Junior Resource Monthly October 2020

Allow me to reintroduce myself.

I’ve always wanted to use that line and given the recent transition I thought it appropriate.

Jokes aside, before we talk gold, copper, portfolio news, etc., I want to say thank you to everyone that’s followed Nick Hodge and I to our new venture, Digest Publishing.

In the coming months we plan on launching the new website which will include all the premium publications we’re proud to bring you. Continuity to subscribers was important to us and the most practical way to keep bringing you our research and insights was through the existing Resource Stock Digest platform.

More on that in a second, but first let me thank you for the kind words and well wishes.

It’s been energizing hearing from so many of you.

For those of you familiar with our work, we look forward to continuing the hard work it takes to deliver the research and insights you’ve grown accustomed to.

For those of you that are new to my work, a few important clarifications.

Nick Hodge and I co-own Resource Stock Digest. The site is a great resource for free research and features companies we feel have merit, along with insights from some of the top minds in the resource space.

Companies pay a fee to sponsor the site (which is how we keep it free for you) and it’s important to us that we are clear that those companies are not recommendations, they are companies we think merit further due diligence.

Only companies in our premium letters — with specific guidance — should be viewed as recommendations as the criteria is different.

There will be companies that are sponsors that make it into our premium letters but be clear that they are there for one reason and one reason only, because we feel they can make you money. Plain and simple.

Those of you that were subscribers to my previous letter — Junior Mining Monthly — should know that the portfolio for Junior Resource Monthly will continue as it was prior to the transition.

On to the markets.

Electrification Trend Accelerates

Every commodity across the commodity complex is currently in a supply deficit with the exception of iron ore, coffee and cocoa.

The reason isn’t overwhelming demand — yet — it’s the structural underinvestment over the past decade.

That’s a long-winded way of saying we are entering the sweet spot of the cycle where quality deposits of gold, copper, silver, palladium, even lithium will command a significant premium in the coming years.

Knowing how to identify those early on is the difference between making double digit gains and triple or even quadruple digit gains in this space.

Nothing wrong with either but there is a big difference.

Wood Mackenzie recently published a report showing that more than $1 trillion of investment will be needed in energy transition metals — their words not mine — like aluminum, cobalt, copper, nickel and lithium — over the next 15 years just to meet the growing demands of decarbonization.

The paradigm shift towards clean energy cannot happen without abundant supplies of these metals.

Companies that are able to adapt will not only survive but thrive.

Speculators that are able to identify the companies that will find the stuff needed to make the stuff people need and want will not only do well, they’ll make a fortune.

Which brings me to gold.

Gold

The perfect storm is building for gold.

One of the world’s largest gold producers in the world — Barrick Gold — estimates a 10.8% drop in third-quarter gold production. It’s not from lack of wanting to take advantage of elevated gold prices, it’s the lack of supply available to mine.

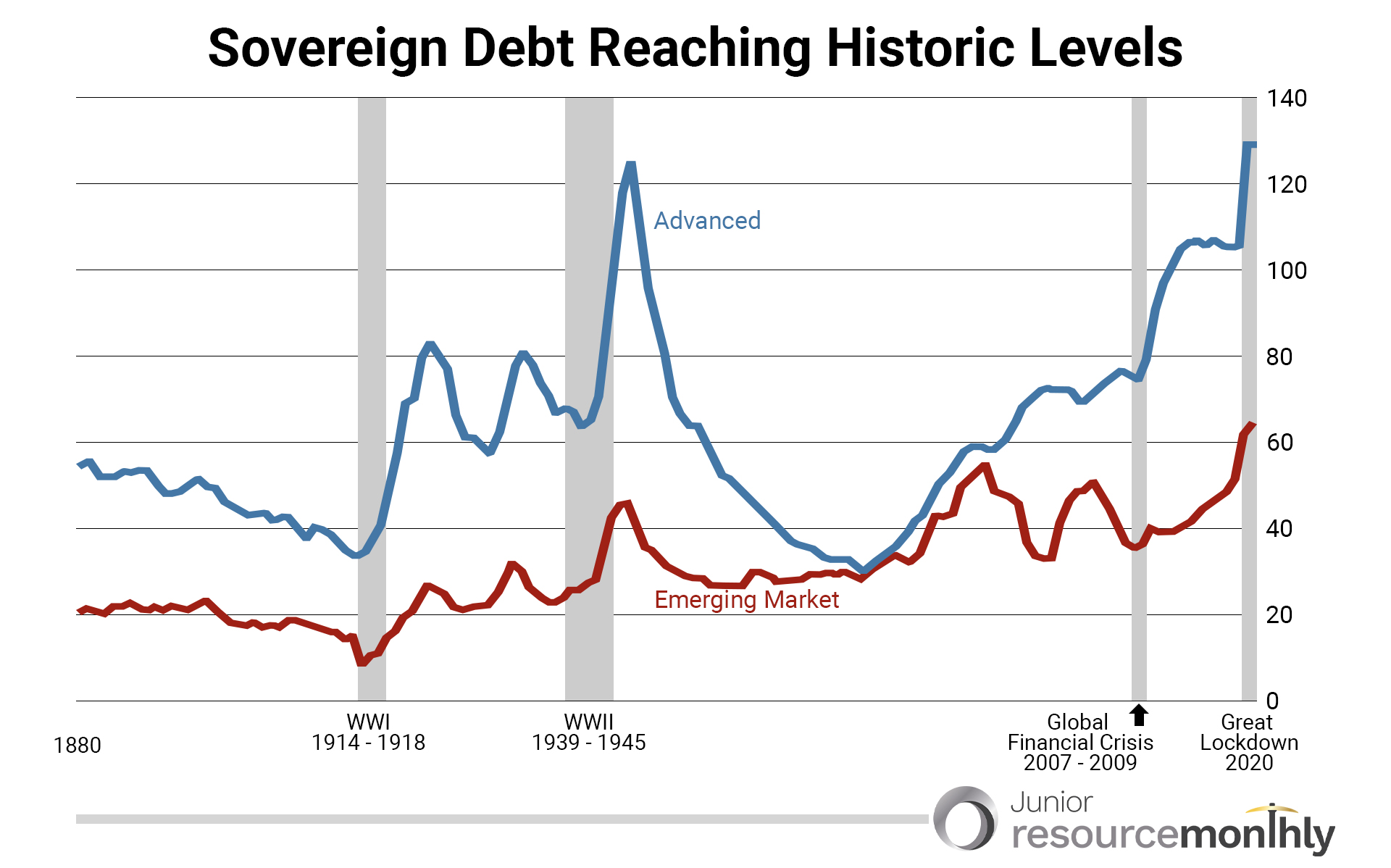

Simultaneously the people — central banks — in charge of monetary policy have signaled they’ll do whatever its takes to backstop financial markets and are begging the people in charge of fiscal policy — politicians — to provide more fiscal stimulus so the central banks can create money out of thin air and buy the stuff — stocks and bonds — that keeps rich people rich.

All during a pandemic. I can’t make this stuff up and it’d be funny if it wasn’t so tragic.

As the Financial Times recently reported, according to the IMF’s Fiscal Monitor, fiscal support has amounted to $11.7 trillion, or close to 12% of global GDP, as of September 11 2020.

In Europe the ECB’s balance sheet just hit a new all time high. The ECB balance sheet is now equal to 66% of Eurozone GDP versus the BoJ’s 137% and the Fed’s 37%.

Again, one day the dollar will meet its maker but for the time being it’s the best in class among a lot of bad choices.

Back to gold and why the recent consolidation in the gold space — and the resource equities — is healthy and necessary.

Monetary and fiscal policy is as predictable as I’ve ever seen it. Faith in governments continues to wither and be clear, government realizes the current monetary system is living on borrowed time.

Bitcoin has surged to multi-year highs recently as none other than the IMF has published its study on the “complex interactions between the incentives to adopt and use central bank digital currencies (CBDCs) and global stable coins (GSCs).

You can read the paper here.

Corporations aren’t waiting around for central bank, governments or institutions to make the pivot away from paper currencies.

Paypal just announced it would begin supporting cryptocurrencies for the first time, allowing any PayPal account holder to store, buy, and sell popular virtual currencies starting later this year.

Much like the gold space, billionaire fund managers like Paul Tudor Jones are now turning bullish on cryptocurrencies.

This service doesn’t focus on cryptocurrencies but does like to get ahead of trends.

I’ve said for years that the next time gold hit real all-time highs it would need to do so alongside not just cryptocurrencies but alongside a higher dollar.

That has yet to happen as the dollar flirted higher before retreating below the 93 level.

I continue to believe the dollar is in for a run higher predicated on the structural deficiencies in other currencies, specifically the Euro.

Could a significant run higher for the dollar lead to a short-term pullback in the gold price in Q1 of 2021? Absolutely.

Does that change the narrative in the mid-long term?

Absolutely not.

To be clear I believe the next move for gold is higher, but to hedge the potential for a pullback in the next few months I’m making it a point to focus my buying in companies that aren’t just depending on higher commodity prices but have company specific catalysts that if successful will move shares higher.

Luckily there are multiple JRM portfolio companies with drill bits turning and assays pending.

On to portfolio news.

Portfolio News

Let’s start with a company that delivered the most misinterpreted set of results of the past several weeks, Revival Gold (TSX-V: RVG) (OTCQB: RVLGF).

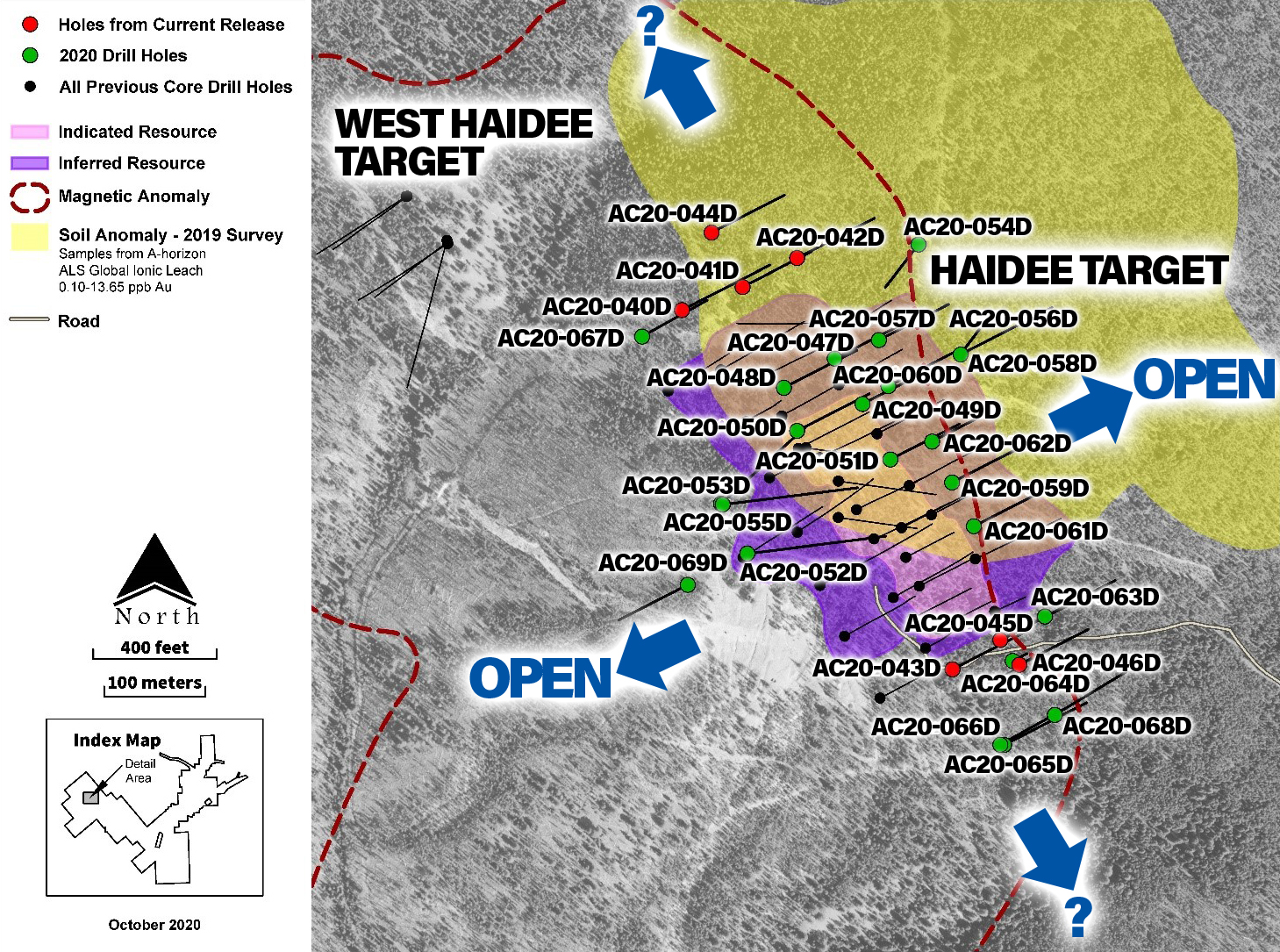

On October 15, 2020 Revival announced results from the first seven holes from the 2020 drill campaign.

The generalist takeaway by the average retail investor — and even a few newsletter writers that are supposed to know better — was that the grade of mineralization was below expectation and the grades were underwhelming.

Let’s break that down.

The highlight numbers included 22.9 meters of 0.63 g/t gold from hole AC20-43D, 41 meters of 0.38 g/t gold in hole AC20-42D and 9.9 meters of 0.30 g/t gold in hole AC20-41D.

The seven holes released were all from the Haidee target area at Arnett and all intersected near-surface leachable mineralization that extended known mineralization beyond the current resource approximately 100 meters to the northwest and 50 meters to the southeast.

This is important. If you’re looking for gold and you find more of it in an area that looks to be an economic satellite deposit to Beartrack, you would think the stock would react positively. It will.

The final point is another critical point that got lost in the release.

A 470-meter exploration drill hole between the North and South Pits was drilled that connects both pits.

Hole BT20-226D intersected the Panther Creek Shear Zone, which is the primary control for Beartrack mineralization, and encountered both oxidized and unoxidized sulfides.

Four follow-up holes are planned for this area and drill pad preparation is underway.

I spoke with Hugh Agro to go over the first set of results, the importance of hole 226D and the ongoing drill program.

You can listen to that here.

Chakana Copper (TSX-V: PERU) (OTCQB: CHKKF)

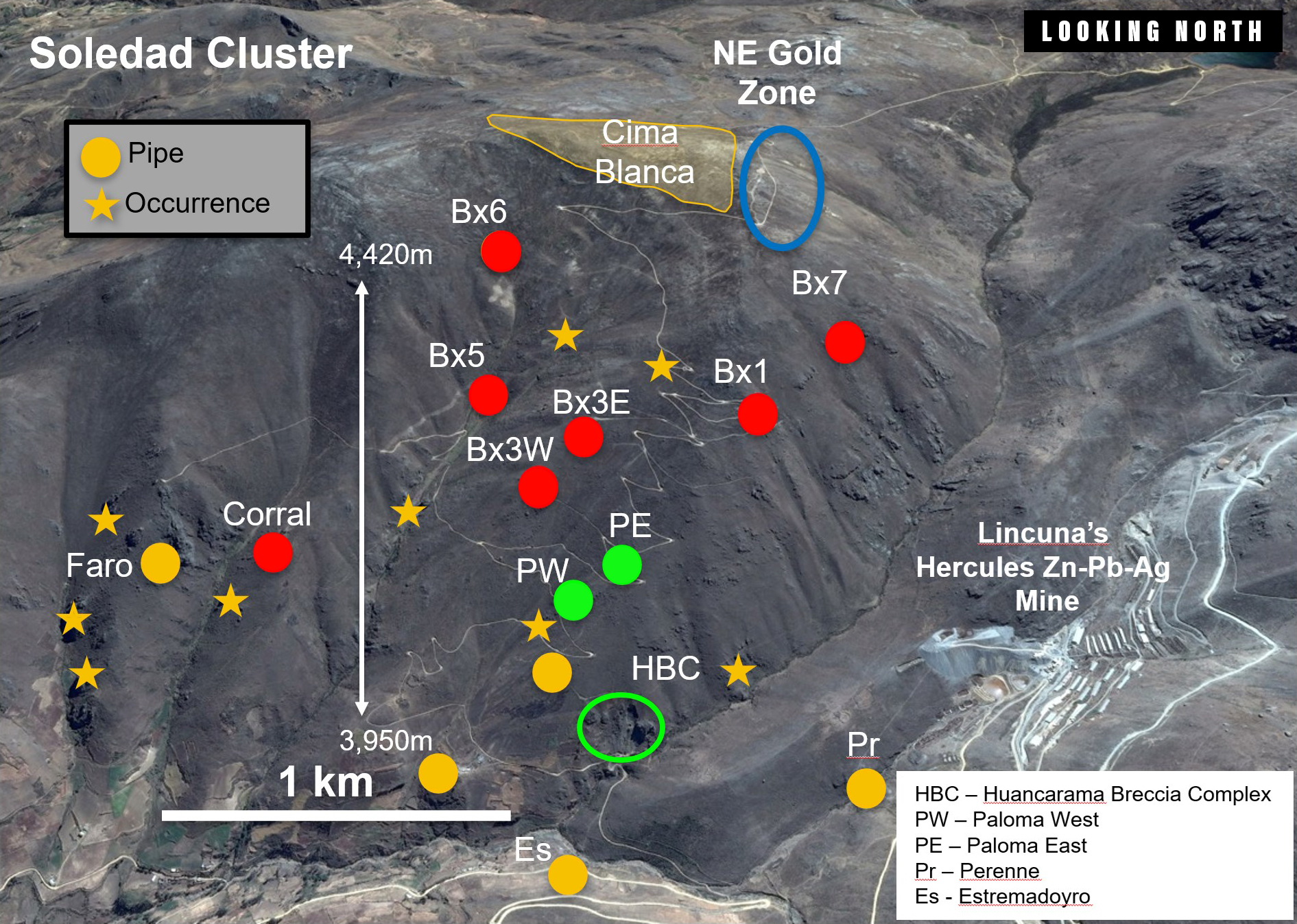

On October 26, 2020 Chakana delivered exactly what I thought — and hoped — it would, very good results from the Paloma East target at its high-grade copper-gold-silver Soledad project in Peru.

The four holes reported include the highlight intercept of 226 meters of 0.34 g/t gold, 0.36% copper and 16.9 g/t silver from a depth of three meters.

Here are the highlights from the release.

Significant intervals of mineralization were encountered in all four holes.

Elevated gold occurs in the top of holes SDH20-137, SDH20-138, and SDH20-139 with intercepts of 51.0 meters with 1.27 g/t gold and 23.9 g/t silver starting from 6.0 meters depth; 15.0 meters with 2.26 g/t gold and 16.6 g/t silver beginning at 21.0 meters depth; and 31.0 meters with 1.10 g/t gold and 8.8 g/t silver from 3.0 meters depth, respectively.

In SDH20-138 - a long interval of moderate grade mineralization was intersected with 226.0 meters with 0.34 g/t gold, 0.36 % copper and 16.9 g/t silver (1.11 g/t gold equivalent) from 3.0 meters.

Higher grade copper intercepts occur in each hole with 6.35 meters of 2.27% copper in SDH20-136 from 49.35 metres; 24.00 meters with 0.80% copper in SDH20-137 from 57.00 meters; 33.00 meters of 0.99% copper in SDH20-138 from 64.00 meters; and 9.45 meters of 1.19% copper in SDH20-139 from 136.45 meters.

David Kelley, President and CEO commented, “These four scout drill holes provide additional support for an extensive mineralized breccia system at Paloma. The long runs of mineralized breccia starting near surface and extending to approximately 200 metres depth is encouraging, particularly with indications of high-grade zones within the breccia. The shape of the breccia expands at depth, similar to what we have seen in several other breccia pipes.”

Pipes that have been drilled in previous campaigns are shown in red. Targets shown in green are the focus on this 15,000m drill campaign.

Phase 3 is testing a tight cluster of high-grade, gold-enriched tourmaline breccia pipe targets within the high-priority Paloma area and will then continue onto the Huancarama breccia complex which many believe is the best target on the property.

Hole SDH20-137 is also teasing the potential for an underlying intrusion.

The last 53 meters of breccia in the hole had elevated molybdenum, reaching 1,430 ppm and averaging 204 ppm (0.02% Mo). The hole is described in the release as a significantly expanded breccia system with high concentrations of pyrite where copper replacement may occur, association with a large late-time TDEM anomaly, and evidence of proximity to an underlying intrusion.

Drilling is ongoing and we can expect consistent news flow for the next several months.

Be absolutely clear, Chakana is on its way to outlining a significant resource and is a strong buy at these levels.

I spoke with CEO David Kelley about the results. You can listen to that here.

Nevada Sunrise Gold (TSX-V: NEV) (OTC: NVSGF)

Game on for Nevada Sunrise, though you wouldn’t know it from the share price.

Drilling at Kinsley continues and is headed towards a total of fifty holes.

Assays are due to start coming in mid-November and we should know soon whether or not we are off to the races.

Meanwhile the company isn’t content on just waiting on Kinsley and is providing multiple shots on goal.

On October 26, 2020 Nevada Sunrise announced that drilling should commence by October 30, 2020 at the Coronado VMS copper property in Nevada.

Exploration by Nevada Sunrise at Coronado has outlined a strong conductive system located within favorable geology in conjunction with a geochemical anomaly, supporting the Company's belief that volcanogenic massive sulphide ("VMS") deposits could be present.

The 2020 Phase 1 drill program is planned to test the Coronado South conductor and consists of up to three diamond drill holes totaling approximately 2,500 feet (762 meters).

Coronado lies within the Tobin and Sonoma Range on a geological trend that includes the past-producing Big Mike open pit mine, where high-grade copper was discovered in the late 1960s resulting in copper production into the 1970s.

VMS deposits tend to occur in clusters and the company believes there is considerable potential for a discovery.

While Nevada Sunrise owns 20% of Kinsley Mountain, it has the right to earn into 100% of Coronado.

Nevada Sunrise is a strong buy at these levels.

While companies that are drilling deserve the bulk of any new capital you want to allocate, it’s important to look forward a bit at companies that will be drilling and present compelling speculations.

I spoke with CEO Warren Stanyer about assays at Kinsley and the upcoming drilling program at Coronado. You can listen to that here.

Enter Abacus Mining & Exploration (TSX-V: AME) (OTC: ABCFF).

Abacus holds a 20% ownership interest in the Ajax copper-gold project, located near Kamloops, British Columbia, which is managed by base metal major KGHM. Abacus owns 20% of 2.7 billion pounds of copper, 2.6 million ounces of gold and 5.3 million ounces of silver.

You would think that would command more than a market cap of approximately C$11 million.

Granted the company suffered a permit denial several years ago (during a brutal bear market) which led to a significant drop in share price. One I’ve used to accumulate a sizable position.

A position I’ll likely add to soon. Here’s why.

The company has hired a new local superintendent whose duties will initially be focused on First Nations, on community and on governmental engagement in order to advance the project towards a potential resubmission of the environmental application.

There are mines nearby, I believe the economic stimulus to the area is more attractive given the lockdowns and hit to the local economy. Once the market catches on I believe shares will be re-rated significantly higher.

In the meantime the company has announced a program of ground IP geophysics has begun at its Jersey Valley gold property, within the Battle Mountain trend of north-central Nevada.

Abacus recently reprocessed the historic IP data, which very clearly shows two flat-lying anomalies (see Company website). The largest target is approximately 600 meters long by 500 meters wide. Both targets are open along strike to the northeast and southwest. The Company doubled the claim size in July of 2020 to cover the southwestern strike extent of these anomalies.

The reprocessing has highlighted the fact that the best portions of the two IP targets are essentially untested and the company plans on testing those targets with the drill bit in late Q4 of this year or early Q1.

In addition, the company is discussing — and I’m advocating for — a testing of the very prospective Willow copper-gold property also in Nevada.

Drilling by the company in 2018 intersected a key intrusive rock unit on Willow that hosts all known porphyry Cu-Mo deposits at the Yerington copper camp.

This rock unit was not previously known to exist on the company’s property, and it represents a significant new discovery.

A discovery I believe will be tested with a drill bit in Q1/Q2 of 2021.

A lot of copper, a lot of gold and the potential for discoveries at multiple properties in one of the best mining jurisdictions in the world.

Abacus is a strong buy at these levels, though I caution that it may take a month or two before we see renewed momentum in the share price.

K2 Gold (TSX-V: KTO) (OTCQB: KTGDF)

Make sure you own K2 Gold.

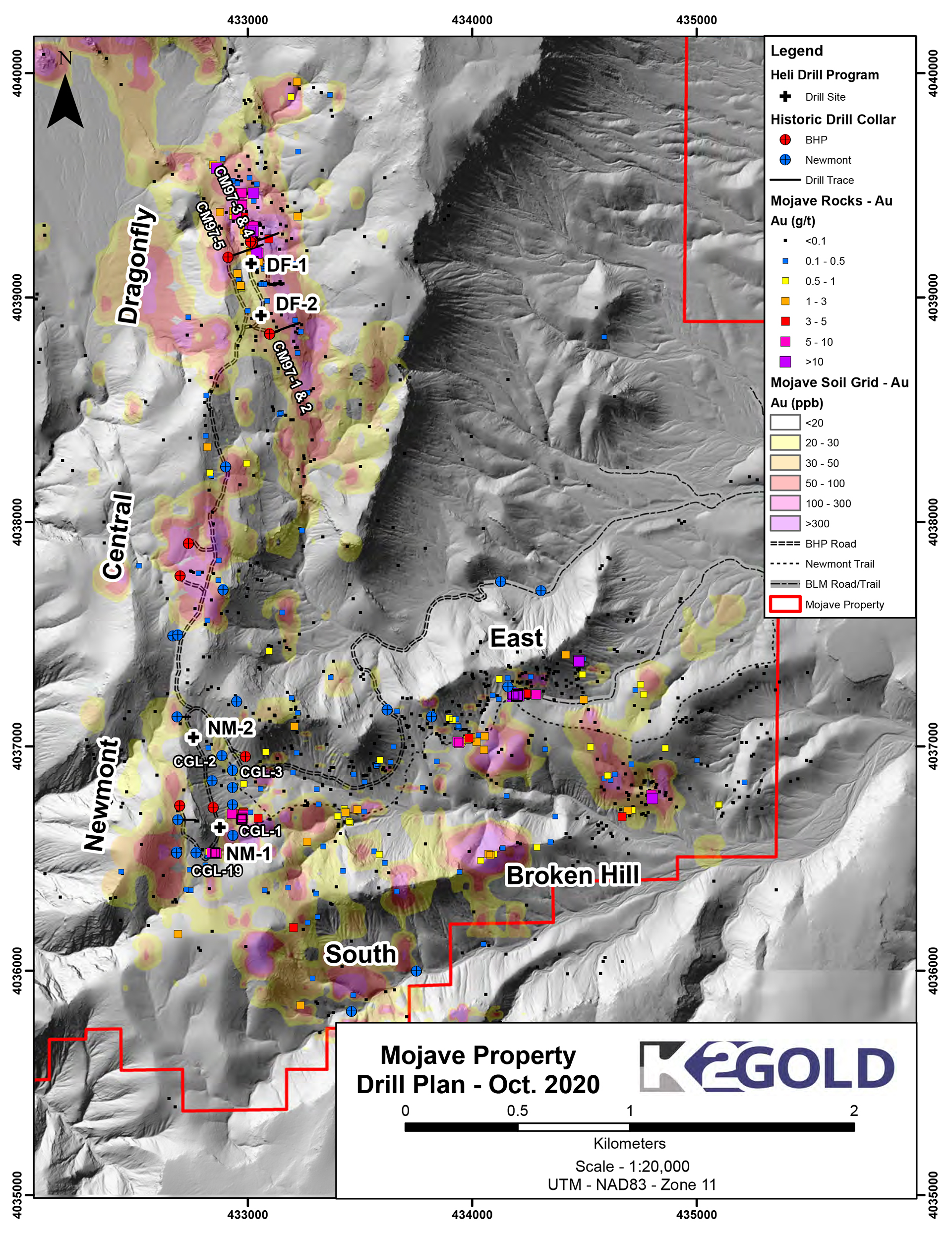

On October 13, 2020 K2 announced the commencement of the company's first drilling program at the high-grade oxide Mojave gold project. The same Mojave project that Chairman John Robins describes as one of the most exciting exploration opportunities he’s ever worked on.

“We have now safely mobilized a drill rig and personnel to Mojave – a high grade oxide gold project which has not been drilled since BHP's 10-hole program in 1997,” stated Stephen Swatton, President and CEO of K2. “With approximately $2.5 million in cash, K2 is fully financed to complete this initial drilling campaign comprising four sites on the Eastern side of the property.”

K2 is permitted to drill two sites at Dragonfly and each will be located at least 90m from previous BHP drilling.

Drilling which was very successful and returned intercepts of up to 4.2 g/t gold over 42.7 meters.

The company is very confident in the targets and with good reason.

I spoke with CEO Stephen Swatton about the project and the targets. You can listen to that here.

The drill program is expected to last approximately three weeks. Rock chip samples will be shipped to MSALABS laboratory in Vancouver, Canada, with an anticipated turnaround time for analysis of rock samples between 3-4 weeks.

K2 is a strong buy at these levels.

Midas Gold (TSX-V:MAX) (OTC: MDRPF)

Midas is entering a very critical part of the “boring” permitting period.

The comment period ended on October 28, 2020 which means we should expect the feasibility study within the next month or two.

The study is an important catalyst as it will allow for the use of higher gold prices than what was included in the pre-feasibility study.

The study will also be able to demonstrate economics using a lower corporate tax rate.

I spoke with CEO Stephen Quin who went over the many near-term catalysts as Midas moves towards what looks like a permit in the sweet spot of the gold bull cycle.

You can listen to that here.

Mawson Gold (TSX-V: MAW) (OTC: MWSNF)

Few JRM companies — Magna is the exception — are as busy as Mawson Gold.

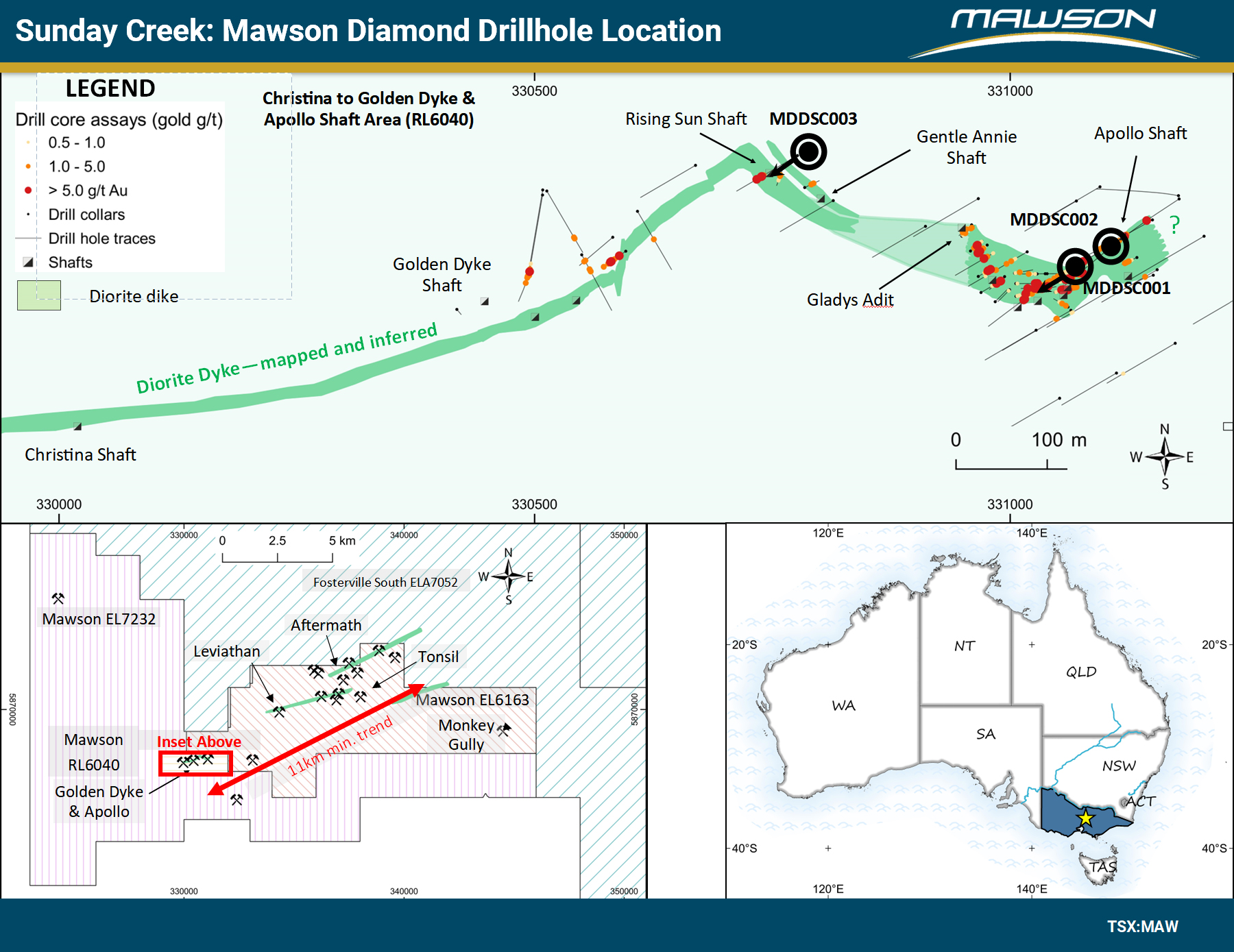

On October 7, 2020 the company announced the first results from drilling at the 100%-owned Sunday Creek project in Victoria, Australia. Very good results.

Hole MDDSC001 intersected 15.2 meters @ 3.7 g/t gold from surface including 0.6 meters at 17.9 g/t gold from 10.4 meters.

Three initial drill holes (MDDSC001-003) have been completed at the Sunday Creek gold project in the Victorian Goldfields for 345 meters of drilling.

The company was so pleased with the intensity, style and grade of mineralization observed in the drilling that a second drill-rig has returned to Sunday Creek.

Mr. Hudson, Chairman and CEO said, “A strong start to our initial drilling in Australia with good gold grades intersected from surface at our 100%-owned epizonal gold project at Sunday Creek. This result confirms the tenor of gold-mineralization found in poorly located reverse circulation drilling from the 1990s and tested what appears to be an unmined area immediately from the surface. Our drilling has opened up this goldfield once again, and given our developing understanding of the intensity, style, scale and grade of mineralization, we have re-mobilized a second rig back to Sunday Creek to continue to grow the project. Meanwhile one rig also continues to drill 7 days a week at the Redcastle project.”

Historic gold mining between 1880-1920 at Sunday Creek occurred over a greater than 11-kilometer trend.

Drilling during 1990-2000s focused on shallow, previously mined surface workings, covering an area of 100 meters in width, 800 meters length but only to 80 meters depth.

Mawson is clearly focused on expanding its presence in Australia. On October 13, 2020 it announced it was joint venturing into the Whroo exploration block in the Victorian Goldfields.

Mawson’s area under tenure and option in the Victorian Goldfields increases by 73%. The JV comprises 199 square kilometers covering the 9 kilometer long Whroo goldfield trend containing both the White Hills and Balaclava Hill mining areas, comprising one of the most significant historic epizonal goldfields in Victoria, Australia.

Mawson now holds interests in three significant epizonal historic goldfields (Sunday Creek, Redcastle and Whroo) within 471 sq km of granted tenements and applications in Victoria.

If that wasn’t enough, on October 19, 2020 Mr. Hudson announced that Mawson has commenced drilling on a combined large-scale gravity/magnetic target under deep cover within the Mount Isa block, northwest Queensland, Australia.

Additionally, the company has applied for an additional 312 square kilometers of exploration permits for a total position of 785 square kilometers of granted exploration licenses and applications.

Mawson now has four rigs turning on three projects through Finland and Australia and will have nine rigs turning by year’s end.

I caught up with Chairman and CEO Michael Hudson to go over the busy fourth quarter. You can and should listen to that here.

Mawson is a strong buy at these levels

.Ethos Gold (TSX-V: ECC) (OTCQB: ETHOF)

While Mawson is busy with the drill bit, Ethos has been quietly but aggressively accumulating district scale gold projects at an impressive pace.

In October alone the company announced updates on four projects.

On October 1, 2020 Ethos announced it had entered into an earn-in agreement under which Ethos may earn a 100% interest in the 8,172 hectare (82 km2) Gaffney gold property located in central British Columbia.

The property is accessible via paved road (Highway 27) and gravel forest service roads, four hours north of Prince George, near the Community of Manson Creek, in the prolific Manson Creek Placer Gold District.

Stated Craig Roberts, P.Eng., President & CEO of Ethos: “The size and tenor of the gold-in-soil and stream sediment anomalies from work to date at Gaffney suggest potential for a significant discovery opportunity. Work going forward will include data compilation, analysis and interpretation, and work on the ground at our earliest opportunity with the intention of advancing this project to the drill stage by mid-2021.”

That was followed by the announcement on October 7, 2020 that Ethos has entered into an earn-in agreement under which Ethos may earn a 100% interest in the 3488 hectare (34.88 km2) Campbell Lake gold project located approximately 40 km north of the town of Armstrong, Ontario.

A 10km long prospective alteration corridor was identified by Ontario Government bedrock mapping initiatives in the area from the late 1970’s.

Extensive sulphide mineralization is described near a regionally significant mafic volcanic–metasedimentary contact zone with reports of significant alteration “sericite schist” along the trend. Coarse geophysical maps show km-scale magnetic anomalies associated with these sericite schists and reported sulphide zones.

Research by Ethos geologists has confirmed that this sulphide trend has not been documented in mineral inventory databases and no prospecting or drilling was ever submitted for assessment.

Ethos is currently completing a high resolution airborne magnetic survey and acquiring detailed satellite imagery this Fall and follow up prospecting and sampling Is expected to begin in the spring of 2021.

Then on October 15th, 2020 Ethos provided an update on the results of a high resolution airborne magnetic survey recently completed on the Fuchsite Lake gold project in Northwestern, Ontario.

Ethos has the right to earn-into 60% of the project.

The survey is the first recorded exploration work in the Archean rocks at Fuchsite Lake since the early 1980’s.

The program was successful in demonstrating large, structurally controlled target corridors coincident with significant gold and base metal occurrences.

The next stage of work will comprise prospecting and ground truthing of these high priority targets in the spring of 2021, including detailed sampling, geological mapping and additional geophysical surveys if warranted, with the intention of generating drill targets by mid-2021.

The following day Ethos announced that it has purchased a 100% interest in 206 mineral claims covering 10,018 Ha (100.2 km2) contiguous to Ethos’s newly staked Sable block, part of the Schefferville Gold Project, 85 km northwest of Schefferville, Quebec.

The newly acquired claims host at least 13 iron formation hosted gold occurrences with samples ranging from ⟩ 1 g/t Au to 6.7 g/t Au.

Craig Roberts, P.Eng., President and CEO said: “These newly acquired claims incorporate areas that have historically returned significant gold values and provide us with a much more continuous land package over the target trends. Our plan is to complete data compilation and analysis over the winter months and then initiate field work early in the spring of 2021 with the intention of then developing and pursuing drill targets.”

Several of you have written in asking about the price action in Ethos. Like with most of the JRM portfolio companies this pullback is an absolute gift and one you should take advantage of.

2021 looks to be a year set for multiple discoveries from a combination of optioning some of the recently acquired projects to companies looking for quality district scale plays and drilling at the most prospective projects.

Ethos is a buy at these levels.

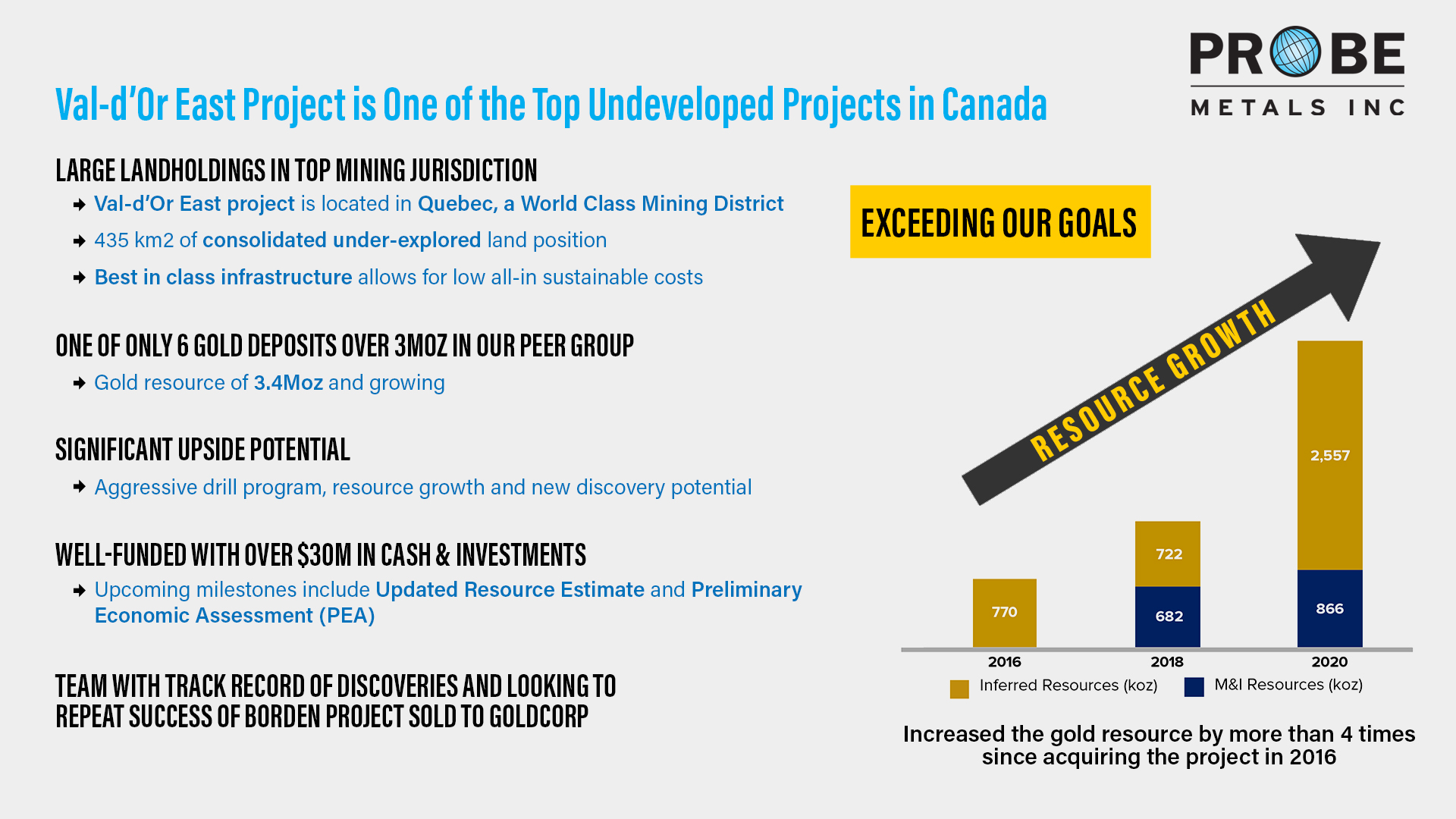

Probe Metals (TSX-V: PRB) (OTCQB: PROBF)

One company whose share price has held up remarkably well is Probe Metals.

Probe continues to pressure potential suitors by continuing to add to its land package while discovering more gold.

On October 8, 2020 Probe announced it had added 52 square kilometers to the La Peltrie option.

The consolidated package now stands at 1,434 claims representing 777 square kilometers along 90 kilometers of the Detour gold trend.

Probe is now the second largest landholder in the Detour belt.

Then on October 27, 2020 it announced it had identified three high-priority areas less than four kilometers south of the Fenelon deposit and the Tabasco, Area 51 and Reaper zones held by Wallbridge Mining.

The three areas were identified by an OreVision induced polarization geophysical survey conducted in September 2020 on the Detour Gaudet-Fenelon Project.

The Gaudet-Fenelon JV property (50% Midland / 50% Probe) consists of 226 claims (125 square kilometers) covering the Lower Detour Gold Trend (“LDGT”) over a strike length of 35 kilometers and is adjacent to the Wallbridge property hosting the Fenelon, Tabasco and Reaper gold zones.

The company has a robust treasury with over C$30 million in cash and investments, no need to dilute, a massive land package and over three million ounces of gold surrounded by top notch infrastructure.

I suspect the company is bought out and then I suspect the management team will turn its attention to its sister company Angus Gold.

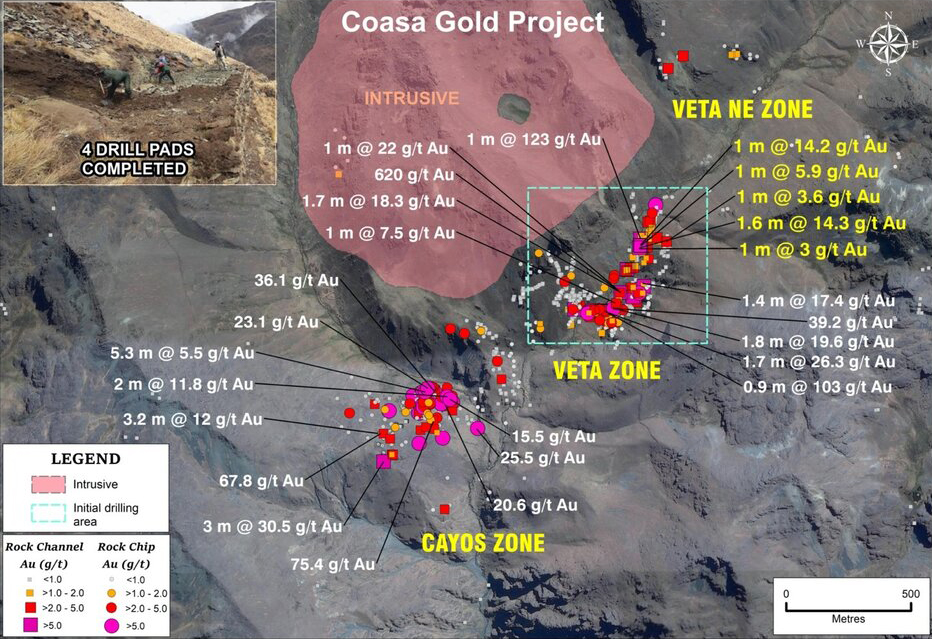

Palamina Corp (TSX-V: PA) (OTC: PLMNF)

Two things are very clear with Palamina. The first is that there is a lot of gold to be discovered on its multiple district-scale projects in Peru.

The second is that the market doesn’t doesn’t care and won’t until it proves it with the drill bit.

That’s expected shortly (within the next month or so) and in the meantime Palamina continues to sample high grades.

On October 7, 2020 Palamina announced 14.3 g/t Au over 1.6 m in known gold structures and at the Veta NE Zone.

Initial sampling has returned samples ranging to 1.6 g/t Au over 1.0 m.

The new Veta NE discovery is located 500 meters NE of the Veta Zone. Gold mineralization now extends along a 2 km NE trend from the Cayos Zone to the newly identified Veta NE Zone.

“The newly discovered Veta NE Zone has extended gold mineralization over a 2 km strike length,” said President Andrew Thomson. “Palamina continues to expand its understanding of the mineralization in the SW-NE mineralized gold trend hosting the Cayos-Veta-Veta NE Zones while it awaits confirmation that it may initiate drilling activities from the Peruvian mines department.”

Then on October 27, 2020 it announced that additional sampling in the newly discovered Veta NE Zone returned values up to 90.3 g/t Au over 1.30 m.

The Veta NE Zone is located 500 m NE of the Veta Zone and only two rounds of channel sampling have been carried out to date.

Palamina will have a phenomenal 2021. The current market cap given the four district-scale gold projects is laughable.

Accumulate it slowly, put it away and sell it at much higher prices next year.

I spoke with CEO Andrew Thomson who is at least as eager as I am to start drilling. You can listen to that here.

Azucar Minerals (TSX-V: AMZ) (OTCQX: AXDDF)

An important update on Azucar which on September 29 2020 announced an initial resource estimate for the Norte Zone at the El Cobre copper-gold project in Mexico.

The Norte Zone is one of five copper-gold porphyry zones identified to date within the El Cobre Project and has been the focus of the majority of exploration work conducted at the El Cobre Project since 2016.

Highlights from the release:

Indicated Mineral Resource of 1. 2 M oz AuEq (million ounce gold equivalent) using the base case NSR (net smelter return) cut off of US $ 12/ tonne, comprised of 47.2 million tonnes grading at 0.77 g/t AuEq (0.49 g/t Au, 0.21% Cu and 1.4 g/t Ag);

Inferred Mineral Resource of 1.4 M oz AuEq using the base case NSR cutoff of US $ 12/ tonne, comprised of 64.2 million tonnes grading at 0.66 g/t AuEq (0.42 g/t Au, 0.18% Cu and 1.3 g/t Ag);

Amenable to an open pit mining method;

Potential for resource expansion at depth within the Norte Zone as well as at other significant porphyry bodies identified across 5km strike length at the Project.

Duane Poliquin, Chairman of Azucar commented, “We are pleased to provide this initial resource estimate for the Norte Zone, which is a significant mineral endowment at just one of the many targets at the Project. This resource provides an excellent basis for continued exploration at the El Cobre Project, both at the Norte Zone itself as well as at the other significant zones discovered between the Norte Zone and the Encinal Zone, 5km to the southeast.”

2.6 million gold equivalent ounces is a robust initial estimate considering the market is assigning Azucar a market cap of approximately C$12 million.

That will change and I’m looking forward to hearing CEO Morgan Poliquin outline clear plans for exploration of the rest of the property.

I spoke with him last month and we talked about the resource estimate and what comes next.

You can listen to that here.

Azucar is a buy at these levels but like Abacus, Palamina and Ethos, you should be buying only if you’re willing to be patient for the next few months while understanding you’re paying pennies on the dollar for shares that will see much higher prices.

Remember uranium? Remember the bull market that was supposed to kick off this year according to me and five years ago according to people a lot smarter than me?

Well we were all wrong and though time will vindicate the call — because the price gains are so leveraged to the upside — it’s important to continue to watch the few quality names in the space that continue to set up shareholders well for the coming uranium but market. It’s coming, I promise.

Which brings me to Skyharbour Resources (TSX-V: SYH) (OTCQB: SYHBF).

On October 22, 2020 Skyharbour announced the execution of a letter of intent with Australian-registered Pitchblende Energy, which provides Pitchblende an earn-in option to acquire an 80% working interest in the North Falcon Point Uranium Project, to be renamed the Hook Lake Uranium Project.

Under the LOI, and subject to completion of the acquisition of Pitchblende by ASX-listed Valor Resources Limited (ASX: VAL), Pitchblende will contribute cash and exploration expenditure consideration totaling CAD $3,925,000 over a three-year period.

The deal gives Skyharbour another shot on goal for participation in a discovery with other people’s money while also gaining exposure and visibility in the Australian exchange.

Meanwhile Skyharbour should have news from the continued exploration at the Moore uranium gold project.

I spoke with Skyharbour CEO Jordan Trimble who not only went over the deal and talked about ongoing work at Moore but also — as usual — provided an excellent overview of the current state of the uranium space.

If you’re interested in the space you should listen to that here.

Leading Edge Materials (TSX-V: LEM) (OTCQB: LEMIF)

Leading Edge Materials is quietly setting the table for a spectacular 2021.

Rare earths are back in the news as U.S./China tensions continue to rock back and forth between volatile and passive/aggressive.

On September 20, 2020 Leading Edge announced the official launch of the European Raw Materials Alliance which was announced by the European Commission as part of an Action Plan on Critical Raw Materials earlier in September.

Last month — for those of you that followed me over from the previous incarnation of this letter — I explained that Green New Deals were popping up everywhere as a response by governments around the world to establish independent (from China) critical metals security supply chains.

Supply chains that need a lot of rare earth and specifically the heavy rare earths that have many defense implications.

The initial focus will be rare earth and magnet value chains before extending to other raw materials required for Europe’s green and digital transitions.

To achieve its goals, ERMA will target deliverables such as an inclusive stakeholder consultation process, support EU industrial policy to mitigate regulatory and financing bottlenecks, set up a Raw Materials Investment Platform to stimulate investment into key projects, and lastly promote public awareness and acceptance on the role of critical raw materials and their role in the transition to a green and digital economy.

Enter Leading Edge whose Nora Karr heavy rare-earth project has the potential to deliver the heavy rare earths that Europe needs.

Norra Karr is one of the world’s principal heavy REE resources, with an unusual enrichment in the most critical REEs that are essential for high strength permanent magnets (dysprosium (Dy), terbium (Tb), neodymium (Nd) and praseodymium (Pr)). Permanent magnets are directly linked and critical to the energy transition due to their applications in electric motors and wind power.

Located in southern Sweden approximately 300km SW of Stockholm close to extensive existing infrastructure, Norra Karr is the only heavy REE deposit of note within the European Union (see ERECON project, 2015) and provides the EU with the long-term opportunity to reduce reliance on imported REE.

Filip Kozlowski, CEO states “As a founding stakeholder in the European Raw Materials Alliance, Leading Edge Materials is looking forward to working with EIT Raw Materials, current and future stakeholders to deliver on the goals of the European Commission to achieve a secure and sustainable supply of critical raw materials to deliver on the European Green Deal. Our portfolio of projects all located within the EU – the Norra Karr heavy rare earth element project, the Woxna Graphite mine, the Bergby lithium project and the Bihor Sud Nickel-Cobalt exploration alliance – is directly aligned with the objectives of the alliance. I commend EIT Raw Materials in their preparatory work on ERMA which has successfully addressed the most pressing challenges facing primary critical raw material sources in the EU from being developed, namely de-risking projects across the value chain, promoting public awareness and acceptance and unlocking investment channels for key projects aligned with EU policy.”

Leading Edge’s participation should help it maneuver through the five year extension of its Norra Karr exploration license (EL) which was recently granted and most recently appealed.

The company applied for the extension in August 2019 even though a lapsed exploration license under the Swedish Minerals Act remains valid for the duration of an ongoing mining lease application with Bergsstaten, which is the case for Norra Karr.

I’ve seen a lot of are-earth companies with market caps that have surged as a result of having exposure to anything rare-earths. The new team at Leading Edge is only now beginning to tell its story and once the market catches on shares will trade closer to $1 than the C$0.20 they currently trade for.

Use the bridge between now and then to accumulate a position steadily and quietly.

Leading Edge is a strong buy at these levels.

Hannan Metals (TSX-V: HAN) (OTC: HANNF)

Very good and timely news from Hannan.

On October 26, 2020 the company announced the resumption of fieldwork at its 100%-owned San Martin copper-silver project in Peru. Field and social teams will mobilize to the San Martin project in early November.

Initial work will focus in the Tabalosos area where systematic geochemical sampling and mapping to define outcropping mineralized zones will be undertaken.

Initially, social teams will enter areas to discuss and permit exploration activities. Technical field teams will then conduct systematic geochemical sampling and mapping to define outcropping mineralized zones. Work during November will focus on the Tabalosos area. Stream sediment sampling over a larger area will also commence.

Within the 30 kilometer trend four key zones have been defined over a 5 kilometer cross strike width.

The project is massive and I anticipate we may see drilling before year-end though early 2021 wouldn’t surprise me given the scale of the project.

Shares have pulled back a bit and present an excellent trade or mid-long-term speculation as I suspect that a deal with a major that allows for major exploration is in the cards.

I spoke with CEO Michael Hudson about the resumption of activity and what the rest of the year looks like.

You can listen to that here.

Closing Thoughts

I’ll be brief because it’s been a long issue.

There’s a lot to look forward to in the coming weeks and you can expect alerts that are time sensitive.

Magna, Revival, K2, Chakana and Nevada Sunrise should be receiving any new capital you’re looking to deploy during this pullback.

They’re drilling, will have news soon and don’t depend on a higher gold price to work.

You should all have a position in Almaden by now as I anticipate news shortly on the permitting front.

I want to encourage you to continue to write in and let me know what you want more of so that the letter provides the most value to you.

Pullbacks are never fun to go through but if used properly can be very profitable. I was buying Nevada Sunrise at C$0.03, I’ve also bought it at C$0.30.

I was buying Almaden at C$0.35, I’ve also paid C$1.00.

Hopefully next month I’m wiring a check to Nevada Sunrise for C$0.50 and watching Almaden become an overnight success over 10 years later.

There’s a lot of companies that are going to have incredible 2021s that have been forgotten.

Kutcho Copper fits that description. I spoke with CEO Vince Sorace about it. You can listen to that here.

I participated in a financing for Almadex Minerals. I’m adding to my Abacus position.

Point is you don’t want to initiate positions when everyone is rushing in, you want to do so when people aren’t paying attention.

I tried highlighting that in this issue and look forward to what is shaping up to be an important month for the Junior Resource Monthly portfolio.

Stay safe and keep an eye on your inbox.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.