GREEN ENERGY RESOURCES IN MINING-FRIENDLY CANADA

CSE: ATCM | OTC: ATMGF

Advancing Multiple Salt-Dome Exploration Opportunities for Green Hydrogen Storage in Newfoundland, Canada

Vancouver-based Atco Mining Inc. (CSE: ATCM)(OTC: ATMGF) is a Junior Exploration Mining Company focused on exploring for Green Energy Metals throughout Canada, including salt deposit/salt-dome exploration opportunities in southwestern Newfoundland, plus sulphide-rich VHMS deposits with potential for significant tonnage of gold, copper, and zinc in Saskatchewan.

Atco’s flagship is its portfolio of seven 100%-owned salt projects — spanning a combined 200-plus sq km — in Newfoundland’s St. Georges Bay Basin.

Early-stage exploration is underway across Atco’s salt projects, all of which are strategically located in southwestern Newfoundland — an area that lays host to a remarkable salt endowment, including Atlas Salt’s Great Atlantic Salt Deposit and Triple Point Resources’ Fischell’s Brook Salt Dome (Triple Point Resources was spun out of Atlas Salt in September 2022).

And while salt typically isn’t the first thing resource speculators think of when seeking out early-stage opportunities in the junior mining space, Atco Mining’s outside-the-box strategy within the St. George’s Bay Basin in southwestern Newfoundland presents a potential early-mover advantage in the growing green hydrogen storage arena as demand for the clean-burning fuel intensifies.

The Atco team has successfully consolidated a large land package (spanning 20,000-plus hectares) of early-stage salt dome exploration projects nearby to key maritime routes in the northern Atlantic that could potentially evolve into becoming an integral component of the burgeoning North American renewable hydrogen export sector.

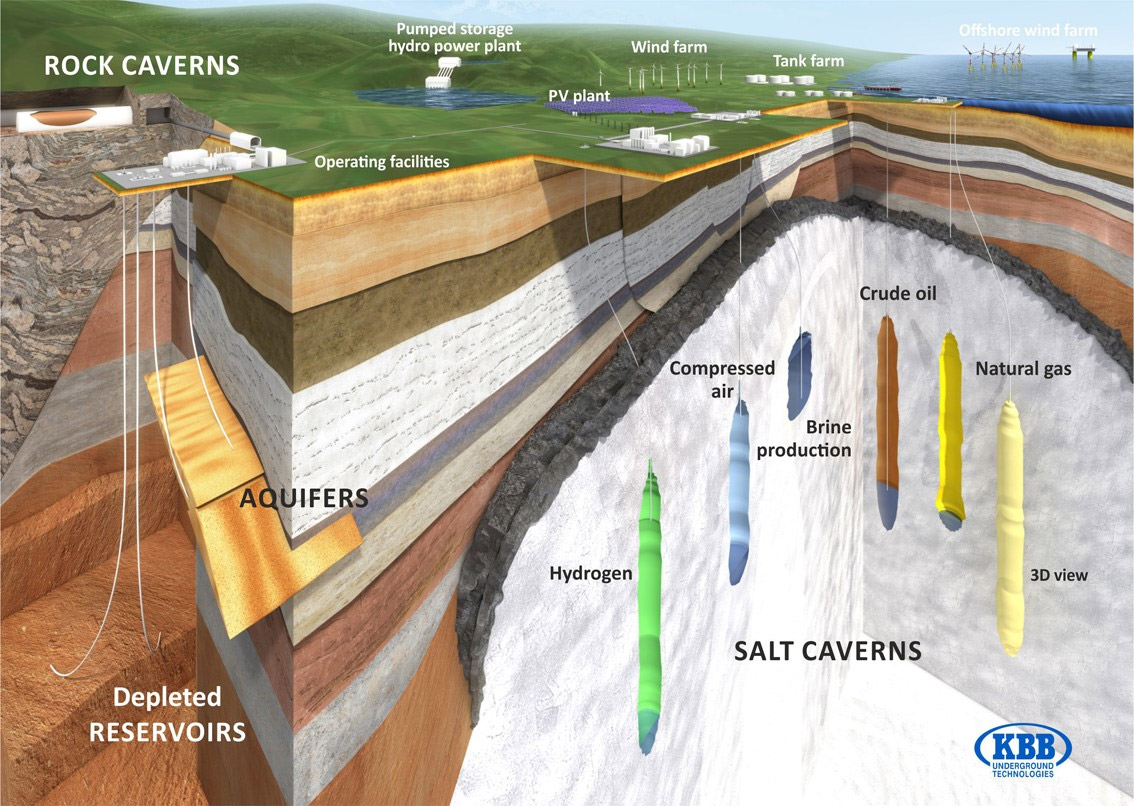

In terms of the salt mining process, once a viable salt dome, or salt cavern, is discovered, next steps involve drilling and injecting water into the salt to dissolve it.

The resulting brine is then extracted, leaving room for a large, air-tight cavern where green hydrogen can be stored under pressure until needed for use, transport, or export.

Recent studies confirm that green hydrogen — hydrogen produced by splitting water into hydrogen and oxygen using renewables such as wind-generated electricity — could supply up to 25% of the world’s energy needs by 2050.

Hydrogen fuel — which is clean and colorless and only emits water when utilized — is expected to play an essential role in the world’s future clean energy mix. Uses include everything from fueling automobiles, trains, and ships to electricity generation for the heating and cooling of homes and buildings.

Increased green hydrogen demand also means there’s going to be a need for increased hydrogen storage capacity in the coming years and decades.

To that end, underground hydrogen storage in giant salt caverns is emerging as a viable solution that Atco Mining intends to capitalize on to the benefit of ATCM / ATMGF shareholders.

As you’re about to discover in our exclusive interview with Atco Mining director Neil McCallum coming right up, the government of Newfoundland is moving forward with plans to utilize the province’s vast wind energy resources to power the production of green hydrogen and other gases.

As you’re about to discover in our exclusive interview with Atco Mining director Neil McCallum coming right up, the government of Newfoundland is moving forward with plans to utilize the province’s vast wind energy resources to power the production of green hydrogen and other gases.

According to industry experts, energy stored as hydrogen in salt domes will be the most cost-effective long duration solution for many countries configuring net-zero grids around intermittent renewables.

That makes green hydrogen storage in Newfoundland’s salt caverns a source of potential competitive advantage, as well as an enormous commercial opportunity as infrastructure and innovations continue to be developed.

And therein lies the opportunity for Atco Mining Inc. (CSE: ATCM)(OTC: ATMGF) in southwestern Newfoundland as exploration efforts ramp up across the company’s impressive salt project portfolio.

Why Salt, Why Green Hydrogen?

Salt domes, or salt caverns, are part of a projected $11 trillion global hydrogen energy boom focused on decarbonization efforts across the US, Canada, and Europe.

Compared to depleted oil and gas reservoirs, salt caverns offer the advantage of lower cushion gas requirements to avoid rock breakage, as well as the large sealing capacity of rock salt and the inert nature of salt structures.

Salt caverns are also a more flexible solution because they can ensure high hydrogen injection rates and withdrawal cycles.

Plus, it’s already a proven methodology.

In fact, the first hydrogen storage salt dome was constructed in the UK way back in 1972 and is still in active operation today.

Hydrogen, while having the potential to deliver sustainable, efficient, and affordable energy at scale, is also quite expensive to store and transport. The team at Atco sees this as an early-mover opportunity as salt domes offer a proven, cost effective solution to hydrogen storage prior to use, transport, or export.

In the United States, the Advanced Clean Energy Storage project in Utah aims to build the world’s largest storage facility for 1,000 megawatts of clean power, partly by putting green hydrogen into underground salt caverns.

Green hydrogen, as noted, is hydrogen produced via renewable power and, hence, zero carbon emissions. The gas is being touted as part of an evolving global energy mix that will lead toward decarbonization worldwide with applications ranging from consumer and industrial power supply to transportation and even spaceflight.

By 2050, US demand for hydrogen could jump to as high as 41 million tonnes per year, up from 10 million tonnes today, according to a recent study by the US Department of Energy’s National Renewable Energy Laboratory.

Scheduled to be operational by 2025, Utah’s Advanced Clean Energy Storage project could become one of the largest renewable energy reservoirs in the world.

Big names are getting involved in the Utah-based project including Mitsubishi Power, a maker of gas turbines, and Magnum Development, which owns salt caverns for liquid fuel storage.

The same thing is happening in Europe, where hydrogen is considered integral to the energy mix in that part of the world.

We already mentioned that the first hydrogen storage salt dome was constructed in the UK way back in 1972 and is still operational today.

The European Commission sees the share of hydrogen in Europe’s energy mix rising from under 2% as of 2019 to 13-14% by 2050. Recent studies also confirm that green hydrogen could supply up to 25% of the world’s energy needs within that same timeframe.

A government-funded German consortium of more than 100 companies plans to build a salt cavern in Saxony-Anhalt — called the HYPOS project — with about 150,000 MWh of energy derived from wind-power-generated, or “green” hydrogen.

And in Newfoundland, Canada — where Atco Mining has its portfolio of salt projects — the province’s pro-mining government is moving forward with plans to utilize the region’s vast wind energy resources to power the production of green hydrogen and other gases.

Newfoundland is aiming to become a leader in the space, first, through green hydrogen production through wind power, wherein permitting efforts are underway.

The second part of that, of course, is green hydrogen storage in salt domes, which is where Atco Mining comes in.

Let’s take a closer look at Atco’s portfolio of early-stage salt projects, including next steps in the exploration process.

Atco Mining: Flagship Salt Projects

Early-stage exploration is underway across Atco’s impressive portfolio of seven 100%-owned salt prospects strategically located in southwestern Newfoundland — an area characterized as having a remarkable salt endowment.

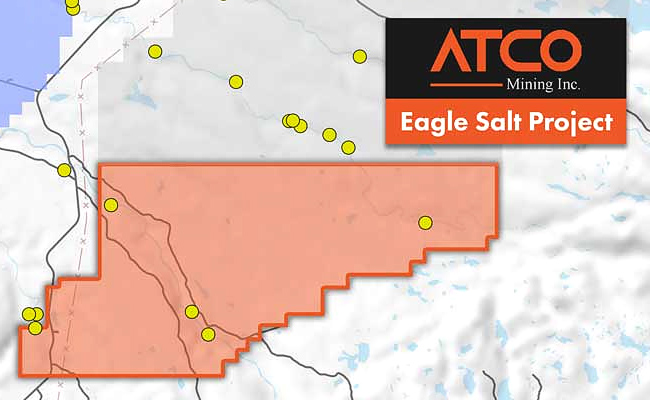

Atco’s salt projects include: Eagle, Blue Mountain South, Lunar North, Apollo, Adonis, Rocky Salt, and Highland.

As noted, the district also lays host to Atlas Salt’s Great Atlantic Salt Deposit and Triple Point Resources’ Fischell’s Brook Salt Dome.

Atco’s current focus is on delineating large salt dome structures on its properties for potential use in underground hydrogen storage.

Atco’s 3D Interpretation Points to Salt Dome Anomalies:

In March 2023, the Atco team announced that final interpretation of a recently completed 816 line-km airborne survey at its portfolio of 100%-owned salt projects in Newfoundland, Canada, confirmed the presence of multiple high-priority, oval-shaped gravity anomaly targets.

Interpretation of the 3D modeling suggests that multiple salt dome structures may be present at a depth as shallow as 300 to 400 meters below surface and extending up to ~1,600 meters below surface.

Of the two primary anomalies identified at Atco’s 10,575-hectare Eagle Salt Project, the Golden Target anomaly measured in at approximately 3 x 1.5 km in size and has a strong correlation with the magnetic-low signature. The second anomaly, Baldy Target, is approximately 6 x 1.5 km in size.

Atco Mining director Neil McCallum — whom you’re about to hear from directly in our exclusive interview coming right up — commented via press release:

“I am very pleased with the results of the interpretation of the recent survey results. They tell us exactly what we were hoping to see, which is a series of gravity and magnetic-low features that are consistent with the interpretation of salt-dome structures.”

The release goes on to explain that the size and geometry of the gravity feature is similar to Triple Point Resources’ Fischell’s Brook Salt Dome gravity anomaly (measuring 4.1 x 1.3 km in size and denoted in the property map below), which is situated ~15 km north of Atco’s Golden Target anomaly at the Eagle project.

Exploration drilling at Fischell’s Brook intercepted salt starting at a depth of 360 meters below surface, which is information the ATCM field team will have to draw upon as it moves toward Phase-1 drilling at its own targets, potentially, as early as this summer.

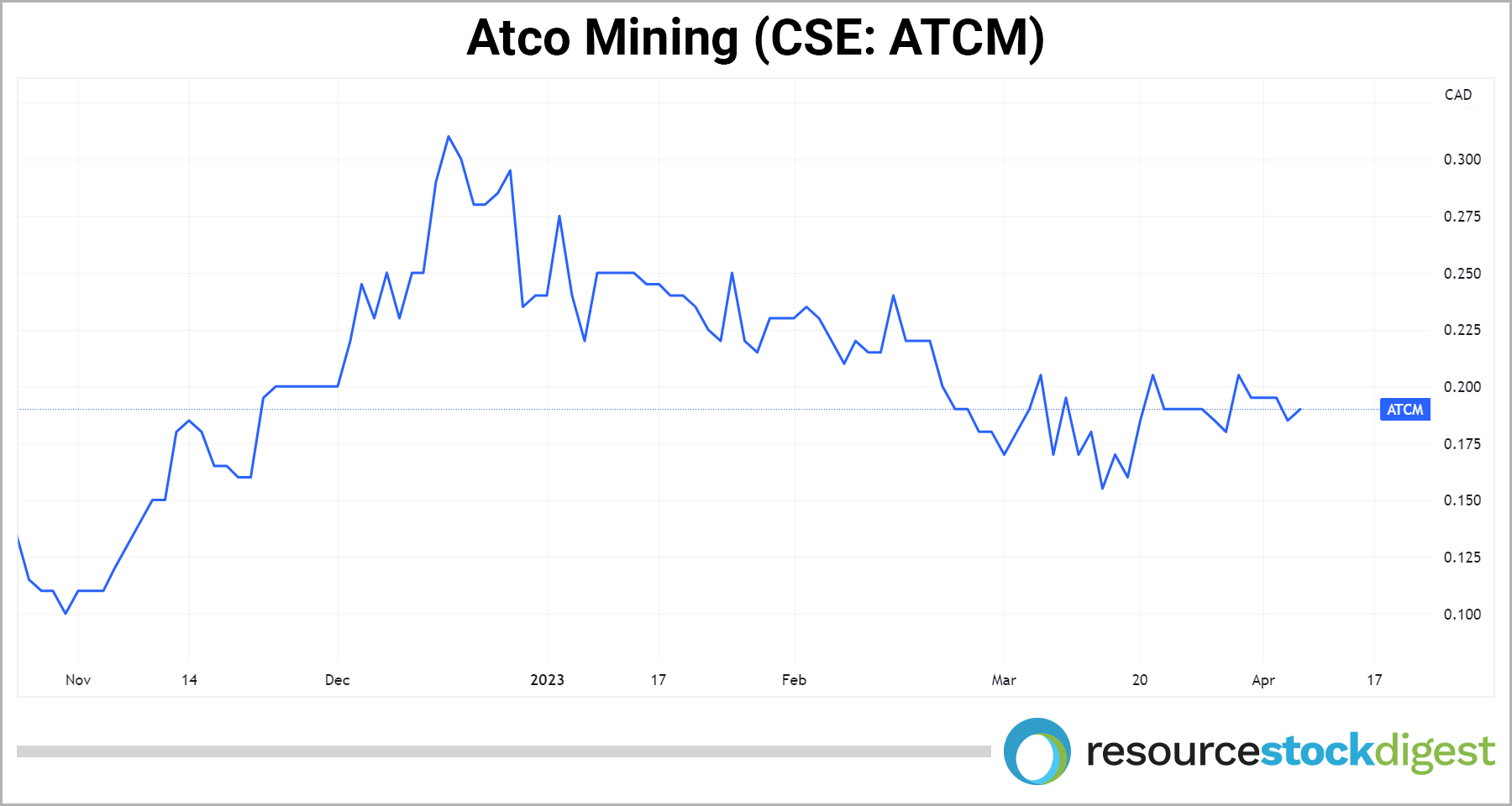

Although at different stages of exploration, when strictly comparing market valuation, Atlas Salt has a current market cap of over C$100 million while Atco is currently sitting well below C$10 million.

And, as you may have guessed, it’s not all about the green hydrogen storage capacity of the salt dome structures themselves. Salt production for industrial use is also key as it can generate robust cash flow as part of the process of building out the caverns.

Salt mining is big business in North America. Since 2020 alone, private equity has completed over US$5 billion in acquisitions in this recession-resistant sector.

Once mined from the Earth, salt is processed for a variety of uses, including for use as road salt, as an ingredient in weedkillers, as tablets for animal feed, as a water softener, and, as well, for beauty products and cleaning solutions.

At present, North America faces an annual road salt production shortfall of 7 to 10 million tonnes — a deficit made up by imports from Chile and North Africa.

Each of Atco’s properties holds potential for not only the presence of possible salt dome structures but also for significant salt resources that may be amenable to economically viable extraction through mining processes starting with early-stage exploration.

Detailed information on each of the seven 100%-owned properties is available at the Atco corporate website and presentation.

May Lake Gold-Copper Prospect, Saskatchewan, Canada:

Atco Mining is simultaneously advancing its early-stage May Lake gold-copper prospect in Saskatchewan, Canada.

The project encompasses 5,487 hectares within the northern portion of the underexplored LaRonge Greenstone Belt, which lays host to numerous high-grade gold deposits (as detailed in the below map).

The project covers a sulphide-rich VHMS deposit with potential for significant gold, copper, and zinc mineralization.

Anomalous values have been obtained from both historic drilling and sampling at May Lake.

Historical boulder samples taken at May Lake have returned values up to 1.15 grams per tonne (g/t) gold and 4.14% copper and 1.3 g/t Au and 7.5% Cu.

Historical drilling has returned values up to 6.8 g/t gold and 2.1% copper over 4.9 meters and 4.3 g/t silver, 0.54% copper, and 0.53% zinc over 6.8 meters.

The mineralized zones encountered by the historical drilling consist of disseminated semi-massive pyrrhotite and pyrite with minor associated chalcopyrite and sphalerite.

Regional exploration data suggests the project exhibits several key elements that are fundamental to exhalative VHMS gold mineralization, such as a cherty exhalate horizon hosting significant sulphides, surrounding felsic-dominated volcanics and two mapped eruptive centers.

For updates on upcoming fieldwork at May Lake, as well as each of the company’s salt projects, be sure to sign up for Atco’s investor email list. You can also follow our ongoing coverage of Atco Mining here.

Exclusive Interview with

Atco Mining Director Neil McCallum

Our own Gerardo Del Real of Resource Stock Digest and Junior Resource Monthly caught up with Atco Mining director Neil McCallum for an in-depth discussion on the company’s early-stage salt projects in southwestern Newfoundland, Canada.

Mr. McCallum is a professional geologist with over 16 years of experience in North America. Upon graduating from the University of Alberta in 2004, Neil has worked extensively with the Dahrouge Geological Consulting group where he has been engaged in the exploration and development of a wide variety of commodities, including salt, lithium, uranium, and rare earth elements (REEs).

We hope you’ll enjoy the conversation.

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the director of Atco Mining — Mr. Neil McCallum. Neil, it is great to have you on. How are you today?

Neil McCallum: I'm well, thanks. Thank you for having me on.

Gerardo Del Real: Well, listen, I want to talk salt. I want to talk Atco. I want to talk about the 100% ownership of the seven salt projects in the portfolio. But before I get into all of that, I joked off air with you that I felt like I had to thank you for some of the most recent successes that you've had in identifying properties, in the case of the Corvette District, that you and your group have turned into what's looking like a generational lithium discovery.

I know that you just took on another position so when I saw your name and I saw Atco and I looked at the tiny market cap, I said, let me reach out… let's see if we can have a conversation on the record with Neil. But first things first, congrats on all of the successes here recently. Well deserved!

Neil McCallum: Oh, thanks…that's great! I think it just goes to show that you need to be early on some of these new ideas. We were looking at lithium as far back as 2015 and 2016 when we first made some of the acquisitions around Corvette. So not a lot of people believed in lithium at that time, and it kind of got forgot about for a little bit. And then, it came back. And obviously, it's the talk of the town, lithium, right now.

And that's kind of my reasoning for joining the Atco team, as well, is we're thinking not just next year… we're thinking 5 to 10 years from now for these salt projects with the idea of getting in early, getting a good land position, getting a good following, and trying to tell the story. So that's the thought there.

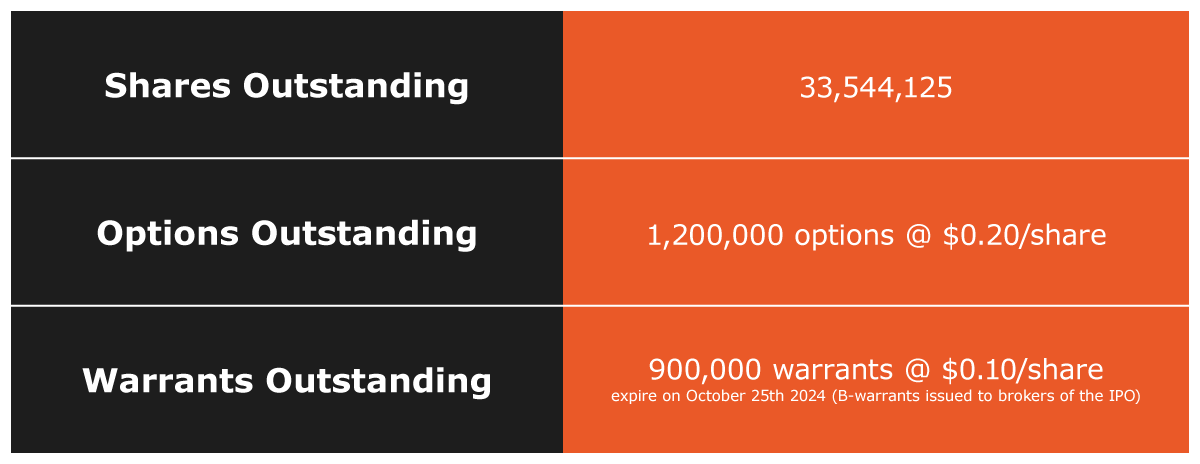

Gerardo Del Real: Well, let me provide a bit of context. I believe you have roughly, I want to say, just shy of 30 million shares outstanding. You trade roughly for, I think, C$0.20 or so the last time I checked. So the market cap here is absolutely tiny. It is maybe just a tad bit above C$6 million.

Let's talk about salt. Why salt? This is, again, a commodity that I don't think gets looked at in our space as a commodity that can provide opportunity. Clearly, you believe in it. Clearly, you've been right more often than not in being early and putting together large scalable projects. And clearly, you've done that here with Atco. Can you tell me about the salt space?

Neil McCallum: Absolutely. There's sort of two parts to the salt space. One of them is providing salt as an industrial commodity for roads and for other industrial purposes. And of course, road salt is another one.

The other part to it is a little bit of a new story… it was new to me when I joined the board. But one part of the green energy and clean energy story that we're trying to reform the world on is hydrogen. And you wouldn't think that the two go along… but hear me out.

When we talk about hydrogen, a big part of that is storage. And one of the best ways to store hydrogen — there are many ways you can do it — but one of the simplest and cheapest ways to store hydrogen, after you produce it, is to send it into an underground salt cavern.

And what we've got on our project in Newfoundland is targets that look like they could be large salt structures based on some of the old work that we've compiled. And there are some other salt structures that have been defined by drilling around us. And we're looking to provide that kind of a solution to what could be one of the largest hydrogen producing areas that could be coming within the next two to three years in Newfoundland.

Gerardo Del Real: Walk me through — and I'm fascinated by this, obviously, because of your past successes — but walk me through the vetting process for these projects. And then, walk me through what you consider the highest priority projects in the portfolio in the near term.

Obviously, every project has merit or it wouldn't be there. But in the near term, where do you tend to want to focus the bulk of your attention here?

Neil McCallum: Yeah, for Atco salts, they're called different projects but essentially they're all within the same geologic domain… and what we've done to prove up the idea here is we flew an airborne gravity survey, which will give us a pretty good indication of where these salt domes are.

When you look for a gravity low, that typically indicates a salt dome because those salt structures are quite a bit less dense than the rocks that are surrounding them. So what we're trying to do is repeat the success of a company called Atlas Salt who is spinning out some of their salt dome projects into a company called Triple Point Resources.

And they're slated to go public very soon, and they have a salt dome that has been drilled in the past. And there's a good chance that they are going to be on some of our projects — namely the Eagle Salt Project, which is about 10 kilometers south of them.

Gerardo Del Real: That is fascinating to me. When we talk peers — and you just mentioned them going public — when we talk about peer valuations, can you provide a bit of context on what Atco is aiming to do? Again, I know from some of your history that you don't tend to get involved with projects if you don't believe there is pretty substantial scale.

I’ve got to believe, by the over 20,000 hectare package that you've managed to put together, that that's absolutely the playbook this go-around. But can you give me some peer comps on what new shareholders — I'm fascinated by the story by the way, especially with the C$6 million market cap — some peer comps as to what Atco is aiming to do here within the next couple of years?

Neil McCallum: Yeah, sure. I think the best comparison would be the Triple Point project. And I'm not sure the fundamentals on what their share structure and valuation is going to be when they come public. But I think that we, at a C$6 million market cap, can do quite well by just continuing to explore and find these salt structures.

Gerardo Del Real: You just announced the final airborne results confirming the presence of large salt dome structures. And the plurality there is important, right; multiple structures. You also just obtained a US listing, which I know is something that the company was working on for a while behind the scenes. So congrats on both fronts.

What does it mean to have the final interpretation of these two to three, is how the release describes it, two to three high-priority oval-shaped gravity anomaly targets. What does that mean for the company? I know it's a big deal. I know that you're happy about it. What does it mean for those that follow the space and are trying to gauge what the potential is here?

Neil McCallum: Absolutely. Yeah, that's a good question. So when we picked up these projects, we had some indication — based on historical information that goes way back to the 50s, 60s, 70s when folks were looking at this area for oil and gas potential — and part of that was with the search for salt domes as those end up being sometimes oil and gas traps.

Well, lo and behold, those salt domes are actually worth something now in terms of the storage potential for the support of the large-scale hydrogen production that's thought of for the area. And with that historical data, it's old, it's outdated, and we needed to really confirm that with the airborne geophysics. And that's just what we've done.

It's done a really good job of confirming it, and more, in terms of giving us a little bit better precision on the data. And we're able to do a lot more with it in terms of geophysics modeling using 3D techniques. It's really interesting to see how these play out.

Gerardo Del Real: Tell me about the different targets. You mentioned two to three, and it sounds like it's not clear whether it's three targets or two targets. Why the discrepancy there?

Neil McCallum: Yeah, absolutely. So when we look at them, there's one that's quite long, it's about 6 km long, and it might be sharing the same roots at depth. As you look through the depth slices as you come towards the surface, there might actually be two of them with the same root at the bottom. So that's why I'm saying two to three. And then, there's another completely distinct one… so that's why I'm saying two to three total.

Gerardo Del Real: Excellent. Now, moving forward, we talked maybe a week or so ago, and we discussed how, in traditional mining, you hire the drills, you get the contractors out there, you start vectoring towards your target, you wait on assays.

And it can be years before you actually get to being able to prove the value that's in the ground. It's very different for what Atco is looking to do here. Can you explain that process a bit for those that may not be familiar?

Neil McCallum: Sure, what we're looking to do is the absolute test, which is the same for virtually any other project, which is drilling. So that's what the geophysics does… is it really gives us the admission to get to the next stage of drilling because, once we drill, the idea is to go right through the salt dome to confirm the presence, the depth, the thickness… that kind of stuff.

Gerardo Del Real: Excellent. As far as the business model goes, how long is it going to take to get a drill turning and to actually prove up what's either there or what's not there?

Neil McCallum: Yeah, it'll be done quickly. We can get out there as early as the summer. Once we've got financing in place and logistics set up and things like that, it's not going to take too long to get to that next step.

Gerardo Del Real: Excellent, so we'll know what we have. What's the potential as far as the hydrogen storage? I know that aspect of the story is a part that, I can tell you from my personal experience, is not as well understood.

I've had subscribers write in asking about the potential. They're intrigued by it but I don't think it's as appreciated in this part of the world. And this part of the world where the projects are at is important because I think that's what really lays the groundwork for what Atco is looking to do.

Neil McCallum: Absolutely, and what Newfoundland is doing is they're positioning themselves as trying to be a leader in the space. They are going to be fast tracking the permitting process for, really, what ends up being a two-stage process.

First, you need to generate the power, and they're going to do that completely through wind power. Next phase is getting the hydrogen production, which is planned to be there. There are companies that have applied for the permits for the wind power, as well as setting the stage for the funding for what will be a large-scale operation there.

So all signals are go… it's just a matter of getting the wind rights from Newfoundland, who are going through that process right now, and then getting that funding towards the hydrogen production.

Gerardo Del Real: And ultimately, Atco, obviously, is positioning itself to play a large part on the storage side of it, correct?

Neil McCallum: Exactly, and that's just the point of it too… with the proposal for the hydrogen production, hands down, people have done this in other parts of the world. Hands down, the cheapest way to store that hydrogen — because you can't always ship it out as soon as you produce it — is to send it underground for underground storage.

They're doing this in, I believe, Texas, Utah, for similar styles of industrial scale production of hydrogen on a large scale. It's way cheaper than compressing it, converting it — all that kind of stuff.

Gerardo Del Real: Well, I've said before, I love being early to stories. I know you and Dahrouge Consulting and the team at Atco love positioning ahead of the crowd and ahead of the herd.

Again, with a ~C$5 million market cap, it's not going to take a lot for this to go much, much higher. And I'm really excited for the next couple of months, getting in position to put a drill out there and see what you turn up. What comes next, Neil?

Neil McCallum: Yeah, like I said, we're positioning ourselves towards drilling. And we're also working on a few other things in the background here that I can't quite talk about yet. But we're looking to build value, and we've got a young energetic group of people working on it. So look forward to more.

Gerardo Del Real: Awesome. Neil, thanks for the time. Appreciate it. Thank you so much.

Neil McCallum: Okay, take care.

The Opportunity

Atco Mining Inc. is advancing its portfolio of seven 100%-owned salt projects in southwestern Newfoundland, plus its May Lake gold-copper project in Saskatchewan.

Atco’s flagship salt project portfolio is centered around having an early-mover advantage in the next wave of global energy development in the area of green hydrogen storage in salt domes for usage and export as the world seeks to attain net-zero by 2050.

The primary focus is on “green hydrogen,” which is hydrogen produced by renewable energy sources; in this case, Newfoundland’s vast offshore wind resources.

The government of Newfoundland is highly committed to green hydrogen production initiatives with the province currently being heralded as the site of Canada’s fastest growing hydrogen development program with permitting underway.

Importantly, all of Atco’s salt projects are located ~50 km southwest of the town and deepwater port of Stephenville, Newfoundland, which is regarded as Canada’s next future green hydrogen hub.

The city was the meeting site between Prime Minister Trudeau and German chancellor Scholz, which led to the 2022 signing of the hydrogen alliance pact between the two nations.

The pact is focused not only on hydrogen development and storage in Newfoundland but also on the prospect for hydrogen exports to Germany by 2025.

Plus, it’s all green: green hydrogen production via renewable electricity generation from wind turbines — all supported by future underground green hydrogen storage in salt caverns.

And it positions Atco Mining as a potential key component of what has quickly become a federally supported mega-project for green hydrogen development in Newfoundland, of which salt domes, or salt caverns, will play a critical role on the storage side of the equation.

In terms of the exploration process, the Atco team recently completed an 816 line-km airborne survey across its seven 100%-owned salt projects with final interpretation of the data confirming the presence of multiple high-priority, oval-shaped gravity anomaly targets.

Interpretation of the 3D modeling suggests that multiple salt dome structures may be present at a depth as shallow as 300 to 400 meters below surface and extending up to ~1,600 meters below surface.

And while still early-stage, the anomalies may prove to be suitable salt dome structures that can be used to store future green hydrogen resources — an emerging opportunity that has the potential to ramp up significantly in the coming years.

You heard directly from Atco director and professional geologist Neil McCallum. He says:

And what we've got on our project in Newfoundland is targets that look like they could be large salt structures based on some of the old work that we've compiled. And there are some other salt structures that have been defined by drilling around us. And we're looking to provide that kind of a solution to what could be one of the largest hydrogen producing areas that could be coming within the next two to three years in Newfoundland.

The company's early-stage salt exploration projects are all located within close proximity to other major salt projects within the St. Georges Basin of Newfoundland, Canada — a top-tier mining address, globally.

For interested speculators, Atco Mining offers exposure to not only salt dome and salt exploration and development opportunities in the ultra-safe mining jurisdiction of Newfoundland but also gold-copper exposure in an equally safe mineral district in Saskatchewan.

Additionally, in March of this year, the Atco team announced the commencement of active trading on the US OTC exchange under the symbol ATMGF. Neil McCallum added:

“This is also an extremely positive step forward for us. This will enable us to broaden our exposure in the United States as we look to boost our profile among investors around the world. We’re committed to growing our audience and this is an important step towards achieving that goal.”

With a potential early-mover advantage in a proven salt district, now is a perfect time to start checking out Atco Mining as it advances no less than seven 100%-owned salt projects in Newfoundland, Canada — all at a sub-C$10 million market cap.

Speculators can reasonably expect additional potential property acquisitions from Atco followed by additional geophysical surveys and, ultimately, drilling at the Eagle Salt Project (and possibly multiple projects), in the near to medium term.

A great place to start your due diligence is Atco’s corporate website where you can learn more about the properties and the team, view the 2023 corporate presentation, and sign up to receive updates directly from the company’s IR department.

Also, click here for more of our ongoing coverage of Atco Mining, including additional late-breaking interviews with upper management as developments arise.

Atco Mining Inc. trades on the Canadian Securities Exchange under the symbol ATCM and on the US OTC Bulletin Board Exchange under the symbol ATMGF.

For additional information on Vancouver-based Atco Mining, be sure to call the company’s IR department at 604-512-5624 or via email at info@atcomining.com.

— Resource Stock Digest Research

Click here to see more from Atco Mining