Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Central bank gold buying surges to 50 year high

Against a backdrop of continued stock market volatility and geopolitical risk, gold demand surged in Q4 of 2018, according to a new report released today from the World Gold Council.

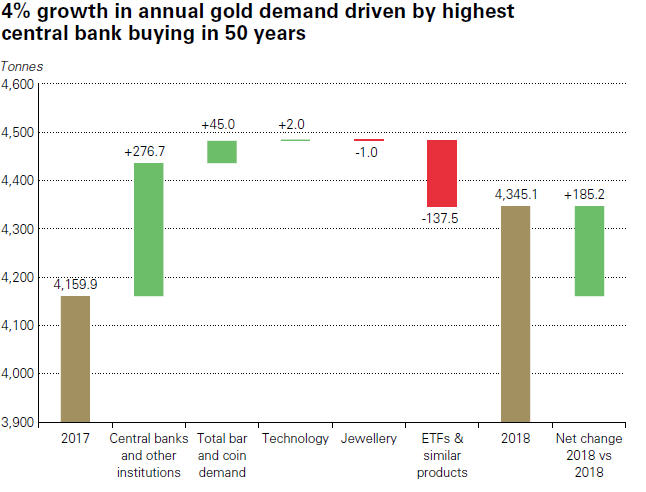

Annual gold demand increased 4% on highest central bank buying in 50 years. Gold demand in 2018 reached 4,345.1 tonnes, up from 4,159.9 tonnes in 2017.

Central banks’ demand for gold soared to 651 tonnes in 2018, 74% higher year over year —the highest level since the dissolution of Bretton Woods and the US eliminated the gold standard.

Net purchases jumped to their highest since 1971, as a greater pool of central banks turned to gold as a diversifier.

Russia, Turkey and Kazakhstan remained key buyers throughout the year, while Russian gold production rose 10% year-over-year.

Central bank buying, Q4 2018, World Gold Council.

World Gold Council analysts assert that central banks reacted to rising macroeconomic and geopolitical pressures by actively increasing their gold reserves.

Click here to continue reading...