The Book of Levi: Picks-and-Shovels for the New Gold Bull Market

The Book of Levi

Picks & Shovels for the New Gold Bull Market

While proper diversification is key to any well-balanced portfolio, it’s also important to have proper diversification within one’s resource-specific investments with a focus on buying the best companies run by the best management teams.

We think the stock featured in this report is an excellent way to get quality exposure to all aspects of the precious metals sector via a team that’s been proving its weight in gold for decades.

It's a play that offers investors access to physical commodities through its tax advantage trust, which holds over $6 billion worth of precious metals.

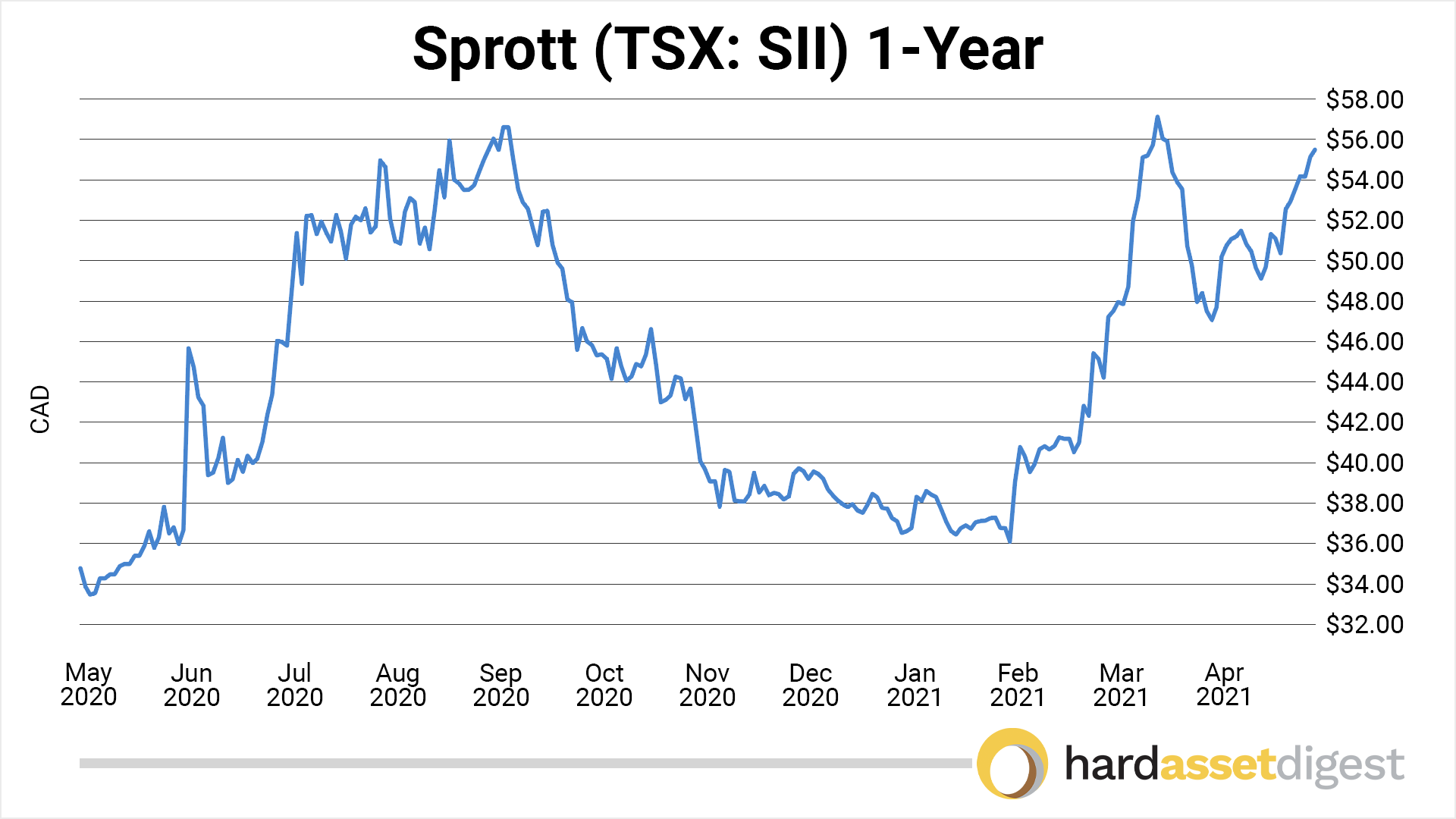

The company is Sprott Inc. (TSX: SII)(NYSE: SII).

Sprott Inc. is an alternative asset manager and global leader in precious metals investments offering physical bullion trusts, managed equities, mining ETFs, as well as private equity and debt strategies.

At the same time, it's the largest secured lender for mine construction in North America. And if that weren't enough, it also manages in excess of $2 billion worth of precious metals equities.

Sprott covers all branches of the resource business — a true picks-and-shovels play — and pays a quarterly dividend of US$0.25 per common share.

Here’s how Sprott bills itself:

Sprott is a global asset manager providing investors with access to highly-differentiated precious metals strategies.

We are specialists. Our in-depth knowledge, experience and relationships separate us from the generalists. Sprott’s specialized investment products include innovative physical bullion trusts, managed equities, mining ETFs, as well as private equity and debt strategies.

We also partner with natural resource companies to help meet their capital needs through our brokerage and resource lending activities. Sprott is a global asset manager with offices in Toronto, New York and London. Sprott’s common shares are listed on the New York Stock Exchange and the Toronto Stock Exchange under the symbol SII.

Sprott today serves over 200,000 global clients and has approximately $17.4 billion in assets under management as of December 31, 2020.

Founded nearly 40 years ago by Eric Sprott, the firm has been a backer of hard asset investments for decades and has now grown into a global powerhouse touching all facets of the industry — from asset management and brokerage services to mining finance, bullion funds, and digital gold.

The Sprott Advantage

By selling dry goods and, later, riveted jeans to the small general stores supplying the gold rush in San Francisco — Levi Strauss was able to make a fortune without prospecting or mining.

Similarly, Sprott Inc. is in a position to build shareholder value in the current resource bull market without having to actually explore, develop, or produce any mining projects.

In essence, it’s a company that provides goods and services for mining companies and investors.

Here’s how Sprott breaks down its business:

- Asset Management (Exchange-listed, Actively-managed)

- Resource Financing (Sprott Resource Lending)

- Wealth Management (Sprott Capital Partners, Sprott USA)

Sprott’s exchange-listed funds and trusts include:

- Sprott Physical Gold And Silver Trust

- Sprott Physical Gold Trust

- Sprott Physical Silver Trust

- Sprott Physical Platinum And Palladium Trust

- Sprott Gold Miners ETF

- Sprott Junior Gold Miners ETF

- Sprott Focus Trust

- Sprott Gold Equity Fund

- Sprott Hathaway Special Situations Strategy

Managing Director,

Senior Portfolio Manager

Those last two funds, by the way, are managed by John Hathaway, who came to Sprott in 2020 after 23 years managing the Tocqueville Gold Fund.

Prior to that, he was with Hudson Capital Advisors, Oak Hall Advisors, and David J. Green & Company.

You can learn more about the company’s impressive leadership team here.

On February 26, 2021, Sprott Inc. released its Q4 2020 and full-year 2020 results.

Highlights include:

- Record $17.4 billion in AUM (Assets Under Management) in 2020, an 88% increase over the prior year.

-

Net income of $6.7 million in Q4 2020, up $5.3 million from the prior period; $27 million on a full-year basis, up $16.8 million.

-

Adjusted base EBITDA of $14.8 million in Q4 2020, up $7.3 million or 98% from the prior period; $44.2 million on a full-year basis, up $15.2 million or 52%.

-

Net fees of $26.2 million in Q4 2020, up $14.8 million from the prior period; $76.3 million on a full-year basis, up $34.3 million or 81%.

-

Gain on investments of $5.1 million on a full-year basis, up $6.2 million.

- Successfully negotiated an amendment to the original terms of the Tocqueville Asset Management gold strategies purchase agreement, enabling the company to retain the full benefits of any additional increase in AUM expected over 2021.

Sprott Inc. has approximately 25.7 million shares outstanding for a current market cap of around C$1.3 billion.

With a hand in nearly every corner of the mining business, Sprott Inc. offers a great picks-and-shovels play in an emerging resource bull market.

To learn more about what Sprott does, how to invest in their products, or how to become a client… check out the Sprott Corporate website and the Sprott Corporate Brochure.