Categories:

General Market Commentary

Topics:

General Market Commentary

It's the One Metal Near a Record, But Palladium Is Unloved

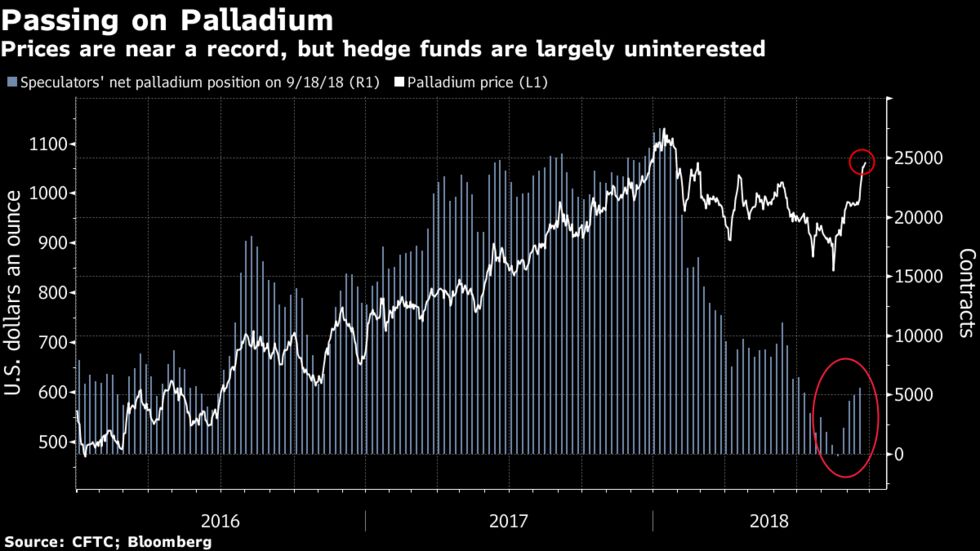

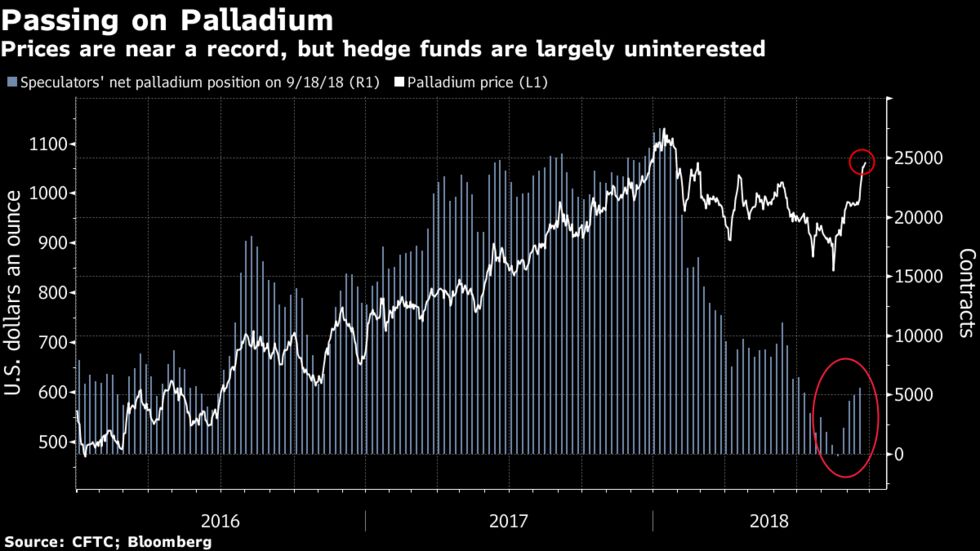

Palladium is the only major commodity that’s within reach of an all-time high, but investors are barely buying.

The metal has climbed to within about 6 percent of January’s record, even as holdings in exchange-traded products slumped to a nine-year low. While hedge funds have become more positive in recent weeks, their bullish bets are just a fraction of what they were at the start of the year.

Prices are rallying sharply, likely because of a squeeze in the market and tight supply and demand for the metal, which is mostly used in autocatalysts, according to Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd. Palladium traded at $1,074.62 an ounce in London on Thursday, not far from January’s peak of $1,139.68.

Palladium is the only major commodity that’s within reach of an all-time high, but investors are barely buying.

The metal has climbed to within about 6 percent of January’s record, even as holdings in exchange-traded products slumped to a nine-year low. While hedge funds have become more positive in recent weeks, their bullish bets are just a fraction of what they were at the start of the year.

Prices are rallying sharply, likely because of a squeeze in the market and tight supply and demand for the metal, which is mostly used in autocatalysts, according to Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd. Palladium traded at $1,074.62 an ounce in London on Thursday, not far from January’s peak of $1,139.68.

The market has been in deficit for most of this decade, and Klapwijk expects that to continue. “This may also have encouraged some precautionary buying from users and of course some speculative interest from the long side,” he said.

That’s helped palladium in recent weeks to outperform other precious metals, which have been pressured by the dollar’s strength and expectations for higher U.S. interest rates. More broadly, industrial commodities have started to shrug off global trade tensions amid optimism that demand will remain robust.

“Palladium has broken from the pack,” said Maxwell Gold, a director of investment strategy at Aberdeen Standard Investments, who sees further price gains in the medium term. “Given that its inherent source of demand is from the auto sector, palladium is highly sensitive to industrial metals, so its recovery has tracked the rebound we’ve seen there.”

Click here to continue reading...