Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Why gold is priced rationally - and how it obtains a real return

It doesn’t pay interest, its highly volatile, and even Fed Chairmen publicly state they don’t know how its priced – gold remains a mystery. Perhaps not.

Gold is generally thought of as a non-income-earning asset held as a hedge when market or political risk perceptions rise. Its role in portfolios has never been clearly defined. In fact, I show in my new peer-reviewed Journal of Investing paper that the price of gold is fully rational, based on fundamental principles, obtains a real return, and is clearly linked to the valuation (P/E) of stock markets (earlier Journal of Investing article).

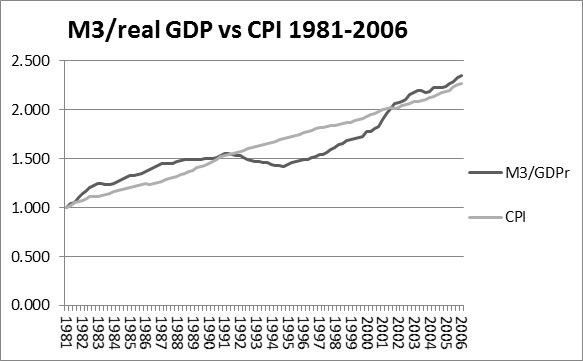

Fiat money itself is not thought of as an investment asset for the simple reason that it loses purchasing power at the rate of inflation. Fiat money-based investment assets pay a return in fiat money – stocks and bonds for example – and must return, in fiat money, more than inflation after taxes to provide a real return in the form of capital gains, dividends and interest. Figure 1 shows the indexed ratio of M3/real GDP against the index of the CPI.

Figure 1: M3/Real GDP vs. CPI 1981 – 2006

A simple regression of this relationship has an R-squared of .83. The striking relationship offers empirical support for the premise that the excess of broad money supply growth in relation to real GDP growth is the source of inflation – loss of purchasing power of goods and services per unit of fiat money.

The author has constructed a similar measure for gold, as a global asset, over a time period with reasonably good data for the total above ground world gold stock, world real GDP, and the world price level – the critical ingredients for an empirical test in Fig. 2.

To continue reading please click link http://www.mining.com/web/why-gold-is-priced-rationally-and-how-it-obtains-a-real-return/