Categories:

General Market Commentary

Topics:

General Market Commentary

Metal prices, financing, exploration and assays are all up

Miners are responding to a rosier metal outlook by increasing spending on exploration and releasing more assay results.

Base metal prices are up. Copper bounced off its 2015 nadir of $4,500 a tonne and in the last few months has found a range of $6,600 to $6,700 a tonne, a metal price that ING says is good level to sustain investment. Nickel is on a tear. It jumped to $15,340 a tonne today, its highest close since January 2015

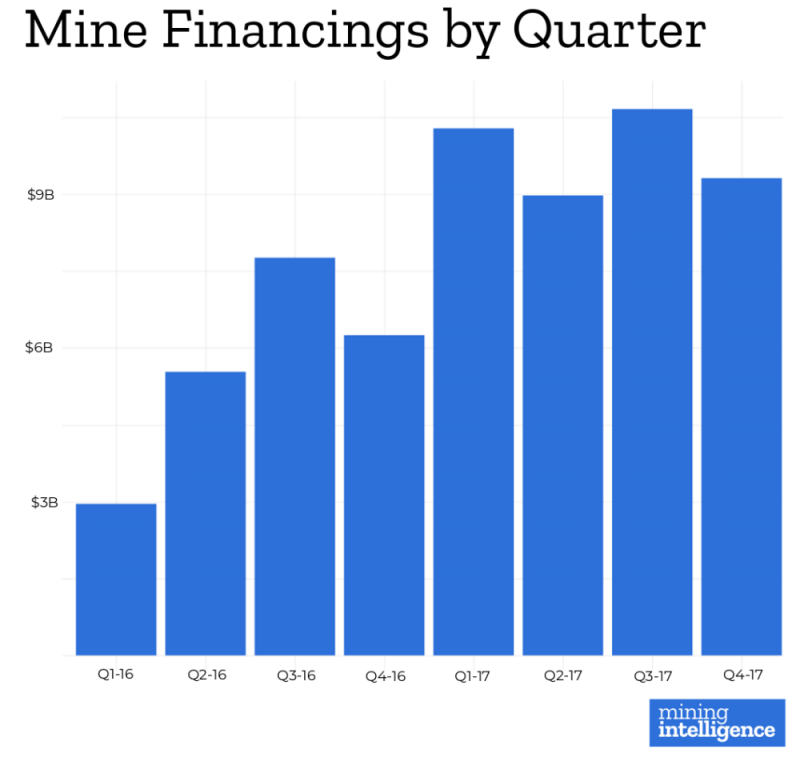

With better metal prices miners are asking for more money. In 2017 miners sought financing totalling $39B compared to $22B in 2016 according to data from Mining Intelligence. Amounts are compiled from publicly-traded companies worldwide that declared intentions to raise funds.

The size of the ask was larger, too. The average funding request was up 25% over the past two years.

Juniors and miners are exploring.

Global mining exploration is expected to increase 15% to 20% year-over-year.

In Canada the exploration spend has grown 37% in the last two years, and total exploration spend in 2018 is forecast at $2.2B.

Click here to continue reading...