Revival Gold

TSX-V: RVG | OTC: RVLGF

4 Million Ounces of Gold & Counting

RVG is Positioned-for-Gains in the NEW Gold Bull Market

Gold is ratcheting higher. The yellow metal recently broke above $1,850 an ounce and may soon test all-time highs above $2,000 as inflation continues to soar.

Quality gold stocks are taking off as well.

Revival Gold Inc. — which is currently trading undiscovered below C$0.60 per share — just announced a positive mineral resource estimate update on its flagship Beartrack-Arnett Gold Project, Idaho.

Highlights include:

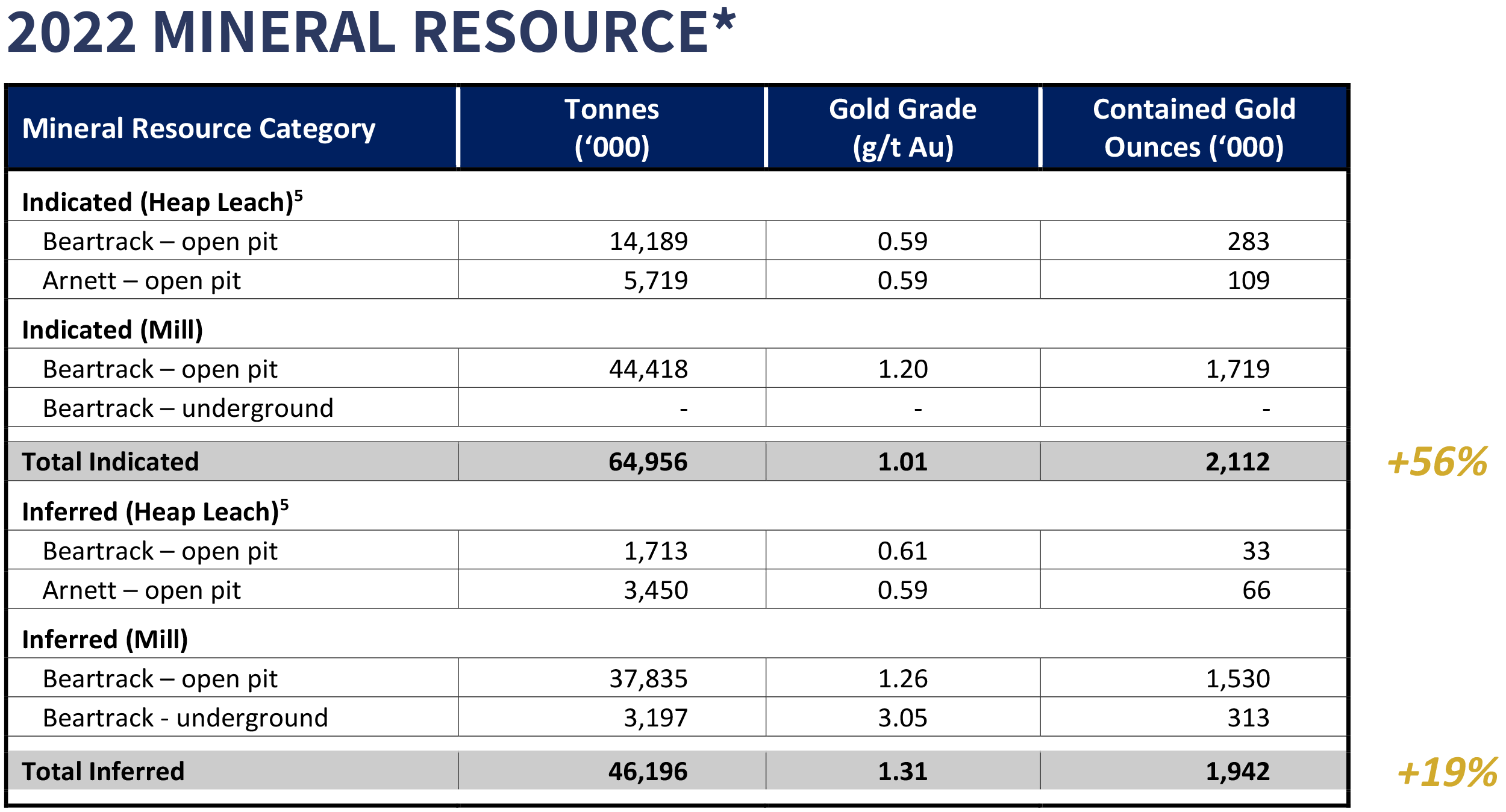

- Indicated Mineral Resource of 65 million tonnes at 1 grams per tonne (g/t) gold containing 2.11 million gold ounces; an increase of 56%

- Inferred Mineral Resource of 46 million tonnes at 1.3 g/t gold containing 1.94 million gold ounces; an increase of 19%

That’s 4 Million Gold Ounces across all categories plus a 39% increase in grade of the underground Mineral Resource!

That Mineral Resource includes all oxide and sulphide material constrained within an economic open pit and minable underground shape based on a gold price of US$1,800 per ounce.

Revival Gold CEO, Hugh Agro — whom you’re about to hear from directly in our exclusive interview — commented via press release:

“Today’s 56% growth in Indicated Resources and 19% increase in Inferred Resource represents an impressive step forward in both the size and quality of resources at Beartrack-Arnett. Revival Gold’s technical progress over the past two years validates our confidence in project geology and the potential we see for Beartrack-Arnett to continue to grow. Today’s news bodes well for work already underway on a PFS to resume gold production utilizing existing infrastructure and it builds on Revival Gold’s understanding of additional potential future development alternatives. Revival Gold’s track record of growing resources, our competitive cost of discovery, and the alternatives we have for potential future development, add up to a compelling opportunity for our shareholders.”

And the company is NOT resting on its laurels!

Building off the current momentum — which currently has the project pegged at an impressive 4 million gold ounces — the plan going forward is to increase the known resource even further by way of the drill.

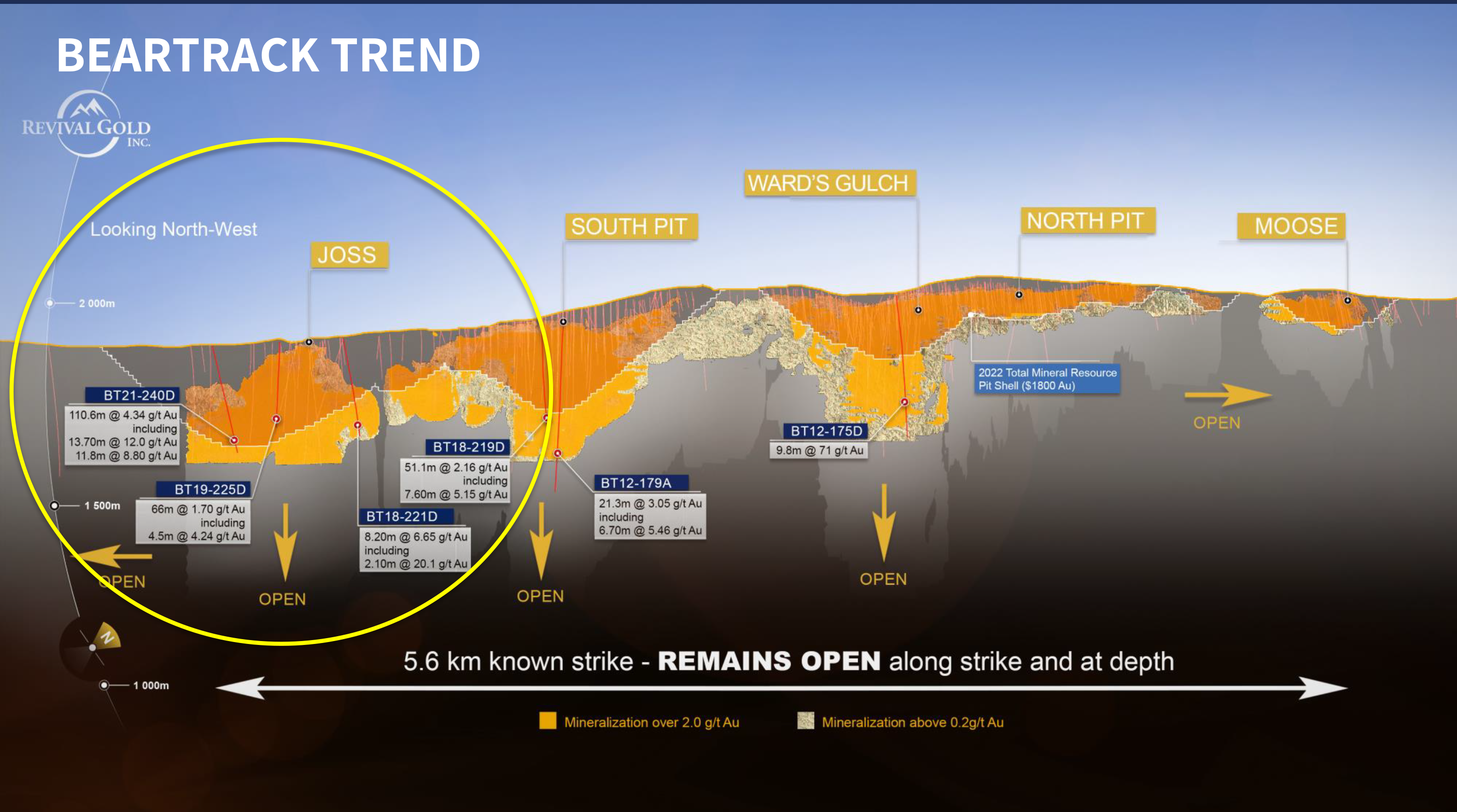

To that end, the RVG team is moving straight into a 7,000-meter drill program with a key focus on following up on the high-grade Joss area where the company recently intersected 4.3 g/t gold over 110 meters.

Mineralization extends for more than one kilometer along strike at Joss and remains open to the south and at-depth.

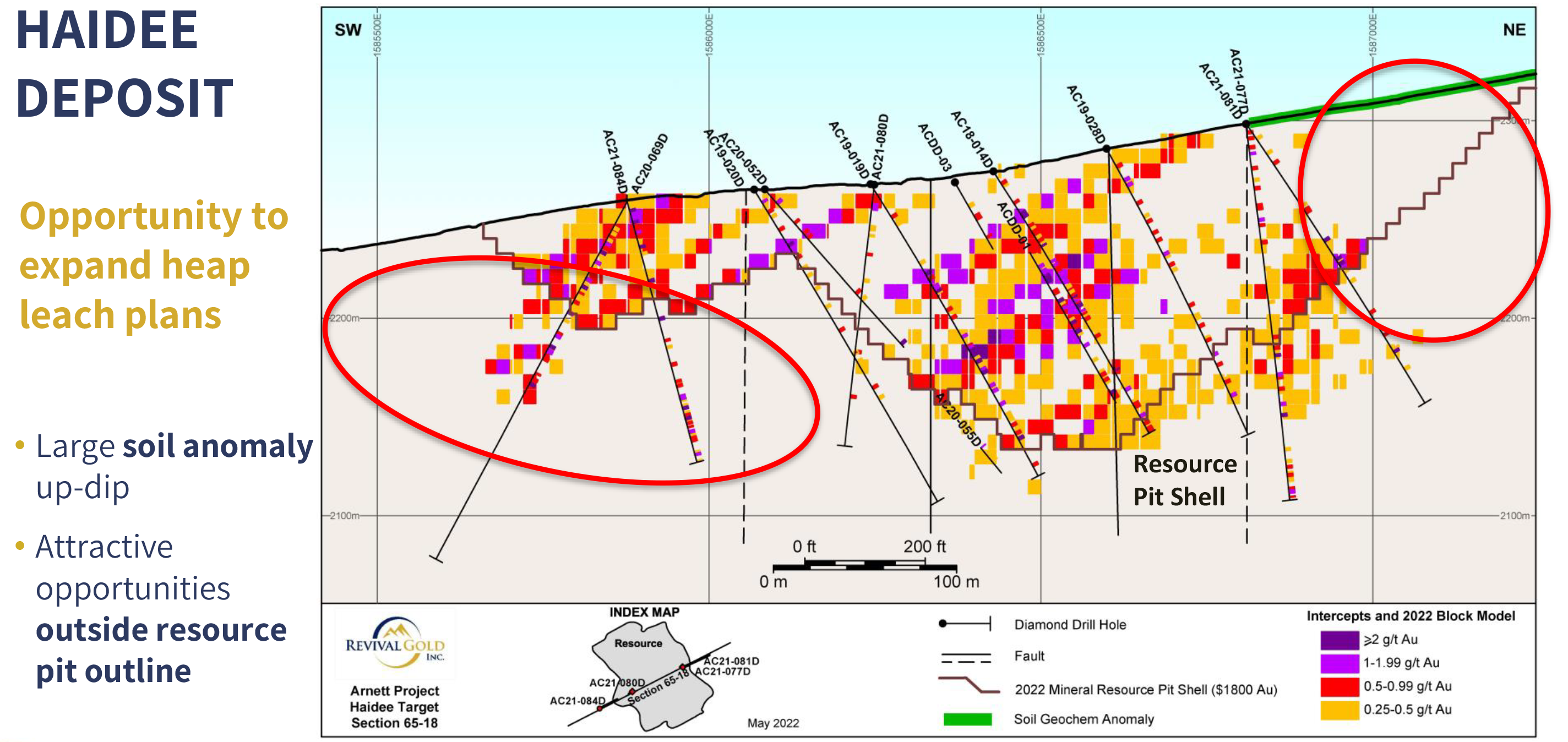

Drilling is also resuming at the Haidee satellite area where Revival continues to advance its Phase-1 project of restarting heap leach production of oxide ores.

The deposit in the Haidee area is envisioned as an open pit operation that could either be operated independently of the main areas of mineralization at Beartrack-Arnett or as a satellite operation taking advantage of existing infrastructure on the property.

The plan is to produce a PFS (Pre-Feasibility Study) on the Haidee heap leach restart before year-end 2022.

The RVG team also intends to get the drills over to the Arnett side of the property where several exploration targets have been identified.

Reduced Risk & Elevated Reward

From a speculation standpoint, it is critical to understand that Beartrack-Arnett is a classic advanced-stage “brownfield” gold project. And it is situated in one of the safest mining jurisdictions on the planet — Idaho, USA.

That brings with it a number of important advantages over the typical “greenfield” mineral exploration project — including reduced risk, significant discounts on capital costs, and a shorter time horizon from exploration to production:

- A key defining advantage of a brownfield project is the vast amount of available infrastructure and exploration data, which derisks many aspects of the project while offering immense economic benefits to both the company and its shareholders.

- Brownfield projects range from advanced development-stage with a known resource (such as Beartrack-Arnett) all the way to proven producer.

- Greenfield exploration projects, on the other hand, carry the risk of operating in literally uncharted territory, typically with very limited geophysical data and drilling (if any).

- The Revival Gold team has a firm understanding of these distinct advantages and has them in-play for RVG shareholders.

The GOLD is THERE!

The state of Idaho has a long and distinguished record of placer gold production and is considered among the most mining-friendly US states. Placer gold was discovered in the Napias Creek drainage after the Civil War with estimated placer production between 400,000 and 600,000 ounces of gold.

A 30-stamp mill was put into operation at Arnett around the turn of the last century but there was little lode production from the project area until the Beartrack deposit was put into production in the late 1990s.

Beartrack — which is located in Lemhi County, east-central Idaho, approximately 13 miles northwest of Salmon — had life-of-mine production of approximately 600,000 ounces of gold during its initial run before low gold prices below $300 an ounce forced its closure in 2000.

At that time, it was considered Idaho’s largest producing gold mine and operated as an open pit heap leach operation.

Times have changed!

Gold is now over $1,850 an ounce. And Revival controls 100% of the Beartrack-Arnett Project where billions of dollars in gold have been left behind by the early operators.

As noted, Beartrack-Arnett boasts a current resource estimate of 2.11 million ounces at 1 grams per tonne gold Indicated and 1.94 million ounces at 1.3 grams per tonne gold Inferred for a total of 4.05 million ounces of gold.

That’s a very substantial near-surface gold resource. We’re talking the kind of size and grade only the top junior gold companies are able to achieve.

Again, it’s one of the distinct advantages brownfield projects hold over their greenfield counterparts!

Gold mineralization at Beartrack is associated with a large, northeast-trending regional structure known as the Panther Creek Shear Zone. Also impressive is the fact that greater than 50% of the resource is in the higher-confidence Indicated category.

At current gold prices of approximately $1,850 per ounce, 4.05 million ounces of above ground gold would have a value of more than US$7.4 billion. And that’s just the start!

Revival is advancing toward a restart of the Beartrack Gold Mine along with a restart of heap-leach production of oxide ores at the Haidee area as the drills aim to delineate even more gold discoveries on the 100%-owned, 5,800-hectare property.

As you can see, there are a lot of exciting things in-play right now for Revival Gold.

The company continues to discover more and more gold — all at a finding cost of less than $5 per ounce — and the upcoming drill rounds could potentially extend the current mineral resource estimate beyond 5 million ounces.

Our own Gerardo Del Real had the opportunity to sit down with Revival Gold’s president and CEO, Hugh Agro.

Hugh is a former executive with majors Kinross and Placer Dome. Needless to say, he knows his way around a precious metals deposit. Please enjoy our exclusive interview.

Exclusive Interview:

Hugh Agro, President & CEO of Revival Gold

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest. Joining me today is the president & CEO of Revival Gold — Mr. Hugh Agro. Hugh, how are you, sir? Congratulations are in order. We'll get to that in a minute. How are things going?

Hugh Agro: Very good, Gerardo. Good to be with you.

Gerardo Del Real: Listen, I've been excited to get this resource update for Revival Gold. I know there was a slight delay, but man, was it worth the wait! You now have a gold resource of over 4 million ounces across all categories. You increased it by over a million ounces and, frankly, there's a lot to like. I'm going to let you provide the context and then I have a few questions for you.

Hugh Agro: Thank you, Gerardo. This is very exciting news for us. It's a 56% increase in the Indicated mineral resource to over 2 million ounces; another 2 million ounces in the Inferred category where we've increased that by 19%. Higher grade in the underground component of this resource, up 39%.

So some really big headline aspects to this, which I think are very exciting for the project. Sets us up for the PFS that's coming. And we'll be back drilling here very shortly in the Joss area so more drill news to come. It's an exciting time of year for us.

Gerardo Del Real: Well, listen, the market received the news really, really well; great volume. You had a good uptick in the stock. But despite that, you're still trading right around the C$0.60 level. I saw an update from a research group that has a C$1.90 target on the stock. Let's get into why I believe that is.

You mentioned the increase in the resource. You mentioned the increase in the confidence. I think it's important to highlight how relative and sensitive the resource is to the gold price assumption that you use. I mean, we can go down to US$1,600 an ounce gold, and the resource is pretty much the same. Am I wrong in reading it that way?

Hugh Agro: No, you're absolutely right. We do not have a lot of sensitivity to the gold price here. The geology is solid; the resource is solid. And we've run relatively conservative cost numbers, all reflecting the current inflationary environment.

And so when we take the gold price assumption down, as an example to US$1,600, we only lose less than a percent of the resource in doing so. So very conservative assumptions going into this. Wood PLC did the work for us on the consulting side. And they're a very conservative firm, and I think you can see that in the numbers here. A number of aspects of this are conservative and, therefore, the resource is rock solid.

Are we trading cheaply? Absolutely. We just continue to deliver on all fronts here, right from day one. I mean, when you first walked the property, Gerardo, we had zero, nil, no resource. And here we are four years later with 4 million ounces. That's a finding cost of less than $5 an ounce. It's value-accretive in all respects.

Gerardo Del Real: A lot of value already there if you never discover another ounce. What's exciting for me is the exploration upside because, frankly, you're following up on a program that you just concluded a few months back and you had some of the best intercepts you've ever had at the project. You have a 7,000-meter program scheduled to begin later this month. Explain to me, Hugh, where the focus will be on that drilling.

Hugh Agro: We'll start at the end of this month in the Joss area, following up on the hole you referenced; Hole 240 intersected 12 grams over 14 meters and another 9 grams over 12 meters. In entirety, that hole intersected 110 meters of 4.3 grams so an obvious target for us to follow up on. We'll be in there at the end of this month and drilling.

And then, we'll head up to Haidee where we want to continue to grow the oxide resource for the restart PFS, which is underway; engineering work is already underway.

And we've got some drilling up there; a couple thousand meters to do, following up an open target there. And then, we'll be drilling out in some of the outlying areas on the project where we want to do some more exploratory work.

We've got at least a half a dozen targets on the Arnett side of the property that we haven't touched yet, and we want to get in and do some RC drilling in those locations. So lots of drilling this year. PFS by the end of the year. And all of this on a brownfields site with existing infrastructure we can redeploy.

So I think there's a lot of aspects to this that are relatively low risk in a choppy market for investors to get exposure at a price which is no different today than it was five years ago when we had just those dreams of finding the four or five million ounces of gold that we've located today.

Gerardo Del Real: You have the four; I think getting to 5 million ounces is a stone's throw away, and I am excited to see what this year's drilling program turns up. Hugh, congratulations!

Hugh Agro: Thank you, Gerardo. I really appreciate your following and interest in the story. Thank you!

Gerardo Del Real: Thanks for your time, Hugh.

An Opportunity in Gold

Revival Gold remains largely undiscovered by Wall Street — giving speculators a timely opportunity to get involved in RVG at this exciting development stage.

The company’s roughly 87 million shares outstanding are currently trading around C$0.55 — giving RVG a market cap of less than C$50 million.

Revival is also well-funded with approximately C$9 million in the treasury as of 31 March 2022.

Earlier, you heard directly from Revival CEO Hugh Agro. He says:

“Are we trading cheaply? Absolutely. We just continue to deliver on all fronts here, right from day one. I mean, when you first walked the property, Gerardo, we had zero, nil, no resource. And here we are four years later with 4 million ounces. That's a finding cost of less than $5 an ounce. It's value-accretive in all respects.”

As Revival continues to add significant gold ounces by way of the drill — while simultaneously advancing its Beartrack/Arnett project toward production — it seems inevitable that the stock will undergo a substantial rerating to the upside in order to compare more equally with its peer group.

Other larger players in the North American mining space are no doubt keeping a close eye on Revival Gold’s pending mine restart at Beartrack and its pending heap leach restart at Haidee.

It’s the kind of brownfield operation that could have large implications across the gold sector as firms seek to reignite other past producing mines across North America and globally in the current $1,850+ per ounce gold market.

As Idaho’s largest past-producing gold mine, Beartrack offers numerous advantages over the typical greenfield exploration project, including a 4 million ounce gold resource, an 11,000 sq ft core facility, leach ponds, and existing power and water.

Plus, the property lies just 10 miles from the town of Salmon, Idaho, making for an easy drive with roads all the way into the main project area.

With drilling set to resume at the Joss and Haidee zones — with potential to grow the known resource to perhaps 5 million-plus gold ounces across all categories — now is the time to begin taking a closer look at Revival Gold.

The company’s shares trade on the Toronto Venture Exchange under the symbol RVG and on the US-OTC Bulletin Board Exchange under the symbol RVLGF.

Learn more about Revival Gold and sign up to its investor list by clicking here.

And click here to get real-time updates from the company on their Twitter feed.

— Resource Stock Digest Research

Click here to see more from Revival Gold Inc.