Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Time for a Huge Reality Check on Gold and Inflation by Adam English

Here is a little dose of reality for all of those inflation naysayers out there:

- 76% of Americans are living paycheck-to-paycheck.

- 65% of Americans say they don't own their homes.

- 53% of Americans have no money in the stock market, even through retirement accounts.

Together, these three depressing facts mean a vast majority of Americans have seen their wealth and income crushed by inflation.

Your wealth needs to have grown 220% over the last 30 years to have outpaced inflation.

Unless you have owned your home for 30 years or heavily invest a large portion of income in the stock market, there is little chance you have experienced anything close.

If you bought a home in 1987, on average the appreciation falls just short of keeping up with inflation.

Right off the bat, we know a third didn't do that. And the real number is much higher.

Considering a 30-year mortgage is the longest you'll find, only 35% of U.S. homeowners don't have mortgage debt, and home value is the dominant form of wealth for a vast majority of homeowners, we can infer that a majority of Americans have seen their total wealth trail well behind inflation.

The S&P 500 is up around 1,000% over 30 years. We know 53% didn't ride that wave. Yet again, the real number is much higher.

The average head of a household in the U.S.A. only has $12,000 stashed away for retirement.

That leaves income as the major source of wealth creation for well over a half of Americans, which is clearly the case considering 76% live paycheck-to-paycheck.

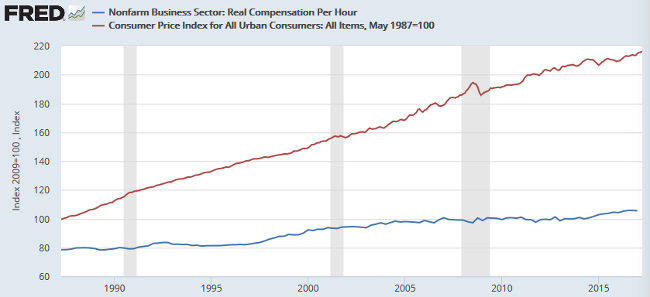

Check out this graph to see how stunningly depressing life has been for Americans over the last 30 years:

There has been about a 30% real wage increase and a nearly 220% increase for all items in the consumer price index.

Effectively, anyone dependent on wages has seen his or her purchasing power drop by half.

Of course, it isn't all roses for investors, either. The compound annual growth rate of the S&P 500 is 11.66% through the end of 2016

According to official U.S. government data, annual inflation has grown at an average of 4% over the last 30 years. What cost $1 in 1987, on average, costs $2.20 today.

Of course, that's after the government implemented all sorts of shenanigans to make inflation seem artificially low. The official line used each time is that the change makes inflation data more accurate. Yet each and every time, and there have been dozens of times, inflation is tweaked down. How convenient.

If we still determined inflation using the calculations from 1980, it'd be significantly higher:

To continue reading please click link http://www.outsiderclub.com/reality-check-on-gold-and-inflation/2337