Hard Asset Digest November 2020

This month, I’m sitting down with Mr. Gerardo Del Real — editor of Junior Resource Monthly and Junior Resource Trader.

Click here to jump straight to the interview.

Based in Austin by way of Chicago and Alaska... Gerardo Del Real is also the president of Resource Stock Digest – one of the top resources for complimentary research on junior mining stocks – and the co-founder of Digest Publishing.

Prior to those roles, he spent nearly a decade behind-the-scenes providing research and advice to large institutional players, fund managers, newsletter writers, and some of the most active high net worth investors in the resource space — including those who count in the $billions.

Gerardo’s unique brand of due diligence, along with his impressive track record, have allowed him to create a powerful network of contacts that he leverages to maximize the incredible money-making opportunities that currently exist in the resource sector.

Gerardo has been successfully trading junior resource stocks for over a decade and has been issuing buy and sell alerts to a paying group of followers for much of that time.

He’s helped everyone from retail investors to billionaires maximize their mining stock returns, while minimizing losses, because the junior space is where he’s made his wealth as well.

Junior Resource Monthly is Gerardo’s portfolio-based monthly newsletter offering buy and sell recommendations for longer-term junior resource speculations with ongoing coverage of each position.

Junior Resource Trader is Gerardo’s premium buy-sell alert service focused exclusively on the explosive junior mining sector. This real-time service mirrors his personal trades using the process he’s developed during his years as a professional trader.

Gerardo’s general market commentary can be found in his weekly editorial at Resource Stock Digest.

I’ve had the distinct pleasure of working alongside Gerardo for the past year and a half — and I’m thrilled to be able to bring you our recent conversation.

In it, we discuss his unique background and expertise, the resource market at large — and he’s been generous enough to share with us some of his top picks from the high-risk, high-reward junior sector.

A Bumpy Ride!

In last month’s issue, I presented my near and longer-term projections for gold.

And while the Trump administration is just now finally starting to acquiesce to a Biden transition, little else has changed, and thus we can expect continued choppiness in the precious metals sector through year-end buoyed by a predictable mid-December bounce in the gold price.

With the major market indices currently trading at or near record highs, gold and silver have been demonstrably weak for the better part of November with gold now hovering just above key support at $1,800 an ounce and silver trading right around $23 per ounce.

That interim weakness is not entirely unexpected as covid-fatigue is now beginning to give way to a palpable sense of hope with the announcement of viable vaccine candidates from drugmakers Pfizer, Moderna, and AstraZeneca — all displaying better-than-expected efficacy rates.

While most infectious disease experts have suggested they’d be content with anything north of 60% efficacy, all three of the aforementioned COVID-19 vaccine candidates are blowing that figure clear out of the water:

- Pfizer’s vaccine is displaying an efficacy rate of nearly 95% but holds the disadvantage of requiring storage at ultra-cold temperatures of around minus-70 degrees Celsius (minus-94 F). Obviously, pharmacies are not equipped with those types of freezers. The Pfizer vaccine is also expensive at a projected cost of about $20 per dose.

- Moderna’s vaccine is also showing about a 95% efficacy rate; it can be stored at standard freezer temperatures and then refrigerated for about 30 days. It’s vaccine is also quite expensive at a projected cost of around $15 to $25 per dose.

- AstraZeneca announced this week that its vaccine is coming in at about a 90% efficacy rate with the very important advantage of being able to be stored at normal refrigerated temperatures. It’s also far cheaper to make than the other two (at a projected cost of about $2.50 per dose).

As responsible citizens, job number one is to get through these next few difficult months while being ever so mindful of our personal decisions on gatherings through the holiday season.

Next year, we can truly let the dogs out!

Vicious Cycle

As Gerardo and I discuss in this month’s issue, we’re in the midst of the biggest counterfeiting operation in the history of the world.

In the last 13 years, central banks have cut interest rates a total of 972 times and have bought $19 trillion in financial assets through what we now refer to as “unlimited” quantitative easing.

The end result has been a near-record $16.8 trillion in negative yielding global bonds.

Just since the start of the pandemic, the US Congress and Federal Reserve have combined to add some $6 trillion in quantitative easing with $trillions more soon to be printed.

We call it “counterfeiting” because the money is essentially printed out of thin air as a means of propping up the stock market. Those $trillions are lent back to big corporations who in turn use the funds to buy back their own shares in many cases.

It’s a vicious cycle… and it’s only the beginning.

In fact, the entire world is now completely addicted to free and easy money with no antidote available nor one being considered or even desired.

And so that is our backdrop for higher gold prices going forward. Every single record the world has ever set, or will soon set, in terms of money printing and debt creation will be obliterated over the course of the coming few years.

In the end, which will be upon us sooner rather than later, fiat currencies will be significantly devalued against gold and silver. And yes, that includes the almighty US dollar.

Doug Casey, who literally wrote the book on contrarian investing, refers to US sovereign debt compared to other sovereign debts as “The prettiest mare at the slaughterhouse,” which certainly is not high praise for the greenback.

Of course, what we’re facing is not a total gloom and doom scenario. The world is not going to crash and burn the way many are postulating.

There is a way out of this… but it will prove immensely painful for savers and will undoubtedly include a lot more quantitative easing (i.e. counterfeiting) and perpetual interest rate management.

The bottom line is that the spenders in society absolutely love it when Congress does quantitative easing — and those legislators invariably get reelected. So like it or not, the easy-money policies over the last decade-plus are here to stay.

And so the vicious cycle I was referring to will prove a tremendous tailwind for gold – and as well for silver – as currencies become increasingly devalued.

That’s because, as currencies are debased, most other things become pricier on a relative basis — with monetary metals like gold and silver, which are priced in US dollars, poised to lead the pack higher.

That’s why it makes absolute sense to worry less about the short-term gyrations in the gold price and to focus more on the macro picture.

And for the yellow metal… that picture is extremely bright!

Now, THAT is Some High-Grade!

In our Precious Portfolio alert from a couple of weeks ago, we announced a buy-signal on SilverCrest Metals (NYSE-American: SILV)(TSX: SIL).

Precisely one week later, the company released a set of spectacular drill results from its Las Chispas gold-silver project in Sonora, Mexico, that very much deserve our attention.

SilverCrest reported over 50 holes in its 16 November release — mostly infill drilling from a key target area that will be used in the company's next resource update.

Only 10 of the 43 known veins at Las Chispas are included in the most recent estimate leaving 33 veins to still be significantly drill-tested. A Feasibility Study is currently underway and scheduled for completion by year-end and is projected to include 20 of the 43 known veins.

But alas, I digress…

What I really want to talk about is the highlight hole as something to behold… and also as something to remind us resource stock speculators that those elusive high-grade deposits are still out there waiting to be unearthed!

And so here it is…

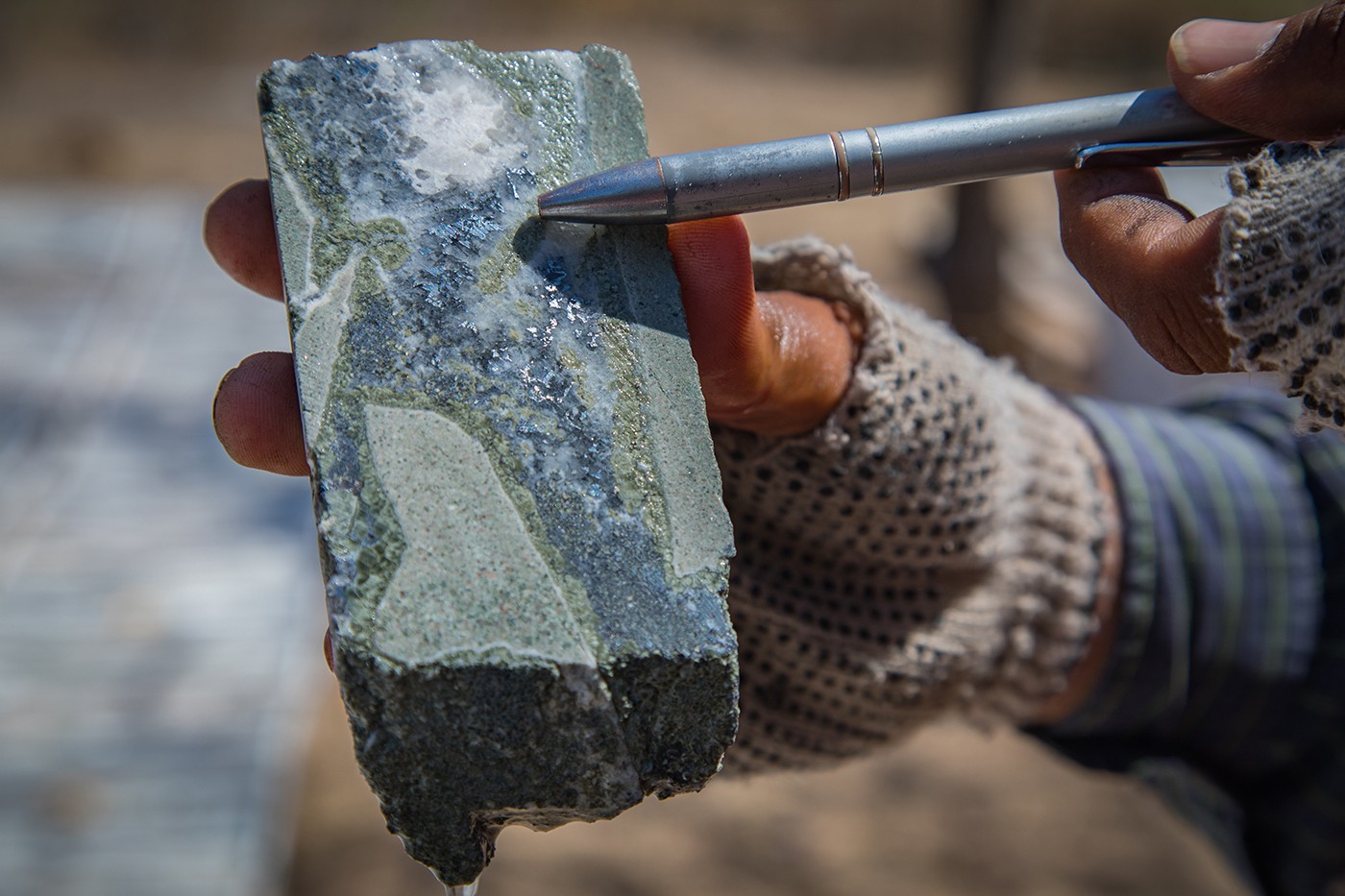

Hole BV2-201 from the Babi Vista Splay Vein at Las Chispas reported 2.4 meters estimated true width grading 555 grams per tonne gold and 19,453 g/t silver — including 0.4 meters grading 3,366 g/t gold and 114,814 g/t silver.

It’s one of the highest grade intercepts I’ve ever witnessed, and it’s no surprise it represents a new grade/thickness record for the project. That subinterval of 0.4 meters equates to roughly 37% silver equivalent by weight — which is truly, truly astounding!

Overall, the intercepts within the high-grade at this particular target at Las Chispas average an impressive 74.27 g/t gold and 3,427 g/t silver over a 1.4 meter true width. Obviously, hole BV2-201 skews the results heavily upward. Yet, even with that bonanza hole removed, the average grade comes in at a robust 10.35 g/t gold and 1,309 g/t silver over an average true width of 1.5 meters.

In all, it means this target area could potentially add a few million ounces of silver equivalent to SilverCrest’s upcoming PEA for Las Chispas, which is great news for the company and its shareholders.

Of course, the trading patterns for gold/silver over the past few weeks have served to produce scant more than a collective yawn over these truly spectacular results — which is something we’ll have to take in stride for the time being.

I firmly believe these types of muted responses will soon morph into ones of market-wide excitement as gold and silver resume their powerful upward trajectory.

Remember, we’re not sweating the little stuff…

Instead, we’re focused on the longer-term macro picture for gold which has us primed for an unprecedented wealth-building opportunity in the resource space over the coming next few years.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with Gerardo Del Real

Editor of Junior Resource Monthly and Junior Resource Trader

Mike Fagan: Gerardo, thank you kindly for coming on. I’m excited to get your take on this gold bull market we’re in — and I’m especially pumped because I know you specialize in the higher-risk, higher-reward junior segment of the broader resource sector.

First, real quick, for my readers who may not know your story, can you take me from Alaska – where you first got started in natural resource speculation – to where you are now in Austin, Texas?

Gerardo Del Real: Mike, thank you very much for having me. It's a pleasure to be with you today and it's an interesting story. I actually met my wife in Anchorage, Alaska. She was born and raised there. And so I lived there for a total of 17 years. The joke in the family is that after we met, it took me another 13 years to convince her to head south for a warmer climate!

And so here we are now just outside of Austin. We've been here for about eight years and we’ve absolutely fallen in love with the city.

It's interesting because I was living in Alaska when I started speculating in the resource space. At that time, I was also speculating in real estate and realized that that bubble was about to burst.

And so I began looking into different ways to diversify into something that provided a much higher reward to go along with the elevated risk factor. And that led me straight into the junior resource space where I’ve been ever since.

Legendary

resource

stock expert

I began educating myself… I chanced upon a book by Bob Bishop, formerly of Gold Mining Stock Report, that he wrote in the mid-80s called The Investor’s Guide To Penny Mining Stocks, and I became fascinated by the potential to make life-changing gains in this space.

Now, admittedly, I was a bit naive to the true risk aspect of it, but the market has a way of teaching you those lessons in due time. I certainly learned a few of those… and that's the very short version of how I got into the resource space.

MF: That’s great! It’s funny you mentioned Bob Bishop. Bob’s been a very close friend of my family for decades. My dad came up through the business with him, and I’ve learned a lot from Bob as well.

Would you mind telling my readers about some of your earliest successes in the resource sector because I know there are several that were absolutely spectacular!

GDR: I’m happy to, Mike. That’s awesome by the way… and it really points to what a small world the resource space actually is.

So yes, going back in time a bit, my first resource speculation was a company called Animas Resources back in 2008. And that’s actually how I got my start writing research reports and consulting for high net worth financiers.

You know the old saying… It's sometimes better to be lucky than good!

Literally, by pure chance, I came across the Animas Resources website and dug into it. Their flagship property was in a part of Mexico I was familiar with.

Global Market

Development

The team they were putting together seemed like a dream team of geologists and people with serial success. People like Odin Christensen and Greg McKelvey; Jeff Phillips, whom we both know and respect, was the original financier that had put the land package together and structured the company.

You know, I've always had an appetite for learning, and the more I dug into how that particular deal was structured, the more fascinated I became by this consolidation of what I thought could be a district of multi-million ounce gold deposits in Mexico.

One thing led to another. I began attending mining conferences including Brien Lundin’s New Orleans Investment Conference. That became really instrumental in my development because it allowed for introductions to people like Bob Bishop, to people in the business, to geologists — people I wouldn't otherwise have had access to.

That really helped me as I began developing my network of contacts in the space. I had some early success that led to me thinking I had things figured out, which as you know is when the market tends to really teach us how little we know. I learned some valuable lessons as all resource speculators eventually do.

In addition to Animas there were several large percentage winners early in my speculating career that contributed to my youthful confidence. One was a company called Rare Element Resources.

I got in I think at 24 cents and over the next year and a half it got as high as $18 per share. QuestRare Minerals, I got in at around 8 cents, and it eventually traded as high as $8; I think I got out around the $6 mark.

I was also trading leveraged options of those companies as well which should tell you everything you need to know about my naiveté.

Though I did very well with the options trading during the rare earth boom, it wasn’t because of smarts — it was just lucky timing. I don’t advise anyone trade leveraged anything.

Almaden Minerals was one of my second or third gold-silver speculations — and that went from 50 cents to as high as $5 on a discovery in Mexico.

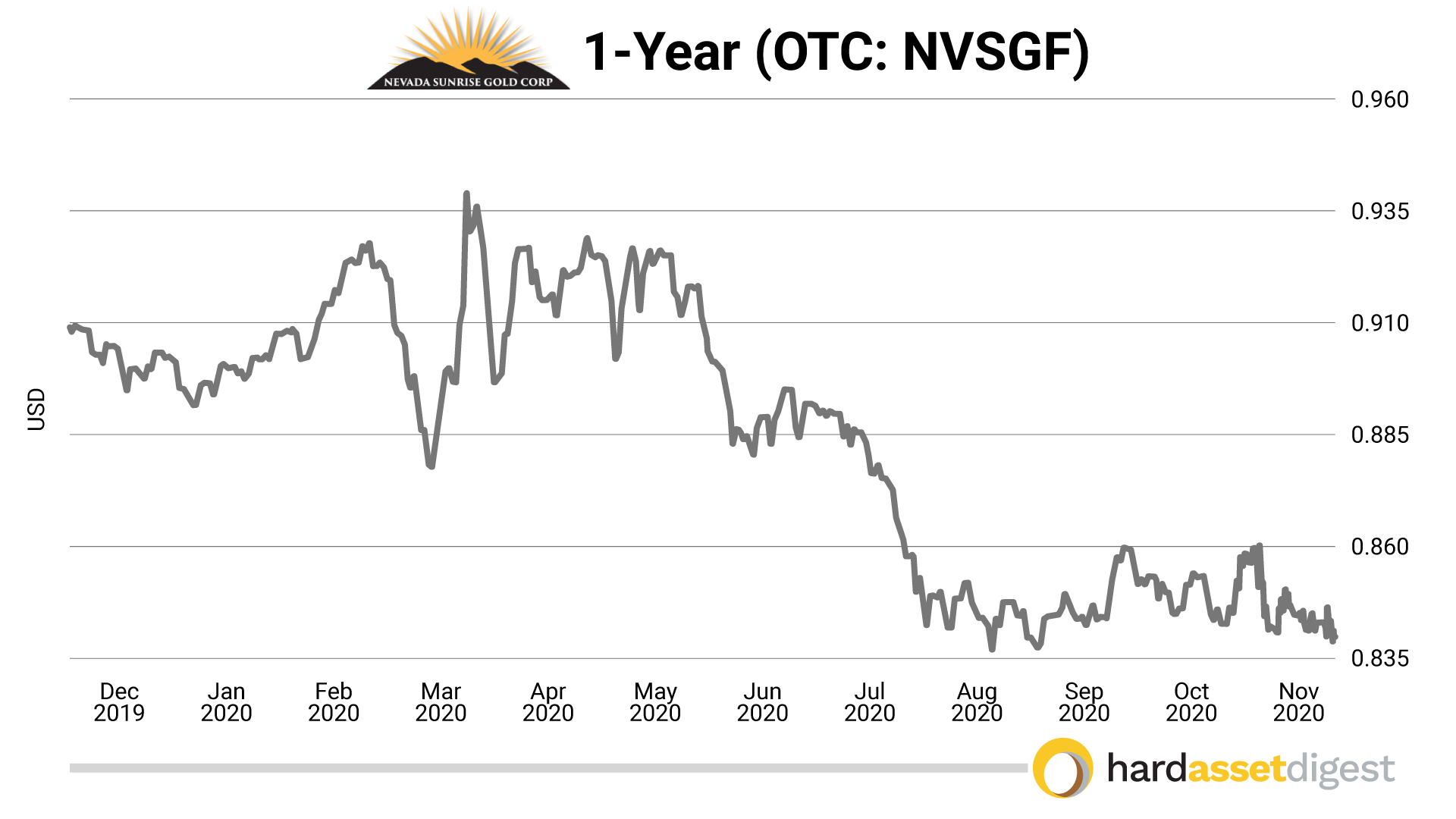

And then, Nevada Sunrise Gold, which I'm crossing my fingers and toes that I get to duplicate those past gains one more time. I started buying that company at around the 8 cent level — and it traded as high as $1.75 per share, but unfortunately that was a round trip back to around 15 cents today.

Yet, I was fortunate enough to do well with a lot of my early speculations, and those early successes were both a blessing and a curse. A blessing in the sense that it allowed me to develop my passion for the business in a way that was profitable, but also a bit of a curse because as I mentioned earlier I thought maybe I was smart!

MF: Very true… nothing like a screaming gold bull market to make any resource speculator feel like they’re a market genius! And then, Gerardo, you moved into publishing your own junior mining stock newsletters for the retail audience. Can you tell me about that?

Co-founder,

Digest Publishing

GDR: Yeah, around 2016 is when I launched the current incarnation of ResourceStockDigest.com along with my business partner, Mr. Nick Hodge, and that coincided with my first premium newsletter under Nick’s guidance. I wrote for a division of a publishing company that he oversaw. And so that led to my first published newsletter.

I really cut my teeth in the business the six years leading up to 2016. That’s where I began doing consulting work for some high net worth investors. And the very simple version of that is — I would analyze deals.

I would analyze share structures and companies' management teams and jurisdictions and everything that led me to refine my due diligence process.

And so I am extremely thankful for the guidance and the experience of those six years because it definitely allowed me to be more thorough and diligent in the way I went about making my recommendations — which, of course, I do to this day.

And so that was my six year degree, if you want to call it that, in the junior resource space… knowing when to say no, when to say yes, picking good entry points and knowing where we are in the cycle.

MF: And it’s a super exciting time because you now have your two new publications, Junior Resource Monthly and Junior Resource Trader…

GDR: Yes, very exciting indeed! As you know, Nick Hodge is the founder and CEO of Digest Publishing – a new publishing venture that he and I co-own – and we're up and running. I have my two new products, Junior Resource Monthly and Junior Resource Trader.

MF: And perfect timing as well with this new gold bull market…

GDR: Absolutely… the timing could not be any better! I'm extremely excited about this new gold bull cycle we’re just now entering. And again, luckily we've had the past four-plus years to sharpen our knives and really refine how to maximize this current cycle.

Not only for myself, but for the subscribers, which is ultimately why we're in this.

MF: And as we discussed, the junior market is the highest-risk segment of the resource sector but it also offers the greatest potential reward. Would you mind going into the top things you look for when evaluating a junior resource company?

GDR: Definitely. First off, I would say one should never, ever speculate in the junior resource space on leverage and definitely not with money you cannot afford to lose.

MF: I agree… that’s definitely rule number one!

GDR: Yeah, I mean the gains can be absolutely spectacular but the losses can be equally devastating. And so you don't want to find yourself on the wrong side of a mining stock speculation too often. It does happen… but the idea is to minimize the inherent risk factors before you wager your risk capital.

With that being said, you know from your own experience in the business and from your father's experience as well that this is a relationship business. It really is about the network… how you and I met, how I ended up meeting Mr. Bob Bishop, how I ended up connecting with someone like Nick Hodge and so on and so on.

That network is all made possible by introductions that people friendly to us have been able to play a large part in. And so that really helps bolster the access to geologists and financiers; the movers and shakers in the business that really have their finger on the pulse.

And so when I get into analyzing a company and deciding whether or not I'm going to allocate capital toward it, the very first thing I look at is the share structure and who owns the shares.

For example, if a company just went public, what do those pre-public shares look like? The pre-IPO shares, were they done at a penny? Were they done at five cents? Were they done at 1/10th of a cent? Are the shareholders insiders who are in it for the long haul?

We could do a whole interview just on share structure. But in general you want to make sure a ton of cheap stock is not about to become free trading by investors who are just looking for a flip. It can mean the difference between a company going from 10 cents to 25 cents versus a company going from 10 cents to $10.

And then, of course, I look at the people running the show. The network that we've developed really allows for vetting of people's backgrounds. And so I have to like the management team; I have to know that they've been successful, that they're able to duplicate what they're attempting to duplicate — which hopefully is past discovery and development success.

I don't want a gold-specific team to all of a sudden become lithium experts and tell me that I should write a check for a company to help them learn how to process lithium. It's not going to work, folks. It's not their knitting, and so you want to make sure that management has experience doing what they’re setting out to do.

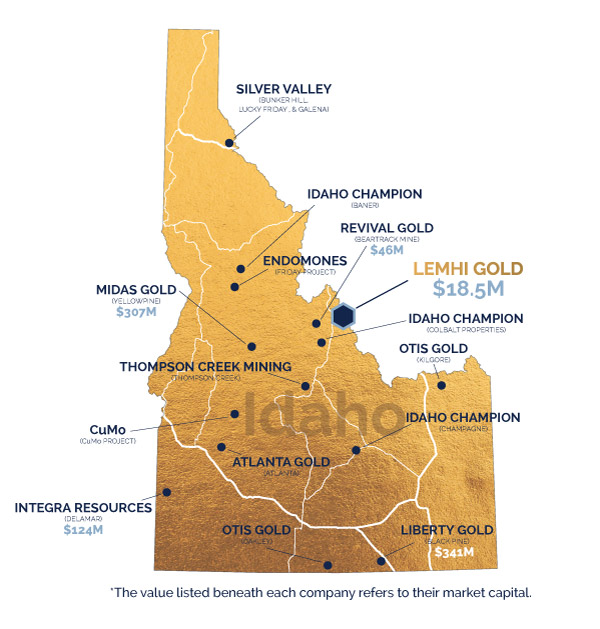

The very next thing I would encourage everybody to dig into is jurisdiction. And I'll give you a very clear example of how that can lead to success. Back in 2016, Nick Hodge and I identified Idaho as the next up and coming US jurisdiction where we believed the politics and the economics of the state would allow for a very friendly environment for mineral exploration companies.

Fast forward five years, and we now have Midas Gold on the verge of being permitted for their Stibnite Gold Project in Idaho.

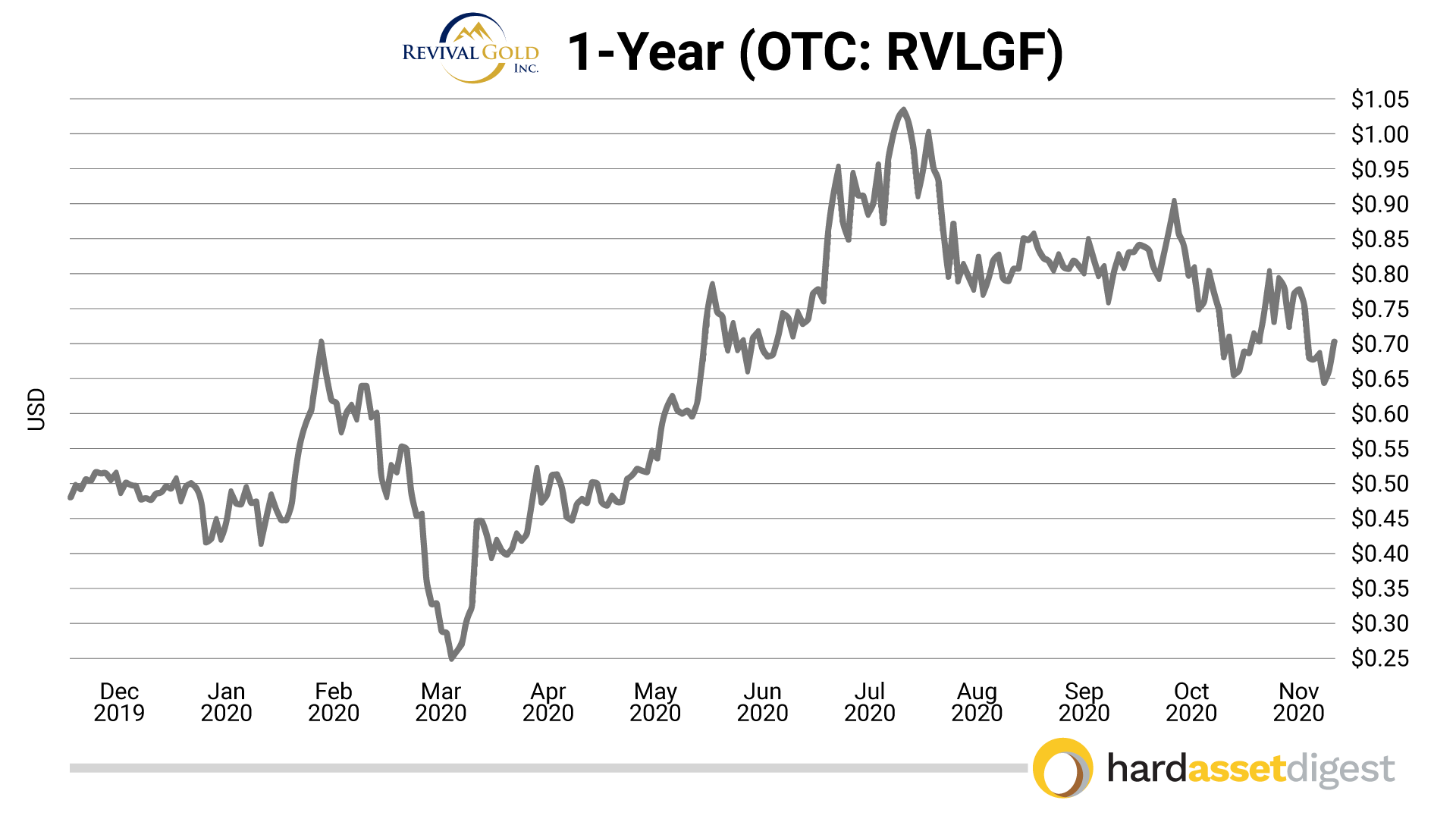

You have companies like Revival Gold advancing a brownfield project there that’s been permitted in the past and just put out a PEA that it can now fasttrack toward a production decision.

You have companies like Integra Resources and Liberty Gold — quality companies doing exceptional work and doing so with bipartisan support in a jurisdiction that, just five or six years ago, was off the radar for a lot of people.

So jurisdiction is very, very important. And, on the flip side of that coin, there are jurisdictions where the political risk simply outweighs the potential reward.

MF: I totally agree, Gerardo. And Idaho certainly has panned out as a great place to mine for precious metals over the last several years.

GDR: For sure. And I think there's a lot still to like in Idaho.

One more box I like to check is upcoming catalysts. At the end of the day, you can have a proven team in a mining friendly jurisdiction with a solid share structure… but you also need upcoming catalysts – such as drilling or permitting – that can move the needle forward.

Midas Gold, for example, is awaiting a feasibility study and, hopefully, a permit next year. Those are the types of catalysts that can add instant value. You don’t want to get stuck holding dead money where there’s nothing happening and nothing much on the near-term horizon.

MF: And that can be especially true when the market ceases to cooperate. I think we’d both agree that we’re at the early stages of a powerful gold bull market with legs. Yet, right now, we’re stuck in a bit of a pause… anything giving you concern at this particular juncture, Gerardo?

GDR: Mike, I'll tell you the only short-term concern I have about this gold bull market – and by short-term, I mean the next quarter or two – is gold's ability to rise alongside a rising dollar. I think there's a very distinct possibility that, with the Euro weakening, the dollar moves higher over the next quarter or two.

Now, I could be completely off on that. And ultimately, if this gold bull cycle plays out the way I believe it will, it won't be consequential. Yet, I’ll preface my next point by saying be careful in the next month or two speculating with capital that you can't afford not to grow or if you need that capital back in the next quarter or two.

In other words — don’t go all in!

I think there's a risk of a dollar rise, and we’re going to have to wait and see if gold is able to perform alongside the dollar and new record highs in the US indices before I'm convinced we're ready for the next leg up.

Now, with that being said, let's be absolutely clear: We are in the midst of the biggest counterfeiting operation in the history of the world. Forget blue waves and red waves. We're in the midst of a wave of corporate socialism where central bankers are literally printing trillions of dollars out of thin air.

They lend it to corporations at ridiculously low rates. Then, they use the rest of that counterfeited money to prop up stock prices by buying stock in the same companies that just borrowed the money in the first place.

Of course, this is all facilitated by the central bankers. Don't try this at home, Mike, because you would go to prison if you did.

And so, there's absolutely a theme, and it's not just US-centric. It’s global — where central bankers have decided they’re going to continue to punish savers. And they’re going to keep rewarding risk takers that have exposure to financial assets. And I think that’s not a policy you can just decide to pivot away from.

We saw toward the end of last year, when the Fed indicated it was ready to pivot away from that strategy, and the market threw such a fit that, two quarters later, we were talking about the possibility of negative interest rates in the United States.

And so that, to me, is the biggest driver of why gold will likely have a historic gold bull market that lasts many, many years.

MF: How high do you see gold going in the current cycle?

GDR: I honestly don’t care much for the hyperbole of $10,000 per ounce gold and $20,000 per ounce gold. But I can clearly see a scenario where $3,000 to $5,000 gold over the next 3 to 5 years is within reach.

Frankly, if all gold ever does is stay at $1,900, we're going to do very, very well because we're fortunate enough to be able to identify companies that can perform well at much lower gold prices.

MF: And speaking of junior firms with high margin assets… I’ve got to ask you about specific companies. My audience would like to know, Gerardo — what are you buying now?

GDR: Mike, I'll preface what I'm about to say by explaining that I do gravitate toward the higher-risk, higher-reward companies. And so I'll give you a very high-risk, very potentially high-reward pick that has done well for me in the past.

And I mentioned it earlier — Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF).

It is a 20% owner of the Kinsley Mountain Gold Project in Nevada. Excellent jurisdiction. Nevada Sunrise Gold has a very decent share structure. I'm a biased large shareholder of the company. And we are, I believe, weeks, if not days away from the first set of assays from Kinsley Mountain with operator, 80% owner, New Placer Dome Gold, and they've drilled, I believe, up to 50 holes now.

So there's going to be newsflow between now and at least February — precisely what we were discussing earlier in terms of near-term catalysts that can add value.

Nevada Sunrise Gold currently has a market cap south of C$12 million. If Kinsley Mountain delivers the type of results I think it's capable of delivering, the company will trade at multiples of today's prices in very short order.

We'll see what mother nature has in store. But if you’re someone who gravitates toward high-risk and high-reward, I would say Nevada Sunrise Gold is a risky but potentially very profitable speculation at this point.

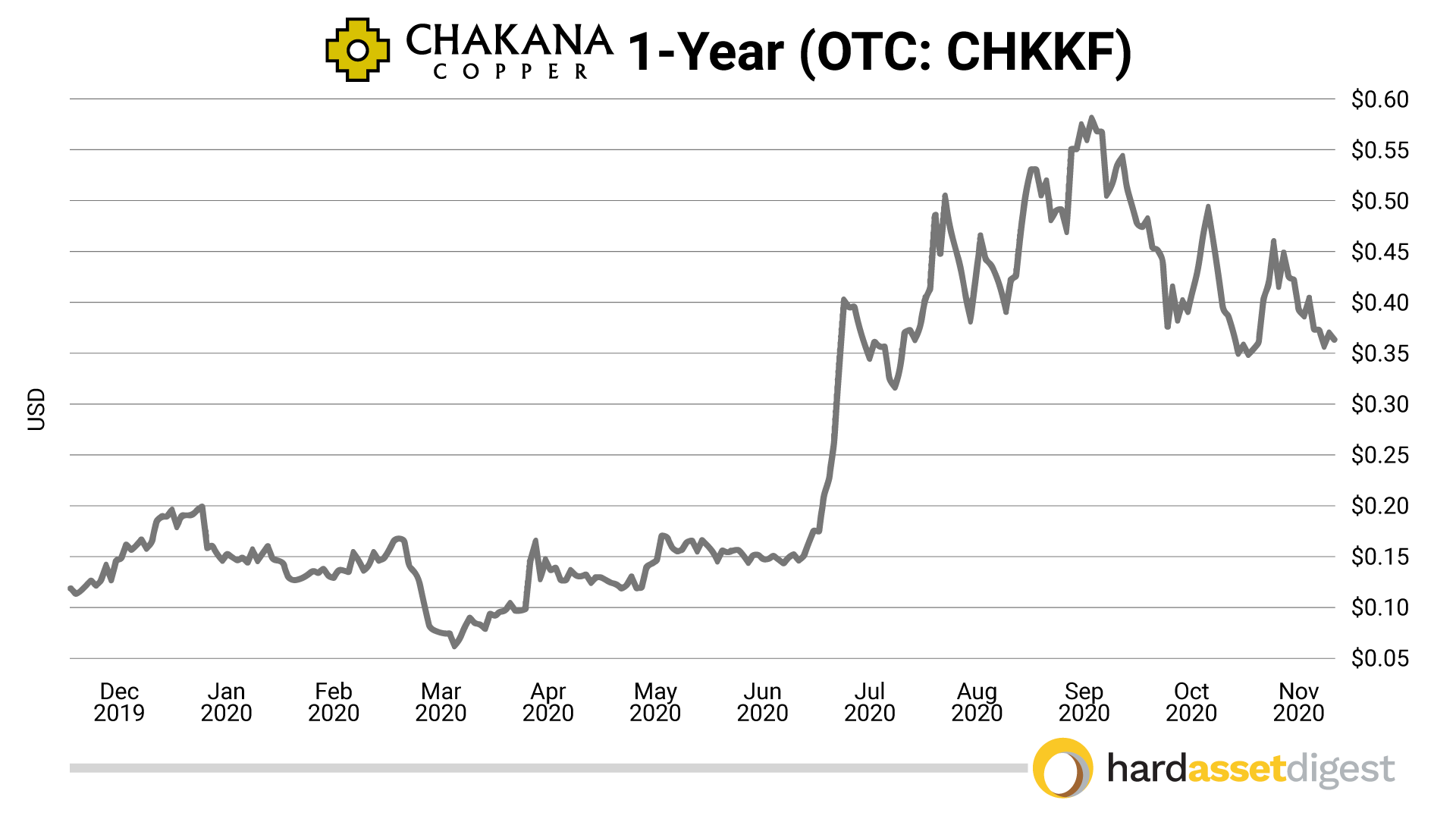

If your readers are looking for something that’s being de-risked with seemingly every news release, I would look at something like Chakana Copper (TSX-V: PERU)(OTC: CHKKF) because I’m really liking copper right now.

Plus, I really like gold, and Chakana Copper, with its Soledad project in Peru, is onto what I believe is a very significant copper-gold-silver discovery that the market hasn't fully processed yet. And I think it will.

There's a resource estimate that's anticipated in the early part of 2021 that I believe will start to allow the market to put some numbers around the potential tonnage, the potential grades, and the potential scale.

They have a partner in Gold Fields that has been very active in Peru. And I think if Chakana Copper continues to deliver with the drill bit, it's a prime takeout target.

And so, again, depending on what the overall markets do — will it get taken out at $70 million, $100 million or $500 million? Well, the market will decide what that is and mother nature to an extent, but a medium-risk, high-reward pick would be Chakana Copper.

And I'll give you one that I believe just became a much lower-risk pick with the potential for very good rewards. And I mentioned this one earlier as well when we were discussing Idaho — Revival Gold (TSX-V: RVG)(OTC: RVLGF).

Just with that small portion of the resource in the current PEA, we’re talking 72,000 ounces of gold production per year for 7 years for a total of 506,000 ounces at an all-in sustaining cost of $1,057 per ounce of gold — meaning the margin currently sits at about $820 per ounce.

So I definitely see this as a project that can be funded, developed, and ultimately put into production, which makes Revival Gold an excellent medium-risk speculation.

MF: Great. Thank you for those, Gerardo. My readers want picks, and you’ve definitely delivered! I know you’re a contrarian by nature, and that leads me to my next question. When are we finally going to see this very elusive uranium bull market?

GDR: Mike, I think uranium has made a fool of many of the smartest minds in the space. These are people you and I both know and respect — and some of them have been calling for a uranium bull market for the last five years!

For me, I thought that by calling for a uranium bull market in 2020, I'd be able to get it right. And sure enough, it has made a fool of me as well.

So look, the reality is that the fundamentals are all there for higher uranium prices. The supply destruction that we anticipated has materialized. What hasn't materialized, however, is the utilities stepping off the sidelines and coming in to sign contracts at higher prices.

It’s clear from the market's reaction that until that happens – until we see that first contract signed at $50 a pound, $60 a pound, $70 a pound – we're not going to get the rerating in the space that we’ve all been anticipating for some time.

Nevertheless, I like to buy when people are not looking. That’s the nature of being a steadfast contrarian.

I did it during the bear market in the gold space, and I did it during the bear market in the copper space. And I'm doing it during this bear market in the uranium space because when the uranium bull truly kicks off, it will be beautiful to see, and it'll be more than worth the pain we've had to withstand.

And the reason for that is there's simply not enough quality uranium juniors – or uranium companies period – to absorb the amount of capital that’ll chase the sector once it heats up.

We’re not there yet… but if you’d like a couple of uranium names, I'd be happy to share one or two with you that I think have great mid-term potential for excellent gains.

MF: I’m all ears!

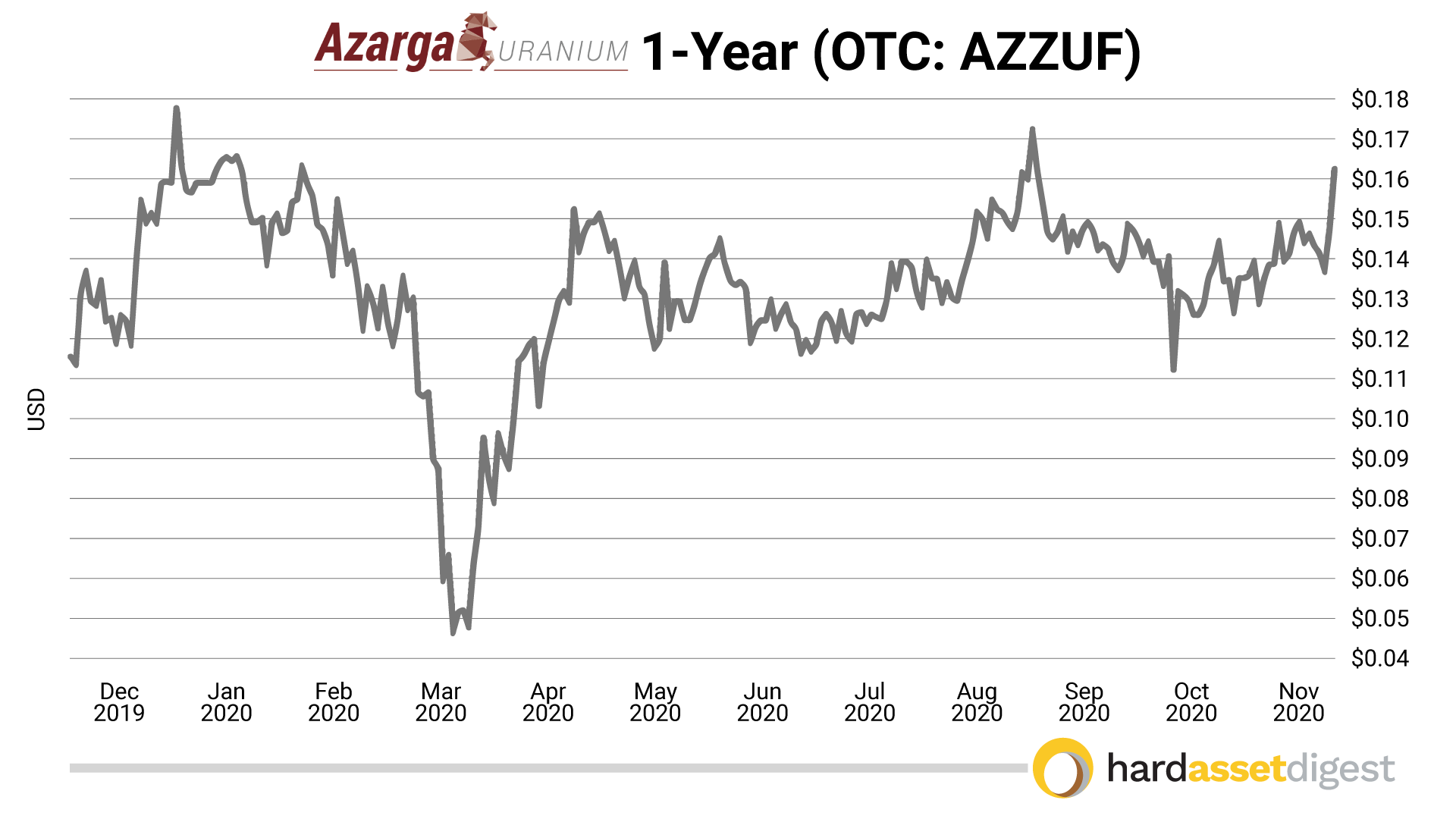

GDR: Okay, one would be Azarga Uranium (TSX: AZZ)(OTC: AZZUF).

Azarga has one of the highest-grade, lowest-cost ISR projects in the United States. I think a permitting decision at their flagship Dewey Burdock project in South Dakota is imminent. By imminent, I mean, I thought it would be granted weeks ago. And so I think any day now we'll wake up and Azarga Uranium will be permitted for production.

And I think it immediately becomes a very accretive asset in a buyout scenario for a North American producer looking to leverage their production profile. So Azarga is one that I think is, by junior resource standards, a relatively lower-risk pick from the uranium sector.

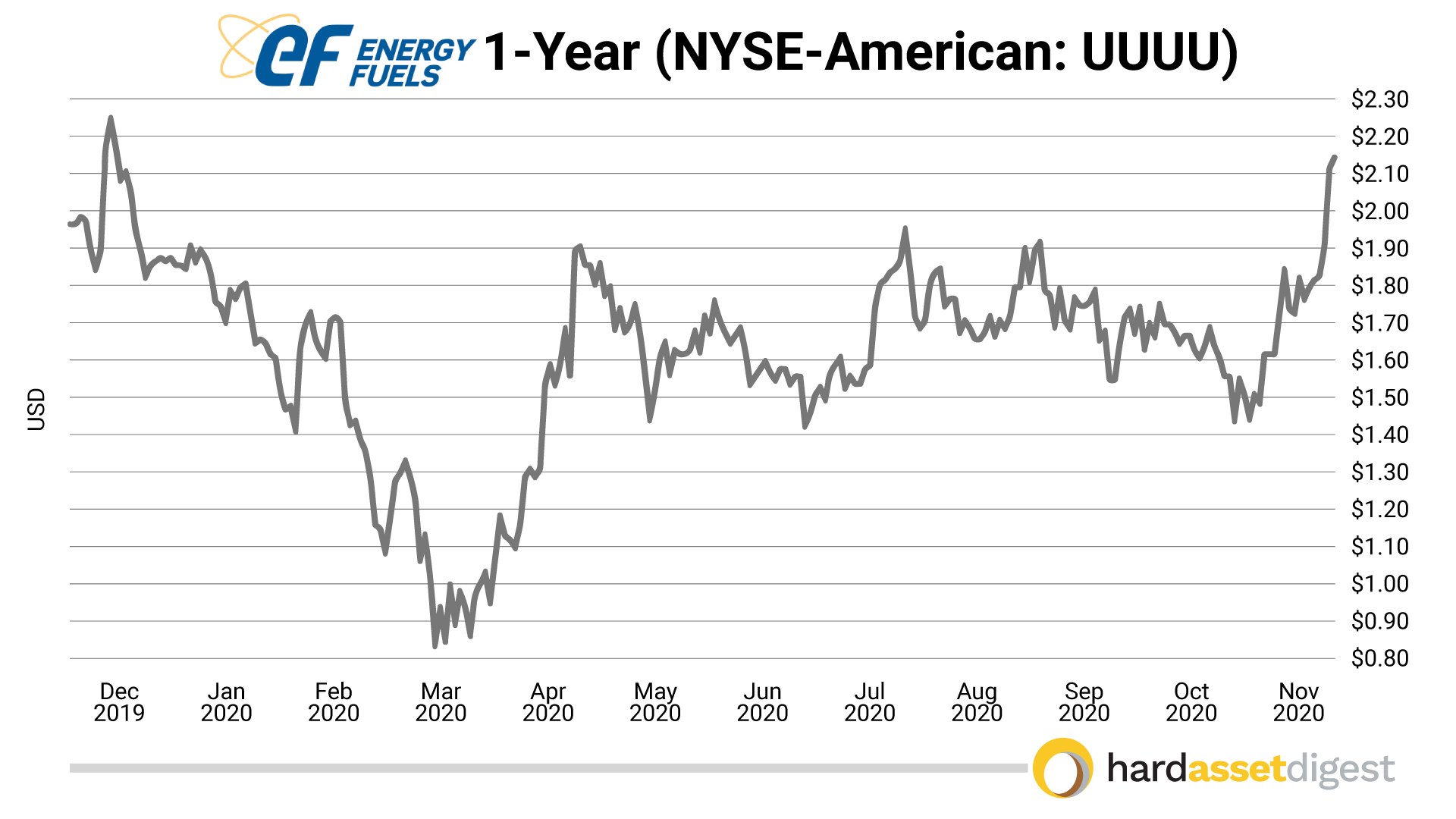

A second name in the space I really like is Energy Fuels (TSX: EFR)(NYSE-American: UUUU) — a company I coincidentally think would probably consider Azarga Uranium as a great addition to its portfolio.

It's producing, it's permitted, it’s got infrastructure. And it just announced recently that it has produced – for the first time in a couple decades – rare earth concentrate.

It can scale that up and is looking to do so. With the geopolitical situation being what it is with President Elect Biden committing to a clean energy bill, I think it makes perfect sense to have exposure to a bigger uranium company like Energy Fuels.

MF: Like you said, a lot of very smart people are just waiting to say — I told you so!

GDR: Too true, Mike.

MF: So before I let you go, Gerardo, can you tell my readers a little bit more about Junior Resource Trader and Junior Resource Monthly?

GDR: Sure, I’d be happy to. Junior Resource Trader, as the name implies, is a trading service wherein I provide buy-sell trade alerts on junior resource companies in real time. It basically mirrors my personal trades using the process I’ve developed over my years as a professional trader.

Junior Resource Monthly is my portfolio-based monthly newsletter, which offers buy and sell recommendations for longer-term junior resource speculations. I provide ongoing coverage of each position, and I try to focus more on the macro picture. And so you get a lot of my macro musings… you get a lot more about my process. You can expect picks from the precious metals space, the base metals space, and energy metals.

You can currently subscribe to both publications by clicking here. You'll also see Nick Hodge's suite of services, which is everything from a private placement service for accredited and high net worth investors to other services that are sector-agnostic.

I tend to focus specifically on the resource space. Mr. Hodge tends to be an expert in seemingly everything he gets his hands on and takes an interest in. And I would highly encourage everyone to look at Mr. Hodge's services as well as yours, Mike. You have two services yourself that I know bring together insights from the top minds in the space.

I think what’s offered is a pretty well-balanced array of opinions and sources for the due diligence process. I was taught very early on, if you want to be successful in this business, you need a wealth of research that you can compare notes on. And I think ResourceStockDigest.com is a heck of a place to start.

MF: I couldn’t agree more, and, of course, I’m a bit biased too! Gerardo, I want to again thank you for your time and for your unique insights into the higher-risk segment of the resource space.

GDR: It’s been my pleasure, Mike. And again, this is something I'm fortunate enough to be able to do for a living. It's an absolute passion of mine. It's something I'll do as long as I'm mentally able to. And with a lot of hard work and a little bit of luck, I think we can do really well in the cycle we've entered.

MF: My sentiments exactly! Let’s catch up again soon!

GDR: Mike, I appreciate it. Thank you for having me on and fingers crossed for a very long and powerful gold bull market.

MF: Thanks, Gerardo!

We have four reports now available highlighting several opportunities for investment in the resource space.

- The Book of Levi: Picks-and-Shovels for the New Gold Bull Market

- Mid-Tier Takeovers for 2020 and Beyond: Two Top Candidates for Premium Takeovers

- The New Standard in Silver

- Exploration Opportunities

Opportunities discussed in those reports and past issues include:

- Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX-V:RVG)(OTC: RVLGF)

- Integra Resources (TSX-V: ITR)(NYSE-American: ITRG)

- Liberty Gold (TSX: LGD)(OTC: LGDTF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Energy Fuels (TSX: EFR)(NYSE-American: UUUU)

- Pan American Silver (TSX: PAAS)(Nasdaq: PAAS)

- Liberty Gold Corp. (TSX: LGD)(OTC: LGDTF)

- HighGold Mining (TSX.V: HIGH)(OTC: HGGOF)

- Bluestone Resources (TSV.V: BSR)(OTC: BBSRF)

- Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Blackstone Minerals (ASX: BSX)

- Clean Air Metals (TSX.V: AIR)

- Golden Goliath (TSX.V: GNG)(OTC: GGTHF)

- FPX Nickel (TSX.V: FPX)(OTC: FPOCF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Niobay Metals (TSX.V: NBY)(OTC: MDNNF)

- Verde Agritech (TSX: NPK)(OTC: AMHPF)

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Sprott Inc. (NYSE: SII)

- Franco-Nevada (NYSE: FNV)

- B2Gold (NYSE: BTG)

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- Blackstone Minerals (ASX: BSX)

- Pan American Silver (NASDAQ: PAAS)

- Hannan Metals (HAN.V)

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)

- Ely Gold Royalties (TSX-V: ELY)(OTC: ELYGF)

- Trilogy Metals (TSX: TMQ)(NYSE: TMQ)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Realgold (private)

- 1903-1926 Gold Commemorative Coins

- Pre-1933 Liberty, Indian, St. Gauden Coins

- Sprott Inc. (TSX: SII)(OTC: SPOXF)

- Alacer Gold (TSX: ASR)(OTC: ALIAF)

- Alamos Gold (TSX: AGI)(NYSE: AGI)

- Silvercrest Metals (TSX: SIL)(NYSE: SILV)

- EMX Royalty Corp. (TSX-V: EMX)(NYSE: EMX)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Revival Gold (TSX-V: RVG)(OTC: RVLGF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

Make sure you never miss an update or issue from Hard Asset Digest by adding editor@hardassetdigest.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Hard Asset Digest, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at editor@hardassetdigest.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Hard Asset Digest does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.