Junior Resource Monthly December 2020

PREMIUM CONTENT FOR PAID MEMBERS ONLY

The most unpredictable year is ending in the most predictable of ways.

President Trump signed another coronavirus relief bill. A bill he called a disgrace. An opinion that led to calls by Trump — and Democrats — for a $2,000 direct payment to most Americans instead of the $600 included in the bill.

The bill was pushed through despite lawmakers not having the time to read through it. A sign of the times and what I call the political bottom.

Two senate races in Georgia on January 5, 2021 could decide just how quickly another round of stimulus is passed as a victory for Democrats there would tip the senate scales in their favor and make a multi trillion stimulus package probable.

Either way, expect another relief/stimulus (I lose track of the different names they come up with for the same thing) and expect a Fed that has promised low rates until at least 2023.

The major U.S. indices continue to make new record highs. Bitcoin is flirting with the $30,000 level — it’s now larger in terms of market cap than all but seven public companies — and we’re even getting the uranium bull market I anticipated earlier in the year… And copper, and rare earths and gold, and real estate in low tax states.

If you haven’t noticed, there’s a bull market in just about anything you can trade your paper currency for.

Why?

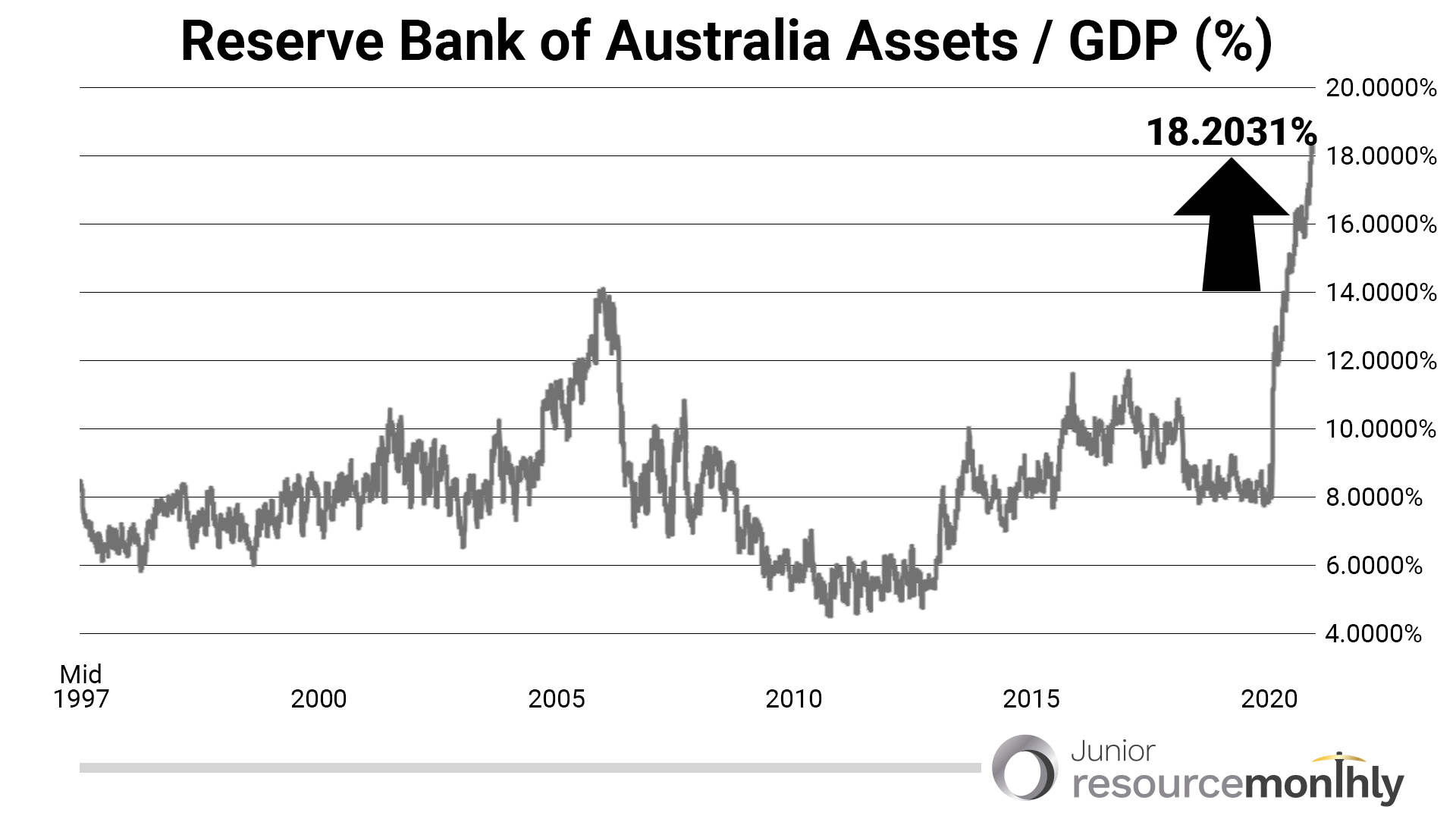

Because there’s also a currency war happening. One that Australia has decided to get in on. The Reserve Bank of Australia (RBA) now owns 18% of assets to GDP and has increased its holdings in rapid fashion recently.

18% isn’t close to the 35% of assets the Fed owns and don’t get me going on Japan and the ECB.

All this matters because of how this ends. Increased wealth disparity, asset bubbles that disproportionately favor those with exposure to financial assets and the ability to transfer those assets to favorable tax jurisdictions.

But hey, enjoy your $600.

Or use it to your advantage. Capital will always flee to where it’s treated best and that flight has allowed for a historic opportunity in the commodity space. I don’t agree with the decimation of the middle class enabled by — and more recently perpetuated by — central bankers, but I sure in the heck plan on making money off of it.

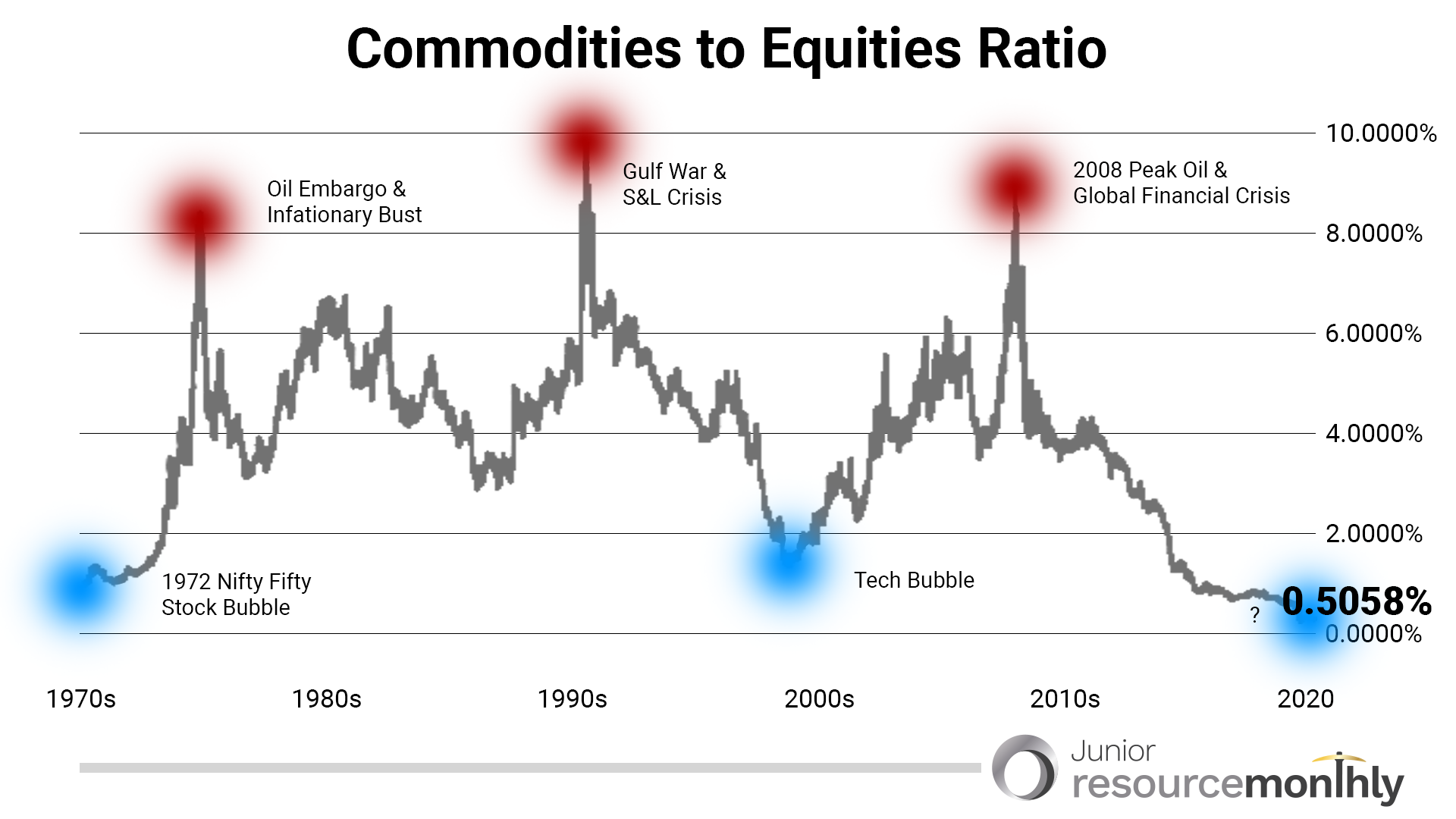

Here’s a chart showing the commodities to equities ratio.

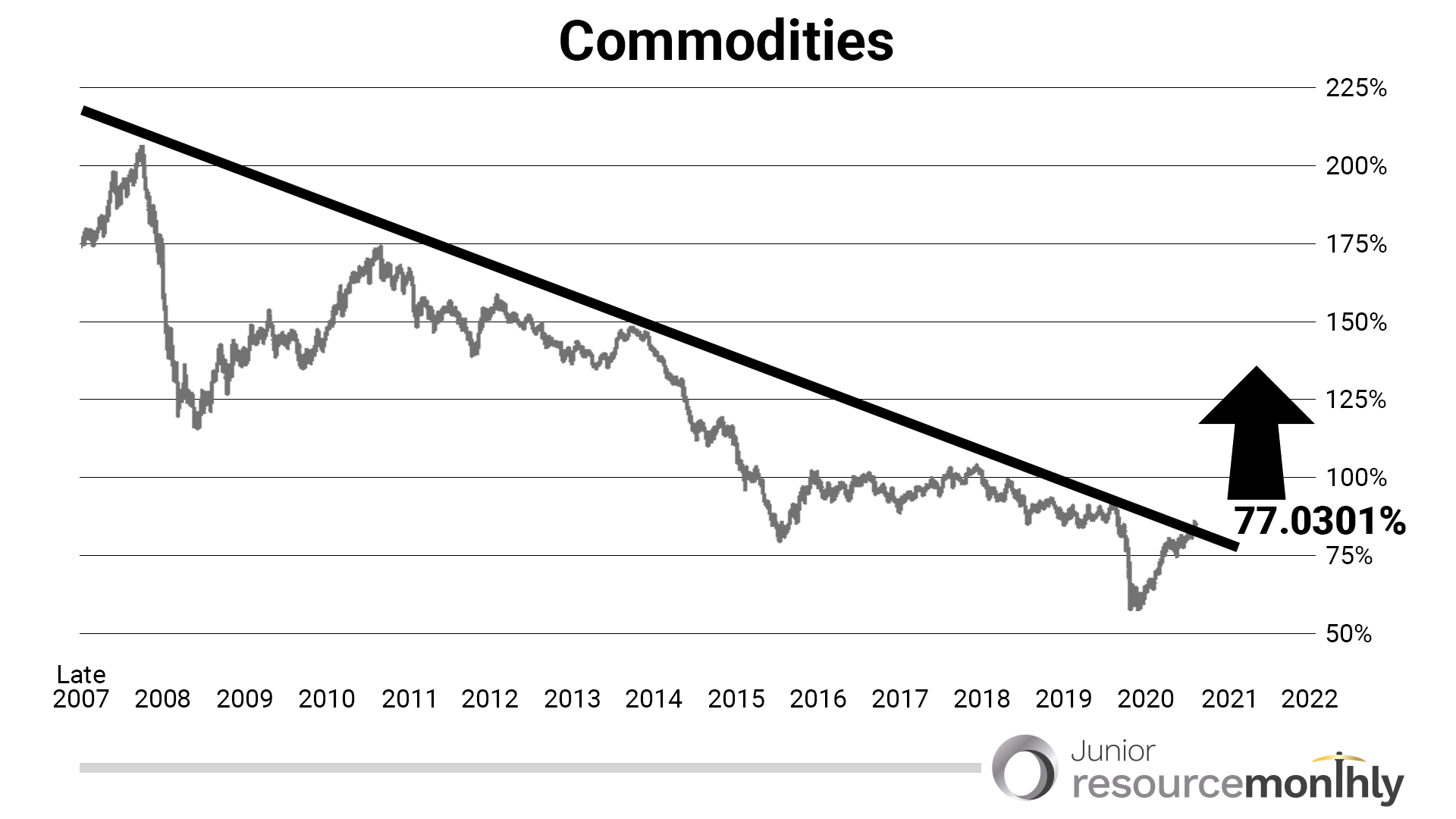

Historically cheap isn’t hyperbole. Inflation is coming and the Bloomberg Commodities Index knows it as commodities just broke through 12-year resistance.

Which brings me to a new precious metals pick. One that replaces Almaden Minerals in the portfolio and one that is liquid, doesn’t carry permitting risk and is significantly undervalued relative to its peers.

Nomad Royalty Company (TSX: NSR)(OTCQX: NSRXF)

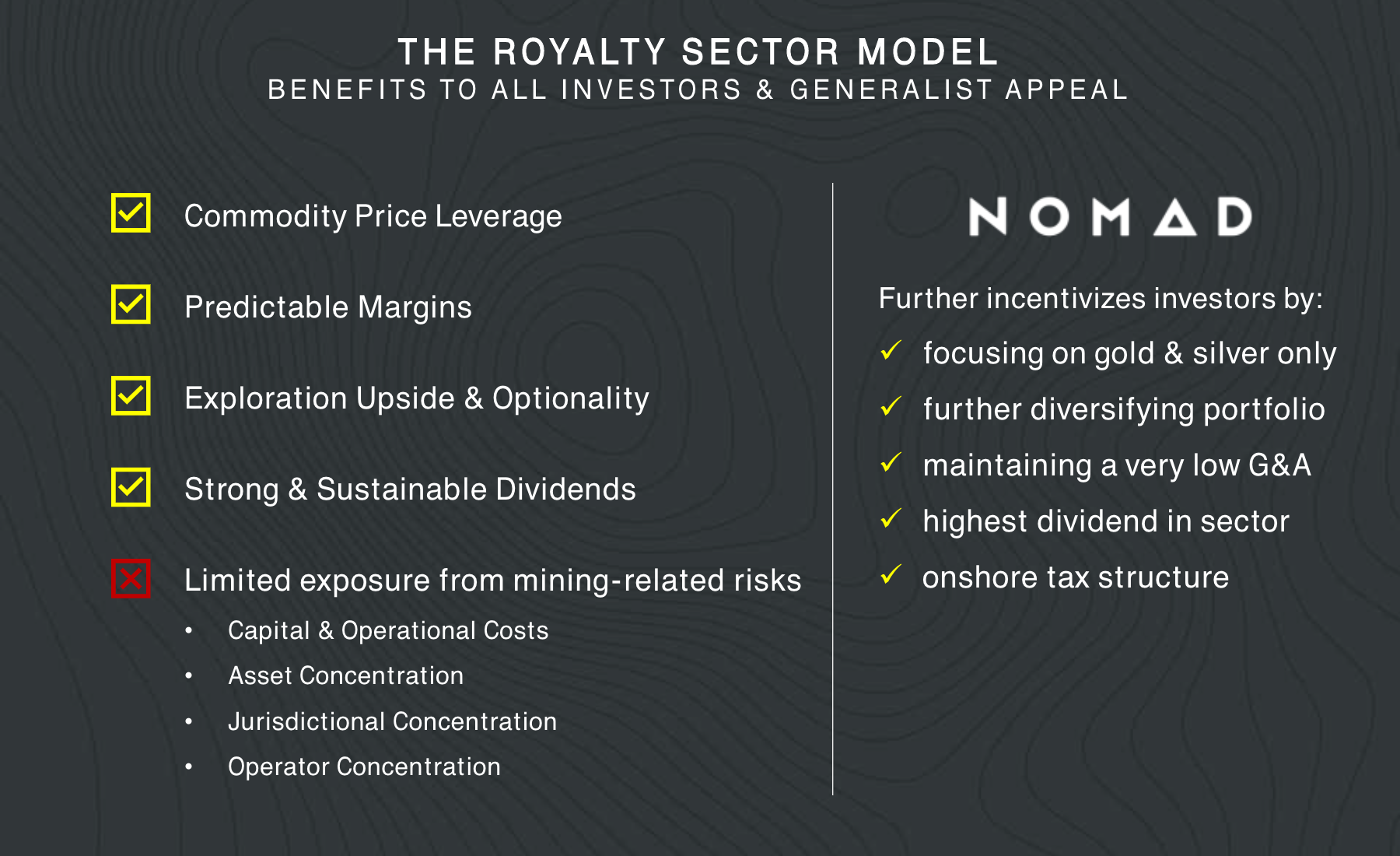

Nomad Royalty is — as the name states — a new precious metals royalty company (shares listed on May 29, 2020) that combines all the best attributes of a precious metals producer without most of the risk that comes with being a precious metals producer.

In addition to the low-risk model the company also pays you a 1.8% dividend, which is the highest in the royalty sector.

Nomad’s business model is to purchase rights to a percentage of the gold or silver produced from a mine, for the life of the mine.

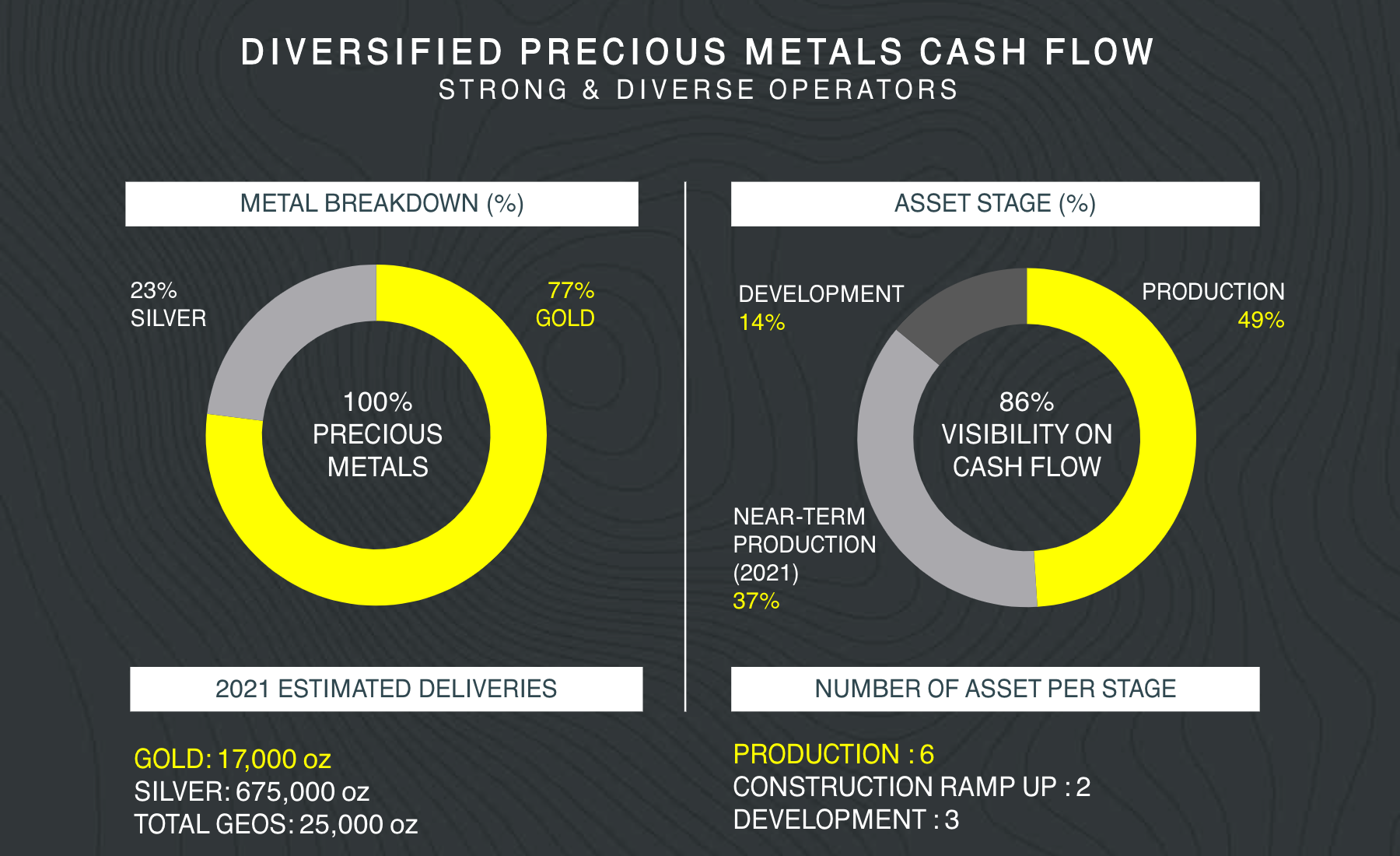

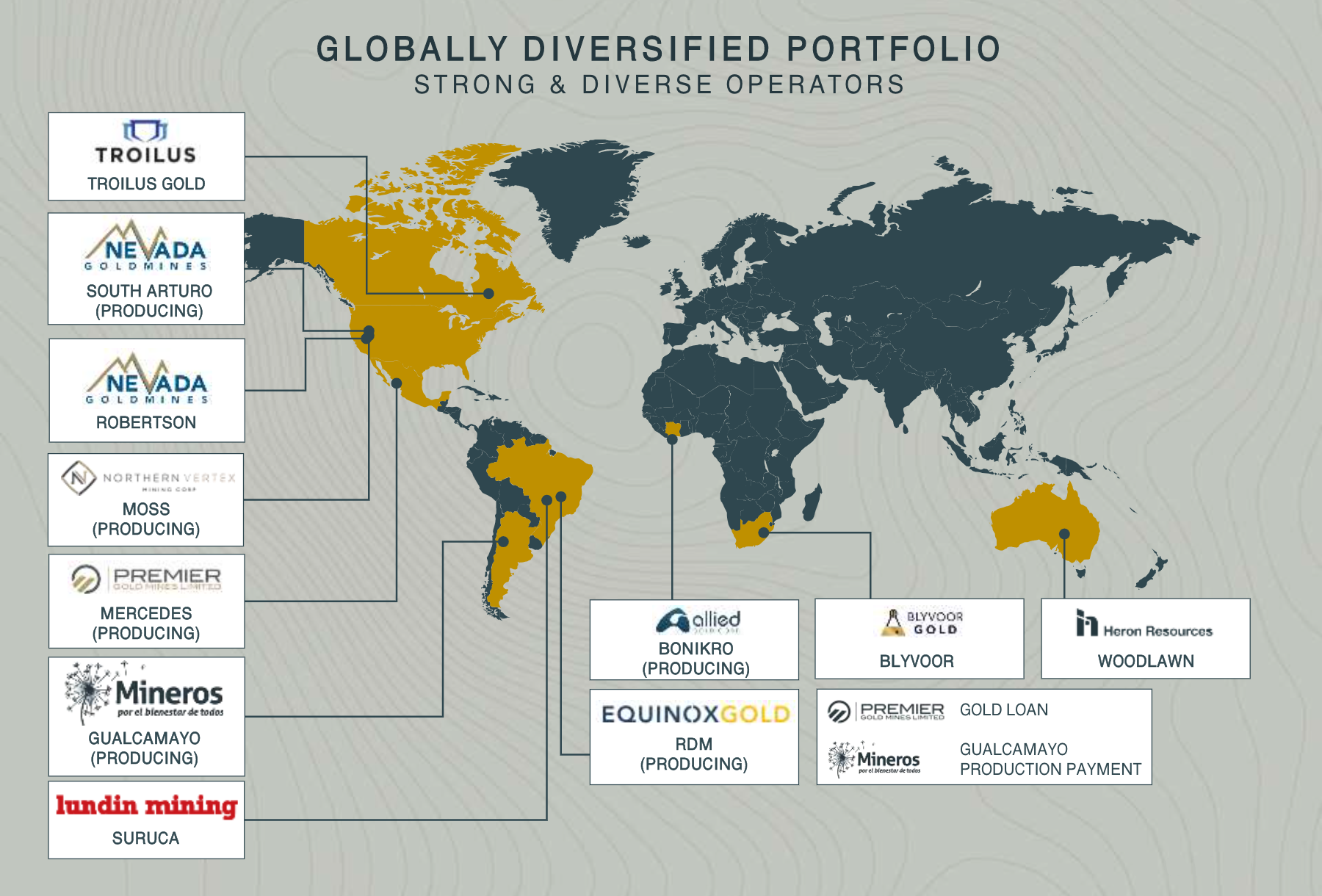

Nomad owns a portfolio of 12 royalty, stream, and gold loan assets, of which six are currently producing mines.

Nomad plans to grow and diversify its low-cost production profile through the acquisition of additional producing and near-term producing gold & silver streams and royalties and it has the team and capital partners to do it.

Management

Nomad Founder

and CEO, Director

The team is led by founder and CEO Vincent Metcalfe who has held a number of officer and senior executive roles with TSX and NYSE listed resource companies.

He has proven experience in capital raising, mergers & acquisitions and financial engineering.

Prior to his executive roles, he advised resource clients with a focus on precious metals, base metals, and bulk commodities, in both mergers & acquisitions advisory and financing at large Canadian investment banks for nearly 10 years.

Nomad Founder

and CIO, Director

Vincent is joined by CIO and founder Joseph de la Plante and founder and CFO Elif Lévesque.

Prior to his current role, Joseph played a key role in the creation of Osisko Gold Royalties where he led the execution of over $1B in financing equity, royalty and stream transactions and two major transactions in his role as Vice President of Corporate Development.

Prior to this, he was with Osisko Mining Corporation through the development, operation and subsequent $4.3B sale of the Canadian Malartic mine in 2014 to Yamana Gold and Agnico Eagle.

Nomad Founder and CFO

Elif is a Chartered Professional Accountant with over 20 years of experience in finance, treasury and strategic management in the Québec gold mining industry.

Prior to her current role, she was Vice President Finance and Chief Financial Officer of Osisko Gold Royalties since its creation in June 2014. In that capacity, she was responsible for leading the efforts to list Osisko on the New York Stock Exchange and played a key role in acquisitions of over C$1.5 billion in stream and royalty interests as well as equity and debt financings of over C$1 billion.

The team in place has the experience, background and network to take Nomad from the current C$598 million market to a multi-billion dollar company.

Share Structure

Nomad has approximately 564.5 million shares outstanding and 597.3 million fully outstanding.

Shares currently trade at C$1.06/US$0.86 per share giving Nomad a market cap of approximately C$598 million and C$632 million fully diluted.

Major shareholders —and important partners — include Orion Finance which owns approximately 70.2% of Nomad shares.

The company has approximately $20 million in cash and an undrawn $75 million revolving credit facility. A credit facility it is keen to use to acquire new royalties.

In addition the company pays a royalty sector leading C$0.02 (1.8%) dividend on every Nomad share so you get paid while the company executes its business model.

Nomad Business Model

A model that is low-risk, focuses and provides immediate cash flow from six cash flowing assets. Cash flow that is low cost and high margin.

As evidenced by the recent permitting difficulties with Almaden Minerals, permitting, building and operating a mine is difficult work. Risky work where management and shareholders alike share in the risks.

With the royalty model shareholders benefit from the exposure to higher metals prices, predictable margins, a dividend in this case and the leverage of jurisdictional diversification which is critical given the increasing geopolitical risk miners face.

Nomad focuses exclusively on gold and silver streams.

The current portfolio — one that will grow rapidly in 2021— consists of six producing gold and silver streams with another two scheduled to come online in 2021 and three others in development.

77% of Nomad’s revenue is generated from gold royalties with the other 23% coming from silver.

Recent financials show a cash operating margin of 86%.

Geographically revenue was sourced 48% from the Americas, 50% from Africa and 2% from Australia.

The revenue stream includes the recently acquired gold-silver royalty on the Robertson gold project which is part of the Cortez and Pipeline mine complex in Nevada.

The royalty from the top gold mining operator in the world Nevada Gold Mines (Barrick and Newmont) has an inferred resource of 2.7 million gold ounces.

The acquisition fits with the Nomad model which if the company executes as is anticipated will lead to a significant re-rating in share price.

Nomad is already paying a 1.8% dividend. The peer average is 0.67%. The company boasts a 17.8X cash flow while better known peers and staples in the royalty sector Franco Nevada enjoy a multiple of 28.1. Ditto for share price relative to net asset value where Nomad has a 1.0X multiple while the peer average is 1.76X.

All metrics that show significant value using today’s cash flow and metals prices. I of course expect the company to aggressively add to its portfolio and I expect new all time high gold prices in 2021.

Shares are undervalued using today’s metrics. If I’m right about the growth and the increase in precious metals prices it won’t be long before the market catches on.

Beat them to it.

Shares have a 52-week high of C$1.89/US$1.50 and have pulled back beautifully which provides an excellent entry point.

Nomad Royalty Company (TSX: NSR) (OTCQX: NSRXF) is a strong buy up to C$1.10/US$0.93

Portfolio News

A lot to get and a lot to come in January of 2021. Let’s get to it.

The biggest disappointment of 2020 was the initial denial of Almaden’s’MIA application. I say initial because there are still legal options that include re-submitting the application or challenging the denial.

The company also has the options of continuing with exploration where substantial upside exists and waiting to re-submit the application or challenge the denial.

For those of you that wrote in and decided to hold shares, be clear that I will continue to support the company and may revisit the position in the future. However in this bull market and with the opportunities that exist within it, I would be doing you a disservice if I asked you to hold shares and wait.

Most of the portfolio is up substantially with the notable exceptions due for a big run in 2021.

Despite the strong performance from the bulk of the portfolio the best is yet to come as lab delays will start working their way through and we start getting results from laggards such as Nevada Sunrise (TSX-V: NEV) (OTC: NVSGF).

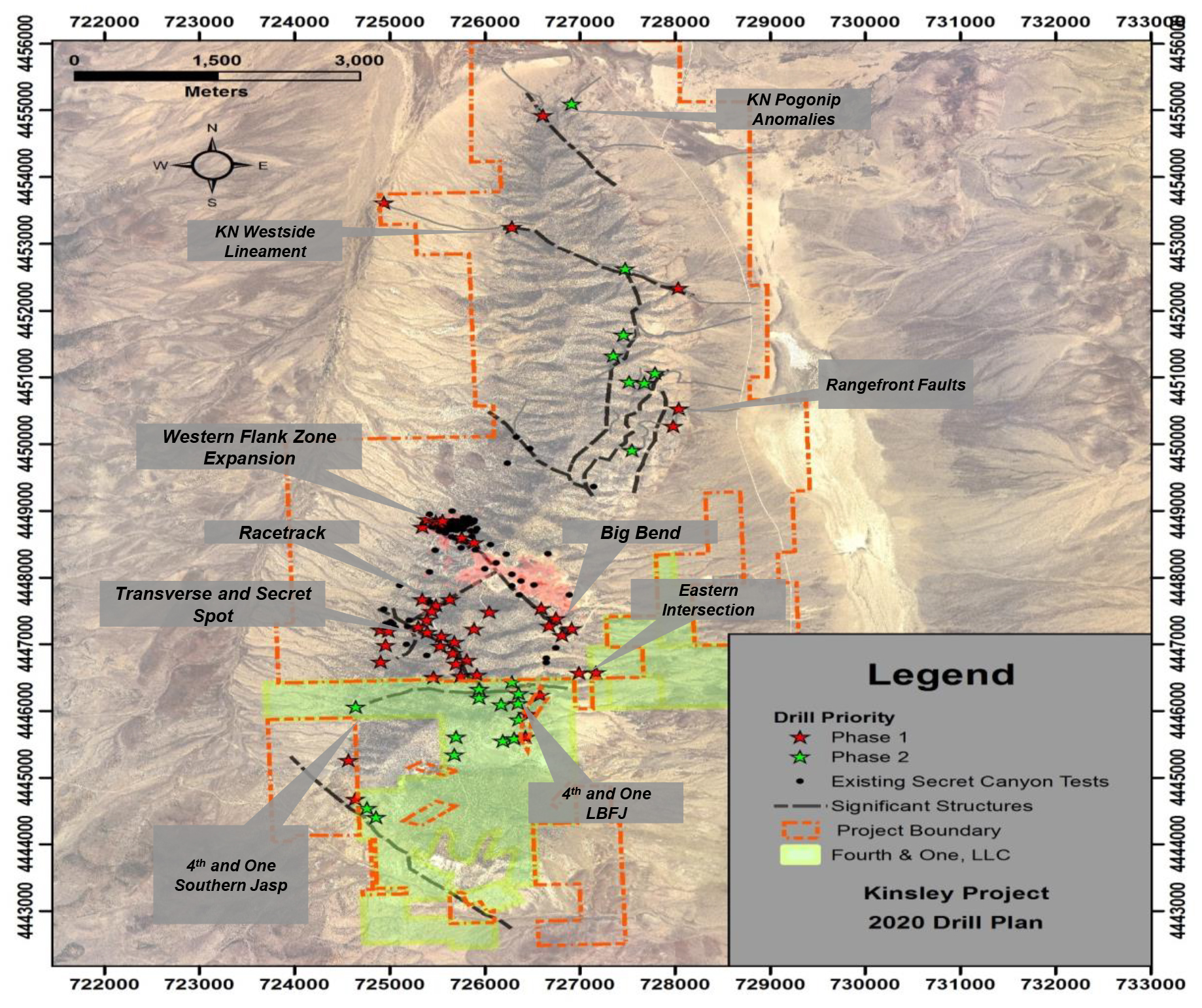

I expect initial assays by the week of the 11th. The first set of 49 holes from the drill program at 20%-owned Kinsley Mountain.

The program focused on finding extensions of the high-grade Western Flank gold zone and drilling for new discoveries.

Initial assays will come from the Western Flank and the Kinsley Northwest Fault Big Bend area.

I expect high-grade extensions at the Western Flank. It’ll be interesting to see how much of that resource can be converted to indicated from inferred and how far the high grade extends.

The real prize however will come from new Western Flank type high-grade discoveries and/or new shallow oxide gold oxide discoveries elsewhere on the property.

There will be misses because that’s the nature of exploration but if either type of mineralization is discovered elsewhere on the property then this will be the second time Kinsley has delivered significant gains to my portfolio.

Shares are a steal at these levels. I’d get that done.

We’ll know soon.

We’ll also know if K2 Gold (TSX-V: KTO) (OTCQB: KTGDF) can follow up the impressive drill results that included 86.9 meters of 4g/t gold from surface.

I’ve explained before that the geology is predictable. That historic drilling — many of these holes are step outs — guided this drill program and that K2 was very undervalued. You had all year to buy it under the buy up to price which I’ve increased multiple times.

I’m up over 100% and I believe the next leg up will be even more impressive and so does the market which quickly decided to buy K2 shares to the tune of C$7 million in a bought deal private placement announced on December 9, 2020.

We should see drill results the first two weeks of January.

Midas Gold (TSX: MAX) (OTCQX: MDRPF)

It’s been a busy month for Midas Gold which I believe is now in play as a near-term takeout target.

Earlier this month the company announced the board of directors was being “refreshed” by Paulson and Co.

Long-time CEO Stephen Quin who navigated the bear market and led the Midas team exceptionally well is out as CEO and Laurel Sayer who was brought in by Stephen is in.

I’ve met Laurel. She’s qualified and will do right by shareholders, but I’d be less than genuine if I didn’t say I personally feel disappointment that Stephen will not be there when the project is built, permitted or bought out.

I now believe that will happen in the opposite order as I’ve seen this movie play out with Detour Gold which Paulson & Co. also “refreshed” that board before a subsequent sale for over a billion dollars.

I believe we’re about to see a similar outcome here. Sooner rather than later.

The last piece of the buyout puzzle — outside of a permit — was delivered on December 22, 2020 when Midas announced its positive feasibility study for the Stibnite gold project in Idaho.

Highlights from the release:

- Over US$1 Billion Investment Set to Restore Brownfields Site, Implement State-of-the-Art Modern Mining Methods, Employ Hundreds of People and Recover nearly 120 Million Pounds of Antimony, a Critical Mineral

- Expected Annual Average Gold Production of 466 thousand ounces at All-in Sustaining Costs of US$427/oz during the First 4 Years of Operation

- At US$1,850/oz gold, Robust Project Economics Yield NPV (5%) of US$1.9 Billion and Average Annual Free Cash Flow of US$594 million in the First 4 Years of Operation.

“The results of the Feasibility Study highlight the attractive economics of the Stibnite Gold Project,” said Marcelo Kim, Chairman of Midas Gold Corp. “The Project’s exceptional grade and low strip ratio place this project in the lowest quartile of the industry cost curve and coupled with its large mineral reserve and manageable capital expenditure profile, make the Stibnite Gold Project one of the gold industry’s most attractive development projects. The Project’s economics are resilient at lower metal prices and also exhibit significant leverage to rising prices. Despite the recent strength in its share price, Midas Gold represents one of the most undervalued gold investment opportunities in North America.

At current market prices, Midas trades at a fully diluted market capitalization of $551 million, or 29% of the Project’s NPV 5% of $1.9 billion at spot gold prices. We remain steadfast in our commitment to continue de-risking and advancing the Stibnite Project for the benefit of all stakeholders.”

It’s important to note that although the company used the higher $1,850 gold price the project is extremely resilient to much lower prices.

All in sustaining costs of $427/oz the first four years of production and $625/oz for year 1-15 are exceptional.

Especially given the bi-partisan support for the project.

Stephen and the Midas team did a phenomenal job of developing and de-risking the project.

Given the economics and the potential for a near-term buyout I’m increasing the buy up to price.

Midas Gold (TSX: MAX) (OTCQX: MDRPF) is a strong buy up to C$1.27/US$1.00.

Hannan Metals (TSXV:HAN) (OTC PINK:HANNF)

Another company that should already be in your portfolio and is set for a big 2021 is Hannan Metals.

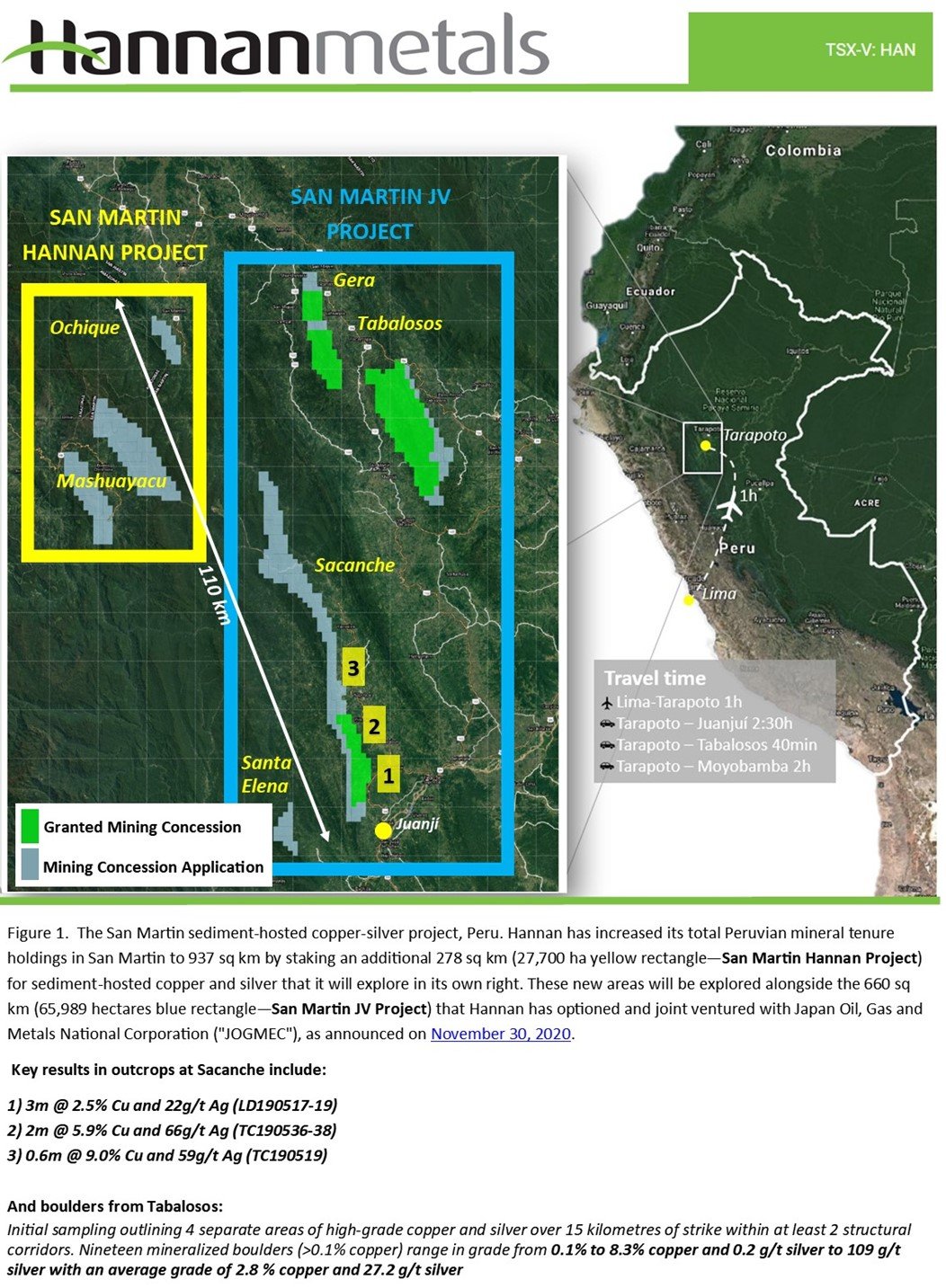

On November 30, 2020 Hannan announced what I told you had to happen, a partnership with a deep pocketed major that would allow Hannan to properly explore the massive basin-scale San Martin copper-silver project in Peru.

The quality of the partner — JOGMEC — speaks to the quality of the project. I went over the details of the deal with chairman and CEO Michael Hudson here.

The most recent bit of news flew under the radar but is significant for several reasons.

On December 21, 2020 Hannan announced that it has significantly increased its mineral tenure holdings in the San Martin district of Northern Peru to a total 937 square kilometers ("sq km") (93,700 hectares ("ha")) of applications and granted mineral concessions prospective for sediment hosted copper-silver mineralization.

As important is that 278 sq km (27,700 ha) for sediment-hosted copper and silver is 100% owned by Hannan outside of current joint venture areas.

That’s massive in its own right and a company maker if a discovery or discoveries of significance is made.

I’ll speculate that in addition to copper and silver on the property there may also be compelling gold targets to be discovered.

To that end the field exploration program is ongoing and we should start receiving results soon.

Michael Hudson, CEO states, "Hannan and JOGMEC recently concluded one of the strongest joint ventures made in the junior exploration space over the last year. In the last 6 months, we have been working to build a dual Peruvian strategy of a hybrid prospect-generator. We have now secured a vast and extremely prospective landholding on the San Martin Hannan Project that we own outright, while actively exploring large areas defined within our fully-funded JOGMEC partnership at the San Martin JV Project.”

I spoke with Michael about the new concessions, why they’re important and what to look forward to in the new year.

You can and should listen to that here.

Hannan has traded under the buy up to price of C$0.40 for the bulk of the year when I urged you to add on weakness. We’re up over 45% and headed higher.

Mawson Gold (TSX: MAW)(OTC: MWSNF)

Another Michael Hudson led vehicle that’s surging higher as the market catches on Mason is finding a lot of gold in a lot of places is Mawson Gold.

While we await assays from Australia, Mawson has been busy drilling a new high-grade gold discovery in Finland. Specifically at Joki East where it recently drilled 5.5 meters of 6.9 g/t gold that included 1 meter of 25g/t gold.

That follows previous results of1.6 meters of 28.3 g/t gold and 1,190 ppm cobalt (29.2 g/t AuEq) from 168.6 meters back in November.

The most recent results also included cobalt assays that showed universal cobalt enrichment.

Mr. Hudson, Chairman and CEO, states: "Joki East continues to deliver high grades of both gold and cobalt with increased confidence of continuity with further 60 metre step-outs reported here. The consistency of high-grade mineralization and the increasing widths down plunge are encouraging. We have remobilized a drill rig back to Joki East, as part of our large 18 kilometre winter drill program and look forward to further results as they come to hand."

I caught up with Mike and asked about the new discovery, the gold, cobalt and the delays from Australia.

You can read that interview here.

Mawson has been right near the buy up to price of C$0.38.

Anything near that is a bargain as drills continue to turn and assays from Australia are due imminently.

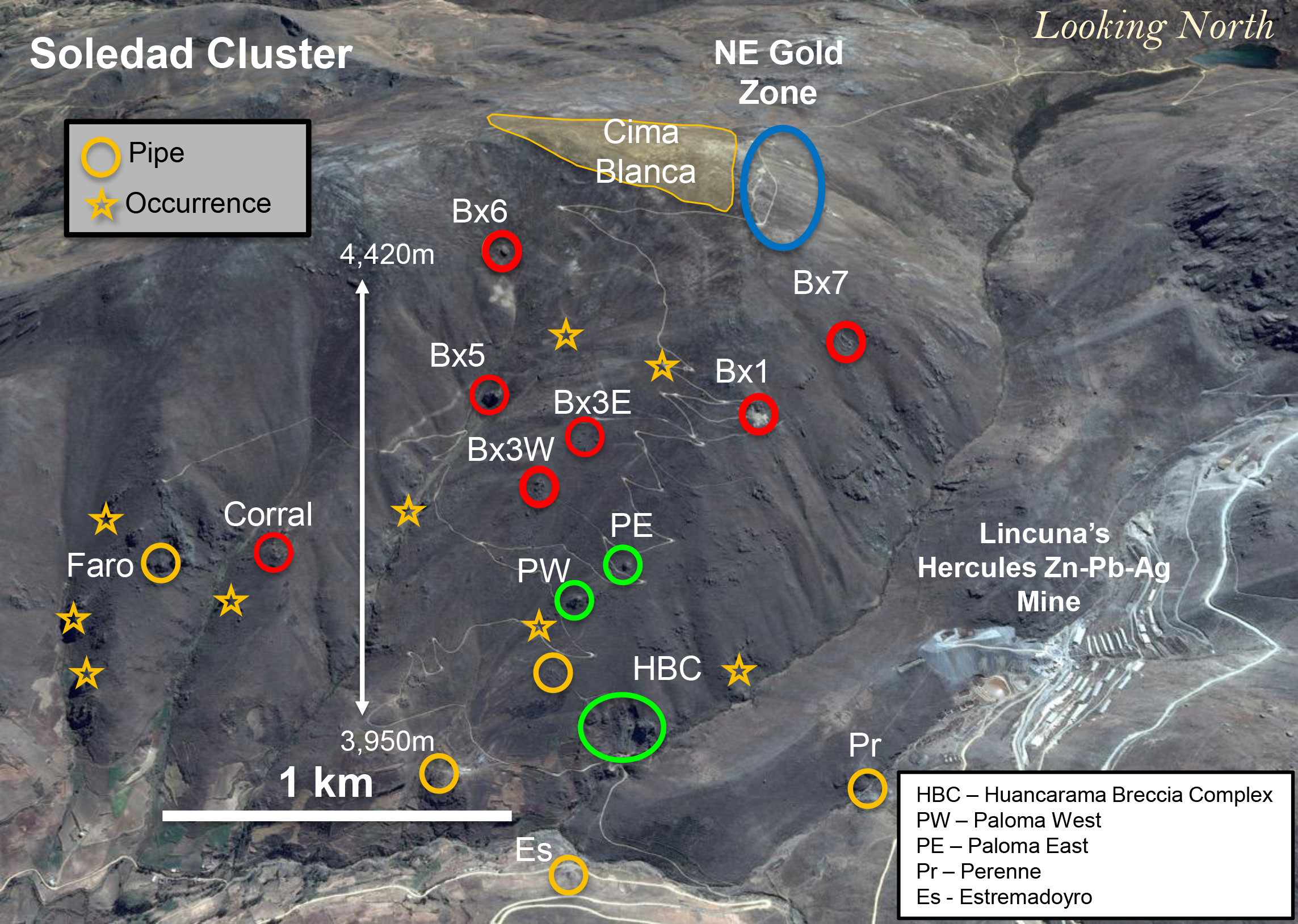

Chakana Copper (TSX-V: PERU) (OTCQB: CHKKF)

At the risk of sounding like a broken record I’ve also urged you to add to your Chakana position while the company was being shorted. That short has now been closed and it’s no coincidence that the share price has started rising alongside more excellent drill results.

The latest results from Chakana were announced on December 16, 2020.

Those results included 101.5 meters of 0.61g/t gold and 0.91% copper from 32 meters.

The results came from four holes at its high-grade copper-gold-silver Paloma West discovery at the expanded Soledad Project in Ancash, Peru.

Twenty holes have now been reported from the two Paloma targets for a total of 3,630 metres. Drilling is currently underway at Huancarama where thirteen holes have been completed thus far.

I spoke with CEO David Kelley about the results. You can read that here.

While most JRM portfolio companies have taken off this year and we’re up 30% on Revival Gold, shares remain a bargain for the bargain shoppers amongst you.

Revival Gold (TSX-V: RVG) (OTCQB: RVLGF)

Revival continues to deliver solid results to the market and the market continues to shrug them off.

On December 10, 2020 Revival Gold announced results from an additional eleven drill holes from the company’s 2020 drilling program on the past-producing Beartrack-Arnett gold project.

Being a past producer is a significant advantage (as evidenced by the recent Almaden setback). The market is also severely discounting the infrastructure advantage at Beartrack-Arnett.

The results included 11 meters of 1.01g/t gold 48.5 meters of 0.86g/t gold. Solid near-surface oxide gold results that continue to expand the open pit heap leach mine plan outlined in the results of Revival Gold’s first phase PEA released in November.

The market wants a new higher grade discovery. Assays are pending but let me be clear, if Revival never finds another gold ounce on the property this stock will trade in dollars not cents in 2021.

Revival Gold is a strong buy at these levels.

Magna Gold (TSX-V: MGR) (OTCQB: MGLQF)

As is Magna Gold which I suspect will soon spin out a Magna Silver to shareholders.

On December 8, 2020 Magna announced high-grade silver results from its La Pima project in Sonora, Mexico.

Results included 302.73 silver equivalent over 1.3 meters. a Pima is an early-stage silver target with an excellent surface target of historical mine workings and outcrops. Magna completed a geophysical survey on the property in September and results were positive. Magna completed a Phase I diamond drill program on the project totaling 1,719 meters in nine core holes. The target is a high-grade silver in replacement deposits hosted in sedimentary rocks.

Magna is planning a 2,000 meter follow up drill program to test additional areas of alteration and to test the assays received at depth. Drill holes 10, 12, 13 and 15 are planned to have deeper tests and six new targets will be drilled: one in the West Target, two in the Au-Ag target, and three at the Pima Mine Target, south zone.

In addition Magna will be testing multiple gold and silver rich properties while ramping up production at the San Francisco mine.

I have 10X gains on Magna already. We’re up over 200% in the JRM portfolio and the best is yet to come.

It’s permitted, producing, reducing cash cost per ounce, cash flow positive and has a host of catalysts in 2021 that will send shares much higher.

Every single one of you should have significant exposure to Magna Gold in your portfolio.

I spoke with CEO Arturo Bonillas earlier this month to go over the multi-pronged approach. You can listen to that here.

It’s under the buy up to price which I’ve adjusted multiple times. Get that done.

Ethos Gold (TSX-V: ECC) (OTCQB: ETHOF)

Ethos has decided that 2020 was the year to collect district scale gold land packages in stable jurisdictions and it has executed brilliantly.

It also recently announced a new president in Alex Heath.

The approach — led by Rob Carpenter of Kaminak fame among other notable discoveries — sets Ethos up for what I believe will be a breakout year for the company.

I recently spoke with incoming president Alex Heath about the approach, how to prioritize targets and when we can expect to see drills turning.

You can and should listen to that here.

You also should own some Ethos while it’s under the buy up to price.

Leading Edge Materials (TSX-V: LEM) (OTC: LEMIF)

Critical metals are on fire. Rare earths, graphite, lithium, copper, nickel, cobalt, anything needed for the electrification of everything is surging.

So are the companies that can provide these metals.

Lithium miner Orocobre, which we inherited in the portfolio when it bought out Advantage Lithium, is at 52-week highs and back to break even after being down some 60%.

I’m not adding Orocobre but I’m not selling it either. Not yet.

I am however asking you— and have been asking — to add Leading Edge Materials on any weakness as it is perfectly poisoned as the only real rare earth option in the EU.

The company recently pivoted to focus exclusively on developing the Norra Karr rare earth project and the Woxna graphite project in Sweden. It’s also waiting on the granting of an exclusive exploration license for Bihor Sud in Romania.

Bihor Sud is an exploration alliance with local JV partner for a potential discovery of high-grade nickel-cobalt mineralizations in the Tethyan Belt in a historic mining area.

As part of that pivot it has decided to sell its Bergby lithium project in exchange for shares and cash.

I used that opportunity to catch up with CEO Filip Kozlowski.

I strongly encourage you to take a minute to familiarize yourself with the company and its assets. You can do so by clicking on the company presentation here.

You can also listen to my in depth conversation with Filip by clicking here.

Closing Thoughts

It’s been a heck of a year.

I’ve been fortunate and am thankful that despite its challenges it’s been a healthy and productive one and I hope that has been the case for you as well.

I’m glad to bid 2020 goodbye and excited to welcome the new year.

2021 will be the year that commodities really break out.

Gold will see new all-time highs, the very few quality uranium names will continue to catch significant bids and if we’re lucky we’ll be back outside and surrounded by loved ones in a more permanent way.

Companies like Kutcho Copper, Millrock Resources and Abacus Mining will make you wish you owned more at these levels.

You can’t and shouldn’t buy everything. Pick the commodities you’re comfortable with, the stage (exploration, development, producing), select a timeline and make sure you articulate to yourself why you’re buying something.

Pick enough companies to spread out your risk but also make sure your exposure is significant enough to where when you get a win, the win matters.

As an example I’ve owned Nevada Sunrise Gold for years. I owned it because I like Kinsley Mountain and wanted to have a large position when it was properly tested.

Did I enjoy seeing it dip to C$0.03 during the recent bear market?

No, but I sure used that opportunity to load up, write several checks to help the company see itself through the nastiest part of the pullback and soon we’ll know if that was a prudent move or not.

The point is the premise which I based the buy call had never proven itself flawed so the price didn’t really matter to me. I was clear on what I was buying and why.

I wish you all a healthy and profitable 2021.

Let's get it!

![]() Gerardo Del Real

Gerardo Del Real

Editor, Resource Stock Digest

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.