Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

This Year's Best Commodity Is One of the Smallest Metals Markets

-

-

Palladium is up 30 percent in 2017, reaching a 16-year high

-

Gains are accelerating as demand picks up amid a shortage

In the main commodity markets, nothing is doing better than palladium this year.

The metal is up 30 percent, beating 33 other raw materials, including lean hogs and aluminum, tracked by Bloomberg. On Friday, prices surged as much as 7.9 percent to a 16-year high of $928.36 an ounce as some traders were said to scramble to get hold of physical supplies.

Palladium, which is mainly used to curb harmful emissions from gasoline vehicles, has rallied on expectations that supply will lag demand for a sixth straight year. It’s now almost as expensive as platinum for the first time since 2001, helped by Volkswagen AG’s emissions scandal two years ago that has prompted consumers to switch from diesel to gasoline cars.

“The fundamentals in palladium are among the best in all the commodities,” said Rene Hochreiter, an analyst at Noah Capital Markets Pty Ltd. in Johannesburg. “It could easily overtake platinum in the near-term. It feels as if the rally has got legs.”

Here are four other charts on palladium’s advance:

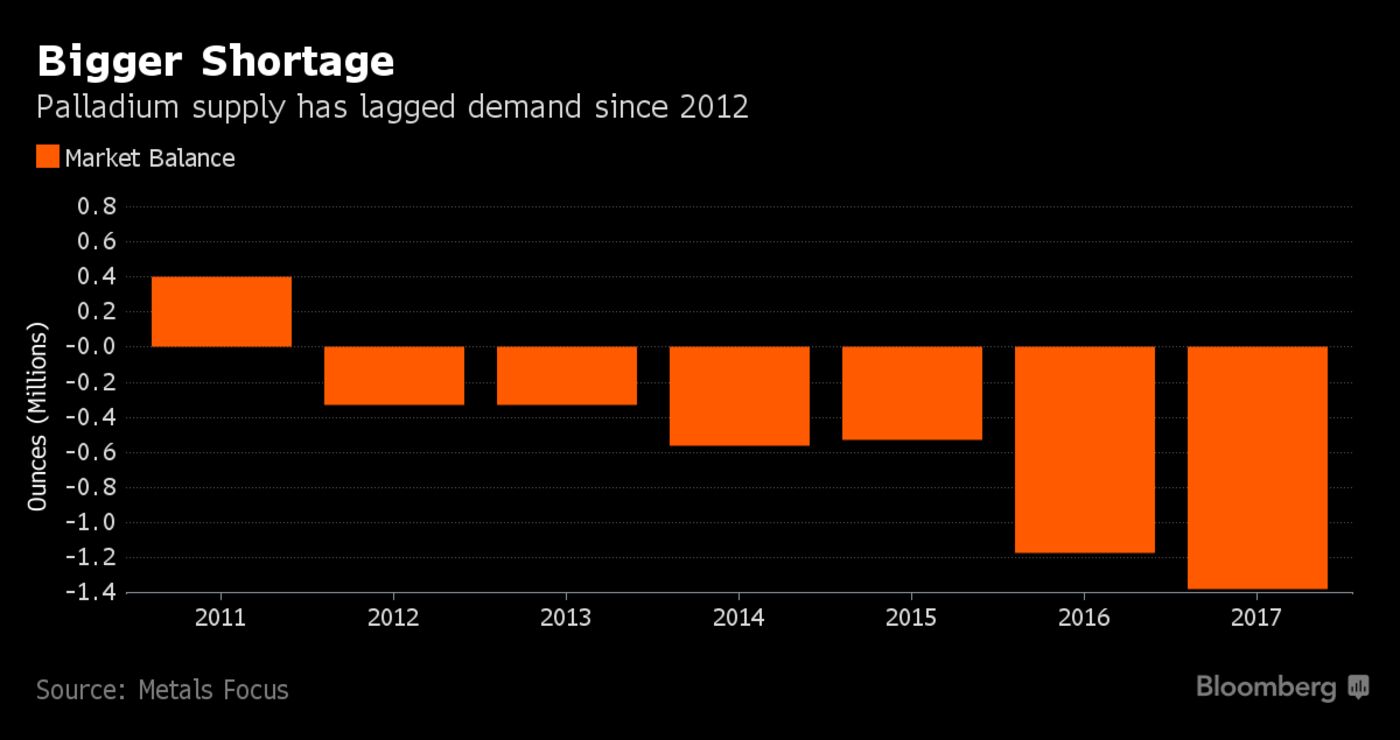

Supply Deficit

Mine production hasn’t been able to keep up with usage since 2012, partly because of rising car sales and stricter emissions limits. While stockpiled metal probably helped feed consumer demand in recent years, that source of supply may now be running out, according to Caroline Bain, chief commodities economist at Capital Economics Ltd.

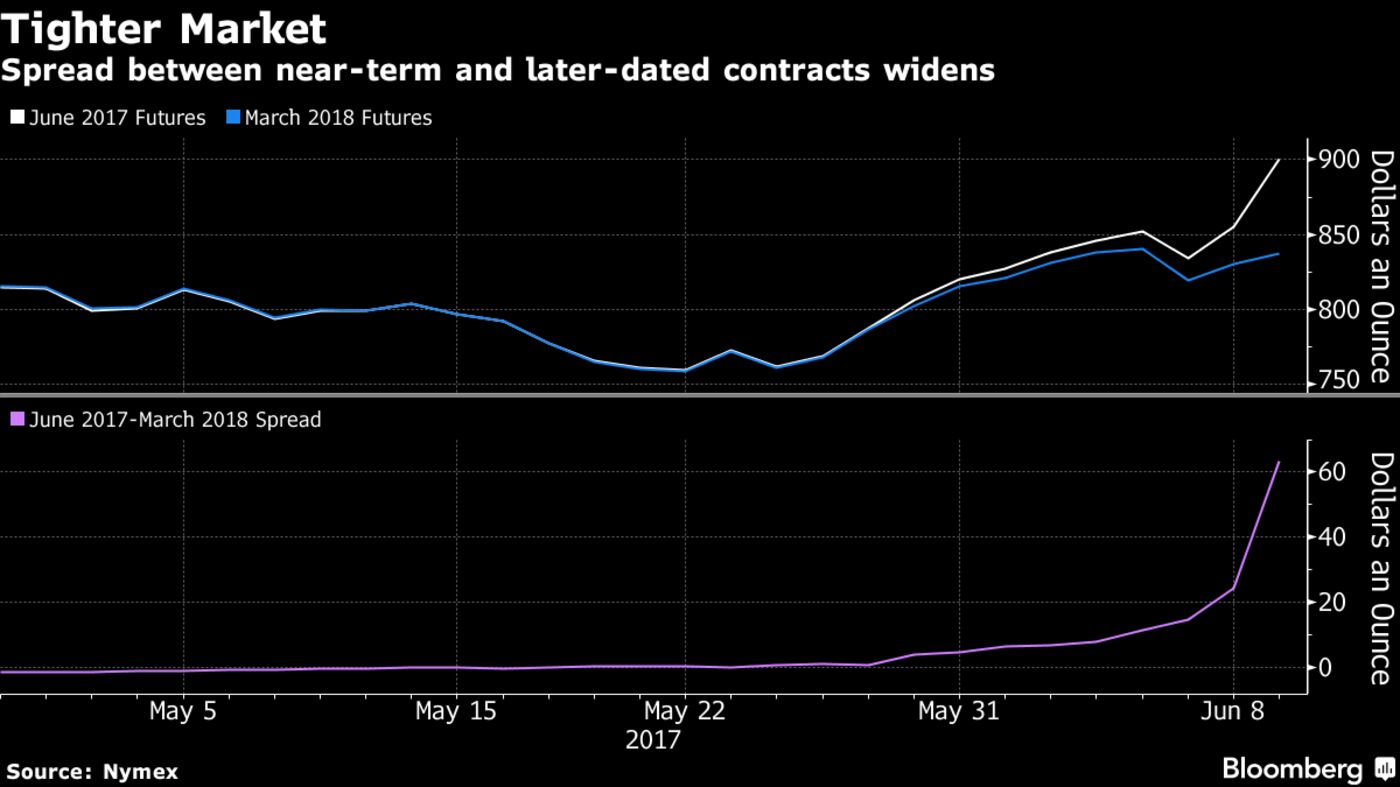

Rush to Buy

The futures market is signaling traders are rushing to buy metal. Palladium for June delivery in New York has become a lot more expensive than the March 2018 contract in recent weeks. That’s indicating there may be concerns about near-term supplies.

“It appears that there is a serious shortage of readily available physical bars for spot settlement,” said Brad Yates, head of trading for U.S. gold refiner Elemetal.

Click here to continue reading...