Categories:

General Market Commentary

Topics:

General Market Commentary

Spend Don't Splurge, Investors Tell Miners as M&A, Capex Surges

The world’s biggest miners are cranking up spending for the first time in half a decade as well as pursuing more takeovers -- and investors are flashing hazard lights as commodities prices slide and as doubts swirl over the outlook.

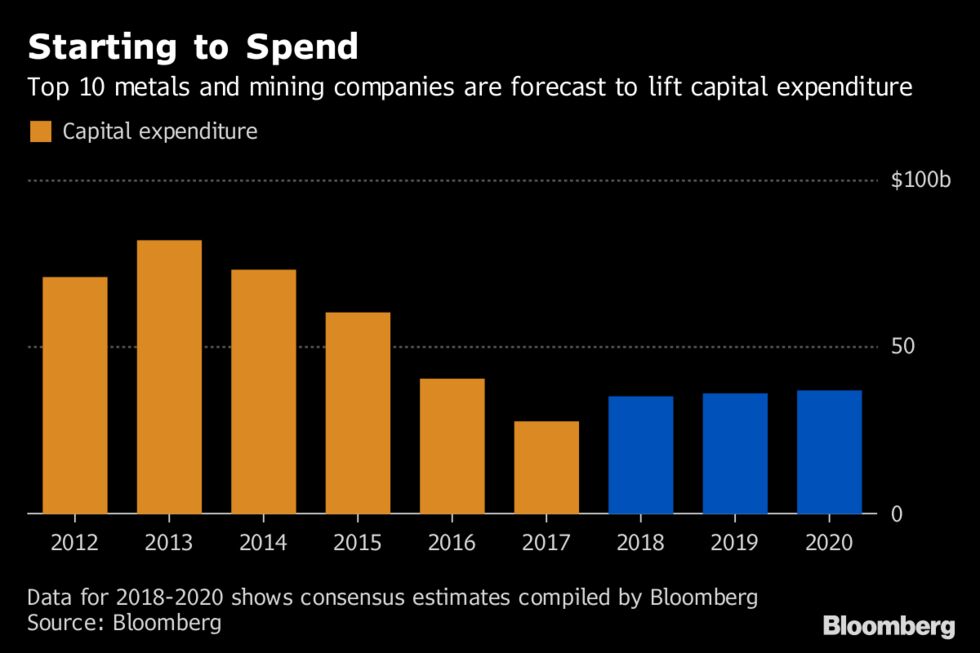

Capital expenditure among the 10 largest metals and mining companies is forecast to advance to about $35 billion this year, the first annual rise since 2013, according to data compiled by Bloomberg.

At the same time, the value of M&A in the sector has already surged to the highest in six years, spurred by deals including Barrick Gold Corp.’s $5.4 billion acquisition of Randgold Resources Ltd.

“You are seeing a sort of a pivot to growth,” said Camille Simeon, a Sydney-based investment manager at Aberdeen Standard Investments, which manages about $730 billion in assets including BHP Billiton Ltd. and Rio Tinto Group shares.

However, companies need to be certain new projects can deliver improved returns, and they should be wary of major deal-making after the industry’s past failures, she said. “Given their history, that’d be a red flag for us.”

Sector leader BHP has flagged a list of growth options, raised its annual exploration budget and this month boosted its stake in SolGold Plc, owner of a coveted copper project in Ecuador. Anglo American Plc in July give the go-ahead to a $5 billion mine in Peru, while Vale SA last week approved about a $1 billion expansion of a Brazilian copper operation.

“The key is that growth equals value for shareholders,” Olivia Markham, co-manager of BlackRock Inc.’s World Mining Trust said in an interview last month. The fund, which is backing companies with copper growth plans, expects miners to also continue to focus on returning cash to investors, she said.

BHP, Anglo and Vale are among companies on the 27-member International Council on Mining and Metals, an industry group with a combined market value of about $500 billion, gathering Tuesday in Melbourne for a bi-annual meeting. Key sector executives, including from Rio, MMG Ltd. and Goldcorp Inc., will also address a separate, three-day conference taking place in the same city through Thursday.

Click here to continue reading...