GoldMining Inc.

TSX: GOLD | NYSE-American: GLDG

Advancing Multiple High-Grade Gold Projects Across the Americas in the 2023 Gold Bull Market

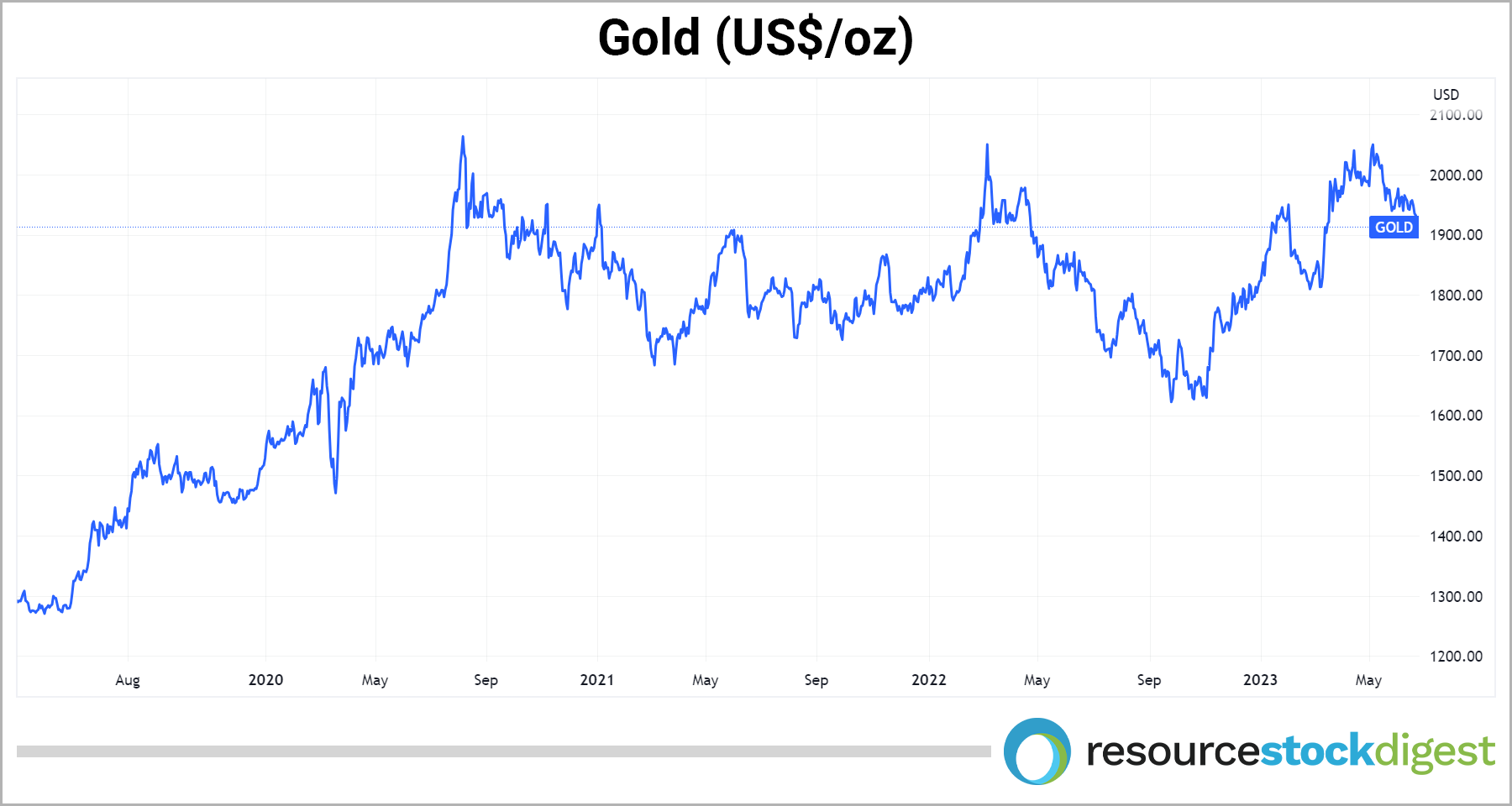

Gold is extending gains in 2023!

In a matter of months, the price of the yellow metal has risen from US$1,625 per ounce to currently well above US$1,900.

The company featured in this Special Report — GoldMining Inc. — is set up perfectly to capitalize on what’s shaping up to be an historic gold bull market.

The GoldMining team, led by CEO Alastair Still, knows a thing or two about acquiring tens of millions of gold ounces on-the-cheap in safe mining jurisdictions throughout the Americas.

You’re about to hear directly from the CEO — who, by the way, hails from the who’s-who of gold producing giants such as Newmont, Placer Dome, Agnico Eagle, and Kinross — in just a moment.

Yet, before we get to that…

Following a decade of underinvestment in the gold industry — and with Au prices languishing — the GoldMining team was able to systematically assemble an industry-leading portfolio of resource-stage gold and gold-copper projects in safe mining jurisdictions throughout the Americas.

Fast-forward a few years, and the company now controls a jaw-dropping 23.3 million gold-equivalent ounces across all categories in the United States, Canada, Brazil, Colombia, and Peru.

THAT AMOUNT OF GOLD TOPS NEARLY EVERY OTHER JUNIOR GOLD FIRM IN EXISTENCE TODAY!

The projects that comprise GoldMining’s epic haul were largely considered subeconomic when they were acquired at US$1,100 to US$1,300 per ounce gold.

Today, at US$1,900-plus an ounce gold — and rising — these projects are all of a sudden much more interesting, and potentially lucrative, from both a future production standpoint and as potential acquisition targets for larger producers seeking to add precious gold ounces to their balance sheets.

Poised for growth, GoldMining Inc. seized on a down-market for gold, built a giant asset base at low gold prices, and is now advancing its projects through the various stages of exploration and development to the benefit of GOLD/GLDG shareholders.

The company also holds a very substantial equity stake in multiple companies, which we’ll delve into in just a moment.

For now, know this: GoldMining’s current equity holdings combine for a valuation of approximately US$153.2 million, which, incredibly, is greater than the company’s entire current market cap!

A Focus on Advanced-Stage Gold Projects

The gold landscape has seen a dramatic transformation since GoldMining Inc. completed its first acquisition in 2012. Back then, sentiment for the yellow metal was quite poor with gold languishing in the US$1,100 to US$1,300 per ounce range.

Today, that narrative has flipped with the yellow metal trading above US$1,900 an ounce with indicators pointing to even higher prices for the traditional safe-haven asset with inflation continuing to chip away at the global financial house-of-cards.

The Proper Acquisition Mindset

The GoldMining team was essentially put together for the stated purpose of exploiting gold’s previous downturn — knowing the cycle would eventually turn in their favor.

It now has… and the investment community is taking notice!

The GoldMining team hit the ground running, scooping up no less than 11 advanced-stage gold projects in 5 countries throughout the Americas. Mind you, 9 of the 11 were acquired during the 2012-16 gold slump at $1,100 to $1,300 per ounce gold.

Altogether, GoldMining has now amassed a jaw-dropping 23.3 million ounces of 43-101 gold-equivalent resources — far more than any other junior resource company we can think of.

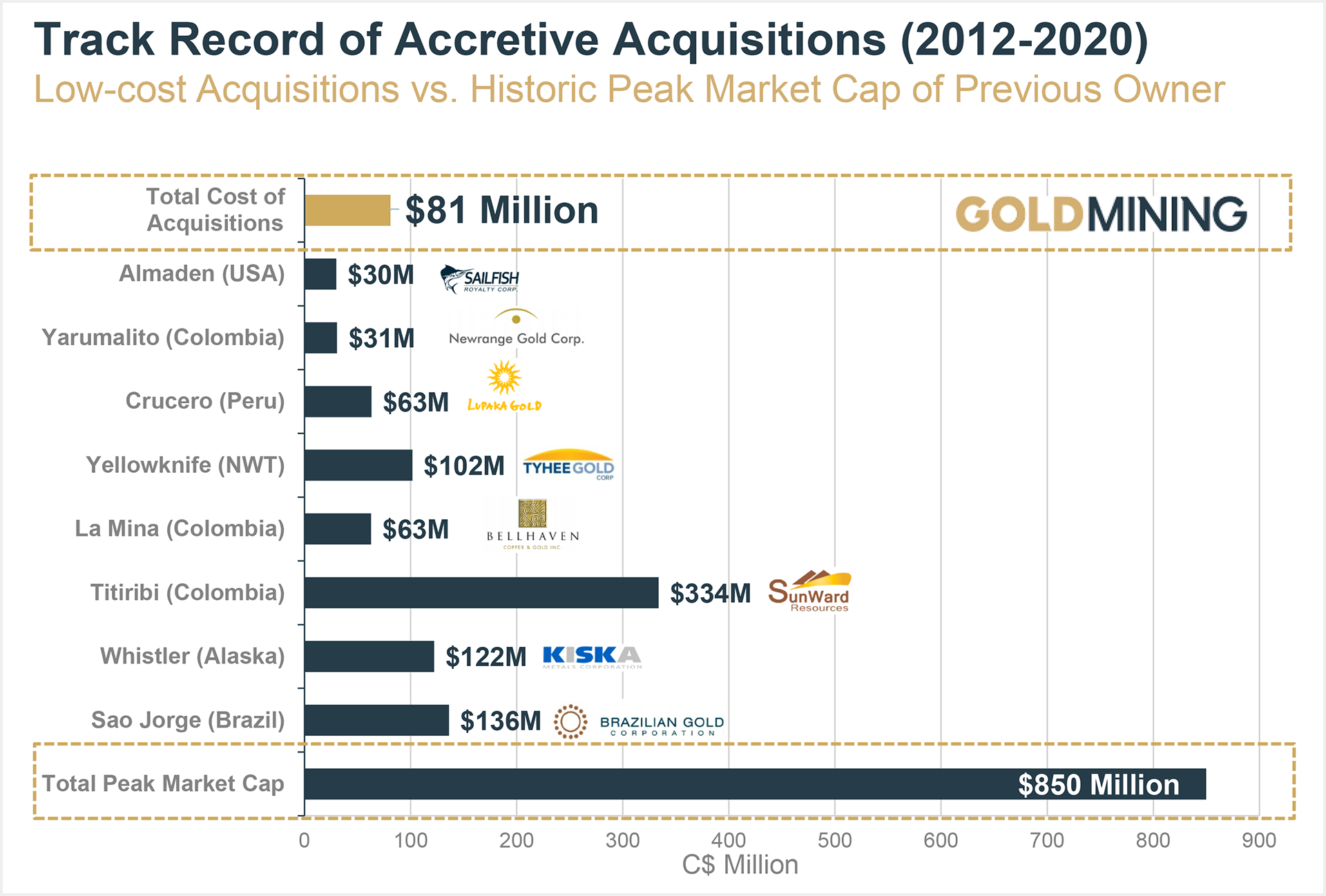

The table below — showing the peak market caps of some of the key companies GoldMining has brought into its portfolio to-date — tells the story well.

Combining for a peak market cap of C$850 million — GoldMining was able to pick up this entire group of exploration companies and their related projects for a grand total of just C$81 million.

That’s roughly 10 cents on the dollar!

Also revealing is the vast amount of prior exploration GoldMining has essentially inherited along with the projects. Cumulatively, these projects represent approximately C$283 million spent on prior exploration and drilling — resulting in substantial 43-101-compliant gold resources across the board.

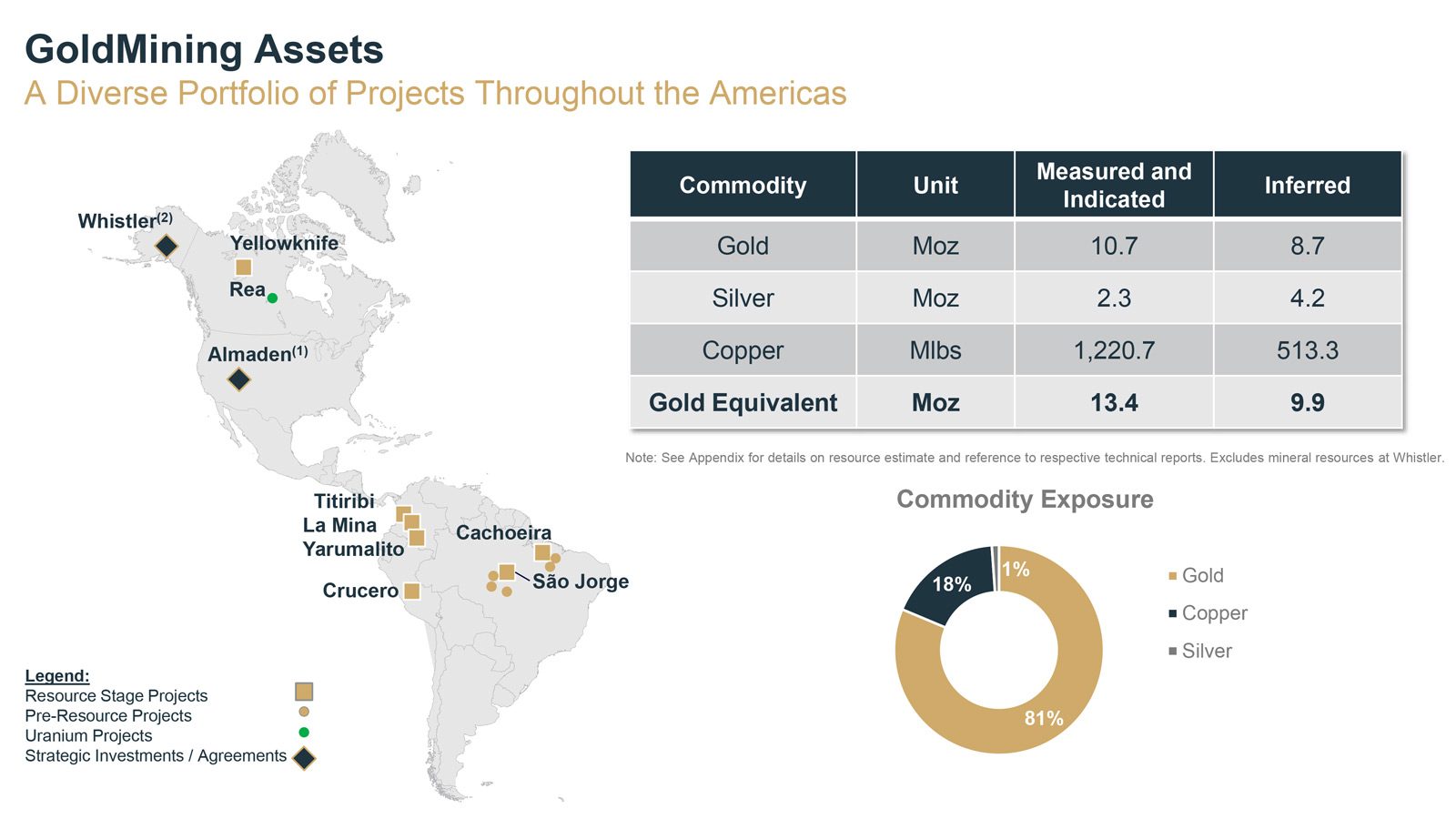

The image (below) is yet another clear indicator of GoldMining’s unmatched gold-project acquisition acumen.

The first thing to note is the geographic diversification of GoldMining’s projects, which was management’s stated plan from the outset.

The company now holds advanced-stage gold projects in 5 mining-friendly countries: United States, Canada, Brazil, Colombia, and Peru.

The second thing is… HOW MUCH GOLD the company now controls.

GoldMining Inc. boasts a combined gold-equivalent resource of 23.3 million ounces — 13.4 million ounces in the Measured & Indicated (M&I) category and another 9.9 million ounces in the Inferred category — all spread across the Americas in safe mining jurisdictions.

The Importance of Jurisdiction Cannot be Overstated

Jurisdiction is of paramount concern to both gold companies and resource stock speculators alike.

That’s because the market typically applies a “political discount” to projects and companies operating in countries — such as China, Venezuela, Kenya et al — that lack government-mandated protections for foreign mining investment.

Additionally, the GoldMining team has been highly successful in acquiring projects located in areas of large-scale regional activity. Again, this is all by design.

From the start, management has been astutely aware of the distinct advantages of working in active production zones where you have much larger companies — including intermediate and major producers — developing an area’s mineral reserves.

That’s the type of environment where you typically witness large-scale area plays emerging along with heightened M&A activity with which to drive share values higher.

GoldMining Now Controls a Combined 43-101 Resource of 23,300,000 Gold-Equivalent Ounces!

GoldMining Inc. is an extraordinarily well-run junior exploration firm boasting a 10-plus year operating history of fiscal responsibility to shareholders.

Think about it: It’s rare to see a pre-production company with even 5 million ounces of gold in the ground. GoldMining’s 23 million-plus gold-equivalent ounces puts it in a completely different ballpark.

When you factor in size, scale, and geographic diversification — it’s hard to imagine ANY junior mineral exploration firm even coming close to equaling GoldMining’s acquisition success over the last several years.

The math is simple: In today’s climate of US$1,900+ gold, it’s simply no longer feasible to acquire that much gold at such little cost.

GoldMining’s 23.3 million ounces make the company highly leveraged to the price of the yellow metal, which should make for very happy GOLD/GLDG shareholders in today’s strengthening gold bull market.

The company has been delivering a steady stream of development news across its impressive resource inventory of ~23 million gold-equivalent ounces (M&I plus Inferred).

Let’s take a look at a few of the company’s key projects

La Mina Gold-Copper Project, Antioquia, Colombia:

In Q1 2023, GoldMining Inc. announced that it had successfully tripled the Inferred Mineral Resource Estimate (MRE) at its 100%-owned La Mina project, located in Colombia’s prolific Mid-Cauca Belt to 1.45 million ounces of gold equivalent (AuEq).

The newly-updated MRE includes a maiden resource estimate for the La Garrucha deposit area — a new discovery zone from 2022 drilling — effectively adding approximately 1.0M/oz AuEq in the Inferred category and 0.2M/oz AuEq in the Indicated category.

In total, the La Mina MRE now stands at 1.15M/oz AuEq Indicated and 1.45M/oz AuEq Inferred.

GoldMining CEO Alastair Still commented via press release:

“We are extremely pleased that the Company's first exploration drilling program at La Mina has identified a significant discovery at the La Garrucha deposit that has added over 1,000,000 gold equivalent ounces of estimated Inferred Resources and 200,000 gold equivalent ounces of estimated Indicated Resources to an already robust Mineral Resource estimate on our La Mina project. This exciting discovery has exceeded our expectations and builds upon the positive economics set out in our 2022 Preliminary Economic Assessment, which was based on the prior resource estimate for the project, exclusive of La Garrucha…”

Next steps include updating the La Mina Preliminary Economic Assessment (PEA), which is slated for completion in 2H 2023.

Titiribi Gold-Copper Project, Antioquia, Colombia:

GoldMining’s 100%-owned Titiribi and La Mina projects are situated just 17 km apart in Colombia’s Mid-Cauca Belt, which is emerging as an attractive region for major mining companies as evidenced by recent investments by Newmont, Agnico Eagle, and Wheaton Precious Metals.

The 3,920-hectare Titiribi project hosts gold-copper epithermal mineralization similar to other porphyry centers in the Mid-Cauca Belt.

Nearby gold projects in the region include San Matias (Cordoba Minerals and HPX Exploration), Buritica (Continental Gold), Zancudo (IAMGOLD and Gran Colombia), and Nuevo Chaquiro (Anglogold Ashanti and B2Gold).

The Titiribi project boasts M&I mineral resources of 5.54 million ounces of gold and 1,061.2 million pounds of copper (434.6 million tonnes grading 0.40 g/t gold and 0.11% copper).

The project also contains Inferred mineral resources of 3.15 million ounces of gold and 212.6 million pounds of copper (241.9 million tonnes grading 0.41 g/t gold and 0.04% copper).

The close proximity of the Titiribi and La Mina properties is expected to create potential synergies and scale as the GoldMining team continues to advance the projects.

As noted, the company has released a positive first-pass PEA on La Mina with phase-one drilling underway and is currently preparing a fully-funded drill program for Titiribi.

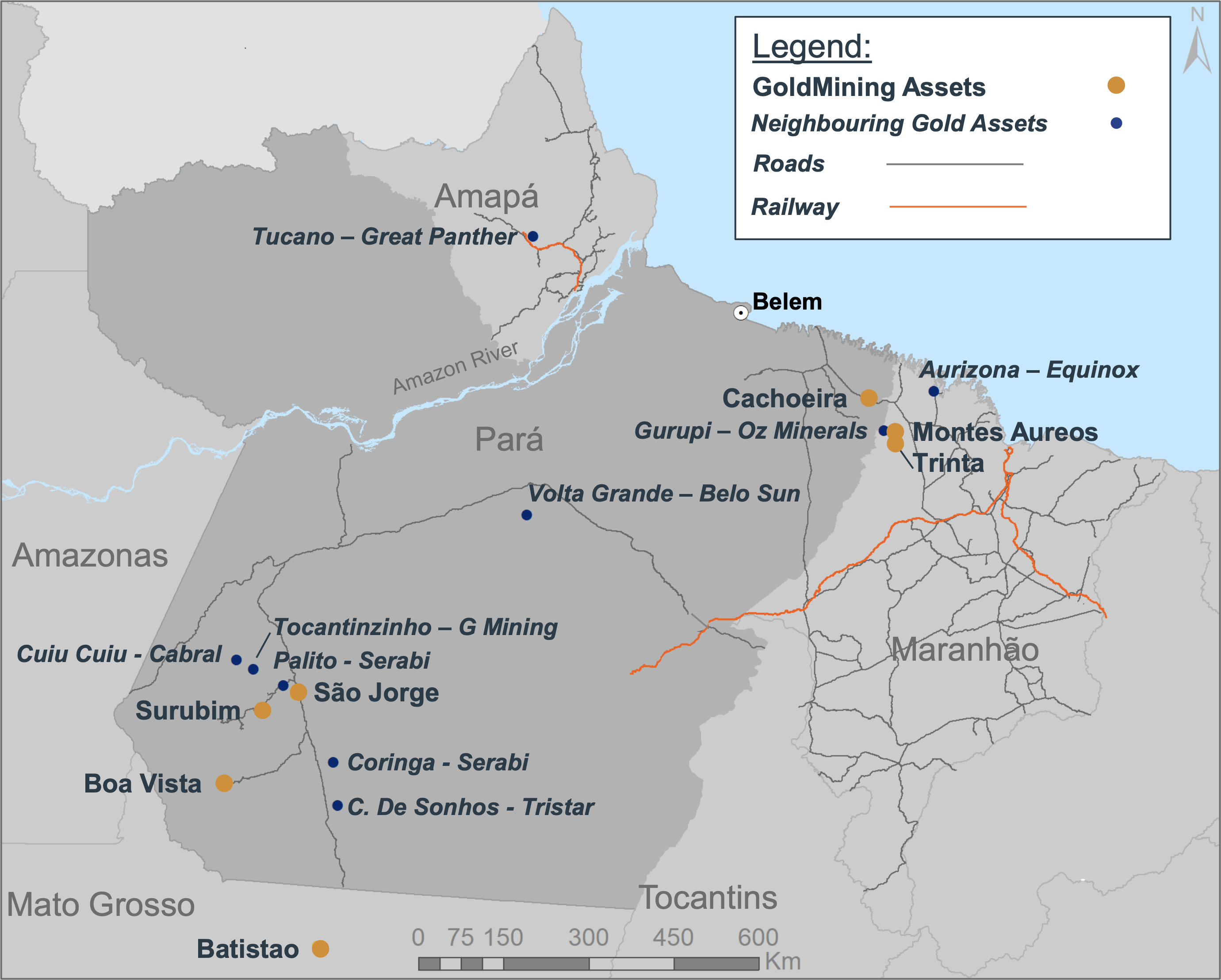

São Jorge Gold Project, Pará State, Brazil:

In Q4 2021, GoldMining released infill assays from its recently completed core sampling program at the 100%-owned, 46,000-hectare São Jorge Gold Project located in Pará State, Brazil.

The program — which focused on previously unsampled core intervals from historical drilling — returned highlight intervals up to 1.06 g/t gold over 7.6 meters in saprolite.

The GoldMining team is in the process of completing a PEA on the São Jorge project, which boasts a current Indicated resource of 0.71 million gold ounces at 1.55 g/t plus 0.72 million gold ounces Inferred at 1.27 g/t.

The aim of the forthcoming PEA will be to further evaluate the economic potential of an open pit operation and to advance opportunities to upgrade and expand the current resource base.

The release of the latest round of infill sampling results should prove valuable in the identification of new targets at São Jorge; additional results from the sampling program are available here.

Whistler Gold-Silver-Copper, Alaska, USA:

In Q2 2023, GoldMining Inc. announced the successful completion of its planned spinoff of US GoldMining Inc. (NASDAQ: USGO), which is focused on the advancement of the flagship Whistler Gold-Copper Project in mining-friendly Alaska.

The massive 170 sq km Whistler project is situated along a prolific geological trend northwest of Anchorage.

The project, which has seen 70,000 meters of historical drilling, has the potential for high-grade epithermal mineralization similar to other porphyry deposits in the area.

Already, the project boasts Indicated mineral resources of 1.94 million ounces of gold, 8.33 million ounces of silver, and 422.0 million pounds of copper (118.2 million tonnes grading 0.51 g/t gold, 2.19 g/t silver, and 0.16% copper).

The project contains additional Inferred mineral resources of 4.67 million ounces of gold, 16.06 million ounces of silver, and 711.4 million pounds of copper (317.0 million tonnes grading 0.46 g/t gold, 1.58 g/t silver, and 0.10% copper).

A field crew has been mobilized to the fully permitted, 200+ sq km property to prepare for what will be a Phase-1, two-year exploration program, including mine engineering and environmental baseline studies and initial core drilling of up to 10,000 meters.

The Phase-1 program is fully funded with US GoldMining fresh off of their highly successful IPO, which raised US$20 million at a valuation of just US$10 per ounce in the ground.

US GoldMining CEO Tim Smith commented via press release:

“US GoldMining is now fully funded and permitted to start our inaugural exploration program at Whistler. We have engaged leaders in the industry with significant local knowledge to execute our exploration plans and we are excited to commence the Phase 1 program. With several exploration targets already identified, we are eager to get to work and drive forward the rediscovery of Whistler.”

By any standard, Whistler is considered a large precious and base metals project with Indicated resources of ~3 million gold equivalent ounces and Inferred resources of ~6.5 million gold equivalent ounces covering an expansive regional land package.

The project comprises a cluster of gold and gold-copper porphyries in a mineral-rich region of southern Alaska that’s wide open for development with multiple operators/deposits in the surrounding area with infrastructure onsite including a base camp and gravel airstrip.

Further, the state of Alaska, as part of its Roads-to-Resources initiative, also recently approved a US$8.5M budget for a road design study that would connect the Whistler project directly with the city of Anchorage and Port MacKenzie — a major Alaskan port.

With gold trading firmly above US$1,900 per ounce, the timing is ideal for US GoldMining’s ambitious plans to advance the Whistler project through boots-on-the-ground exploration and drilling.

Importantly, GoldMining Inc. is the largest shareholder of US GoldMining at 9.8 million USGO shares.

At the time of the compiling of this report, USGO was trading right around US$12 per share. That puts the value of GoldMining’s USGO share position at approximately US$117 million.

GoldMining’s current market capitalization is just above that at right around US$150 million, which shows the enormous value of GoldMining’s substantial position in US GoldMining.

Needless to say, if the US GoldMining team is able to take the Whistler project to the next level via the drill-bit, that share position could quickly become even more valuable to GoldMining Inc. and GOLD/GLDG shareholders.

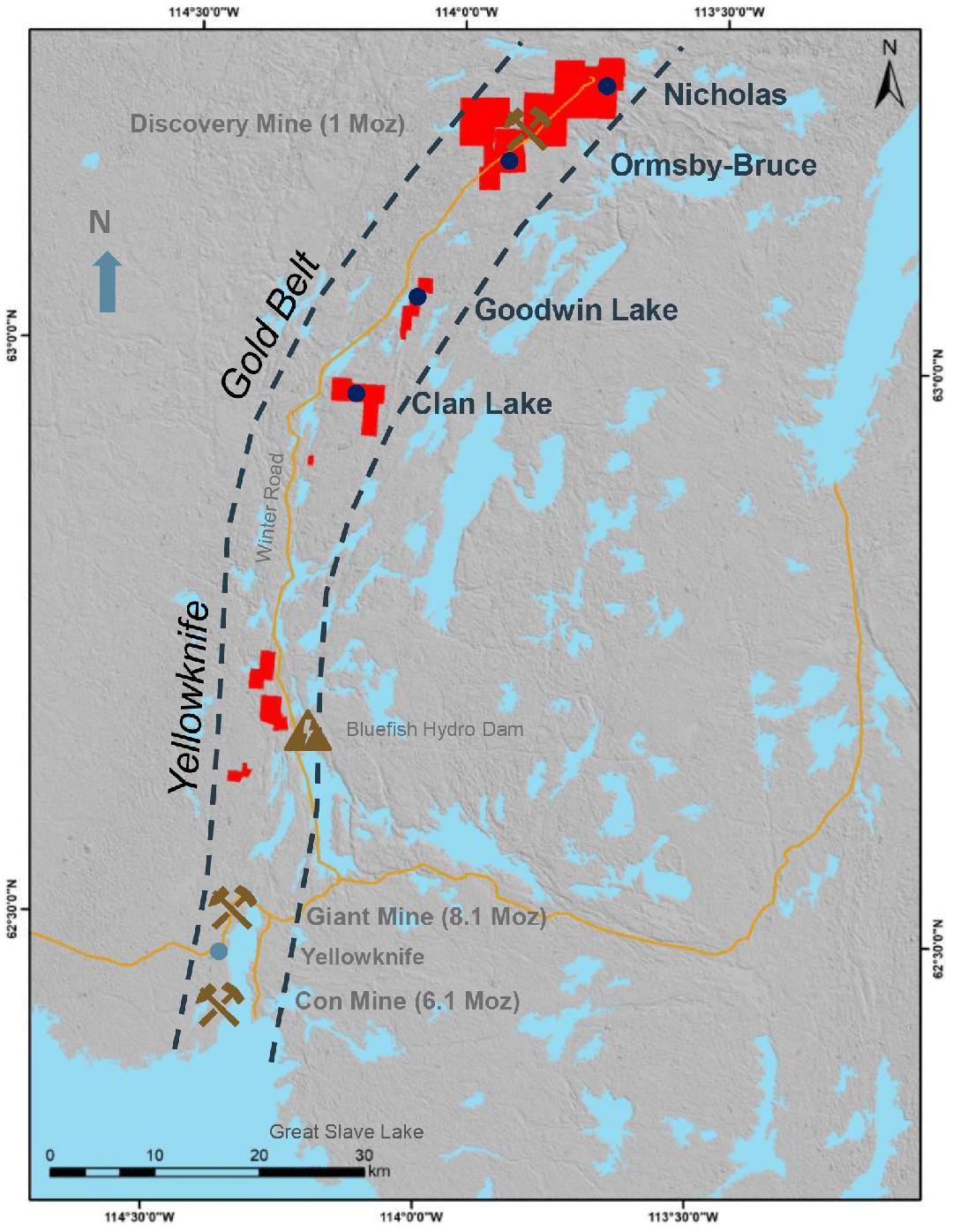

Yellowknife Gold Project, Northwest Territories, Canada

GoldMining has released an amended technical report for its 100%-owned, 12,240-hectare Yellowknife Gold Project situated in one of Canada’s highest-grade gold belts — the Yellowknife Greenstone Belt.

The Yellowknife project comprises several properties — Nicholas Lake, Ormsby, Goodwin Lake, Clan Lake, and Big Sky — and covers portions of the Yellowknife Greenstone Belt from 17 to 100 km north of the town of Yellowknife.

The project is on-trend with three of the highest-grade gold mines in Canada:

- Giant Mine: 8.1 Moz @ +0.5 oz/t

- Con Mine: 6.1 Moz @ +0.5 oz/t

- Discovery Mine: 1 Moz @ +1 oz/t

The Yellowknife project boasts Indicated mineral resources of 1.06 million ounces of gold (14.11 million tonnes grading 2.33 g/t gold) plus Inferred mineral resources of 0.74 million ounces of gold (9.30 million tonnes grading 2.47 g/t gold).

Altogether, with a foundation of more than 23 million gold-equivalent ounces (M&I plus Inferred) spread across the Americas, GoldMining is progressing on multiple fronts and should have quite a lot of news flow throughout 2023.

Almaden Gold Project, Idaho, USA

In Q3 2022, GoldMining completed the grant option of its Idaho-based Almaden gold project to Nevgold Corp. (TSX-V: NAU)(OTC: NAUFF) for total cash and/or share consideration of up to C$16.5 million.

GoldMining has now received initial consideration of C$3.0 million via the receipt of 4.4 million common shares of Nevgold; a strategic investment. Future cash and/or share payments to GoldMining to include:

- Additional payments of C$6.0 million related to the option

- Contingent payments of up to C$7.5 million tied to project milestones

Keep in mind also that the GoldMining team picked up the Almaden project more than two years ago for just C$1.15 million and, with the closing of the option agreement with Nevgold, will continue to maintain direct exposure to any future advancement of the project — as will GOLD/GLDG shareholders.

The value of GoldMining’s share position in Nevgold currently stands at approximately US$1.2 million.

GoldMining Inc. Spins Out Gold Royalty Corp.

In Q1 2021, GoldMining completed the successful IPO launch of Gold Royalty Corp. (NYSE-American: GROY).

The spinout was met with a ton of investor enthusiasm with Gold Royalty raising nearly US$100 million via the IPO.

GoldMining Inc. is the largest shareholder of Gold Royalty Corp. with 21.1 million GROY shares on the balance sheet.

GROY is currently trading right around US$1.75 per share, which equates to over US$35 million in liquid assets for GoldMining Inc. at current prices.

GoldMining Inc. shareholders, thereby, maintain indirect ownership via the company’s 49% equity stake in GROY, which boasts a current market value of approximately US$250 million.

Taken altogether, we’re talking about a very strong equity position for GoldMining Inc. with strong value growth potential going forward:

- Current value of US GoldMining position: ~US$117M

- Current value of Nevgold position: ~US$1.2M

- Current value of Gold Royalty position: ~US$35M

That comes out to approximately US$153.2 million in equity holdings, which is actually slightly above GoldMining’s current market cap of around US$150 million.

In other words, shareholders are getting all of GoldMiming’s other projects — which currently combine for 23.3 million gold equivalent ounces across all categories — essentially for free.

Exclusive Interview with GoldMining Inc. CEO Alastair Still

GoldMining’s seasoned management team, led by CEO Alastair Still, has the company well-positioned for growth.

Our own Gerardo Del Real of Resource Stock Digest had the opportunity to sit down with Alastair at the 2023 BMO Capital Markets conference in beautiful Hollywood, Florida.

Inside, they delve into GoldMining’s intelligent strategy for building long-term value for shareholders, including the recently completed drilling at La Mina and the launch of US GoldMining Inc., which is focused on advancing the Whistler project, Alaska.

We hope you’ll enjoy the conversation.

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the CEO of GoldMining Inc. — Mr. Alastair Still — live from BMO [BMO Capital Markets’ 32nd Global Metals, Mining & Critical Minerals Conference]. Alastair, how are you?

Alastair Still: I am excellent today. Thanks very much for having me on, Gerardo. Pleasure to be here.

Gerardo Del Real: Great to have you back on. First and foremost, let's get right into BMO; the conference, the sentiment. We talked a bit off air. I've had reports that it's very well attended and that it's busy. What's your take on what you've seen thus far?

Alastair Still: Absolutely. This is about as busy as I've ever seen it here, and I've been going to this show for some 15 years. A lot of cautious optimism in the air. There's a lot of attendees, lots of investors, lots of presenting companies. It's generally a very good vibe and a very busy time here.

Gerardo Del Real: Well, listen, gold has been playing peekaboo with the US$2,000/oz level for the past, it seems like, 12 to 18 months, right? We had a really good run up that I thought was going to lead to a breakout. And I still do believe it’s going to lead to a breakout, although I think we're a few weeks to a few months away. But we're sitting there right at US$1,825/oz, which is a great, great floor if this is indeed the floor.

GoldMining has always been brilliant at executing and positioning its shareholders to benefit from those turns higher when the gold price does finally turn. You just announced the launch of the U.S. GoldMining IPO. I understand that it was very well received. And then, back in late January, you tripled the gold equivalent Inferred resource estimate at the La Mina project to 1.45 million ounces.

So again, GoldMining is doing what it does best: positioning shareholders for those pivots. Can you speak to both those pieces of news there?

Alastair Still: Well, absolutely. I mean, exciting news on both fronts. And I think they both speak to, very much, the optionality and the diversity of our portfolio and the different opportunities we have to continue to unlock value. We'll start with the earlier announcement in January. We had a tremendous successful exploration drill program at La Mina throughout 2022.

We compiled those results, and we came out with a new 43-101 resource in January. And as you saw on the news headlines, we tripled the Inferred resource. That deposit has grown to the size and quality that it's attracting a lot of attention now. So that was a great success for us.

And with the drilling cost that we've put into that, we discovered those ounces somewhere between US$1 to US$2 per ounce, which is a tremendous value add for our company and our shareholders. And we're going to move right into the next phase, which is the PEA on that project, which should be owed around mid-year this year, which will even firm up the economics and show people the value we've created there.

On the second news, it just came out this week, which is tremendously exciting for all of us, is, of course, the IPO announcement — the launch of U.S. GoldMining Inc. We've been discussing this and showing people the value of our Whistler project for some time. We've now taken it to the market. We're launching this with a tremendous reception to it.

It was great to see that GoldMining, the parent company, outperformed the market yesterday. We were up over 6% when the comparable index, the GDXJ, was up less than 1%. So that’s a good indication that the market liked it. GoldMining Inc. will be retaining a very large share position, almost 80% post-financing, and we are attempting to raise US$20 million with a great offering priced at US$10 a share; it comes with a full warrant priced at US$13 at the tradable warrant valid for three years.

So exciting times. There's a lot of action and a lot of interest down here on our new launch this week.

Gerardo Del Real: I suspect this isn't the last time we're going to be chatting this year. I know there's a lot going on behind the scenes as there always is with you and GoldMining. Alastair, I'll let you get back to it. Thank you so much for your time. Anything else to add to that?

Alastair Still: No, pleasure to be here. We look forward to getting this offering closed. There's a tremendous appetite for it, which is great to see. And I know that our team has been working hard in the background not only for the launch but preparing ourselves for the upcoming drill program.

We're going to get right into that drill program this summer; get our camp activated. So stay tuned for some very exciting news not just on Whistler but on our other portfolio of assets as well.

Gerardo Del Real: Well, I know you'll be at PDAC [Prospectors & Developers Association of Canada Conference] next week. Anybody that is wanting some great gold exposure, I always consider GoldMining as top tier when it comes to leverage to a rising gold price. I encourage everyone to stop by the booth if you happen to be in Toronto. Alastair, we'll see you next week in person. Thanks again for the chat.

Alastair Still: Yeah, always a pleasure, Gerardo. Look forward to seeing you next week at PDAC.

Gerardo Del Real: Alright, see you there.

An Opportunity in GOLD

It’s hardly a coincidence that GoldMining Inc. trades under the symbol GOLD on the Toronto Stock Exchange.

The company also uplisted to the NYSE-American exchange in 2021 where it trades under the symbol GLDG.

GoldMining has amassed a veritable treasure trove of the yellow metal and is now poised to move up substantially on any future rallies in the gold price.

You heard directly from GoldMining CEO, Alastair Still. He says,

“We're going to get right into that drill program this summer; get our camp activated. So stay tuned for some very exciting news not just on Whistler but on our other portfolio of assets as well.”

As you can see, gold is in a confirmed bull market… rallying from US$1,300 to US$1,900+ an ounce since Q2 2019.

And keep in mind also that the healthiest bull markets are ones that grind upward — not shoot straight up — and the above chart indeed shows that gold is grinding its way higher.

With gold flexing its muscles, it’s easy to see the value of owning shares in a company like GoldMining Inc., which is highly-leveraged to the price of the yellow metal.

A Focus on Value

In the resource sector, you’re only as good as the people running the show — and we believe GoldMining Inc. has the right personnel at the controls to build value for GOLD/GLDG shareholders going forward.

It’s a team that’s highly committed to building long-term value for its shareholders — and the proof is in the numbers. The company currently has ~US$160 million of liquid assets on its balance sheet (~US$153M in equity holdings + ~US$7M in cash) and hasn’t needed to go to the markets to raise capital since 2016.

It’s that type of sound corporate governance that has allowed the company to amass an astounding 23.3 million gold-equivalent ounces (M&I plus Inferred) for mere pennies on the dollar.

For investors seeking exposure to a rising gold market — GoldMining Inc. holds tremendous upside potential from current price levels as it advances its suite of high-potential gold projects throughout the Americas.

GoldMining Inc. trades on the Toronto Stock Exchange under the symbol GOLD and on the NYSE-American under the symbol GLDG.

Learn more about GoldMining Inc. and sign up to its investor list by clicking here.

And click here to get real-time updates from the company on their Twitter feed.

CLICK HERE FOR THE MOST RECENT INVESTOR PRESENTATION.

— Resource Stock Digest Research