Hard Asset Digest February 2020

February 2020

This month, I have the distinct pleasure of bringing you my exclusive interview with Mr. James Dines, founder and editor of The Dines Letter investment newsletter, which has been in continuous publication for many decades.

As America’s foremost financial forecaster, Mr. Dines has correctly predicted numerous bull markets in natural resources; the Internet stock boom in 1996; the dot-com bust in 1999; the second wave of gold and silver bull markets in 2001; the rise of China; the housing collapse in 2007, and the current deflation.

|

FREE INTRODUCTORY OFFER! Mr. Dines is legendary for having made correct market calls that go against the grain of the mainstream financial pundits. Click here for a complimentary online copy of The Dines Letter’s 8 November 2019 Issue (no email required). You can also view the front page only of his 2020 ANNUAL FORECAST DOUBLE ISSUE there — he says it’s the most important one he’s ever published! Mr. Dines is offering this Forecast Issue to readers of Hard Asset Digest as a Special Subscription Bonus with your order. To subscribe, simply click above for your complimentary issue and enrollment details. |

The Dines Letter has proven so immeasurably valuable to its long-time subscribers that it’s often handed down to second generations as a life-compass to sustained knowledge and wealth-creation.

In an industry where it takes courage and conviction to consistently go against the crowd, Mr. Dines defiantly warned investors of the “invisible crash” that would bring down stocks in 1966; the unexpected gold boom of 1974; the Internet revolution of 1994; the market top in 2000, along with countless other wealth-generating forecasts.

From Military Intelligence to Market Brilliance

Mr. Dines' innate ability to anticipate market trends before the competition began during his days serving in Military Intelligence and later as a National Honor Scholar at the University of Chicago where he worked toward his doctorate.

He would quickly become a Junior Security Analyst with the Wall Street brokerage firm of Auerbach, Pollak & Richardson. Shortly thereafter, he rose to the rank of Senior Security Analyst at AM Kidder & Co.

In an early exhibition of the brilliance that would rapidly propel him to the top of the financial world, Mr. Dines was promoted to write Kidder's Weekly Market Letter at a time when very few young men were permitted to hold positions of such clout on Wall Street.

Just a year later, the publication was renamed The Dines Letter — a reflection of his successful predictions and unique investment style.

The Courage to be Right

The financial community was finally waking up to Mr. Dines. Not only did they begin to recognize his brilliance as a Security Analyst but also as perhaps the most courageous financial forecaster to come along in decades.

Indeed, he risked his entire career by insisting that the almighty dollar would be devalued, which was considered a treasonous view at that time. He also correctly predicted that gold would rise in a historic bull market from government-fixed levels of $35 to over $400 an ounce.

Regularly challenged by the higher-ups, Mr. Dines refused to be censored and began publicly recommending gold stocks in The Dines Letter. In those days, being called a goldbug was to be called a dirty name — so Mr. Dines defiantly claimed the title of “The Original Goldbug.”

This self-proclamation was based on his being the very first Wall Street Analyst to have consistently and very outspokenly recommended precious metals assets.

In fact, his then-outrageous claim of $400/oz gold was ultimately proven conservative as gold actually soared past $850!

Subscribers to The Dines Letter began stacking up profits from his spot-on recommendations. As his number of correct calls increased, so did his subscriber base — and The Dines Letter quickly gained notoriety as one of the most successful investment newsletters in the world.

The Death of a Wall Street Firm & The Birth of a Legend

Mr. Dines was the first Wall Street Security Analyst to predict that, without a link to gold and silver, the US dollar would lose its integrity and suffer a massive devaluation — a prediction that unfortunately holds true to this day.

During that time, the prevailing attitude toward gold was so hostile that it undermined Mr. Dines' opportunities for advancement within corporate Wall Street. Undaunted, Mr. Dines refused to cower to the powers that be and was unceremoniously fired by AM Kidder, specifically for his bullish gold predictions.

After gold and silver soared as he predicted, AM Kidder & Co. went defunct, and James Dines' reputation grew even more legendary.

Mr. Dines began publishing The Dines Letter independently and immediately began warning the world of The Coming Gold Crisis. Therein, he wisely alerted his subscribers to an imminent gold boom with silver following suit. The investment community scoffed — claiming that gold is dead and that silver was merely an industrial metal.

Yet, subscribers who heeded Mr. Dines’ warning were rewarded with 2,300% growth in gold and 2,900% growth in silver within ten years.

Hailed by Barron's as a Classic

By establishing his own unique brand of philosophy, Mr. Dines created an entirely new way of approaching the financial markets. He began putting his unique investment analysis and strategies on paper and, fourteen years later, released his groundbreaking treatise on Technical Analysis — one of the earliest books on the topic.

Simply titled, Technical Analysis, the book was immediately hailed as a classic as reviewed by Barron's:

"Technical Analysis by James Dines is the most comprehensive text ever written on the entire arcane field of investment analysis. This book was deliberately designed to attract the novice and then turn him into a pro. The established pro could learn much from it. We wholeheartedly recommend that you read the book."

The Legend Grows

At the start of 1980, The Wall Street Journal wrote, "Metals mania vindicates such economic Cassandras as James Dines who for years have urged investment in gold as a safe hedge in an inflation-weary world."

Kevin Boden, on his Moneyline radio show on June 4, 1981, said, “Mr. Dines is one of the most extraordinary men in America today; a man with a long and glorious reputation in being one of the first people to call real turns in the strategic moves that happened in our marketplaces over the years. He was the man to first pull the plug on the stock market when the Dow hit 1,000. He was the first person to recommend in a forceful manner that we buy gold and continue buying it."

The Dines Letter Gets It Right — AGAIN!

Of course, gold did not rise forever, and Mr. Dines once again broke from the crowd on June 15, 1982 imploring his subscribers to sell gold! And like clockwork, the gold and silver index began a 70%, 3-year decline.

The financial world was stunned once again when, on June 15, 1982, James Dines flashed a Major Buy Signal with the Dow Jones Industrial Average at 796. The New York Times later said, "It was a truly magnificent call. The DJIA ultimately reached its 27-month closing low on August 12, 1982 at 776.92."

Continuing his prescience, Mr. Dines proclaimed in 1994 that the Internet would revolutionize the world. Investment professionals again scoffed, claiming that the Internet would take 10-20 years to catch on.

But as we all know, the Internet took off in the biggest boom in history, and Mr. Dines' recommended stocks climbed thousands of percentage points over the next 6 years.

Not Blinded by Irrational Exuberance

As great as the Internet run was, Mr. Dines famously protected his subscribers once again by foreseeing the imminent top to the dot-com craze. On December 3, 1999, he told his subscribers about his concern that professional money managers and new Internet mutual funds were pouring into the market and that this was strongly signaling a market top.

He stated in the pages of The Dines Letter, "We are never more uncomfortable than when too many investors agree with us, as it requires an iron will to avoid being swayed by lemming stampedes." He went on to say, "...accordingly, note our carefully placed stops in the Supervised Lists."

As predicted, Internet stocks began to fall just 60 days later in one of the biggest bubble-bursts the market has ever witnessed. His subscribers, though, had been astutely protected by his well-placed stops and were able to exit the Internet arena with huge gains.

Correct Calls Amid Heightened Volatility

Mr. Dines successfully called the 1997 Asian currency crisis; the 1999 euro plummet; the crash of the Toronto Stock Exchange, and the NASDAQ bottom and subsequent rise, and “The Coming Real Estate Crash” on PBS International Television on 30 June 2006.

What's Next? Perhaps only James Dines Knows...

If you’re ever granted the good fortune of being able to sit down for a conversation with Mr. Dines, as I have had, you’ll notice right away that he’s as passionate as ever about publishing The Dines Letter and continuing to prove naysayers wrong with his bold predictions.

In today’s global turbulence, it’s difficult to know what the market has in store for us next. Yet, one thing's highly likely… whatever it is, Mr. Dines will surely be among the first to see and report on it.

And his subscribers will continue to profit — as they long have!

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with

James Dines – The Dines Letter

Mike Fagan: Mr. Dines, it’s wonderful to talk with you today — thank you so much for taking the time. Not that you require an introduction, but let me just say… you’ve been publishing The Dines Letter continuously for a long time, and you’ve built a venerable career on the discovery of countless bull market cycles ahead of the so-called experts and the investing herd.

You’ve done this consistently over the decades as The Original Gold Bug, The Original Silver Bug, The Original Internet Bug, The Original Uranium Bug, and more. You wrote extensively about gold in your newly-released 2020 double-sized Annual Forecast Issue… but let’s first take a step back.

Which havens do you recommend as hedges for the next scary market?

James Dines: Mike, very happy to be with you as well, and thank you for the kind introduction. Everyone knows that Treasury bonds are the classic haven. Yet, unfortunately, everyone has crowded into them, and they've pushed the price up so high that they’re no longer a haven.

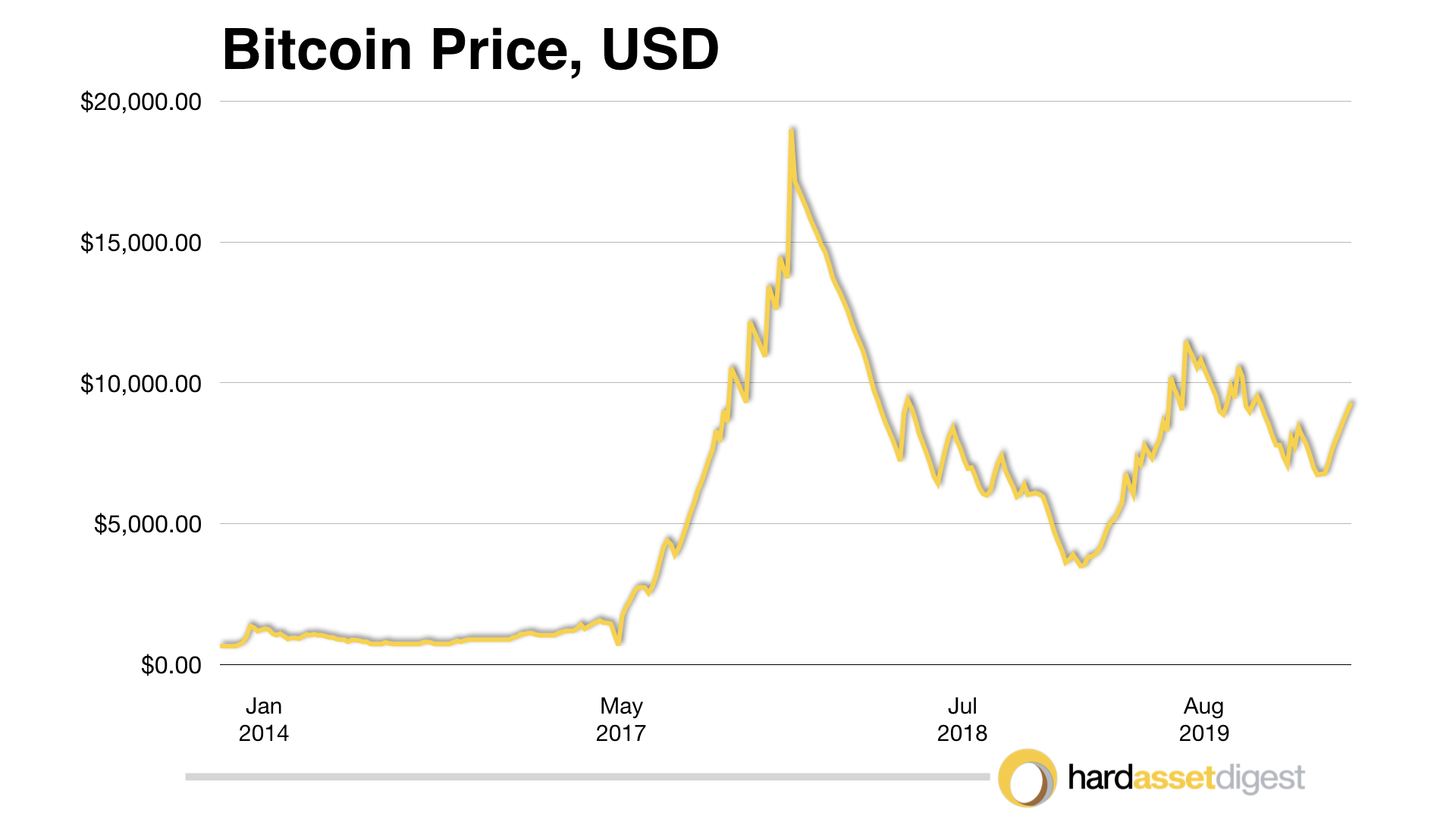

I like the crypto coins. There are five of them in our Recommended List, and we’re holding them long-term. I was the Original Crypto Bug… so we got into them at very low prices.

Also, Mike, one of my key discoveries has been that gold tends to rise during a declining stock market. I call that the Dines Rule of Gold Countertrend, DIGROC. And so that's billed as a haven.

Also, another one of my discoveries has been that the precious metals tend to run together as a group — and I call that the Dines Wolfpack Theory in my Mass Psychology book. The five precious metals tend to move together in kind of a wolfpack with different ones leading at different times.

For the moment, palladium is red hot, and we've done very well with that. And, likewise, rhodium. And then, there’s also the Dines Gold Stock Average, DIGSA. We flashed a buy on that on February 5th, 2016 — and that marked the beginning of what I call “Super-Major” Wave Three.

There were two major trends before that; one that ended around 1979 and the other around 2011. The next top in gold is going to be far, far higher!

MF: Staying with the precious metals, I’m interested to get your perspective on what you believe is the best way to own gold? I know you’re a proponent of owning rare gold coins as an investment and as an intelligent hedge against the devaluation of paper currencies.

A couple of months ago, I sat down with a colleague of ours, Van Simmons of David Hall Rare Coins, who obviously shares that same sentiment. I recently became a collector myself starting with Saint-Gaudens $20 gold pieces… I guess you could say I’m hooked!

What’s your take on gold from a numismatist perspective?

JD: I think gold coins are the best money in the world — they'll even get you across a border!

My favorite gold coin is the Saint-Gaudens Double Eagle, which is almost one ounce of gold. So you can tell what the melt price of the coin is at any given time simply by watching the price of gold. And it's the most beautiful American coin, I think, ever made.

1923 Saint-Gaudens Gold $20 Double Eagle

It’s the work of Augustus Saint-Gaudens – who designed the coin under commission from Teddy Roosevelt – as he was dying of cancer. I believe he just managed to finish it. I think he also designed the Indian Head gold coin, which is another pretty one.

But you know, many nations are buying gold these days; most notably China, India, and Russia. In my most recent Dines Letter, I was against putting a large amount of money into gold coins because of storage difficulties. I feel like gold mining stocks are still the best hedge for all of the precious metals and also for some income.

In my next Dines Letter, I'll be coming out with a very handsome income stock that I think everyone has overlooked.

As you said, Mike, my letter pioneered ownership of each of the five precious metals. I did this ahead of any other Security Analyst, and I had to endure a fair amount of heat from many of them because when I recommended gold — it was a felony to own it.

Of course, I wouldn't break the law, but I did find a way to recommend gold by recommending gold mining stocks… and that didn't endear me to a lot of people either.

Anyway, the next up cycle has already begun, and my current favorite produces four of the five. I'll be covering that in the next Dines Letter.

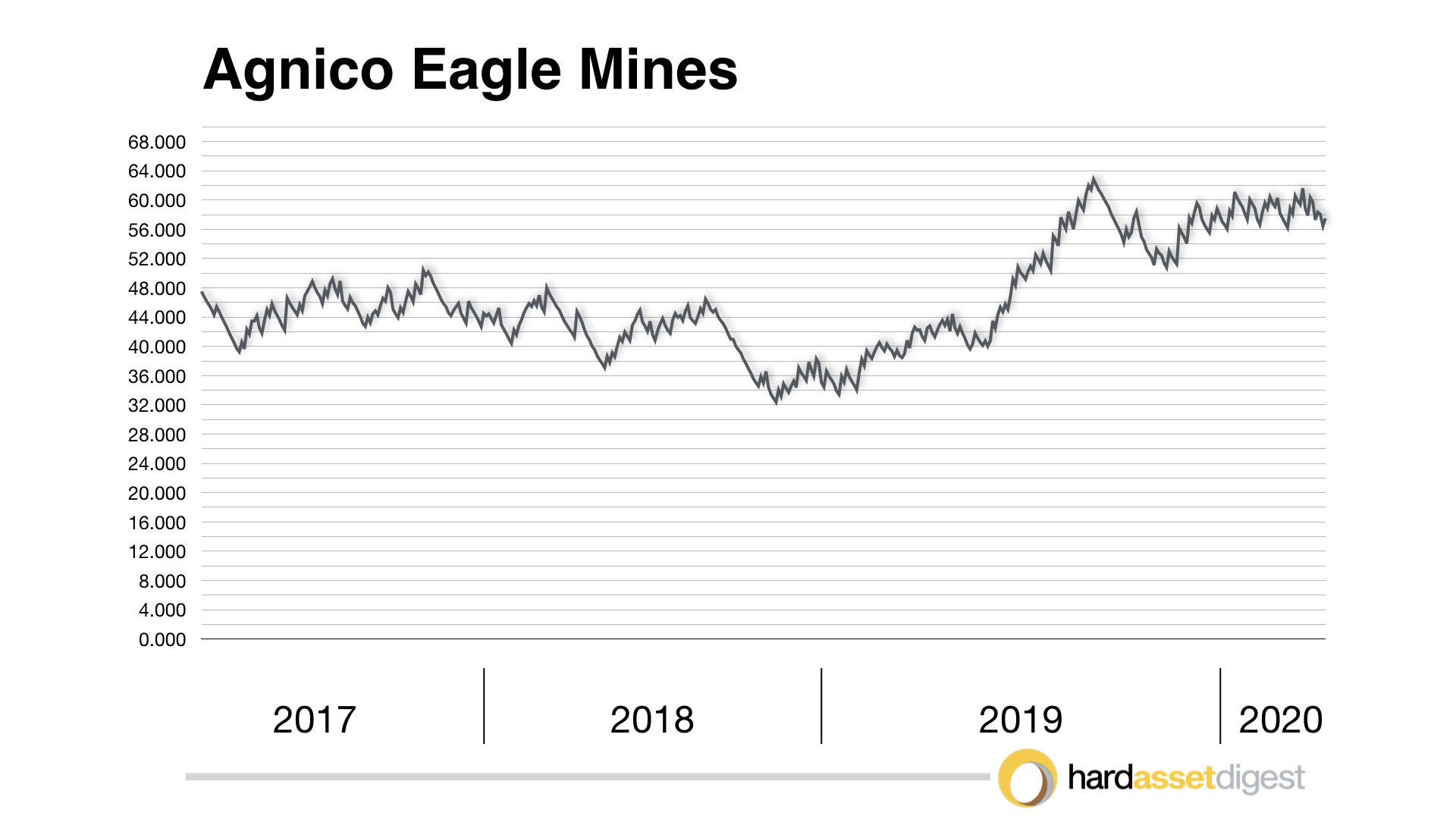

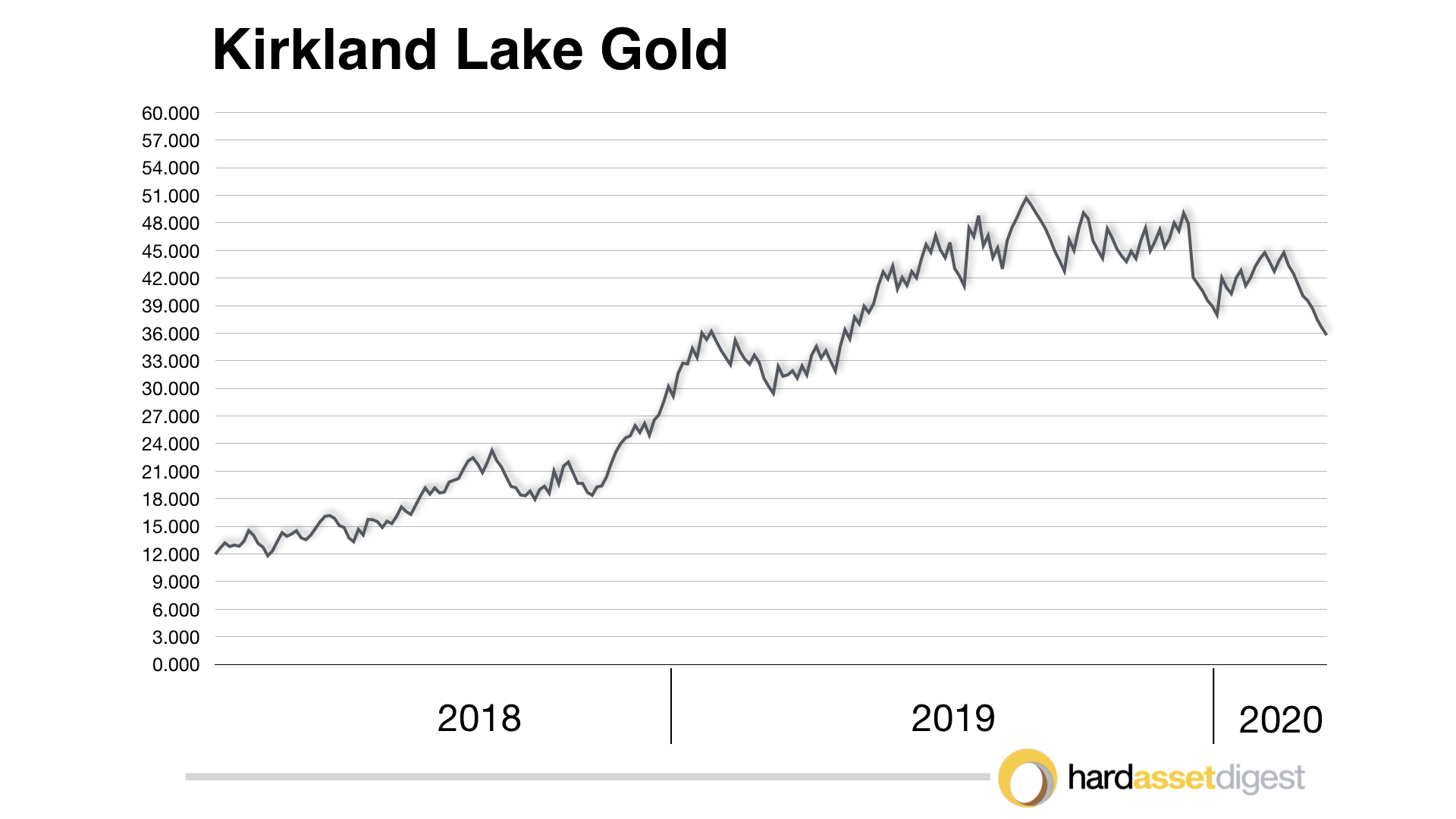

MF: Excellent, I’ll look forward to receiving that. Mr. Dines, the major gold producers as a group have done extraordinarily well over the last year and a half in response to gold’s impressive rise of about 30% from $1,200 an ounce to currently above $1,575 an ounce. During that span, Agnico Eagle and Kirkland Lake Gold, both of which are covered in The Dines Letter, have risen substantially.

What’s your outlook for those two companies over the next, say, 24 to 36 months?

JD: Well, as you know, Mike, I'm very close to Agnico Eagle. It's an interesting story. I was reading The Northern Miner one day, and I read that this company, Agnico Eagle, was refusing to sell its ore at $35 an ounce and was going to store it instead. I knew right away that whoever was running the company agreed with me that the price of gold was going to go up.

So I went to the phone and I called him up. His name was Paul Penna — a wonderful man. And we quickly became friends. The two of us were pretty much alone on gold in those days. He built the company from the ground up, and now the next generation has come in and has taken over.

I recommended the stock at $2 a share, and I think it's over $60 now. It's a well-run, high integrity company, and I think it's a wonderful long-term holding.

Kirkland Lake Gold is a more recent one of mine. It's being brilliantly managed, and it’s also on my Recommended List. They just made a good acquisition. I think there's going to be a new phenomenon in gold in terms of the brilliance of management and the application of blockchain to mining.

MF: Turning to silver, Pan American Silver is covered in The Dines Letter, and that stock has had an impressive run over the last several months from $14 to above $30 a share. Would you mind delving a bit into the history of Pan American Silver for my readers along with your outlook for the company’s shares?

JD: Sure. I remember one of my friends, Ross Beaty – who’s a very nice man of high integrity – when he started Pan American Silver back in 1994. I watched him buy silver companies during every silver downturn. And so I knew that he had a clear understanding that silver was in a long-term uptrend, unlike the cyclicality, for example, of copper.

Pan American Silver is a fine long-term silver holding. They've got some large blocks of stock in countries that are presently difficult, politically, in the Western Hemisphere. But they'll do well when peace finally arrives there, which will be closer than anyone thinks, I believe.

And they’ll do exceptionally well when silver prices go over $50 an ounce. And I'm not joking about that!

When I first recommended it, silver was just $0.925 an ounce. I had a very public fight with Paul Volcker who was the US Treasury Secretary at the time. He was wanting to sell America's entire silver coin hoard at $0.925 an ounce in order to melt it down for the silver… and The Dines Letter was screaming at him not to do that!

Anyway, he couldn't be stopped; he sold it all for melting … and all of those old Morgan Silver Dollars were gone with the wind.

Silver then rose to $50 an ounce, which was a phenomenal price rise of over 50 times higher. Hence, what Volcker had sold at $0.925 an ounce eventually went to $50 an ounce — which I knew would happen.

And then, a second silver bull market followed. I'm not sure of the exact year, but that also got up to $50 an ounce, and we sold right around $46 — very close to the high.

As you know, Mike, silver has come all the way back down again. I think it's going to go up to $50 for a third time — but this time it's going to go right through it.

Of course, nobody's going to believe it… they didn't believe me the first two times… but I'm looking for silver prices of at least $300 an ounce!

And at that price, a silver stock like Pan American Silver would be… as is popular to say these days… out of sight!

MF: Hell, if you’re saying it, Mr. Dines — I’m sure as heck buying it! Now, I know you spend a lot of time studying and evaluating China. What, if anything, should we be buying in China right now?

JD: I turned extremely bullish on China shortly after Mao Tse-tung died in 1976. I even predicted that China would dominate the 21st century. And, I did that in front of a room full of reporters — you’ll find more on that in my introductory kit of The Dines Letter.

Yet, I've been bearish on China's markets for the last few years. I'm looking for trouble to begin in their banking and real estate sectors. And I've looked wrong as they’ve seemed to have survived and are still flourishing.

But I'm standing my ground.

I think the Wuhan virus might trigger the projected bear market I’ve been anticipating. I truly hope that’s not the case. But you know, hope is not a plan. So, I wouldn't be buying any Chinese stocks at this point.

I think there's a great deal of turmoil going on, and possibly political turmoil, starting in Hong Kong. I think it has been handled in a very Low-State fashion, and, as a result — it's gotten much worse than it could have been or should have been for the Chinese government.

At this point, they've scared Taiwan. Taiwan will never go into China now. Just very badly handled… and I think there are far better things to be buying in the world than China right now.

I'd like to stand back, especially with this brand new virus floating around and which I think is greatly understated. I think there are only about 250 deaths so far. But, unfortunately, I think it's going to go much higher for various reasons.

MF: I agree, it’s an alarming situation, and it seems to be quickly spreading to nearly every continent. Turning to the broader market, I think most investors and analysts would agree we’re at the latter stages of the most powerful bull market in history. That being said, there are plenty of warning signs of an impending slowdown or recession across seemingly every corner of the globe.

Would you mind giving my readers your… shall we say… 10,000 foot view of the global state and what you’re recommending in terms of preparedness and wealth protection? When do you foresee the next recession?

JD: Well, first of all, Mike, in my letter I've been writing that the world is already in a recession. And I know nobody agrees with me — but that's my stance.

And furthermore, I think we're in a deflation.

Nation after nation are reporting what they call an economic slowdown. “It's a slowdown,” they're all saying. They're still not recognizing that it’s the other side of a top.

Nonetheless, keep in mind that a recession doesn't necessarily guarantee a bear market due to the factor of mass psychology as outlined in my Mass Psychology book.

You can have a recession, and the stock market can go up and vice versa. And that's because all markets oscillate between mass fear and mass greed. And that's another thing in my newsletter; I call it DIMAPSO, the Dines Mass Psychology Stock Oscillator.

But right now, markets are seized by a panic to buy income at any price – ANY PRICE – even buying bonds at a certain loss. And they're going to look back on this the same way we look back on the tulip mania bubble.

It’s the most overpriced bond bubble in the last 2,000 years!

I’ve based that on Sidney Homer's classic book, A History of Interest Rates, from 2000 BC until the present. And if that title doesn't put you to sleep, reading the book certainly will! It's a thick book, and it certainly kept me well slept while I was fighting through it.

I’ve based that on Sidney Homer's classic book, A History of Interest Rates, from 2000 BC until the present. And if that title doesn't put you to sleep, reading the book certainly will! It's a thick book, and it certainly kept me well slept while I was fighting through it.

But anyway… we've never had negative interest rates before. And it seems to be like a new kind of normal. It also ties into my feelings about mass psychology, and it's not a coincidence that street protests are erupting and spreading these days by, what my book calls, Mass Contagion.

So, I think we're in a recession and a deflation. Even economists of whom I've been very critical for their Keynesian economic theories — I warned that it would not work, and they're at that stage right now.

They believe that when labor is at full employment, you get inflation. And they're absolutely wrng. We have full employment, and there is no inflation. And that's because this is a deflation. They just don't have a clue as to what’s going on. They don't even know what inflation really is.

All I can do is write about it and wait for them to catch up.

MF: Very true indeed! Mr. Dines, you’ve been first in so many new bull markets, so I have to ask… what is your secret?

JD: I guess, Mike, my secret is… I like to see for myself where others fear to go.

For example, when Americans were threatened by felony prosecution just for owning gold, I recommended gold stocks instead as I've already mentioned. That was one way.

And I did that because I knew that the price of gold had to go up because gold, at that point, was tied to the US dollar.

You could take your dollar and get a gold coin for it at a bank. But when you start printing too much money, you're going to run out of gold. It doesn't take too much knowledge to have foreseen that. It meant that the price of gold had to go up or else the link between gold and the dollar would have to be broken, either way. And of course, the way it worked out… both happened!

You could take your dollar and get a gold coin for it at a bank. But when you start printing too much money, you're going to run out of gold. It doesn't take too much knowledge to have foreseen that. It meant that the price of gold had to go up or else the link between gold and the dollar would have to be broken, either way. And of course, the way it worked out… both happened!

Anyway, if you read my Goldbug! book, you’ll see that story laid out in explicit detail.

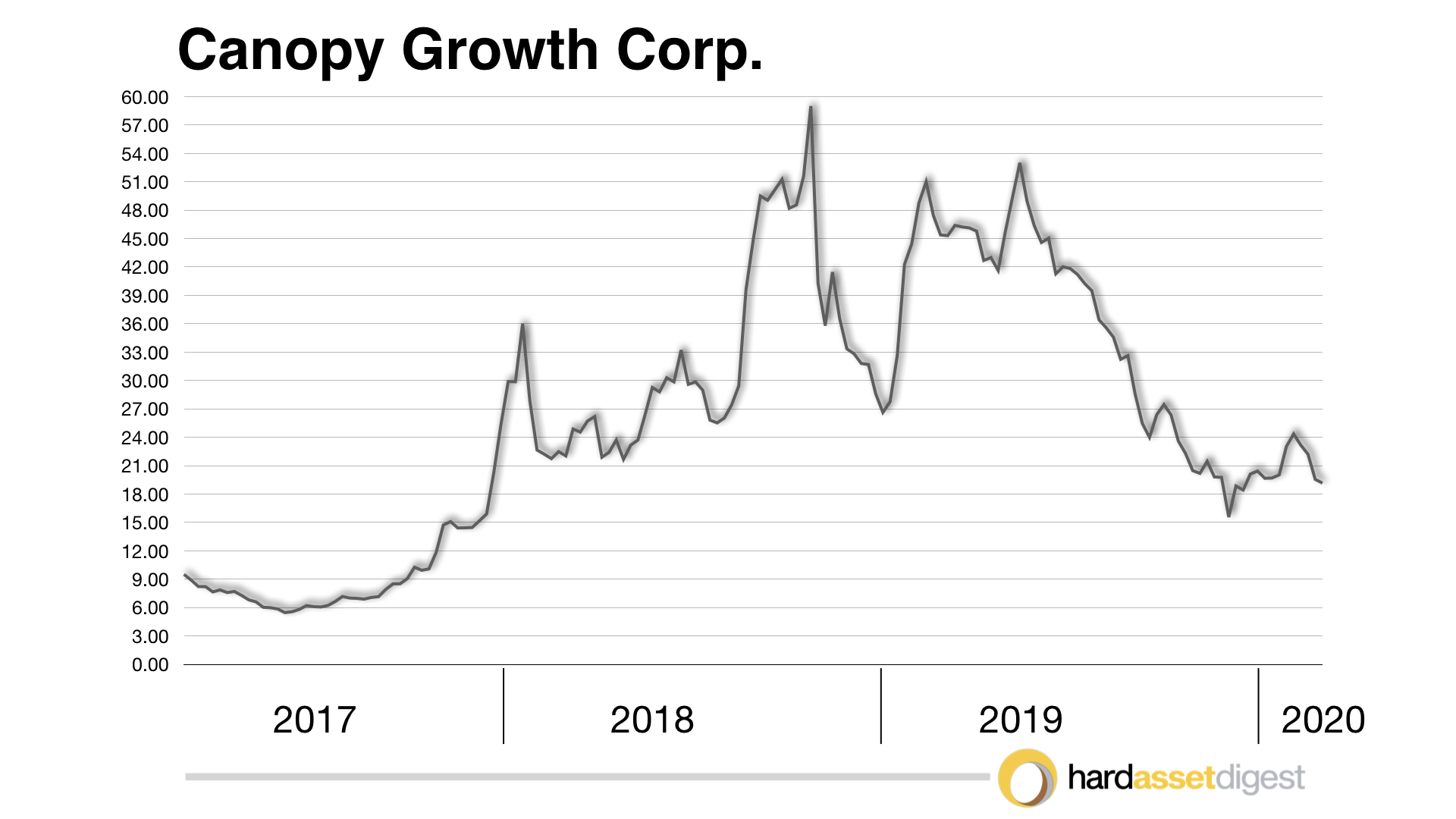

Another one was cannabis. I paid attention to the polls every year, and it was plain to me that more and more of the public wanted legalization. So I knew that the law would be changed… and, I believe it will be, decisively, after this election.

And it doesn't matter who gets elected. I think both sides have indicated they would like to see cannabis legalized on a federal level. I think it's going to be one of the biggest growth industries in history.

So yes… I'm the Original Pot Bug, and I'm still very bullish on it!

I became the Original Bitcoin Bug when it was darkly hinted that it was illegal, a criminal instrument, terrorism — blah, blah. I didn't trust the mass on that. So I brushed it aside and I got my subscribers in at rock bottom as the Original Bitcoin Bug in November 2016.

I guess I ponder why a field is shunned, and I brave the disapproval of the majority if I see an opportunity to buy upstream from the herd.

And as the humorist Henny Youngman once said, "It's not the way you play the game, it's the way you bet that counts." And everything I've said today is in my 2020 Annual Forecast issue.

I think it's the most important one I've ever produced.

MF: No doubt! It’s an incredible issue! I’ve already read it once and will be starting it again after we hang up! I was just talking with Jeff Phillips… he’s already read it four times!

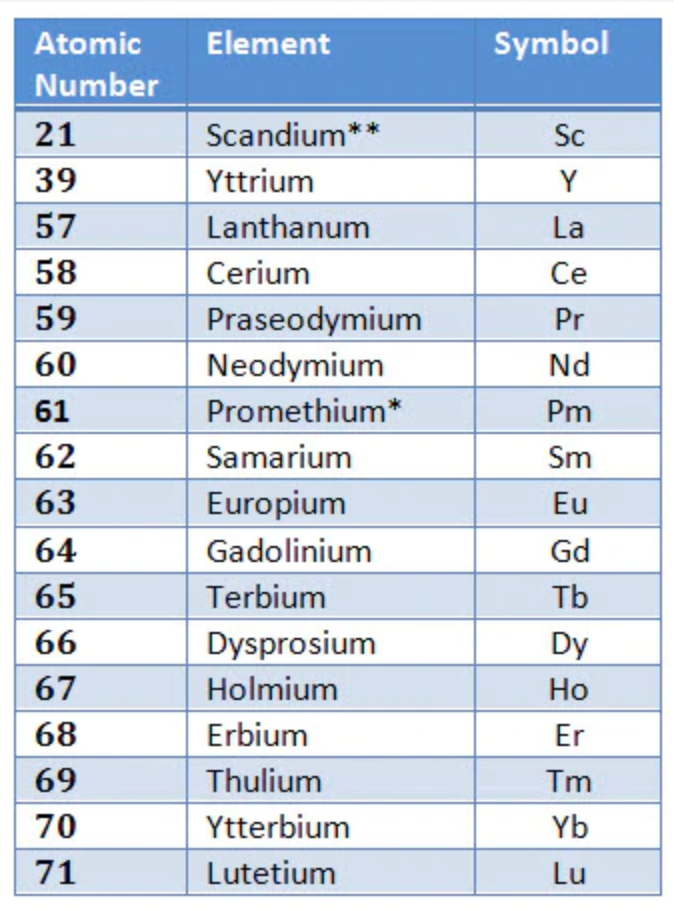

Now, the rare-earth metals industry is yet another market segment where The Dines Letter was, at the time, the first to report on China’s underhanded, yet legal, theft of America’s rare-earths industry. The “Original Rare Earth Bug.” A decade-plus later, and the US Defense Department is now scrambling to secure, as well as find ways to extract, rare-earth elements.

Based on the present scenario, is now a good time to start looking at the very few rare-earth stocks that exist outside of China such as Lynas Corporation as covered in The Dines Letter?

JD: As for the rare-earths, it personally upsets me even to discuss it. I was unable to awaken America to China taking our rare-earth metals industry. They did it legally; they didn't do anything wrong — we were just stupid. Not we; our leaders were stupid!

When I tried talking to Congressmen about it, I said, "There's a problem in the rare-earths," and they began to edge away from me.

When I tried talking to Congressmen about it, I said, "There's a problem in the rare-earths," and they began to edge away from me.

And sometimes they'd say, "How can rare-earths be rare when the whole planet is made of them?" Before I had a chance to answer, they were walking away.

So you're dealing with people who don't understand things. And what I did was, I reported it to my subscribers — and we got in and made major killings in the rare-earth stocks.

So how do I do it? I guess I'm fearless. As long as I think I'm telling the truth — I'm not afraid to state it. And if they don't like it, they can just not listen to me… which is a relief to me personally.

But in terms of which ones to buy now, well… the Chinese own the industry. They're all Chinese stocks, and I'm not going to buy a stock controlled by a communist state.

They vacuumed up the whole industry: the scientists, the patents, the methodologies, and even the samples. It was all shipped to China, which they had promised they wouldn't do when they acquired the American company.

Lynas Corporation is the only rare-earth stock in our Supervised List currently. It's pretty flat right now. I'm waiting for the correct chart pattern to emerge before I recommend it strongly. But the industry is out of our hands. The Chinese own it; they own the patents cold — all of the ones we pioneered when we built it.

Very upsetting to me. I still don't like talking about it.

MF: I agree wholeheartedly; a huge unnecessary loss that we’re paying dearly for now.

We touched briefly on the cannabis sector, and, as The Original Pot Bug, you’ve had your finger on the pulse of this sector for a number of years. Pot stocks as a group literally went from boom-to-bust leading up to and following Canada’s legalization of cannabis in October of 2018.

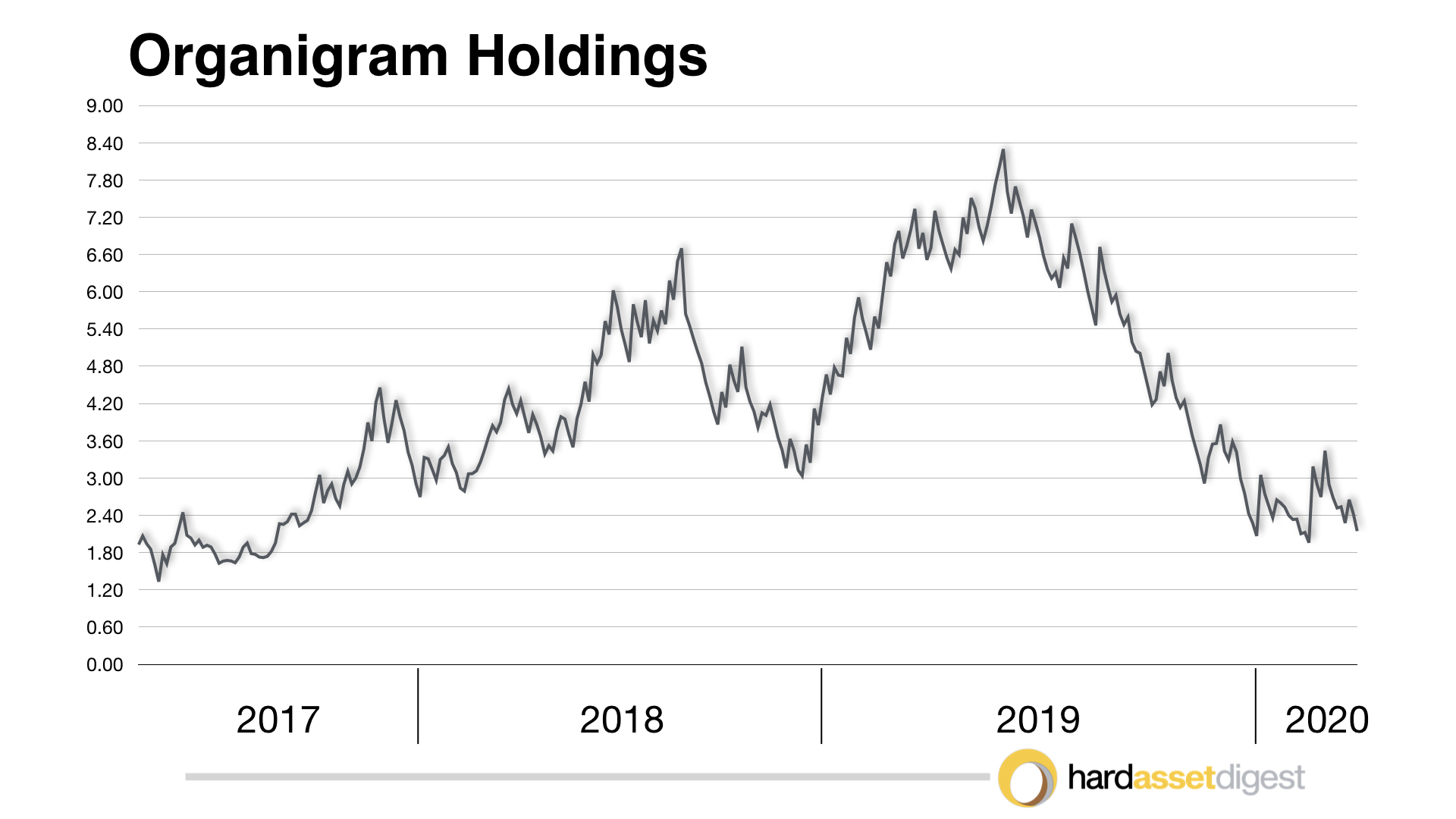

You jumped on Canopy Growth very early on – I believe around $2 per share – before it shot-up 2,500% to $60. Also, OrganiGram at 81 cents before it rose 932% to $8.36 a share.

Would you mind sharing your thoughts on the key issues facing this nascent industry, where it’s heading next, and which companies you believe will be the select few survivors worthy of commanding our speculative attention?

JD: Sure, as I mentioned before, Mike, I'm very bullish on pot long-term. I'm going to be discussing an important feature in my letter about addiction. I’m making the outrageous prediction, which nobody believes yet, that the US Government will eventually give cannabis away for free to people who are addicted to hard drugs such as heroin.

That’s because marijuana is not addictive; it can be habit-forming, but that's different. I'll be discussing that in an upcoming Letter.

I think that the government itself is going to come in very strongly behind pot, partially because all of them use it. Not all of the legislators — but certainly a lot of them do. Maybe they didn't inhale (laughs!).

Anyway, I'm very bullish on this. At this point, it's still under government control. They still can't use banks, and they're still being undercut by illegal sales, which are now priced around 50% lower than what they’re attempting to sell in the stores.

In my letter, I cover how badly Canada has handled this.

First of all, they're trying to control everything. They want to build the retail outlets, which of course they didn't do fast enough in order to sell all of the product. And a lot of these companies are now teetering on the edge of bankruptcy because of it.

I think Canopy Growth is one exception. It's still backed by a major blue chip, and even though they've threatened not to give it any more cash, they're not going to let an asset that valuable slip away. So that chart has already turned up.

As you mentioned, we got into Canopy at around $2 a share. We have already made a gain of 2,500%.

I try to buy stocks that have huge percentage potential, and you can't do that on the stuff that everybody has walked over. You need to go upstream from the herd to really find that kind of money.

OrganiGram is another one of my favorites. I picked it out when it was a penny stock. And it only went up 930% — but I still think it's going to do a lot better because they're the only one that really paid attention to the profitability of what they’re doing.

It caught my eye when management revealed that it had the lowest cost basis in the industry. But still, they're no match for the illegal sales. If the government wants to pile up taxes and costs and social justice and everything else on it — it simply won't sell.

They'll take in less than they would have had by letting the industry grow.

And in fact, as I’ve said in my letter, what the government is doing is comparable to strapping a brush to an infant’s chest so as it crawled around the floor, it could polish the floor a little bit. I think the Canadian government needs to give the child a chance to grow up before they put it to work!

MF: And you mentioned that you do see the US Federal Government eventually legalizing marijuana…

JD: Absolutely… and I’ve even given a timeframe to it. I think it'll happen shortly after the election. No politician is going to raise a controversial topic unnecessarily. And some of them still associate pot with hard drugs, which of course cannabis is not. And certainly hemp is not — and even it has been painted by the same brush.

So I'm very skeptical anything will happen before November 3rd of this year in terms of legalization.

But I do believe that shortly thereafter, early in 2021, we’re going to see legalization being pushed quickly through the legislative process, and I think we’re going to see another boom.

However, you also need to consider, or at least I need to consider, the anticipatory nature of stocks. I think the stock market itself is well aware that legalization is going to occur, and they'll probably start discounting it some months before the election.

So I'm looking for a mysterious rise in the cannabis stocks sometime around September/October or perhaps sooner. And that will be a sign that we're ready to get back in. Yet, the time to buy some of these stocks is now. They're floored. Their backs are on the floor. Some of them are almost down to where we first recommended them.

I tell my people, my followers, to sell partially on the way up; sell small percentages on the way up of the holdings. I have one subscriber who sold half of his holdings right at the top. And I think that's an important way to handle stocks in terms of knowing when to sell; it’s even more difficult than knowing when to buy.

MF: On the other side of the spectrum are the base metals – such as copper, lead, nickel, and zinc – which individually, and as a group, are trading near historically low prices. Of course, there are lots of reasons for that — some of which we already covered.

My question to you, Mr. Dines, is… which catalysts are you on the lookout for that could signal a buying opportunity in the base metals stocks?

JD: That's a very good question, Mike. None of the industrial metals has a bullish chart as of today. And I watch them every day for signs of their next bull market.

I keep asking myself this key question, “How could you have a bull market for so many years and not need the raw materials with which to build things unless there's a very deep recession waiting somewhere ahead?”

So I look at something called Doctor Copper, which is supposed to forecast what the economy is going to do. And as a result of that, I have been leery of an economic boom here in the United States.

I even said in my last letter that something is going to happen — particularly in view of the mass geopolitical cycle that we’re at the bottom of now. We don't have enough room to go into it here… but it's called TDL’s Political Gamut (TPG) in our Mass Psychology book.

And it’s approaching, politically, at a time toward socialism, communism, and upheavals. And usually, it occurs right before a reversal toward capitalism.

The last one… and we correctly called this… happened shortly before the 9/11 terrorist attacks. I think it was 1999; I wrote that there would be terrorism coming into the United States. In fact, it's in one of my books published before it happened.

When 9/11 hit, I said... we are now at the top of the TPG, which means we're at total freedom. We have the newest thing, the Internet, which is the most important communicative device since the Gutenberg printing press in the 15th century. And we're going to start moving toward a police state.

And sure enough, it wasn't but a couple of years later, we had the so-called Patriot Act, which introduced scanning and intrusion into our privacy like nothing before. Not even George Orwell conceived it this thoroughly.

And so that was one cycle, and now I'm beginning to look for the upward cycle on it, and it's going to be toward more freedom. I don't know what's going to do it, but I'm on full alert for it — and I know it's coming.

MF: Mr. Dines, I’m not sure if you remember this, but the first time I interviewed you was way back in the mid-1990’s when I was just breaking into the business. You were more than gracious then, and I’ll always be appreciative of your willingness to share your wisdom with me.

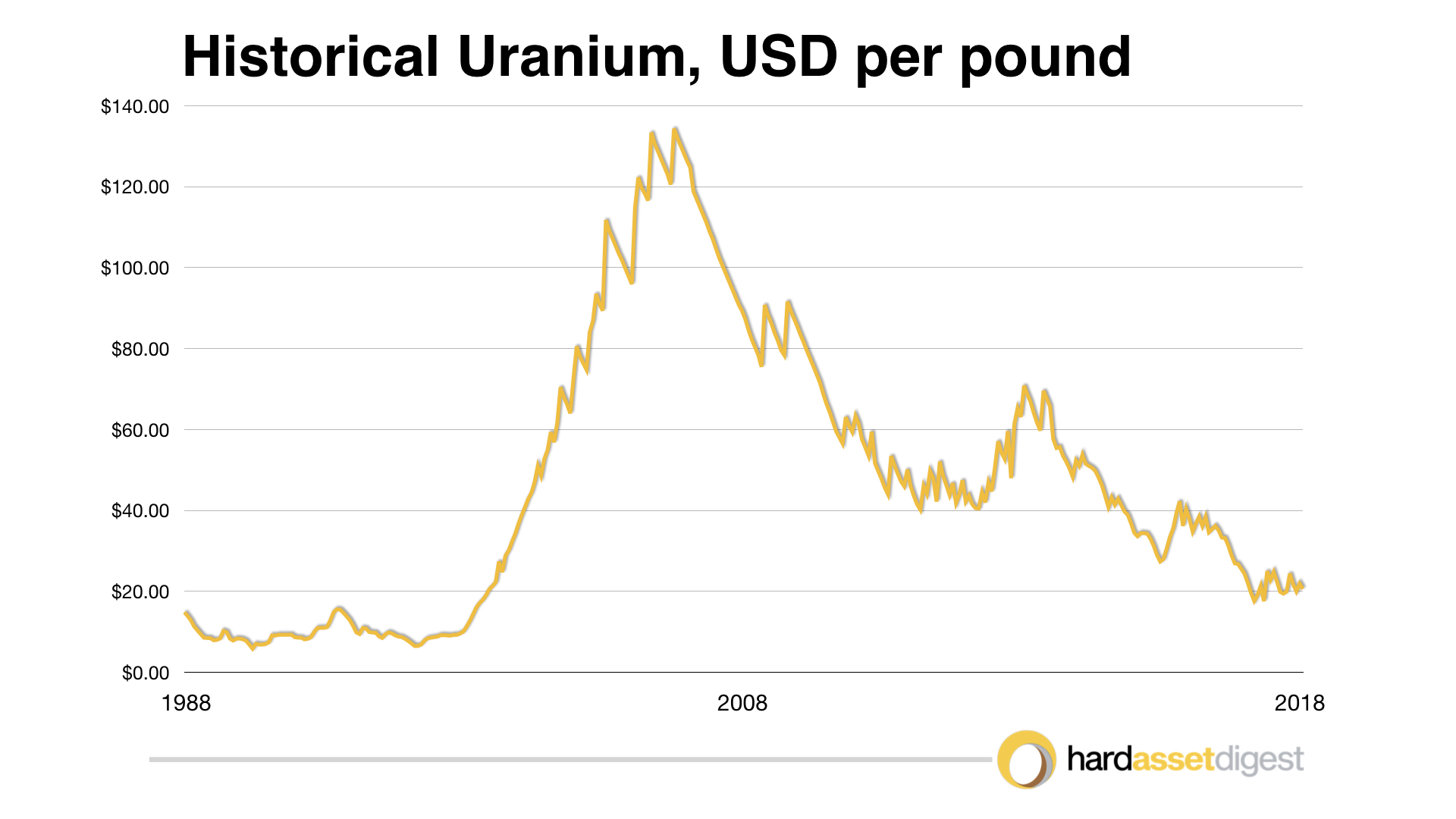

Now, as The Original Uranium Bug, you know I can’t let you get away without asking you about the uranium sector. Of course, this is a sector that peaked in 2007, crashed in 2011 on the heels of the Fukushima disaster, and has been mired in a painfully slow recovery ever since. Like the rare-earth elements, it’s a sector where the Chinese seem lightyears ahead of us both in mindset and action.

In your eyes, is a near-term turnaround imminent, and how should we, as astute yet wary speculators, approach this critical, clean-energy market segment?

JD: We recommended uranium at $8 a pound as the Original Uranium Bug, and it got up close to $150 a pound near the top.

It was a phenomenal bull market!

And since then, uranium has basically been in a bear market. And investing in uranium has been dead money. So our strategy is to wait for the charts to turn bullish again, and then we'll flash an Interim Warning Buy-Signal through our service.

But my prediction still stands – and nobody will believe this – that eventually the anti-uranium environmentalists, themselves, will be leading the charge back to atomic power.

Believe the unbelievable — or not!

Fukushima was not the fault of atomic energy. It was the fault of cheapskate Japanese wall-builders who tried to save money by not building the anti-tsunami wall high enough.

And in life you should never chase a penny to save a dollar.

And then the other time was Chernobyl, which they blame on atomic power. They should have been blaming the vodka-besotted Soviet bureaucracy that ignored safety standards, playing fast and loose with a very dangerous technology. Fires are dangerous also, and we still use fire. So, uranium will be back big-time — but I’m not seeing it just yet.

MF: Mr. Dines, it’s always intriguing hearing your insights on metals, markets, investing, and life in general. Is there anything else you’d like to mention before I let you go?

JD: Well, Mike, I'd like to talk about my prediction of the coming physical immortality if that’s alright with you?

MF: By all means, Mr. Dines… I’m all ears!

JD: Okay, the first thing I want to say is that I very much believe in this prediction of the coming physical immortality. I first predicted it publicly as a keynote speaker at the James Blanchard seminar in New Orleans back in 1985.

Since then, science has made mind-blowing progress in understanding where in the genome “the switch” is concealed.

And I cover this in the health feature in my letter. Personally, I think the health part of my letter is the most important feature because without your best health possible, you’ll always have less.

But I think that physical immortality is definitely coming. And now that we have the genome figured out — it's only a question of figuring out where on the genome it's hiding.

And in fact, I recently saw some research on the baobab tree, which is a very fat tree. Apparently it’s missing a gene that ends its life. And that's why it just keeps growing fatter and fatter.

And, you know, I just can't believe some scientist somewhere, hopefully reading this, isn’t saying, "Hey, wait a second. If that gene is missing, we know approximately where it is on the genome. Why don't we zero in on that?!"

But anyway, when it happens… it's going to change history very decisively!

MF: And not necessarily in a good way, I would imagine!

JD: Both! My final comment, Mike, would be… whether you’re rich or whether you’re poor — it’s good to have a lot of gold!

And you can quote me on that!

MF: Mr. Dines, always a fascinating discussion. Best of health to you in the new year… and I look forward to catching up with you again soon.

JD: Best to you as well, Mike. And please say hello to your wonderful parents for me.

MF: Will do, Mr. Dines. Thank you again.

We have four reports now available highlighting several opportunities for investment in the resource space.

- The Book of Levi: Picks-and-Shovels for the New Gold Bull Market

- Mid-Tier Takeovers for 2020 and Beyond: Two Top Candidates for Premium Takeovers

- The New Standard in Silver

- Exploration Opportunities

Opportunities discussed in those reports and past issues include:

| Issue Mentioned: | Mentioned By: | Opportunity: |

| January 2020 | Mickey Fulp | Ely Gold Royalties (TSX-V: ELY)(OTC: ELYGF) |

| January 2020 | Mickey Fulp | Trilogy Metals (TSX: TMQ)(NYSE: TMQ) |

| January 2020 | Mickey Fulp | Azarga Uranium (TSX: AZZ)(OTC: AZZUF) |

| January 2020 | Mickey Fulp | Realgold (private) |

| December 2019 | Van Simmons | 1903-1926 Gold Commemorative Coins |

| December 2019 | Van Simmons | Pre-1933 Liberty, Indian, St. Gauden Coins |

| November 2019 | Rick Rule | Sprott Inc. (TSX: SII)(NYSE: SII) |

| November 2019 | Rick Rule | Alacer Gold (TSX: ASR)(OTC: ALIAF) |

| November 2019 | Rick Rule | Alamos Gold (TSX: AGI)(NYSE: AGI) |

| November 2019 | Rick Rule | Silvercrest Metals (TSX: SIL)(NYSE: SILV) |

| November 2019 | Rick Rule | EMX Royalty Corp. (TSX-V: EMX)(NYSE: EMX) |

| October 2019 | Jeff Phillips | Midas Gold (TSX: MAX)(OTC: MDRPF) |

| October 2019 | Jeff Phillips | Almaden Minerals (TSX: AMM)(NYSE: AAU) |

| October 2019 | Jeff Phillips | Revival Gold (TSX-V: RVG)(OTC: RVLGF) |

| October 2019 | Jeff Phillips | Azarga Uranium (TSX: AZZ)(OTC: AZZUF) |

|

FREE INTRODUCTORY OFFER! Mr. Dines is legendary for having made correct market calls that go against the grain of the mainstream financial pundits. Click here for a complimentary online copy of The Dines Letter’s 8 November 2019 Issue (no email required). You can also view the front page only of his 2020 ANNUAL FORECAST DOUBLE ISSUE there — he says it’s the most important one he’s ever published! Mr. Dines is offering this Forecast Issue to readers of Hard Asset Digest as a Special Subscription Bonus with your order. To subscribe, simply click above for your complimentary issue and enrollment details. |