Click here to read important disclaimer & disclosures Click here to see more about Standard Uranium

TSX-V: STND | OTC: STTDF

Drilling for the Next High-Grade, District-Scale

Uranium Discovery

in Canada’s Prolific Athabasca Basin

The 2024 uranium bull market is well underway with U3O8 prices surging to decade-plus highs well above US$80 per pound as the world turns to carbon-emission-free nuclear energy powered by uranium.

Importantly for investors, it’s still very early-innings in the current uranium boom, which means plenty of near-term upside ahead for uranium commodity prices with select small-cap uranium explorers with operations in safe, Tier-1 mining jurisdictions offering additional upside in the clean-energy transition.

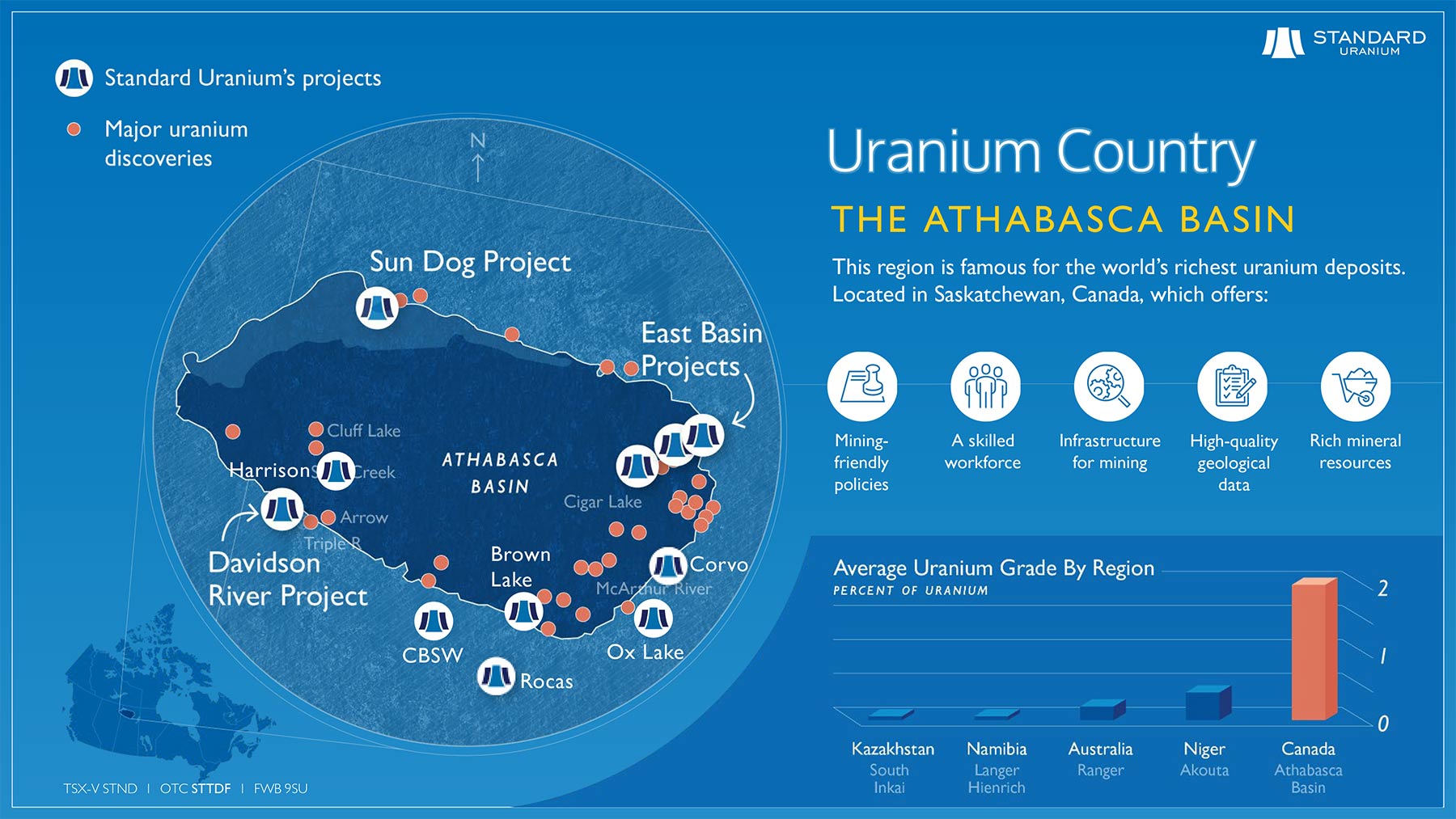

The exceptionally well-run small-cap uranium company featured in this report — Standard Uranium Ltd. (“STND”) — is brilliantly deploying its hybrid prospect generator model in search of the next high-grade, district-scale discovery in perhaps the best place on Earth for uranium mining: the Athabasca Basin region of northern Saskatchewan, Canada. At present, STND boasts 11 Athabasca-based uranium projects with a minimum of 7 exploration programs planned for 2024 with 5 of those being drill programs.

The Athabasca Basin region is a proven Tier-1 uranium mining jurisdiction with an established history of unwavering government support for the exploration and development of world-class uranium deposits. Led by CEO Jon Bey, who boasts 15-plus years in the industry, Standard Uranium’s intelligent approach to uranium exploration and discovery will see the company drilling multiple partner-funded exploration projects in key Athabasca production zones this year. With uranium in a confirmed bull market as we head into the second quarter of 2024, Standard Uranium is set up for a transformative year with multiple opportunities for discovery success via the drill-bit.

Uranium Bull Market Underway in 2024

There’s a major positive shift happening in the global nuclear energy market.

The world is quickly realizing that lofty climate goals will be impossible to meet without clean-burning, carbon-emission-free nuclear energy being an integral part of the clean-energy mix.

That fact is adding escalating pressure on an already constrained global uranium supply.

With uranium, what we arrive at is a market that’s consuming close to 200 million pounds of yellowcake annually — yet producing only around 140 million pounds.

That equates to a 60-million-pound structural deficit this year… which, when compounded over the next six years to the end of the current decade, balloons to a jaw-dropping ~360 million pounds.

That’s a staggeringly large deficit… and it underpins the escalating need for new domestic and friendly uranium sources reaching the supply chain.

And it’s really only the start.

On the demand side, we have Japan looking to restart a further 16 of its reactors. The island nation is also seeking ways to safely extend the plant-life of its existing reactor fleet from 40 to 60 years.

China just approved the construction of six new nuclear reactors across three provinces with plans to build 150 new reactors over the next 15 years as part of their newly-enhanced decarbonization mandate.

South Korea and India have also joined the fray and are now fully onboard with a cleaner energy future that will require vast amounts of uranium, or U3O8.

In Europe, France’s economy minister has doubled down on the need for a top-to-bottom overhaul of the electricity market saying, “there is no energetic transition without nuclear energy.” The nation has announced plans to construct a new generation of nuclear reactors for the first time in decades.

Even Finland’s Green Party — following decades of staunch opposition — voted overwhelmingly to categorize nuclear power as a form of sustainable energy. At present, one-third of Finland’s electricity is derived from nuclear power. And just last year, the country’s OL3 reactor, Europe’s largest, finally went online.

Other European nations are quickly falling in line with Finland’s pro-nuclear stance. Britain and Sweden are each planning new nuclear reactor projects with Belgium and Spain also cementing their support for the clean energy source.

At last year’s COP28 conference in Dubai, 22 nations including some of the largest economies in the world, signed a declaration to triple nuclear capacity by 2050.

Here in the United States, TerraPower is currently constructing a US$4B nuclear power plant in Wyoming that’ll use an all-new blend of enriched uranium.

Once completed, it is expected to generate efficient, low-cost, clean energy while utilizing enhanced safety standards that greatly reduce the risk of accident — even on par with wind power plants.

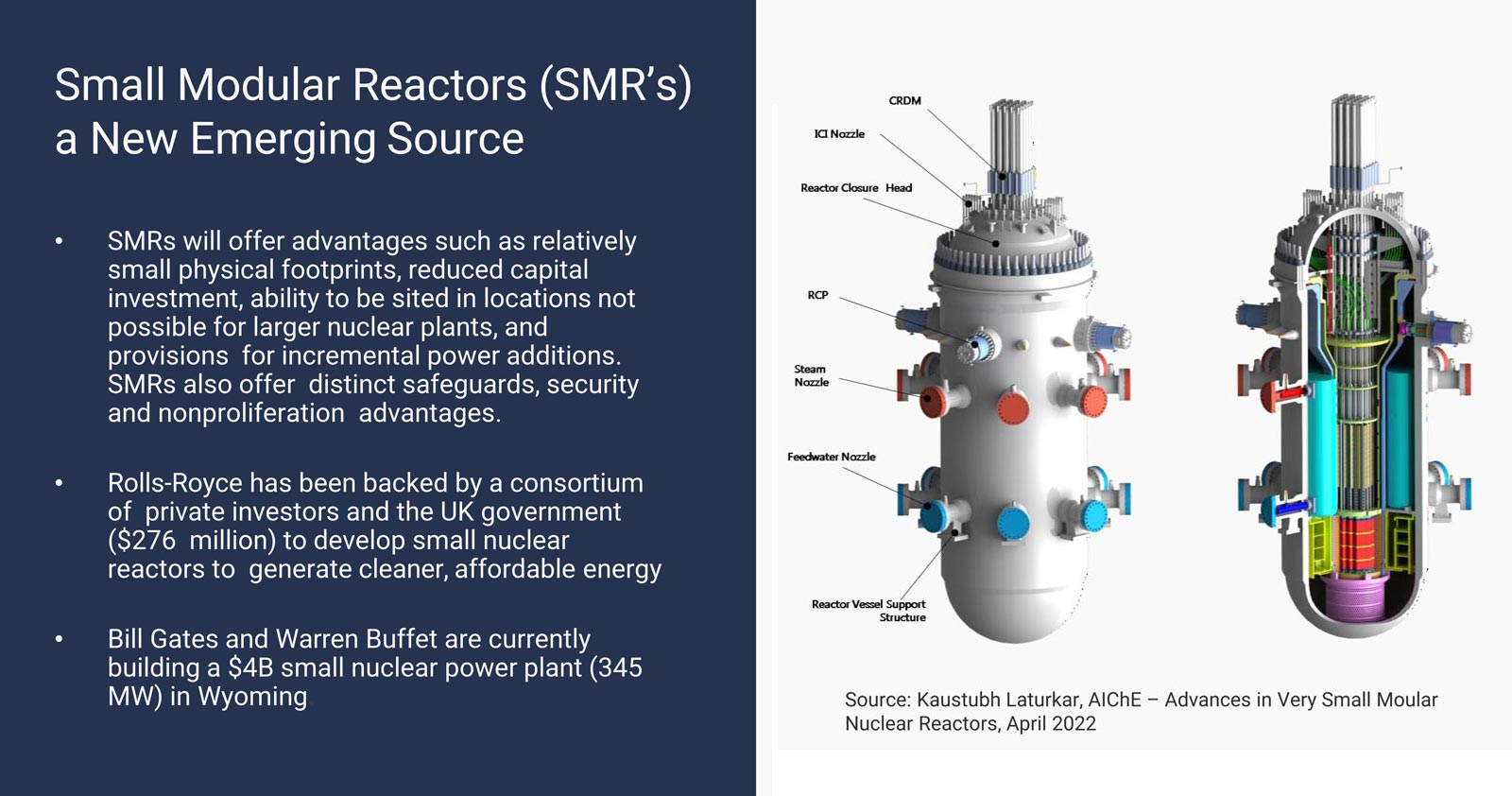

NuScale recently became the first company to be granted approval by the US government on small modular reactor (SMR) designs with the US Nuclear Regulatory Commission giving it the green light. Privately-owned Standard Power followed up that news with an announced partnership with NuScale on the construction of two SMRs.

Put plainly, increased uranium demand is coming from all angles. And that includes a new contracting cycle that’s just now getting underway with major utilities entering the market to secure their next long-term U3O8 contracts.

The combination of dwindling secondary supplies, supply cuts from the highest-margin producers, and utilities coming back into the market will create what many experts agree could be the greatest uranium bull market anyone has ever seen.

The Inflation Reduction Act of 2022 also provides funding for US nuclear power projects, including a tax credit for electricity produced at qualified nuclear power facilities.

Next, you have to look at the precariousness of the global uranium supply to really get the full picture.

Kazakhstan — a former soviet republic and the world’s largest uranium producer — produces roughly 40% of global supply. In 2022, as you may recall, the country erupted into what’s now known as ‘Bloody January’ wherein over 225 people were killed in a government crackdown on nationwide protests.

Cameco, which owns 40% of the giant Inkai uranium mine in Kazakhstan, had this to say:

“As 40% of the world's uranium supply, any disruption in Kazakhstan could of course be a significant catalyst in the uranium market. If nothing else, it's a reminder for utilities that an over-reliance on any one source of supply is risky. It also reinforces the shift in risk from suppliers to utilities that has occurred in this market.”

Cameco, which accounts for roughly 17% of global uranium production, is experiencing production issues of its own — to the tune of about a 2.7 million pound shortfall — citing ongoing difficulties at its Cigar Lake and McArthur River mines as well as at its Key Lake Mill in Canada.

Uranium supply is being further hampered by a recent military coup in Niger (the world's seventh-largest producer representing over 4% of supply).

It’s that type of geopolitical chaos that’s leading to increased energy insecurity around the world as supply comes under increasing pressure, particularly in the global uranium market.

Uranium supply is also under siege as companies look to capitalize on the opportunity to purchase large amounts of drummed uranium in the open spot market with the Sprott Physical Uranium Trust (SPUT) acquiring some 50M lbs over the last couple of years — and with others like Yellowcake PLC and Uranium Energy Corporation following suit.

As a result, uranium inventories are continuing to shrink, most notably from 3.5 years to around 2 years of supply right here in the United States, well below the historical average.

We also talked about restarts and lifespan extensions on reactors… and it’s not just Japan that’s going down that road.

In California, steps are underway to potentially extend the life of the Diablo Canyon reactor for an additional 5 years from 2025 to 2030. The same exact thing is happening in countries such as Belgium, Finland, and Slovakia.

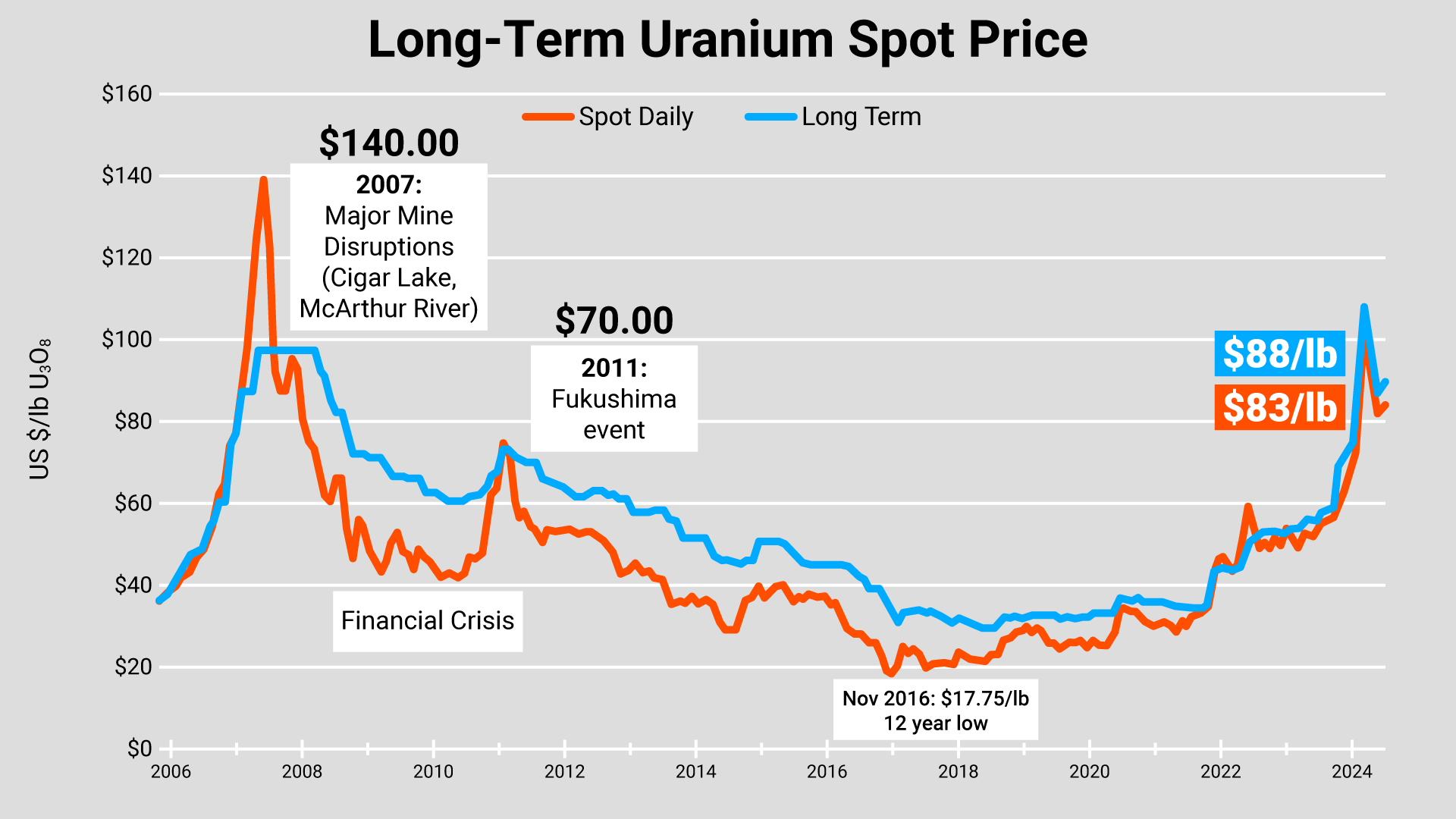

All of that is to say that any further disruptions to the global uranium supply chain could lead to a run on uranium spot prices — possibly like what we saw back in 2006-07 when uranium soared to US$140 per pound upon the flooding of Cameco’s Cigar Lake Mine.

That upsurge caused the share prices of most uranium mining companies to break out… resulting in substantial gains for well-timed investors.

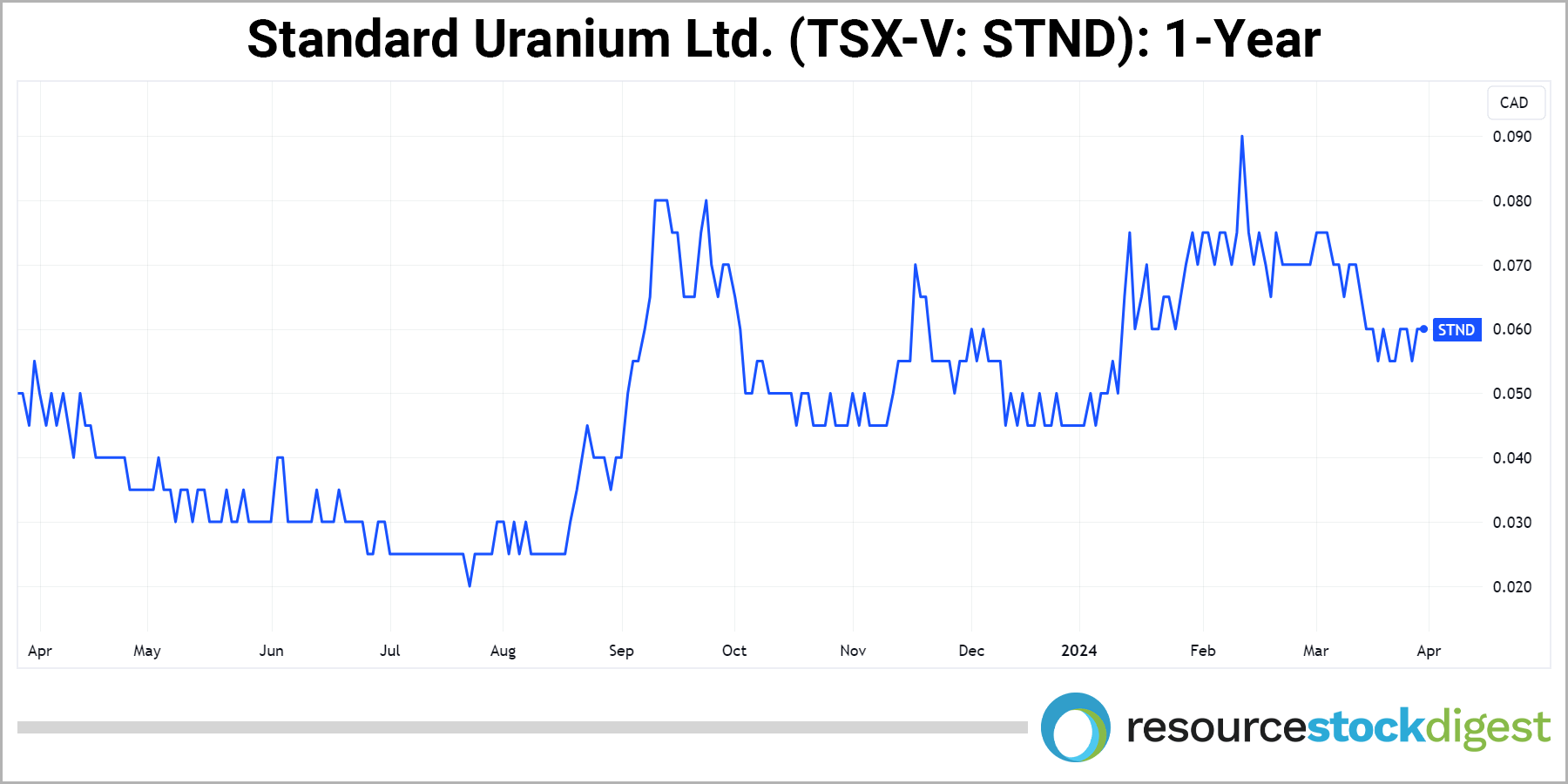

Following a pullback from just above US$100/lb, we’re currently sitting well north of US$80/lb U3O8. And remember, just a couple of years ago, uranium prices were languishing at the US$30/lb level. So the uptrend is undoubtedly underway as you can tell by the uranium price chart below.

With geopolitical upheaval at an all-time high in key uranium producing countries, including Russia (which will have its uranium exports sanctioned by the United States in the coming years), the writing’s clearly on the wall for even higher uranium prices going forward.

It also underpins the need for increased uranium production from safe, Tier-1 jurisdictions such as the Athabasca Basin, located in northern Saskatchewan, Canada, where Standard Uranium has its operations.

We’re only at the very beginning of the current uranium uptrend, which means now is an opportune time for resource speculators to consider positioning for what could be a material move higher.

Enter Standard Uranium Ltd. (TSX-V: STND)(OTC: STTDF).

Standard Uranium: Brilliantly Deploying a Hybrid Prospect Generator Growth Model in Canada’s Athabasca

With a total of 11 high-potential uranium exploration projects in Saskatchewan’s Athabasca Basin region, Standard Uranium has quickly established itself as one-to-watch in the small-cap uranium exploration sector.

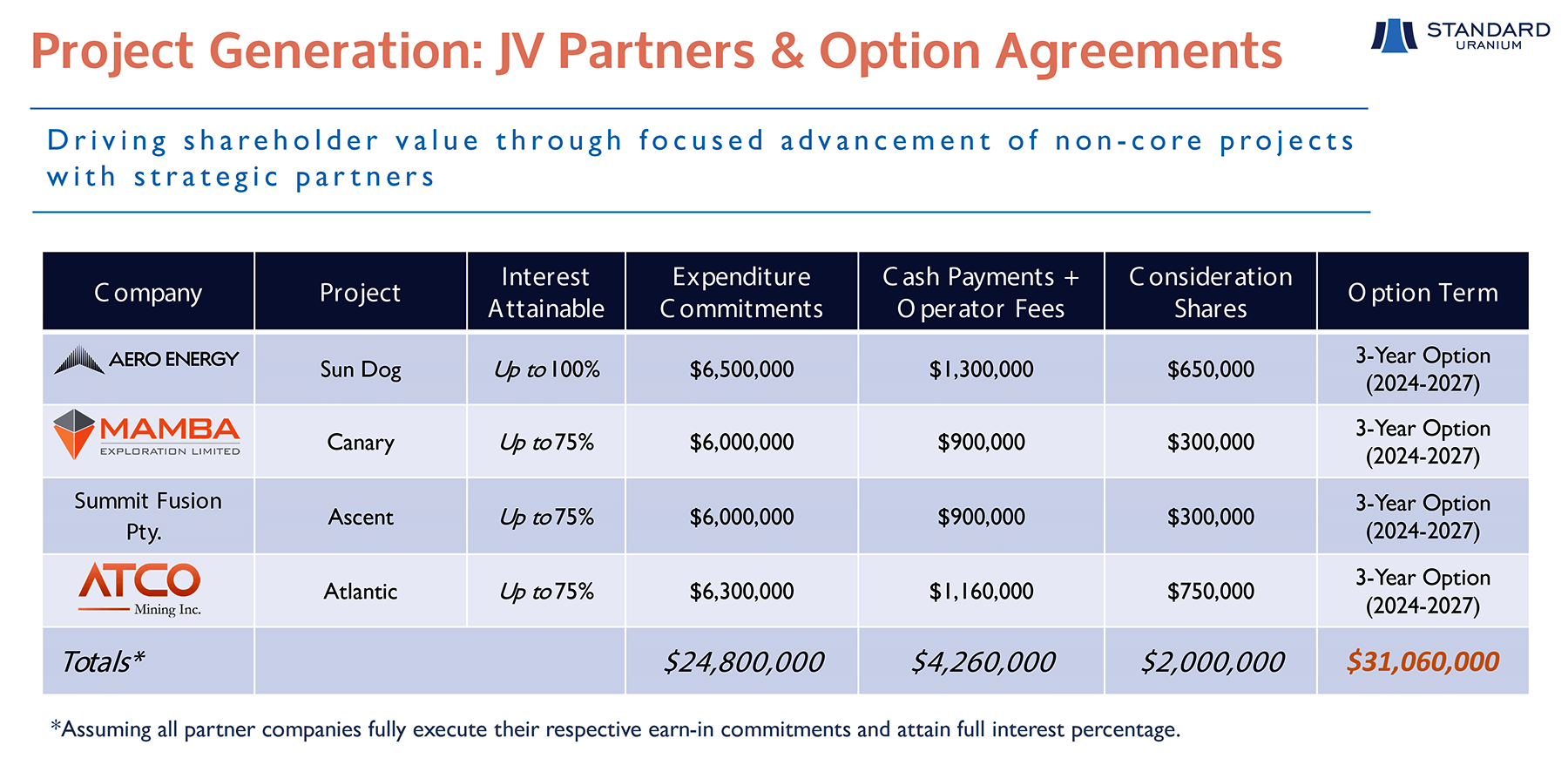

A key component of the hybrid prospect generator model Standard Uranium is systematically deploying in the Athabasca is that all current and future option/JV agreements on the company’s properties will have Standard Uranium as operator with the option or JV partner paying the company cash and/or shares to secure an interest in the said property and, as well, to fund exploration expenditures.

In terms of STND’s partner-funded projects, exploration and drilling expenditures are mostly, if not entirely paid for by the option/JV partner with Standard Uranium running the projects from top to bottom as operator while maintaining a partial ownership stake in each optioned property.

The below table outlines Standard’s four key partner-funded uranium exploration projects: Sun Dog, Canary, Ascent, and Atlantic.

Portfolio-wide, STND currently boasts a combined C$30-million-plus committed by partners to its Athabasca-based uranium exploration programs over the next three years.

The well-timed execution of this proven growth model has Standard Uranium (click link for brief video presentation) set for partner-funded exploration across seven Athabasca-based projects in 2024 with four projects (as noted above) being fully-funded by partners.

Naturally, that level of participation and funding would have been near impossible to amass at ~US$30/lb uranium — which is what the market had grown boringly accustomed to the last several years.

Yet today, with the uranium spot price skyrocketing to decade-plus highs well above US$80 per pound, there’s simply no shortage of highly-experienced, well-funded uranium exploration firms looking to participate in the potential upside of an exploration/drilling project in key areas of the Athabasca Basin region — the undisputed epicenter of North American uranium production.

With a burst of upward momentum going into the second quarter of 2024, Standard Uranium is systematically proving that it has not only the properties and projects but also the team and exploration acumen to make things happen for STND/STTDF stakeholders in the Athabasca.

That high level of expertise and experience brings with it the potential for the inking of additional option/JV agreements in the coming quarters and, henceforth, more boots-on-the-ground exploration and more drill holes going into the ground in search of the next high-grade Athabasca-based uranium discovery of significance.

Using a hockey analogy for what Standard is achieving in the region, it’s like having multiple, multiple shots-on-goal for discovery — mostly on other companies’ dimes.

With all that being said, let’s take a closer look at STND’s primary flagships. Then, we’ll get you right over to our exclusive interview with Standard Uranium CEO Mr. Jon Bey.

Standard Uranium: Advancing Multiple High-Potential Uranium Exploration Projects in Canada’s Prolific Athabasca

Standard Uranium Ltd. (TSX-V: STND)(OTC: STTDF) is off to a very busy and productive start in 2024 marked by a number of significant milestones and accomplishments in Saskatchewan’s Athabasca Basin region, including:

- Optioned the Ascent uranium project to Summitt Fusion Ltd.

- Expanded the Ascent property by 3,728 hectares, effectively doubling the project size

- Acquired the Cable Bay Southwest, Ox Lake, Brown Lake, and Harrison uranium projects through staking

- Optioned the Atlantic uranium project to Atco Mining Inc. where drilling is underway

Standard Uranium CEO Jon Bey — whom you’ll be hearing from directly in our exclusive interview coming right up — commented on the expansion of partner-funded exploration commitments across multiple properties via press release:

“We are pleased to announce our fourth option agreement since transitioning to a project generator in July 2023. The Company now has over C$30 million committed to our exploration programs over the next three years and C$9 million committed to exploration in 2024. Heading into the 2024 exploration season, we now have 11 projects across the prolific Athabasca Basin, with a minimum of 7 exploration programs planned with 5 of those being drill programs at the Atlantic, Sun Dog, Canary, Ascent, and Davidson River projects.”

The five properties mentioned in the press release quote above — Atlantic, Sun Dog, Canary, and Ascent, plus the self-funded Davidson River project — are the current flagships.

Let’s take a closer look at those key exploration properties now.

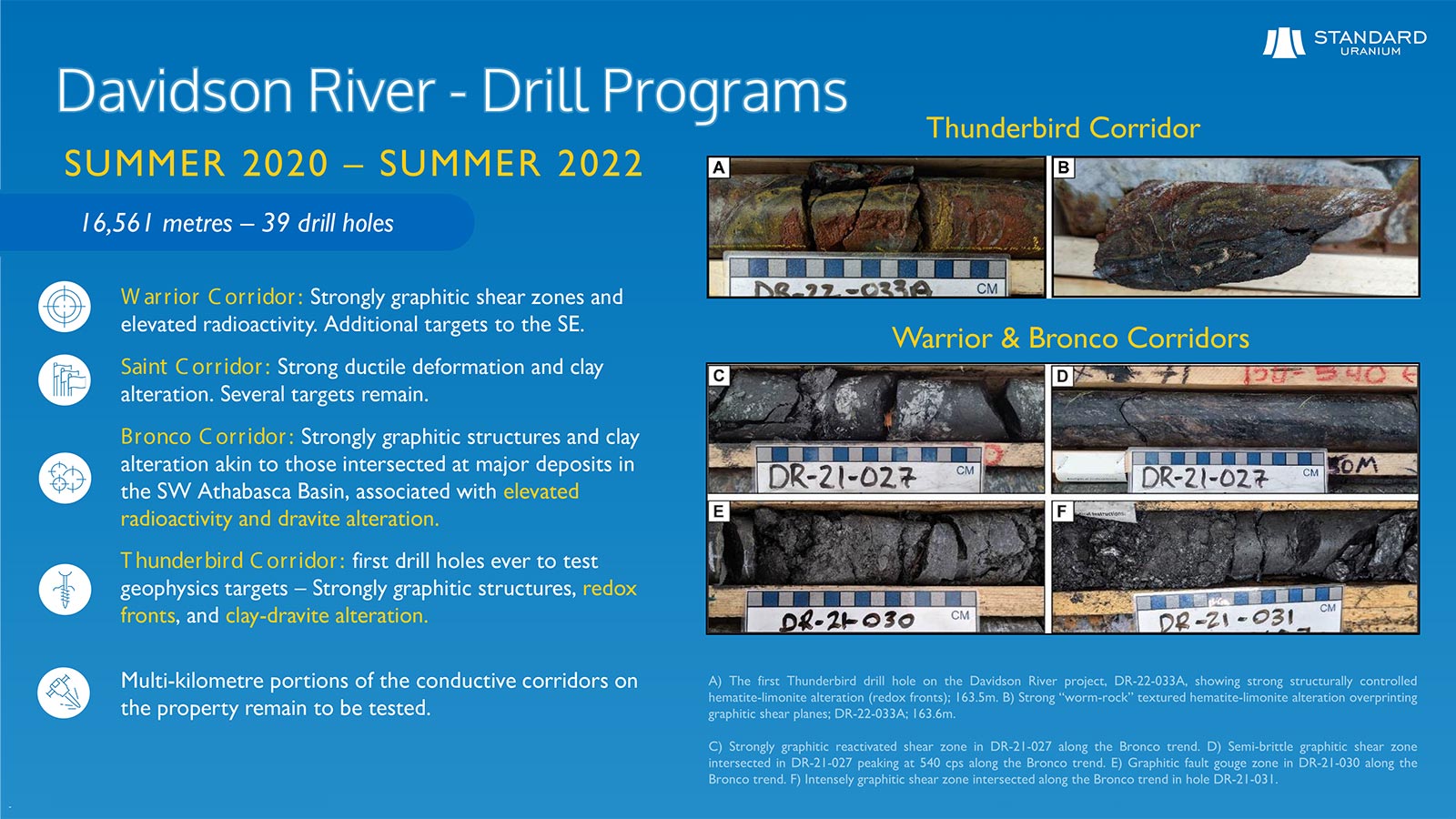

Davidson River Uranium Project (Self-Funded)

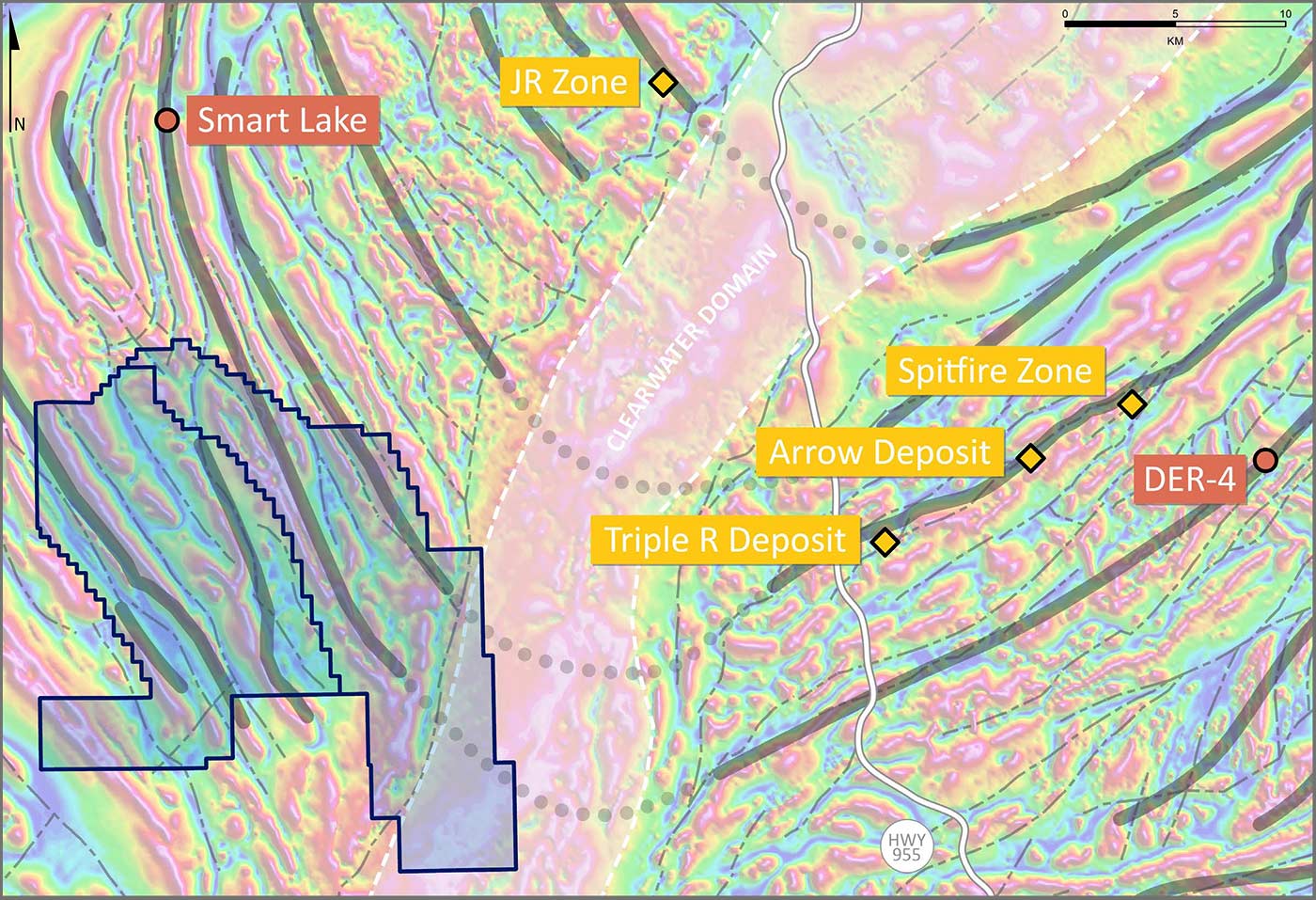

Standard Uranium’s flagship Davidson River project is located in the heart of the Patterson Lake Uranium District in the southwestern Athabasca Basin, an area ripe with potential for further district-scale uranium discoveries.

With only a handful of holes drilled to-date on the project, the Standard Uranium team has only just begun to scratch the surface of what the property potentially holds at depth.

The Davidson River project comprises 10 mineral claims spanning 30,737 hectares in an area of the Athabasca Basin that contains over 400 million pounds of high-grade uranium in world-class deposits — including Fission Uranium’s Triple R and NexGen Energy’s Arrow deposits.

Standard Uranium has laid the foundation for discovery using industry-leading surveys to define more than 70 km of prospective exploration trends at Davidson River.

The “geological mirror theory” has been validated by the discovery of the JR Zone by F3 Uranium in 2022, which is located to the west of the Clearwater domain. Standard Uranium president and VP Exploration Mr. Sean Hillacre explains:

“We've expanded the project since then and brought in some new land to the southeast that you can compare apples-to-apples geologically with the JR Zone discovery by F3 Uranium recently. And that completely validates our mirror theory there, that we know that there's world-class uranium endowments on the east side of that Clearwater domain, speaking to Arrow and the Triple R deposit and the Spitfire discovery. So now, we can point directly to the JR Zone on the western side where Davidson River lies, and that's exactly what we're looking for.”

Integral to the company’s state-of-the-art discovery approach, Standard is the first uranium firm to leverage GoldSpot Discoveries’ cutting-edge, data-driven machine learning process, which the STND team is now utilizing to delineate and prioritize drill targets at Davidson River.

With a treasure trove of geological data in hand, the Standard Uranium team is mapping out its planned drilling program at Davidson River for H2 2024 with a primary aim of following up on positive drill results from previous campaigns from 2020 to 2022.

Specifically, in 2022, Standard Uranium’s drills intersected prospective graphitic structures in basement rocks, as well as favorable alteration zones in all holes drilled at Davidson River.

Standard Uranium president and VP Exploration Sean Hillacre commented at that time:

“The Davidson River Project continues to deliver exciting and encouraging results with each drill program as we search for high-grade basement-hosted uranium mineralization. The alteration zones and structure intersected during the 2022 drill program are just the ingredients we want to see…”

Standard’s upcoming 2024 drill program (see 2024 field images below) will test new high-priority targets akin to F3 Uranium’s neighboring JR Zone discovery within the newly-added southeast claim blocks.

Atlantic Uranium Project (Partner-Funded)

In Q1 2024, Standard Uranium optioned its drill-ready Atlantic uranium project to Atco Mining Inc. whereby Atco can earn a 75% interest in the project over three years.

The project lies on the eastern side of the Athabasca Basin area where STND has amassed an impressive multi-project presence (see below).

The 3,061-hectare Atlantic uranium project covers 6.5 km of an 18-km-long east-west trending conductive exploration trend hosting numerous uranium occurrences.

A four-to-six hole ~C$1M inaugural drill program is underway and is being fully funded by option partner Atco.

The ultra-fast turnaround time from the consummation of the agreement to the start of drilling is a true testament to Standard’s strong presence and exploration proficiency in the Athabasca Basin region.

With Standard as operator and with Atco funding 100% of the exploration costs, the 2,000 to 3,000 meter program is being deployed to test for high-grade unconformity-related uranium mineralization based on historical drill holes, geophysical anomalies, and EM conductors.

Standard Uranium completed a high-resolution ground gravity survey on the western claim block in 2022, which produced multiple subsurface density anomalies, potentially representing significant hydrothermal alteration zones in the sandstone rooted to basement conductors.

STND has commenced drilling of the first hole at Area A, a high-priority target based on EM conductors and interpreted faults. Additional holes will follow up on highly anomalous uranium results within a major structure intersected in Area A in previous drill hole BL-16-32 (see below, left).

Standard Uranium president & VP Exploration Sean Hillacre commented on the start of drilling at the Atlantic JV project via press release:

“The team and I are thrilled to announce that the drill is spinning ahead of schedule, kicking off our ambitious 2024 exploration season. There will be rocks in the box just in time for me and Jon Bey to continue sharing our story at the 2024 PDAC Convention, and we look forward to keeping the market updated as we progress our first eastern Athabasca drill program.”

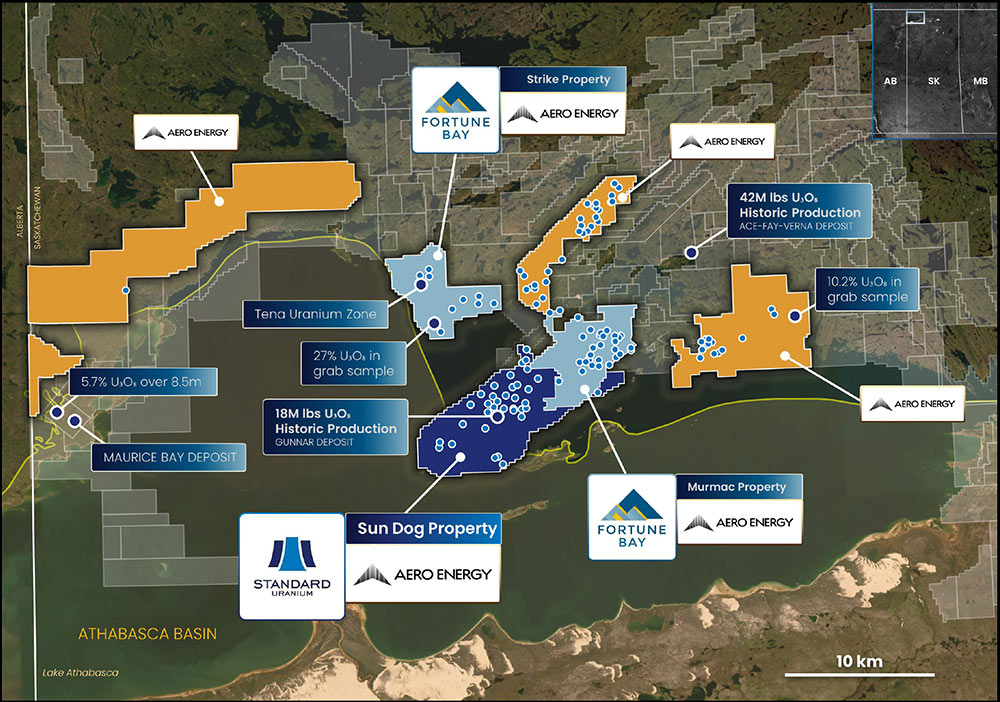

Sun Dog Uranium Project (Partner-Funded)

The Sun Dog uranium project is part of Standard’s “Uranium City Vision” wherein STND’s Sun Dog property and Fortune Bay’s Murmac and Strike uranium properties have been consolidated to form a district-scale uranium exploration opportunity in the northwestern Athabasca Basin area.

Collectively referred to as the Sun Dog project, Standard Uranium optioned the drill-ready project to Aero Energy Ltd. in Q1 2024 wherein Aero can acquire between 70% and 100% of the three uranium exploration properties.

The combined optionable properties cover a total area of 39,381 hectares, which, together, lay host to high-grade uranium mineralization at surface along with high prospectivity for basement-hosted uranium mineralization associated with the Athabasca Basin unconformity.

Fully-permitted and situated within the Uranium City area of the Athabasca — the Sun Dog project comprises nine claims and is host to the historical Gunnar Uranium Mine, which produced ~18M lbs U3O8 between 1953 and 1981.

The Sun Dog project also hosts historical uranium mineralization at surface ranging between 0.1% and 3.58% U3O8.

To-date, STND has invested ~C$4M in exploration at Sun Dog; 13 holes drilled in 2022 and 2023 resulted in the identification of anomalous radioactivity in broad zones of strong hydrothermal alteration requiring follow-up.

Ground gravity surveying and drilling, to-date, have identified significant areas of alteration; detailed airborne magnetics have identified cross-cutting structures.

Previous drilling by Standard and Fortune Bay intersected narrow zones of uranium mineralization within significant zones of hydrothermal alteration. Shallow, elevated uranium in drill core on each property is associated with electromagnetic conductors sourced from brittle-deformed graphitic rocks and pathfinder elements typical of high-grade Athabasca-based U3O8 deposits.

Standard Uranium CEO Jon Bey — whom you’ll be hearing from directly in our exclusive interview coming right up — commented on the company’s Uranium City Vision via press release.

“The vision for the Uranium City region has been shared by the management of Standard Uranium and Fortune Bay for some time. By combining our properties and infrastructure under one company, Aero Energy, we can now explore this region year-round, decreasing exploration expenses and creating work for the local communities and exploration vendors. The Standard Uranium technical team will be heavily involved in planning and operating the exploration programs.”

A ~C$1.5M exploration/drill program is being planned for H1 2024 to be fully funded by Aero Energy. The program will test the depth extent of high-grade uranium mineralization present at surface across multiple high-priority targets at Sun Dog.

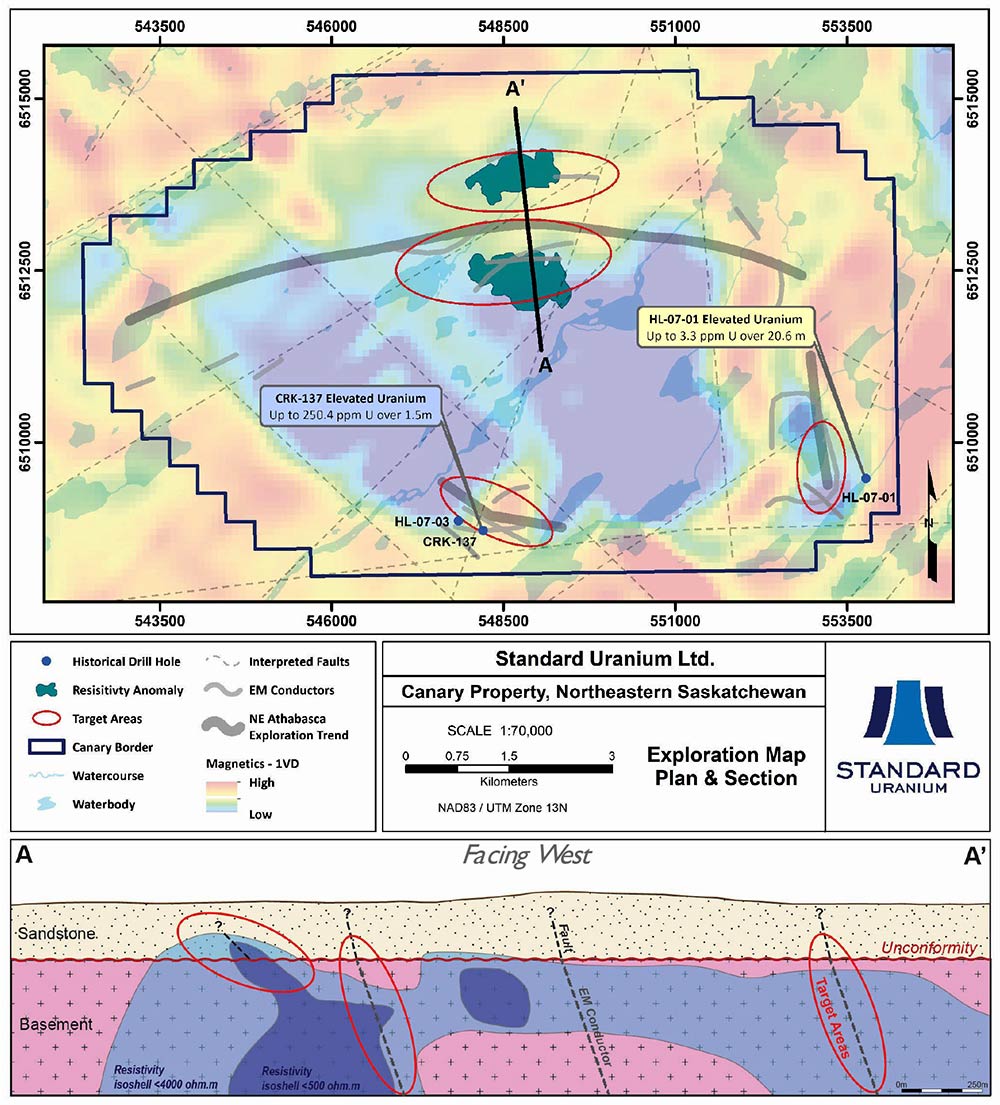

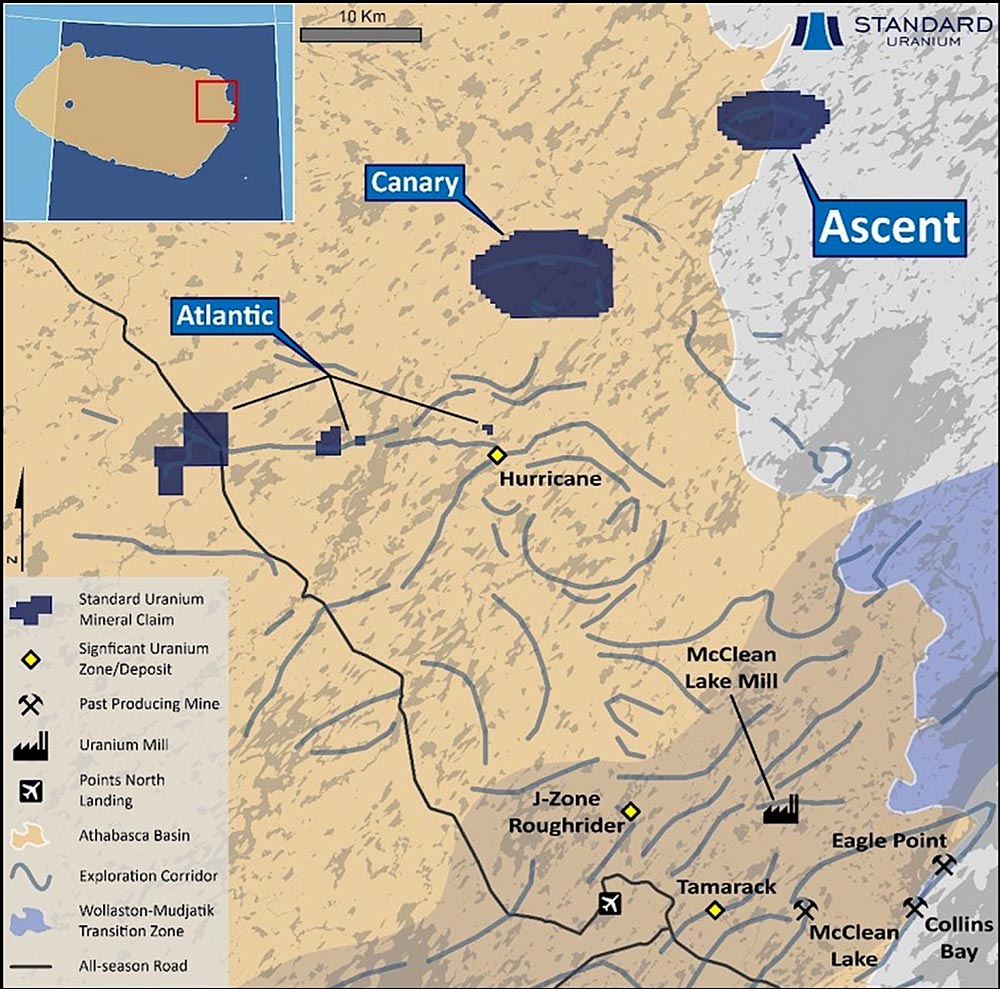

Canary Uranium Project (Partner-Funded)

In Q4 2023, Standard Uranium optioned the 7,302-hectare Canary uranium property to Mamba Exploration Ltd. whereby Mamba can earn a 75% interest in the project.

The drill-ready property, which is situated just 11 km north of IsoEnergy’s high-grade Hurricane uranium deposit (see below) presents exceptional potential for a high-grade unconformity-related uranium discovery.

The underexplored Canary project lies within the Mudjatik geological domain where several recent U3O8 discoveries have been made, including the aforementioned Hurricane deposit (IsoEnergy).

With a robust geological dataset in hand from high-quality geophysical surveys and interpretations completed at Canary in 2023, Mamba Exploration will fund an inaugural ~C$1M drill program planned for H1 2024 with the aim of delineating high-grade unconformity-related uranium mineralization.

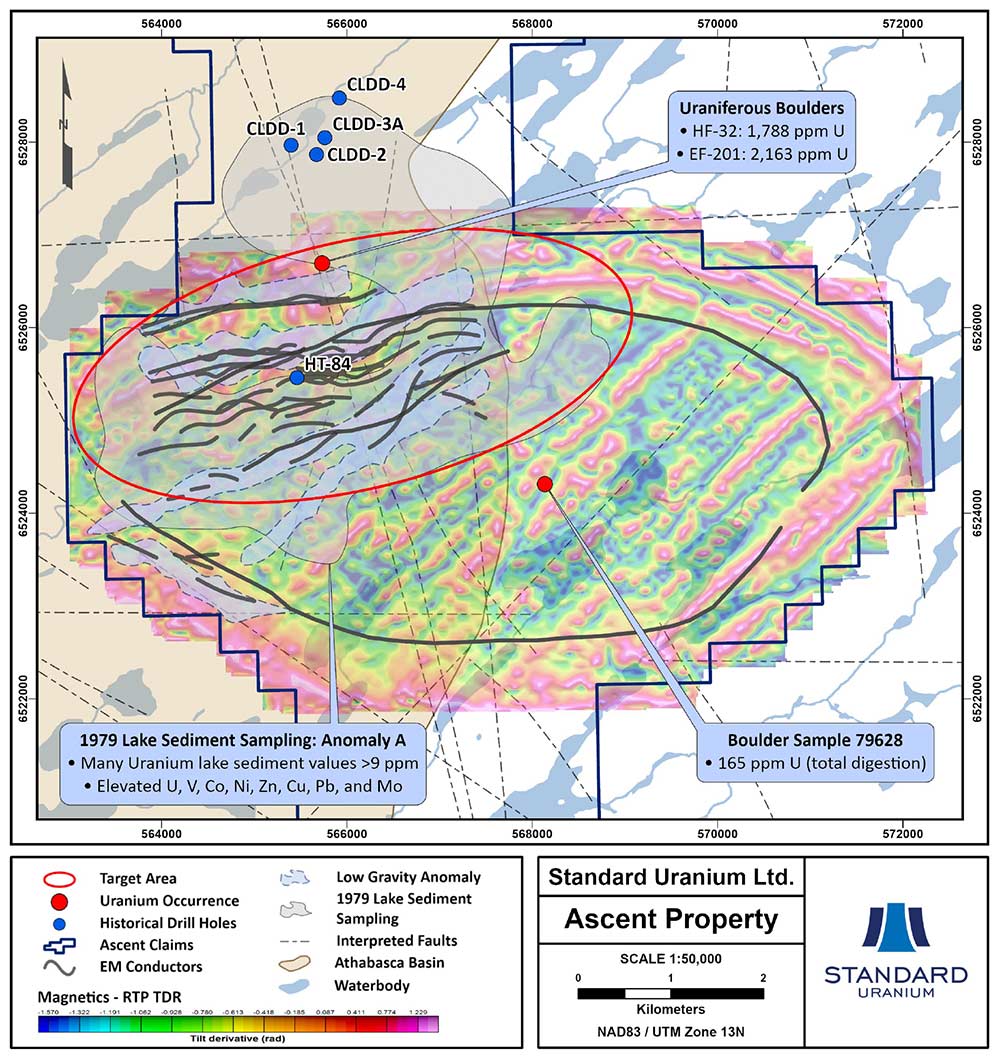

Ascent Uranium Project (Partner-Funded)

In Q1 2024, Standard Uranium signed a term sheet with Summit Fusion Pty. Ltd. on the Ascent uranium property wherein Summit can earn up to a 75% interest in the project over two stages.

As per the term sheet, Summit would fund ~C$6M in exploration expenditures during the full earn-in period.

The Ascent project, which resides to the east of Standard’s Atlantic and Canary projects (see below), was recently increased by 3,728 hectares, effectively doubling the project size.

In 2022, STND completed a high-resolution airborne TDEM survey at Ascent, bolstering the historical EM corridors and identifying significant structural disruptions presenting prime targets for U3O8 mineralization.

With that advanced dataset in hand, Summit will fund an inaugural ~C$1M drill program slated for spring 2024.

With those five projects being the primary self-funded and partner-funded flagships, a couple of honorable mentions are the Corvo and Rocas uranium projects, which the Standard Uranium team staked in August 2023 and May 2023, respectively.

The Corvo project covers ~12 km of two northeast trending EM conductor corridors with previous showings of anomalous uranium and/or radioactivity.

The Rocas project covers 5.5 km of a northeast trending EM corridor hosting several uranium anomalies.

Standard Uranium is planning geophysics for both properties with plans to get both projects drill-ready by 2025.

2024 Exploration Plan

Standard Uranium’s systematic deployment of the hybrid prospect generator model now has the company set up for partner-funded exploration and drilling across multiple projects in 2024 in what’s shaping up to be a transformative year for the junior explorer.

Standard Uranium CEO Jon Bey recently commented on the company’s full plate of exploration and drilling via press release:

“... Heading into the 2024 exploration season, we will have a minimum of six exploration programs underway with four of those being drill programs at Sun Dog, Canary, Ascent, and Davidson River projects. 2024 is shaping up to be our most exciting exploration year to date.”

And keep in mind also that Saskatchewan’s Athabasca Basin is the No. 1 undisputed highest-grade uranium depository on the entire planet.

It’s where industry leaders like US$18B Cameco have their flagship uranium mines… including some of the biggest and richest in existence such as McArthur River and Cigar Lake (see below).

And speaking of ultra-safe, Tier-1 mining jurisdictions, Saskatchewan is consistently ranked by the Fraser Institute as one of the best mining jurisdictions in the world.

That’s an operational benefit that simply cannot be overstated in today’s world where the nationalization and over-taxation of mining assets by rogue governments has become all-too commonplace.

To that end, Standard Uranium is advantageously set for multi-project drilling in perhaps the best place on Earth for large-scale, high-grade uranium discovery: Canada’s famed Athabasca Basin region.

Exclusive Interview with Standard Uranium

CEO Jon Bey

Following a hybrid project generator model, Standard Uranium has the team, the projects, and the exploration acumen to advance its portfolio of high-potential Athabasca-based uranium projects via the drill-bit to the benefit of STND/STTDF stakeholders.

We introduced you to the company’s VP Exploration Sean Hillacre.

Sean Hillacre

President & VP Exploration

Sean brings a decade-plus of experience working as an economic geologist in the Athabasca Basin, including five years as part of the technical team credited with progressing the world-class Arrow uranium deposit towards production with C$5.5B NexGen Energy.

The Standard Uranium team also includes lead technical director Neil McCallum.

Neil McCallum

Lead Technical Director

Neil boasts 15-plus years of experience primarily in North American mineral deposit exploration with a focus on targeting and discovery of unconformity-related uranium deposits. Having managed and conducted uranium exploration in and around the Athabasca Basin and other jurisdictions for multiple companies, Neil presently serves as project manager for Edmonton-based Dahrouge Geological Consulting Ltd.

Finally, as promised, and to get the full picture of all the activity surrounding this impressive, yet undiscovered junior uranium explorer, our own Gerardo Del Real of Resource Stock Digest and Junior Resource Monthly caught up with CEO Jon Bey for an exclusive chat.

Jon Bey

CEO & Director

Jon is a seasoned capital markets executive with 15-plus years of expertise in the junior exploration industry with boots-on-the-ground experience in uranium, gold, silver, lead, zinc, diamonds, and oil and gas. He’s also the founder and managing director of the Steel Rose Group of companies.

Inside, Gerardo and Jon delve into STND’s hybrid prospect generator model and the multi-project exploration and drilling underway in Saskatchewan’s Athabasca Basin region — the world’s highest-grade uranium depository.

We hope you’ll enjoy the candid conversation.

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the chairman & CEO of Standard Uranium — Mr. Jon Bey. Jon, how are you today?

Jon Bey: I am doing very well, Gerardo. How are you doing?

Gerardo Del Real: I am doing great. We have ourselves a uranium bull market. Look, I've been a uranium bull for quite some time, and even I think that I was a bit conservative in my price targets. I said when uranium was at 20 bucks per pound that I thought eventually it would overshoot to US$200/lb. And I thought we would have a violent uranium bull market that lasted anywhere between 18 and 24 months.

And I think now, that prediction is going to prove conservative. Looking at the setup, we have the uranium spot price firmly over the US$100 level, and the utilities are just starting to creep off the sidelines.

[Editor’s note: the uranium spot price is currently experiencing a healthy pullback to around the US$85/lb mark and has begun to inch back toward US$90/lb.]

So I want to talk Standard Uranium and I want to talk about why I wrote a check recently and why I'm a happy and excited shareholder. Yet, before that, I have to get your take on the uranium space because I think your timing for what you have going is absolutely perfect.

Jon Bey: Sure, Gerardo. I’m also super bullish on where the uranium market is going. Like yourself, we got into this space a few years back. Not only a few years… we started this company back in 2017.

We had a timeline of around 2020 where we thought it was going to move, and we were early. But that’s okay because having six years to build out this company has really set us up beautifully for where we are today and what we're capitalizing on. And we can get into that in a bit more detail as we get into the company here.

But yes, we're extremely bullish… US$100/lb, like you said, we think that's a great price to be at, and I think we're going higher. I'm not going to put a number on it but I think we've got a lot of room to run here.

Gerardo Del Real: I couldn't agree more. For those that aren't familiar with you and the team, can you speak a bit to your involvement and, obviously, you mentioned coming into the uranium space and building a company. Frankly, you still only have a ~C$16 million market cap.

We know what happens in these markets, Jon, when you are successful in executing the business model. And we will get into the business model in just a second. But I can tell you that the market cap is going to be a whole heck of a lot higher than ~C$16 million if you're able to execute the way I think you will. But let's talk about the team a bit because I think that's important.

Jon Bey: Sure, we have a team of great exploration geologists, for one, so I'll start there. My right-hand man is Sean Hillacre. He is our president and VP Exploration. Sean joined us in 2020 after spending five years at NexGen where he was a geologist. And he actually did his Master's degree on the Arrow deposit. Now, we thought that was remarkable because our flagship, Davidson River, is right across the street.

At the time when we started Standard Uranium, I brought on a few key directors. One of those was a guy named Garrett Ainsworth who was the VP Exploration at NexGen. He joined our team because he too knew the Davidson River project and he wanted to be a part of exploring that.

Shortly after that, within a week, I brought on Neil McCallum. Neil is still with the company as a director and as our lead technical advisor. Some of your listeners may know Neil from his involvement in other uranium endeavors as well as his role with Dahrouge Geologic and his role with Patriot Battery Metals on the lithium side. Neil is a remarkable 35-plus-year veteran. And for those who don't know, he is really an expert in the uranium space.

Another geologist we have on our board is Mike Young. Mike, for those who’ve been in this space, was founder and CEO of Vimy Resources in Australia. He ran that for eight years before joining our board about two years ago.

So we’ve got a fantastic team of people who are uranium-specifically focused. And that is so crucial when you're focused on the uranium market. There are so many other companies that have no board members or geologists that have any uranium experience.

So looking at our team… and for a company, as you mentioned, at a sub-C$20 million market cap and where we're going… our team makes a huge difference.

Gerardo Del Real: Let's get into what that team has been able to accomplish as far as bringing in a portfolio of quality assets with a hybrid prospect generator business model. I would love for you to touch on that, and I want to dig in and dissect that in a bit more detail here.

Jon Bey: Sure, so when we started the company, we built the company around our flagship project, which is the Davidson River project, which is still our flagship; it's got huge home run potential and we can get into that.

As the years progressed, we continued to add more projects. During a time when the uranium market wasn't so hot, we were able to pick up some remarkable targets, specifically our Sun Dog project in the north near Uranium City. And later, three projects on the eastern side of the Athabasca Basin — our Atlantic, Canary, and Ascent projects.

Over the last couple of years, we've completed two drill programs at Sun Dog to advance that along. We did all of the geophysics and all of the permitting and all of the First Nations agreements for all three eastern Athabasca Basin projects. So those are the flagships — the five big projects in the company right now.

We also staked the Corvo and Rocas properties in the last year and a half, and we have plans to do some geophysics on those and get those drill-ready for 2025. And then, we also staked another few projects. So we have 11 projects currently in the Athabasca Basin; some very early-stage and others that are drill-ready.

We've made a few announcements already but we're going to be exploring seven of those projects, and five of those will have drill programs in 2024. So it is a super exciting time if you're a believer in adding great value to the company with drill programs and making discoveries.

Gerardo Del Real: That's a lot of drilling. How is that parceled out, Jon, as far as how much of that will be specifically on the 100%-owned flagships and how much of it will be partner-funded essentially, right? Because you're able to do that really nimbly and you do it better than most of the groups out there.

Jon Bey: Yes, so when we got into this situation a couple of years ago, we were looking at the space and thinking, ‘Look, our portfolio of projects is getting large and we're not going to be able to fund the exploration work we want to be doing on all of those projects ourselves.’

So we started analyzing the best way to go about creating a hybrid project generator model… getting other companies to spend on our projects. And we pulled the trigger on that last summer and we’ve moved into that model.

Our model is pretty simple. We are going to be the complete operators on all of these projects. Our deals are a combination of the company we work with: they pay us cash and they pay us in shares and they pay us to operate the project. We run it from top to bottom. We actually arrange all of the permits and arrange all of the First Nations agreements.

For a JV partner coming in, we have to make sure that they're good people and that they've got a good company and that they have the ability to raise cash and that they have cash. They show up with those things and then we run everything. It's a remarkable model.

We’ve got seven projects being explored this year. We’ve got four projects that are going to be fully-funded by our JV partners. Sun Dog is going to be a C$1.5 million exploration program this year.

Ascent, Canary, and Atlantic are going to be C$1 million-plus each funded by our JV partners. And we’re going to run our flagship Davidson River project ourselves, funding that one 100% on our own and driving that one forward.

Gerardo Del Real: Jon, looking ahead to a critical and transformational 2024, I have to believe that, given the network and the access you have to quality projects, you're likely still on the hunt for more. Would that be accurate… is M&A something that's attractive to the company?

Jon Bey: It's very accurate, Gerardo. As you can imagine, with the market being this hot, our phones are ringing off the hook not only with companies wanting to work on our projects but also companies that have projects that they’re offering to us.

We have to be very careful with how we manage our bandwidth. We've got a team of four geologists in-house that are running everything. So I want to make sure that their plate is busy but not overstretched.

As we continue to grow, we’re going to be adding more members to our team as well, and not just the average regional generalist geologists. We're specifically hiring uranium-specific geologists with specific experience in Saskatchewan. And Sean Hillacre has a great network of those people.

We're building a really strong technical group that works really well together. And we're getting a lot of inbound calls from other geologists that we know that may not be happy where they currently are and see our team as a great team to be a part of.

Gerardo Del Real: I’m excited to be a shareholder… and I’m excited for a busy, busy 2024. Anything to add to that, Jon?

Jon Bey: Yes, I’d say that for investors who are hearing our story for the first time, it's great to understand that the uranium spot price has moved up significantly. We're seeing the producers’ and the near-term producers’ share prices moving up.

Yet, those companies that are in the sub-C$30 million market cap area, like us, haven't really moved yet. So that is going to happen, I think, later on this year.

So to those listeners, I’d say, find companies that have good projects that are actually going to be doing the work… that have experience with exploration… and find a few that you like and get invested now while the share prices are at a great point to get in.

Gerardo Del Real: Jon, I agree wholeheartedly. Thank you for the update… and I look forward to chatting again soon.

Jon Bey: You’re welcome, Gerardo. Good chatting with you, and we'll talk again soon.

Gerardo Del Real: Cheers.

The Standard Uranium Opportunity

Uranium has entered a powerful bull market that looks poised to only strengthen over time as the world increasingly turns to clean-burning nuclear energy powered by uranium.

The global shift away from coal-fired plants to carbon-emission-free nuclear energy is not only key to a cleaner and greener future for our planet… it’s also creating a climate where uranium discovery success in safe, Tier-1 mining jurisdictions can produce escalating gains buoyed by strong commodity pricing for yellowcake.

Led by CEO Jon Bey and president & VP Exploration Sean Hillacre, Standard Uranium Ltd. is putting the rubber to the road with its hybrid prospect generator model that’ll see pattern-funded drilling across multiple high-potential uranium exploration projects in Canada’s Athabasca this year.

Jon outlined that succinctly in our exclusive interview, stating:

“We’ve got seven projects being explored this year. We’ve got four projects that are going to be fully-funded by our JV partners. Sun Dog is going to be a C$1.5 million exploration program this year. Ascent, Canary, and Atlantic are going to be C$1 million-plus each funded by our JV partners. And we’re going to run our flagship Davidson River project ourselves, funding that one 100% on our own and driving that one forward.”

Now, compare that to a lot of other junior uranium explorers that only have one flagship project, which they’ll typically fund all of the exploration expenditures, including highly capital intensive drilling, themselves. In that type of scenario, if the company is unable to hit paydirt on its initial targets, and they end up draining the treasury in the process… well, you get the picture!

Standard Uranium, on the other hand, and getting back to our hockey analogy, presents speculators with multiple shots-on-goal for discovery success via the drill-bit… and they’re doing it mostly on other companies’ dimes.

In other words, more chances for uncovering a uranium deposit of merit while preserving capital and minimizing shareholder dilution every step of the way.

It’s a brilliant growth model that could potentially lead to multiple uranium discoveries for STND… and it’s all happening in an area widely regarded as one of the best places on Earth for the discovery and development of high-grade, district-scale uranium deposits.

With a robust portfolio of 11 Athabasca-based uranium exploration projects being advanced in a bullish uranium environment — Standard Uranium’s sub-C$15 million market cap is considered small compared to some of its peers.

As we discussed in detail, the next major leg up in the uranium price will be driven by utilities coming into the market to secure long-term U3O8 contracts. That’s happening now. And it means we could be setting up for an even higher uranium price environment — potentially well above US$100 per pound — for years to come.

For speculators, the combination of 100%-owned and partner-funded projects makes Standard Uranium one-to-watch in the newly-resurgent uranium bull market.

Right now is an opportune time to begin conducting your own due diligence on Standard Uranium Ltd. — symbol STND on the Toronto Venture Exchange and symbol STTDF on the US-OTCQX Exchange.

A great place to start is Standard Uranium’s corporate website.

There, you can sign up to receive updates directly from the company, view the most recent Corporate Presentation and much more.

Be sure to also follow our exclusive interviews with upper management here.

— Resource Stock Digest Research

Click here to see more from Standard UraniumIMPORTANT DISCLAIMER & DISCLOSURES

Resource Stock Digest, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction.

Please do not rely on the information presented by Resource Stock Digest as personal investment advice.

If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor.

The communications from Resource Stock Digest should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

Standard Uranium has sponsored this report.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom.

Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter. Resource Stock Digest nor any employee of Resource Stock Digest is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. Resource Stock Digest, its owners, directors, and employees are also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED:

In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Resource Stock Digest has received cash compensation from Standard Uranium and is thus extremely biased. It is crucial that you conduct your own research prior to investing. This includes reading the companies' SEDAR and SEC filings, press releases, and risk disclosures. The information contained in our profiles is based on data provided by the companies, extracted from SEDAR and SEC filings, company websites, and other publicly available sources.

Resource Stock Digest, and its owners, directors, employees, and members of their households may own shares of Standard Uranium Therefore, Resource Stock Digest is extremely biased. Measures are in place such that no shares will be sold during the active awareness campaign.

HIGH RISK:

The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE:

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Resource Stock Digest, and all partners, members, and affiliates harmless in any event or claim. While Resource Stock Digest strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Resource Stock Digest is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS:

Certain information presented may contain or be considered forward-looking statements. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated in these statements. There can be no assurance that any such statements will prove to be accurate, and readers should not place undue reliance on such information. Resource Stock Digest does not undertake any obligations to update the information presented or to ensure that such information remains current and accurate.