Mike Fagan's Precious Portfolio: Special Alert No. 4: Tier-1 & Tier 2 Portfolio Additions

Alert No. 4

November 10, 2020

Special Alert: Tier-1 & Tier 2 Portfolio Additions

Dear Precious Portfolio subscriber,

In our previous alert, we initiated our first two picks from Tier-3 (Juniors): Trilogy Metals and Bluestone Resources.

In today’s alert, we’re announcing two new portfolio additions: One from Tier-1 (Majors) and one from Tier-2 (Mid-Tiers).

Precious Portfolio: Alert #4

Tier-1: Sibanye-Stillwater Ltd. (NYSE: SBSW) → BUY

Tier-2: SilverCrest Metals Inc. (NYSE-Amex: SILV)(TSX: SIL) → BUY

Tier-1: Sibanye-Stillwater Ltd. (NYSE: SBSW) → BUY

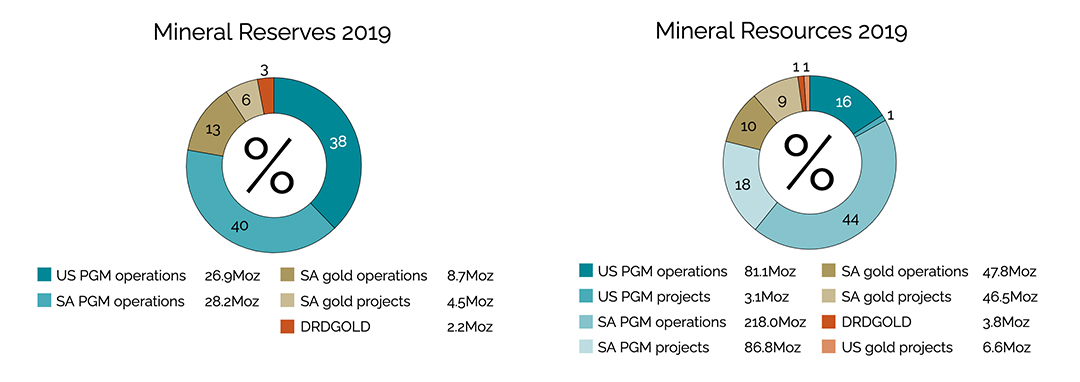

Sibanye-Stillwater is a diversified metals producer and the largest individual producer of gold from South Africa and one of the ten largest gold producers globally. The company is also the world’s third largest producer of palladium and platinum.

Sibanye generates most of its EBITDA from platinum group metals (PGMs) with South Africa accounting for 58.8% of 2019 EBITDA and the United States representing 48.7%.

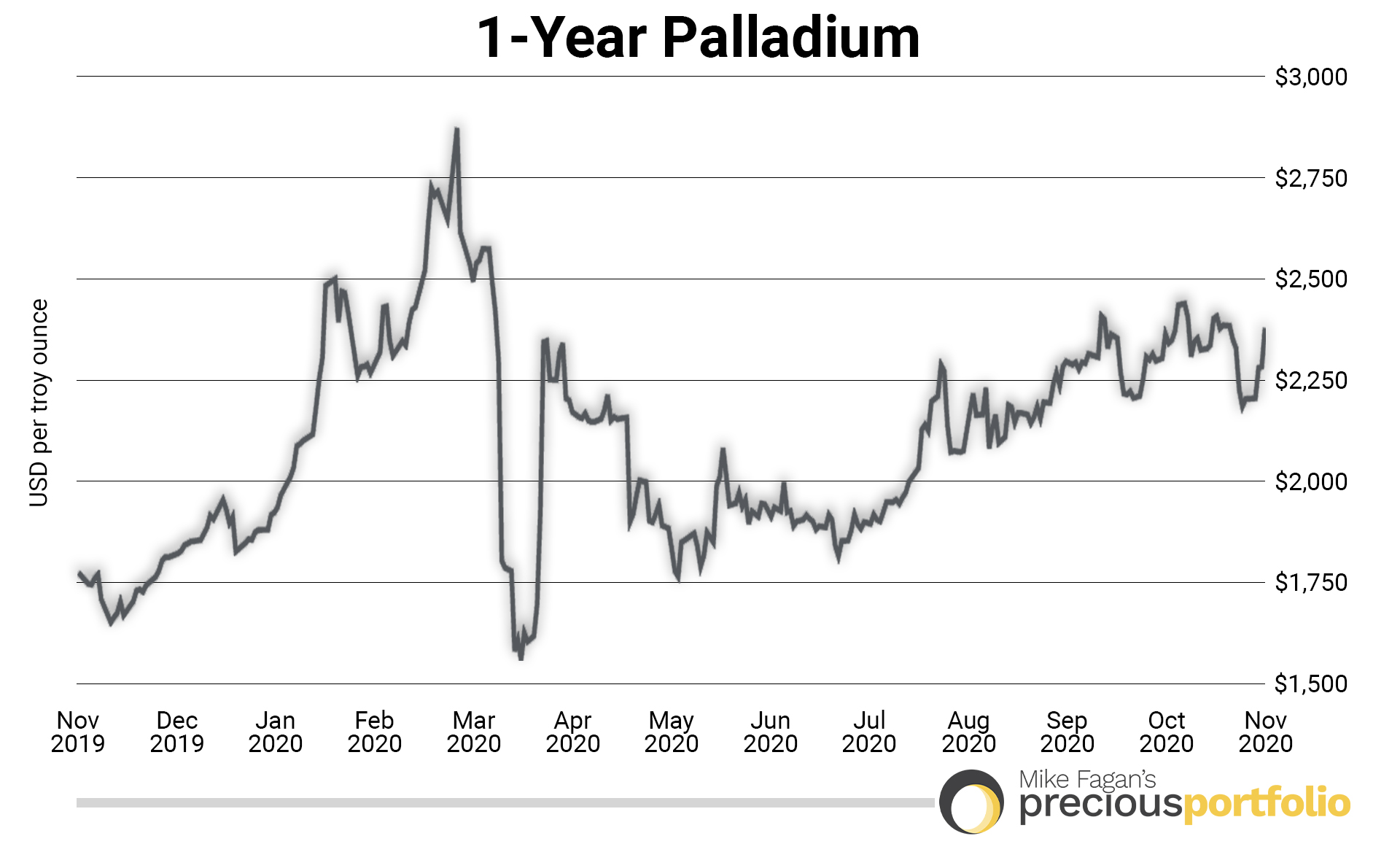

Demand for palladium is expected to increase over the next decade as China, Europe, and India implement tighter emission standards for cars and trucks.

Sibanye’s gold projects in the South African region include Beatrix, Cooke, Driefontein, and Kloof. Its PGM projects include Kroondal, Rustenburg (Marikana), Mimosa, and Platinum Mile.

Sibanye’s other projects in the South African region include Burnstone, Kloof Decline, Driefontein decline, The West Rand Tailings Retreatment Project (WRTRP), and The Southern Free State (SOFS) project.

The company’s PGM projects in the Americas include East Boulder, Stillwater, and the Columbus Metallurgical Complex. Its other projects in the Americas include Blitz, Altar, and Marathon.

Sibanye posted record earnings in Q2 2020 despite significant COVID-19 disruptions in its South African operations; the company has contributed approximately US$100 million to-date to COVID-19 social relief efforts.

Importantly, management has been deploying an intelligent acquisition strategy with 94% of the company’s Q2 2020 earnings derived from recently acquired operations.

Record earnings - despite COVID-19

- Q2 2020 impacted by COVID-19 but anchored by strong Q1 2020

- 8x increase in adjusted EBITDA year-on-year

- US$990m vs US$142m in H1 2019

- 94% of earnings from operations acquired through successful acquisition strategy

- Deleveraged back to pre-acquisition levels

Sibanye recently declared a quarterly dividend of US11.8 cents per share; management discussions appear to favor adjusting to a higher dividend amount at some point within the next few business quarters.

Sibanye-Stillwater has approximately 731 million shares outstanding for a current market cap of US$9.8 billion. The company posted record earnings for the six months ended June 2020 of US$531 million and adjusted free cash flow of US$655 million.

In the first half of 2020, cash and cash equivalents increased by US$293 million to US$694 million and net debt was reduced by 38% to US$930 million.

Current price: US$13.32 per SBSW share: Buy up to US$13.40

Establish your Sibanye-Stillwater (NYSE: SBSW) position incrementally and look for opportunities to buy on weakness. Learn more about Sibanye-Stillwater at www.SibanyeStillwater.com.

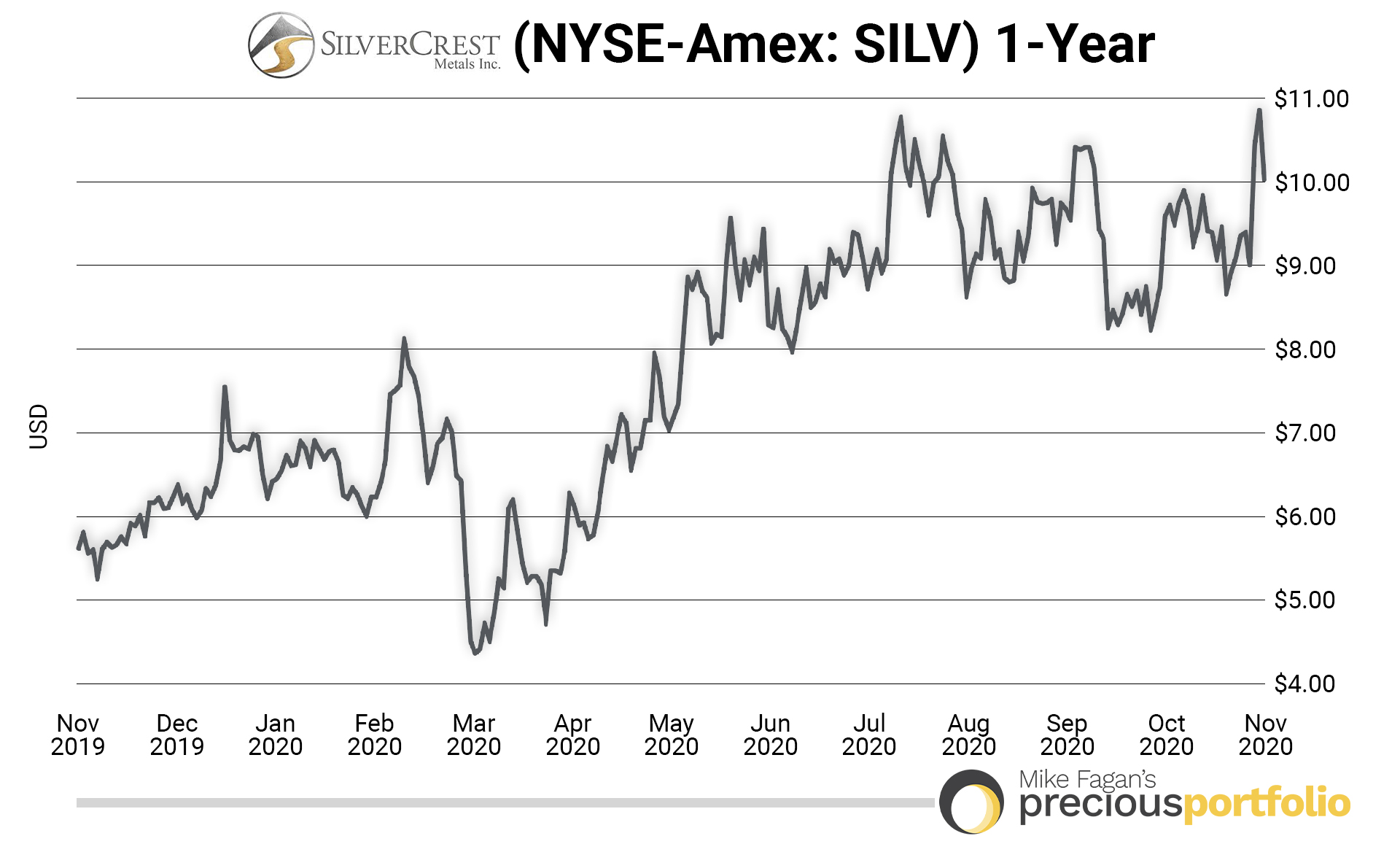

Tier-2: SilverCrest Metals Inc. (NYSE-Amex: SILV)(TSX: SIL) → BUY

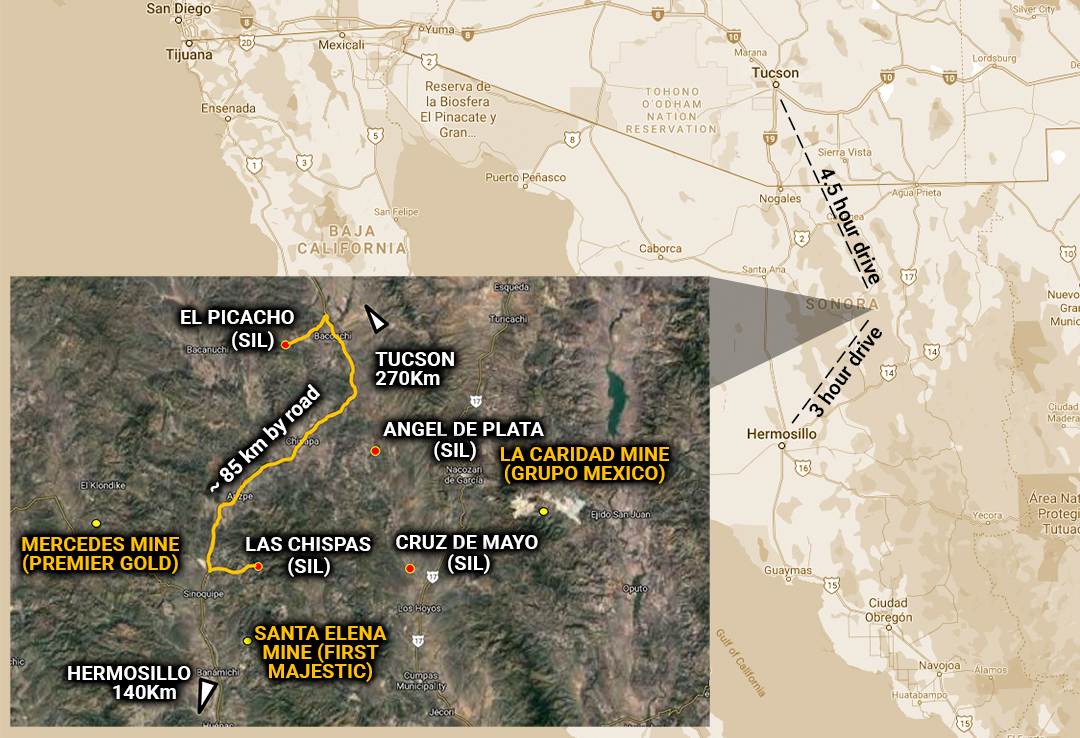

SilverCrest Metals is a Canadian precious metals exploration company focused on new discoveries, value-added acquisitions, and targeting production in northwest Mexico’s historic precious metal districts.

SilverCrest is the first company to drill-test the historic, high-grade Las Chispas Silver-Gold project in Sonora, Mexico, which is a past producer and the 3rd highest-grade primary silver deposit in the world.

The ore from this project is so impressive that specimens from Las Chispas are on display at the New York Museum of Natural History.

SilverCrest Metals is led by CEO, Eric Fier, who discovered, permitted, financed, built (on-time and under budget), and operated the Santa Elena Mine nearby to the Las Chispas property. He also built 5 other mines. The company’s COO, Pierre Beaudoin, led the design and construction of the Detour Lake Mine — Canada’s largest mine.

Las Chispas is the flagship project; current drilling has intersected significant mineralization on 70% of drill holes to-date including a new discovery zone called El Muerto where drilling will continue into next year.

The Las Chispas property consists of 28 concessions totalling 3,450 acres wherein the company has 16 drill rigs testing discovery, expansion, and infill targets.

Only 10 of 43 known veins have been put toward the latest resource estimate leaving 33 veins to still be significantly drill-tested. A Feasibility Study is currently underway and scheduled for completion in Q4 2020 and is projected to include 20 of the 43 known veins.

During the first half of 2020, the company completed approximately 97,700 meters of infill and expansion drilling (66% in-fill and 34% expansion).

Target budgeted drilling of an estimated 48,000 meters is planned for the second half of 2020 focusing on high-grade resource expansion. SilverCrest has drilled an estimated 400,000 meters across 1,480 drill holes since inception of the project.

Last year’s Prefeasibility Study on the Las Chispas Silver-Gold project returned the following projections based on a silver price of $16.68/oz and a gold price of $1,269/oz:

- 1,250 tonnes per day (“tpd”) production rate with an initial mine life of 8.5 years;

- Average diluted grades for silver (or “Ag”) at 411.0 grams per tonne (“gpt”), gold (or “Au”) at 4.05 gpt and silver equivalent (or “AgEq”; based on 75 (Ag): 1 (Au), defined in table below) at 714 gpt;

- Average annual production of 5,384,000 oz Ag and 55,700 oz Au, or 9.6 million oz AgEq;

- Years 1 to 4: average annual production of 7,575,000 oz Ag and 81,600 oz Au (13.7 million oz AgEq).

- Life-Of-Mine (“LOM”) All-in sustaining cash costs (“AISC”) of $7.52/oz AgEq;

- Years 1 to 4: AISC of $4.89/oz AgEq.

- Initial Capital Expenditure (“Capex”) of $100.5 million;

- LOM Sustaining Capex of $50.3 million;

- Payback period of 9 months;

- After-tax IRR of 78%;

- After-tax NPV of $406.9 million; and

- Cumulative Undiscounted Net Free Cash Flow of $522.5 million.

In addition to an impressive IRR of 78% and short payback period of 9 months, another key takeaway is that, in the first 4 years of production (assuming the mine is put into production), the company should be able to produce an ounce of silver at less than US$5 per ounce. That makes the company a prime potential takeover target with silver currently trading right around US$24.50 per ounce.

On the acquisition front, earlier this year, the company acquired the El Picacho Property – located just 25 miles northeast of the Las Chispas project – which could become a standalone mine or a satellite project for additional mill feed to Las Chispas. The property is a historic gold and silver producer with the first noted production in the late-1800s with grades greater than 15 grams per tonne gold.

SilverCrest is well-funded with cash and cash equivalents of US$157 million as of July 2020. The company has approximately 129 million shares outstanding for a current market cap of US$1.3 billion.

Current price: US$9.86 per SILV share: Buy up to US$9.95

Establish your SilverCrest Metals (NYSE-Amex: SILV)(TSX: SIL) position incrementally and look for opportunities to buy on weakness. Learn more about SilverCrest and its other Mexico gold-silver projects at www.SilverCrestMetals.com.

Upcoming…

In our next bi-weekly alert, we’ll be adding an additional 1 to 2 stocks to our Precious Portfolio; we are currently reviewing a number of small-cap, mid-tier, and large-cap resource stocks that meet our criteria.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3

Make sure you never miss an update or issue from Mike Fagan’s Precious Portfolio by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Mike Fagan’s Precious Portfolio, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Mike Fagan’s Precious Portfolio does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.