Hard Asset Digest December 2020

December 2020

For our final interview of 2020, I’m sitting down with Mr. Van Simmons — partner and president of David Hall Rare Coins and one of the most highly regarded coin dealers in the United States.

Click here to jump straight to the interview.

Van is held in the highest esteem by his clientele… many of whom have been with him for more than forty years.

A self-admitted coin junkie, Van has been a rare coin collector since age twelve and a rare coin dealer since 1979. And as one of the founders of the Professional Coin Grading Service (PCGS) – the largest coin grading service in the world – he has helped to revolutionize the rare coin market.

Specializing in portfolio construction, set building, and helping clients acquire the world's finest rare coins and collectibles – Van is well respected by his peers for both his industry knowledge and his reputation for integrity.

Van has also won acclaim as a collectibles dealer in sports cards and memorabilia, rare firearms, western memorabilia, and collectible knives.

Even with this wide range of interests, Van’s number one collecting passion remains rare coins. His fascination with the beauty, rarity, and historical significance of coins continues to be his lifelong pursuit.

I could go on and on, but hopefully you get the picture. The bottom line is… there’s no one in the rare coin and collectibles universe I trust more than Van Simmons.

A Safe-Haven Investment

We’ve talked about rare coins as a safe haven before – yet I think it bears repeating: In today’s environment of ultra-low interest rates, increased market volatility, and waning personal privacy – top quality, rare, and important collectibles offer a way to maintain, store, and transfer real wealth on a long-term basis and in a very private manner.

Here are a few tips for success:

#1: Buy What You Like

There’s lots of different types of collectibles. And because of that, Van recommends focusing on buying what you like. If you buy what interests you, you’ll learn more and more about that specific niche – and you’ll be able to make better informed decisions as your knowledge grows.

#2: Stick with Major Markets and Major Items

To put it another way, don’t get too esoteric. It doesn’t matter how rare an item is if nobody cares. In collectibles, it’s not just rarity that matters. Demand is also an important issue. So stick with items people care about and collect.

#3: Quality Counts!

In all collectibles, quality is of paramount importance. Typically, the better the condition, the bigger the buyer demand, and the higher the price. Which means, in most instances, you’re best served by buying the best quality you can afford. Eye appeal matters!

#4: Think Long-Term

Collectibles markets are expertise-driven niche markets. These are not markets where you can “Beat the Dealer.” And unless you’re an expert dealer, you cannot be a successful short-term trader.

But you do hold a distinct advantage over the dealers. You have staying power. You don’t NEED to sell. You can buy great collectibles and hold them to ride the long-term trend. Dealers don’t do that because they’re in the sales business… not the storage business. They buy and sell. You can buy and hold as a safe-haven investment — so think long-term.

#5: Use Third-Party Grading and Authentication

As noted, quality is a major value component in the collectibles arena. And, obviously, authenticity is a must. Fortunately, many markets have third-party grading and authentication companies, such as PCGS, that can give you an unbiased expert assessment of the quality and authenticity of a collectible.

You don’t want to buy a “Very Fine” item for an “Extremely Fine” price. And obviously, you want to avoid counterfeits at all costs. Counterfeiters are extremely talented, and grading can be subtle and subjective. You really should have an expert opinion before laying down your hard-earned cash.

#6: Find an Expert You Can Trust

While third-party grading and authentication can help you make the right purchases, there are additional issues for which you can use expert assistance. Even items that have the same “official” grade can have slight differences… mostly due to eye appeal.

A true expert can guide you and make sure your purchases are of the greatest value possible. And experts can help you find and buy the right items… and for the right price. How do you find the right expert?

In my slightly biased opinion — there’s none better than Van Simmons.

#7: FOCUS, FOCUS, FOCUS!

Van often says, “The easiest thing to do in the collectibles market is spend your money!” Yet, all successful collectors have one thing in common… and that’s focus! The idea is to buy with purpose!

Simply by sticking to one or two general areas or genres, you’ll have no choice but to make “informed purchases” of important items as your knowledge base and buying and selling experience broadens.

In general, you’ll be best served by adhering to these “5 Do-Not’s”

- Do not buy items randomly. Remember, focus!

- Do not buy “raw” items that haven’t been graded and authenticated by an expert third party.

- Do not buy items from TV or online sellers; most often these are common, overpriced items.

- Do not buy second or third editions; it’s the “firsts” that hold real value.

- Do not overly focus on bargain hunting; if a price sounds too good to be true, it probably is!

The Rare Coin Advantage

The rare coin market – which is estimated at $8 billion in sales annually – offers a few key advantages over most other collectibles genres.

First, rare coins are, by far, the most liquid of all collectibles. It’s really easy to sell rare coins. Second, the difference between buy and sell prices for rare coins is typically smaller than in any other collectibles genre. Finally, rare coins maintain a direct correlation to gold and silver bullion markets.

At present, Van is seeing tremendous value in specific areas of the rare coin market, which means the timing is in your favor as a potential buyer.

Gold & Silver Bounce Higher As Predicted

In our September issue, I stated, “Looking at precious metals, we should see correction lows set in both gold and silver sometime within the next few days to the next few weeks.”

Then, in last month’s issue, I added, “...we can expect continued choppiness in the precious metals sector through year-end buoyed by a predictable mid-December bounce in the gold price.”

Thus far, our assessments have been dead-on accurate.

On November 29th, we saw correction lows set for both gold and silver at $1,762 and $22 per ounce, respectively. Gold has since rallied 7% to currently $1,885 per ounce, and silver has performed even better… jumping 20% to currently $26.50 an ounce.

And that predictable mid-December bounce in gold I mentioned?

Well, on December 13th, gold hit an interim low of $1,822.70 before spiking to an interim high of $1,912.00 just one week later.

With the November bottoms AND year-end uptrend now confirmed, I’m confident we’ll see gold trading firmly above $1,900 an ounce within the next few weeks followed by a strong move to above $2,000 sometime in the first quarter.

Las Chispas Update

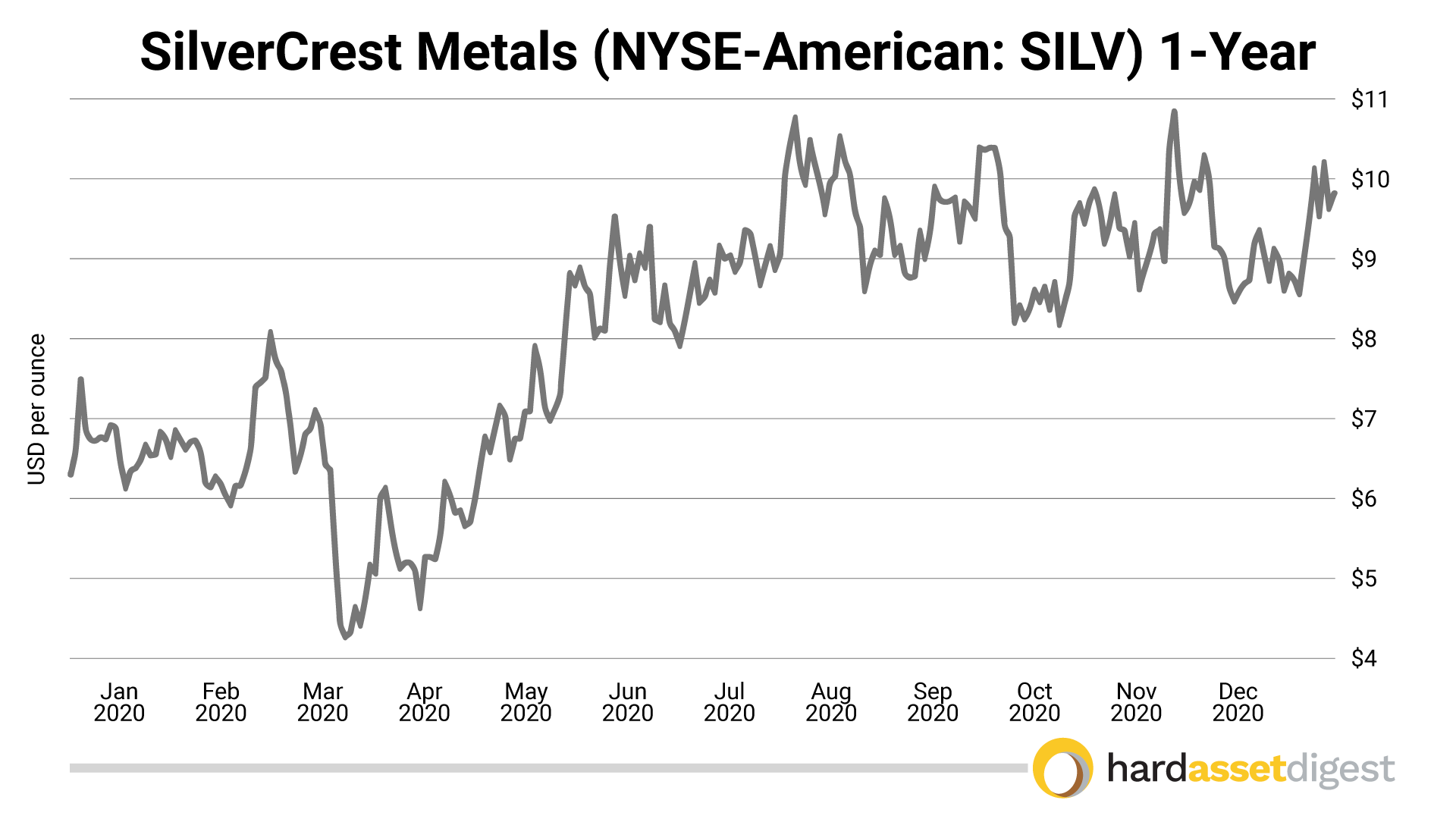

Last month, I shared with you a stunning drill intercept by SilverCrest Metals from their Las Chispas gold-silver project in Sonora, Mexico:

I also noted that, due to weak gold/silver sentiment at that moment, the market’s reaction to those spectacular results was essentially nada! I added, “I firmly believe these types of muted responses will soon morph into ones of market-wide excitement as gold and silver resume their powerful upward trajectory.”

And that’s exactly what we’re beginning to see now.

At the time of those comments, SilverCrest was trading right around $8.50 per share. Today – just four weeks later and with gold and silver surging higher as predicted – SilverCrest has moved firmly above $10 per share on steadily increasing trading volume.

One thing to keep in mind as we finally leave 2020 in the proverbial rearview is that our panel of experts are all in agreement that we’re at the very beginning stages of a powerful, multi-year gold bull market.

To that end, our SilverCrest example illustrates the type of fast-developing opportunities we’ll be targeting in the new year… from the juniors and mid-tiers all the way to the senior producers.

With New Year’s fast approaching, I can’t help but think it’s going to be one to remember! Not so much for the spirited celebrations… but more so as a collective reflection on the hardships endured by so many families and the important lessons learned along the way.

So to my valued Hard Asset Digest subscribers, I humbly say… be extra safe over the holidays and get ready for a very profitable and prosperous 2021 in the resource space.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with Van Simmons

Partner & President, David Hall Rare Coins

Mike Fagan: Van, it’s great to catch up with you. It’s been an interesting year to say the least! How have you been?

Van Simmons: Very well, Mike. Working hard and plugging along… trying to survive all the viruses in the world.

MF: Yep, exactly! I imagine if it were normal times, you’d be busy flying back and forth to your office in Paris to grade and buy rare coins for your clients. Yet, here we are in a year that really couldn’t be any further from normal. How is the pandemic affecting things on your end… and, secondly, are the majority of the gold coins you’ve been buying this year still coming out of Europe and South America?

VS: Well, Mike, the shows have certainly been affected because all of them have been closed since last January. So where I used to travel to shows every three or four weeks, I haven’t had any coin shows at all this year, which has made it very difficult to buy nice coins. I still travel to see clients and I travel to buy deals, but as far as the show part — that’s been hard.

I guess I've been more dependent now on buying coins from collectors and things like that; clients I’ve had over the last 40 years and so forth. And the environment we're in today is really giving investors and collectors time to focus on what they want and what they’re trying to accomplish.

As far as coins coming from overseas, most of the $20 gold pieces, $10 gold pieces, and $5 gold pieces do come from Europe and South America. I mean, that’s where they all went in the 1800s and early-1900s.

And I think I told you last time there was a large hoard that was found, and that’s been coming to me almost daily. It’s just different coins at different times. But I’m not seeing a lot of really rare gold coins coming out of Europe right now.

MF: There’s definitely something to be said for having more time on our hands this past year to really focus and evaluate all kinds of things.

So let’s talk about the Professional Coin Grading Service (PCGS) which you cofounded in 1986 with your business partner, David Hall. And also, Van, if you wouldn’t mind giving my audience an overview of how your business works and what you do for your clients.

VS: Sure. So let’s start with David Hall Rare Coins. I was a very active coin buyer, and David was a very active coin buyer and dealer, back in the 1970s. And he and I met in the late-70s. We ended up working together and became partners a little over 40 years ago. And we've specialized in putting together a variety of different things.

Let’s start with gold, silver, platinum and palladium. We have a large client base that buys a lot of metals from us, whether it’s in the form of US Gold Eagles or $20 gold pieces or whatever it may be. And then the other focus is on rare coins. We have a client base that wants to focus on putting together sets of rare coins for a variety of reasons.

A lot of people in their fifties, sixties, and seventies collected coins as kids. And as they’ve become more successful in life, they now want to put together a serious collection of coins. A lot of people are trying to put together coin collections as a store of value… and high quality rare coins certainly fit that.

And then you have a lot of people who are quietly trying to pass wealth from one generation to the next. We’ve moved into a very confiscatory tax system, and now they're talking about a wealth tax, an inheritance tax, and everything else. So a lot of people are buying coins for a variety of different reasons.

Mostly, they like them! I was just on the phone with a client and he goes, “You told me years ago, Van, that the best description of high quality rare coins is that they're the absolute purest form of our American heritage.”

MF: No argument there… I mean the history just comes straight through the coins!

VS: Exactly! When a country makes its own coins, they’re really telling the world, “We're our own free sovereign nation now.” And that’s certainly what we did in 1793 when we started making coins here.

MF: Absolutely. And about the PCGS?

VS: Right. So back in the early-1980s, there was a tremendous demand created for high-quality Morgan Dollars and Peace Dollars and things like that. And what that was is, in 1976, silver was $2 or $3 an ounce. And then it went to $40 or $48 an ounce by 1980.

And silver dollars in 1976, in mint state, were $60 to $65. And in 1980, they were only $80! So silver had gone up, let’s say, 10 times or more, and the coins had only gone up by 20% or 30%.

So one morning, David and I were having breakfast, and I said,

“Dave, these things just haven’t done what the rest of the market has done, and they're very overlooked. It’s hard to find something made in the United States that’s made out of virtually pure silver in perfect condition for $100. It’s over a hundred years old; it doesn’t make sense!”

So we jumped on those and, by about 1984, it was becoming very difficult to buy the coins. By 1980, we were buying them at $90 and selling them at $100. At one point, I want to say in '86 or '87, I was buying them for $900 to $1,000 a coin. They'd gone up quite a bit because it was just an underpriced area of the market.

A lot of people don’t realize that bear markets create bull markets and bull markets create bear markets. I was complaining because so many dealers were sending us silver dollars and other coins they were grading at certain grades… and both David and I would disagree. We would only keep about one out of every 30 coins that were sent to us.

So the next day, David comes to me and says, “Why don’t we start a grading service and set a standard in the coin business?” So that’s what happened, and it expanded and expanded.

David and I owned a large percentage of the company, and we took in five small partners who were all dealers we could trust. Once we set the standard, there really wasn’t anyone who could argue with it. Of course, coin dealers would argue that their grades were higher than the grade we said — but the industry and prices adjusted to that.

The company became profitable within the first 30 days and remained in the black every single month from February of 1986 on.

MF: That’s truly impressive!

VS: Yeah. We took it public in 1999, and it trades on the NASDAQ under the symbol CLCT. And I think we've paid out well over $100 million in dividends over the last 10 or 15 years. And it’s just been a real fun and exciting successful company.

We grade baseball cards, coins, etc. That being said, and I don’t know if you've talked to Jeff [Phillips] about this or not, but after 35 years, I finally stepped off the board a year and a half ago. I basically said, “I'm not going to run for reelection. I've been here, I’ve done my time. I like my shares, but I don’t need to be here any longer.”

So I stepped off the board and moved away from it. And, as I’m sure you’ve heard, the company got sold last week. The guy who owns the New York Mets just put up an offer of, I think it was $75.25 a share, and he's paying us $700 million for the company.

So it’s like the All-American story. You build a company up and sell it!

MF: Yes and congratulations are absolutely in order!

VS: Thank you! Yeah, and I had one guy call up and say, “Man… nice lucky hit!” To which I replied, “Yeah, you’re right… I only worked at it for 36 years!”

MF: True overnight success story, right!

VS: Yes, exactly!

MF: So, Van, turning to more of a macro perspective, we’ve got this ongoing war on currencies, and we’ve talked about this before, wherein we’ve been stuck in this low-rate “easy money” environment ever since the 2008 financial crisis.

And of course, on top of that, we now have the COVID-19 pandemic and the $Trillions in sovereign debt creation that’s really only just getting started.

How do you see this perpetual environment of unlimited debt creation and currency debasement by governments, not just here in the US but around the world, affecting the gold market and the rare coin market in the coming years?

VS: Unfortunately, Mike, governments always inflate! Going back to 2008, which you just mentioned, I mean, not that I'm correct, but my feeling was back then and my feeling is now — they shouldn’t have bailed out anybody. Companies would have readjusted and got bought out by other companies that did have money… and the world would have gone on.

Instead, they created so much debt, and they’ve added a few $Trillion more this year. It’s difficult to see what the outcome is going to be.

I recall, I was having lunch with Dr. Milton Friedman, the Nobel Prize winning economist, along with his lovely wife, and I asked him, I said, “What do you think the price of gold is going to do?” And he looks at me kinda funny and says, “What do you mean?” And I emphasized, “Long-term.” And he kind of laughs and his wife begins to chuckle.

And he says, “Well, you know, Van, you have to realize, politicians have to make promises to get elected. And once they get elected into office, they have to fulfill those promises. They then have to create money out of thin air. And every time they do, they create more money and it devalues your money. So you can just count on sooner or later the dollar being zero and gold being a million dollars an ounce!”

MF: Right… exactly! It’s one of those things no one really pays much attention to until it’s way too late!

VS: Right… and he goes, “I can’t tell you when that’s going to be… but that’s what’s going to happen!”

And if you look at a chart of the US dollar in the last 30 or 40 or 50 years, it has just continued to go down.

MF: True… and it’s near impossible to get out of a downward spiral like that once it starts…

VS: And so the market on gold assets or rare coins or any tangible product – whether it’s stock in a company or real estate that produces income or things like that – I mean, even though we've been in a very deflationary economy, I think at some point this is going to turn around and we're probably going to see large inflation that’s going to push people to buying tangible products.

Technology is changing things and making things so deflationary where simple stuff… like we used to buy maps and now they’re just on our phones… has lowered our cost of living.

But the value of the dollar and the value of all currencies is just toxic. And the funny part is, you sit there and you think… at some point, isn’t this going to stop and the rest of the world is going to stop accepting the dollar? Well, they're all doing the same thing!

MF: And, Van, I think you just answered my next question which essentially is… what we’re seeing play out globally, monetarily, is extremely bullish for gold and rare coins!

VS: Yes, I think coins, gold, or any tangible product like that has pretty good upside over the next 10 years or 15 years or however long it’s going to take.

MF: There’s also this ongoing effort to restrict people's freedoms: There’s a war on cash… a war on gold… a war on privacy. One very current and poignant example is how the government is planning on tracking COVID-19 vaccinations here in the US.

Can you talk to that a bit… and how does investing in rare coins help you and I as private citizens, and as savers, stand up and fight back against a system that’s continually being rigged against us?

VS: Well, I agree with the wars and everything else you’re talking about. I think one thing you left out is this war on wealth.

In my opinion, we're not that far away from a wealth tax, and our government has talked about it. And certainly here in California, they've talked about it. Rare coins are a very private way to invest your wealth where people really don’t pay attention to it. It’s really no different than having an expensive watch and passing it on to your kids.

I mean, you could have a $10 million rare coin collection, and it’s pretty hard for someone to find it.

And it’s not where they're jealous and they say, “I want what Mike has and I'm going to do everything I can to get it.” It’s… “I want what Mike has. I'm going to do everything I can to get it AND I'm going to make sure Mike doesn’t have it anymore!”

That’s the difference between jealousy and envy. And I think we are moving into an area of envy where there's some pretty vicious people that are frightening to me. But that’s what’s happening.

MF: Scary but true. I completely agree.

So let’s talk coins! You and I have spoken before about the important differences between newly-minted coins versus old circulated coins; those that were struck prior to 1933. For those in my audience who may be relatively new to numismatics — would you mind going over some of those key differences?

VS: Mike, a lot of people will think about buying gold, and the first thing they’ll do is call and want to buy gold bars. Well, almost nobody deals in gold bars anymore. They do, but it’s not a desirable product.

And in the late-1970s, you had people buying Krugerrands; in the early-1980s, you had people buying Maple Leafs; in the mid-80s, you had people buying the US Gold Eagle as they came out in 1986.

All during that time, the old pre-1933 $20 gold pieces were trading at 75% to 125% over the spot price of gold, which is what they always have done. In the last few years, there's been so much supply of them coming on the market that the premium has come down to where you can now buy an old $20 gold piece for about the same percentage over the spot price of gold as you can a Gold Eagle.

I mean, some days it’s the same price; other days it’s $5 less or perhaps $20 more… but it gives you an advantage for several reasons.

First, it works almost as an arbitrage because if you bought Gold Eagles and gold stays at $1,850 an ounce — then, ten years from now, you have that same $1,850 an ounce. Now, if you buy the old $20 gold pieces and they’re $1,850 a coin, you have the potential for that premium coming back.

And the premium doesn’t have to come all the way back to 100% over spot. I mean, if it just comes back to 25% or 50% over spot, it’s a major hit over owning the Gold Eagles.

So owning the Gold Eagles at this point, to me, doesn’t make a lot of sense. If you were my brother, I'd tell you to sell your Gold Eagles and buy the old $20 gold pieces. It may cost you $20 a coin or something — but it’s a wise trade in my mind.

The other advantage is, when they outlawed gold in 1933, the government classified the old $10 and $20 gold pieces and things like that as collector coins, and they were never confiscated. Roosevelt was a big coin and stamp collector, and the public didn’t realize it and ended up turning in most of the $20 gold pieces and $10 gold pieces and stuff like that.

The case law on the books shows that these older coins would indeed be upheld as collectibles. Jim Rickards, in his book Currency Wars, has talked about our government putting a windfall profits tax on gold bullion of 98% or 99% at some point.

If that ever happened, these would probably bypass all of that because they're classified more as a collector coin as opposed to a bullion coin.

MF: I like that! You get the inherent protections… PLUS you get the upside of the collectability of the coin, the rarity of it, above and beyond the actual gold content value.

VS: Right! To me, it’s almost the easiest no-brainer trade in the marketplace right now. And I don’t mean to be cavalier about it. But I've been doing this full-time for over 40 years, and I was a collector for 10 or 15 years before that. It’s like seeing a beautiful property on a beach and understanding the value there.

MF: Makes perfect sense. Van, we touched on the old circulated $20 gold pieces. Are there other areas where you’re seeing good value right now?

VS: Almost across the board, Mike, because the rare coin pantheon has not followed the bullion market in the last few years because rare coins tend to move up more during times of inflation. As we said a little while ago, we've been in a deflationary economy.

So I like going with the most popular coins. For example, 20th century modern singles like Buffalo Nickels, Mercury Dimes, Walking Liberty Halves, Standing Liberty Quarters. Those are some of the most beautiful coins ever struck in the United States. That’s one area.

MF: Are those what you’d consider the classics?

VS: The 20th century classics. Yes, absolutely!

And then the 19th century type coins, which would include Liberty Seated… they made half dimes, dimes, quarters, half dollars, and silver dollars. This is Miss Liberty seated on the obverse and an eagle on the reverse; very, very collectible series… some of the most beautiful coins ever struck in the United States. I like those in business strikes and proofs.

Same thing with Barber dimes, quarters, and halves. These are long-term lock deals; they've always been collectible because people can do a complete set. They were struck from 1892 to 1916. The business strikes were struck at several different mints, and the proofs were all struck at the Philadelphia Mint. Very collectible, very desirable.

And then some of the 18th century coins are a little tough to buy right now. Like I said, I just got off the phone with a guy who called on a 1793 chain cent, which is a $155,000 coin. And it’s hard to argue with it not being one of the best buys in the marketplace. I mean, in 40 years, this is the nicest one I've ever handled, and it’s in almost uncirculated condition.

They had chains on the reverse which didn’t sit well with the public because they thought it referred to slavery. And then they were doing things with hand presses. And sometimes they get dye-clash where they stamped the dyes together accidentally and it would imprint the reverse of the coin to the obverse of the coin.

And some of the coins, like this one [not the coin pictured above], have a slight image of the chains around the neck of Miss Liberty!

MF: Geez, I can only imagine the uproar!

VS: Yeah, everybody had an outcry about it being about slavery, as it was misconstrued, and they only made them for 8 days or 12 days. And they were the first US coins made. I love that stuff!

And then when you get into gold coins… generic common date $10 Liberties and $5 Liberties and things like that, in my mind, almost seem free. I mean, if you look at PCGS, we've probably graded 150,000 $20 St. Gaudens at MS65, and it’s about a $2,400 or $2,500 coin. Great coin but very common because they were all saved.

If you move back to the older coins like the $10 Liberty, I think in the last 35 years, we've probably graded a little over 2,600 coins at MS65. So what’s that make it… 50 times rarer maybe… and it’s about $2,500 or $2,600.

I mean, it’s only a couple hundred dollars more and you’re getting something that’s 50 times more rare but not 50 times the price! There's just real value there in some of the stuff that has been overlooked. Great arbitrage plays right now in my mind.

MF: You briefly mentioned sets… what types of sets are you finding yourself piecing together for clients these days?

VS: If you were starting with gold sets, you can have an 8-piece type gold set, which includes a $2 1/2 Liberty, $2 1/2 Indian, $5 Indian, $5 Liberty and so on. There's eight of those.

You can get a 10-piece set, which includes a $3 gold piece or two of the gold dollars. And then you can get a 12-piece gold set keeping in mind that the Type 2 gold dollar is a pretty rare coin; it’s about a $25,000 to $30,000 coin in MS65.

So most people buy 8 or 10-piece sets. I think just a nice example of every gold coin that was made from 1850 to 1933… that’s good. The gold commemoratives is an 11-piece gold set; very oversold, very inexpensive. They’re nine gold dollars and two $2 1/2 gold pieces.

They've been collected since 1903. It’s a very popular series; a very completable series.

Over the last three or four years, while prices were down, I've put together lots and lots of sets for clients. Now, the coins are a little harder to get. I mean, I had a client call today wanting to do a set, and I have 3 of the 11 coins. I told him it may be a few months before we can finish the set.

There are two $50 gold pieces in that set that are six-figure coins that most people don’t include in the set because it may be out of their price range. But believe me, the large $50 Slugs, as they are nicknamed, are two of the most powerful and important coins in the rare coin marketplace. My business partner, David Hall, just bought two of the coins for his wife. I laughed and told him he must have a lot of guilt! He thinks they are one of the best values in the marketplace today. Remember, he can buy any coin he wants.

You and I have a friend who's got about 20 of them!

MF: That’s right… we do!

VS: I mean, they're some of the most important gold coins ever. So for gold sets, those are two that I like.

I also like sets of Mercury Dimes, Walking Liberty Halves, Buffalo Nickels, and Standing Liberty Quarters right now. I think for 20th century modern coins, they’re just fantastic!

And then if you look at the 19th century coins, a lot of people will put together a set of every quarter starting with a Draped Bust Quarter to a Capped Bust Quarter to a Liberty Seated Quarter to a Barber Quarter.

And there's several different varieties in each quarter. Liberty Seated Quarter; there's Liberty Seated no motto, then with motto, then arrows at date, then arrows and rays and arrows at date from 1853 to ‘54 then 1873 to ‘74. And I know I'm giving you too much information here and I apologize for that.

MF: No, not at all. I appreciate the detail and I’m sure my audience will as well!

VS: Okay. And then some people buy one of every coin. They like to look in their box and say, “This is a great half dollar. This is a great quarter. These are the 5 or 10 different half dollars we made in this country.”

Some people like all silver dollars. A collection of silver dollars or $20 St. Gaudens. Rich guys always want to put together the finest set of $20 St. Gaudens, and I think that’s great.

Obviously, I think it’s great. I mean, they buy them from me! But I like all coins… I guess you could say I'm just a coin junkie!

MF: That’s why you’re the best, Van!

So I’ve had quite a few people come up to me and ask… what’s the smartest and safest way to store rare coins? And obviously, you don’t want to tell anyone where your coins are hidden unless they’re a trusted family member… and perhaps not even them! But in general, how should someone go about storing their coins?

VS: There's a couple of things. I used to have a client in Tokyo who just had about $15 million worth of coins in his credenza behind his desk and not even a safe because Tokyo is very safe. It depends on where you live.

I like home safes or safes that are in offices or safety deposit boxes. And I get a lot of static, people say, “Safety deposit boxes! They're not safe!” Well, they really are. I mean, most people can’t tell me when the last time they knew of one that got broken into and they happened to hit your one specific safety deposit box… it’s pretty rare.

And even in 1929 when the banks closed, the next day they opened all of the safety deposit boxes because it was people's private personal property and they couldn’t keep the banks closed on that. I like safety deposit boxes the most and private storage is also fine. I have clients who want to do private storage in vaults, and I have some very safe places they can do that. And they just have to realize they have to pay a fee every year.

And if they don’t mind paying 1% or something every year to store their coins, that’s one thing. But if all of a sudden you have a million bucks worth of coins and you’re paying $10,000 a year just to store them — it gets pretty expensive!

MF: I’ve also had people ask… okay, so once you own a rare coin portfolio, what’s the easiest and most reliable way to determine the value of a particular coin or set?

And, when it does come time to sell, what’s the best way to go about doing that? Do you recommend going with an established auction company? And what if you’re just selling a couple of coins that aren’t particularly high value?

VS: There's many online price guides. We have one on our website that shows every US coin, every grade, and so on and so forth.

Auction companies are fine but they charge you a fee to sell. They also charge the buyer a fee. You’re usually giving away 20% to 35%. If a coin is graded and certified by PCGS, it’s very simple to find out the value. You can just go online, look up today’s value, call two or three dealers to see who's paying the most, and get paid that day.

I mean, I wouldn’t go to an auction company because they usually low ball you because they don’t care if it sells for $90,000 or $80,000 — they just want it to sell. If they're making 20%, the difference between those two figures doesn’t really make a lot of difference to them.

MF: Van, one of the most exciting aspects of numismatics is the truly rare collectible coins such as the 1794 Flowing Hair Silver Dollar which sold at auction in 2013 for a record $10 million, and coincidentally, went unsold a couple months ago at auction in Las Vegas.

As one of the most experienced numismatists out there, can you share with my audience any similar stories you’ve been a part of where someone came into perhaps an unexpected windfall?

VS: Yes, let me go back to 1794 because my understanding on that coin was that a friend of ours wanted to buy it and really wanted to buy it. And my business partner, David, told him, “Well, if you want to buy it, just stop all the BS and make some ridiculous bids.”

So the thing opened at $5 or $6 million and the next bid was him at $10 million. And then that was the last bid; he didn’t want to get into a bidding war to $15 million.

So now that the owner put the coin back in auction a few months ago where it didn’t sell, I have people who are once again interested in it. It’s a coin that'll sell. It’s a very important coin. It’s rumored to be the first silver dollar struck in the United States. So it’s a pretty important coin.

Similar stories… when we used to own an auction company back in New Hampshire, there was a school teacher who collected coins in the 1950s and ‘60s and ‘70s who passed away. No one really knew who he was because he hadn’t bought coins since the 1970s.

So the heir to his rare coin collection called our auction company and sent us these coins. And we went and looked at them and they were just wonderful, rare, expensive coins. Everyone was like, “Who was this guy?” Well, all of the dealers he had dealt with over the years and decades had also passed away. So nobody in the coin or auction business really knew who he was.

So the president of the American Numismatic Association calls my business partner at the time and says, “What about his 1804 Silver Dollar he had?” Of course, we don’t know, so we call his widow and she says, “He lost that coin back in the 1970’s.” He was just sick because the 1804 Silver Dollar is one of the all-time classic and famous rare coins.

Then, a couple of weeks before the auction, the president of the American Numismatic Association calls back and says, “Did you call and ask her about the 1804 Dollar?” We said, “Yeah, but she says the coin was lost.” He goes, “He was a bit lackadaisical with his collection when he showed me his coins in the late 70’s; I was holding a tray of coins and he was in his safe; he told me to just put them on top of the china cabinet.”

I’m scratching my head thinking, “Here's one of the most famous coins ever struck and it’s quite possible it’s been sitting there out in the open for decades and decades!” So my partner calls her back and asks if she wouldn’t mind looking on top of her China cabinet.

And lo and behold, here’s that 1804 Silver Dollar in all its glory that had essentially been “missing” since the mid-seventies!

We ended up selling the coin at one of our auctions for, I think, around $4.3 million. At the time, I believe it was the most expensive coin ever sold!

MF: Wow, crazy! I would say that qualifies as a windfall!

VS: Total windfall! Likely, she would have eventually passed away, and that old China cabinet would have been sold at a garage sale with the coin inside… and somebody else would have hit the lotto!

MF: Yeah! Or perhaps even worse… with the new owner thinking it’s just an old worthless coin never to see the light of day again!

Van, I really enjoyed the conversation. Every time we talk, I learn something new about the rare coin business!

Before I let you go… how would someone in my audience, say, a person who’s never bought a rare coin let alone owned a collection, get started with you? And, what kind of money are we talking in order to get the ball rolling on a rare coin collection?

VS: You know, Mike, I really don’t have a price limit. I have lots of people who start with $1,000 or $2,000 and I have people who have endless amounts of money. It’s kind of whatever a person’s interest is, what they're looking to accomplish, and what we can do to figure out something that’s going to work for them.

And everyone's a little bit different. Yet one thing all collectors seem to share in common is… when you hold a rare coin in your hand, you can’t help but think… “Okay, I get it now! This makes sense to me!”

MF: I know exactly what you mean, Van. That feeling you get… taking in a coin’s beauty and history just takes your breath away. It’s like going back in time! You can’t help but think about the people long since passed that may have held that same coin and perhaps used it to purchase things.

In fact, my son is now beginning to take an interest in coins… and it’s exciting for me knowing one day I’ll be passing my collection on to him.

VS: That’s it… exactly! I’m glad to hear he’s taking an interest!

MF: One more thing, Van. What’s the best way for someone in my audience to get a hold of you if they're interested in starting a collection?

VS: They can either email me at van@davidhall.com or they can give me a call at 800-759-7575.

MF: Van, thank you again for your time and for your insights into the world of coins. I truly appreciate it!

VS: My pleasure, Mike. Stay safe out there.

MF: Thank you. You as well.

We have four reports now available highlighting several opportunities for investment in the resource space.

- The Book of Levi: Picks-and-Shovels for the New Gold Bull Market

- Mid-Tier Takeovers for 2020 and Beyond: Two Top Candidates for Premium Takeovers

- The New Standard in Silver

- Exploration Opportunities

Opportunities discussed in those reports and past issues include:

- 19th century: Liberty Seated half dimes, dimes, quarters, half dollars, silver dollars

- 20th century: Buffalo Nickels, Mercury Dimes, Walking Liberty Halves, Standing Liberty Quarters

- Barber dimes, quarters, and halves

- Common date: $10 Liberties, $5 Liberties

- 19th century quarter sets: Draped Bust Quarter, Capped Bust Quarter, Liberty Seated Quarter, Barber Quarter

- 20th century coin sets: Mercury Dimes, Walking Liberty Halves, Buffalo Nickels, Standing Liberty Quarters; other various: 8-piece sets, 10-piece sets, 12-piece sets

- Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX-V:RVG)(OTC: RVLGF)

- Integra Resources (TSX-V: ITR)(NYSE-American: ITRG)

- Liberty Gold (TSX: LGD)(OTC: LGDTF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Energy Fuels (TSX: EFR)(NYSE-American: UUUU)

- Pan American Silver (TSX: PAAS)(Nasdaq: PAAS)

- Liberty Gold Corp. (TSX: LGD)(OTC: LGDTF)

- HighGold Mining (TSX.V: HIGH)(OTC: HGGOF)

- Bluestone Resources (TSV.V: BSR)(OTC: BBSRF)

- Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Blackstone Minerals (ASX: BSX)

- Clean Air Metals (TSX.V: AIR)

- Golden Goliath (TSX.V: GNG)(OTC: GGTHF)

- FPX Nickel (TSX.V: FPX)(OTC: FPOCF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Niobay Metals (TSX.V: NBY)(OTC: MDNNF)

- Verde Agritech (TSX: NPK)(OTC: AMHPF)

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Sprott Inc. (NYSE: SII)

- Franco-Nevada (NYSE: FNV)

- B2Gold (NYSE: BTG)

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- Blackstone Minerals (ASX: BSX)

- Pan American Silver (NASDAQ: PAAS)

- Hannan Metals (HAN.V)

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)

- Ely Gold Royalties (TSX-V: ELY)(OTC: ELYGF)

- Trilogy Metals (TSX: TMQ)(NYSE: TMQ)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Realgold (private)

- 1903-1926 Gold Commemorative Coins

- Pre-1933 Liberty, Indian, St. Gauden Coins

- Sprott Inc. (TSX: SII)(OTC: SPOXF)

- Alacer Gold (TSX: ASR)(OTC: ALIAF)

- Alamos Gold (TSX: AGI)(NYSE: AGI)

- Silvercrest Metals (TSX: SIL)(NYSE: SILV)

- EMX Royalty Corp. (TSX-V: EMX)(NYSE: EMX)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Revival Gold (TSX-V: RVG)(OTC: RVLGF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

Make sure you never miss an update or issue from Hard Asset Digest by adding editor@hardassetdigest.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Hard Asset Digest, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at editor@hardassetdigest.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Hard Asset Digest does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.