Strathmore Plus Uranium Corp.

TSX-V: SUU | OTC: SUUFF

Advancing Multiple Permitted Uranium Exploration

Projects in the Hotbed of U.S. Uranium Production

Wyoming

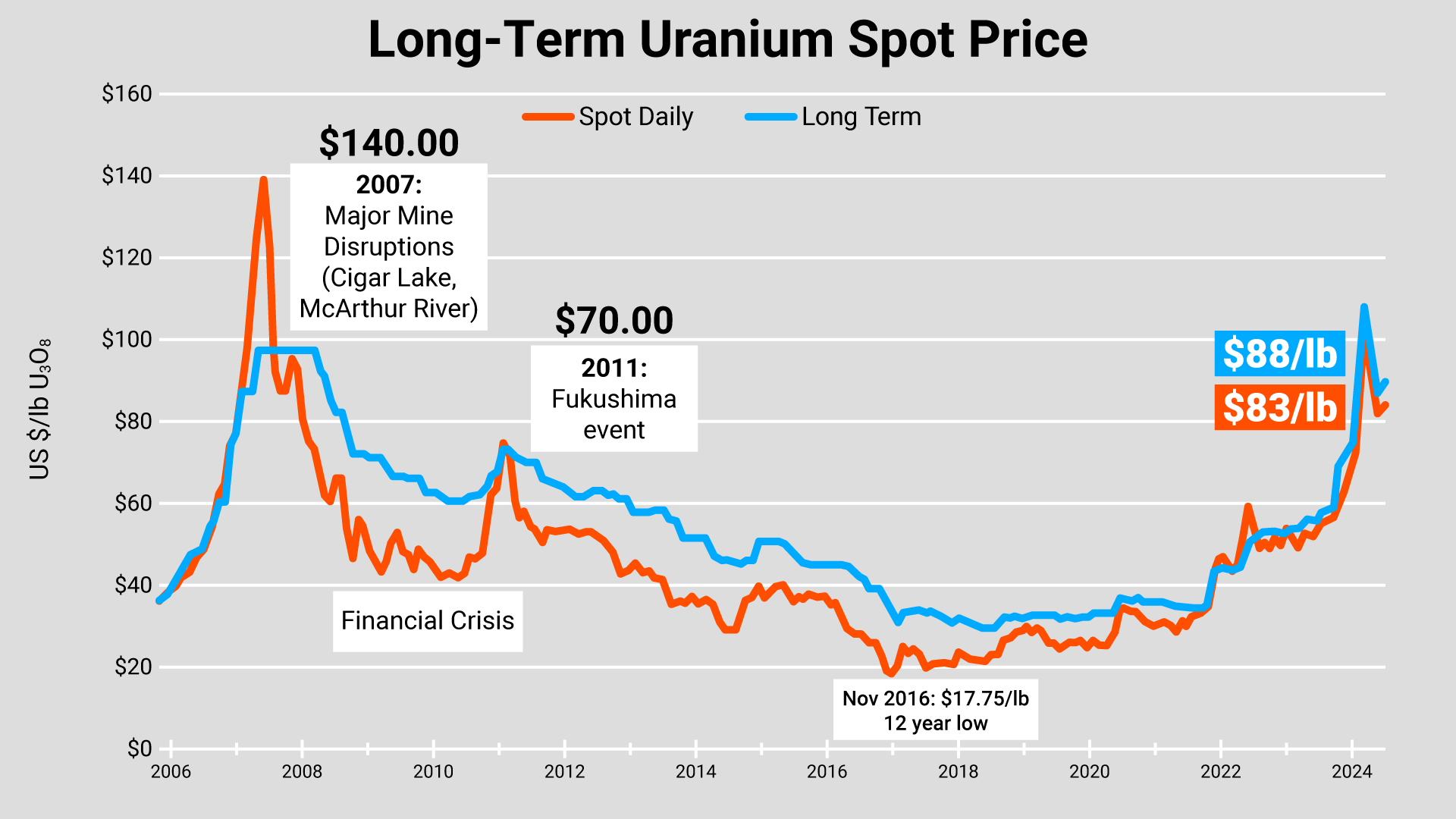

Uranium prices are soaring in 2024 — now at decade-plus highs well above US$80 per pound — as nuclear energy continues to gain global acceptance as a key baseload energy solution devoid of greenhouse gas emissions. Uranium’s historic rise is presenting investors with a timely opportunity as we head into the second quarter of 2024, particularly in the small-cap space.

The small-cap uranium company featured in this report, Strathmore Plus Uranium Corp. (“SUU”), is advancing three permitted uranium exploration projects in the state of Wyoming — the leading US uranium-producing state.

SUU’s brilliant hub-and-spoke strategy in The Equality State is being advanced through drilling, which is precisely how early-stage uranium properties are progressed through the various stages of exploration through to the ultimate goal of U3O8 production. Most importantly, it’s all happening in concert with one of the most powerful uranium bull markets the world has ever seen — making now an opportune time for speculators to capitalize on the opportunity at hand.

2024 Uranium Bull Market

There’s a major positive shift happening in the global nuclear energy sector.

The world is finally coming to the realization that lofty climate goals will be impossible to meet without clean-burning, carbon-emission-free nuclear energy being an integral part of the clean-energy mix.

That fact is adding escalating pressure on an already constrained global uranium supply with U3O8 prices now sitting at decade-plus highs well above US$80 per pound after starting the previous year at just US$50 per pound.

With uranium, what we arrive at is a market that’s consuming close to 200 million pounds of yellowcake annually — yet producing only around 140 million pounds.

That equates to a 60-million-pound structural deficit this year… which, when compounded over the next six years to the end of the current decade, balloons to a jaw-dropping ~360 million pounds.

That’s a staggeringly large deficit… and it underpins the escalating need for new North American and friendly uranium sources reaching the supply chain.

And it’s really only the start.

On the demand side, we have Japan looking to restart a further 16 of its reactors. The island nation is also seeking ways to safely extend the plant-life of its existing reactor fleet from 40 to 60 years.

China just approved the construction of six new nuclear reactors across three provinces with plans to build 150 new reactors over the next 15 years as part of their newly-enhanced decarbonization mandate.

South Korea and India have also joined the fray and are now fully onboard with a cleaner energy future that will require vast amounts of uranium, or U3O8.

In Europe, France’s economy minister has doubled down on the need for a top-to-bottom overhaul of the electricity market saying, “there is no energetic transition without nuclear energy.” The nation has announced plans to construct a new generation of nuclear reactors for the first time in decades.

Even Finland’s Green Party — following decades of staunch opposition — has voted overwhelmingly to categorize nuclear power as a form of sustainable energy.

At present, one-third of Finland’s electricity is derived from nuclear power, and the country’s OL3 reactor (see below), Europe’s largest, is now connected to Finland’s national grid.

Other European nations are quickly falling in line with Finland’s pro-nuclear stance. Britain and Sweden are each planning new nuclear reactor projects with Belgium and Spain also cementing their support for the clean energy source.

And at the 2023 COP28 conference in Dubai, twenty-two nations, including some of the largest economies in the world, signed a declaration to triple nuclear capacity by 2050.

America’s Uranium Resurgence

Here in the United States, the Biden administration is finally putting its money where its mouth is when it comes to nuclear power generation and the revitalization of the nation’s uranium production sector.

US Energy Secretary

US Energy Secretary Jennifer Granholm revealed that the United States is developing a comprehensive uranium strategy focused on becoming self-reliant on domestic sources of yellowcake — following decades of underinvestment in uranium mining — for our own consumption, stating:

“The United States wants to be able to source its own fuel from ourselves, and that's why we are developing a uranium strategy both through the Defense Production Act as I mentioned, as well as seeking an additional large amount by the year end for a more fulsome strategy. We’ve got to develop our own supply chain in order for our existing reactors to continue to function as well.”

Part of that strategy may also include heavy sanctions or an all-out ban on Russia’s state-owned uranium firm Rosatom. The Biden administration has already placed a ban on the import of Russian fossil fuels; uranium may be the next shoe to drop.

According to the US Energy Information Administration (EIA), Russia is the United States’ fourth-largest source of uranium. Approximately 14% of uranium imports to the US come from Russia. America’s top three sources of yellowcake are Kazakhstan (35%), Canada (16%), and Australia (15%).

In addition to the pending US$4.3 billion for the revitalization of America’s domestic uranium sector, the administration has issued a Notice of Intent for the implementation of a US$6 billion nuclear credit program to support the operation of reactors across the nation.

Further, the US Department of Energy recently awarded over US$60 million for 74 US-based nuclear projects.

Interestingly enough, most Americans don’t realize that the United States used to produce all the uranium it needed. That was back in the 1960s through the 1980s. At our peak, we produced over 40 million pounds annually.

Today, that figure has plummeted to less than 1 million pounds per annum. Yet, with nuclear power back in the spotlight as the cleanest, most reliable baseload energy source on the planet — America’s once-dominant uranium sector is set for a major rebirth.

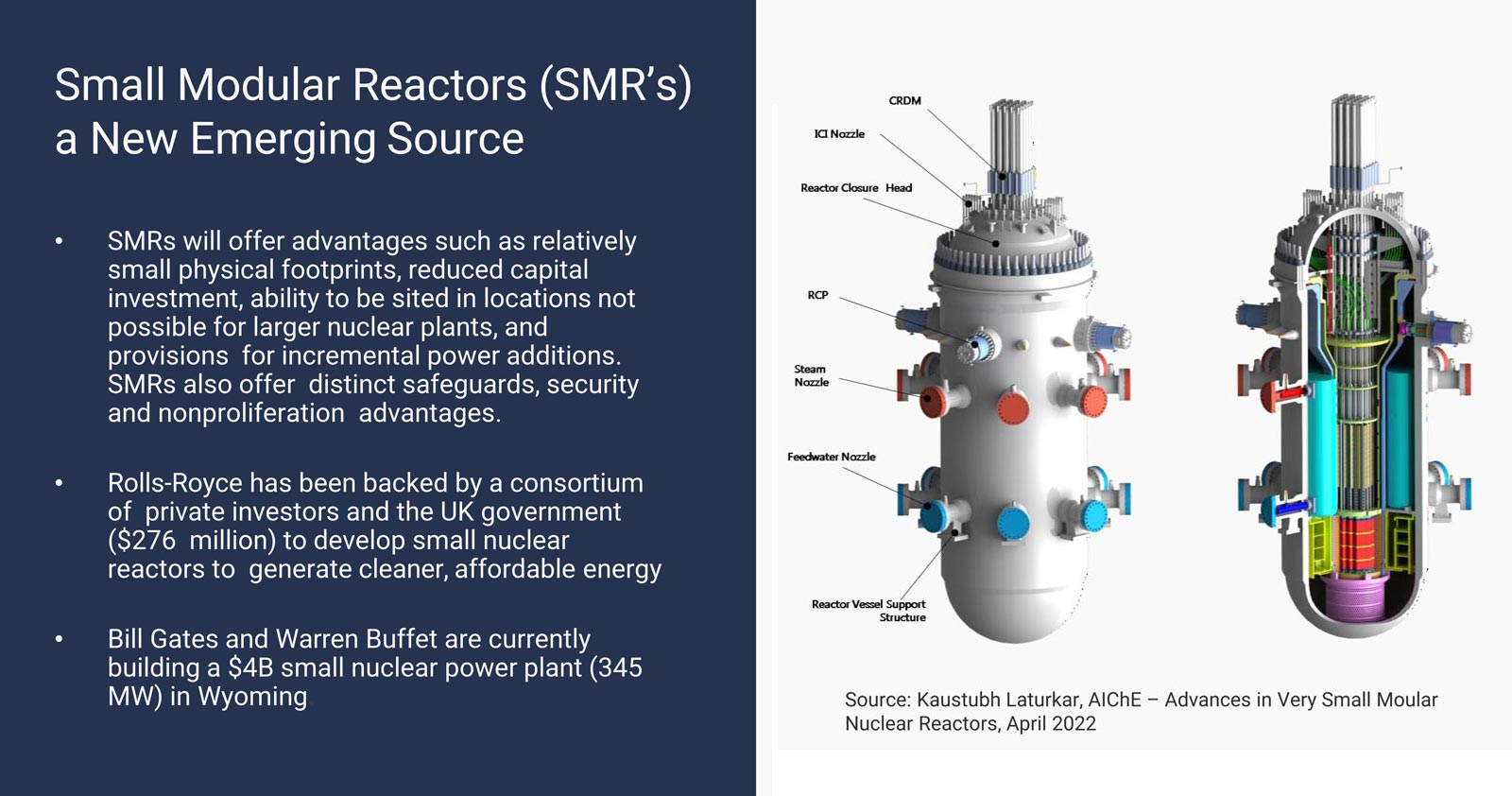

Key to America’s uranium production resurgence is the advent of Small Modular Reactors, or SMRs, which are becoming integral to the US Department of Energy’s goal of developing safe, clean, and affordable nuclear power options.

NuScale recently became the first company to be granted approval by the US government on small modular reactor (SMR) design with the US Nuclear Regulatory Commission giving it the green light. Privately-owned Standard Power followed up that news with an announced partnership with NuScale on the construction of two SMRs.

TerraPower, founded and backed by Bill Gates, is currently constructing a next-generation US$4B nuclear power plant at a retiring coal plant in Wyoming (the same state where Strathmore Plus has its operations) that’ll use an all-new blend of enriched uranium.

Once completed, the plant is expected to generate efficient, low-cost, clean energy while utilizing enhanced safety standards that greatly reduce the risk of accident, even on par with wind power plants.

From an investment perspective, it’s vitally important to ONLY look at uranium exploration companies that are developing projects in states where there’s strong local support for uranium mining along with a sound regulatory framework for getting projects permitted.

And frankly, it doesn't get any better than the state of Wyoming, which has a populace that stands firmly behind the shift away from coal in favor of clean-burning nuclear energy powered by uranium — not to mention the state’s multi-decade history of uranium mining and production.

Rising Demand in the Face of Uncertain Supply

Put plainly, increased uranium demand is coming from all angles. And that includes a new contracting cycle that’s just now getting underway with major utilities entering the market to secure their next long-term U3O8 contracts.

The combination of dwindling secondary supply, utilities coming back into the market, and supply cuts from the highest-margin producers has kicked off what many experts agree could be the greatest uranium bull market anyone has ever seen.

The Inflation Reduction Act of 2022 also provides funding for US nuclear power projects, including a tax credit for electricity produced at qualified nuclear power facilities.

Next, you have to look at the precariousness of the global uranium supply to really get the full picture.

Kazakhstan — a former soviet republic and the world’s largest uranium producer — produces roughly 40% of global supply. In 2022, as you may recall, the country erupted into what’s now known as ‘Bloody January’ where more than 225 people were killed in a government crackdown on nationwide protests.

Cameco, which owns 40% of the giant Inkai uranium mine in Kazakhstan, had this to say:

“As 40% of the world's uranium supply, any disruption in Kazakhstan could of course be a significant catalyst in the uranium market. If nothing else, it's a reminder for utilities that an over-reliance on any one source of supply is risky. It also reinforces the shift in risk from suppliers to utilities that has occurred in this market.”

Cameco, which accounts for roughly 17% of global uranium production, is experiencing production issues of its own — to the tune of about a 2.7 million pound shortfall — citing ongoing difficulties at its Cigar Lake and McArthur River mines as well as at its Key Lake Mill in Canada.

Uranium supply is being further hampered by a recent military coup in Niger (the world's seventh-largest producer representing over 4% of supply).

It’s that type of geopolitical chaos that’s leading to increased energy insecurity around the world as supply comes under increasing pressure, particularly in the global uranium market.

Uranium supply is also under siege as companies look to capitalize on the opportunity to purchase large amounts of drummed uranium in the open spot market with the Sprott Physical Uranium Trust (SPUT) acquiring some 50M lbs over the last couple of years — and with others like Yellowcake PLC and Uranium Energy Corporation following suit.

As a result, uranium inventories are continuing to shrink, most notably from 3.5 years to around 2 years of supply right here in the United States, well below the historical average.

We also talked about restarts and lifespan extensions on reactors… and it’s not just Japan that’s going down that road.

In California, steps are underway to potentially extend the life of the Diablo Canyon reactor for an additional 5 years from 2025 to 2030. The same thing is happening in countries such as Belgium, Finland, and Slovakia.

All of that is to say that any further disruptions to the global uranium supply chain could lead to an even greater run on uranium spot prices — possibly like what we saw back in 2006-07 when uranium soared past US$140 per pound upon the flooding of Cameco’s Cigar Lake Mine.

That upsurge caused the share prices of most uranium mining companies to break out… resulting in substantial gains for well-timed investors.

We’re currently sitting at decade-plus highs north of US$80 per pound U3O8. A couple of years ago, uranium prices were languishing at the US$30/lb level and were at US$50/lb at the beginning of 2023. The uptrend is undoubtedly underway as you can tell by the uranium price chart below.

With geopolitical upheaval at an all-time high in key uranium producing countries, including Russia, which, at any time, could have its uranium exports sanctioned by the United States, the writing’s clearly on the wall for strong uranium pricing going forward.

It also underpins the need for increased uranium production from safe jurisdictions such as Wyoming USA where Strathmore Plus Uranium is operating and advancing its three permitted uranium exploration projects.

It’s still early innings in the current uranium uptrend, which means now is an opportune time for resource speculators to consider positioning for what could be a material move higher.

Enter Strathmore Plus Uranium Corp. (TSX-V: SUU)(OTC: SUUFF).

Strathmore Plus: 3 Key Permitted Projects

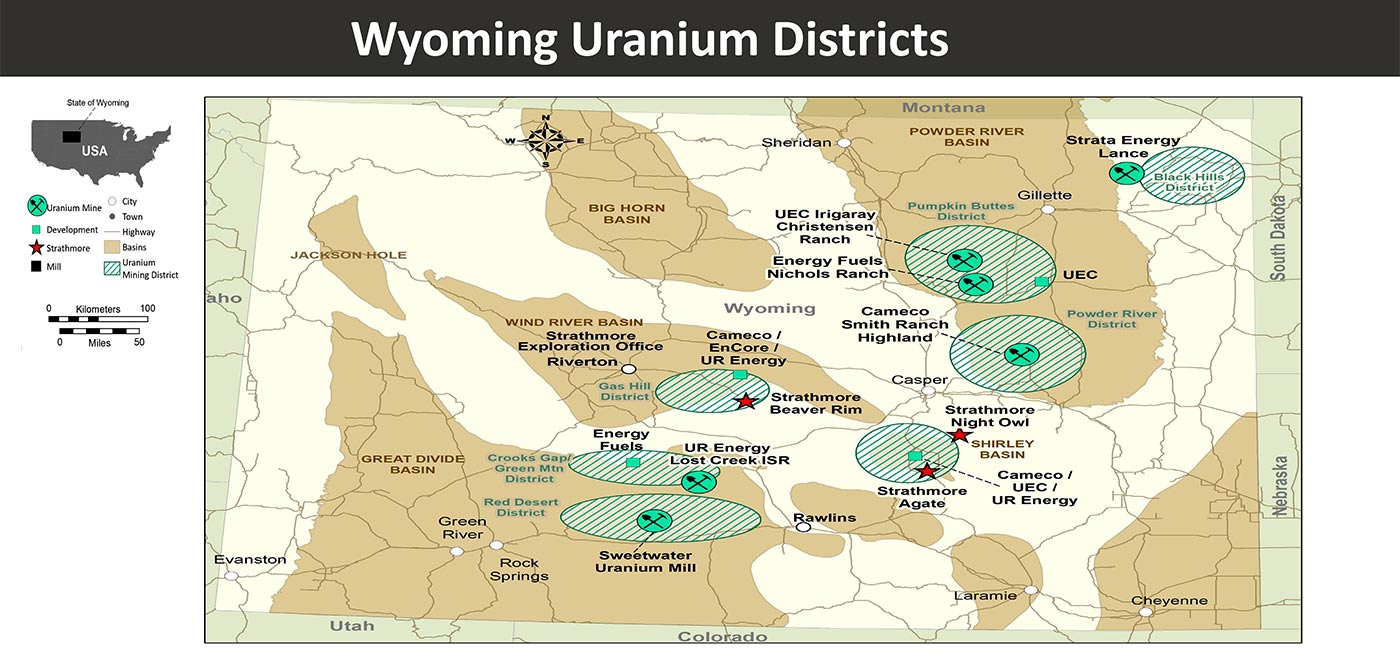

Strathmore Plus Uranium (“SUU”) is focused on advancing its impressive suite of three wholly-owned and permitted uranium exploration projects in America’s #1 uranium producing state — Wyoming.

Strathmore’s properties — denoted by the red stars below — are the Agate, Night Owl, and Beaver Rim projects.

All three properties hold potential for ISR (in-situ recovery), which is the preferred uranium extraction methodology in North America.

ISR projects are considered a much lower-cost and much more environmentally-friendly alternative to conventional uranium mining and represent the largest source of growth in uranium production globally.

Agate & Night Owl Uranium Projects

Strathmore’s neighboring (and permitted) Agate and Night Owl uranium projects are situated in Wyoming’s Shirley Basin Uranium District.

The Shirley Basin boasts 55 million pounds of historic uranium production (peaking in the 1960s - 1970s) from open-pit, underground, and the first-ever successful ISR (in-situ recovery) uranium operations in the USA.

Today, with uranium trading multiples above where it was during that era, Wyoming’s Shirley Basin has been thrust back into the spotlight as integral to America’s mandated push for increased uranium production from domestic sources.

Agate Uranium Project

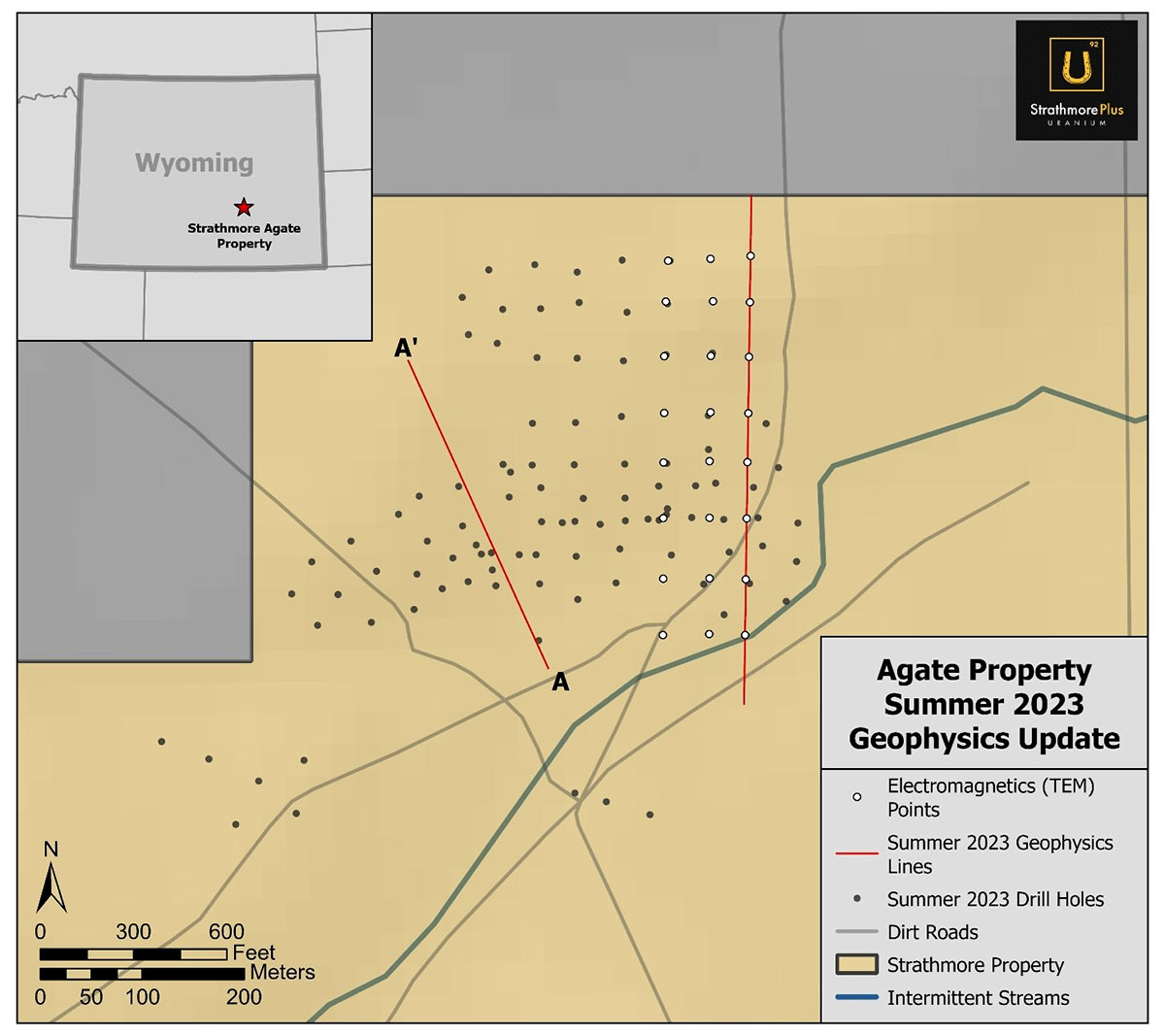

Strathmore Plus is currently conducting data analysis from its recently completed 4,500-meter drilling and exploration program at the flagship, 100%-owned Agate project.

As illustrated in the property map (above), the project lies just to the south of uranium properties held by industry leader Cameco (NYSE: CCJ; US$18B market cap) and significant uranium player Uranium Energy Corp. (NYSE American: UEC; US$2.6B market cap).

The Agate property consists of 52 wholly-owned lode mining claims covering 435 hectares and was previously explored by Kerr-McGee in the 1970s, the largest uranium producer in the United States at that time.

On 16 November 2023, SUU announced the completion of the first phase of exploratory drilling at Agate. Hitting at an impressive 93% success rate, the company reports that uranium mineralization was encountered in 93 of 100 holes drilled to date. The 4,500-meter program was completed on time and on budget at just US$275,000.

The uranium mineralization encountered proved typical of the classic Wyoming-type roll front deposits that were first described historically in the Shirley Basin district in the 1960s.

The Strathmore Plus team describes the mineralization at Agate as shallow — at just 4.5 to 45 meters depth — and lying just below the water table, making it potentially amenable to in-situ recovery, with grades ranging from 0.02% to 0.11% U3O8 equivalent.

Highlights from this first phase of drilling include 0.114% U3O8 equivalent over 2.6 meters and 0.11% U3O8 equivalent over 4.4 meters. As a result, the company has now more than doubled the size of the mineralized area at Agate since the start of the program.

Strathmore Plus director and P.Geo. John DeJoia — whom you’ll be hearing from directly in our exclusive interview coming right up — commented on the results via press release:

“The drilling results to date support what our expectations were of the Agate project. The mineralization is shallow, with the thickness, quality grades, and requisite permeability, porosity, and transmissivity parameters necessary for in-situ recovery of uranium, all of which the Shirley Basin district is notable for in the mining industry.”

The SUU team is currently in the planning and permitting process for its upcoming spring 2024, 200-hole drill program at Agate.

Drill hole locations are currently being delineated based on analysis of the recently completed drilling and exploration program, as well as results from an ongoing geophysical study being conducted by the University of Wyoming (UW).

The UW study is being deployed to delineate roll fronts, the noses of which are anticipated to host thicker, higher-grade intervals of uranium mineralization.

As data is compiled and as the drilling start-date approaches, the Strathmore Plus field team will begin the process of ranking drill targets based on data analysis and 3D modeling.

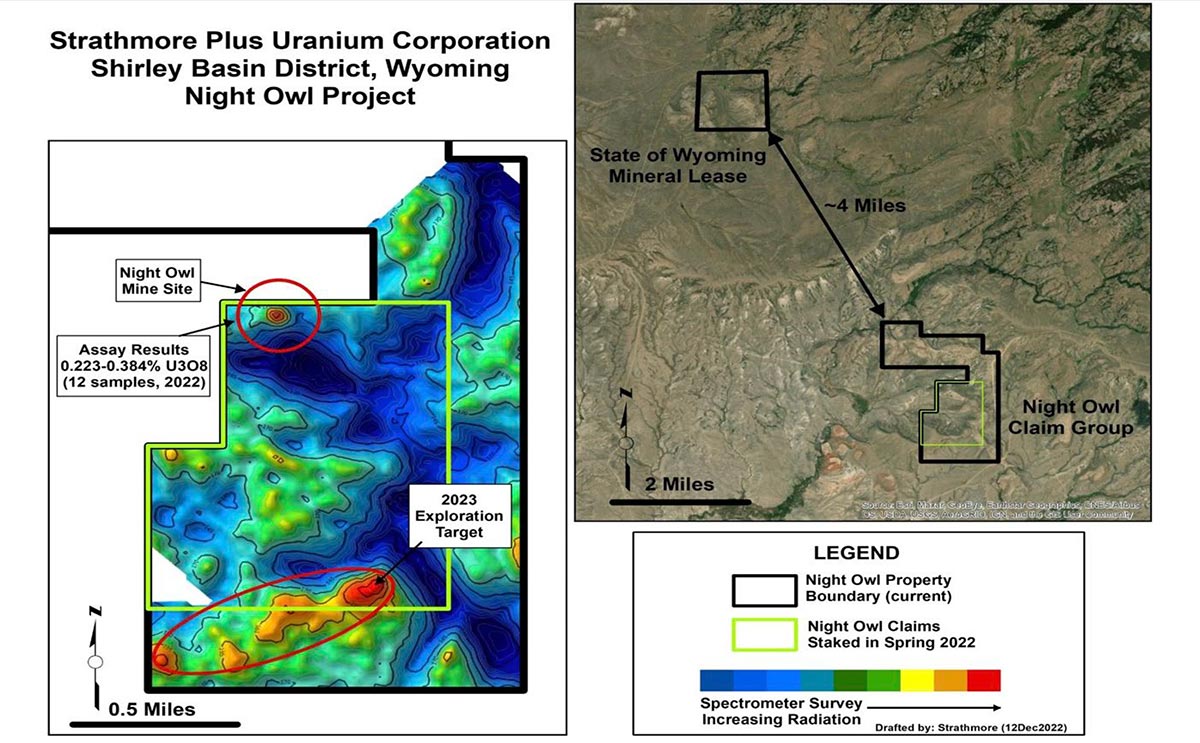

Night Owl Uranium Project

Strathmore Plus owns 100% of the neighboring Night Owl uranium project where 30 drill holes were completed in late 2023.

The property hosts the past-producing Night Owl Uranium Mine, which was formerly mined as a near-surface U3O8 deposit by Night Owl Properties & Battle Axe Mining Co.

During its heyday, in the late 1950s to early 1960s, the mine produced 93 tons of ore at a grade of 0.24% U3O8. Production began in the mid 1950s without drilling along outcrop exposures, which highlights the property’s robust potential for new mineralized showings.

A key historical aspect of SUU’s Night Owl project is that the mine’s production was halted due to low uranium prices at that particular point in time — around US$7 per pound U3O8 — not due to lack of resource.

Today, as we’ve been discussing, uranium is trading at decade-plus highs well above US$80/lb, which makes the Night Owl project — and all three of Strathmore’s uranium exploration projects, for that matter — all the more prospective for potential production.

Also worth noting is that this is the first time the Night Owl project is being explored via modern exploration and drilling techniques.

The recently completed drill program (30 holes) encountered shallow uranium mineralization in and around the old Night Owl mine site.

And although downhole drilling did not encounter abundant mineralization at depth, the Strathmore Plus team reports that previously collected samples from outcrops produced assay results ranging from 0.22% to 0.38% U3O8, confirming and even exceeding the historically reported mined average.

All of those factors combined should give the Strathmore Plus field team a number of high-priority targets for early 2024.

Beaver Rim Uranium Project

Situated to the northwest of the Agate and Night Owl projects, SUU’s 100%-owned Beaver Rim Uranium Project comprises 131 lode mining claims totaling 1,095 hectares in Wyoming’s Gas Hills Uranium District.

Strathmore holds a drilling and exploration permit for the property.

The claims are strategically located in areas previously delineated by drilling by other operators as highly prospective for uranium mineralization.

The claim groups are adjacent to and south of industry-leader Cameco’s Gas Hills Uranium Project, which is fully permitted for in-situ uranium recovery.

Historical and recently compiled reports suggest that 50 to 100 million pounds of uranium resources remain in the Gas Hills Uranium District with significant discovery potential in the underexplored areas to the south, including in the Beaver Rim area.

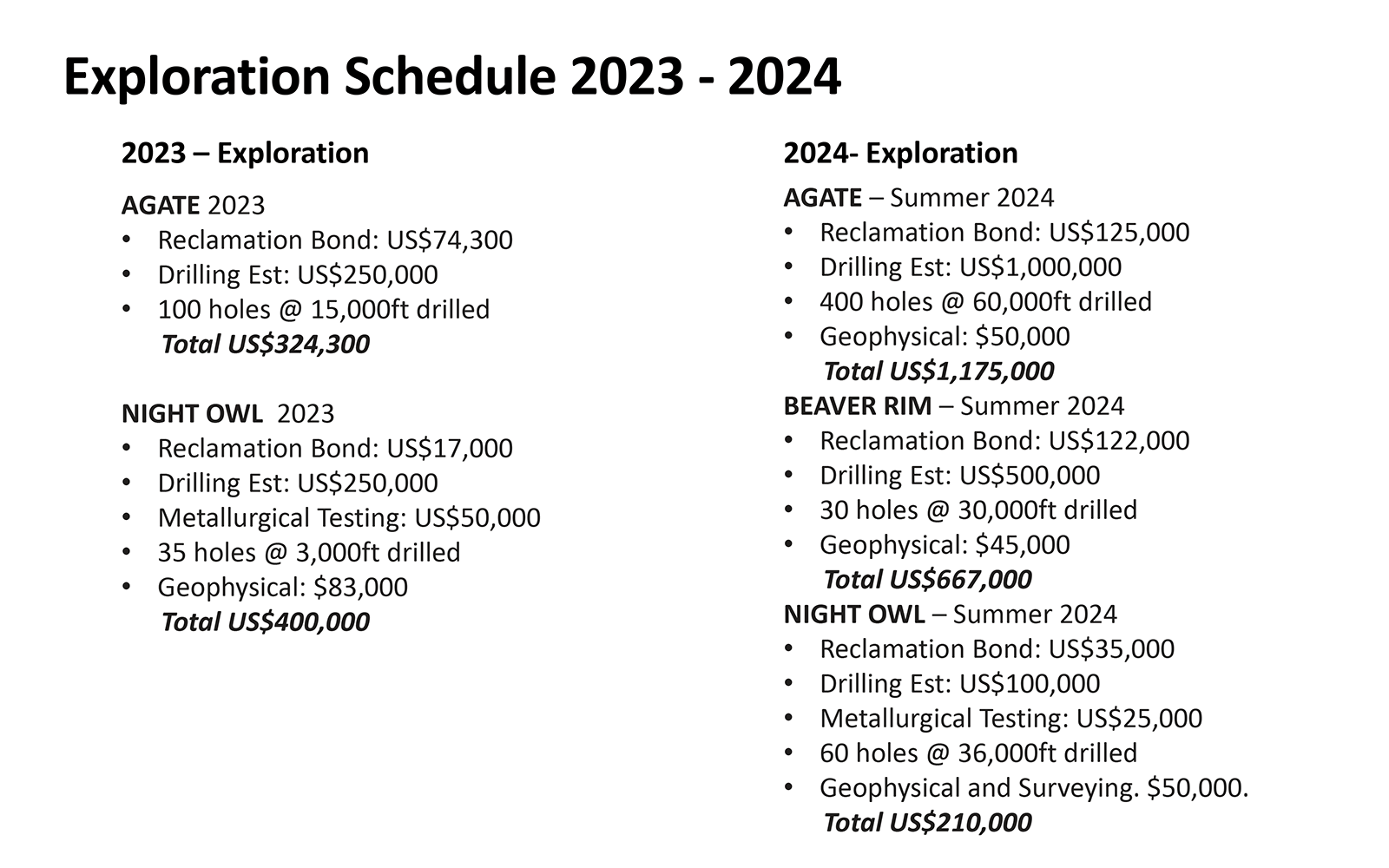

2024 Exploration Plan

With multiple targets spread across three high-potential Wyoming-based uranium projects, the SUU team has mapped out a robust exploration and drilling plan (see below), which should generate a steady stream of news flow over the coming quarters.

The Ur-Energy Connection

Underpinning the multi-project initiatives just discussed, Strathmore Plus Uranium has entered into a working agreement with Ur-Energy (TSX: URE; C$550M market cap) to evaluate ways to advance the Agate, Night Owl, and Beaver Rim projects.

The coordinated plan is to assess the feasibility of a negotiated business transaction for future processing of uranium from Strathmore’s Wyoming-based projects at Ur-Energy’s nearby facilities.

These include Ur-Energy’s operating Lost Creek and Shirley Basin facilities, which are fully-licensed and permitted for in-situ recovery. In fact, the tailings facility at Shirley Basin is one of the few operational facilities in the United States that is licensed to receive and dispose of byproduct waste material from other companies’ in-situ uranium mines.

As part of SUU’s broader hub-and-spoke strategy in Wyoming, the company anticipates shorter lead times for development and production of its projects by building upon Ur-Energy’s expertise in permitting, as well as potential future utilization of Ur-Energy’s fully-licensed facilities.

A Highly-Adept Team of Uranium Mining Professionals

Strathmore Plus Uranium boasts a highly-experienced management and technical team with a history of success in the North American uranium sector.

It’s a team with nearly a century of combined experience in the uranium space highlighted by multiple discoveries of merit in Wyoming, USA, and Saskatchewan, Canada — two of the best and safest uranium jurisdictions on the planet.

With uranium currently trading at decade-plus highs above US$80/lb with plenty of runway ahead, the team’s foresight has not only proven dead-on accurate but the company’s projects are all of a sudden that much more valuable.

Let’s meet a few of the key principals who’ve been instrumental in placing Strathmore Plus Uranium Corporation in this enviable position to the benefit of SUU/SUUFF stakeholders.

Dev Randhawa

Chairman & CEO

A seasoned mining CEO, Dev boasts a wealth of experience in building resource, exploration, and energy companies. In 2013, The Northern Miner named Dev ‘Mining Person of the Year’ with Finance Monthly awarding him ‘Deal Maker of the Year.’ As part of the Fission Uranium team, he also took home The Mining Journal’s ‘Excellence in Exploration’ award in 2015.

Dev was part of the Fission Uranium team that made the initial high-grade uranium discovery at PLS. He also founded Strathmore Minerals in 1996 and remained CEO until September 2008. In 2007, Dev spun Fission Energy Corp. out of Strathmore to focus on uranium exploration in Saskatchewan. He remained CEO and chairman until the company sold its Waterbury Lake discovery and a large selection of its assets to Denison Mines in 2013. Dev is also the current chairman and CEO of F3 Uranium Corp.

Terrence Osier, P.Geo.

VP Exploration

Terrence is a professional geologist with 17 years of experience in the uranium industry, formerly serving as lead geologist for Strathmore Minerals Corp. from 2004 to 2013 in their Wyoming operations. Terrence received his Master’s of Science in Geology from Idaho State University and is a registered member of the Society of Mining Metallurgy and Exploration.

John DeJoia, P.Geo.

Director

John is regarded as one of the most experienced uranium geologists in the United States and has been instrumental in the acquisition and ongoing development of all three of Strathmore Plus Uranium’s current Wyoming-based uranium exploration projects.

In a distinguished career spanning five decades, John has overseen the mining of over 20 million pounds of uranium in Wyoming, including in-situ recovery operations. John received his Bachelor of Science in Geology from the University of Wyoming. Let’s hear from him directly now.

Exclusive Interview with Strathmore Plus Uranium

Director & P.Geo. John DeJoia

There are few uranium exploration companies in the junior space that can match the uranium exploration and discovery acumen of the Strathmore Plus team.

As promised, and for a closer look, our own Gerardo Del Real of Resource Stock Digest and Junior Resource Monthly caught up with SUU director and professional geologist John DeJoia to discuss the company’s robust exploration and drilling plans for the full portfolio in 2024. Please enjoy!

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is director and P.Geo. of Strathmore Plus Uranium — Mr. John DeJoia. John, it is a pleasure as always to have you on. How are you today, sir?

John DeJoia: I'm doing well, and it's always a pleasure to talk with you.

Gerardo Del Real: Well, let's get right into it. We've had what I view, and we talked a bit off air, as a really healthy correction in the uranium space. We've seen a surge from the US$70/lb level to the $110/lb level.

We've pulled back to the US$85 per pound level. I think it's healthy. I wanted to get your thoughts on the uranium space, and then we can pivot a bit to what should be an exciting 2024.

John DeJoia: Well, I see things much as you do. It jumped pretty high, pretty fast. So slinking back a little bit is probably a good correction. However, we still need those high prices.

Gerardo Del Real: I couldn't agree more. If we're talking baseball parlance, right, I like to use the baseball analogy: What inning, out of nine innings, do you think we're in in this uranium bull market?

John DeJoia: Well, having started in it over 50 years ago, it feels like we're in the 13th inning! However, looking at it in the context of the past few years, we're probably in the second inning.

Gerardo Del Real: I like it… that's music to my ears and I couldn't agree more. I think we're in the second or third inning at most. Strathmore Plus just closed a financing for just over C$1.4 million. What do you plan on allocating that capital towards because I know 2024 is going to be a pivotal year for a lot of uranium companies — Strathmore Plus Uranium included.

And I have to say, I think that by the end of 2024, we're going to see a distinction between companies that have projects of merit and assets that can be advanced to add value… and companies that are just trying to catch the wave and get higher share prices off of the uranium bull market. I think that'll come to an end by year-end.

So I would love to hear how that capital is going to be allocated and what the focus is going to be here for the rest of the year?

John DeJoia: As you know, Gerardo, our properties are located in Wyoming, and we're very happy about that because it’s one of the best permitting environments in the country and possibly the world.

For this year, most of the money that we've brought in will be allocated towards drilling at Agate and Beaver Rim because we need to find out what's there. We drilled 100 holes at Agate last year, and 93% of them hit mineralization at some good thicknesses and decent grades.

We had one hole with 16 feet of 0.08% eU3O8 and another one with 21 feet of 0.09% eU3O8. Those are good grade thicknesses. They're contained between two aquitards in a porous sandstone. Our goal at Agate is to essentially define what we've got there. We covered a fairly small area last year… and we're hoping to drill 200 holes at Agate this year.

Now, they're shallow holes but even shallow holes require money. We're still talking about a lot of money just to drill even at $15 per foot. So we're talking reclamation; we may try to put in a monitor well or two because we feel Agate is bound for ISR (In-situ recovery).

And it's very shallow. I don't want to call it a deposit just yet but I think we’ll be able to by the end of summer. In terms of mineralized areas, very few of these ISRs are less than 150 feet thick, and this one is below the water table. So that's where a good portion of our money, probably 30% of our recent raise, will go.

The other large use of our money will be on the Beaver Rim property. Now, Terrence Osier and I have both drilled up there in the past. Terrence is our vice president of exploration. And when we were with the former Strathmore Minerals — the predecessor to our current Strathmore Plus — he was up there drilling, and he hit stacked roll fronts in a couple of holes.

We divested after he had done that drilling but we feel that we're going to find more of that. This is the old mineralizing area for the whole Gas Hills. And the Gas Hills were the biggest producer in Wyoming and probably the second biggest producer in the country. Basically, a lot of ore came out of the Gas Hills.

Now, we're up on Beaver Rim. And just down from the top of Beaver Rim, there are two old underground shafts: The Atlas Shaft to the northwest and the UPZ Shaft to the northeast.

The UPZ Shaft is located on the properties I used to work with out there with Federal American Partners. We had a brand new shaft down to ore at around 900 feet. I've actually been in the shaft and have sampled the ore. And our properties are just to the south of this. We're in the conduit area, the old mineralizing channels, where all of the ore moved through and into the Gas Hills.

Now, it's fairly deep. In the old days… and when I say old days, I'm talking 60 years ago, 50 years ago, 40 years ago… none of us really got a chance to go up and explore this area because there was so much ore in the Gas Hills that we didn't need to find additional ore bodies. We needed to develop and mine the ones we had.

Obviously, we know what happened in the 1980s where the whole thing just kind of fell apart. And this area never got the exploration it deserved. When Dev Randhawa, our chairman & CEO, first called me, this was the first target I gave him, and we agreed to found the new Strathmore.

And it turns out that Terrence had actually picked up some of these claims. So we were able to hire Terrence and acquire a land position at the same time. And since then, we've acquired more land in the area, and we are very excited about Beaver Rim.

We're small. We have limited capital. We have limited personnel. And we have three properties that we are really high on. So we've got to get to Beaver Rim this summer. We couldn't get there last year as the roads were wiped out, and we needed permit modifications in order to do it.

That's where another approximately two-thirds of the money that we raised will be spent on exploration at Beaver Rim. And we'll also do some reconnaissance work at our Night Owl property. That's where we're going with the capital raise we just did.

Gerardo Del Real: Well, listen, I think it's going to be a year of discovery. You mentioned that you didn't want to label it as a deposit just yet but that you felt that by the end of summer you'd be able to. Summer comes quickly! We're in the month of March, as you know.

I’m excited to see rigs turning at what sounds like a pretty aggressive drill program to figure out what it is that you have there. Anything else to add to that, sir?

John DeJoia: Well, just that we're very optimistic. We talk almost daily. Terrence is stationed in Wyoming. The rest of us are scattered around various places. However, they had an easy winter up there but they do have snow. I know a lot of people are saying, ‘Well, geez, I just went through Casper and there's nothing!’ Well, Shirley Basin and Beaver Rim are not Casper.

Gerardo Del Real: Not Casper at all!

John DeJoia: We've got permits. We need to do a couple of little modifications because we used up some of our acreage allocation on Agate. But we think we have enough to drill a couple hundred holes this summer.

Up on Beaver Rim, we have a permit. We're going to have to do a little modification there because of some dirt work, sage-grouse issues. But we're planning to start when the sage-grouse allow us to go into the area, which is probably around August 1st.

Gerardo Del Real: Excellent! Well, listen, I'm excited for it. I'm looking forward to it. You have the permits. Let's see what Mother Nature left behind. I suspect that we're going to be chatting quite often here over the summer months.

John DeJoia: I suspect we will because we already know that there are roll fronts up there. We know the locations, and we're going to go up there and try to verify those results and, of course, add to them.

And we're very hopeful because this was the mineralizing conduit for the whole Gas Hills. A hundred million pounds went through here. How many stayed behind? Well, just north of us, there’s one new and one old underground with high-grade, high ore reserve numbers still remaining. And they're just feet from us… it's the next land to the north.

Gerardo Del Real: We're going to see what's there. And again, it can't come soon enough. Thanks again for your time today, sir.

John DeJoia: Thank you, Gerardo. It's always great talking with you.

Gerardo Del Real: Alright, cheers.

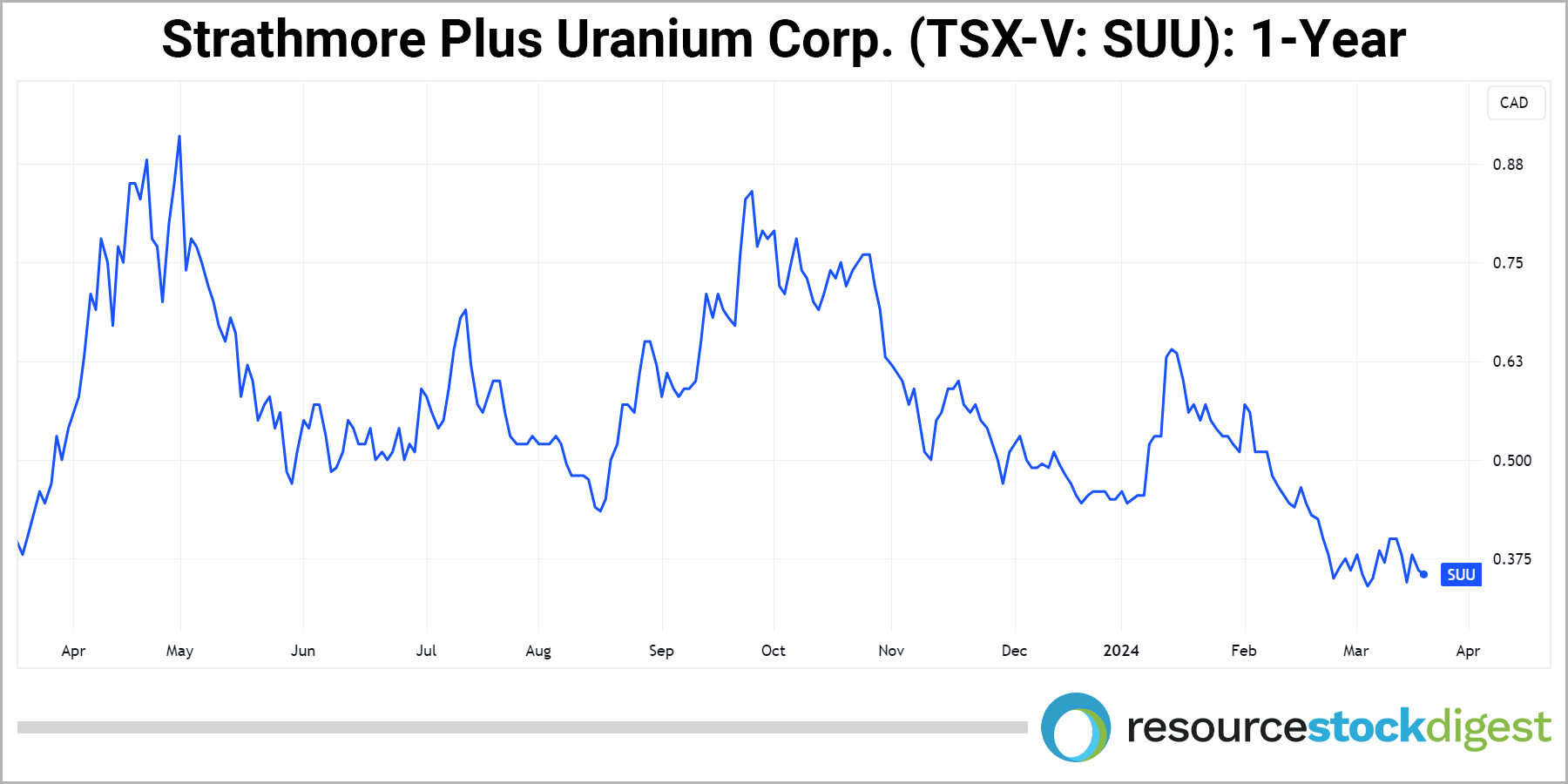

The Strathmore Plus Uranium Opportunity

The 2024 uranium bull market has officially arrived… and it’s only just getting started.

Uranium prices have now surged to decade-plus highs well above US$80 per pound with tons of runway ahead, and select small-cap uranium stocks appear poised to follow suit — including Strathmore Plus Uranium (TSX-V: SUU)(OTC: SUUFF).

As discussed in detail, the next major leg up in the uranium price will be driven by utilities continuing to come back into the market to secure long-term U3O8 contracts. That means we could be setting up for an even higher uranium price environment — potentially in the neighborhood of US$150 per pound — in the coming years.

Led by chairman & CEO Dev Randhawa, Strathmore Plus Uranium is positioned for success in key Wyoming uranium districts in concert with renewed bipartisan support for the bolstering of America’s domestic uranium production sector.

With the timing spot-on and with numerous tailwinds forming in the space, Dev has put together a well-rounded team that knows how to advance early-stage uranium projects through the various stages of exploration all the way through to the ultimate goal of U3O8 production — particularly ISR (in-situ recovery) production.

The plans and process for that are well underway with boots-on-the-ground exploration and drilling being mapped out at the company’s Agate, Night Owl, and Beaver Rim projects for 2024.

Underpinning those initiatives, SUU is working closely with C$550M market cap uranium producer Ur-Energy (TSX: URE), which operates key ISR uranium production and processing facilities in Wyoming’s Shirley Basin — home to Strathmore’s Agate and Night Owl projects.

You heard directly from Strathmore Plus Uranium director and P.Geo. John DeJoia. He says,

“… this was the mineralizing conduit for the whole Gas Hills. A hundred million pounds went through here. How many stayed behind? Well, just north of us, there’s one new and one old underground with high-grade, high ore reserve numbers still remaining. And they're just feet from us… it's the next land to the north.”

In other words… no shortage of high-priority targets, portfolio-wide, to point the drills at in 2024.

With a robust portfolio of three wholly-owned and permitted Wyoming-based uranium exploration projects being advanced in a confirmed uranium bull market — and a tight corporate structure at just over 60 million shares outstanding on a fully diluted basis — SUU’s sub-C$20M market cap is considered minuscule compared to many of its peers.

Strathmore Plus is also well-funded to complete its near-term exploration plans with approximately C$3.5 million in the treasury as of March 2024 — having recently raised C$1.41 million via private placement — as it progresses its broader hub-and-spoke strategy in the uranium-rich state of Wyoming.

With clean-burning, carbon-emission-free nuclear energy powered by uranium back in favor both in North America and globally, now is an excellent time to begin conducting your own due diligence on Strathmore Plus Uranium Corporation — symbol SUU on the Toronto Venture Exchange and symbol SUUFF on the US-OTCQX Bulletin Board Exchange.

A great place to start is Strathmore Plus Uranium’s corporate website.

There, you can sign up to receive updates directly from the company, view the most recent Corporate Presentation and much more.

Be sure to also follow our exclusive interviews with upper management here.

— Resource Stock Digest Research

Click here to see more from Strathmore Plus Uranium