Mid-Tier Takeovers for 2021 and Beyond: Two Top Candidates for Premium Takeovers

Rick Rule of Sprott Inc. (NYSE: SII) says the climate is ripe for a steady stream of mergers and acquisitions, not merely in precious metals, but throughout natural resources.

Bigger companies are more liquid, so they have a lower cost of capital. They spread opportunity sets over a bigger asset base, and they have less general and administrative expenses relative to their operating expense. So there's huge drivers to M&A.

There are two ways to play it. One, find the companies that are vulnerable to takeover. Not just companies that appear cheap, but companies where there's a logical strategic buyer for the asset.

You have to dig deep to play this game and that is precisely what we’ve done with the two takeover candidates featured below.

The other is to find the teams that have a history of being able to buy assets that are cast off by others in amalgamation.

Rick often talks about the historic examples of Silver Standard, Pan American, and Lumina Copper. Those were teams that were able to buy assets that had languished in other corporate vehicles and then build enormous companies out of them.

So, again, there's two ways to play M&A. One, buy the targets. And two, back the teams that use the M&A market to grow more rapidly than they otherwise could. Both of those approaches should do very well in the current metals cycle.

In general, buying the targets can result in a more immediate win as target companies are typically bought out at a substantial premium to the current share price.

They also offer the added benefit of having the potential to appreciate on their own through the advancement of projects within their own portfolio — especially in a rising commodities market; in this case, gold/silver. And on top of that, many mid-tier producers, including the two featured below, pay a quarterly dividend.

Following are two very well run precious metals miners that we believe are well-positioned as key potential takeover targets in the current metals cycle.

Two Top Candidates for Premium Takeovers

Hecla Mining Co. (NYSE: HL)

Established in 1891, Hecla Mining Company is the largest and lowest cash cost silver producer in the United States and is responsible for about one-third of all silver produced in the USA.

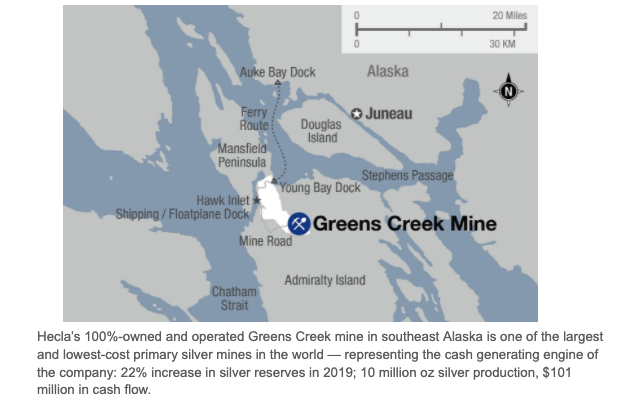

The company has operating silver mines in Alaska (Greens Creek), Idaho (Lucky Friday), and Mexico (San Sebastian) and is a growing gold producer with operating mines in Quebec, Canada (Casa Berardi) and Nevada (Fire Creek).

In addition to its diversified silver and gold operating and cash-flow generating base, Hecla has a number of exploration properties and pre-development projects in 8 world-class silver and gold mining districts in North America.

With an active exploration and development program, the company has consistently grown its reserve base for future production with reserves totaling 212 million ounces of silver and 2.7 million ounces of gold reserves — all calculated using some of the lowest price assumptions in the industry.

Hecla Mining has done an outstanding job managing the COVID-19 crisis including bringing in a lab to Juneau, Alaska, to provide real-time testing at the Greens Creek mining operation.

In Q3 2020, the company produced 3.5 million ounces of silver and 41,000 ounces of gold, and, aided by strong silver margins, recorded its highest level of free cash flow in a decade.

Hecla’s 100%-owned and operated Greens Creek mine in southeast Alaska is one of the largest and lowest-cost primary silver mines in the world. Last year, the mine produced 9.9 million ounces of silver at an average cash cost of $1.97 per ounce (Note: silver currently trades north of $25 per ounce).

Hecla recently announced the following mining updates:

Greens Creek Mine, Alaska: At the Greens Creek mine, 2.6 million ounces of silver and 12,838 ounces of gold were produced in the quarter. Higher silver production compared to the third quarter of 2019 was due to slightly higher ore production and grades. The mill operated at an average of 2,340 tons per day (tpd). Greens Creek’s nine months production was higher than anticipated due to higher silver grades. The fourth quarter assumes planned grades.

Lucky Friday Mine, Idaho: At the Lucky Friday mine, 636,389 ounces of silver were produced in the quarter. The mine has continued normal operations during the pandemic with the ramp-up proceeding as planned. Lucky Friday is expected to increase production in the fourth quarter to full throughput before the end of the year resulting in an estimated annual production of approximately 3 million ounces in 2021.

Casa Berardi Mine, Quebec, Canada: At the Casa Berardi mine, 26,405 ounces of gold were produced in the quarter, including 6,800 ounces from the East Mine Crown Pillar pit, with the decrease primarily due to lower mill throughput resulting from major planned mill maintenance activities. The mill operated at an average of 3,138 tpd. Casa Berardi’s nine-month production was lower than anticipated because of the government-mandated shutdown and planned mill maintenance activities, but production in the fourth quarter should increase due to expected high-grade underground production from the East Mine.

San Sebastian Mine, Durango, Mexico: At the San Sebastian mine, 0.3 million ounces of silver and 1,931 ounces of gold were produced in the quarter. Mining was completed in the third quarter and milling is expected to be completed in the fourth quarter of 2020. The mill operated at an average of 512 tpd. The Company continues to explore this highly prospective land package and will evaluate further mining based on exploration success.

Nevada Operations (Elko County, NV): At the Nevada operations, ore mined during the quarter has been stockpiled for the third-party processing expected in the fourth quarter. Gold production may not be realized until the first quarter of 2021. Mining of non-refractory ore is substantially complete. Mining of refractory ore for the bulk sample test is expected to continue through the remainder of 2020. Production from this test is expected to be between 5 and 10 thousand ounces of gold.

Additionally, Hecla has acquired a ~10% interest in junior silver company, Dolly Varden (TSX-V: DV)(OTC: DOLLF), which is advancing a 40 million-plus ounce silver project in British Columbia, Canada.

Hecla also recently announced a 50% increase in its quarterly dividend plus a lower realized price threshold for its silver-linked dividend. On a per ounce produced basis at $25, the aggregate dividend returns more than 5% of the silver price.

Alamos Gold (NYSE: AGI)(TSX: AGI)

Alamos Gold – which was formed in 2003 via the merger of Alamos Minerals and National Gold – is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America.

That includes the Young-Davidson and Island Gold mines in northern Ontario, Canada, and the Mulatos mine in Sonora State, Mexico.

Additionally, the company has a leading growth profile via a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States.

Alamos boasts a long-life reserve base with 9.7 million ounces in Proven and Probable Mineral Reserves plus 7 million ounces in the M&I (Measured & Indicated) category and another 5.9 million ounces in the Inferred category.

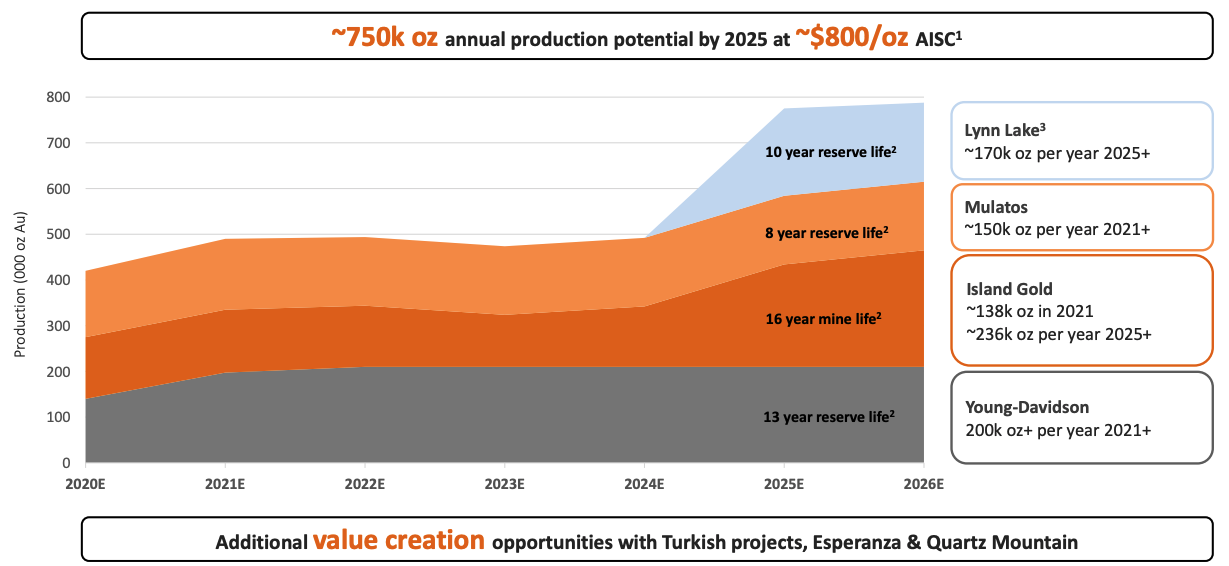

The company produces well over 400,000 ounces of gold per year on average from its combined operations at AISC (All-In Sustaining Cost) of $1,030-$1,070 per ounce.

So there’s a lot to like whether you’re an investor or a major looking to acquire.

The Young-Davidson Mine near Kirkland Lake, Ontario, is the company’s flagship operation and is considered one of Canada’s largest underground gold mines. At ~140,000 gold ounces per year at AISC (All-In Sustaining Cost) of $1,180-$1,220 per ounce, the project should continue to serve as a foundation for growth for Alamos for many years to come.

The company’s Island Gold Mine, also located in Ontario, is regarded as one of Canada’s highest grade and lowest cost gold mines. Through ongoing exploration success, its Mineral Reserves and Resources have continued to grow in size and quality.

The mine produces ~135,000 gold ounces per year at AISC of $740-$780 per ounce. The mine is expected to produce over 240,000 ounces annually once the Phase III expansion is completed in 2025.

The Mulatos Mine is Alamos Gold’s founding operation. It was acquired for $10 million and has produced over two million ounces of gold and has generated more than $400 million in free cash flow since 2005. At ~145,000 gold ounces per year at AISC of $940-$980 per ounce, Mulatos remains a consistent gold producer and significant cash flow generator for Alamos with strong exploration potential.

Alamos has paid a dividend every year for more than a decade and has returned over US$179 million to shareholders to date. Most recently, the company declared a quarterly dividend of US$0.015 per common share.

In Closing

Hecla Mining and Alamos Gold offer speculators exposure to gold/silver with current production plus exploration upside. Both pay a quarterly dividend, and both have the potential to be bought out by a larger producer at a substantial share price premium in the current metals cycle.