|

Monday June 20th, 2011 - Baltimore, MD

Ethos Capital Update

Dear Hard Money Millionaire Readers,

Over the past two months, the share prices of junior gold companies have taken quite a hit. Canada's TSX Venture Exchange, which is composed of ~50% junior mineral firms, has dropped over 20% since March. Take a look:

But this pullback is ultimately of little to no concern, and it will really serve to create a buying opportunity for us.

The fact is, these types of pullbacks are common, and temporary. The junior market experienced similar setbacks in 2010 and 2009 before rebounding and breaking into new highs. Take a look at a chart of the TSX Venture since 2009:

And despite these short-term sell-offs, gold stocks have climbed 1,400% off of their 2000 lows while the S&P 500 Index has experienced an 11% decline, according to J.P. Morgan.

Frank Holmes, CEO and Chief Investment Officer of U.S. Global Investors, noted in an article on MineWeb this morning:

Gold stocks have historically outperformed the gold price by roughly a 3-to-1 ratio. This means that a 5 percent rise in the price of gold generally translated into a 15 percent rise in the miners. Recently, this leverage has eroded to about a 1-to-1 ratio, or lower at times, according to BofA-Merrill Lynch.

With the general junior mineral market currently being undervalued, today's investors will be exceedingly rewarded as the share prices of junior firms recover from the sell-off and quickly catch up to rising metal prices.

And I think one of the best ways to take advantage of the down market right now is owning shares of Ethos Capital.

Ethos Capital (TSX-V: ECC)

|

|

|

Company

|

Ethos Capital Corp.

|

Corporate Presentation

|

|

Exchange: Symbol

|

TSX-V: ECC (Canada)

|

|

|

OTCQX: ETHOF (U.S)

|

|

Share Price

|

~$1.15

|

|

Shares Outstanding

|

40.7 million

|

|

Market Cap

|

$46.8 million

|

|

Working Capital

|

~$20.0 million

|

|

Avg. Daily Volume

|

~65,000

|

|

Website

|

www.EthosCapitalCorp.com

|

Orex Minerals is focused on exploration and development of three main projects. The first two are primary silver exploration projects in Mexico, and the third is a gold development project in Sweden.

Ethos Capital is moving fast. The company just staked another 1,460 claims right in the heart of the Yukon gold rush.

The newly staked claims are contiguous with Ethos' Betty and Bridget properties, and they increase the company's total land position in the Yukon by over 34%.

Ethos has now optioned over 188,500 acres of highly prospective land from target generator Shawn Ryan in the rapidly developing White Gold District.

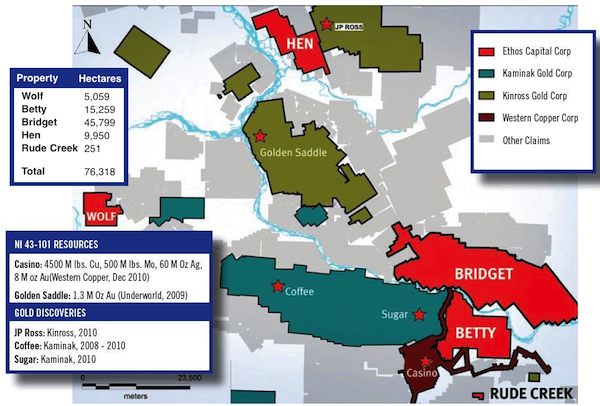

Here's a broad overview of the company's total Yukon claims surrounding recent mineral discoveries by Kinross (NYSE: KGC), Western Copper (AMEX: WRN), and Kaminak Gold (TSX-V: KAM):

Ethos is the third-largest public mineral claim holder in the White Gold District, next to Kaminak and Kinross – an enviable position right now given all the excitement surrounding the new Yukon gold rush.

But the company isn't just sitting around waiting for the gold to find them. Ethos has just initiated an aggressive exploration campaign that will give the company and its investors better understanding of the gold mineralization on the company's projects.

Here's the plan...

Ethos will spend $6 million this summer on a comprehensive and systematic field program that consists of prospecting, trenching, soil sampling, mapping, terrain modeling, and a bit of drilling at the Wolf property, where the company has already found significant levels of gold in the soil.

The main component to Ethos Capital's summer exploration schedule, however, is the soil sampling.

The company will collect and test for gold levels at approximately 33,000 carefully mapped out locations across the Betty, Bridget, and Hen properties.

This is one of the largest soil sampling programs currently being conducted in the Yukon. The company's field exploration team is expected to gather soil samples across an area of over 900 line miles. That's 100 miles farther than a drive from New York to Chicago.

The Betty and Bridget properties will be the focus of Ethos' soil sampling program this summer. The company will take 16,000 soil samples and 13,500 soil samples from Betty and Bridget, respectively. Ethos will also collect an additional 2,500 samples from the Hen property.

The company's field exploration team has a streamlined system of collecting and submitting approximately 2,000 soil samples daily to the local preparation lab to get ready for testing. The prepared samples are then flown to Vancouver for mineral analysis and recording.

Ethos will use the data from this soil sampling program to evaluate and identify new targets for future exploration drilling with the potential to discover billions of dollars in not only gold, but other vital economic metals. The company says:

The Bridget porphyry target conceptually has similarities to the Casino copper-molybdenum-gold porphyry project located 20 kilometers to the south which contains NI43-101 mineral resources of 8.5 million ounces gold, 4.5 billion pounds copper, and 500 million pounds of molybdenum.

At $16 per pound, the molybdenum alone at Casino is potentially worth billions. So Ethos' interest in the Betty and Bridget properties is more than justified.

Shares of ECC have taken a hit along with the rest of the market, creating a nice buying opportunity. At last look shares of Ethos were trading between $1.10 - $1.15. ECC has already traded up to $1.50 before the summer lull cooled it off a bit. And that was well before the company started its summer exploration program.

As the results from the summer exploration program come in, I believe we'll see the share price of Ethos climb back well past the $1.50 mark and over $2.00 a share (more with a significant discovery) by the end of the summer. So, I'm urging you buy the stock now.

Shares of Ethos Capital trade mainly on Canada's TSX Venture Exchange under the symbol ECC. However, the company's stock is also traded on the U.S. OTCQX exchange under the symbol ETHOF.

Good Investing,

Luke Burgess

Investment Director, Hard Money Millionaire

Hard Money Millionaire

Hard Money Millionaire, Copyright © 2011, Angel Publishing, LLC., P.O. Box 84905, Phoenix, AZ 85071. For Customer Service, please call (877) 528 2645. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Angel Publishing and Hard Money Millionaire does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. The publisher, editors and consultants of Angel Publishing may actively trade in the investments discussed in this newsletter. They may have substantial positions in the securities recommended and may increase or decrease such positions without notice. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.

| ![]()

![]()