TSX-V: FUU | OTC: FUUFF

Advancing the Near-Surface High-Grade

PLN Uranium Discovery

in Canada’s Prolific Athabasca Basin

Uranium prices are soaring — now at 15-year highs well above US$80 per pound — as nuclear energy continues to gain global acceptance as a key baseload energy solution devoid of greenhouse gas emissions. Uranium’s historic rise is presenting investors with a timely opportunity as we enter 2024, particularly in the small-cap space.

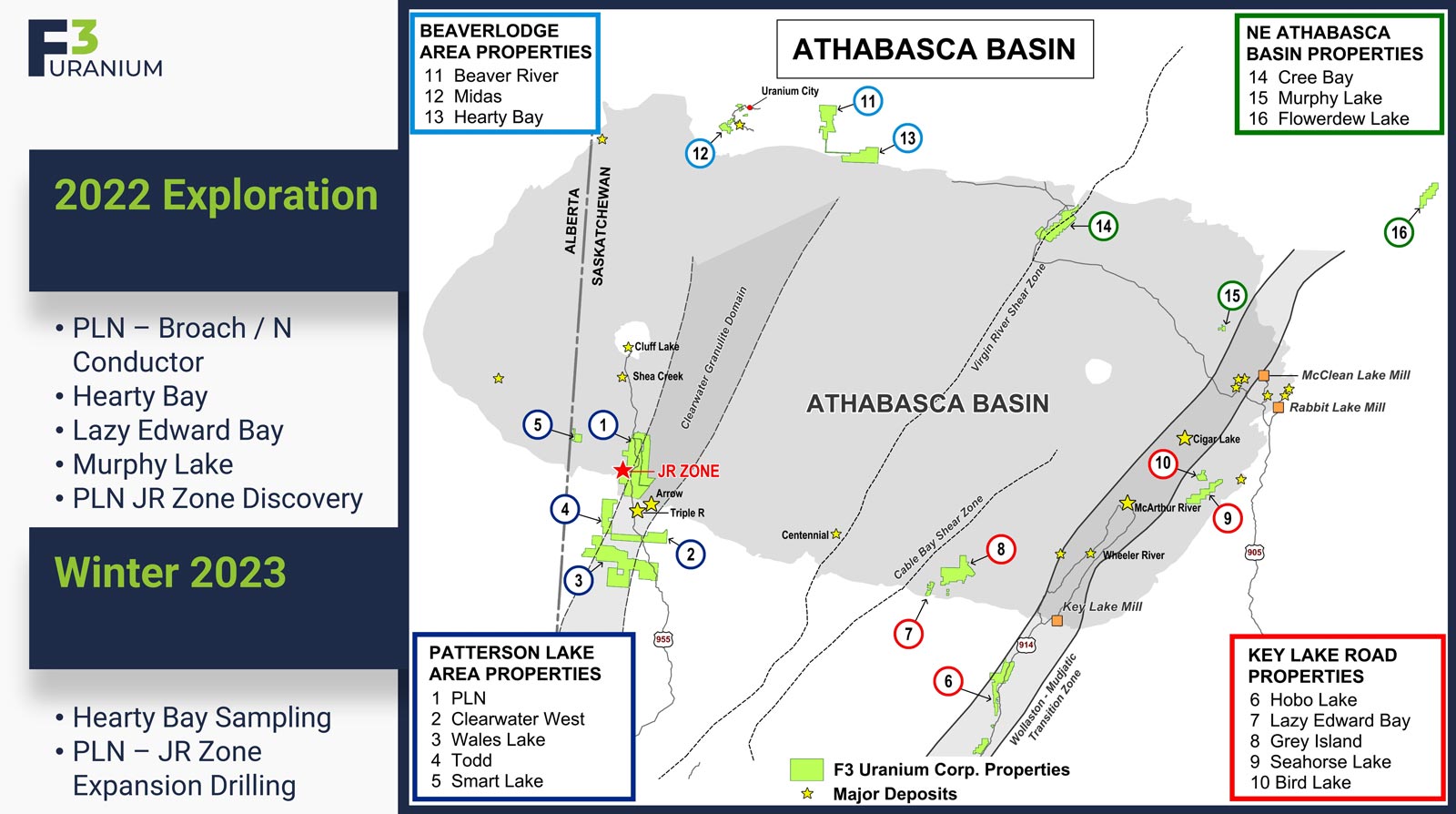

The small-cap uranium company featured in this report, F3 Uranium Corp. (“FUU”), is a bona fide uranium discovery story in Canada’s famed Athabasca Basin — the highest-grade uranium depository on the planet and home to industry-leader Cameco’s McArthur River and Cigar Lake mines. In late 2022, F3 Uranium, which boasts a robust portfolio of 18 projects in the Athabasca Basin region, discovered the near-surface, high-grade JR Zone at its flagship, 100%-owned PLN Uranium Project in the southwestern portion of the basin — a key area that’s poised to become the next uranium producer and home to a number of world-class uranium deposits including Fission Uranium’s Triple R and NexGen Energy’s Arrow discoveries.

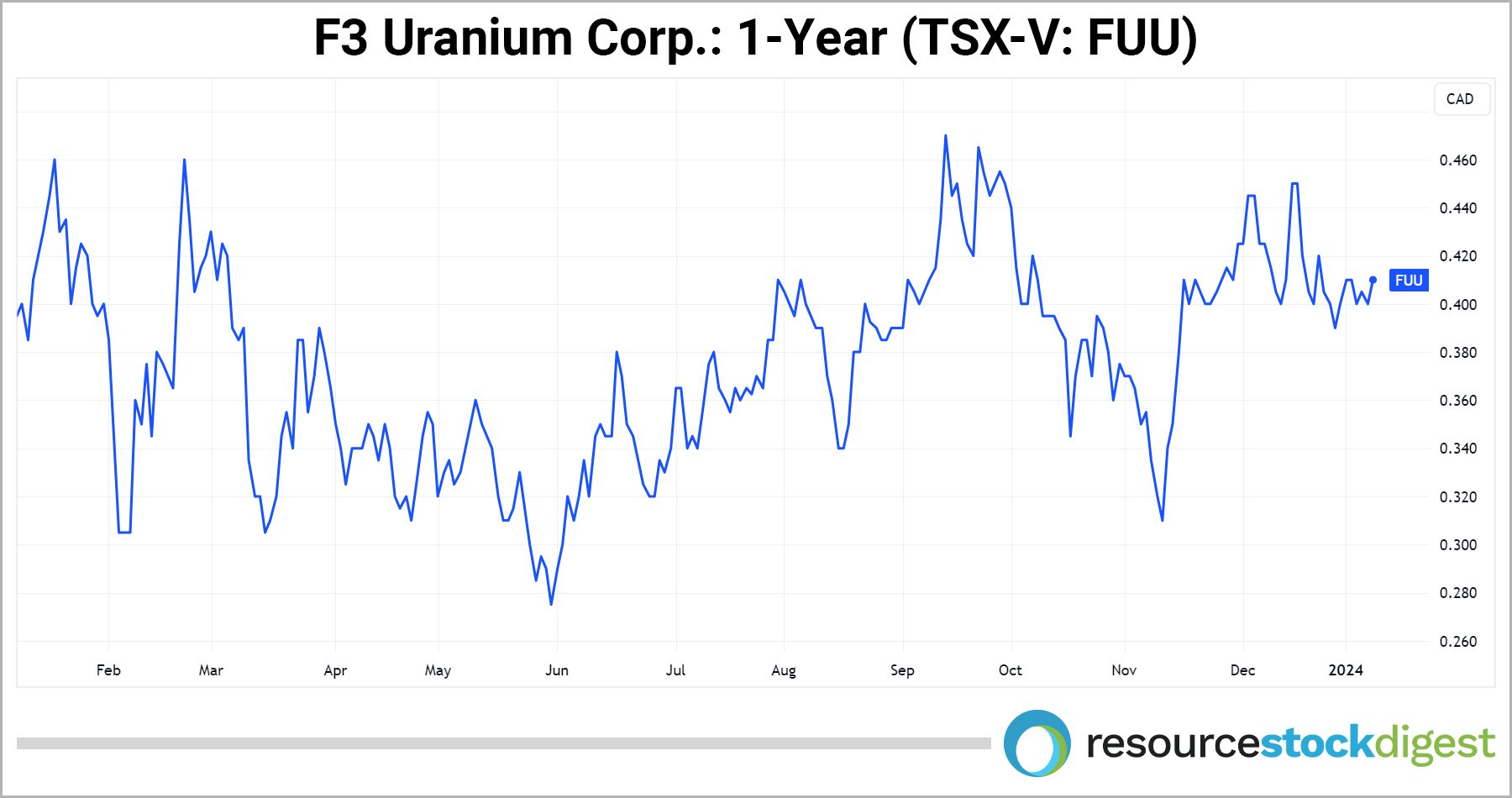

Following F3’s initial discovery at PLN, the company’s market cap has risen from around C$20M to currently around C$175M with industry giant Denison Mines (TSX: DML)(NYSE-Amer: DNN) coming in with a C$15M strategic investment. With the near-surface, high-grade nature of the JR Zone discovery — and a C$16M ground geophysics and drilling program underway — the key question for investors now is… just how much uranium is there at PLN? We’ll be exploring that key question, and more, in this Special Report.

Uranium Bull Market Surging Into 2024

There’s a major positive shift happening in the global nuclear energy market.

The world is finally coming to the realization that lofty climate goals will be impossible to meet without clean-burning, carbon-emission-free nuclear energy being an integral part of the clean-energy mix.

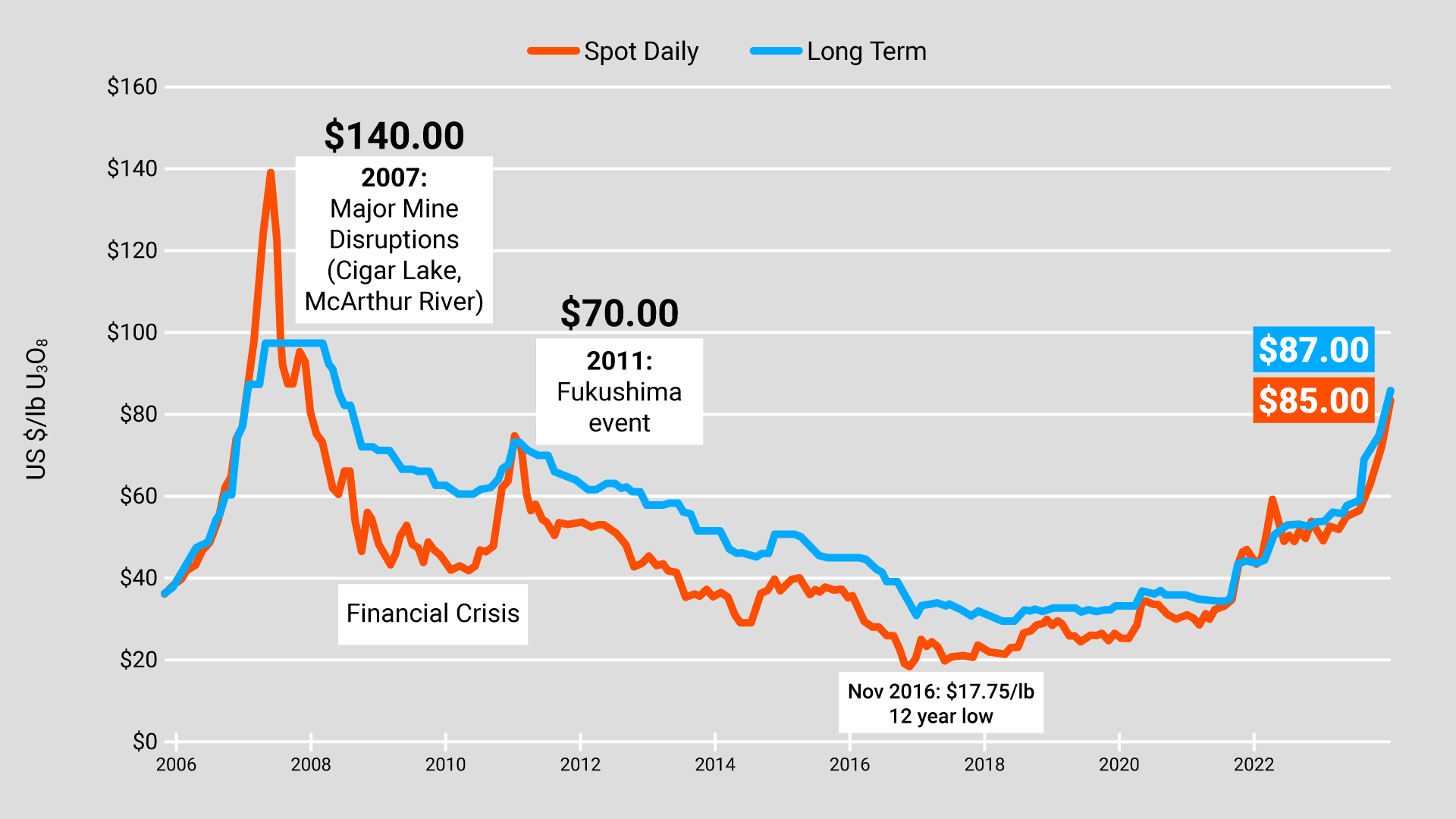

That fact is adding escalating pressure on an already constrained global uranium supply with U3O8 prices now sitting at 15-year highs above US$80 per pound after starting 2023 at US$50 per pound.

With uranium, what we arrive at is a market that’s consuming close to 200 million pounds of yellowcake annually — yet producing only around 140 million pounds.

That equates to a 60-million-pound structural deficit this year… which, when compounded over the next six years to the end of the current decade, balloons to a jaw-dropping ~360 million pounds.

That’s a staggeringly large deficit… and it underpins the escalating need for new North American uranium sources reaching the supply chain.

And it’s really only the start.

On the demand side, we have Japan looking to restart a further 16 of its reactors. The island nation is also seeking ways to safely extend the plant-life of its existing reactor fleet from 40 to 60 years.

China just approved the construction of six new nuclear reactors across three provinces with plans to build 150 new reactors over the next 15 years as part of their newly-enhanced decarbonization mandate.

South Korea and India have also joined the fray and are now fully onboard with a cleaner energy future that will require vast amounts of uranium, or U3O8.

In Europe, France’s economy minister has doubled down on the need for a top-to-bottom overhaul of the electricity market saying, “there is no energetic transition without nuclear energy.” The nation has announced plans to construct a new generation of nuclear reactors for the first time in decades.

Even Finland’s Green Party — following decades of staunch opposition — voted overwhelmingly in 2022 to categorize nuclear power as a form of sustainable energy. At present, one-third of Finland’s electricity is derived from nuclear power. And earlier in 2023, the country’s OL3 reactor, Europe’s largest, finally went online.

Other European nations are quickly falling in line with Finland’s pro-nuclear stance. Britain and Sweden are each planning new nuclear reactor projects with Belgium and Spain also cementing their support for the clean energy source. And at the COP28 climate conference in Dubai, more than 20 countries endorsed a declaration to TRIPLE the share of world nuclear power by 2050.

Here in the United States, TerraPower is currently constructing a US$4B nuclear power plant in Wyoming that’ll use an all-new blend of enriched uranium. Once completed, it is expected to generate efficient, low-cost, clean energy while utilizing enhanced safety standards that greatly reduce the risk of accident — even on par with wind power plants.

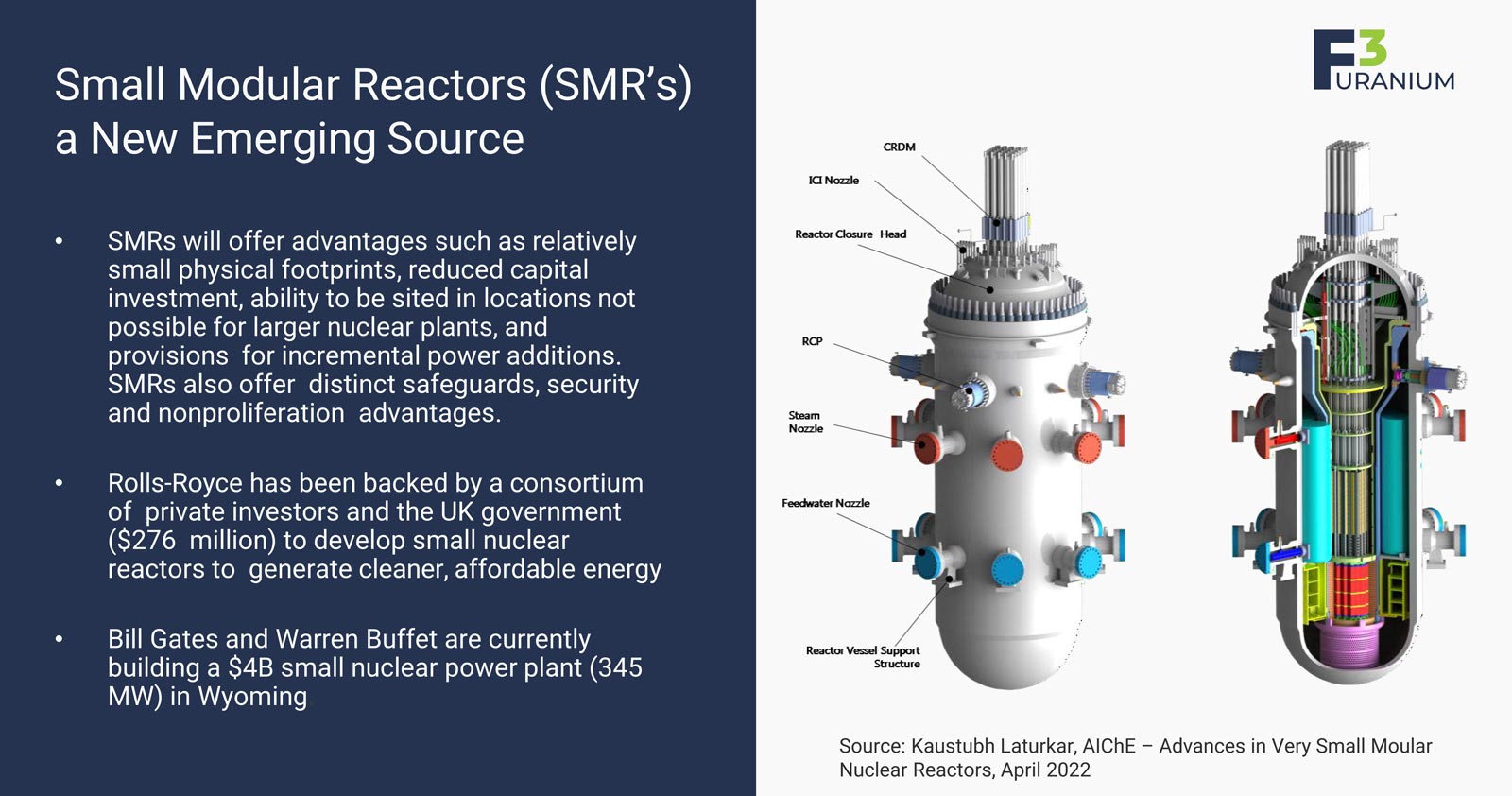

NuScale recently became the first company to be granted approval by the US government on small modular reactor (SMR) design with the US Nuclear Regulatory Commission giving it the green light. Privately-owned Standard Power followed up that news with an announced partnership with NuScale on the construction of two SMRs to power its data center company customers.

Put plainly, increased uranium demand is coming from all angles. And that includes a new contracting cycle that’s just now getting underway with major utilities entering the market to secure their next long-term U3O8 contracts.

The combination of supply cuts from the highest-margin producers and utilities coming back into the market has kicked off what many experts agree will be the greatest uranium bull market anyone has ever seen.

The Inflation Reduction Act of 2022 also provides funding for US nuclear power projects, including a tax credit for electricity produced at qualified nuclear power facilities.

Next, you have to look at the precariousness of the global uranium supply to really get the full picture.

Kazakhstan — a former soviet republic and the world’s largest uranium producer — produces roughly 40% of global supply. In 2022, as you may recall, the country erupted into what’s now known as ‘Bloody January’ wherein over 225 people were killed in a government crackdown on nationwide protests.

Cameco, which owns 40% of the giant Inkai uranium mine in Kazakhstan, had this to say:

“As 40% of the world's uranium supply, any disruption in Kazakhstan could of course be a significant catalyst in the uranium market. If nothing else, it's a reminder for utilities that an over-reliance on any one source of supply is risky. It also reinforces the shift in risk from suppliers to utilities that has occurred in this market.”

Cameco, which accounts for roughly 17% of global uranium production, is experiencing production issues of its own — to the tune of about a 2.7 million pound shortfall expected for full-year 2023 — citing ongoing difficulties at its Cigar Lake and McArthur River mines as well as at its Key Lake Mill in Canada.

Uranium supply is being further hampered by a recent military coup in Niger (the world's seventh-largest producer representing over 4% of supply).

It’s that type of geopolitical chaos that’s leading to increased energy insecurity around the world as supply comes under increasing pressure, particularly in the global uranium market.

Uranium supply is also under siege as companies look to capitalize on the opportunity to purchase large amounts of drummed uranium in the open spot market with the Sprott Physical Uranium Trust (SPUT) acquiring some 50M lbs over the last couple of years — and with others like Yellowcake PLC and Uranium Energy Corporation following suit.

As a result, uranium inventories are continuing to shrink, most notably from 3.5 years to around 2 years of supply right here in the United States, well below the historical average.

We also talked about restarts and lifespan extensions on reactors… and it’s not just Japan that’s going down that road.

In California, steps are underway to potentially extend the life of the Diablo Canyon reactor for an additional 5 years from 2025 to 2030. The same thing is happening in countries such as Belgium, Finland, and Slovakia.

All of that is to say that any further disruptions to the global uranium supply chain could lead to an even greater run on uranium spot prices — possibly like what we saw back in 2006-07 when uranium soared to US$140 per pound upon the flooding of Cameco’s Cigar Lake Mine.

That upsurge caused the share prices of most uranium mining companies to breakout… resulting in substantial gains for well-timed investors.

We’re currently sitting at 15-year highs well above US$80 per pound U3O8. A couple of years ago, uranium prices were languishing at the US$30/lb level and were at US$50/lb at the beginning of 2023. The uptrend is undoubtedly underway as you can tell by the uranium price chart below.

With geopolitical upheaval at an all-time high in key uranium producing countries, including Russia (which, at any time, could have its uranium exports sanctioned by the United States), the writing’s clearly on the wall for strong uranium pricing going forward.

It also underpins the need for increased uranium production from safe jurisdictions such as the Athabasca Basin, located in northern Saskatchewan, Canada, where F3 Uranium is operating and advancing its high-grade discovery via the drill-bit.

It’s still early innings in the current uranium uptrend, which means now is an opportune time for resource speculators to consider positioning for what could be a material move higher.

Enter F3 Uranium Corp. (TSX-V: FUU)(OTC: FUUFF).

F3’s Flagship: Patterson Lake North (PLN)

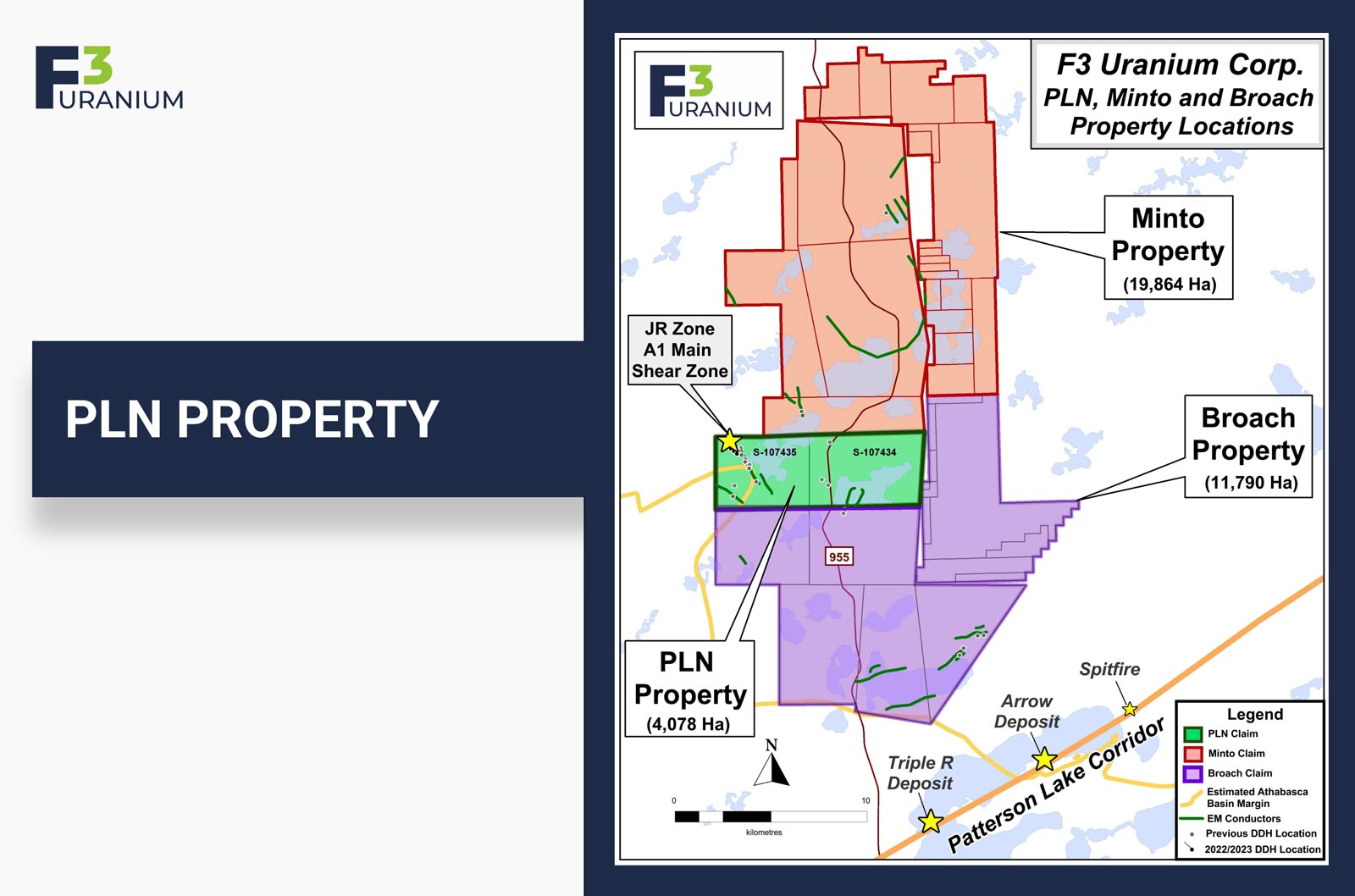

As noted at the beginning of this Special Report, F3 Uranium’s 100%-owned, 4,078-hectare Patterson Lake North (PLN) uranium project — located in the southwestern portion of Sasckatehwewan’s prolific Athabasca Basin — is the current flagship.

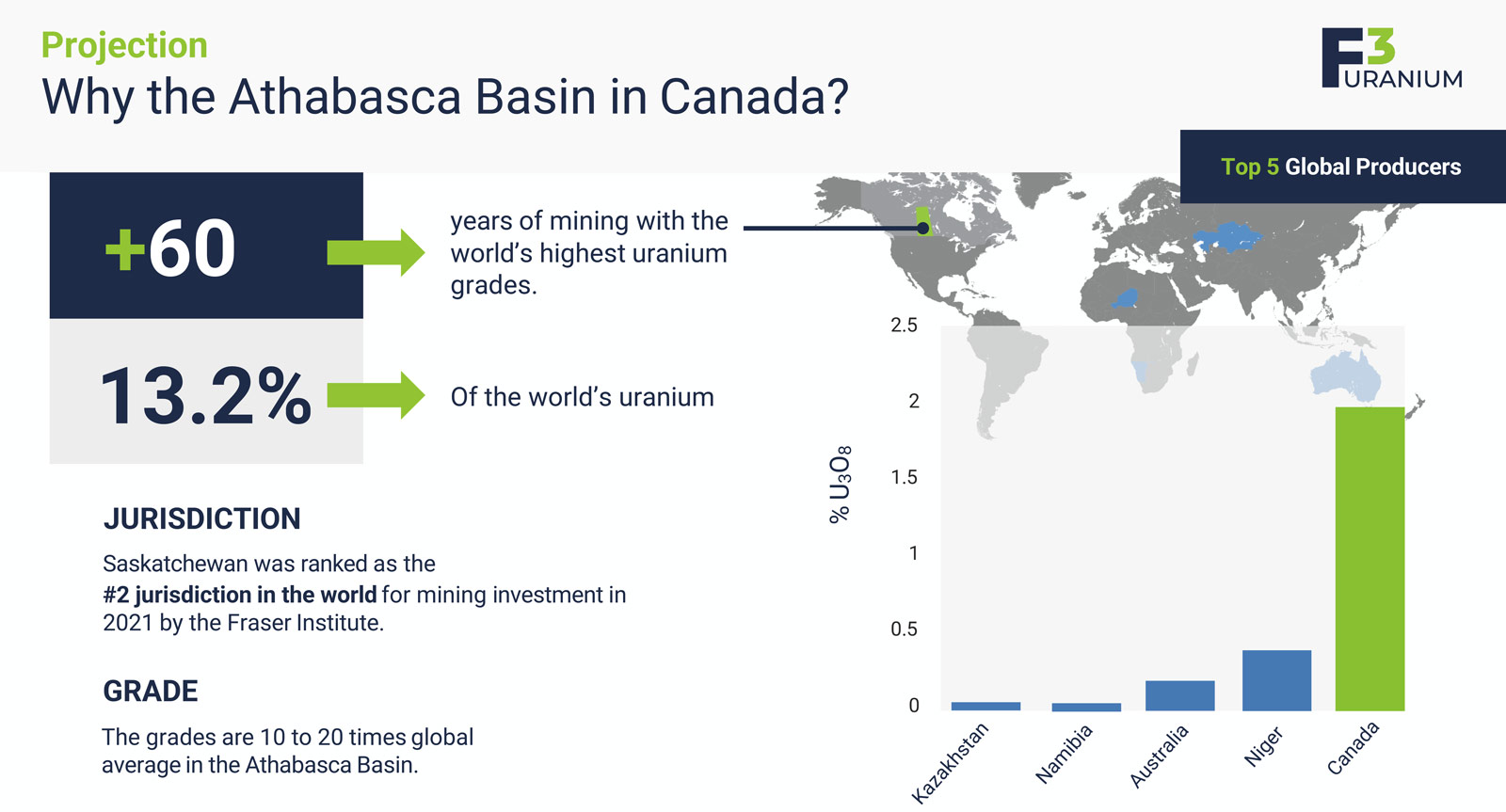

In terms of mining address, it really doesn’t get any better, or safer, than Saskatchewan’s Athabasca Basin, which lays host to around 15% of the world’s uranium.

Uranium mining has been happening in the basin for 60-plus years within an expansive geological formation that regularly produces uranium grades 10X to 20X the global average.

The basin also contains the world’s largest and highest-grade uranium mining and milling operations, including Cameco’s McArthur River and Cigar Lake uranium mines, as well as the Key Lake and McClean Lake uranium mills.

F3 Makes Near-Surface, High-Grade Discovery at PLN

Just over a year ago, the F3 Uranium team announced a game-changing discovery at the JR Zone — the only recent high-grade uranium discovery in the Athabasca Basin by a junior explorer and one of the top new uranium discoveries globally — and is now advancing that project through surveying and drilling.

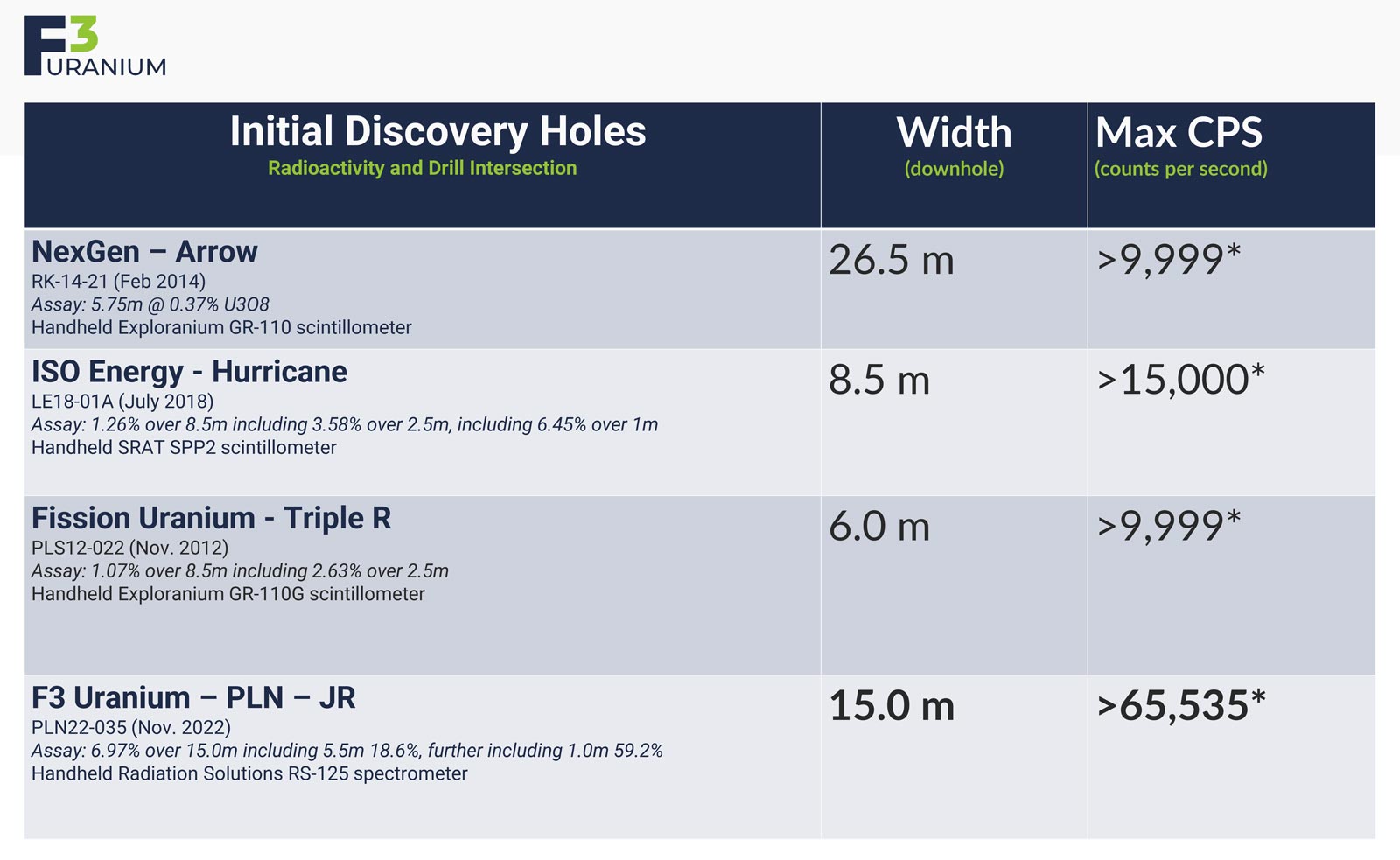

Uranium assay results from the initial discovery hole (Hole PLN22-035) returned a continuous 15-meter interval averaging 6.97% U3O8 including an exceptionally high-grade 5.5-meter interval averaging 18.6% U3O8.

In resource exploration, grade is king… and there’s not a mining analyst out there that could argue that those numbers are not high-grade. And on top of that, the uranium mineralization that’s being uncovered is considered near-surface — at only around 150 meters down.

In other words, F3 has that unbeatable combination of near-surface AND high-grade AND, equally important, a highly-adept technical team with the knowhow and experience to advance the project in a systematic way to the benefit of stakeholders.

And that’s why the industry is paying such close attention to what F3 Uranium is doing at PLN.

Assays from the JR Zone discovery hole also confirmed an ultra-high-grade core at an astonishing 59.2% U3O8 over 1 meter.

As you can see below, F3’s initial discovery hole at the JR Zone — which can be characterized as wide, near-surface uranium mineralization with a high-grade core — is one of the most spectacular discovery holes in the history of the Athabasca Basin.

The importance of location also cannot be overstated. And to that end, F3 Uranium’s discovery is located just 25 km northwest of the Patterson Lake area, host to Fission Uranium’s (TSX: FCU)(OTC: FCUUF) Triple R and NexGen Energy’s (TSX: NXE)(NYSE: NXE) Arrow world-class uranium deposits.

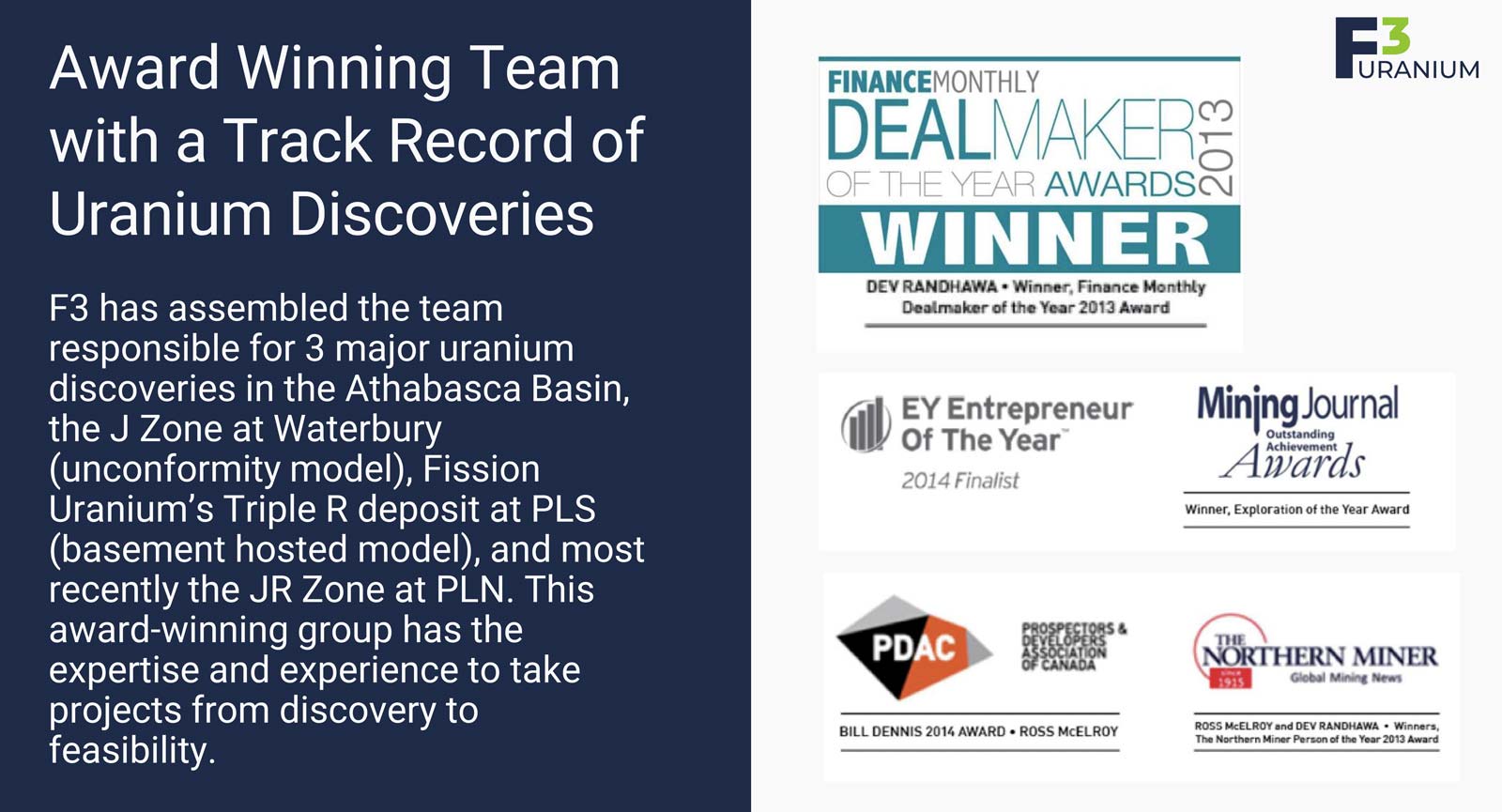

Better still, F3’s management team — headed up by Dev Randhawa, CEO, Raymond Ashley, president (whom you’ll be hearing from directly in just a second in our exclusive interview), and Sam Hartmann, VP Exploration — is the same team that founded Fission Uranium in 2012 and made the Triple R discovery at Patterson Lake.

They’re also the same team that founded Fission Energy, making the J-Zone discovery at Waterbury Lake in the eastern Athabasca Basin, and built Fission into a TSX Venture 50 Company.

With the JR Zone discovery now being systematically advanced via a newly commenced C$16M ground geophysics and drilling program (slated for 55 holes across 24,000 meters), the F3 team looks primed for similar success in the southwestern portion of the Athabasca Basin.

This particular area — where F3 has its flagship PLN project — is poised to become the next major area of development for new uranium operations in the basin.

That upward momentum has attracted industry giant Denison Mines (TSX: DML)(NYSE-Amer: DNN) who has come in with a C$15M strategic investment in F3. The deal — which amounts to an approximate 6% stake in FUU — closed on 18 October 2023 and represents a powerful endorsement of F3’s position in the basin.

F3 Uranium CEO Dev Randhawa commented on the Denison agreement via press release:

“We are pleased to welcome Denison as a strategic investor in the Company. Denison is a uranium industry leader, possessing a diverse array of both early and advanced-stage assets in the Athabasca Basin, where F3 is currently advancing the Patterson Lake North (PLN) property. We highly value Denison's perspectives on uranium exploration and look forward to pursuing a productive relationship.”

Denison Mines CEO David Cates added:

“F3’s technical team has an incredible track record of exploration success including the discovery of the JR Zone on the PLN property, which represents one of the top new uranium discoveries globally. We are pleased to be investing in F3 and supporting the further assessment of the PLN property.”

Proceeds from the C$15M investment will be used primarily for exploration and development of the PLN property with F3 benefitting from having a highly experienced partner on board in Denison Mines and Denison benefitting from any future upside in the project’s advancement.

As a result, F3 Uranium is exceptionally well-suited and well-funded to carry out its near-term exploration initiatives having, in addition to the C$15M investment from Denison Mines, raised C$17M in flow through, elevating the company’s treasury to ~C$47M as of December 2023.

F3’s Drills Continue to Hit High-Grade Uranium at PLN

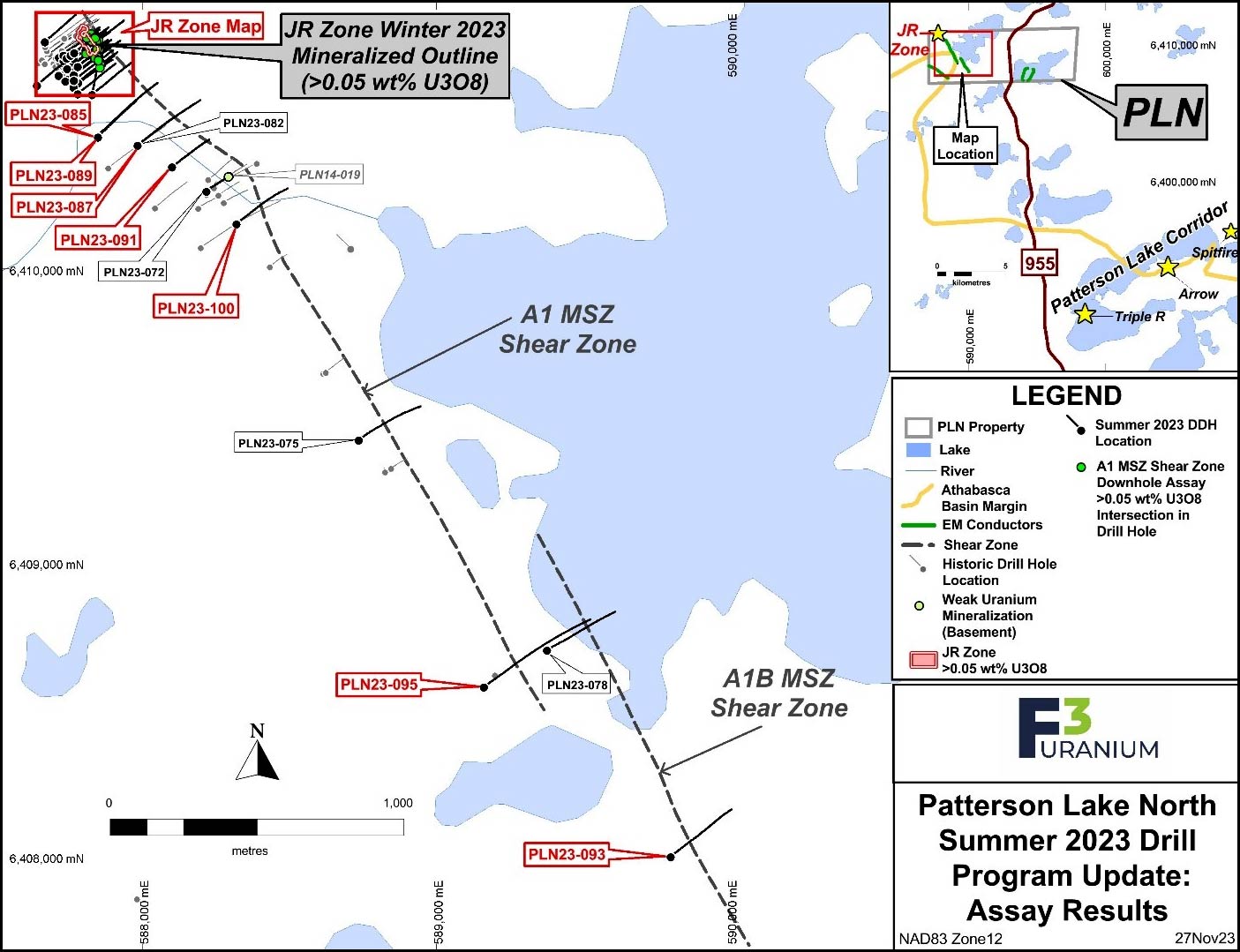

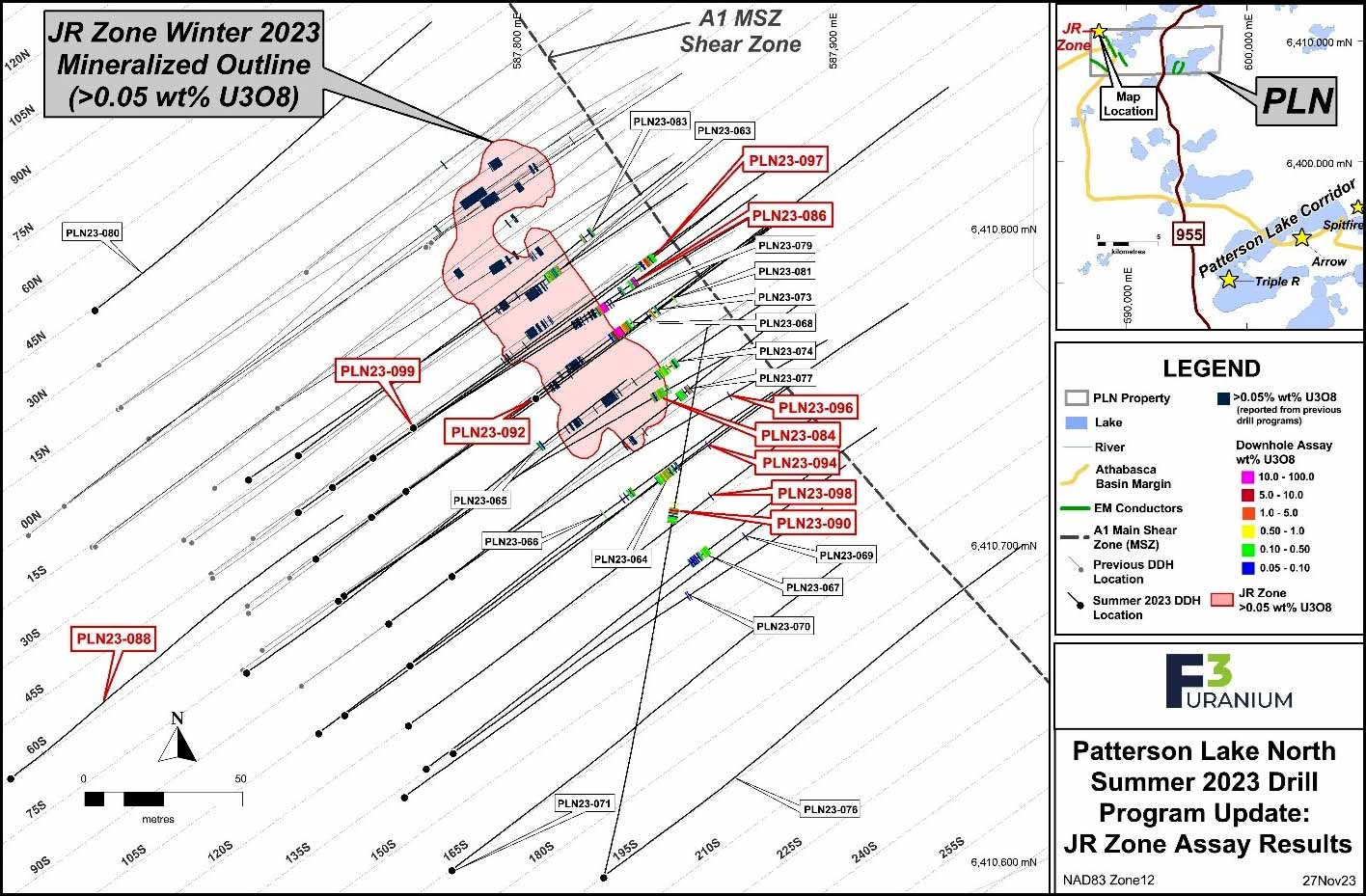

On 27 November 2023, the F3 Uranium team announced an intercept of 20.6% U3O8 over 2 meters within a broader intercept of 7.56% U3O8 over 5.5 meters at PLN’s JR Zone.

That’s well in line with the initial discovery hole, which, as you’ll recall, returned 6.97% U3O8 over 15 meters.

The company’s drills also encountered a 2-meter interval averaging 5,557 ppm (parts per million) Boron — a key pathfinder element for uranium mineralization — in highly-altered Athabasca sandstone, approximately 17 meters from the unconformity along the A1B Shear Zone.

One thing that’s vitally important for resource speculators to understand is that uranium discoveries along the southwestern edge of the Athabasca Basin tend to come packaged in multiple shear zones, which points to the very real potential for additional high-grade uranium discoveries to be made by FUU in and around the JR Shear Zone.

F3 Uranium VP Exploration Sam Hartmann commented on the assays and the importance of the boron values via press release:

“In addition to high-grade assay intercepts reported in the JR Zone, we are pleased to discuss our first geochemical exploration drilling results from the A1B area; drill hole PLN23-093, where intense sandstone and basement alteration was previously reported, returned a 2.0 meter interval with significant individual boron values between 3,000 and 10,000 ppm. Boron values over 5,000 ppm, associated with dravite veining and breccias, have previously only been intersected on the property within Athabasca Sandstone immediately above the JR Zone, 3.5 km away…”

On 18 December 2023, F3 announced additional off-scale scintillometer results, including multiple high-grade U3O8 intercepts, from the last 11 drill holes of its fall 2023 drill program at PLN.

Highlights include:

- Drill hole PLN23-110: 11.5-meter mineralized interval from 216 meters to 228 meters, including

- 3.0m of mineralization from 216m to 219m, and

- 4.0m of mineralization from 224m to 228m, including

- 1.50m continuous off-scale radioactivity (> 65,535 cps) between 226m and 227m

- Drill hole PLN23-112: 11.5m mineralized interval from 229m to 240m, including

- 1.35m composite off-scale radioactivity (> 65,535 cps) between 231m and 240m

Sam Hartmann commented on the results:

“As we break for the holiday season, we would like to thank our staff and contractors for their hard work and dedication over the past six months. Preparation and planning for the winter 2024 program is already underway, and we look forward to receiving exploration geochemistry results from the B1 area, as well as ground resistivity interpretations from the A1 and B1 areas which will drive exploration efforts aimed at discovering additional mineralized zones. Recent JR Zone drilling focused on defining the boundaries of mineralization, but continued to yield high grade intercepts which will be followed up. Phase 1 of the DIAS 3D-DCIP ground resistivity survey is still in progress, and currently working over the B1 area. Recent drill hole intercepts at B1, including sandstone dissolution and silicification, as seen in PLN23-111 [see drill core image below], as well as basement hosted conductive structures related to the B1 shear, will be used to create constrained 2D and 3D inversions to assist in our winter drill targeting.”

A total of 53 drill holes totaling 19,800 meters have been completed at PLN since June 2023, and the company has delineated 5 additional targets for its newly commenced C$16M ground geophysics and drilling program.

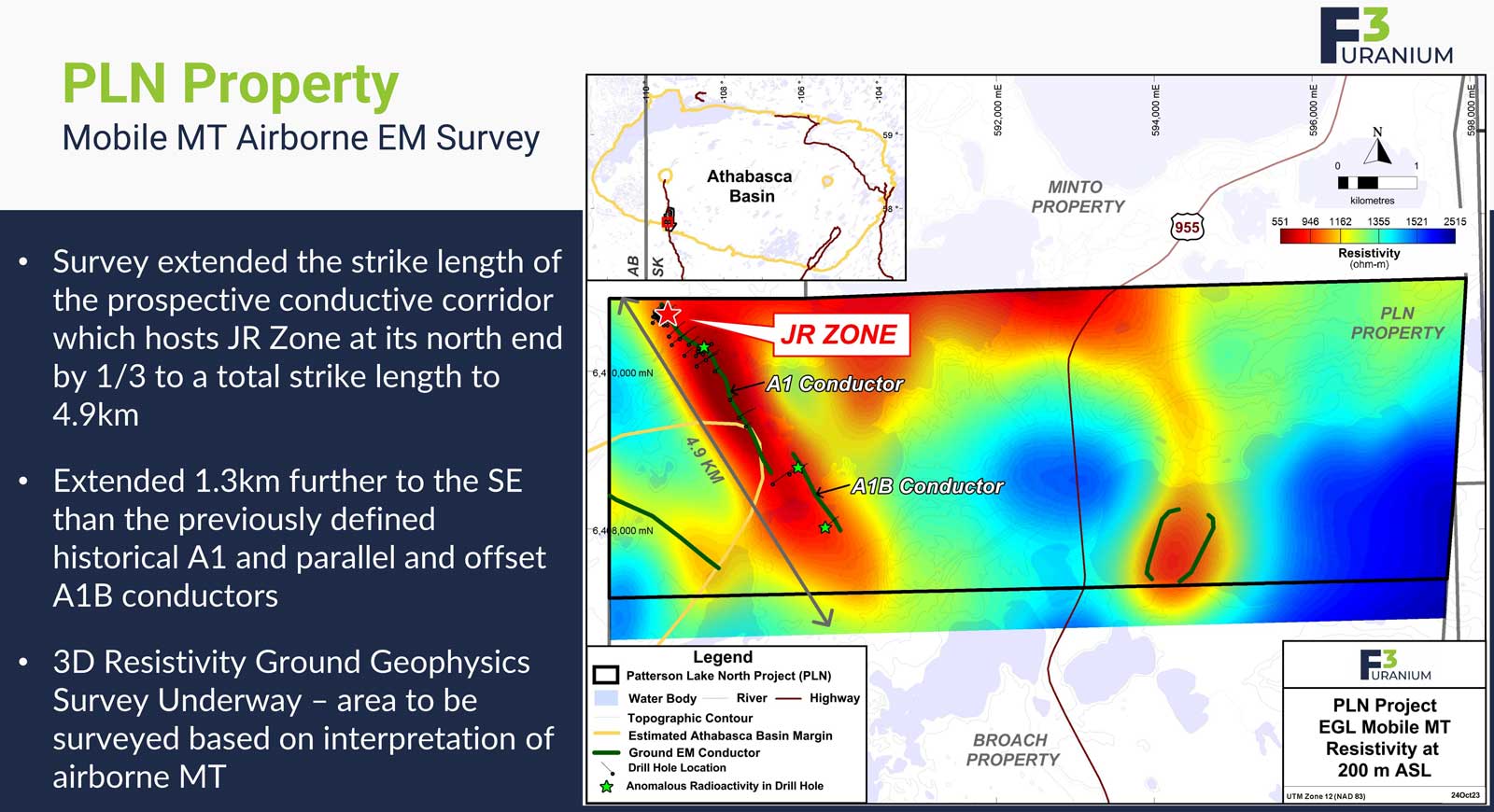

Electromagnetic Surveying Underway

The F3 Uranium team is presently conducting an airborne EM survey and data analysis at PLN with a focus on the JR Zone, and, more specifically, the A1B Shear Zone, as a means of enhancing future drill targeting at PLN.

In the above image, you can see the areas that are lit up like a Christmas tree in red. It’s the graphite and sulfides within the shear zones that do that, and it’s just one more tool the F3 team is using to hone in on below-ground U3O8 mineralization.

The survey’s focus is on the lower two-thirds of the 4,000-plus-hectare PLN property and, as reported by the company, shows that the mineralized lens of the A1B Shear Zone is much longer than initially thought.

The survey has also successfully identified a number of northwest-trending conductors that were not apparent from the historical data records.

Following up, FUU is moving forward with a large 3D ground resistivity survey (with plans for additional ground surveys in early 2024) with the aim of combining the historical datasets with incoming data to map out the next set of high-priority drill targets at PLN. The company is also looking into using AI (artificial intelligence) as part of the broader data evaluation process.

Of further importance, the fact that the shear zones are northwest trending — as opposed to northeast trending, as is the case at the world-class Triple R and Arrow deposits — has only increased FUU’s confidence that PLN holds true regional potential on par with other large uranium deposits in the basin.

FUU has also confirmed that the near-surface uranium mineralization at the JR lens is in close proximity to the unconformity (i.e., the bottom of the sandstone and the top of the basement rocks), pointing to enhanced potential for unconformity-style mineralization, or what can be deemed as a highly favorable “sandstone-hosted” component to the U3O8 mineralization at PLN.

Drill mobilization is underway for the aforementioned 2024 work program, which will include approximately 55 dill holes totaling 24,000 meters, with Mr. Hartmann adding:

“We are excited to set out on this aggressive winter program aimed at JR Zone expansion and discovery of additional mineralized zones along the 5km long A1 and parallel B1 shear zones…”

In other words, tons of discovery upside in a catalyst-rich environment: Large property with a confirmed high-grade discovery in a key area of the Athabasca Basin with drilling and surveys underway… all in a rising uranium market.

The one remaining question, of course, is scale. And that’s where the drilling comes into play. No one knows for sure what lies below surface until the drills have their say. And that’s what makes resource speculation so exciting. Yes, it carries risk… but when the drills hit paydirt after paydirt after paydirt, the market response can be truly phenomenal.

Keep in mind also that, in the small-cap mineral exploration sector, you’re really only as good as the people running the show. What you want to look for is a serially successful team of industry professionals with a nose for uncovering mineral deposits of merit and, most importantly, a long-established track record of delivering value to shareholders.

As you’re about to discover, FUU has all of that in spades. Let’s take a closer look at the F3 Uranium team now.

A Highly-Adept Team of Uranium Mining Professionals

F3 Uranium boasts a highly-experienced management and technical team with a history of success in the North American uranium sector.

It’s a team that foresaw the uranium bull market we’re now in and who built a robust, low-cost base of uranium exploration properties in the hotbed of North American uranium production — Canada’s Athabasca Basin region.

With uranium currently trading at 15-year highs above US$80 per pound, and with plenty of runway ahead, the team’s foresight has not only proven dead-on accurate but the company’s projects are all of a sudden that much more valuable.

Let’s meet a few of the key principals who’ve put F3 Uranium Corporation in this enviable position.

Dev Randhawa

Chairman & CEO

A seasoned mining CEO, Dev boasts a wealth of experience in building resource, exploration, and energy companies. In 2013, The Northern Miner named Dev ‘Mining Person of the Year’ with Finance Monthly awarding him ‘Deal Maker of the Year.’ As part of the Fission Uranium team, he also took home The Mining Journal’s ‘Excellence in Exploration’ award in 2015.

Dev was part of the Fission Uranium team that made the initial high-grade uranium discovery at PLS. He also founded Strathmore Minerals in 1996 and remained CEO until September 2008. In 2007, Dev spun Fission Energy Corp. out of Strathmore to focus on uranium exploration in Saskatchewan. He remained CEO and chairman until the company sold its Waterbury Lake discovery and a large selection of its assets to Denison Mines in 2013. Dev is also the current chairman & CEO of Strathmore Plus Uranium.

Raymond Ashley, P.Geo.

President & Director

A 35-year mining industry veteran, F3 Uranium president Raymond Ashley leads the company’s uranium exploration programs throughout Canada. Ray was a key geoscientist on the Fission Uranium PLS discovery. Formerly with major BHP, Ray was also a key member of the discovery team at Ekati — Canada’s first diamond mine.

Sam Hartmann, P.Geo

VP Exploration

Serving as VP Exploration for F3 is Sam Hartmann — an established professional geologist with extensive experience in Athabasca-based uranium deposits. His experience ranges from exploration and drilling to geotechnical studies. Previously, with Fission Uranium, Sam was part of the technical team that made the initial Triple R discovery in 2012 and, as chief geologist, took the project from discovery to feasibility.

Exclusive Interview with

F3 Uranium President Ray Ashley

There are few uranium exploration companies in the junior space that can compare to F3’s level of discovery success and even fewer that can boast the size, number, and quality of projects the company is currently advancing in the Athabasca Basin.

Our own Gerardo Del Real of Resource Stock Digest and Junior Resource Monthly caught up with F3 Uranium president Raymond Ashley to discuss the plans and process for expanding the high-grade PLN uranium discovery via the drill-bit in 2024.

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the president of F3 Uranium — Mr. Ray Ashley. Ray, always a pleasure having you on. How are you today, sir?

Ray Ashley: I'm doing really well, Gerardo. Thank you for having me on. It's nice to talk to you always.

Gerardo Del Real: It's always great having you on. Listen, we talked earlier in the year about the uranium market that we saw developing. And that has played out perfectly, and I believe it continues to pick up steam going into 2024. So I thought it an opportune time to have you on and recap all of the developments of 2023.

Obviously, you have this new exciting high-grade discovery. And then, let’s set the table for 2024. I'd love a recap, for those that maybe are looking for exposure to the uranium space, on what you were able to accomplish and where you're at today, I think is appropriate.

Ray Ashley: Sure. November, a year ago, we drilled a beautiful discovery hole: high-grade uranium; nice wide intersection. It's been characterized as the most exciting high-grade uranium discovery resource being drilled anywhere. We're very lucky to have started there.

Maybe I'll start by saying this… the uranium sector is hot, and all of the uranium companies in the sector are going up as the spot price is going up. The difference, really, between F3 and our peers is that we're a discovery story, and it started a year ago.

And so what happened? Well, we started by raising money and carrying out a winter program to try and expand or get a sense of the size of the zone of uranium that we drilled into, which we call the JR Zone.

For our winter program, we managed to extend the strike length of the lens to 105 meters, hosted within the A1 Shear Zone, which is what we call it, at the very north end of the A1 Shear Zone, which is 3.6 km long.

During the summer program, we continued and managed to extend the strike length of the JR Zone another 50% to its current 156 meters in strike length. And up-dip and down-dip in the structure, it's something like 45 meters. So it's a lens of mineralization that is just below the top of the basement rocks in an area where there are 60 meters of Athabasca sandstone overlying the basement, and it's a horizontal lens.

So the summer program was very successful as it continued to hit wide and very strong mineralization; beautiful, beautiful high-grade intersections. We extended that drill program into the fall, and we just recently stopped the program for the Christmas break. We're currently planning and preparing to go back to work, probably mobilizing on January 5th to continue drilling. We've raised the flow through funds to be able to carry on… so we have C$17 million of flow through raised. And that will fund our ongoing exploration.

So, where are we right now? Well, most recently, we released the last 11 holes of the fall program. We’re at the stage now of trying to test the boundaries of this first lens called the JR Zone. And while doing that, we also, again, hit some nice high-grade intersections.

In the last press release, on December 18th, we highlighted having intersected on 15S and 60S; those section lines produced some more off-scale radioactivity. The other thing we've started to do is to look for the next zone of mineralization along this 5-km-long corridor.

So where we are now is looking for additional mineralization. These types of deposits often occur as several zones along one structure. Here we have a 5-km-long structure. We found the first zone of mineralization at the north end of it. We started exploring with the summer exploration holes; one drill was testing along the corridor looking for the next zone while another drill continued to grow and expand the JR Zone.

Most recently, we've had extremely prospective geology being intersected at what we call the B1 Shear Zone. It's a parallel shear zone at the south end of A1, and we're hitting intense sandstone brecciation and faulting in the sandstone there. We're hitting clay alteration, silicification, and very intense brecciation.

At the bottom of the sandstone, in hole 93, we found 10,800 ppm (parts per million) boron in hole 93, just 17 meters above the basement in the bottom of the sandstone. And the only other place we see boron — elevated boron like that in all of the drilling we've done at A1 and B1 — is right above the JR Zone high-grade mineralized lens. So that boron is very significant.

Most recently, we drilled a hole 200 meters to the north of that. And that hole had even better alteration in the sandstone faulting brecciation and in the basement below intense deformation. Those are all signs, to us, that down there at B1, the geology is really indicative of another zone in close proximity to high-grade uranium.

In the fall, we started a ground 3D-DCIP resistivity survey. It's a very modern 3D survey. And that's still being done right now. It's still ongoing. That survey covers the B1 area and, as well, the JR Zone.

And what we're also awaiting is the geochemistry from the drill core from the last 11 holes that we've reported. That geochemistry doesn't just give us uranium assays, it also gives us 32-Element-ICP, which is the geochemistry of all of the other elements.

Gerardo Del Real: Let me ask you something really quick because it's clear to me from hearing the description of the work programs that are ongoing and the drill programs that are coming, that, with Denison coming in in October 2023 with a C$15 million strategic investment, that there's the potential for F3 to be taken out.

And I have to believe that the company is aggressively wanting to prove out as many discoveries and as much value in the ground before that materializes. Would that be accurate?

Ray Ashley: It's very accurate; it's exactly the case. We don't know when that might happen. It would be obvious that F3 is a takeover target given this significant discovery. But you're absolutely right that we're going forward.

I am lucky to work with a team who's seen three of these high-grade deposits and worked on them and expanded them and defined them. We have the funds in place, we have the expertise, we're going after it, and we're moving forward.

We see all of the signs that there's additional mineralization at B1. Now, we're going to have the geochemistry and the ground geophysics to help us target and narrow in and focus in on the other mineralization that stands to be there. And absolutely, if we tap into another zone, I think it's pretty clear that our market cap will go up. And it would be nice to do that before an auction has started if that stands to happen.

Gerardo Del Real: I couldn't agree more. Ray, it's always a pleasure catching up. It's clearly an exciting time, and I cannot wait for 2024. I want to wish you and all your loved ones a Merry Christmas, a great holiday, and a great New Years. And let's make sure we pick up this conversation on the other side of 2023.

Ray Ashley: Absolutely, we'll be at it early in the new year, and I'll be happy to give you an update as we go. Merry Christmas to you as well, and thank you as always for having me.

Gerardo Del Real: Always a pleasure, sir. Thank you.

The F3 Uranium Opportunity

The new uranium bull market has officially arrived… and it’s only just getting started.

Kicking off 2024, uranium prices have surged to 15-year highs well above US$80 per pound, and select small-cap uranium stocks are following suit — including F3 Uranium.

As we discussed in detail, the next major leg up in the uranium price will be driven by utilities continuing to come back into the market to secure long-term U3O8 contracts. And that means we could be setting up for an even higher uranium price environment — potentially in the neighborhood of US$100 per pound — for years to come.

Led by chairman & CEO, Dev Randhawa, FUU has amassed an impressive portfolio of 18 uranium exploration projects in the famed Athabasca Basin region — oftentimes referred to as “The Saudi Arabia of Uranium.”

All of this was accomplished during uranium’s last commodity downturn in anticipation of a stark reversal of that trend. That brilliant foresight is now beginning to pay off handsomely for FUU investors with uranium now in the midst of a historic bull market run and with the company currently advancing its high-grade uranium discovery via the drill-bit.

When evaluating the company, one thing to keep in mind is that F3 Uranium is the only junior explorer in the basin to have confirmed a recent near-surface, high-grade uranium discovery.

That’s a very big deal… and, as you can see, the market is beginning to take inventory of what F3 is accomplishing at its flagship PLN project.

You also heard directly from F3 Uranium president Raymond Ashley. He says,

“November, a year ago, we drilled a beautiful discovery hole: high-grade uranium; nice wide intersection. It’s been characterized as the most exciting high-grade uranium discovery resource being drilled anywhere … I am lucky to work with a team who’s seen three of these high-grade deposits and worked on them and expanded them and defined them. We have the funds in place, we have the expertise, we’re going after it, and we’re moving forward.”

Moving forward indeed… F3’s drills are continuing to intersect high-grade uranium mineralization at PLN seemingly with every turn. Plus, the company is presently conducting an airborne EM survey underway across key shear zones at PLN to enhance drill targeting for the early part of 2024.

With a robust portfolio of 18 Athabasca-based uranium exploration projects in a rising uranium market — plus a confirmed near-surface, high-grade uranium discovery at PLN where a fully-funded C$16M ground geophysics and 24,000-meter drill program is underway — FUU’s sub-C$200M market cap is considered minuscule compared to many of its peers.

F3 is also exceptionally well-funded having secured a C$15M investment from industry stalwart Denison Mines plus another C$17M in flow through, elevating the company’s treasury to ~C$47M as of December 2023.

Now is an excellent time to begin conducting your own due diligence on F3 Uranium Corporation — symbol FUU on the Toronto Venture Exchange and symbol FUUFF on the US-OTCQX Bulletin Board Exchange.

A great place to start is F3 Uranium’s corporate website.

There, you can sign up to receive updates directly from the company, view the most recent Corporate Presentation, and much more.

Be sure to also follow our exclusive interviews with upper management here.

— Resource Stock Digest Research

Click here to see more from F3 Uranium