, a large strategic shareholder of the company.

The project is an advanced-stage uranium exploration property with high-grade uranium mineralization at the Maverick Zone that has returned drill results of up to 6.0% U3O8 over 5.9 meters, including 20.8% U3O8 over 1.5 meters at a vertical depth of 265 meters.

In addition to the Maverick Zone, the project hosts other mineralized targets with strong discovery potential, which the Skyharbour team plans to test with future drill programs. In fact, the company is planning a 3,000 meter drill program in Q1 of 2024 to continue delineating and expanding known high-grade zones at the Maverick Corridor as well as testing regional targets.

Skyharbour CEO, Jordan Trimble — whom you’ll be hearing from momentarily in our exclusive interview — commented via press release:

“We continue to discover and delineate new zones of uranium mineralization at our high-grade Moore Project and have plans for future drilling and exploration at the property…”

Keep in mind also that the main Maverick corridor is approximately 4.7 km long with just over half having been systematically drill tested to date, which means there’s plenty of expansion potential along strike and at depth.

Option with Rio Tinto to bring in Second Flagship Project: Russell Lake Uranium Project

On May 19th, 2022, Skyharbour announced that it had successfully entered into an option agreement with Rio Tinto to acquire up to a 100% interest in the Russell Lake uranium property.

The property is strategically located between Skyharbour’s other flagship, 100%-owned Moore uranium project and Denison Mines’ Wheeler River uranium project, and gives SYH a dominant land position in the southeastern corner of the basin (see below).

The Russell Lake project — which can be considered a co-flagship for Skyharbour — is an advanced-stage exploration property comprising 26 claims and covering more than 73,000 hectares (283 sq mi).

The property is in close proximity to critical regional infrastructure including Cameco’s McArthur River Mine and Key Lake Mill as well as a road, powerline, and exploration camp situated on the property.

The deal — which has an initial earn-in of 51% and can ramp up to 100% — provides Skyharbour, as operator, with a nearly contiguous block of highly prospective uranium claims totaling over 100,000 hectares (420 sq mi) when combined with the company’s adjacent Moore project.

The Russell Lake property benefits from a significant amount of historical exploration and drilling — 95,000 meters across 230 drill holes — resulting in the identification of numerous prospective target areas along with several high-grade uranium showings and drill hole intercepts.

Skyharbour completed an inaugural three-phased, 9,600-meter drill program in 2023 across 19 holes at the Russell Lake Project. Given the success of the inaugural drill program carried out by the Company at Russell Lake, a follow-up drill program of 5,000 meters will be carried out in Q1 of this year.

Skyharbour Resources CEO Jordan Trimble commented by press release:

“We are very pleased with the inaugural drilling program at the Russell Lake Uranium Project. Numerous holes at the Grayling target area intersected significant zones of uranium mineralization including hole RSL23-01 which represents one of the best drill results at the project. Skyharbour has also expanded the extent of the known mineralized zones to over a kilometer at Grayling. Most of the drilling at the project historically has been widespread exploratory drilling and we are even more confident in the discovery potential and exploration upside at Russell Lake given this program along with the many highly prospective target areas hosting the geological ingredients necessary for high-grade uranium deposition. Planning is well underway for an upcoming, fully-funded winter drilling program with the project accessible all year round with road access, powerlines and an exploration camp.”

The initial first-phase of drilling in the 2023 program consisted of approx. 3,662 meters with a primary focus on the Grayling Zone where historical drilling has intercepted high-grade uranium mineralization in multiple holes. This was followed by a second phase of drilling consisting of 2,730 meters in four holes at the Fox Trail target area, then returning to the Grayling Zone for the final phase where an additional 3,203 meters was drilled in seven holes. Uranium mineralization was intersected in the majority of holes at the Grayling Zone over a strike length exceeding one kilometer.

Drill hole RSL23-01 intersected one of the best ever drill results from the project, returning a 5.9 meter wide intercept of 0.151% U3O8 at a depth of 338.4 meters, which includes 1.0 meters of 0.366% U3O8 at 343.3 meters depth within a thrust wedge.

The program also followed up on notable historic exploration and findings, including the drill-testing of additional targets with the potential to generate new discoveries. Several notable exploration targets exist on the property in addition to the Grayling Zone and the Fox Lake Trail area, including the M-Zone Extension target, the Little Man Lake target, and the Christie Lake target. Some of these will be tested in the upcoming winter program starting in January 2024.

Importantly, more than 35 km of largely untested prospective conductors in areas of low magnetic intensity exist on the property. Of course, never a bad thing having an industry titan like Rio Tinto as a large shareholder and also as a potential future project partner at the co-flagship project.

Partner Funded Projects: Multiple Drill Programs Planned

In addition to the co-flagship Moore Uranium Project and the option agreement with Rio Tinto on the other co-flagship Russell Lake project, Skyharbour boasts a total of 8 additional partner projects in Saskatchewan’s Athabasca Basin region:

- Preston: JV with Orano Canada Inc.

- East Preston: JV with with TSX-V-listed Azincourt Energy

- Mann Lake: Option partnership with CSE-listed Basin Uranium Corp.

- Hook Lake: Option partnership with ASX-listed Valor Resources

- Yurchison: Option partnership with CSE-listed Medaro Mining Corp.

- Falcon: Option partnership with TSX-V-listed North Shore Uranium

- South Falcon East: Option partnership with TSX-V-listed Tisdale Clean Energy Corp.

For speculators, having a suite of active partner projects means Skyharbour will be delivering news flow not just from its primary projects but also by way of its regional partner-funded projects as developments arise and as milestones are checked off.

Preston Uranium Project

Skyharbour is joint-ventured with industry-leader Orano Canada Inc. at the Preston Uranium Project whereby Orano — France's largest uranium mining and nuclear fuel cycle company — has earned a 51% interest by way of exploration expenditures and cash payments. Skyharbour currently holds a 24.5% interest in the project.

The Preston project spans 49,635 hectares and is strategically located proximal to NexGen’s (TSX-V: NXE) high-grade Arrow uranium deposit and Fission Uranium’s (TSX: FCU) Patterson Lake South project, host to the high-grade Triple R deposit. Orano has plans for exploration and drilling in 2024 which will further add to Skyharbour’s news flow over the coming months.

East Preston Uranium Project

Skyharbour is joint-ventured with Azincourt Energy on the neighboring East Preston Uranium Project (see below) whereby Azincourt has earned a majority interest through exploration expenditures, cash payments, and share issuance. Skyharbour maintains a 9.5% interest in the project.

Azincourt completed a 3,000-meter, 13-hole drill program at East Preston in Q3 2023.

Azincourt VP of Exploration Trevor Perkins noted:

“The alteration we are seeing in the K and H-Zones is very encouraging. The associated elevated uranium present is also very promising and shows that we are vectoring towards something in this area. The identification of dravite and illite clays with the elevated uranium emphasizes that we are on the right track and getting close. This target area will be a top priority moving forward and based on results we may see the north-northwest trending structures taking on more significance for targeting on this trend and others on the property.”

Although not an official discovery as of yet, it’s important to note that numerous Athabasca-based uranium deposits — including Key Lake, Millennium, and McArthur River — have been discovered by mapping out zones of alteration by way of the drill-bit.

To date, Azincourt has identified three distinct corridors at East Preston totaling over 25 km of combined strike length, each with multiple EM conductor trends.

Based on data collection from previous exploration and drilling, and with permits now in hand, the company is putting together a winter 2024 drill program at East Preston focused primarily on the property’s H- and K-Zones. Other zones will also be tested, including conductive corridors within the A-Zone through to the G-Zone.

Falcon Uranium Project

In Q2 2023, Skyharbour entered into an agreement wherein North Shore Uranium can earn-in up to a 100% interest in the Falcon Property in the Athabasca Basin.

North Shore is planning exploration and drilling programs to commence in 2024, which will be focused on several targets along a well-defined, dominantly northeast-southwest-trending EM conductor system at the southeastern end of the claim block.

The property contains 11 mineral claims, comprising approximately 42,908 hectares located approximately 50 km east of the Key Lake mine.

Back in 2022, Skyharbour completed a FALCON® airborne magnetic survey over nine of the eleven claims; the new geophysical data should go a long way in assisting North Shore in prioritizing areas along the EM conductor system for the upcoming drilling planned.

At Falcon, North Shore can earn-in an initial 80% of the project through C$3,550,000 in exploration expenditures, C$525,000 in cash payments as well as C$1,225,000 in share issuances over three years followed by the option to acquire the remaining 20% of the project from Skyharbour through a cash payment of C$5,000,000 plus C$5,000,000 in shares.

South Falcon East Uranium Project

The South Falcon East project is located in the eastern perimeter of the Athabasca Basin and contains a NI 43-101 inferred resource totalling 7.0 million pounds of U3O8 at 0.03% and 5.3 million pounds of ThO2 at 0.023%.

The project is currently optioned to Tisdale Clean Energy Corp., whereby Tisdale can acquire an initial 51% interest and earn up to 75% by issuing 1.1 million Tisdale shares, spending C$10.5 million on exploration, and making cash payments totaling C$11,100,000 of which C$6,500,000 can be settled for Tisdale shares over the five-year earn-in period.

Tisdale is planning an extensive preliminary drill program to commence in early 2024, which will consist of approx. 2,000 meters. The priority will be to confirm and expand the existing mineralization associated with the Fraser Lakes Zone B uranium deposit.

Located just outside the Athabasca Basin approximately 50 km east of the Key Lake Mine, South Falcon East — which has seen plenty of historical exploration and has a small inferred resource — consists of a series of 16 mineral claims totaling 12,234 hectares.

Mann Lake Uranium Project

Basin Uranium Corp. has an option to acquire a 75% interest in the Mann Lake Uranium Project from Skyharbour.

The project has seen more than C$5 million in previous exploration expenditures and is situated just 25 km southwest of Cameco’s McArthur River mine — the largest high-grade uranium deposit in the world — and 15 km to the northeast of Cameco’s Millennium uranium deposit.

In Q1 2023, Basin Uranium received assays from a Phase-2, four-hole drill program across 2,776 meters at Mann Lake with multiple holes intersecting uranium mineralization in the targeted basement rocks.

Basin Uranium CEO Mike Blady commented via press release:

“The completion of our phase two drill program represents the culmination of a very active and successful 2022 exploration program that was comprised of nearly 6,300 meters of diamond drilling and multiple geophysical programs at our Mann Lake project. We were able to advance this project from a grassroots-stage, one that had not seen any modern exploration techniques or benefitted from the last two decades of exploration understanding in the basin, through to a multi-phased diamond drill program that defined the unconformity and intersected uranium mineralization.”

To complete the previously announced 75% earn-in, Basin Uranium Corp. must pay Skyharbour C$850,000 in cash plus C$1.75 million in shares and spend C$4 million on exploration over a three-year period. Basin Uranium is planning exploration programs for 2024.

Hook Lake Uranium Project

At Hook Lake, Valor Resources can earn-in 80% through C$3,500,000 in exploration expenditures, C$475,000 in cash payments over three years, plus an initial share issuance to Skyharbour.

Valor Resources completed its maiden drilling program at Hook Lake earlier in 2022.

The drill program comprised eight drill holes for 1,757 meters with six holes at the S-Zone prospect and two at the V-Grid prospect.

A total of 305 samples were collected from the program and submitted for assay with all results having now been received. The assays came in within the boundaries expected and highlight uranium mineralization at depth.

Those results, coupled with 11 new targets from a recently completed airborne survey, should allow for the delineation of new potential drill targets for next-phase drilling at Hook Lake.

Yurchison Uranium Project

At Yurchison, Medaro Mining Corp. can earn-in an initial 70% of the project through C$5,000,000 in exploration expenditures, C$800,000 in cash payments as well as share issuances over three years followed by the option to acquire the remaining 30% of the project from Skyharbour through a cash payment of C$7,500,000 plus C$7,500,000 in shares.

Medaro has completed an airborne geophysical survey at Yurchison with the aim of refining existing historical targets plus the identification of new high-priority drill targets. Exploration and drilling is being planned for 2024.

South Dufferin Uranium Project

In Q2 2023, Skyharbour acquired 100% of the South Dufferin Uranium Project in the Athabasca Basin region from Denison Mines (TSX: DML)(NYSE-Amer: DNN).

Skyharbour plans to seek a joint venture or option partner for the advancement of the project as part of its hybrid prospect generator business model.

The South Dufferin project is situated just south of the southern margin of the Athabasca Basin nearby to industry leader Cameco’s Centennial deposit.

Skyharbour Resources CEO Jordan Trimble commented via press release:

“We are very pleased to have reached an agreement with Denison to acquire a 100% interest in South Dufferin, adding to our recently staked properties and to our dominant uranium project portfolio in the Athabasca Basin. South Dufferin complements our more advanced-stage exploration assets including Russell Lake, Moore and South Falcon Point, and provides additional ground to option or joint-venture out to new partner companies as a part of our prospect generator business. Furthermore, Denison Mines has been a valuable strategic partner for a number of years and we welcome them as an even larger shareholder now.”

As part of the transaction, longtime strategic partner Denison Mines has effectively increased its investment in SYH. Additionally, Skyharbour owns a 922 hectare claim (Preston project; JV with Orano) adjacent to South Dufferin, bringing its cumulative total landholding in the immediate area to ~13,000 hectares (~130 sq km) over ten claims.

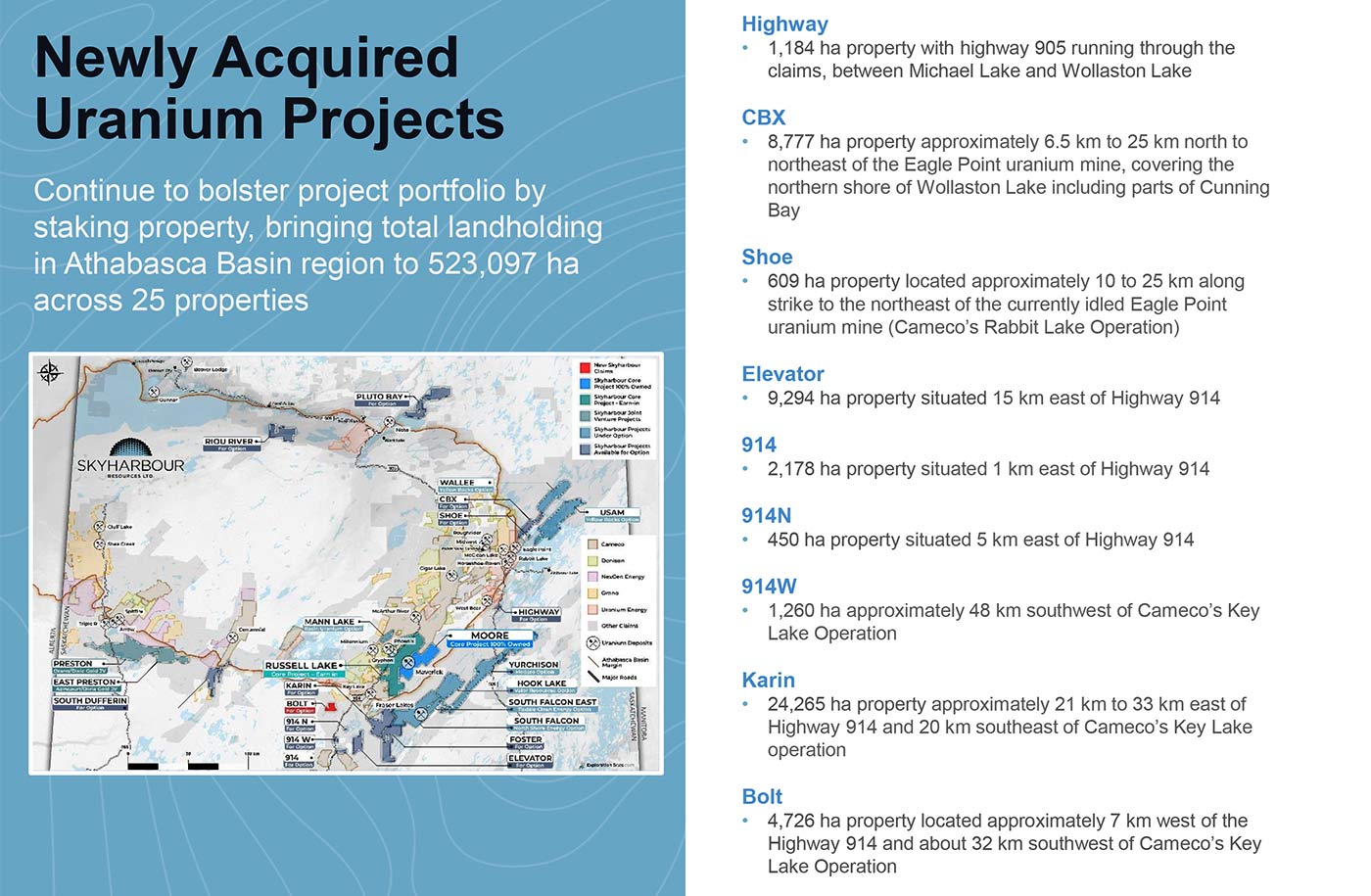

9 Newly Acquired Uranium Projects

In Q2 2023, Skyharbour acquired, through staking, eight new 100%-owned prospective uranium exploration properties within the Athabasca Basin. In Q4, Skyharbour added an additional two claims via staking, bringing the total to 9 new 100%-owned properties added to the project portfolio.

As an active hybrid prospect generator, Skyharbour intends to seek joint venture partners for the advancement of the newly-acquired early-exploration-stage assets.

Skyharbour Resources CEO Jordan Trimble added:

“These new mineral claims complement our existing properties and provide additional ground to option or joint-venture out to new partner companies as a part of our prospect generator business. We continue to add to our uranium project portfolio in the Athabasca Basin with this recent staking while advancing our main projects through ongoing drilling and exploration. Skyharbour is fully funded for its drilling and exploration plans in 2024 with over $10 million in the treasury. Details are forthcoming on specific plans for drilling at Russell and Moore in the new year.”

These newly acquired assets bring the company’s total land package in the Athabasca Basin region to nearly 5,000 sq km across 25 properties.

Prospect Generator Business

Tallying up the numbers, Skyharbour now has signed option agreements in place that could see partner companies contributing upwards of ~C$80 million in combined exploration expenditures, cash payments, and share issuances assuming these partner companies complete their entire earn-ins at the respective projects.

These partner-funded projects will no doubt provide a steady stream of news flow into 2024 while complementing Skyharbour’s forthcoming drill programs at the co-flagship Russell Lake and Moore Uranium Projects.

As noted, Skyharbour will also be actively seeking project partners for the nine early-stage uranium assets recently acquired, along with the other remaining 100% projects in and around the Athabasca Basin.

Exclusive Interview: Jordan Trimble, CEO, Skyharbour Resources Ltd.

We’ve done our due diligence on Skyharbour Resources… and we’re impressed with the company’s vast uranium property portfolio in the Athabasca, its partnerships with global uranium mining companies, and its highly-adept management team starting with CEO, Jordan Trimble.

Skyharbour boasts a highly impressive amalgamation of talent — one we firmly believe has what it takes to get the job done for early SYH / SYHBF shareholders.

It’s a team that includes none other than professional geologist and strategic advisor, Paul Matysek, who founded and led Energy Metals as CEO prior to its eventual buyout by Uranium One for US$1.5 billion in 2007. Also on the board is Denison Mines’ CEO David Cates.

These are the types of industry professionals you can have confidence in and that you want to bet on in this highly competitive industry.

Please enjoy our exclusive interview with Skyharbour president & CEO, Jordan Trimble.

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the president & CEO of Skyharbour Resources — one of my favorite uranium players in the space — Mr. Jordan Trimble. Jordan, how are you today?

Jordan Trimble: I'm doing well. It's good to be back on, and happy New Year to everyone.

Gerardo Del Real: Happy New Year to everyone is right. Happy New Year to us uranium bugs that have been waiting for this market to develop. The last time you and I spoke publicly, we were talking about a US$70/lb uranium spot price. We mentioned in that interview that it seemed like it would take a lot less time to go from US$70 to US$100 than it did to go from US$50 to US$70. That has played out beautifully.

I want to talk Skyharbour and how you positioned the company to take advantage of what I think is going to be a uranium bull market for the books. But before that, I have to get your take on the uranium space, the price action in the spot price, and how you see things developing because the supply/demand fundamentals make me giddy. I think it's going to be a profitable, profitable couple of years for us, Jordan.

Jordan Trimble: I agree. And I think when we last spoke about this, you're right, we were climbing through US$70, US$75 a pound. The market has now eclipsed US$90 a pound and is approaching US$100. We're not there quite yet but I do think we'll be there in short order.

There's a confluence of factors that are driving a higher uranium price. We've gone over the very, very compelling underlying supply/demand fundamentals. And just to recap that, because I think it's always important to remember these fundamentals, we have seen a major supply side response play out over the last six to seven years, culminating in what is now a significant supply crunch.

We simply do not have the secondary supplies, and in particular, the mobile secondary supplies that we once had to fill the structural supply deficit. We've got about 190 to 200 million pounds of annual demand… and it's worth noting that the growth in that demand has increased quite a bit over the last several years. It has been revised up from about 2.5% a year to over 4% a year. And I think that will continue to grow.

But the backdrop for that growing demand is a supply side that is about 140 to 145 million pounds a year of primary mine supply. So there is a major structural supply deficit. Again, secondary supplies from various sources have been able to plug that supply deficit. We’re seeing the age of having a lot of secondary supply coming to an end, and this is one of the main reasons we're seeing upward pressure on the uranium price.

When we look at the contract markets for uranium — and just to remind listeners that you've got a couple of prices that uranium is quoted in including the spot price, which a lot of market participants look at and which is what we're talking about — that has just moved through US$90 into the mid-US$90s. But most uranium is traded through long-term contracts. And when we look back at the long-term contracting market in 2023, we almost hit the replacement rate of 180 million pounds. It was reported that the volume for the year was just over 160 million pounds. So I expect we will see that replacement rate hit this year and in the coming years.

It's also important to note that when you look at previous years where replacement rate volumes were exceeded, those were years where you saw significant moves in the uranium price. We saw that in the mid-2000’s. We saw that again in the early 2010’s. So we're working our way to another one of those years where we'll see continued significant volumes in the long-term contract market.

I think Tim Gitzel, the CEO of Cameco, said it best when he said, "We've never been this early in the cycle with prices as high as they are today." And when we look at previous cycles like 2006-07 or 2010-11, where, again, you had high contracting volumes, you had upward pressure on the price. We haven't started at this US$80, US$90, US$95 uranium price before. So it's very, very bullish, I think, going into the new year.

A couple of other important developments that are worth keeping an eye on, is the fact that certain parts of the world like Kazakhstan and parts of Africa contribute to meaningful amounts of the primary global mine supply. And the West is going to have to be less reliant on these jurisdictions for its primary mine supply going forward.

As we see geopolitical tensions take hold as they have been, Western utilities are going to have to be more reliant on Western suppliers. And we just simply do not have new supply that can come online in the West in the next few years to meet that growing demand and, quite frankly, meet the current demand.

It's a very exciting time for the commodity. I think we're going to see much higher uranium prices. One other thing to talk about here is the fact that there is some catching up to do with the uranium equities, in particular the smaller and mid-cap names. This isn't unusual to see a bit of a lag as, typically, the smaller and mid-cap mining stocks outperform later in the cycle. I think that's yet to come.

And so investors have a lot to look forward to over the coming months and over the coming years with this sector and with the uranium price.

Gerardo Del Real: Let's talk about how you've positioned Skyharbour and shareholders to take advantage of that bull market that we are in. You have a ton of catalysts in 2024, not just at the co-flagships, which will see drilling, but also with your partner-funded activity, which is going to be substantial in 2024 and kind of positions shareholders for discovery potential across the board. You want to chat about some of those catalysts real quick?

Jordan Trimble: Yeah, absolutely. We announced this morning an 8,000-meter combined drill campaign across our two co-flagship projects. This will be the first time in our history as a company that we’ll be simultaneously advancing two of our core projects, Russell Lake and Moore.

Russell Lake is a project that we optioned from Rio Tinto. Rio has been a shareholder and strategic partner of ours now for well over a year. We completed an inaugural 9,600-meter drill program in 2023 and intersected significant zones of mineralization at what's called the Grayling target area at the project. We are planning to go right back into that target area. But this go around, we're going to be testing what's called the Grayling East target area and the Fork Zone.

The Grayling East target, as the name implies, is the eastern extension of the main Grayling conductive corridor. It's been sporadically drill-tested over many years. There's very strong discovery upside potential and we're seeing all of the right geological indicators. There's a big long conductive corridor, a mag low, and a number of the indicator minerals that you need to see for uranium deposition. So that's going to be a primary target that we're drill-testing early in this 5,000-meter drill program.

To the west of the main Grayling corridor is the Fork Zone, and this is actually an extension of a uraniferous conductive corridor from Denison's adjacent Wheeler River Project. Again, Denison Mines is a very large strategic shareholder of ours, and their main project, Wheeler River, is adjacent to Russell to the west. So this Fork Zone and Fork target area is the extension of a number of conductors that trend from Denison's Wheeler River Project. We're going to be drilling a few holes there, testing that target area.

And then, we're going to go a little bit further to the north and test what's called the M-Zone extension. This is also a continuation of uraniferous conductive corridors that host mineralization on Denison's Wheeler River Project that trend onto our Russell Lake Project.

Notably, all of these target areas are road accessible. There's an exploration camp that we've inherited from Rio Tinto as a part of the property transaction. We're going to be staging out of that, so that'll bring our drill costs down quite significantly. In fact, last year, when we drilled this project in the inaugural drill program, our all-in costs were quite a bit lower than what they would be if we were drilling a more remote project and certainly much more competitive than some of our peers.

We get a lot of bang for our buck drilling at Russell Lake. The 5,000 meters will start this month in January and probably take us right through into March. And at that point, we will look to move the rig over from Russell to our adjacent Moore Lake Project, which I think most of your listeners are familiar with as it has been a flagship in the company as an advanced-stage exploration project since 2016.

We've done a fair bit of drilling there over the years. We've had some noteworthy high-grade intersections highlighted by 21% U3O8 over 1.5 meters. That was within a 6-meter zone that hosted 6% U3O8. So very, very high-grade uranium mineralization.

We've been drilling a little bit deeper there in recent years into the underlying basement rocks below the high-grade at the Maverick Main and Maverick East Zones. And we've had success drilling into these basement rocks. Just a couple of years ago, we announced our highest-grade intercept of 7% U3O8 over 2 meters in these underlying basement rocks. So we're going to go back in, and we're going to do some infill and definition drilling in those high-grade zones at the Maverick corridor.

This should produce some results and some numbers that I think will get the market's attention. We're then going to continue exploring at regional targets at Moore Lake including the Grid Nineteen target area, which we drilled a few holes into over these last several years.

It’s going to be a very exciting few months coming up: 5,000 meters at Russell Lake followed by 3,000 meters at Moore. We're fully funded; we've got just under C$10M in the treasury. We're expecting the budget for this drilling to come in around C$3M to C$3.5M, so we'll have plenty left over to carry out additional drill programs and exploration programs going right through 2024.

Gerardo Del Real: I would be very surprised, Jordan, if we don't end 2024 with Skyharbour trading in dollars, not cents. I know that you're close to a 52-week high despite the recent consolidation. Catalyst after catalyst, we really didn't touch on all of the partner-funded drilling that's going to happen. Can you speak to that before I let you go?

Jordan Trimble: Skyharbour operates a hybrid model and strategy with focused high-grade uranium exploration and discovery potential at our main projects of Russell and Moore, but coupled with that, we act as a prospect generator. We look to bring in partner companies to advance our secondary and tertiary projects.

We've signed option agreements with a handful of partner companies across a number of our other projects in the Athabasca Basin, two of which are now joint ventures, one of which is Orano at our Preston Project. Orano is a strategic partner of ours. They are France's largest uranium mining and nuclear fuel company. They are planning an exploration program for 2024. We are planning to participate in that program so there will be some news out on that soon as they advance the Preston Project.

Adjacent to the Preston Project, another joint venture that we have is with Azincourt. Azincourt is the majority holder of the project, and we still retain a minority interest, and they have plans this year for additional drilling and exploration at the project. So we expect some news flow out on that as well.

And then, of the option partners that we have, we are expecting a handful of them to be carrying out exploration and/or drill programs over the course of this year.

As we announced late last year, we're expecting drill programs from Tisdale Clean Energy at our South Falcon East Project. This is host to the Fraser Lakes Zone B deposit. It's a very exciting, advanced-stage exploration project and we can't wait for them to get to work there. It's a project that we've spent money on over the course of the last six years. It's drill-ready, and I think there is going to be a lot of exploration upside realized on that project when Tisdale gets the drill rig there this year.

Adjacent to South Falcon East is the Falcon Project, which we've optioned more recently to North Shore, and they are planning a small inaugural drill program there in the first quarter of this year. Actually, both companies are planning to stage out of our camp at Russell Lake, and there are some cost savings associated with co-mingling resources and contractors. It's going to be an exciting couple of months for both of those companies as they advance the Falcon and South Falcon East Projects.

And then, when we look outside of that project area, we are expecting programs and some exploration expenditures from Medaro Mining at our Yurchison Project as well as at the Mann Lake Project, which is currently under option to Basin Uranium.

There's a lot going on. I just covered a handful of the option and JV partners. There's going to be a lot of news flow as a result of this. And again, one of the great things with this model is that you get exposure not just to the exploration and potential discovery upside that we offer at Russell and Moore but you also get exposure to potential new discoveries and exploration success that our partner companies offer.

Gerardo Del Real: Listen, I think for any uranium company that just wants to sit idly by and hope that a rising spot price gains you traction, Mr. Trimble, I think, just gave a class on how to be active and proactive in a bull market.

And again, kudos to you and the team, Jordan, because you were doing this during the bear market when the spot price was in the US$20 range. It's why you're so well positioned. Congrats on that front. Looking forward to a year full of discoveries and looking forward to more updates here. Anything to add to that?

Jordan Trimble: I think that covers it. Again, maybe just touching back on some of the important upcoming macro developments. We talked about the supply/demand fundamentals. We talked about the market bifurcation. We're seeing the sentiment around nuclear energy improve almost on a daily basis.

There was the COP28 conference in Dubai where 22 nations, including some of the largest economies in the world, signed off on a declaration to triple nuclear capacity by 2050. The big question mark there is where are they going to get the fuel for that?

We continue to see positive news on small modular reactors (SMR’s) and other advanced nuclear technologies. We're seeing this Russian uranium import ban work its way through Congress. I expect we'll see that fully passed here shortly. That's just, again, exacerbating this strain on the supply side and specifically the domestic supply side in the United States.

And as I talked about earlier, these Western utilities are going to have to rely more on Western suppliers. One other thing that's interesting and worth keeping an eye on is nuclear's role in the advent of artificial intelligence. I mean, this is a massive amount of new electricity demand that's going to be coming on.

We've already seen companies like Constellation Energy in the United States sign an agreement with Microsoft to provide them with emissions-free nuclear electricity for some of their data centers. And it'll be interesting to see how, as more electricity and power is needed to power AI, nuclear energy — again, as the only source of emissions-free, baseload, reliable, scalable, and affordable electricity generation — could play an integral role in that.

So there's a lot to be excited about. We are seeing the price move higher. I think there's going to be some catching up for the equities, and, in particular, the smaller and mid-cap uranium equities.

As we've seen in previous cycles, these companies outperform later in the cycle, and I do believe that we're going to see higher uranium prices throughout the year as the market has very much tightened up. We just simply do not have the near and mid-term supply side answer to this growing demand side.

Gerardo Del Real: Couldn't have said it better. Literally, could not have said it better. Jordan, thank you again.

Jordan Trimble: Thanks, Gerardo.

The Skyharbour Resources Opportunity

The new uranium bull market has arrived… and it’s only just getting started.

“Uranium has likely reached a pivotal inflection point that could force the price higher by as much as three to four-fold over the next several years. For the first time in history, uranium has slipped into a persistent and widening deficit. We believe the results will be dramatic.”

That’s how Goehring & Rozencwajg Associates, LLC describes the state of the uranium market — and we couldn’t agree more!

After an extended consolidation in the space, the uranium spot price is now riding decade-plus highs above US$100/lb with plenty of runway ahead.

We suspect the climb from US$100 to US$130-plus per pound will be an expedited one compared to how long it took to go from US$30 to where we are today.

Why? Several reasons.

The ongoing coups in Africa, coupled with other geopolitical factors — including Russia's invasion of Ukraine — are underscoring the need for clean energy sources that can contribute to a coordinated push for increased energy efficiency and energy security worldwide as a means of meeting net zero climate initiatives.

Nuclear energy is THE answer… and uranium is THE fuel source.

Earlier, we talked about ongoing uranium supply constraints with Cameco adding further fuel to the proverbial fire by announcing a 2.7 million pound uranium shortfall for 2023 from its Cigar Lake and McArthur River mines.

It’s a sign of the times: As old, existing mines deteriorate, exhaust their resources, and ultimately shutter, the global uranium supply will become increasingly dependent on new discoveries, such those being sought and made in Canada’s prolific Athabasca Basin.

With a ~360 million pound shortfall expected by the end of the current decade, uranium outperformed all other metals in 2023, gaining more than 50% and topping US$100/lb for the first time in 16 years.

Select small-cap uranium stocks — including Skyharbour Resources — appear poised to follow suit.

Led by President & CEO Jordan Trimble, Skyharbour Resources has amassed an impressive portfolio of 25 projects covering over 1.2 million acres (4,856 sq km or 1,875 sq mi) in and around the prolific Athabasca Basin region — oftentimes referred to as The Saudi Arabia of Uranium.

The combination of 100%-owned and partner-funded projects makes Skyharbour one to watch in the newly-resurgent uranium bull market.

You heard directly from CEO Jordan Trimble. He says,

It's a very exciting time for the commodity. I think we're going to see much higher uranium prices. One other thing to talk about here is the fact that there is some catching up to do with the uranium equities, in particular the smaller and mid-cap names. This isn't unusual to see a bit of a lag as, typically, the smaller and mid-cap mining stocks outperform later in the cycle. I think that's yet to come.

As we discussed in detail, the next major leg up in the uranium price will be driven by utilities coming into the market to secure long-term U3O8 contracts. That’s happening now.

And it means we could be setting up for a much higher uranium price environment — potentially well above US$100 per pound — for years to come.

The Skyharbour team is currently focused on advancing its co-flagship Moore and Russell Lake uranium projects located in the southeastern portion of the Athabasca Basin in close proximity to Denison's Wheeler River uranium project and Cameco’s McArthur River uranium mine.

The option agreement with Rio Tinto at Russell Lake — which has an initial earn-in of 51% and can ramp up to 100% — provides Skyharbour, as operator, a key advanced-stage exploration project with strong backing from an equally powerful partner.

Additionally, Skyharbour has partners funding some of its other projects in the Athabasca Basin region. Most of these partner companies are planning exploration activities and/or drill programs that they'll be funding the lion's share of over the next 12-18 months.

It’s a brilliant model of advancing certain 100%-owned projects on their own — such as the flagship Moore project — while joint venturing or optioning out other properties with the vast majority of exploration expenditures being on other companies’ dimes.

Skyharbour typically retains a minority interest in the property that’s being optioned out while also securing an equity holding in the partner company.

Collectively, Skyharbour inked earn-in option agreements with partners that total to over C$32 million in partner-funded exploration expenditures, over C$26 million worth of shares being issued, and over C$19 million in cash payments coming into Skyharbour, assuming these partner companies complete their entire earn-ins at the respective projects.

With a robust portfolio of twenty-four Athabasca-based uranium exploration projects, ten of which are drill-ready, being advanced in a bullish uranium market — Skyharbour’s sub-C$100 million market cap is considered small compared to some of its peers.

Plus, you really cannot overstate the significance of having three very well-established strategic partners in Denison Mines, Orano, and Rio Tinto, as discussed throughout.

Skyharbour is also well-funded with over C$9 million in cash and equity holdings with more money and stock coming in from partner companies earning-in at the company’s secondary projects.

Now is an excellent time to begin conducting your own due diligence on Skyharbour Resources Ltd. — symbol SYH on the Toronto Venture Exchange and symbol SYHBF on the US-OTCQX Exchange.

A great place to start is Skyharbour’s corporate website. Sign up for updates directly from the company here. View the 2024 Corporate Presentation here.

And be sure to follow our exclusive interviews with upper management and much more.

— Resource Stock Digest Research

Click here to see more from Skyharbour Resources Ltd.