Gladiator Metals Corp.

TSX-V: GLAD | OTC: GDTRF

Advancing the Flagship Whitehorse Copper Project

in Yukon Territory, Canada

Copper is entrenched in a widening structural deficit with prices starting to trek higher. Select small-cap copper exploration firms with large, high-grade copper projects in Tier-1 mining jurisdictions are poised to generate outsized returns this year, and in the coming years, as demand for the red metal intensifies in the global energy transition.

The small-cap copper company featured in this Special Report, Gladiator Metals Corporation (“GLAD”), is advancing the previously-producing Whitehorse Copper Project in Canada’s Yukon Territory — an established Tier-1 mining jurisdiction with unwavering governmental support for the copper mining industry.

As a large, past-producing project — 330,000,000 lbs Cu — the Whitehorse Copper Project is enjoying its first full-scale program of exploration and drilling in decades. The modern drilling techniques the GLAD team is systematically deploying across multiple known mineralized prospects at Whitehorse is already beginning to pay dividends. With upwards of 30,000 meters planned for 2024 alone — and with drills currently turning at multiple key high-grade targets — speculators can expect a steady stream of news flow over the coming weeks and months as drilling updates and drill-core assays are released to the market.

Copper Deficit in 2024

Copper is “THE” metal of electrification… making it absolutely essential to the global energy transition.

The billion-dollar question is… will there be enough of the red metal available to meet escalating demand in this greener, highly-connected, hyper-electrified world?

The amount of copper needed for the transition, and for the planet to attain net-zero emissions by 2050, would require more copper production, in a relatively short period of time, than the world has ever witnessed.

The problem is… the last major copper investment cycle occurred way back in the 1970s when there were still plenty of large-scale, high-grade copper deposits to be found.

And while the sector is presently entering a period of increased greenfields and brownfields exploration, new copper discoveries of merit are proving extraordinarily difficult to come by and are falling woefully short of compensating for the precipitous decline in ore grades from established mines.

In other words… most of the “easy” copper deposits around the globe have already been found, and the vast majority of the easy-to-reach high-grade ore has already been scooped up.

Another major roadblock for bringing new supply online is the exorbitant amount of time required for bringing a new copper mine from discovery to production.

We’re talking 10-plus years from the time an economically viable copper resource is discovered all the way through the various stages of feasibility, permitting, and mine construction.

And that’s assuming each process goes smoothly, which, as anyone involved in mining knows, is very rarely the case.

That’s why it’s so important to invest only in copper companies with assets in Tier-1 mining jurisdictions — such as Canada, the United States, and Australia — where permitting is typically not an issue and where there’s an established history of governmental support for base metals mining and permitting.

A Global Copper Shortfall

Disruptions in major copper-producing nations have been in the spotlight in recent years, particularly in Peru — the world’s #2 copper producer at 10% of global supply — which has been beset by worker strikes and large-scale community protests since the ouster of former President Pedro Castillo.

Wood Mackenzie’s VP of Metals & Mining, Robin Griffin, states, “We’re already forecasting major deficits in copper to 2030,” attributing that sentiment largely to ongoing unrest in Peru and higher demand for copper in the energy transition industry.

Additionally, Chile — the world’s largest copper producer at 27% of global supply — recorded a year-on-year decline of 7% in November 2022. “Overall we believe Chile will likely produce less copper from 2023 to 2025,” according to Goldman Sachs.

Moreover, much of the world’s copper resources are situated in high-risk mining jurisdictions such as the Congo and Inner Mongolia… not exactly the kinds of places speculators want to be allocating their risk capital, especially considering what’s been transpiring in South America.

All of those factors are combining for what many industry experts predict will be a protracted global copper shortfall that could last for decades.

And it’s why investing in select small-cap copper stocks in areas with large mineral endowments and strong governmental support for mining makes plenty of good sense as we kick off 2024.

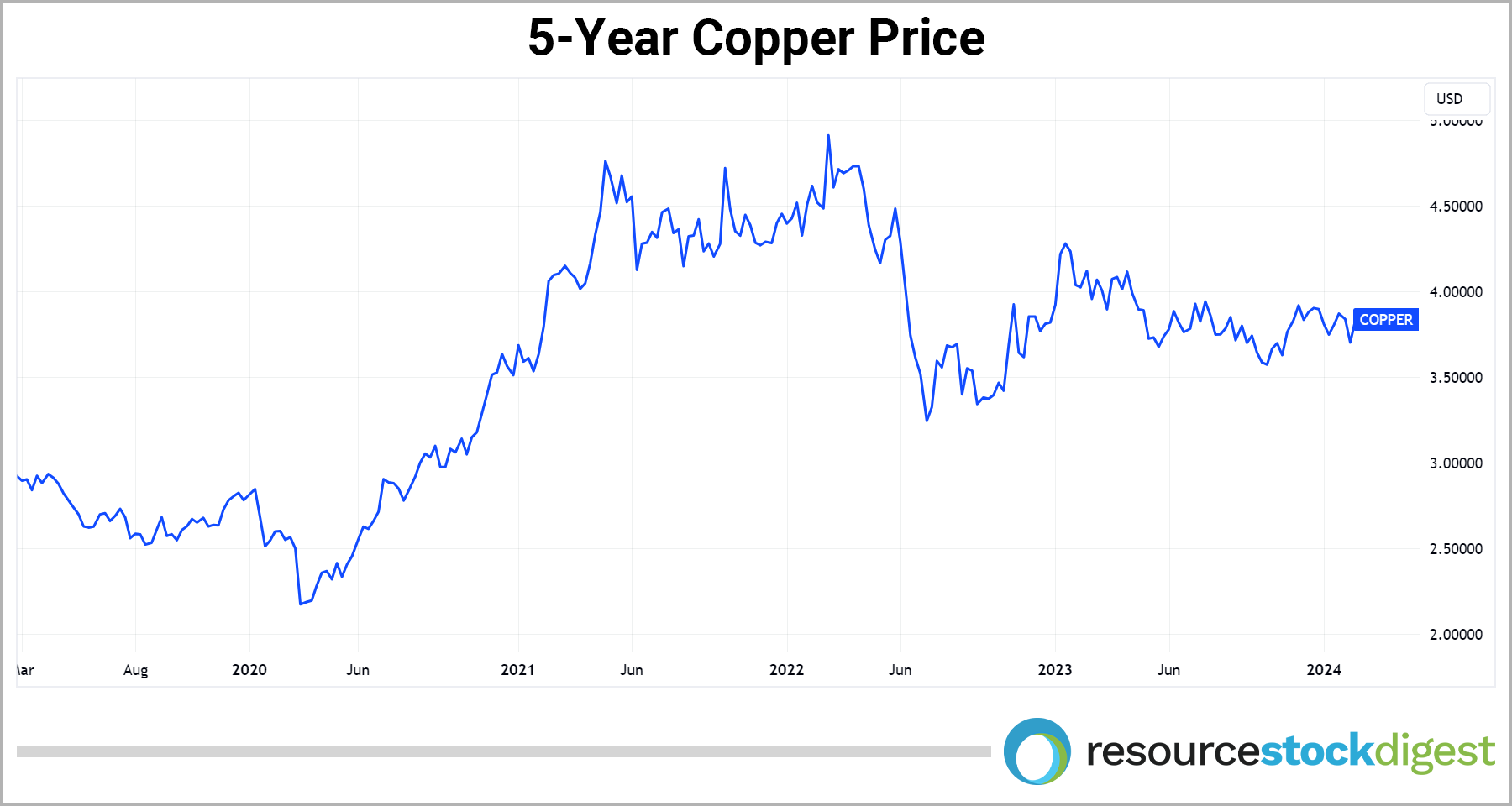

In viewing the 5-year copper price chart below, we can see that the overall price trend of the red metal has been bullish, albeit a bit choppy, since 2020.

Most recently, at the beginning of 2024, we witnessed a slight pullback in the copper price to around US$3.65 per pound. Yet, with the market now coming to grips with the fact that a large copper deficit is indeed looming in the not-too-distant future, prices have begun to inch back up toward the US$4/lb mark and could soon be well on their way to US$5-plus.

Commodities, and base metals in particular, are typically beset by short-term cyclical price volatility. Yet, the longer-term outlook for copper remains exceedingly bullish as higher prices will be required to incentivize new exploration and project development globally.

Further, the reopening of China’s economy, and the high level of demand growth expected in the country’s EV, 5G, and energy transition sector is only going to stoke further demand for the red metal going forward.

As alluded to, copper demand is set to undergo a generational shift as decarbonization efforts ramp up across the globe in efforts to attain net-zero carbon emissions.

Al Chu, lead portfolio manager at BNY Mellon, says, “Copper is typically used as a construction metal for wiring for building, wiring for machinery and what not, but if we look at the decarbonization net zero energy transition trend — copper is the new oil.”

The bottom line is that, when it comes to electrifying something and transmitting electricity, you need copper — plain and simple. And that means everything from wind and solar power generation and the much needed revamping of electrical grids to EVs, 5G, and consumer electronics.

For example, EVs require up to 175 lbs of copper per vehicle, which is roughly 4X the amount used in a typical combustion engine vehicle.

Plus, the global EV boom really can’t happen without the building out of $Billions in EV charging infrastructure, which is also highly copper intensive.

Turning to renewables, wind energy requires 2,000 tonnes of copper per gigawatt on average. Solar needs even more; about 5,000 tonnes of copper per gigawatt.

The global electricity grid needs to double by 2050 to meet net-zero targets with an estimated cost of roughly US$20 trillion to achieve that.

The Oregon Group recently published a report stating that 427Mt of copper will be needed by 2050. That’s more than 8 times the current demand level for wind turbines, solar panels, and energy storage combined.

That same report highlighted that, in order to meet those targets, annual investment will need to increase from US$274 billion in 2022 to US$1 trillion by 2050. This year, global annual spending is expected to increase to US$300 billion.

McKinsey & Company states that, for the world to meet its net-zero emissions targets, it will be short 50Mt of copper by 2030.

In other words, the global energy transition is highly dependent on an ample supply of copper.

And while recycled material plays an important role in copper stockpiles, there is no current methodology for the economic retrieval of the metal from the billions of tonnes of lower-grade waste rock scattered around the world’s past and present copper mining operations.

It all points to the near and long-term profit potential of well-run, well-structured copper exploration and development firms with high-potential copper projects in ultra-safe mining jurisdictions.

Enter Gladiator Metals Corp. (TSX-V: GLAD)(OTC: GDTRF).

Gladiator Metals: Flagship Whitehorse Copper Project

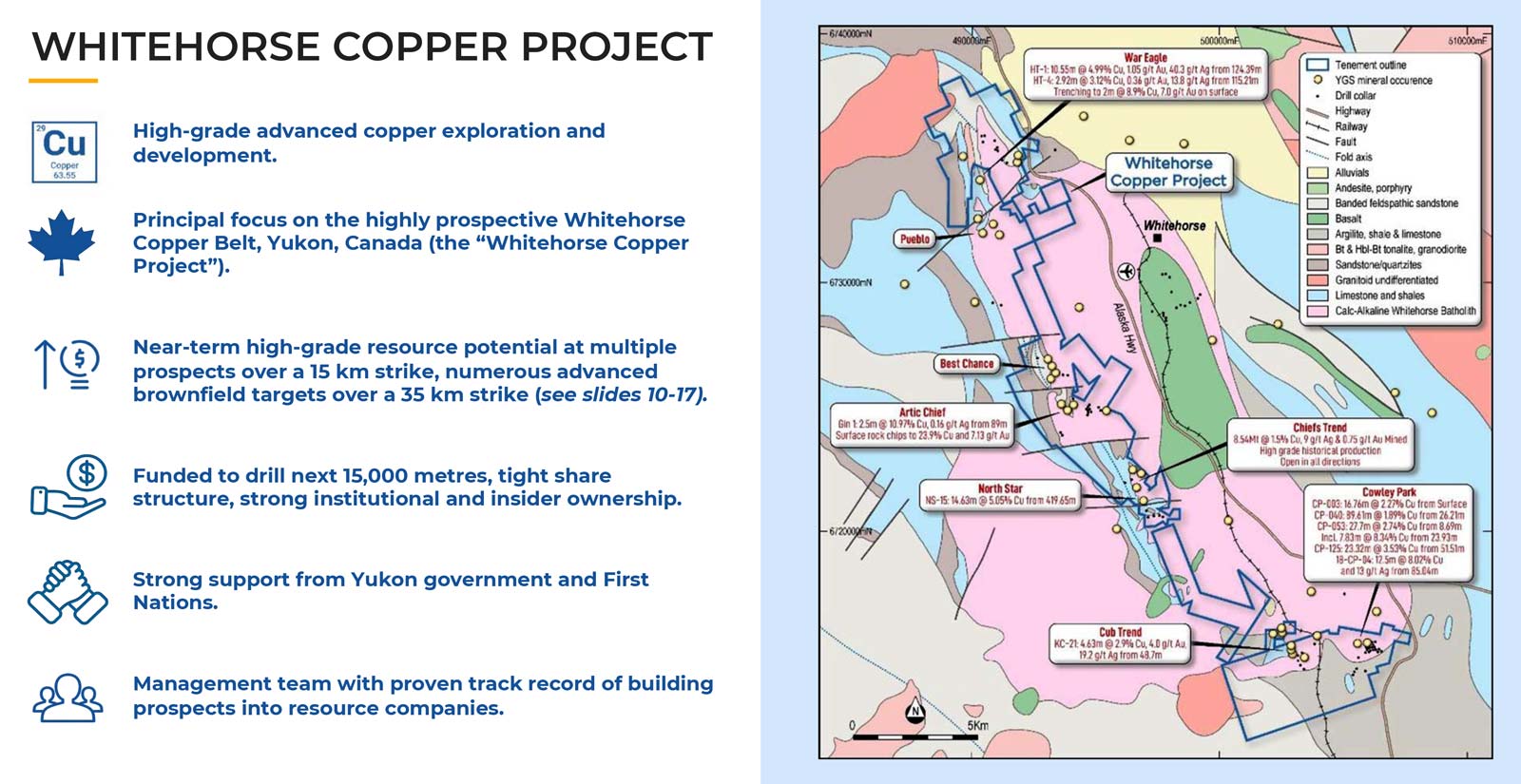

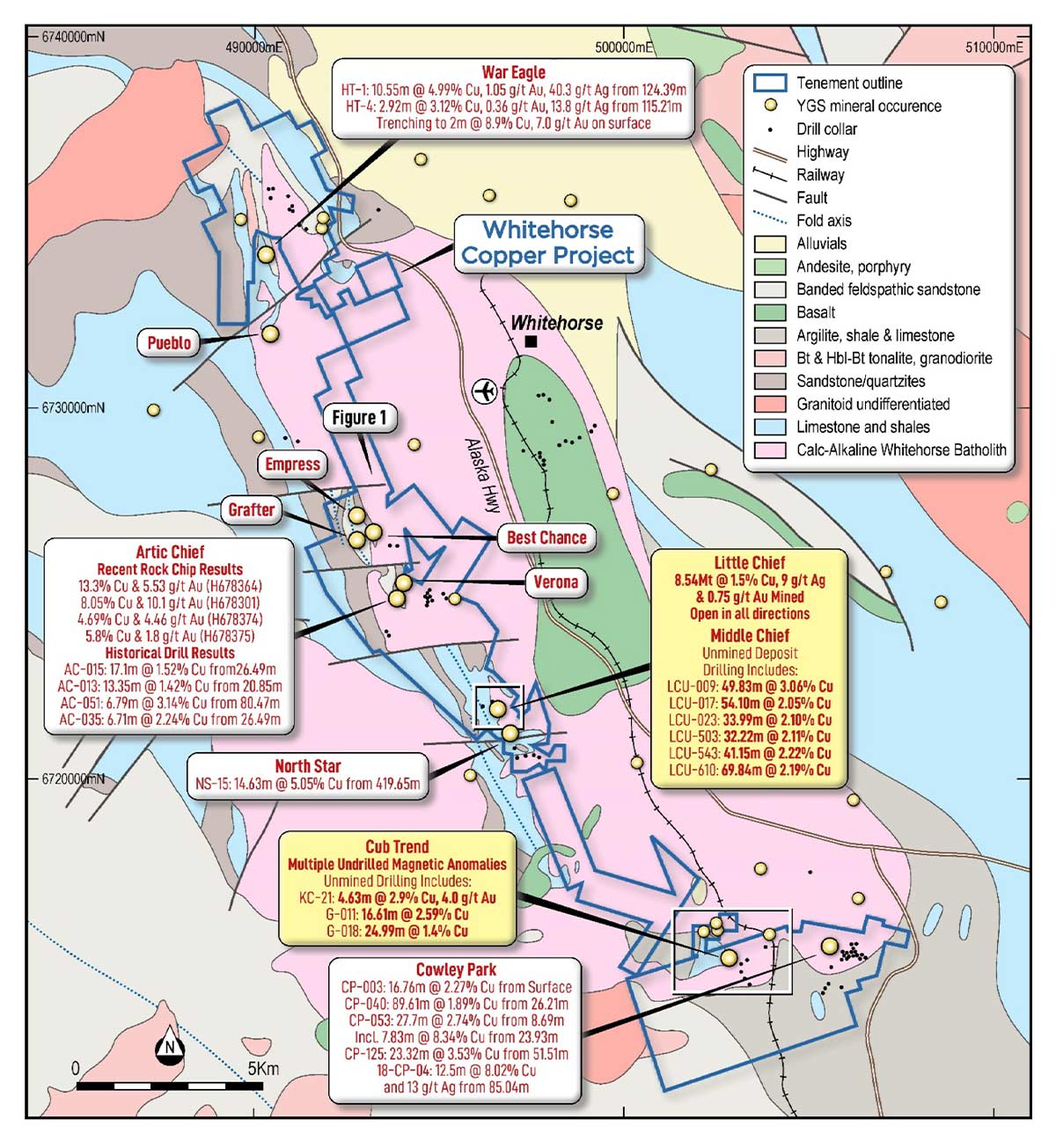

Gladiator Metals (“GLAD”) is focused on advancing the flagship Whitehorse Copper Project located just outside the town of Whitehorse in Yukon Territory, Canada — an established Tier-1 mining jurisdiction.

The project produced around 330 million pounds of copper between 1967 and 1982. The high-grade ore — 10 million tonnes of it at 1.5% copper, plus gold and silver credits — came from both open pit and underground workings under the banner of major operator Hudbay.

The Whitehorse project contains 30 known copper-magnetite skarn targets within a 35 km x 5 km area, many of which outcrop at surface, giving Gladiator a wide array of high-priority targets as it executes the first modern exploration and drilling at Whitehorse in some 40-plus years.

Following Hudbay’s operatorship, the Whitehorse project was consolidated by the Coyne family of Yukon fame and is now in a new vehicle — Gladiator Metals Corp. — with excellent structure, a seasoned management team, and drilling underway via multiple rigs.

Gladiator has acquired an option to earn-in 100% of the Whitehorse project from H. Coyne & Sons Ltd. The brownfields project benefits from excellent infrastructure in place, including roads and power, along with strong support from the Canadian and local government, as well as First Nations representatives.

Exploration and drilling costs are kept in check by way of the project’s close proximity to the town of Whitehorse; drill costs at the project are generally coming in below C$220 per meter.

As mentioned, the Whitehorse project produced over 300M lbs Cu ending in 1982 with major miner Hudbay as operator; Gladiator Metals is the first company to be exploring the full land position since that time.

The project covers about 35 km of strike with 10,000 meters of drilling underway at the Middle Chief prospect — a key high-grade copper-dominant target. A second rig has been mobilized to the Cub Trend prospect where 5,000 meters of drilling is underway to test near-surface potential areas of magnetite-copper skarn mineralization.

One of the most compelling aspects of the Whitehorse project is that Hudbay drilled multiple key zones to reserve status, meaning the Gladiator team is in the enviable position of not having to go out and find these areas of high-grade Cu mineralization on its own.

In essence, these large copper-dominant mineralized zones have already been delineated as brownfields prospects with Gladiator additionally in possession of a vast dataset of drill logs and drill assays from previous operators, including, of course, Hudbay.

With that treasure trove of drill data in hand, the Gladiator team is zeroing in on five previously identified prospects with near-term resource potential: Cowley Park, Middle Chief/Little Chief, Cub Trend, Arctic Chief, and War Eagle Trend.

GLAD’s primary goal for 2024 is to put 5,000 to 10,000 meters each of diamond drilling into the Middle Chief prospect (10,000 meters underway), the Cub Trend prospect (5,000 meters underway), and the Arctic Chief prospect (permitted for 10,000 meters) to confirm the copper-dominant mineralization drilled out by Hudbay and other previous operators and, as well, to delineate the resource upside of each area.

The company’s longer-term aim is to systematically define 50 million to 100 million tonnes at previously mined grades, which averaged roughly 1.5% copper through the five main zones.

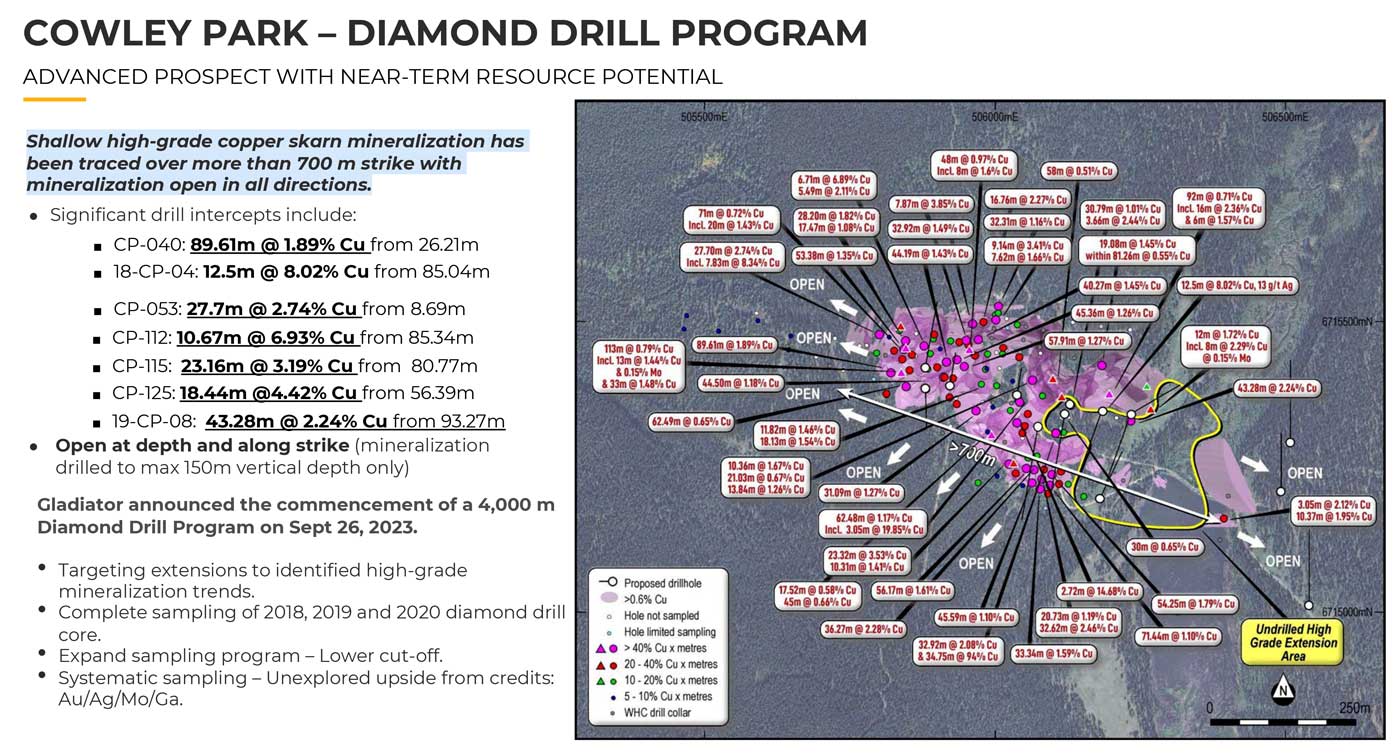

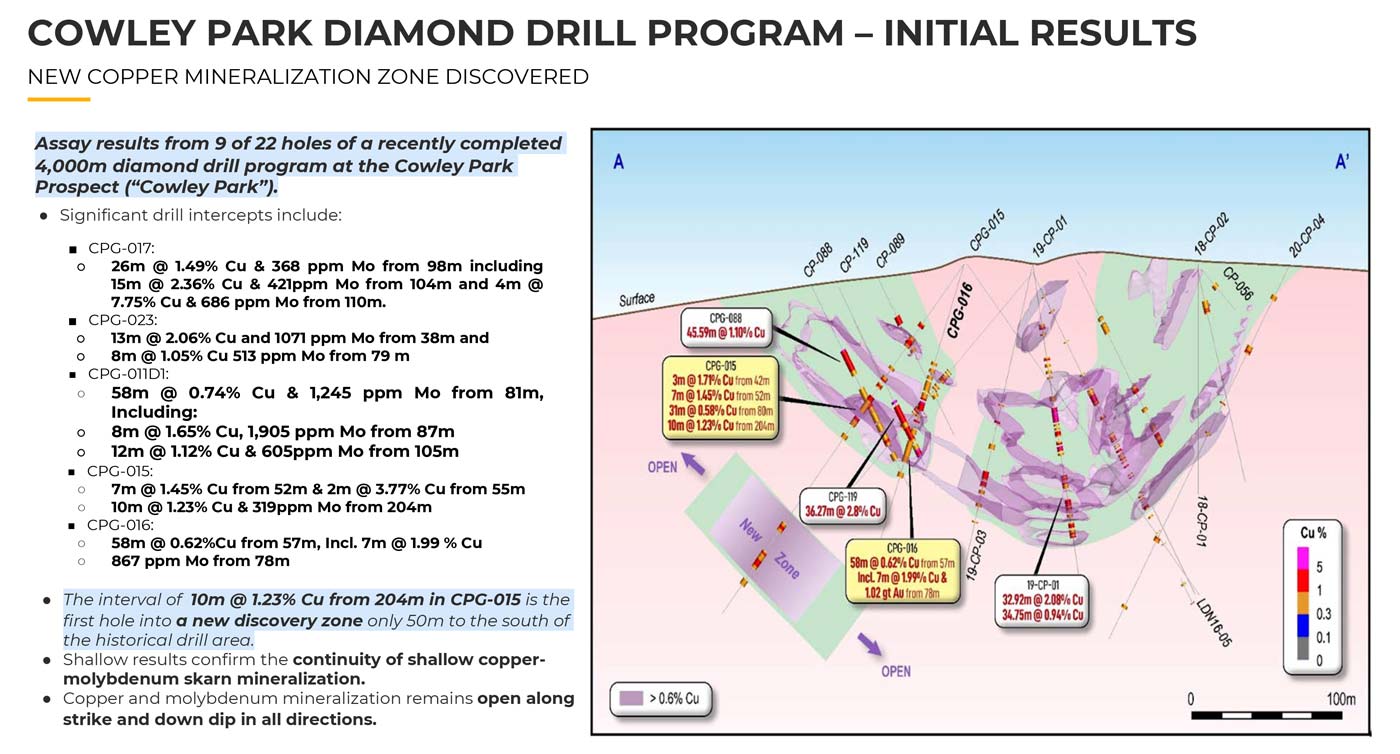

Cowley Park Prospect

To that end, the current 10,000-meter drill program at Middle Chief follows a recently completed campaign of 8,000 meters at the Cowley Park prospect in the southeast portion of the project area, which confirmed the continuity of shallow, copper-molybdenum skarn mineralization over approximately 800 meters.

The Cowley Main Zone boasts historical reserves of 884,000 tonnes at 1.04% Cu, 3.8 grams per tonne (g/t) Ag, and 0.07% Mo.

The next exploration stage at Cowley Park will consist of extensive geophysics (drone magnetics and ground-based EM programs) with a focus on defining the exploration potential of the prospect along strike and determining the next set of high-priority drill targets.

Cowley Park’s basin-shaped mineralization (see below, right) illustrates the potential for it to optimize into an open pit design with the deepest part of the mineralization situated just 170 meters below surface.

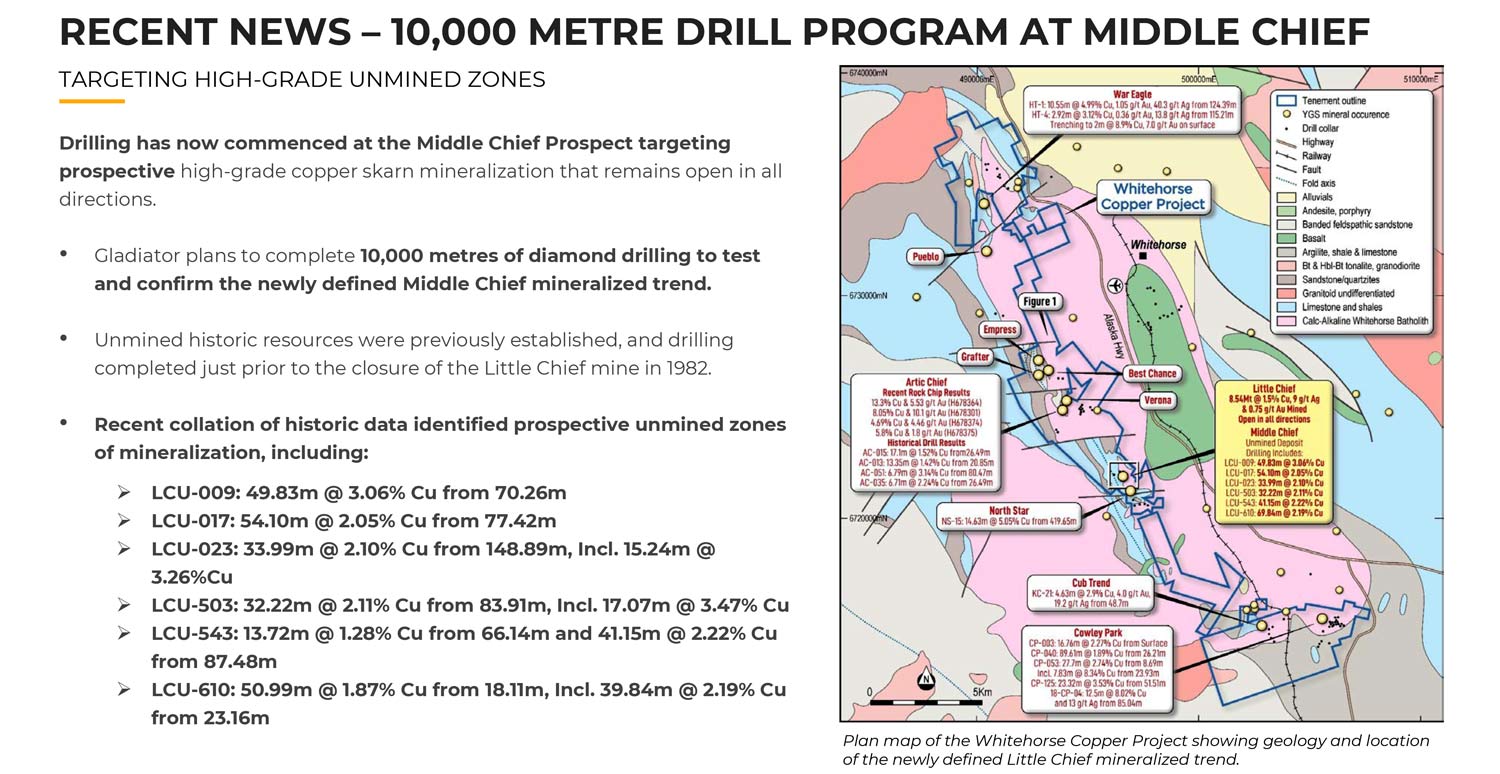

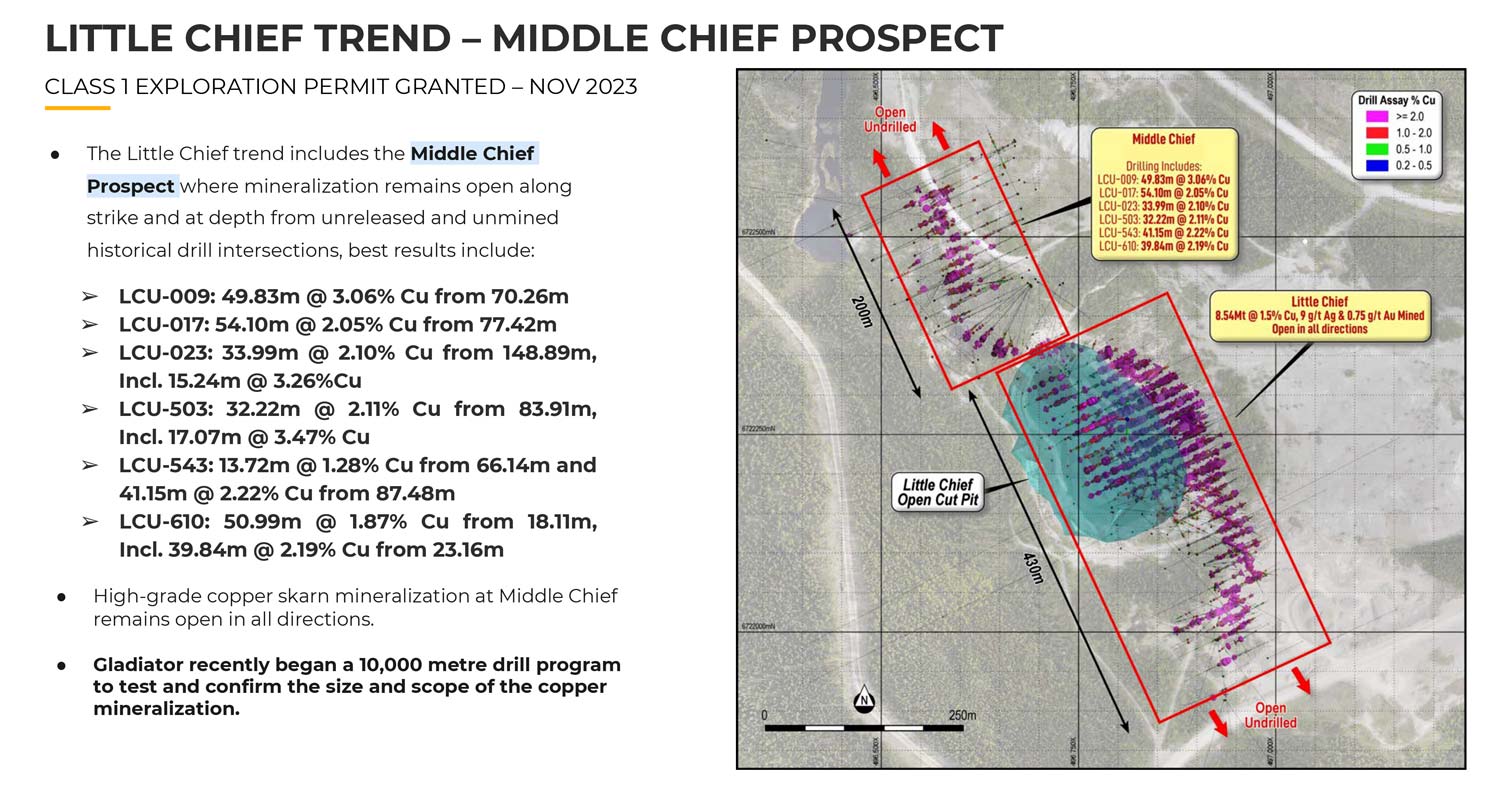

Middle Chief Prospect

As noted, a drill rig has been mobilized to the Middle Chief prospect — the area of most significant historical production at Whitehorse — where a campaign of 10,000 meters of diamond drilling is underway.

Middle Chief is situated just to the north of the past-producing Little Chief Mine, which boasts historical production of over 8 million tonnes grading 1.5% Cu and 0.75 g/t Au from open pit and underground and is regarded as the largest past-producing mine in the prolific Whitehorse Copper Belt.

Little Chief, as noted, was closed in 1982 due to low copper prices at that time — not because of lack of resource. The contiguous Middle Chief target was drilled by Hudbay but never mined, which is where Gladiator is currently cranking out 10,000 meters.

The ongoing program at Middle Chief is being deployed to test for near-surface, high-grade copper skarn mineralization, which the company reports is open in all directions.

Importantly, historical assays from the Middle Chief and Little Chief zones tested for copper only; Gladiator will be testing for additional metals credits, including gold, silver, and molybdenum.

The Gladiator team reports that it is already realizing a very significant 30% to 40% upgrade in copper equivalent grade by assaying for these other key metals.

Gladiator Metals CEO Jason Bontempo commented on the current drill program at Middle Chief via press release:

“Gladiator has commenced the first diamond drilling campaign at the Middle Chief Prospect since mine closure in 1982. The planned 10,000m diamond drilling is designed to test areas of high-grade copper skarn mineralization identified from its data compilation of historic drilling datasets at the Middle Chief target as well as near mine extensions to the historic Little Chief mine. These targets represent near surface areas of mineralization open in all directions with limited exploration or development away from historical underground infrastructure.”

The focus of the current drill-phase at Middle Chief is on infilling the strike extents wherein the company is continuing to report on the continuity of mineralization throughout the known strike length.

Beyond Middle Chief, Gladiator is conducting a detailed magnetic survey at the Cowley Park prospect (with drone magnetics, ground-based EM programs, and resource definition drill planning in progress), has 5,000 meters of drilling underway at the Cub Trend prospect, and has announced that the Arctic Chief prospect is approved for 10,000 meters of drilling.

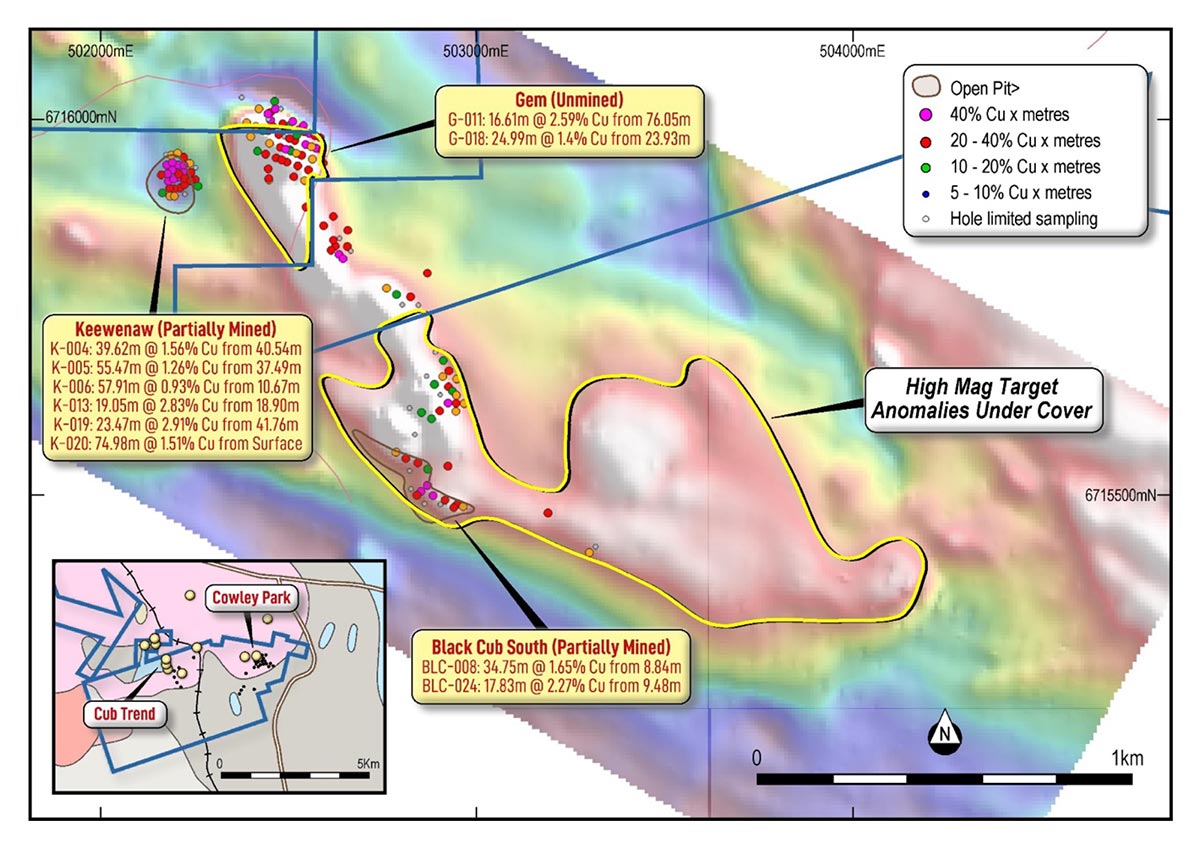

Cub Trend Prospect

The Cub Trend prospect — where 5,000 meters of diamond drilling is underway via a second rig — is another key area of the Whitehorse project offering significant near-term resource potential.

The Cub Trend prospect saw historical mining by Hudbay from two small pits wherein a deposit called Gem (see below, left) was pre-stripped but never mined.

The Gladiator team reports seeing good geological continuity in drone magnetics along multiple high-mag targets in areas of the Cub Trend prospect where there has been zero historical drilling along strike.

Gladiator Metals CEO Jason Bontempo commented on the start of drilling at the Cub Trend prospect via press release:

“Gladiator has mobilized a second rig at the Whitehorse Copper Project and commenced the first diamond drilling campaign at the Cub Trend Prospect since the 1980s. This drilling has been driven by recently returned preliminary drone magnetics which have highlighted large magnetic anomalies under cover and along strike from both previous mining operations at the Keewenaw and Black Cub South open pits and significant, shallow copper-skarn intercepts identified from Gladiator’s compilation of historical drilling. The planned 5,000 meter diamond drilling is designed to test near surface potential areas of magnetite-copper skarn mineralization open in all directions with limited exploration or development away from outcropping areas.”

With drone-mag survey results and historical datasets in hand, and with drilling underway, the Gladiator team is focused on mapping out a much larger and broader mineralized system that underpins the area, potentially linking those prospects on a macro scale with linkage to the nearby Cowley Park prospect located to the east.

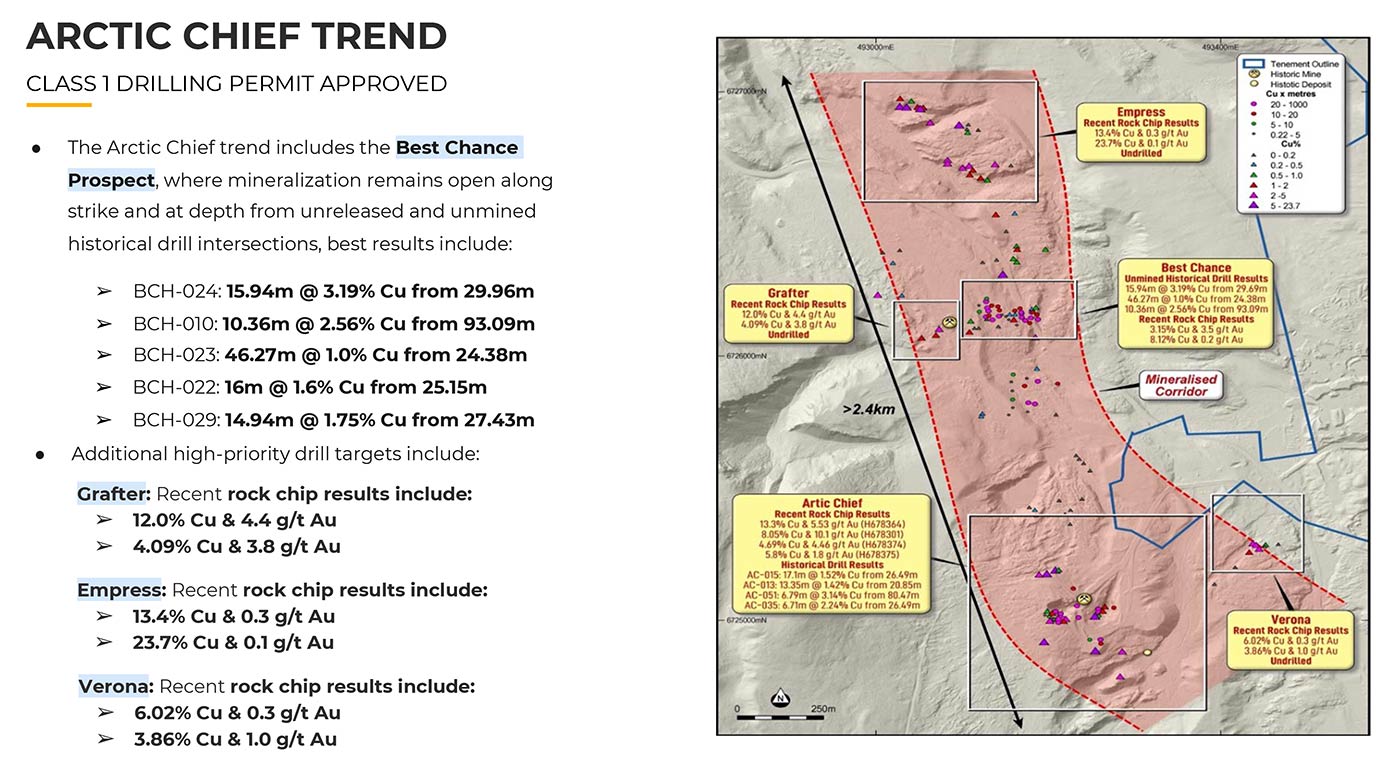

Arctic Chief Prospect

The next prospect to see 2024 drilling will be the Arctic Chief prospect, which comprises a 2.5-km-long unmined trend of sporadic drilling and near-surface workings.

Historical exploration was focused on known areas of near-surface mineralization with drilling around outcrops.

The GLAD team anticipates putting 10,000 meters of drilling into the Arctic Chief prospect to test for geological continuity and to determine the depth-extent of copper-gold mineralization in between those areas of past workings.

Supporting the delineation of high-priority drill targets, Gladiator completed a program of detailed mapping of the Arctic Chief prospect last summer and is currently conducting drone magnetics across the known strike length.

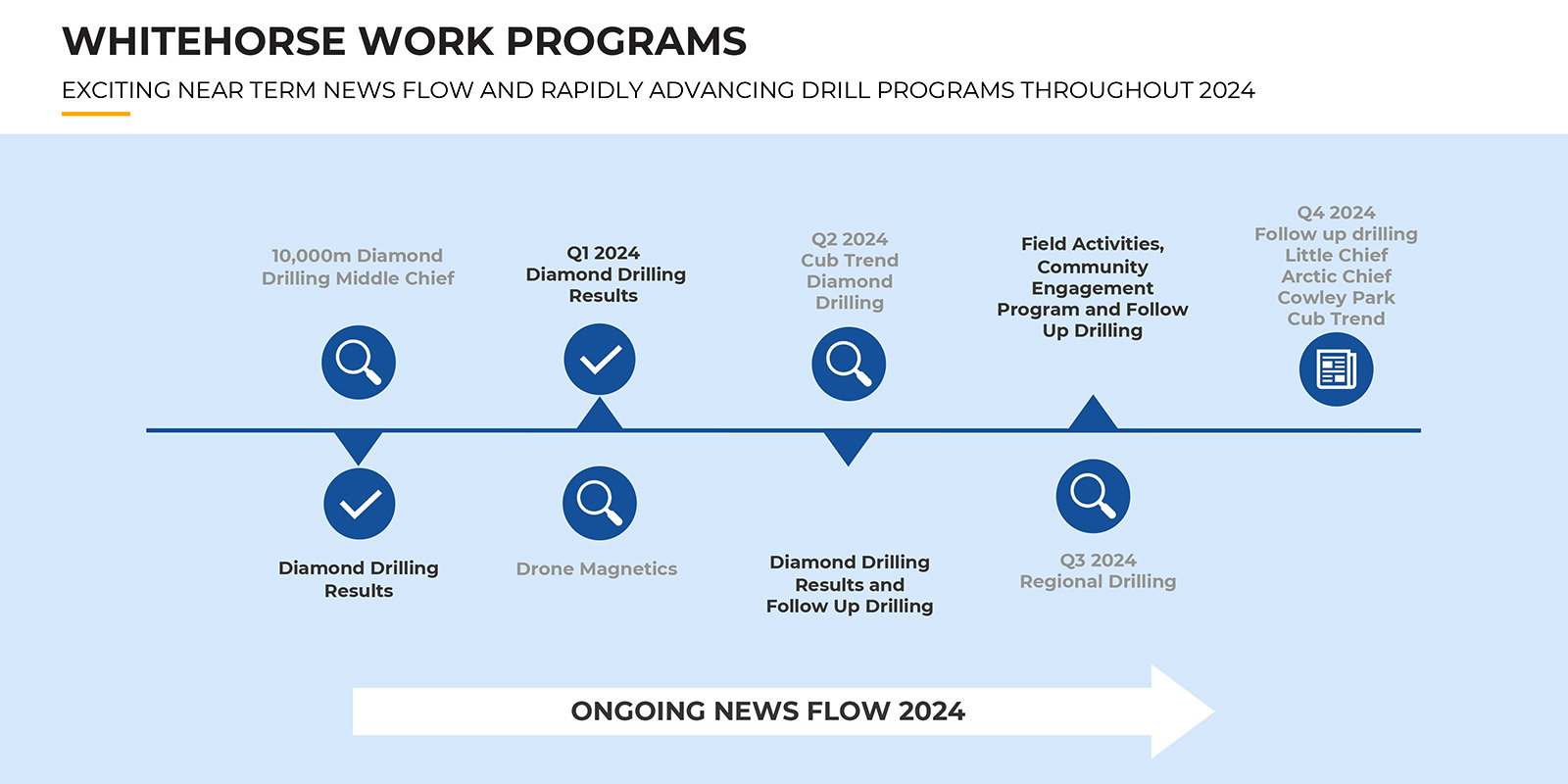

Overall, 2024 is shaping up to be a very busy and transformative year for Gladiator Metals by way of the drill-bit:

- Middle Chief: 10,000 meters underway via one rig

- Cub Trend: 5,000 meters underway via one rig

- Arctic Chief: Currently permitted for 10,000 meters

That level of drilling should take the company right through to the end of the current calendar year with the aim of proving up the near-term resource potential of each key target area.

Another primary focus will be on metallurgy and assaying wherein Gladiator, as noted, will be testing for not only copper but also additional metals credits; gold, silver, molybdenum, et al.

At that point, the Gladiator team will be in the enviable position of ranking each target in terms of which areas to convert to resources first, obviously, taking into consideration grade, scale, and proximity of mineralization to surface.

With drill momentum now building at Whitehorse via multiple rigs, we jumped at the opportunity to sit down with Gladiator Metals president Mr. Marcus Harden for an exclusive chat.

Exclusive Interview with Gladiator Metals

President Marcus Harden

There are few copper companies in the junior space that can match the copper exploration and discovery acumen and capital markets expertise of the Gladiator Metals team.

You heard from CEO and director Jason Bontempo earlier. Jason is based in Australia and boasts 20-plus years in public company management as a chartered accountant.

The team also includes VP of Exploration Kell Nielsen, who brings 30-plus years of experience in project generation and exploration and who was instrumental in the discovery, development, and management of several large resource projects.

Those include the Ngualla Rare Earths Deposit (Tanzania), the Selenge Iron Project (Mongolia), the Diamba Sud Gold Project (Senegal), and multiple projects for Placer Dome including the delineation of the ~7MOz Wallaby Gold Mine (Australia).

The Gladiator Metals board is rounded out by:

- Shawn Khunkhun: Current CEO and director of Dolly Varden Silver and founding director of Goldshore Resources. Shawn has raised over C$1 billion in equity for resource companies.

- Ian Harris: A mining engineer and current CEO of AMAK Mining and Para Resources. Ian formerly took the Mirador Mine in Ecuador through feasibility, engineering, and construction as VP and Country Manager of Corriente Resources.

- Darren Devine: Founder of K92 Mining, founder of Underworld Resources, and chairman of Dolly Varden Silver.

As promised, and for a deeper dive into the company, the team, and the flagship Whitehorse Copper Project, our own Gerardo Del Real of Resource Stock Digest and Junior Resource Monthly sat down for an exclusive interview with Gladiator Metals president Marcus Harden, who brings 20-plus years of industry experience, including key roles in multiple discoveries globally with three projects currently operating.

Please enjoy the candid conversation.

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the president of Gladiator Metals — Mr. Marcus Harden. Marcus, how are you today?

Marcus Harden: I'm very well, thank you, Gerardo.

Gerardo Del Real: It's good to have you back on. Listen, let's get right into it. You've commenced drilling at the Middle Chief copper prospect. You've had a lot of success with the drill-bit the past several months.

I thought we would start by just providing a bit of an update on how the last couple of months have come together, the success with the drill-bit, and then we can talk about Middle Chief and what you're expecting there.

Marcus Harden: Thanks, Gerardo. Yes, all of our previous drilling was mostly around a prospect called Cowley Park.

We've put 8,000 meters of diamond drilling into that and proved up continuity of mineralization over about 800 meters; maximum depth is around 170 meters so still fairly shallow drilling. The next stage for that is really step-out drilling… looking for those exploration multiples on the resource potential that we can see in-house.

As things start to dip under cover away from the current drill area, we’re putting together the lead datasets for that prospect area with airborne magnetics. These are the copper-magnetite skarns we're exploring for so we're really going to use that to help drive the exploration upside.

In the meantime, like you mentioned, we've moved on to another priority target area at Middle Chief. Middle Chief is located just to the north of a prospect called Little Chief where there was some historical production; 8.5 million tonnes at 1.5% [Cu] came out of that as well as almost a gram per tonne of gold.

Our drill rig has currently moved onto that; we've got about 10,000 meters that's going to be going into that.

Middle Chief itself, which is located just to the north of the historical [Little Chief] mine, was unmined despite there being historical results such as 49 meters at 3% copper and 54 meters at just over 2% copper. And those are quite shallow results from 70 and 77 meters down hole.

The other thing we're really excited about is that none of those historical copper assays has gold assays to go along with it so we'll be adding that dataset onto it. We're also excited about the fact that it's very much open along strike so we'll be putting some holes in to test its potential to the north along strike.

As I mentioned for Cowley Park, we're currently doing a detailed drone magnetic survey, and that has picked up a couple of very nice anomalies to the north of Middle Chief as well, which we'll be putting a couple of holes into. So, we’re very busy there.

We've also been advancing permitting at a third prospect area on the Cub Trend, which is located just to the south of some historical pits, and we hope to be putting some drill holes into that in the coming months as well.

We’re advancing multiple prospects all within about 15 km of one another through the next couple of months and hoping to put a line of sight on some near-term resource potential on the high-grade end of things, keeping in line with historical drilling steps around 1.5%.

Gerardo Del Real: It should be noted, and I think this point is an important one, that there is a lot of historical drilling and testing of this target. So it's a pretty well understood target that you're drilling into. You're not coming in blind drilling and hoping that there’s mineralization. It's really a matter of how much is there, right?

Marcus Harden: Yes, that's right, Gerardo. But it was also discovered from the decline to the underground mining operations so it's only been drilled from the underground. Projected mineralization to surface hasn't been drilled at all; the top 120 meters hasn't been drilled. And it's also very much open along strike because the drilling was only from the underground. There's been no drilling to the north of that area either.

We are confirming those historical drill results that I was talking about, and we're also going to be doing, call it, low-hanging fruit exploration; step-out drilling guided by the drone magnetics just to put extensions onto that known mineralization as well.

Gerardo Del Real: Given the success that you've had with the drill-bit and the size of the land package, what kind of scale are you starting to see come together as you drill out the property and get a better understanding of continuity and width of mineralization? How is that coming along?

Marcus Harden: Our internal objective, Gerardo, is to have line of sight on between 50 and 100 million tonnes at 1.5% copper, and we see the way to do that is by putting about 10,000 meters into 5 of our priority target areas.

And essentially, what we'd like them all to do is to look like Cowley Park… so to have continuity of mineralization over a significant strike length, to have geometries that would be easy to start drilling towards resources — and some shallow nature to those resources as well — but also to investigate not only the copper potential but also the potential credits that might go along with that, which have been omitted from all of that historical drilling that you're talking about.

But I think you raise a key point there, Gerardo. These aren't really discoveries based on geophysics or mapping. There is actually drilling into all of these prospects. It's historical in nature but we've spent a lot of time putting it together from PDFs and paper datasets into modern 3D contexts.

We're really talking about understanding those areas of resource potential and starting to rank them against one another to decide which areas are going to offer the most bang for our buck and which areas we're going to be able to start converting to resources the quickest and in the most cost-effective manner as well.

Gerardo Del Real: Do you have a timeline for resource estimates?

Marcus Harden: We don't currently, Gerardo. We're intending to hit all five of our priority target areas with at least 10,000 meters. At Cowley Park, we've largely met that. Little Chief/Middle Chief, we should be there within the next two to three months. As I mentioned, we're in a pretty advanced-stage of permitting for the Cub Trend. And the Arctic Chief Trend has approved drilling already. So we're looking to do that this year.

[Editor’s note: A second rig has been mobilized to the Cub Trend prospect where 5,000 meters of diamond drilling is underway.]

And then, I think that's going to answer that question, Gerardo. Once we've got drill meters into all of those target areas, and we have some understanding of the upside potential and the grade potential and the credits that are going to come along with that copper mineralization, then we'll be able to rate and rank those five target areas and start to decide which ones are going to get us towards our targeted resources the fastest.

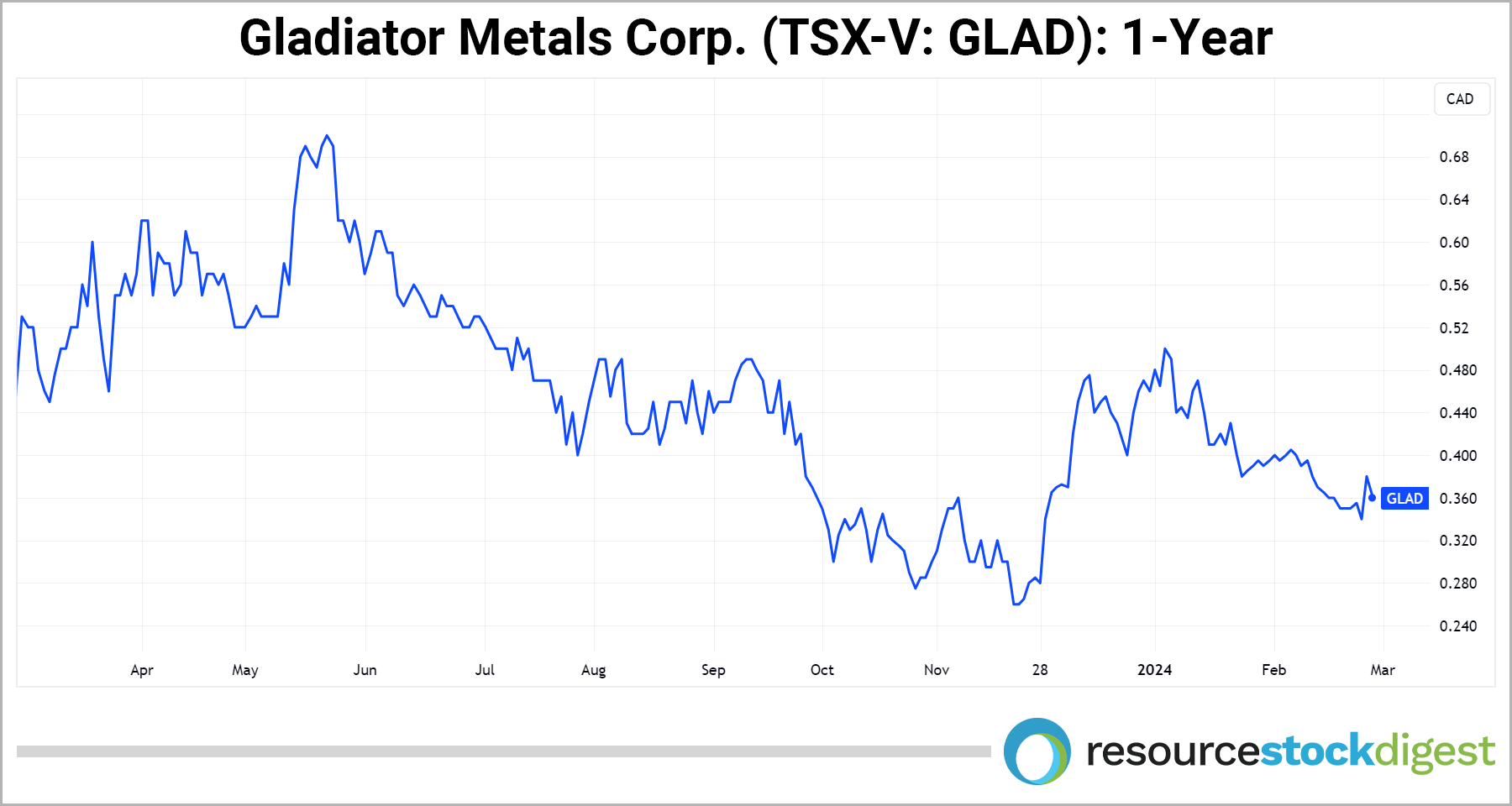

Gerardo Del Real: Sounds like it's going to be a busy year. I know that copper has pulled back slightly. Everyone I speak with, and I share the sentiment, pretty much agrees that the second half of this year is going to be a great, great market for the copper space and that there's a pretty substantial deficit that's materializing that I think is underappreciated by the market right now.

You're positioning yourself beautifully to take advantage of that. Anything else to add to that, Marcus?

Marcus Harden: Yes, I think just building on what you said, Gerardo… we agree with that sentiment, and we see ourselves positioning in that looming deficit. We have infrastructure in place. It’s a historical mining district. It's only 25 to 30 km from Whitehorse.

The Yukon territory is a favorable mining jurisdiction. And also grid hydropower is located 30 km from the project as well. There are power lines criss-crossing it, and there are existing haul roads throughout the property as well. We really see ourselves as being able to position to meet the early stage of that supply deficit.

Gerardo Del Real: Good stuff. Marcus, thank you so much for the update. Appreciate it.

Marcus Harden: Thank you, Gerardo.

The Gladiator Metals Opportunity

With copper being an essential component for wind and solar energy, EVs, and numerous other forms of next-generation infrastructure, usage of the red metal should continue to climb over the coming years and, perhaps, decades.

Robust projected demand growth from the global energy transition — coupled with a dearth of tier-one-hosted discoveries and the long lead times required for mine development — should boost not only the price of copper but also the share prices of select small-cap copper explorers such as Gladiator Metals Corp. (TSX-V: GLAD)(OTC: GDTRF).

Led by an experienced team of mining professionals, Gladiator has multiple drills turning at its flagship Whitehorse Copper Project in the Yukon with drilling lined up and underway across multiple prospects that should have the company drilling right through to the end of the current calendar year.

The potential for year-round drilling is a key operational advantage in the exploration space as most mining jurisdictions have limited drill seasons. Whitehorse, on the other hand, is accessible year-round and has excellent road and drill-site access along with access to existing grid hydropower.

Keep in mind also that Whitehorse is a brownfields copper project, meaning the main mineralized zones have already been mapped out through historical fieldwork, including mapping, sampling, and extensive drilling.

As covered in detail in this Special Report, the Whitehorse project, as a past-producer under the Hudbay banner, produced more than 300 million pounds of copper between 1967 and 1982 with the high-grade ore — some 10 million tonnes of it at 1.5% copper, plus gold and silver credits — coming from both open pit and underground workings.

With five main prospects mapped out, and with historical drill datasets in hand, Gladiator is on-track for upward of 30,000 meters of drilling in 2024 across the Middle Chief prospect, the Cub Trend prospect, and the Arctic Chief prospect with the main goal of ranking the targets and building resources (copper, gold, silver, molybdenum, et al) for forthcoming Mineral Resource Estimates.

You heard directly from Gladiator Metals president Marcus Harden. He says,

“Our internal objective, Gerardo, is to have line of sight on between 50 and 100 million tonnes at 1.5% copper, and we see the way to do that is by putting about 10,000 meters into 5 of our priority target areas … Once we've got drill meters into all of those target areas and we have some understanding of the upside potential and the grade potential and the credits that are going to come along with that copper mineralization, then we'll be able to rate and rank those five target areas and start to decide which ones are going to get us towards our targeted resources the fastest.”

Translation: With an unwavering focus on resource growth via the drill-bit, Gladiator Metals should have plenty of news flow over the coming quarters with which to potentially move the needle higher.

Gladiator Metals is well-funded to complete its near-term exploration plans with approximately C$5 million in the treasury as of February 2024 as it advances its flagship Whitehorse Copper Project in Yukon Territory, Canada.

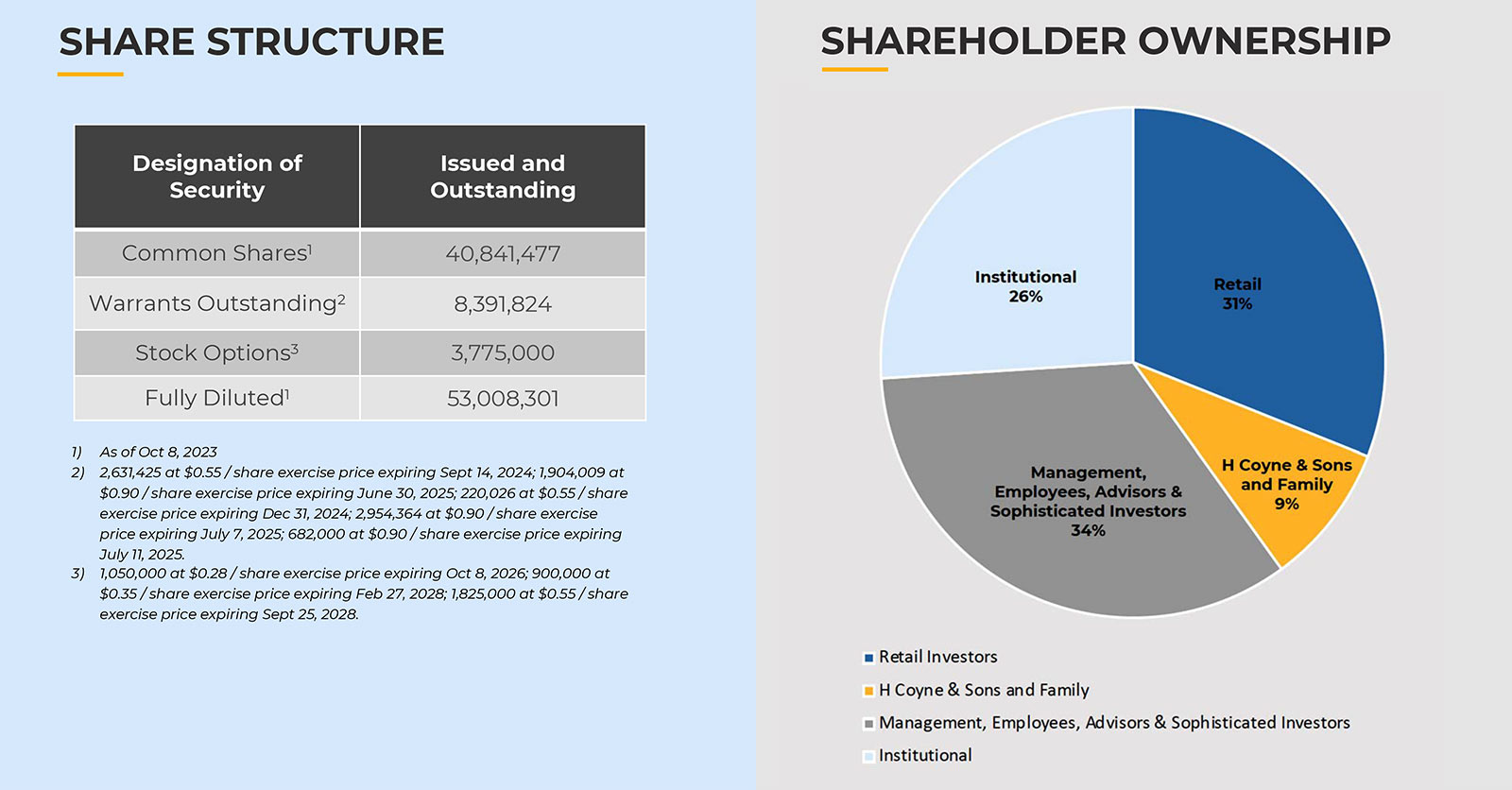

Gladiator is also well-structured with only 53 million shares outstanding on a fully-diluted basis with a large percentage of those shares currently held by insiders and/or institutions.

Both management and the property vendor are strategically aligned with shareholders.

With copper poised for a strong upward push, now’s an excellent time to begin conducting your own due diligence on Gladiator Metals Corporation — symbol GLAD on the Toronto Venture Exchange and symbol GDTRF on the US-OTCQX Bulletin Board Exchange.

A great place to start is the Gladiator Metals corporate website.

There, you can sign up to receive updates directly from the company, view the most recent Corporate Presentation and much more.

Be sure to also follow our exclusive interviews with upper management here.

— Resource Stock Digest Research

Click here to see more from Gladiator Metals