Junior Resource Monthly November 2020

PREMIUM CONTENT FOR PAID MEMBERS ONLY

Geopolitics don’t matter until they do.

The past week saw the Guatemalan capitol set on fire... a blockade in Mexico blocking the restart of Equinox’s Los Filos project... Peru has had three presidents in the span of a week or so...

And here in the U.S. the sitting president is publicly alleging widespread election fraud on twitter, on TV, and everywhere but in a courtroom.

This service focuses on making money in the junior resource space not politics, but politics is playing an increasingly important part in what happens next and when it happens.

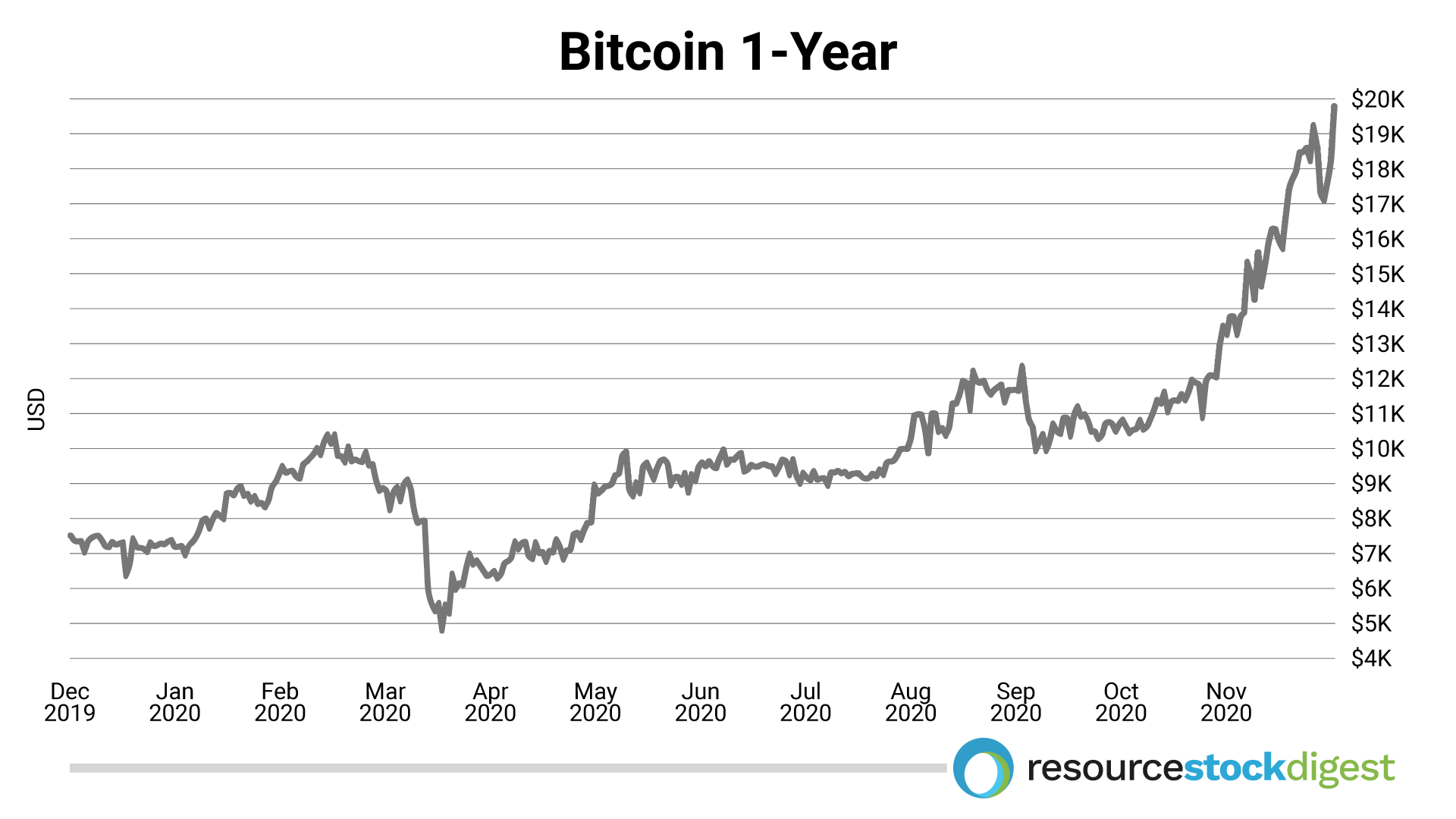

Throw in tax-loss selling, a resurgent bitcoin price (it’s up 160% this year), a resurgence in COVID-19 infections, hospitalizations, and a new potential COVID-19 vaccine being announced every few days — and we have ourselves an interesting set up to close out the year.

I expect the consolidation in the gold price — a four month low — and the related equities will continue for another three weeks or so throughout most of the sector. Use it to your advantage.

Imagine selling Bitcoin in March near the $6,000 level.

Imagine selling Bitcoin in March near the $6,000 level.

Back to geopolitics and managing risk...

When it comes to jurisdictional risk, context is extremely important.

Guerrero, Mexico — the site of the Los Filos blockade — is very different from, say, Sonora, Mexico where Magna Gold operates.

All of Mexico isn’t the same just like all of the U.S. or Canada isn’t the same. If you don’t know the difference you’ll end up throwing out the baby with the bathwater.

I’ve explained repeatedly to allocate capital to companies that have catalysts independent of a rising gold/silver price. The recent trading action is a great example of why that’s important.

A rising tide lifts all boats. But tides don’t just rise.

The focus over the coming weeks and months will be on companies that can add material value during this consolidation.

Be clear that’s exactly what this is: a consolidation because plans for a near-term stimulus plan have been deferred. It’ll happen, it's just the scale and timing of it that’s in question.

Companies like K2 Gold, Chakana Copper and — for the higher-risk inclined like myself — Nevada Sunrise Gold are all extremely attractive at these levels.

All should have drill results for the next several months.

Despite the noise, the macro picture has not changed.

Will balance sheets be normalized? Will central bankers around the world pivot and raise rates? You know the answers to those very basic questions, which means you know the direction that monetary and fiscal policy will continue.

They will try to inflate away the debt. They will support the markets at all costs. And that’s going to lead to inflation, lower rates, and higher gold prices.

The inflation getting priced in is actually what is driving gold lower in the near-term as equities are dominating the capital demand. There will be another rotation back into gold but it may take a few weeks and maybe not until early Q1.

Service providers are reporting that input costs are increasing across the board. Higher supplier prices —the highest since October 2018 — are being passed on to the consumer, which points to higher inflation in 2021.

This is happening alongside rising real rates, hence the beatdown in the gold price recently.

In other commodity news... copper just reached a two-year high and currently trades at the US$3.45 per pound level and critical metals are back in the spotlight.

China Supply Chain Positioning

While everyone is spooked about gold at $1,800/oz. — it may even fall to the $1,750 level — China is busy positioning itself for the next several decades.

Fifteen countries, including China, signed the Regional Comprehensive Economic Partnership (RCEP) this month, forming the largest trade pact in the world.

The deal is meant to stimulate trade for companies that produce and sell within the region.

The deal excludes the U.S., and is meant to allow China to sustain its global supply chain advantage.

It’s not a coincidence that rare earth companies (even Leading Edge is finally moving) have surged recently.

Last month I told you about green new deals popping up everywhere as governments pivot to clean energy. Clean energy that requires a lot of copper, lithium, and important rare earths.

The trade deal comes right on the heels of China’s new cybersecurity regulations meant to instruct public and private sector companies and organizations — both Chinese and foreign — on how they must secure their networks.

It is possible that China could instruct foreign firms to switch to Chinese equipment, which of course would present an existential problem as China could — and has — reverse engineer the tech and make it its own.

The South China Morning Post reported that Samm Sacks, a cybersecurity policy and China digital economy fellow at the Washington think tank New America, said the multilevel protection scheme was not an “obscure compliance development” that applied only to tech companies.

Taken alongside Beijing’s other policies, the regulations were part of a government drive to significantly boost its ability to monitor companies across all industries, she said.

Under the new rules, all companies that operate a network must tell the government how sensitive the data they handle is.

For a more comprehensive overview of the potential risks of the new regulations from the South China Morning Post article click here.

The bottom line is the maneuvering will continue and despite the very real effort by the U.S., Europe and the rest of the world to establish its own critical metal supply chain, it’ll take at least a decade for those regions to set up the infrastructure necessary to truly be independent from Chinese supply chain threats.

I plan on making money off of the uncertainty which brings me to portfolio news, of which there is a lot.

Let’s start with a company with one of the few real, world-class rare-earth projects in Europe: Leading Edge Materials.

Portfolio News

Leading Edge Materials (TSX-V: LEM)(OTCQB: LEMIF)

Rare earth companies are surging on the heels of the MP Materials (NYSE: MP) merger that has brought deserved attention to the rare-earth space.

MP stock has more than doubled since June. Several companies are now — predictably — hitching their fortunes to the rare-earth train.

Most don’t have real assets or the technological acumen to actually ever produce any of the rare-earths that China has a production stranglehold on, but that won’t prevent those companies from doing very well… until they don’t.

I saw this in 2010. Rare earth bubbles are like uranium bull cycles in that there aren’t many quality names available to absorb the speculative capital that rushes into the sector when the mania kicks off.

That makes for unsustainable but very profitable moves to the upside if you’re positioned correctly.

Which brings me to Leading Edge, which not only has a very real rare earth asset in Norra Karr, but also has a very real graphite asset with a mill and all in its Woxna asset.

Last month the company announced it has commissioned an economic assessment study on the Woxna graphite project. This follows the news that the company has also initiated a PEA on the Norra Karr project.

I had a chance to speak with CEO Filip Kozlowski on the portfolio of critical metals assets, the management team, the path forward and why the European Union is as committed as ever to developing its own critical metals supply chain.

It’s a lengthy conversation but well worth your time.

Leading Edge is a strong buy up to C$0.25/US$0.19. Get that done sooner rather than later as I don’t believe these prices will last very long.

Click here to listen to the interview.

Almaden Minerals (TSX: AMM)(NYSE: AAU)

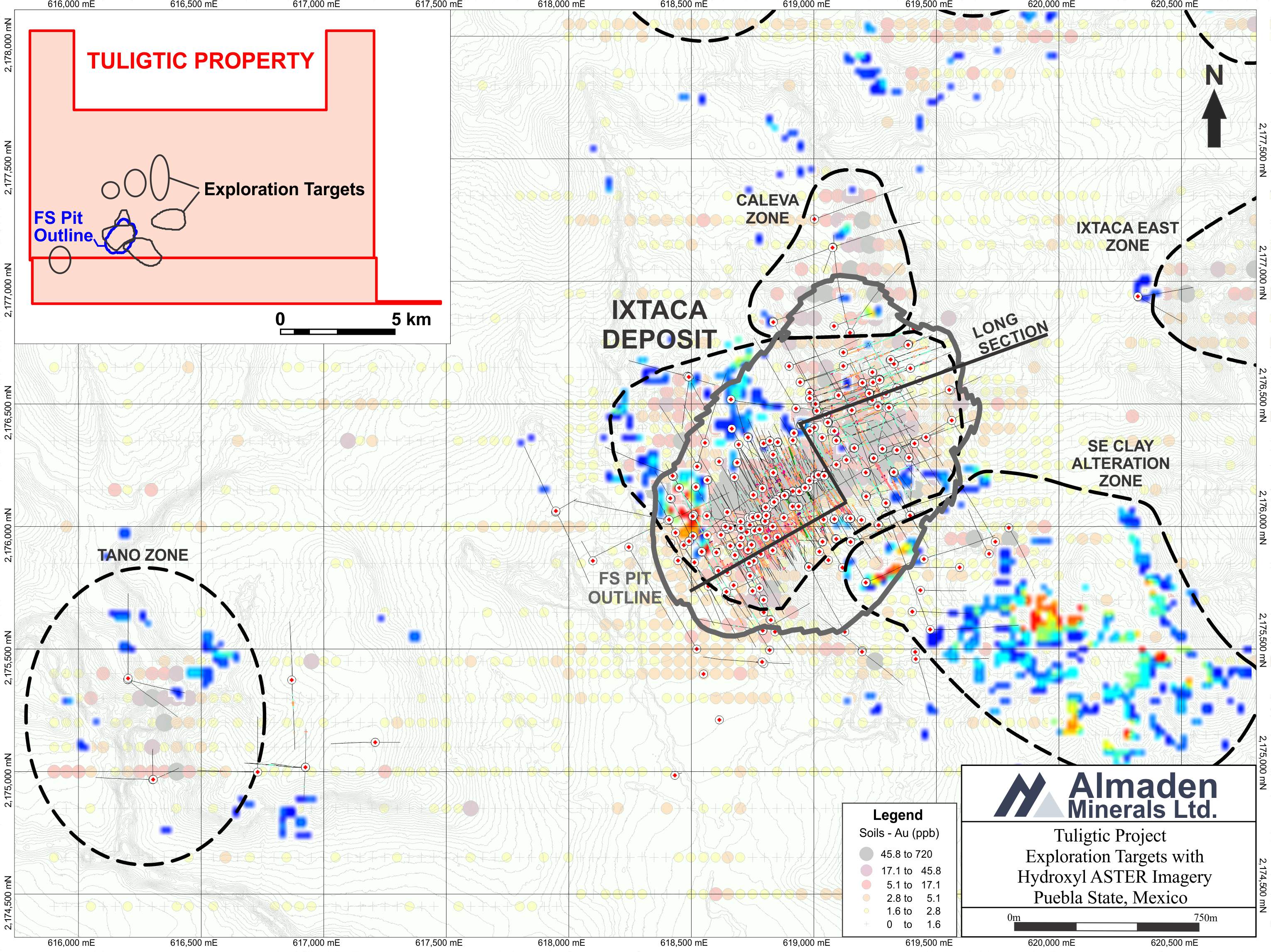

Almaden continues to wait — everything takes longer than it should — for a permitting decision from SEMARNAT, which is working abbreviated shifts and only a few days a week due to Covid-19 restrictions and precautions.

While Almaden waits for that decision it is busy delineating exciting new targets at its already very robust and economic Ixtaca project.

On November 5, 2020. Almaden announced additional results from its ongoing review of exploration targets that lie outside the resource.

The Main Ixtaca Zone of the Ixtaca deposit is hosted by limestone, where the veins form a wide zone of veining referred to as a vein swarm.

The Main Ixtaca Zone of the Ixtaca deposit is hosted by limestone, where the veins form a wide zone of veining referred to as a vein swarm.

Vein swarms and limestone are what the company wants to see and the company seems to be on to multiple swarms in different locations.

Adjacent to the Main Ixtaca Zone, shaley carbonate rocks host the more discrete focussed gold-silver vein related mineralization of the Northeast Extension Zone, which also has higher associated zinc and lead values.

According to Almaden, based on structural interpretation the Main Ixtaca Zone gold-silver vein swarm could be the upper part of a vein system that transitions at depth to structurally controlled silver-lead-zinc dominated mineralization, where the Northeast Extension Zone would project down dip underneath the Main Ixtaca Zone.

Drilling beneath the Main Zone is now a priority.

That release was followed by a new discovery of several areas of possible high-level epithermal veining being identified cropping out within the Southeast alteration zone of the Ixtaca Project.

The newly identified zones of veining may represent higher levels of a potential underlying epithermal system.

These new veins have been sampled with assays pending.

I encourage you to listen to my interviews with CEO Morgan Poliquin going over the new targets.

You can do so by clicking here and here.

Almaden is back under our buy up to price if C$1.25/US$1.00 and is a buy at current levels.

While Morgan and the team aren’t out discovering new vein swarms at Ixtaca, they’re drilling at El Cobre.

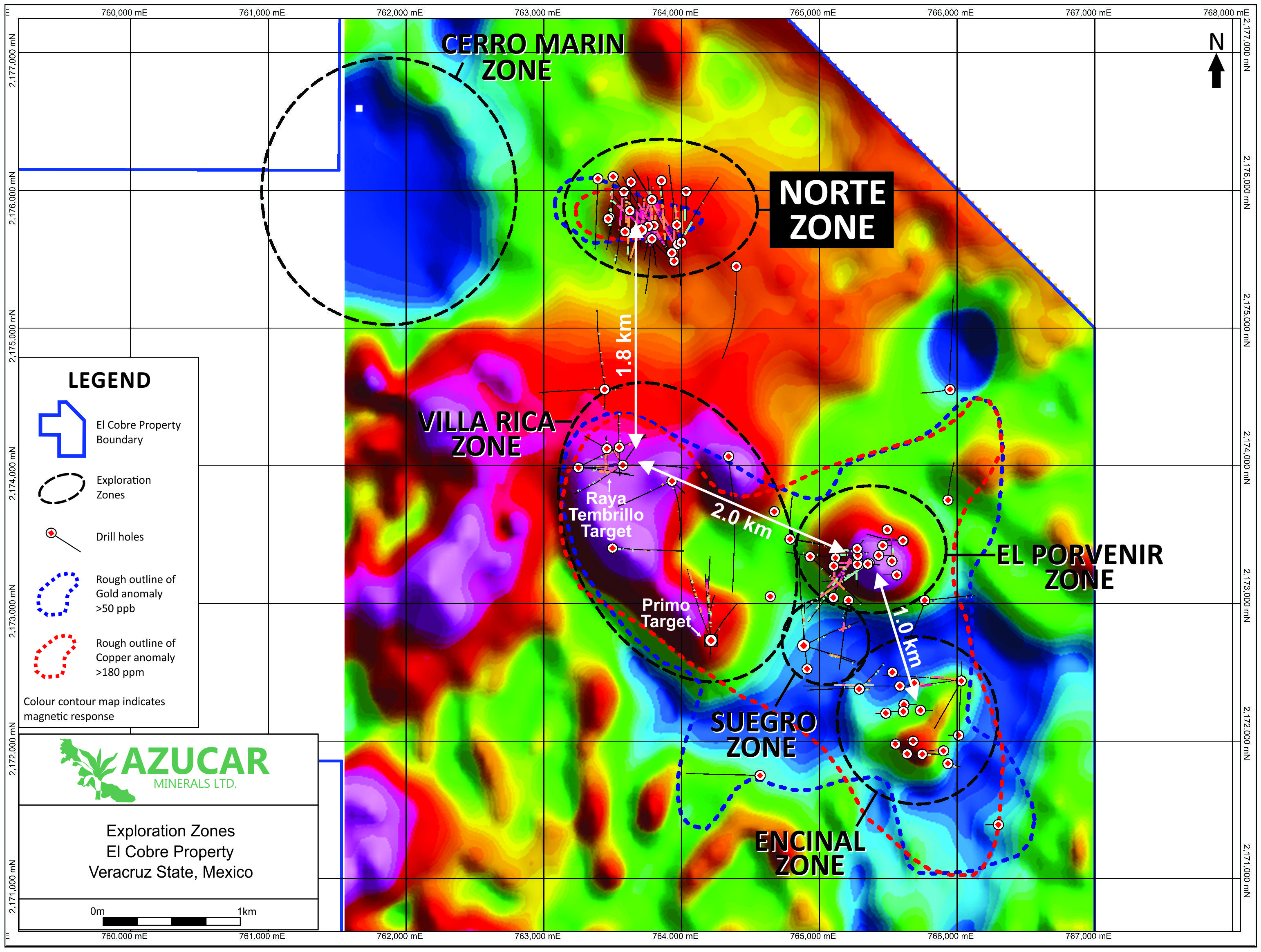

Azucar Minerals (TSX-V: AMZ)(OTC: AXDDF)

On November 12, 2020, Azucar announced it had resumed drilling at the El Cobre copper-gold project in Veracruz, Mexico.

The company is first deepening hole EC-20-108, which is located in the Primo Zone. One of at least five zones on the project.

The company intends to continue exploration at the Primo, Porvenir, and Villa Rica targets in an effort to further delineate resource potential at the project beyond that contained in the initial Norte Zone resource estimate.

The company intends to continue exploration at the Primo, Porvenir, and Villa Rica targets in an effort to further delineate resource potential at the project beyond that contained in the initial Norte Zone resource estimate.

The initial resource estimate for the Norte Zone comprises an indicated resource containing 748,000 ounces of gold and 221 million pounds of copper (47.2 million tonnes grading 0.49 g/t Au, 0.21% Cu 1.4 g/t Ag) and an inferred resource containing 860,000 ounces of gold and 254 million pounds of copper (64.2 million tonnes grading 0.42 g/t Au, 0.18% Cu and 1.3 g/t Ag).

For those of you keeping track that’s nearly half a billion pounds of copper and just over 1.6 million ounces of gold.

Infrastructure is excellent. So is the exploration potential.

Azucar’s current market cap is a ridiculous C$12 million.

Azucar is a strong buy and well below the buy up to price of C$0.42/US$0.33.

I spoke with CEO Morgan Poliquin about the resumption of drilling and the cautious approach the company is taking within the context of the most recent Covid-19 surge. You can listen to that here.

Midas Gold (TSX: MAX) (OTCQX: MDRPF)

The plot thickens.

On November 20, 2020, Midas Gold announced that Paulson & Co., which owns 44.1% of outstanding Midas shares, sent Midas employees a letter requesting a special meeting in an effort to “refresh” (it's what the letter said) the company’s board of directors.

Paulson & Co. is requesting Midas redomicile from Canada to the United States and “show leadership at the top by refreshing itself with more U.S., and specifically Idaho-based, directors, and by adding people with skills that better align with the future direction of the company.”

There were several sentences in the letter that make it clear Paulson is willing to step up with a check to put Stibnite into production.

The line that stood out to me was “we believe now is the appropriate time to start planning the next phase of the Company as it evolves from seeking permits to eventually taking the Stibnite Gold Project into production.”

It’s clear Paulson doest intend to monetize his position any time soon and it’s also clear that having a billionaire shareholder provides a great hedge against any hostile offer or a buyout offer that doesn’t properly value the Stibnite project.

Paulson was also keen on mentioning the antimony aspect of the project, which has always had positive permitting implications.

The bottom line is Stibnite is on the verge of becoming a lot more visible as the next great American gold deposit and it’s clear there is substantial interest and support in seeing it get built.

I’m raising the buy up to price to C$1.00/US$0.75.

I realize that it’s currently trading around the C$1.14 level but if the pullback in gold lasts for weeks and not days then it’s reasonable to assume that we’ll have the opportunity to add at those levels.

Revival Gold (TSX-V: RVG)(OTCQB: RVLGF)

Revival Gold has pulled back during the recent consolidation and is now back under the buy up to price of C$1.10/US$0.85.

The pullback is an opportunity as the company just delivered a very solid PEA that will serve as an anchor moving forward.

The PEA announced on November 17, 2020 outlines a near-term production scenario for just the heap leach oxide portion of the three million ounce resource.

Beartrack-Arnett Phase One Heap Leach Gold Project - PEA Highlights *

- Production of 72,000 ounces of gold per year for a total of 506,000 ounces of gold over an initial seven-year mine life;

- Pre-production capital of $100 million and life-of-mine (“LOM”) sustaining capital of $61 million;

- Total cash cost of $ 809 per ounce and all in sustaining cost of $1,057 per ounce of gold;

- After-tax NPV at a 5% discount rate (of $88 million and after-tax IRR of 25% at $1,550 per ounce gold increasing to a $211 million NPV 5% and 49% IRR at $1,950 per ounce gold;

- After-tax payback period of 3.0 years;

- Lower technical and execution risk of a brownfields project with existing infrastructure and recent history as the largest past-producing gold mine in Idaho; and

- Excellent additional exploration potential as demonstrated by this season’s drill results and with over 10km of favorable geological structure to explore.

Permitting the heap leach operation will be much more efficient as the project is a past-producing project with excellent infrastructure.

Drills are turning, assays are pending, and gold is pulling back — making Revival an excellent speculation.

I spoke with CEO Hugh Agro about the recent results and the exploration. You can listen to that here.

I also caught up with Hugh about the PEA. You can and should read that by clicking here.

There’s a reason that analysts have price targets as high as C$2.50. Use the pullback to your advantage.

K2 Gold (TSX-V: KTO)(OTCQB: KTGDF)

On November 16, 2020, K2 announced it has completed its phase one drilling program at the high-grade oxide Mojave gold project.

The program consisted of 17 RC drill holes for a total of 2,540 meters.

We are pleased to have completed this initial drilling program at Mojave, the first such program since the project was successfully drilled by BHP in 1997. Initial assay results are expected within the next month,” stated Stephen Swatton, President and CEO of K2. “The results from the first phase of drilling will lay the groundwork for a larger exploration program. An application for a modified Plan of Operations utilizing an existing reclaimed exploration road for the second phase of drilling is expected to be submitted to the Bureau of Land Management by December.”

The drilling program focused on the Dragonfly and Newmont target areas; two gold rich zones within a 4.5 kilometer strike length of known mineralization.

The deepest hole was drilled to a vertical depth of 201.2 meters. All historic holes drilled by Newmont and BHP within the Newmont and Dragonfly targets intersected alteration and anomalous gold mineralization — and I expect excellent results from this program.

Results that will send shares higher.

The company will be following up this drill program with an expanded program and it recently identified a new large regional gold target.

I spoke with CEO Stephen Swatton about the program and what comes next.

You can listen to that here.

K2 is below the buy up to price of C$0.56/US$0.42 and is a strong buy.

Another strong buy — and one I’m very excited to be able to add more of at these prices — is Magna Gold.

Magna Gold (TSX-V: MGR)(OTC:MGLQF)

Magna CEO Arturo Bonillas continues to make good on his promise to build the next mid-tier gold producer. He’s also quietly putting together an impressive collection of silver properties that I believe should be spun out as a pure silver company, Magna Silver.

On November 2, 2020, Magna announced operational results for May 7, 2020 through September 30, 2020.

Highlights include gold ounces sold of 12,408 ounces since acquiring San Francisco, including 7,473 ounces during the quarter ended September 30, 2020.

It’s had revenues of US$22.4M and cash operating margin of US$7.3M since acquiring the San Francisco mine.

Commencement of mining and processing of fresh ore from the La Chicharra and San Francisco open pits in August 2020, along with the processing of low-grade stockpile, has resulted in approximately 9,400 tpd of ore currently being placed on the heap leach pads.

In addition, Magna is busy drilling multiple projects and just closed the acquisition of the Margarita silver project from Sable Resources.

The project consists of two mining concessions, covering 125.625 hectares, located within the prolific Sierra Madre Gold Belt, which hosts numerous multi-million-ounce gold-silver deposits, 88 kilometers south of the state capital of Chihuahua in the Municipality of Satevo, State of Chihuahua, Mexico.

The Property lies 15 kilometers northwest on strike with Sunshine Silver Corp.'s Los Gatos Mine.

Sable conducted two core drill campaigns during 2018-2019 of 5,245.40 meters in 35 holes. I encourage you to look over the release at the previous intercepts which include some very high-grades.

"Margarita displays an outcropping high grade core zone 2 meters to 14 meters in width, and 14 meters to 60 meters lower grade halo that continues at least to 100 meters of depth, at elevations of 2,000-2,100 m.a.s.l., with clear upside potential down dip the structure as evidenced by the high grade sulphide rich mineralization as at the nearby Los Gatos Mine, where the top of the mineralized zone is at an elevation of 1,500 m.a.s.l. Further upside potential exists in undrilled gaps along the upper levels of Margarita, and in the other four known veins. Acquiring the Property gives the Company exposure to a potential high-grade silver project and additional optionality to rising silver prices" commented Arturo Bonillas, President and Chief Executive Officer of the Company.

The property hosts five quartz-barite and minor calcite epithermal veins-breccias of low to intermediate sulphidation affinity hosted by volcanic rocks of andesitic and rhyolitic composition.

I spoke with CEO Arturo Bonillas about the multi-pronged approach he’s taking with Magna. You can listen to that here.

I’ll be catching up with Arturo about the Margaritas acquisition soon.

Magna is a strong buy and is currently well under our buy up to price of C$1.25/US$0.85.

Ethos Gold (TSX-V: ECC)(OTC: ETHOF)

Ethos is busy collecting district-scale gold projects.

The latest was announced on November 19, 2020. Ethos entered into two earn-in agreements under which it may earn a 100% interest in the 1475 hectare (14.75 km2) Deep Cove claim group and 1875 hectare (18.75 km2) Virgin Arm claim group located on New World Island, approximately 65 km north of Gander, Newfoundland.

Dr. Rob Carpenter, Chief Technical Advisor to Ethos commented:

“It is rare to find a project area of this size with this number of high grade gold showings that has received this little work to date. Historic work has been limited and sporadic but has nonetheless delivered very encouraging results, and the project is wide open to a new effort to understand the controls of gold mineralization and to look for economic concentrations of near surface gold. We are currently compiling and interpreting all available historic data look forward to kicking off a significant program on the ground in the spring of 2021, with the intention of developing drill targets.”

Ethos is planning to start field exploration in the spring of 2021 including property-wide prospecting, mapping, and sampling with the objective of defining drill targets for testing later in 2021.

I encourage everyone to go to the news section of the Ethos Gold site for a thorough overview of the multiple recent acquisitions. Acquisitions that make for a spectacular 2021 for shareholders.

Ethos is a buy up to C$0.26/US$0.22.

Mawson Gold (TSX: MAW)(OTC: MWSNF)

If you like gold exploration it’s hard not to own Mawson Gold.

With nine rigs turning on four projects Mawson should be on every speculator's radar.

On November 10, 2020, it announced it has discovered high-grade gold for the first time at the Joki East prospect at the 100%-owned Rajapalot Project in Finland. Joki East is located 1,600 metres north-east of the Raja resource area and is permitted for year-round drill access.

AL0241, the discovery drill hole at Joki East, returned 1.6 meters @ 28.3 g/t gold from 168.6 meters. A total of eight drill holes have been completed at Joki East, and visible gold has been identified in four of the eight drill holes completed to date.

I caught up with CEO Michael Hudson about the first set of results and the multiple drill programs. You can listen to that here.

The discovery hole at Joki East was followed by news a week later announcing another high-grade intercept of 1.2 meters of 19.2 g/t gold. PAL0242 returned 1.6 meters @ 19.2 g/t gold from 155.0 meters and was drilled 27 meters north east of PAL0241.

Rigs continue to turn in Australia as well, and Mawson is on to significant discoveries there, too.

Expect lots of news. Expect more good results. And expect higher prices.

Click here for my most recent interview with Chairman and CEO Michael Hudson.

Mawson Gold is a buy and right at the buy up to price of C$0.38/US$0.27. Get that done.

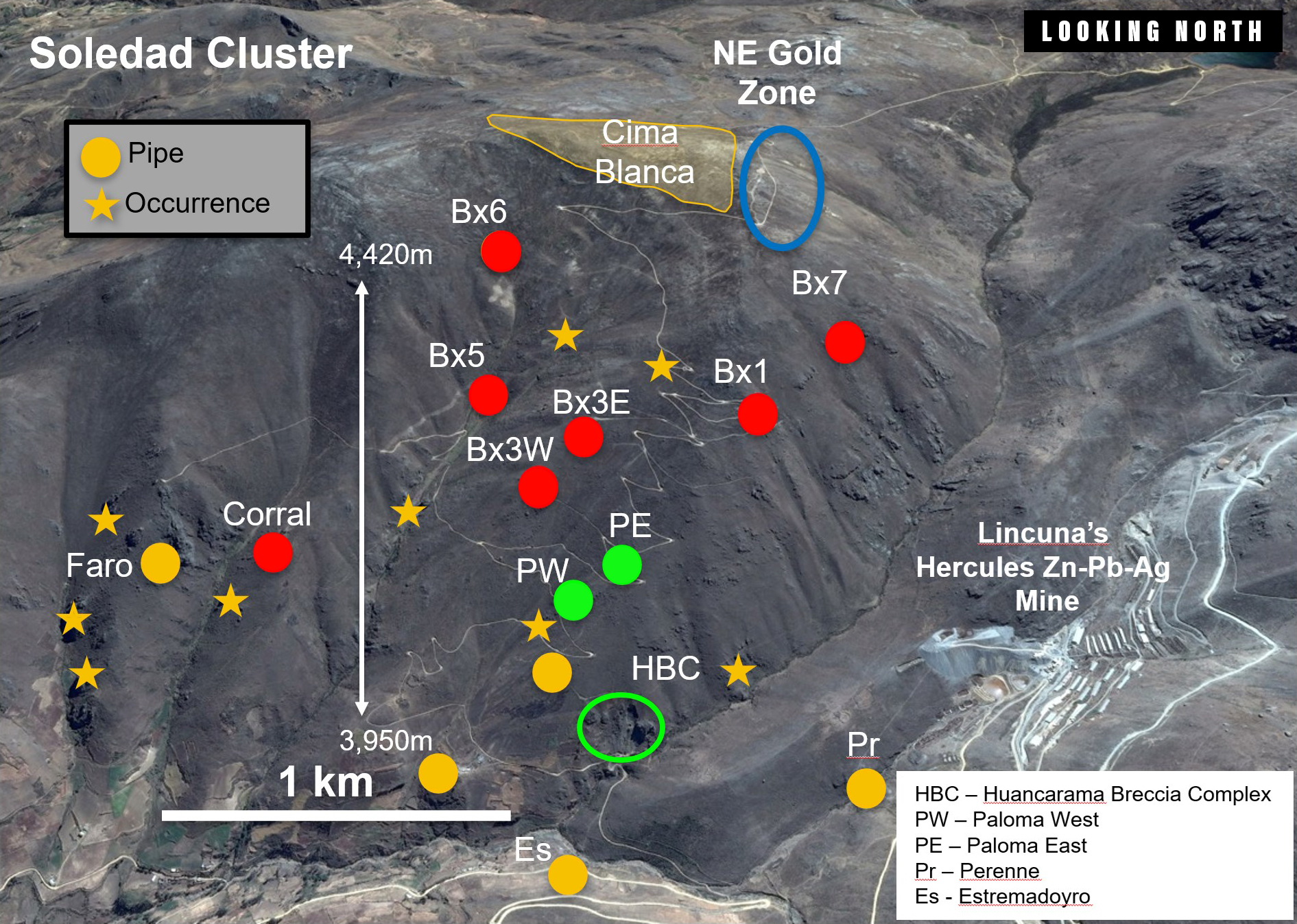

Chakana Copper (TSX-V: PERU)(OTCQB: CHKKF)

Another stock that’s going higher — and that I’ve added significantly over the past few weeks — is Chakana Copper.

I sent JRM readers an alert earlier this month when Chakana drilled 22.65 meters of 2.81 g/t gold, 3.80% copper, and 56.2 g/t silver (9.36 g/t gold equivalent) from 48 meters.

That was followed by news on the 19th of November reporting 10.7 meters of 7.25g/t gold, 163.5g/t silver and 10.2% copper or 24.99 gold equivalent.

Absolutely spectacular results that should have sent the stock higher but didn’t as Chakana finds itself in the midst of programmed selling of shares, 500 shares at a time on any up move.

That allowed me to add significantly to my personal position and I’m encouraging you to do the same as Chakana is on to a significant discovery that will eventually be bought out at much higher prices.

David Kelley, President and CEO commented:

David Kelley, President and CEO commented:

“these are some of the highest grades we have ever seen on the Soledad project after 33,000m of drilling. Intersecting 10.7m with 7.25 g/t gold, 10.2% copper and 163.5 g/t silver demonstrates the high-grade potential of the tourmaline breccias at Soledad. In addition to the high grades at Paloma West we are seeing a much higher density of high-grade mineralization hosted in structures and breccia dikes surrounding the breccia pipes. This is likely an indication of the strength and potential extent of the mineralizing system in this part of the project. We have just started to explore these targets and the drill program continues to run smoothly. We look forward to releasing further drill results on Paloma West and Huancarama in the near future.”

I caught up with CEO David Kelley to go over the results, the political turmoil in Peru and what to expect the remainder of the year. You can read that here.

Chakana Copper is a strong buy and is under our buy up to price. I don’t believe that will last.

Western Copper & Gold (TSX: WRN)(NYSE: WRN)

A few of you wrote in asking if Western Copper & Gold is still a buy at these levels. The stock is back right at the original buy price of C$1.47/US$1.12 and presents a great long-term buy for exposure to both copper and gold.

Assays from the recent drill program are overdue. I reached out to management, which explained that, like many in the space, they are suffering from delays from the labs.

In the meantime, the company topped off its treasury and closed a C$28.75 million financing at C$1.45/share.

In the near-term we have assays from the recent drilling. That will be followed up by the DFS in 2021, which will put some firm updated economics around the Casino project.

The bottom line is there are few projects around the world with the type of scale (both gold and copper) that the Casino project provides.

It’s important to note that Dr. Bill Williams has been appointed to the board of directors. Dr. Williams is an economic geologist with nearly 40 years of experience related to the exploration and development of mining and oil & gas projects, as well as oversight of mining operations.

He provides consulting services to the mining industry with a focus on company/project evaluations, M&A analysis, risk analysis, project management, and permitting strategies — a skill set that will serve Western Copper & Gold well in the event of a potential buyout.

Most recently, he served as the Interim CEO and Director of Detour Gold Corporation.

Western Copper & Gold remains a buy up to C$1.75/US$1.36.

Last but not least is a company that has held up well despite the recent pullback, and is also a prime takeout target, Probe Metals.

Probe Metals (TSX-V: PRB)(OTCQB: PROBF)

The reason Probe has held up well is because it keeps delivering with the drill bit.

The most recent release highlighted the new discoveries on the Pascalis gold trend at the 100%-owned Val-d’Or East Pascalis property.

Expansion drilling continued to discover near-surface mineralization around the current gold resources.

Drilling returned 5.9 g/t over 9.2 meters 600 meters south of the Former Beliveau mine, between surface and 150 meters vertical depth. Drilling also intersected 1.7 g/t Au over 11 meters in the same area.

A new gold zone was also discovered southeast of the New Beliveau deposit, including 1.4 g/t Au over 26.4 meters, 94.1 g/t Au over 0.6 meter and 1.3 g/t Au over 11 meters, between surface and 100 meters vertical depth.

Another new gold zone was discovered 300 meters north of the North Zone, including 3.6 g/t Au over 6.2 meters and 1.9 g/t Au over 7.1 meters, between surface and 50 meters vertical depth.

Four drills are busy finding more gold, adding to the 3.4 million gold ounce resource base.

The company is well cashed up after announcing a financing for C$10 million.

I anticipate someone will make a run at Probe soon at a premium. The stock is a buy and right at our buy up to price of C$1.50/US$1.15.

Closing Thoughts

A bit of context around where we stand in November of 2020.

The Dow is up 13%, at record highs, and having its best month since 1987.

The Russell 2000 is up 20% and having its best month ever.

S&P energy is up 37% and having its best month ever.

S&P financials? Up 19% and you guessed it, best month ever.

Industrials? You got it. Up 18% and best month ever.

Bitcoin is at all-time highs, vaccines are on the way, Janet Yellen is the next Treasury Secretary. And everything is awesome!

Except it’s not.

Millions are still unemployed. Counties, cities and states still haven’t been able to agree on how best to mitigate the economic damage from government mandated lockdowns while addressing the health concerns around Covid-19.

In the next month I expect we’ll finally start seeing first assays from Nevada Sunrise and Kinsley Mountain.

I’ve been in touch with both management teams (Nevada Sunrise Gold and 80% partner and operator New Placer Dome Gold) and both expressed genuine frustration at the lab delays.

I suspect that Hannan Metals will soon find a JV partner for its 100%-owned basin-scale San Martin copper-silver project.

$3.45 per pound copper has a way of expediting discussions.

Millrock Resources has completed one of two planned holes, following up the exciting but ultimately disappointing hole #7 at its 64North Gold project, which is joint-ventured with earn-in partner Resolution Minerals.

Two holes totaling 1,100 meters are planned for the final phase of drilling in 2020. The first hole, which is being drilled from the same site as hole 20AU07, is nearing the target depth. Drilling operations will cease by mid-December.

I expect gold to continue its consolidation — and hope you all take advantage of the pullback — because that’s all it is.

President Trump is now following transition protocols, the Senate looks like it will be Republican, which means you can expect a similar monetary and fiscal approach moving forward. It’s why everything is awesome.

Except it’s not.

Own some gold stocks. Add during this pullback. The buy up to prices are there for a reason — to provide guidance and discipline.

The instinct is to add when everything is going up. You should already have your positions firmly established when that happens.

Stay safe.

I hope you enjoyed your Thanksgiving

And buckle up because I expect a busy December.

Let's get it!

![]() Gerardo Del Real

Gerardo Del Real

Editor, Resource Stock Digest

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.