Mike Fagan's Precious Portfolio: Special Alert: Tier-3 Portfolio Additions

Alert No. 3

October 27, 2020

Special Alert: Tier-3 Portfolio Additions

Dear Precious Portfolio subscriber,

In our previous alert, we initiated our first two picks from Tier-2: Alamos Gold and Dundee Precious Metals.

In today’s alert, we’re announcing our first two stock selections from Tier-3 — representing the small-cap or “junior” precious metals explorers and prospect generators.

In Tier-3, our aim is to build a base of well-run junior mineral exploration companies that are advancing high-potential projects either through their own fully-funded drill programs or via joint ventures with larger developers.

Precious Portfolio: Alert #3

Tier-3: Trilogy Metals Inc. (NYSE-Amex: TMQ)(TSX: TMQ) → BUY

Tier-3: Bluestone Resources Inc. (OTC: BBSRF)(TSX.V: BSR) → BUY

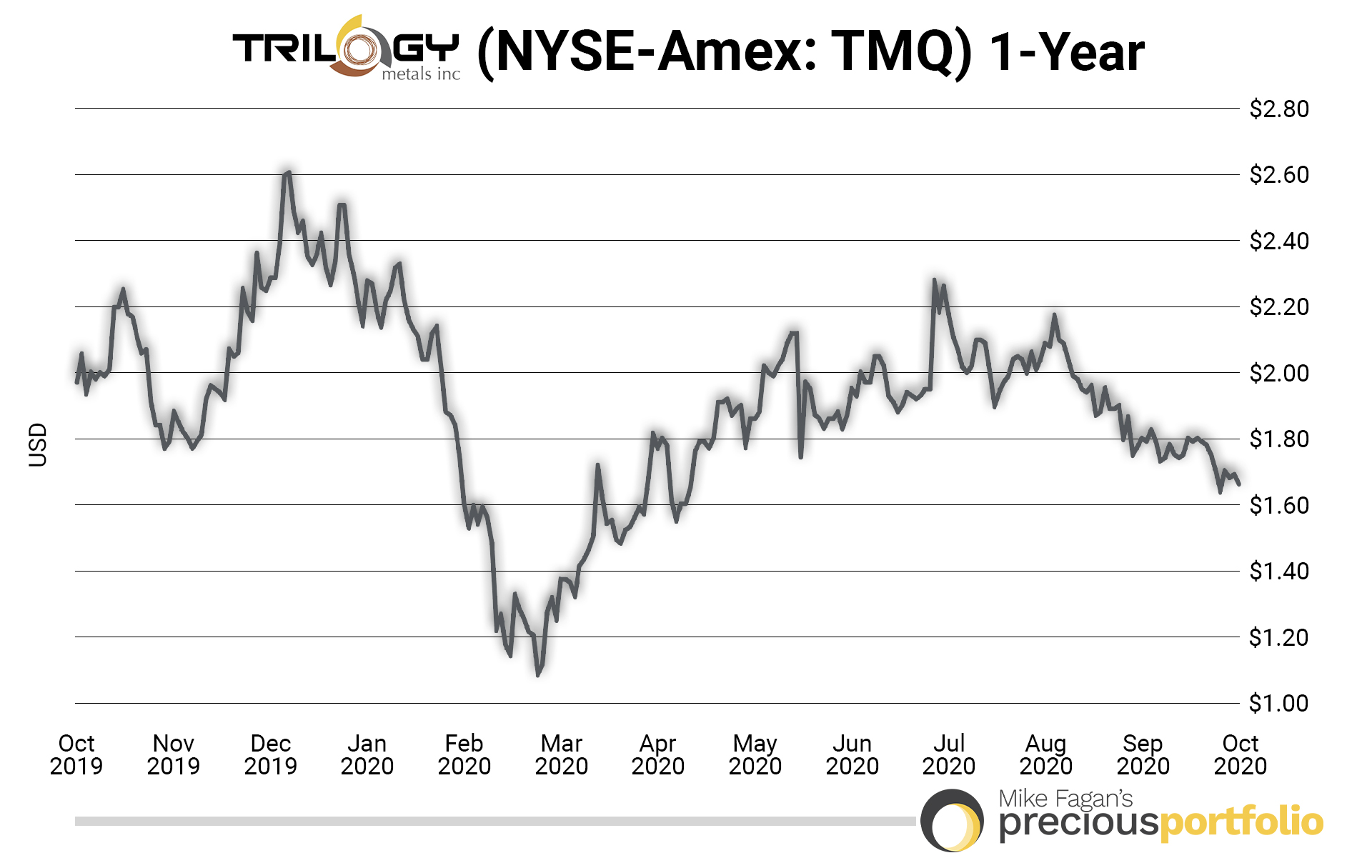

Tier-3: Trilogy Metals Inc. (NYSE-Amex: TMQ)(TSX: TMQ) → BUY

Trilogy Metals is advancing the feasibility-stage Arctic deposit – a district scale volcanic massive sulfide-style copper dominant polymetallic deposit – with South32, a major diversified miner based out of Australia, in the Ambler Mining District of northwestern Alaska.

The Arctic deposit is one of the highest-grade copper deposits in the world with an average grade of 5% copper equivalent.

The company’s 2020 Feasibility Study for the Arctic project outlines the potential technical and economic viability of establishing a conventional open-pit copper-zinc-lead-silver-gold mine and mill complex for a 10,000 tonne per day operation.

The project comes in at a base case Pre-tax NPV (8% discount rate) of approximately US$1.5 billion and an IRR of 30.8% based on a 12-year mine life and estimated payback period of 3 years.

Average annual payable production is projected to be more than 155 million pounds of copper, 192 million pounds of zinc, 32 million pounds of lead, 32,000 ounces of gold, and 3.4 million ounces of silver for LOM (Life of Mine).

Trilogy’ president & CEO, Tony Giardini, states, “Arctic is a special project due to its unique high-grade polymetallic nature.The only other time that I’ve seen a project of this quality where the grades were similar was in an underground mining scenario.However, Arctic is mineable in an open pit scenario. I also want to highlight that Arctic contains a significant amount of gold and silver. At current spot metal prices, the precious metals output represents almost 20% of its revenue. The annual gold equivalent (gold and silver) payable output is about 80,000 ounces per year.”

Trilogy is also advancing the exploration-stage Bornite deposit located near Kobuk, Alaska. This high-grade copper project sits just 15 miles southwest of the company’s Arctic deposit and has the potential to further enhance the long-term economics of the Ambler Mining District.

In 2018, an NI 43-101 Technical Report was released on the Bornite deposit outlining Indicated Resources of 900 million pounds of copper and Inferred Resources of 5.5 billion pounds of copper and 77 million pounds of cobalt.

Trilogy is led by president and CEO, Tony Giardini, who brings a wealth of experience working with major mining companies including serving as vice president of Placer Dome, president of Ivanhoe Mines, and executive vice president of Kinross Gold.

The company’s senior director of operations, Robert Jacko, brings 35-plus years of experience in both underground and open pit operations including serving as general manager at the high-grade Pogo Gold Mine in Alaska.

Richard Gosse, the company’s vice president of exploration, is a highly seasoned exploration geologist with 35 years of experience including serving as senior vice president of exploration for Dundee Precious Metals (one of our Tier-2 portfolio positions) and vice president of exploration at Ivanhoe Mines.

Trilogy has 143 million shares outstanding for a current market cap of US$237.4 million. As of August 2020, the company reported US$12.8 million in cash and cash equivalents and working capital of US$11.8 million.

Trilogy’s current Alaska projects are fully funded by Ambler Metals, and the company does not anticipate needing to fund its 50% share of future expenditures to advance the projects until approximately US$142 million is spent by its joint venture partner, South32.

Current price: US$1.66 per TMQ share: Buy up to US$1.70

Establish your Trilogy Metals (NYSE-Amex: TMQ)(TSX: TMQ) position incrementally and look for opportunities to buy on weakness. Learn more about Trilogy Metals at www.TrilogyMetals.com.

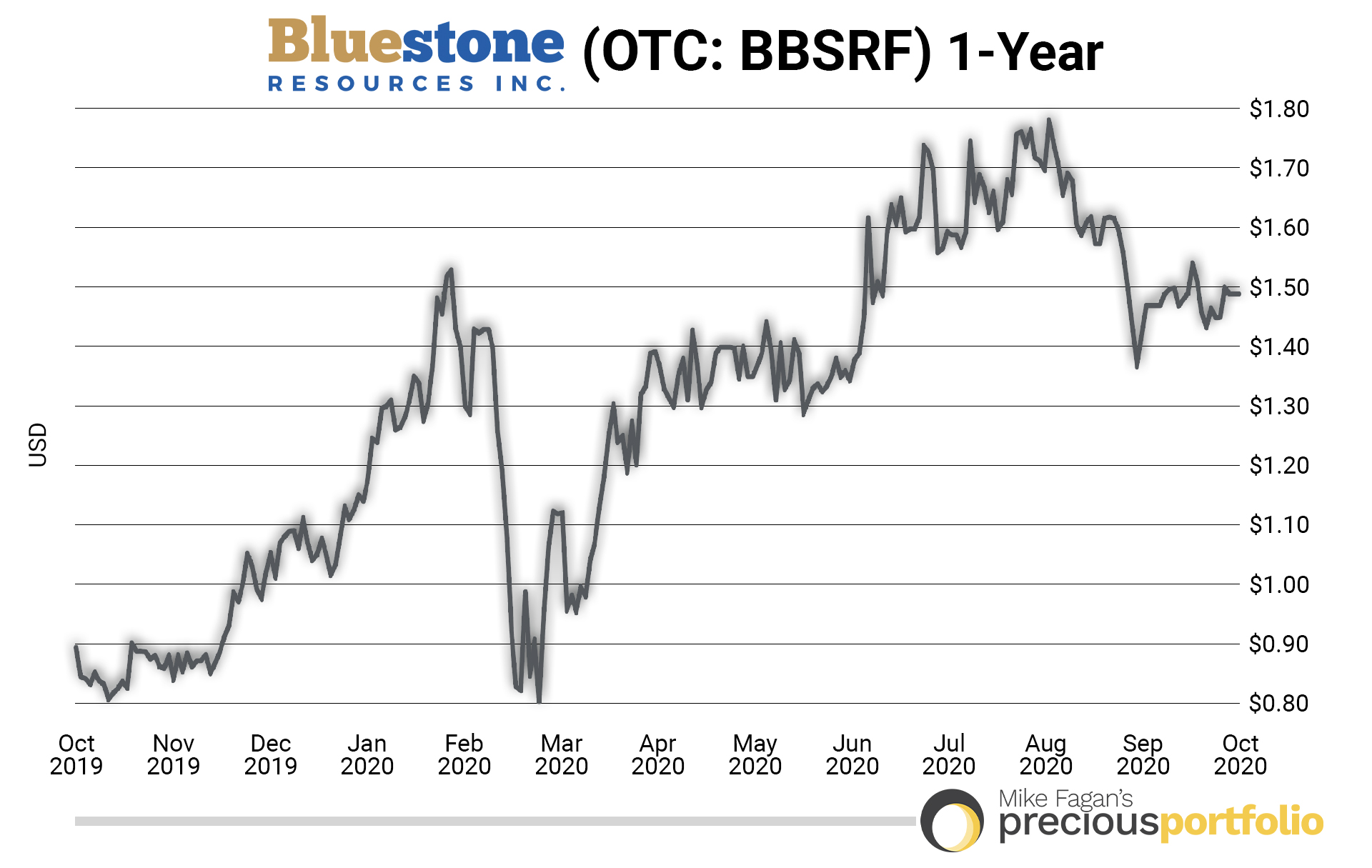

Tier-3: Bluestone Resources Inc. (OTC: BBSRF)(TSX.V: BSR) → BUY

Bluestone Resources is advancing the Cerro Blanco Project — a permitted, high-grade underground gold project located in southeastern Guatemala.

A 2019 Feasibility Study on Cerro Blanco returned robust economics outlining projected average annual production of 146,000 ounces of gold per year over the first 3 years at AISC (All-In Sustaining Cost) of $579 per ounce.

With strong backing from The Lundin Group, and particularly through the efforts of Bluestone’ CEO, Jack Lundin, the company is seeking to repeat the success of the Fruta Del Norte Gold Mine (now in commercial operations by Lundin Gold) by bringing some of the key personnel from that highly successful operation over the Cerro Blanco.

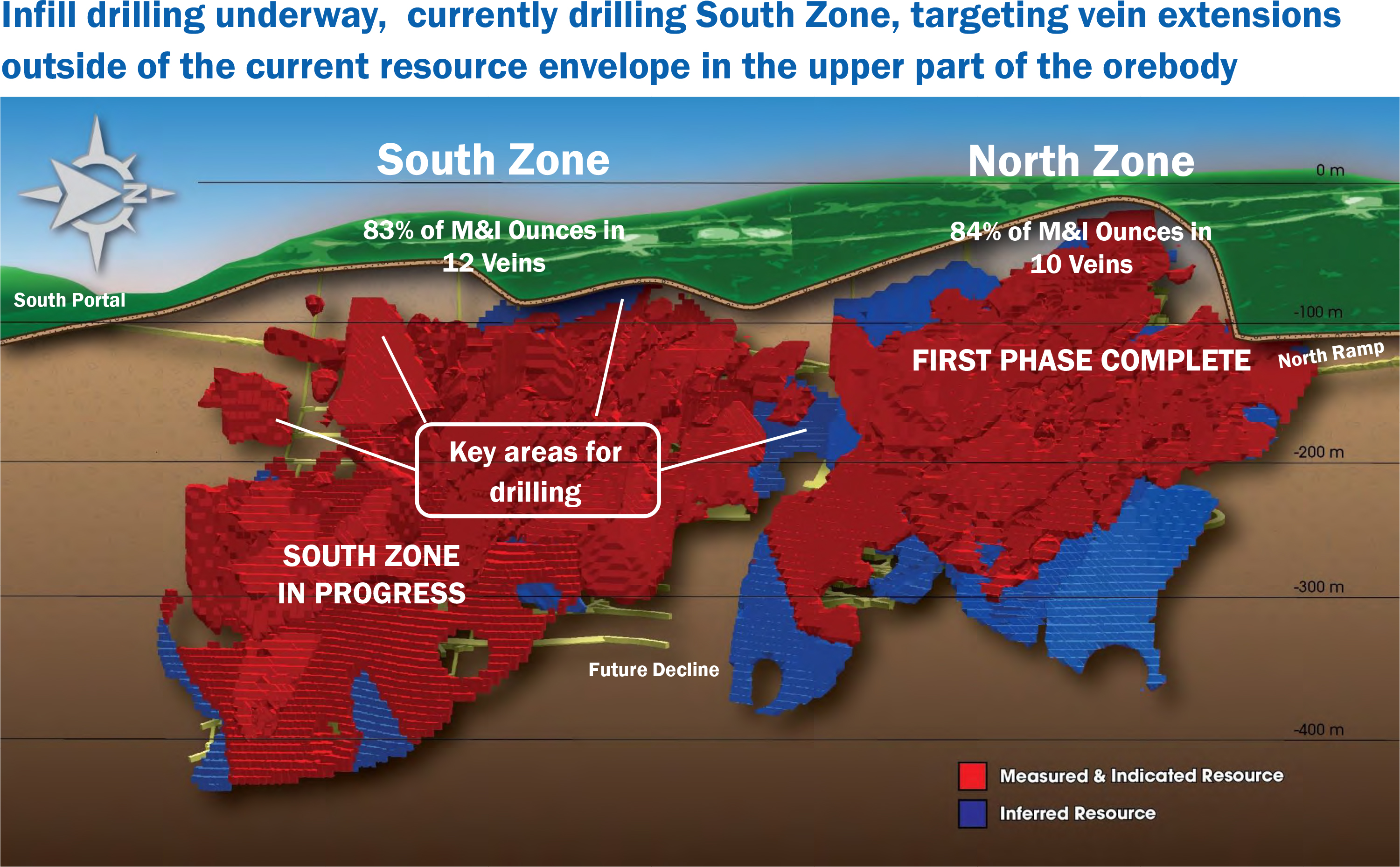

Bluestone Resources is in the midst of an infill drill program at Cerro Blanco with a total of 5 drill rigs now operational and drilling in the underground workings and on surface. Recent highlights from this program include high-grade intercepts of 21.6 g/t Au (grams per tonne gold) over 15.0 meters, 15 g/t Au over 7.2 meters, and 12 g/t Au over 6.0 meters.

Cerro Blanco Gold Project, Guatemala

The current focus of the program is infill drilling in the South Zone and the improved definition of key veins in parallel to testing vein extensions outside of the current resource envelope.

The work is expected to build on the infill drill program completed in the North Zone in 2019 which resulted in an updated resource estimate of 1.41 million ounces of gold averaging 10.3 g/t in the M&I (Measured & Indicated) category.

Jack Lundin states, “Exciting intercepts continue to be delivered through our ongoing drilling campaign which is focused on infill drilling and resource expansion at Cerro Blanco. Our strong understanding of the geology and consistency of the drilling results continue to demonstrate further upside in the deposit. In addition to the drilling, great progress continues to be made on advancing Cerro Blanco towards project readiness activities which are set to commence before the end of this year.”

As noted, Bluestone Resources is led by CEO, Jack Lundin, who holds a Master of Engineering degree in Mineral Resource Engineering from the University of Arizona. Jack was instrumental in the recent successful execution of Lundin Gold’s Fruta del Norte Gold Mine in southern Ecuador where he served as project superintendent.

The company’s vice president of exploration, David Cass, is a professional geologist with 25-plus years of international experience in mineral exploration and mining for precious and base metals including 15 years with major mining company Anglo American.

Bluestone has 143 million shares outstanding for a current market cap of US$213.4 million. Bluestone recently completed a bought deal equity financing providing the company with gross proceeds of C$92 million.

Current price: US$1.50 per BBSRF share: Buy up to US$1.55

Establish your Bluestone Resources (OTC: BBSRF)(TSX.V: BSR) position incrementally and look for opportunities to buy on weakness. Learn more about Bluestone at www.BluestoneResources.ca.

Upcoming…

In our next bi-weekly alert, we’ll be adding an additional 1 to 2 stocks to our Precious Portfolio; we are currently reviewing a number of small-cap, mid-tier, and large-cap resource stocks that meet our criteria.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Make sure you never miss an update or issue from Mike Fagan’s Precious Portfolio by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Mike Fagan’s Precious Portfolio, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Mike Fagan’s Precious Portfolio does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.