Mike Fagan's Precious Portfolio: Special Alert: Tier-2 Portfolio Additions

Alert No. 2

October 13, 2020

Special Alert: Tier-2 Portfolio Additions

Dear Precious Portfolio subscriber,

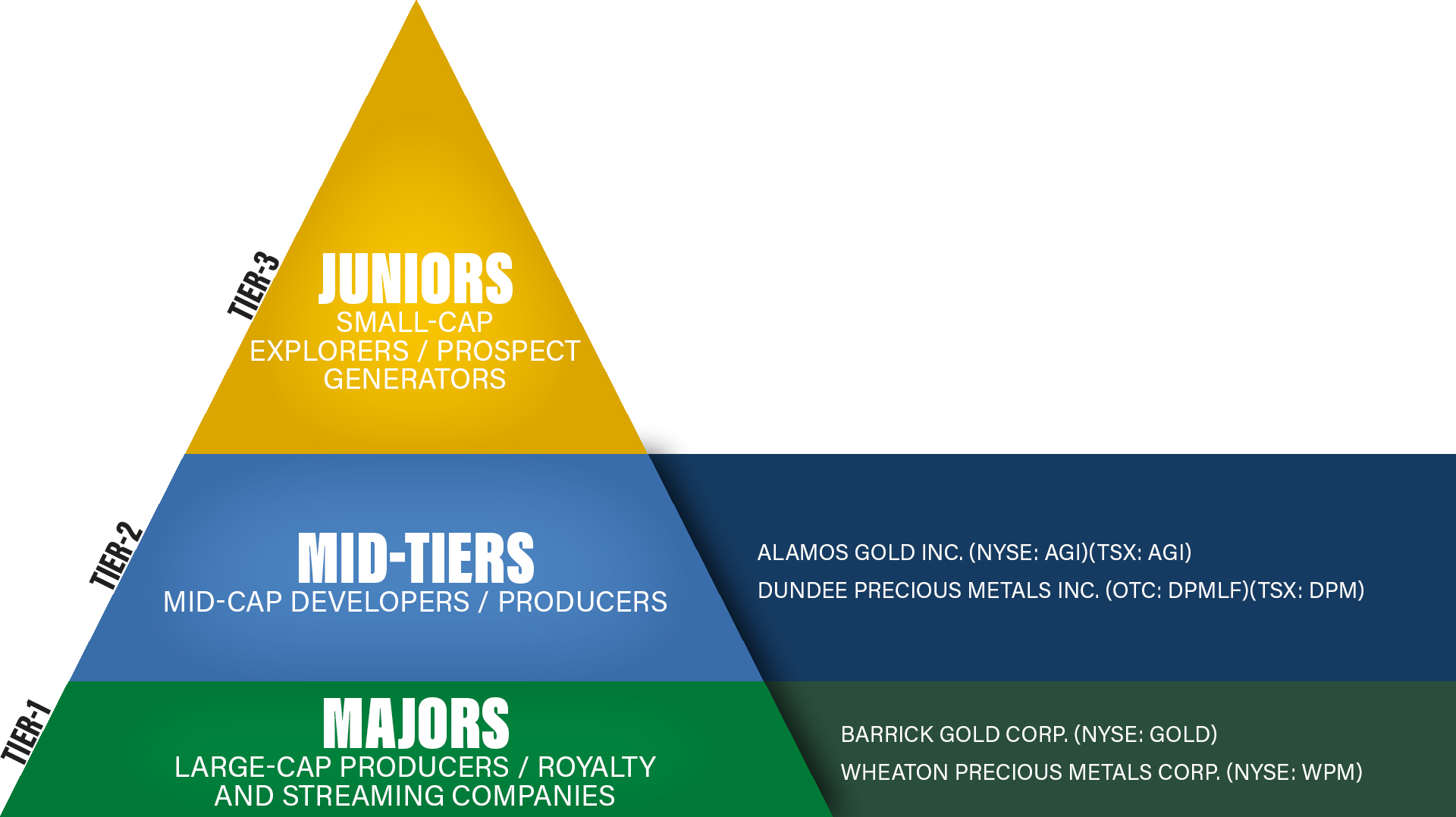

In our last alert, we provided an overview of our Precious Portfolio service and we initiated our first two picks from Tier-1: Barrick Gold and Wheaton Precious Metals.

In today’s alert, we’re announcing our first two stock selections from Tier-2 — representing the mid-cap precious metals producers, prospect generators, and royalty/streaming companies.

In Tier-2, our aim is to build a base of mid-tier producers that possess capable management teams, balance sheets that can withstand lower metals prices, and strong organic growth through development of advanced projects and/or exploration programs at existing assets.

Precious Portfolio: Alert #2

Tier-2: Alamos Gold Inc. (NYSE: AGI)(TSX: AGI) → BUY

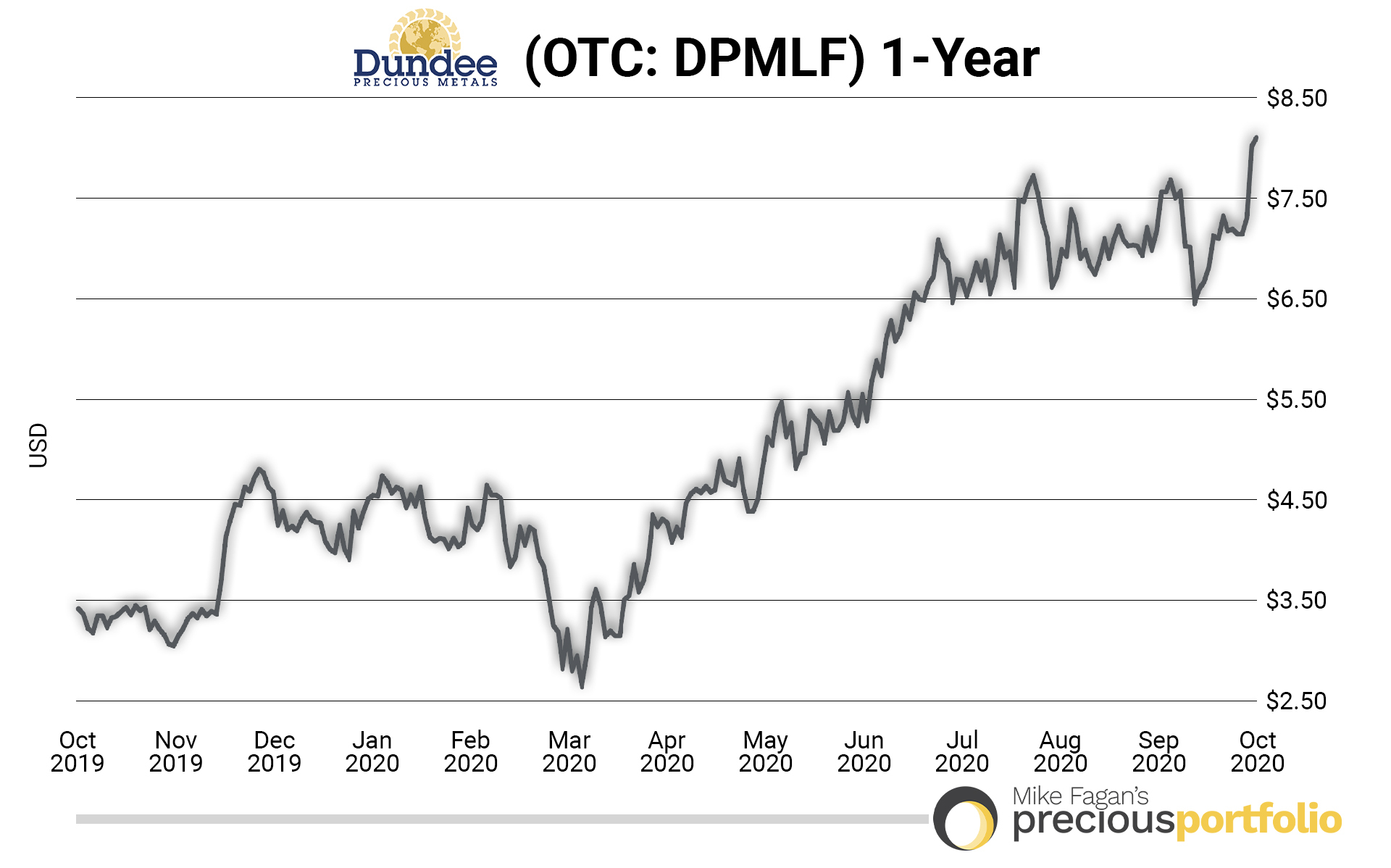

Tier-2: Dundee Precious Metals Inc. (OTC: DPMLF)(TSX: DPM) → BUY

Tier-2: Alamos Gold Inc. (NYSE: AGI)(TSX: AGI) → BUY

Alamos Gold – which was formed in 2003 via the merger of Alamos Minerals and National Gold – is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America.

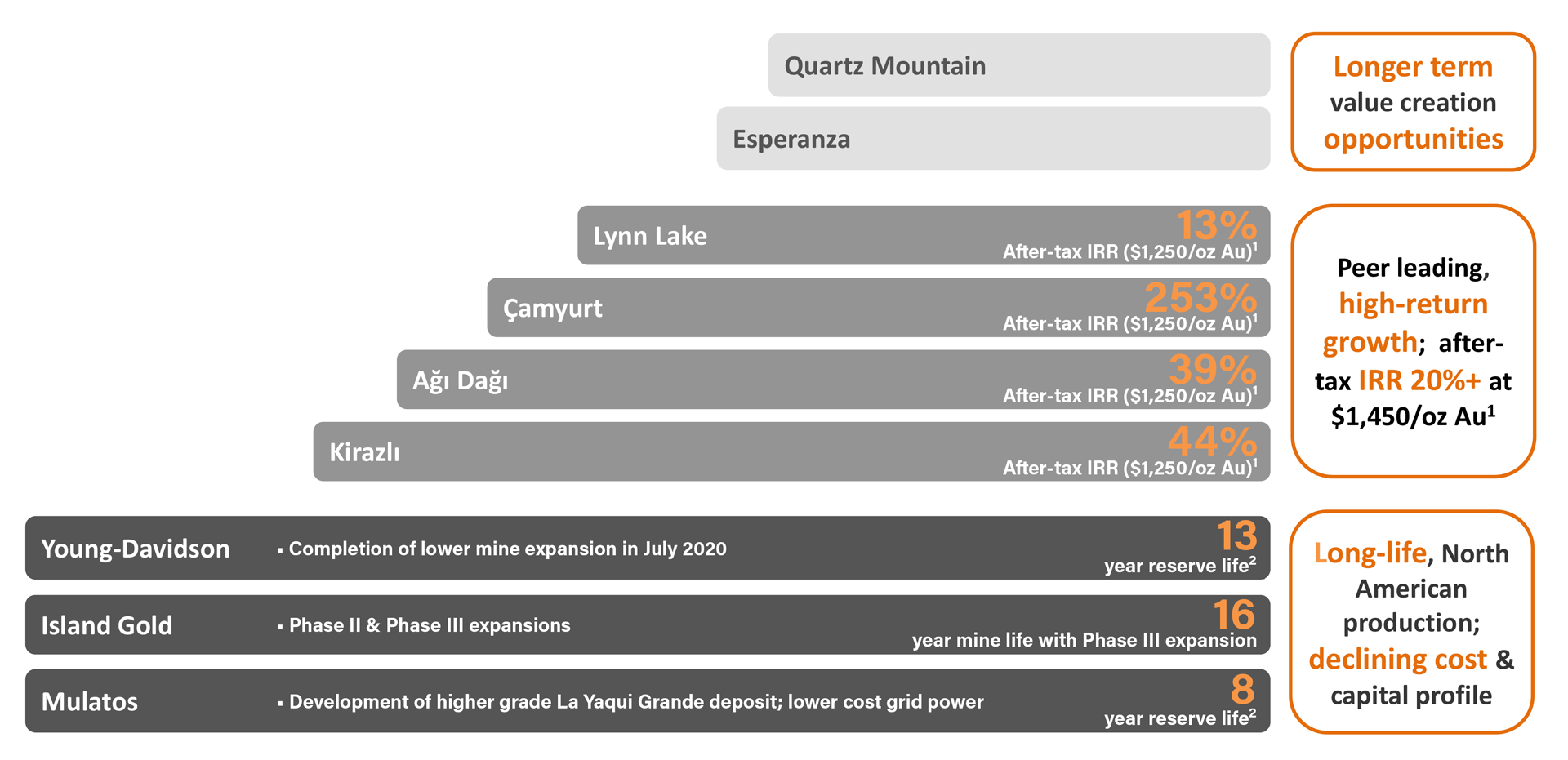

That includes the Young-Davidson and Island Gold mines in northern Ontario, Canada, and the Mulatos mine in Sonora State, Mexico.

Additionally, the company has a leading growth profile via a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States.

Alamos boasts a long-life reserve base with 9.7 million ounces in Proven and Probable Mineral Reserves plus 7 million ounces in the M&I (Measured & Indicated) category and another 5.9 million ounces in the Inferred category.

The company produces well over 400,000 ounces of gold per year on average from its combined operations at AISC (All-In Sustaining Cost) of $1,030-$1,070 per ounce.

The Young-Davidson Mine near Kirkland Lake, Ontario, is the company’s flagship operation and is considered one of Canada’s largest underground gold mines. At ~140,000 gold ounces per year at AISC (All-In Sustaining Cost) of $1,180-$1,220 per ounce, the project should continue to serve as a foundation for growth for Alamos for many years to come.

The company’s Island Gold Mine, also located in Ontario, is regarded as one of Canada’s highest grade and lowest cost gold mines. Through ongoing exploration success, its Mineral Reserves and Resources have continued to grow in size and quality. The mine produces ~135,000 gold ounces per year at AISC of $740-$780 per ounce. The mine is expected to produce over 240,000 ounces annually once the Phase III expansion is completed in 2025.

The Mulatos Mine is Alamos Gold’s founding operation. It was acquired for $10 million and has produced over two million ounces of gold and has generated more than $400 million in free cash flow since 2005. At ~145,000 gold ounces per year at AISC of $940-$980 per ounce, Mulatos remains a consistent gold producer and significant cash flow generator for Alamos with strong exploration potential.

Alamos has 391 million shares outstanding for a current market cap of US$3.65 billion. The company boasts a strong balance sheet, and, at June 2020, had US$231 million in cash and US$100 million in debt — resulting in net cash of US$131 million.

Alamos has paid a dividend every year for more than a decade and has returned over US$179 million to shareholders to date. Last month, the company declared a quarterly dividend of US$0.015 per common share.

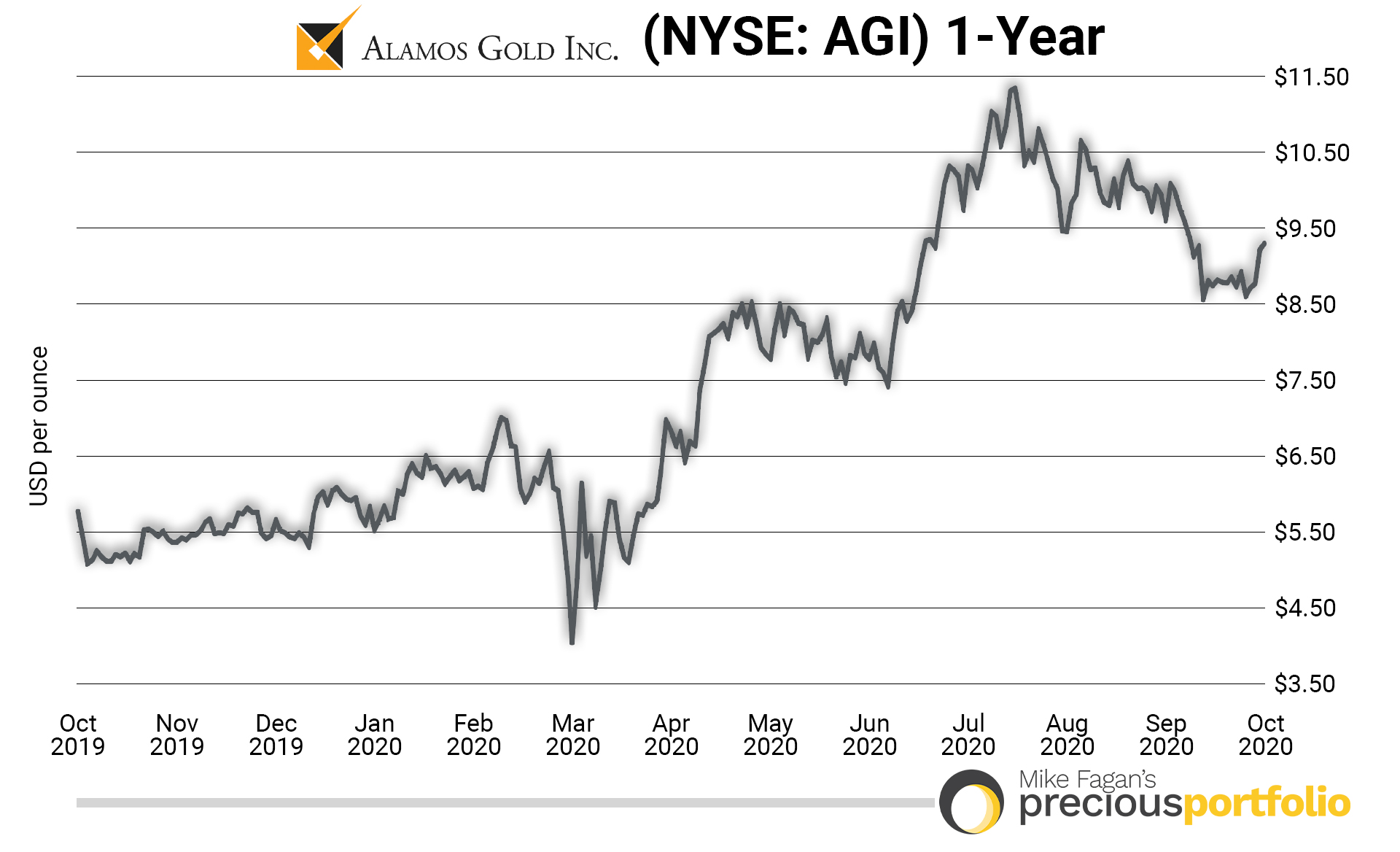

Current price: US$8.99 per AGI share: Buy up to US$9.25

Alamos Gold’s share value is closely tied to the commodity price for gold. Establish your Alamos Gold (NYSE: AGI)(TSX: AGI) position incrementally and look for opportunities to buy on weakness. Learn more about Alamos Gold at www.AlamosGold.com.

Tier-2: Dundee Precious Metals Inc. (OTC: DPMLF)(TSX: DPM) → BUY

Dundee Precious Metals is a Canadian-based international mining company engaged in the acquisition, exploration, development, mining and processing of precious metal properties with current operations in Namibia and Bulgaria and with exploration in Armenia, Bulgaria, and Serbia.

The company produces ~275,000 ounces of gold per year on average from its combined operations at AISC (All-In Sustaining Cost) of $680-$760 per ounce.

Dundee’s Chelopech gold-copper-silver complex located in central-western Bulgaria is the company’s flagship asset. The project boasts a long-life reserve base with Proven and Probable Mineral Reserves of 1.6 million gold ounces and 336 million lbs of copper plus 1.3 million ounces of gold and 296 million lbs of copper in the M&I (Measured & Indicated) category. Additionally, the company is testing a number of exploration targets around Chelopech including the West Shaft, Wedge, and Krasta zones.

The company’s Ada Tepe Gold Mine located in southeastern Bulgaria is considered one of the highest grade open pit mines in the world with a LOM (Life Of Mine) gold grade of 4.04 grams per tonne. The site boasts production of ~275,000 ounces of gold at AISC of $680-$720 per ounce with free cash flow estimates of $140-$250 million annually over the next 3 years.

Dundee’s smelter in Namibia is expected to deliver record performance in full-year 2020 with complex concentrate smelted estimated to be between 230,000-265,000 tonnes — representing a 15% increase from 2019 production levels. The company has an option to expand to 370,000 tonnes per annum in the future.

Following encouraging results from last year’s optimization work at the Timok Gold Project, Serbia – Dundee has initiated a PFS (Prefeasibility Study) which is on-track to be completed by year-end.

| Chelopech Mine, Bulgaria (100%) | Ada Tepe Mine, Bulgaria (100%) | Tsumeb Smelter, Namibia (94%) | Timok Project, Serbia (100%) | Strategic Investment Portfolio (valued at $65M) |

|

|

|

|

Sabina Gold & Silver (9.4%) – Nunavut, Canada

|

In Q2 2020, the company reported record quarterly gold production, free cash flow, and net earnings – reflecting higher gold prices and a strong operating performance at Chelopech and Ada Tepe, which, combined, achieved its highest quarterly production to-date.

Dundee has 181 million shares outstanding for a current market cap of US$1.47 billion. The company boasts a strong balance sheet, and, at June 2020, had US$75.7 million in cash and no outstanding debt.

Dundee Precious Metals announced an inaugural quarterly dividend in 2020 of US$0.015 per common share.

Current price: US$7.63 per DPMLF share: Buy up to US$8.00

Dundee Precious Metals’ share value is closely tied to the commodity price for gold. Establish your Dundee Precious Metals (OTC: DPMLF)(TSX: DPM) position incrementally and look for opportunities to buy on weakness. Learn more about Dundee Precious Metals at www.DundeePrecious.com.

Upcoming…

In our next bi-weekly alert, we’ll be announcing our first stock selections from Tier-3 — representing the junior explorers and prospect generators.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio